false

0001296445

0001296445

2023-10-23

2023-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2023

Ormat Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-32347

|

88-0326081

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

6140 Plumas Street, Reno, Nevada 89519-6075

(Address of principal executive offices) (Zip Code)

(775) 356-9029

(Registrant’s telephone number, including area code)

Not applicable

(Former name of former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Shares

|

ORA

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 23, 2023, Snow Wolf Holdings LLC (“Purchaser”), a wholly-owned subsidiary of Ormat Technologies, Inc. (the “Company”), entered into a Membership Interest Purchase Agreement (the “MIPA”) with Enel Green Power North America, Inc. and Enel Kansas, LLC (“Sellers”), and with Enel Geothermal, LLC, EGP Nevada Power, LLC, Stillwater Woods Hill Holdings, LLC, Enel Surprise Valley, LLC, and Enel Cove Fort II, LLC (the “Acquired Companies”), subsidiaries of Enel SpA (ENEL.MI) (“Enel”), pursuant to which Purchaser has agreed to purchase from Sellers one hundred percent (100%) of the outstanding membership interests in the Acquired Companies, other than certain membership interests of Stillwater Woods Hill Holdings, LLC that are held by a third party pursuant to a previously existing tax equity financing undertaken by the Sellers and a third party in relation to that Acquired Company. The Acquired Companies directly or indirectly own (a) the Cove Fort geothermal power plant located in Beaver County, Utah (the “Cove Fort Project”), (b) the triple hybrid Stillwater geothermal, Solar PV and Solar thermal power plants located in Churchill County, Nevada (the “Stillwater Project”), (c) the Salt Wells geothermal power plant located in Churchill County, Nevada (the “Salt Wells Project”), (d) the Stillwater Solar PV II, located in Churchill County, Nevada, (the “Stillwater Solar Project”), (e) the Solar PV park located in Windham County Connecticut (the “Woods Hills Solar PV Park”) and (f) two greenfield development assets, for an aggregate cash purchase price of $271 million (the “Transaction”). The purchase price is subject to a customary post-closing working capital adjustment based on the levels of net working capital of certain of the Acquired Companies as of the closing of the Transaction (the “Closing”).

The MIPA contains customary representations and warranties of Purchaser and Sellers for the benefit of the other party. The MIPA also contains customary covenants, including, among others, covenants of Purchaser and Sellers to cooperate and use commercially reasonable efforts to obtain all consents required for the Transaction, covenants requiring Sellers to cause the Acquired Companies to conduct their business in the ordinary course of business consistent with past practice and to not solicit proposals relating to alternative transactions, and covenants regarding the treatment of certain employees of Enel to whom the Company has agreed to make offers of employment as of the Closing. The Company has purchased a representations and warranties insurance policy in connection with the MIPA, under which the Company may seek recourse for breaches of Sellers’ representations and warranties in the MIPA. The representations and warranties insurance policy is subject to customary conditions, exclusions and deductibles.

The Closing of the Transaction is expected to occur by the first quarter of 2024, subject to the satisfaction of customary conditions contained in the MIPA, including, among others, (a) receipt of certain third party consents, (b) expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, (c) approval of the Federal Energy Regulatory Commission under Section 203 of the Federal Power Act, (d) the absence of injunctions or other legal restraints prohibiting the Transaction, (e) the accuracy of Purchaser’s and Sellers’ representations and warranties in the MIPA and (f) compliance by Purchaser and Sellers with their respective covenants in the MIPA. The MIPA allows for Sellers to exercise an option to delay closing with respect to the Stillwater Woods Hill Holdings, LLC and EGP Nevada Power, LLC membership interests if necessary to complete required receipt of certain third-party consents. In the event Sellers exercise the option to delay closing for these assets, the cash purchase price paid at Closing will be reduced by $20 million, with the $20 million to be paid at the time the delayed closing is finalized, subject to the same post-closing working capital adjustment described above.

The MIPA may be terminated in certain circumstances, including if the Transaction has not been consummated within 150 days from the signing, or in the case of the delayed closing interests, a maximum of 270 days after signing.

The foregoing description of the MIPA and the transactions contemplated thereby does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the MIPA, a copy of which will be filed as an exhibit to the Company’s next Annual Report Form 10-K.

The MIPA will provide the Company’s investors with information regarding its provisions. It is not intended to provide any other information about the Company, its subsidiaries or its affiliates. The representations and warranties contained in the MIPA were made only for purposes of the MIPA and as of specific dates, are solely for the benefit of Purchaser and Sellers, may be subject to limitations agreed upon by Purchaser and Seller (including as set forth in confidential disclosure schedules provided by Sellers to Purchaser in connection with the signing of the MIPA), may have been made for the purposes of allocating contractual risk between Purchaser and Sellers instead of establishing the matters covered by them as facts, and may be subject to standards of materiality applicable to the Purchaser, Sellers, the Company or Enel that differ from those applicable to the Company’s investors. The Company’s investors are not third-party beneficiaries to the representations and warranties contained in the MIPA and should not rely on those representations and warranties or any descriptions of them as the actual state of facts or condition of Purchaser, Sellers, the Company or Enel or any of their respective subsidiaries or affiliates.

Item 7.01 Regulation FD Disclosure.

On October 23, 2023, the Company issued a press release announcing its entry into the MIPA. A copy of that press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

Description

|

|

|

99.1

|

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

| |

|

|

|

*Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K.

|

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this report that address activities, events or developments that the Company expects or anticipates will or may occur in the future, including such matters as the Company’s projections of annual revenues, expenses and debt service coverage with respect to the Company’s debt securities, future capital expenditures, business strategy, competitive strengths, goals, development or operation of generation assets, market and industry developments and the growth of the Company’s business and operations, are forward-looking statements. When used in this report, the words “may”, “will”, “could”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “projects”, “potential”, or “contemplate” or the negative of these terms or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain such words or expressions.

These forward-looking statements generally relate to the Company’s plans, objectives and expectations for future operations and are based upon its management's current estimates and projections of future results or trends. Although the Company believes that its plans and objectives reflected in or suggested by these forward-looking statements are reasonable, the Company may not achieve these plans or objectives. Actual future results may differ materially from those projected as a result of certain risks and uncertainties and other risks described under "Risk Factors" as described in the Company’s annual report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 24, 2023, and in the Company’s subsequent quarterly reports on Form 10-Q that are filed from time to time with the SEC.

These forward-looking statements are made only as of the date hereof, and, except as legally required, the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ORMAT TECHNOLOGIES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Doron Blachar

|

|

|

|

Name:

|

Doron Blachar

|

|

|

|

Title:

|

Chief Executive Officer

|

|

Date: October 24, 2023

Exhibit 99.1

|

Ormat Technologies Contact:

Smadar Lavi

VP Head of IR and ESG Planning & Reporting

775-356-9029 (ext. 65726)

slavi@ormat.com

|

|

Investor Relations Agency Contact:

Alec Steinberg or Joseph Caminiti

Alpha IR Group

312-445-2870

ORA@alpha-ir.com

|

ORMAT TO ACQUIRE CONTRACTED OPERATING GEOTHERMAL AND SOLAR ASSETS IN NEVADA, UTAH, AND CONNECTICUT FOR $271 MILLION

| |

●

|

ORMAT PLANS TO ENHANCE THE ACQUIRED POWER PLANTS EBITDA BY SIGNIFICANTLY IMPROVING THEIR OPERATIONS, PROFITABILITY AND GENERATION

|

| |

●

|

ACQUISITION ADVANCES ORMAT’S ELECTRICITY GROWTH PLANS AND FURTHER SOLIDIFIES ITS COMMITMENT TO SUSTAINABLE, LOW CARBON FOOTPRINT ENERGY SOLUTIONS

|

RENO, Nev. October 23, 2023, Ormat Technologies, Inc. (NYSE: ORA), a leading renewable energy company, announced today that it has entered into a purchase agreement with Enel Green Power North America (EGPNA), a subsidiary of Enel SpA (ENEL.MI), to acquire a 150 MW portfolio, which includes two contracted operating geothermal power plants and one triple hybrid geothermal, solar PV (20MW nameplate) and solar thermal power plant with a total generation of approximately 43 MW, two Solar assets with a total nameplate capacity of 40 MW, and two greenfield development assets, for a total of $271 million. The acquisition of these US-based operating geothermal and solar assets supports Ormat’s strategic portfolio expansion goals. The acquisition is expected to close by the first quarter of 2024, subject to regulatory approvals and customary closing conditions.

Ormat expects to finance most of the purchase price through new long-term corporate debt.

The acquired assets include:

| |

1.

|

Cove Fort geothermal power plant – located in Beaver County, Utah, this Ormat-designed binary geothermal power plant sells its clean electricity generation to the Salt River Project under a long-term Power Purchase Agreement (PPA).

|

| |

2.

|

Stillwater Hybrid geothermal and solar – located in Churchill County, Nevada, the triple hybrid power plant consists of a geothermal binary unit, Solar PV plant, and solar thermal plant that sells its clean electricity under a long-term PPA with NV Energy.

|

| |

3.

|

Salt Wells geothermal power plant – located in Churchill County, Nevada, this geothermal binary power plant has a long-term PPA with NV Energy.

|

| |

4.

|

Stillwater Solar PV II – located in Churchill County, Nevada, this Solar PV facility sells its electricity output to Wynn Las Vegas under a long-term PPA.

|

| |

5.

|

Woods Hill Solar PV Park - located in Windham County Connecticut, this Solar PV facility sells its electricity output to seven different off-takers under a long-term PPA.

|

| |

6.

|

Greenfield development projects – Ormat has acquired the rights to explore and potentially develop two greenfield projects, one adjacent to the Cove Fort power plant, and the other in a high-potential geothermal resource area in California.

|

These acquired assets have collectively generated an annual revenue of approximately $35.0 million and an EBITDA1 of approximately $24.0 million for the years 2020-2022. Ormat is committed to a series of value-enhancing growth initiatives for these assets, which include:

| |

1.

|

Enhancement and optimization of Cove Fort, Stillwater, and Salt Wells – Ormat intends to enhance and optimize the three operating geothermal assets by installing Ormat’s state-of-the-art equipment. This is expected to add approximately 17 MW and generate an additional $15 million of EBITDA in the next 12 to 24 months, with an expected $55 million investment.

|

| |

2.

|

Expansion of Cove Fort – in addition to the enhancement and optimization noted above, Ormat plans to expand the Cove Fort power plant by 20 MW in the next 5 years.

|

| |

3.

|

Development of two green fields – Ormat intends to explore, and potentially develop the two greenfield projects as part of Ormat’s long-term growth plans.

|

Doron Blachar, CEO of Ormat Technologies, stated, “We are excited to announce this strategic acquisition, marking a significant milestone for Ormat as we expand our generating capacity portfolio and expand our footprint in the renewable energy sector. We are confident that this accretive acquisition, which carries approximately an 8x EV/EBITDA multiple (inclusive of the future planned enhancement and optimization but excluding the Cove Fort expansion), will support both our short and long-term growth plans, further leveraging our unique core capabilities to maximize the efficiency and output from these power plants' energy sources, strengthening our financial position, and delivering meaningful value to our investors. This transaction demonstrates our commitment to environmental stewardship, economic growth, and a greener, more sustainable future for all, aligning seamlessly with our business strategy of pursuing accretive M&A transactions alongside organic growth.”

ABOUT ORMAT TECHNOLOGIES

With over five decades of experience, Ormat Technologies, Inc. is a leading geothermal company and the only vertically integrated company engaged in geothermal and recovered energy generation (“REG”), with robust plans to accelerate long-term growth in the energy storage market and to establish a leading position in the U.S. energy storage market. The Company owns, operates, designs, manufactures, and sells geothermal and REG power plants primarily based on the Ormat Energy Converter – a power generation unit that converts low-, medium- and high-temperature heat into electricity. The Company has engineered, manufactured, and constructed power plants, which it currently owns or has installed for utilities and developers worldwide, totaling approximately 3,200 MW of gross capacity. Ormat leveraged its core capabilities in the geothermal and REG industries and its global presence to expand the Company’s activity into energy storage services, solar Photovoltaic (PV), and energy storage plus Solar PV. Ormat’s current total generating portfolio is 1,277 MW with a 1,107 MW geothermal and solar generation portfolio that is spread globally in the U.S., Kenya, Guatemala, Indonesia, Honduras, and Guadeloupe, and a 170 MW energy storage portfolio that is located in the U.S.

ORMAT’S SAFE HARBOR STATEMENT

Information provided in this press release may contain statements relating to current expectations, estimates, forecasts, and projections about future events that are "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such matters as projections of future revenues and/or EBITDA, future capital expenditures, business strategy, competitive strengths, goals, development or operation of generation assets, market and industry developments and the growth of our business and operations, are forward-looking statements. When used in this press release, the words “may”, “will”, “could”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “projects”, “potential”, or “contemplate” or the negative of these terms or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain such words or expressions. These forward-looking statements generally relate to Ormat's plans, objectives and expectations for future operations and are based upon its management's current estimates and projections of future results or trends. Although we believe that our plans and objectives reflected in or suggested by these forward-looking statements are reasonable, we may not achieve these plans or objectives. Actual future results may differ materially from those projected as a result of certain risks and uncertainties and other risks described under "Risk Factors" as described in Ormat’s annual report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 24, 2023, and in Ormat’s subsequent quarterly reports on Form 10-Q that are filed from time to time with the SEC.

These forward-looking statements are made only as of the date hereof, and, except as legally required, we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events, or otherwise.

1 See a reconciliation table of non-GAAP measures below.

NON-GAAP FINANCIAL MEASURES

The Company provides below a reconciliation of EBITDA of the group of assets acquired under the purchase agreement with EGPNA. The EBITDA which is calculated based on the seller’s financial statements is a non-GAAP financial measure, for each of the past three years. However, the Company is unable to provide a reconciliation for the projected EBITDA data presented in this press release without unreasonable efforts, due to high variability and complexity with respect to estimating certain forward-looking amounts. These include interests, income tax expenses, and other non-cash expenses and adjusting items that are excluded from the calculation of EBITDA.

|

$ in millions

|

2020

|

2021

|

2022

|

|

Net income (loss)

|

(3.3)

|

(3.9)

|

(3.7)

|

|

Adjusted for:

|

|

|

|

|

Financial Income & Charges

|

(0.0)

|

(0.1)

|

(0.1)

|

|

Income tax provision

|

0.0

|

0.0

|

0.0

|

|

Depreciation and amortization

|

28.1

|

28.4

|

25.8

|

|

EBITDA

|

24.9

|

24.5

|

22.0

|

v3.23.3

Document And Entity Information

|

Oct. 23, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Ormat Technologies, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 23, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-32347

|

| Entity, Tax Identification Number |

88-0326081

|

| Entity, Address, Address Line One |

6140 Plumas Street

|

| Entity, Address, City or Town |

Reno

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89519-6075

|

| City Area Code |

775

|

| Local Phone Number |

356-9029

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares

|

| Trading Symbol |

ORA

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001296445

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

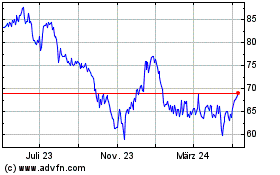

Ormat Technologies (NYSE:ORA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

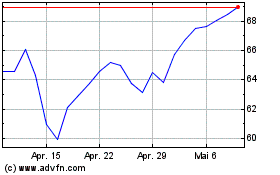

Ormat Technologies (NYSE:ORA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024