- Closed Credit Agreement Amendment

-

- Declares Dividend of $0.10 Per Share for

Third Quarter -

- Updated 2023 Outlook -

Orion Office REIT Inc. (NYSE: ONL) (“Orion” or the “Company”), a

fully-integrated real estate investment trust focused on the

ownership, acquisition and management of single-tenant net lease

mission-critical suburban office properties located across the

U.S., announced today its operating results for the second quarter

ended June 30, 2023.

“We continue our efforts to evolve and reposition our portfolio

of high-quality properties,” stated Paul McDowell, Orion’s Chief

Executive Officer. “We reported another solid quarter of financial

performance from our high-quality portfolio, and while the pace of

completing the dispositions of non-core properties and securing new

leases is extended relative to our initial outlook, we continue to

make progress. Most importantly, we recently completed an amendment

to our credit facility that allows us to extend the maturity until

2026 and gives us the financial flexibility to execute on the

Company’s business plan and to maintain our low leverage balance

sheet.”

Second Quarter 2023 Financial and Operating

Highlights

- Total Revenues of $52.0 million

- Net Loss Attributable to Common Stockholders of $(15.7)

million, or $(0.28) per share

- Funds from Operations (“FFO”) of $24.4 million, or $0.43 per

share

- Core FFO of $26.9 million, or $0.48 per share

- EBITDA of $20.4 million, EBITDAre of $32.2 million and Adjusted

EBITDA of $32.7 million

- Net Debt to Annualized Adjusted EBITDA of 3.93x

Second Quarter 2023 Financial Results

During the quarter ended June 30, 2023, the Company generated

total revenues of $52.0 million, as compared to $52.8 million in

the same quarter of 2022. The Company reported a net loss

attributable to common stockholders of $(15.7) million, or $(0.28)

per share, during the second quarter of 2023, as compared to a net

loss of $(15.6) million, or $(0.27) per share, reported in the same

quarter of 2022. Core FFO for the second quarter of 2023 was $26.9

million, or $0.48 per share, as compared to $28.4 million, or $0.50

per share in the same quarter of 2022. Due to the timing of an

expense reimbursement that fell in the second quarter of 2023, the

Company’s results benefited by $0.02 per share in the quarter. This

benefit is offset by $0.02 per share of expense we incurred in the

first quarter of 2023, thus having no 2023 year to date or full

year impact.

Leasing and Disposition Activity

During the quarter ended June 30, 2023, the Company entered into

one 5.0-year lease renewal for 44,000 square feet at the Company’s

property in Redding, California, leased 100% to the United States

Government. The Company also entered into one new 3.0-year lease

for 3,000 square feet at its multi-tenant property in The

Woodlands, Texas. Additionally, Orion is in various stages of

negotiation and documentation for new leases and renewals at

multiple properties.

Shortly after quarter end, Orion closed the sale of a 227,000

square foot vacant property in Berkeley, Missouri, for a gross

sales price of approximately $9.7 million. The Company also has

agreements currently in place to sell eight additional properties,

representing approximately 631,000 square feet, for an aggregate

sale price of $41.0 million, including the six property Walgreens

campus in Deerfield, IL.

Balance Sheet and Liquidity

On June 29, 2023, the Company closed on an amendment of its

credit agreement. Under the terms of the amendment, the Company

used borrowings from its $425.0 million-capacity credit facility

revolver to repay and retire its $175.0 million credit facility

term loan which was scheduled to mature on November 12, 2023. The

amendment also provides the Company with the option to extend the

credit facility revolver for an additional 18 months to May 12,

2026 from the current scheduled maturity of November 12, 2024. The

extension option is subject to customary conditions including the

payment of an extension fee.

As of June 30, 2023, the Company has total debt of $557.3

million, comprised of $175.0 million under the Company’s $425.0

million-capacity credit facility revolver, $355.0 million under the

Company’s securitized mortgage loan (the “CMBS Loan”) and $27.3

million which represents Orion’s pro rata share of indebtedness of

the Unconsolidated Joint Venture.

As of June 30, 2023, Orion had $292.9 million of liquidity,

comprised of $42.9 million cash on hand, including the Company’s

pro rata share of cash from the Unconsolidated Joint Venture, as

well as $250.0 million of available capacity on Orion’s $425.0

million-capacity credit facility revolver. Following quarter end,

the Company deposited $28.0 million of its cash on hand into an

escrow account with the credit facility lenders as additional cash

collateral. These funds will, in accordance with the terms of the

credit facility revolver, be used to prepay borrowings thereunder

upon the scheduled expiration in November 2023 (or earlier

termination) of the Company’s interest rate swap agreements with

respect to $175.0 million of borrowings under such revolver.

Dividend

On August 8, 2023, Orion’s Board of Directors declared a

quarterly cash dividend of $0.10 per share for the third quarter of

2023, payable on October 16, 2023, to stockholders of record as of

September 29, 2023. The dividend was sized to permit future growth

while preserving meaningful free cash flow for reinvestment into

the current portfolio and for accretive investments.

Real Estate Portfolio

As of June 30, 2023, Orion’s real estate portfolio consisted of

81 properties as well as a 20% ownership interest in the Arch

Street Joint Venture, Orion’s Unconsolidated Joint Venture with an

affiliate of Arch Street Capital Partners, LLC, comprising six

properties. As of June 30, 2023, the Company’s portfolio occupancy

rate was 86.5%, with 73.7% of annualized base rent derived from

Investment-Grade Tenants, and the portfolio’s weighted average

remaining lease term was 3.9 years.

As of June 30, 2023, the Unconsolidated Joint Venture owned six

real estate assets for total Gross Real Estate Investments of

approximately $227.3 million. Orion is continuing to review a

number of potential property acquisitions for its real estate

portfolio.

2023 Outlook

Orion is providing the following revised guidance for fiscal

year 2023:

Prior 2023 Guidance

Revised 2023 Guidance

Core FFO per share

$1.55 - $1.63

$1.59 - $1.63

General and Administrative Expenses

$18.75 million - $19.75

million

$18.25 million - $18.75

million

Net Debt to Adjusted EBITDA

4.3x - 5.3x

4.3x - 5.0x

Webcast and Conference Call Information

Orion will host a webcast and conference call to review its

financial results at 10:00 a.m. ET on Thursday, August 10, 2023.

The webcast and call will be hosted by Paul McDowell, Chief

Executive Officer and President, and Gavin Brandon, Chief Financial

Officer, Executive Vice President and Treasurer. To participate,

the webcast may be accessed live by visiting the “Investors”

section of Orion’s website at onlreit.com/investors. To join the

conference call, callers from the United States and Canada should

dial 1-877-407-3982, and international callers should dial

1-201-493-6780, ten minutes prior to the scheduled call time.

Replay Information

A replay of the webcast may be accessed by visiting the

“Investors” section of Orion’s website at onlreit.com/investors.

The conference call replay will be available after 1:00 p.m. ET on

Thursday, August 10, 2023 through 11:59 a.m. ET on Thursday, August

24, 2023. To access the replay, callers may dial 1-844-512-2921

(domestic) or 1-412-317-6671 (international) and use passcode,

13738938.

Non-GAAP Financial Measures

To supplement the presentation of the Company’s financial

results prepared in accordance with U.S. generally accepted

accounting principles ("GAAP"), this press release and the

accompanying quarterly supplemental information as of and for the

quarter ended June 30, 2023 contain certain financial measures that

are not prepared in accordance with GAAP, including Funds from

Operations (“FFO”), Core Funds from Operations (“Core FFO”), Funds

Available for Distribution (“FAD”), Earnings Before Interest,

Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”),

and Adjusted EBITDA. Please see the attachments to this press

release for how Orion defines these non-GAAP financial measures and

a reconciliation to the most directly comparable GAAP measure.

About Orion Office REIT Inc.

Orion Office REIT Inc. is an internally-managed real estate

investment trust engaged in the ownership, acquisition and

management of a diversified portfolio of mission-critical and

headquarters office buildings located in high-quality suburban

markets across the U.S. and leased primarily on a single-tenant net

lease basis to creditworthy tenants. The Company was founded on

July 1, 2021, spun-off from Realty Income (NYSE: O) on November 12,

2021 and began trading on the New York Stock Exchange on November

15, 2021. The Company is headquartered in Phoenix, Arizona and has

an office in New York, New York. For additional information on the

Company and its properties, please visit onlreit.com.

About the Data

This data and other information described herein are as of and

for the three and six months ended June 30, 2023, unless otherwise

indicated. Future performance may not be consistent with past

performance and is subject to change and inherent risks and

uncertainties. This information should be read in conjunction with

the consolidated and combined financial statements and the

Management's Discussion and Analysis of Financial Condition and

Results of Operations sections contained in Orion Office REIT

Inc.'s (the "Company," "Orion," "us," "our" and "we") Annual Report

on Form 10-K for the year ended December 31, 2022 and Quarterly

Reports on Form 10-Q for the periods ended June 30, 2023 and March

31, 2023.

Definitions

Annualized Base Rent is the monthly aggregate cash amount

charged to tenants under our leases (including monthly base rent

receivables and certain contractually obligated reimbursements by

our tenants), as of the final date of the applicable period,

multiplied by 12, including the Company's pro rata share of such

amounts related to the Unconsolidated Joint Venture. Annualized

Base Rent is not indicative of future performance.

CPI refers to a lease in which base rent is adjusted

based on changes in a consumer price index.

Credit Rating of a tenant refers to the Standard &

Poor's or Moody's credit rating and such rating also may reflect

the rating assigned by Standard & Poor's or Moody's to the

lease guarantor or the parent company as applicable.

Double Net Lease ("NN") is a lease under which the tenant

agrees to pay all operating expenses associated with the property

(e.g., real estate taxes, insurance, maintenance), but excludes

some or all major repairs (e.g., roof, structure, parking lot, in

each case, as further defined in the applicable lease).

Earnings Before Interest, Taxes, Depreciation and

Amortization for Real Estate ("EBITDAre") and Adjusted

EBITDA

Due to certain unique operating characteristics of real estate

companies, as discussed below, the National Association of Real

Estate Investment Trusts, Inc. ("Nareit"), an industry trade group,

has promulgated a supplemental performance measure known as

Earnings Before Interest, Taxes, Depreciation and Amortization for

Real Estate. Nareit defines EBITDAre as net income or loss computed

in accordance with GAAP, adjusted for interest expense, income tax

expense (benefit), depreciation and amortization, impairment

write-downs on real estate, gains or losses from disposition of

property and our pro rata share of EBITDAre adjustments related to

the Unconsolidated Joint Venture. We calculated EBITDAre in

accordance with Nareit's definition described above.

In addition to EBITDAre, we use Adjusted EBITDA as a non-GAAP

supplemental performance measure to evaluate the operating

performance of the Company. Adjusted EBITDA, as defined by the

Company, represents EBITDAre, modified to exclude non-routine items

such as transaction related expenses and spin related expenses. We

also exclude certain non-cash items such as impairments of

intangible and right of use assets, gains or losses on derivatives,

gains or losses on the extinguishment or forgiveness of debt,

amortization of intangibles, above-market lease assets and deferred

lease incentives, net of amortization of below-market lease

liabilities and our pro rata share of Adjusted EBITDA adjustments

related to the Unconsolidated Joint Venture. Management believes

that excluding these costs from EBITDAre provides investors with

supplemental performance information that is consistent with the

performance models and analysis used by management, and provides

investors a view of the performance of our portfolio over time.

Therefore, EBITDAre and Adjusted EBITDA should not be considered as

an alternative to net income, as computed in accordance with GAAP.

The Company uses Adjusted EBITDA as one measure of its operating

performance when formulating corporate goals and evaluating the

effectiveness of the Company's strategies. EBITDAre and Adjusted

EBITDA may not be comparable to similarly titled measures of other

companies.

Enterprise Value equals the sum of the Implied Equity

Market Capitalization and Net Debt, in each case, as of an

applicable date.

Fixed Charge Coverage Ratio is (a) Adjusted EBITDA

divided by (b) the sum of (i) Interest Expense, excluding non-cash

amortization and (ii) secured debt principal amortization on

Adjusted Principal Outstanding. Management believes that Fixed

Charge Coverage Ratio is a useful supplemental measure of our

ability to satisfy fixed financing obligations.

Fixed Dollar or Percent Increase refers to a lease that

requires contractual rent increases during the term of the lease

agreement. A Fixed Dollar or Percent Increase lease may include a

period of free rent at the beginning or end of the lease.

Flat refers to a lease that requires equal rent payments,

with no contractual increases, throughout the term of the lease

agreement. A Flat Lease may include a period of free rent at the

beginning or end of the lease.

Funds Available for Distribution ("FAD")

Funds available for distribution, as defined by the Company,

represents Core FFO, as defined below, modified to exclude capital

expenditures and leasing costs, as well as certain non-cash items

such as amortization of above market leases, net of amortization of

below market lease liabilities, straight-line rental revenue,

amortization of the Unconsolidated Joint Venture basis difference

and our pro rata share of FAD adjustments related to the

Unconsolidated Joint Venture. Management believes that adjusting

these items from Core FFO provides investors with supplemental

performance information that is consistent with the performance

models and analysis used by management and provides useful

information regarding the Company's ability to fund its

dividend.

However, not all REITs calculate FAD and those that do may not

calculate FAD the same way, so comparisons with other REITs may not

be meaningful. FAD should not be considered as an alternative to

net income (loss) or cash flow provided by (used in) operating

activities as determined under GAAP.

Nareit Funds from Operations ("Nareit FFO" or "FFO") and Core

Funds from Operations ("Core FFO")

Due to certain unique operating characteristics of real estate

companies, as discussed below, Nareit has promulgated a

supplemental performance measure known as FFO, which we believe to

be an appropriate supplemental performance measure to reflect the

operating performance of a REIT. FFO is not equivalent to our net

income or loss as determined under GAAP.

Nareit defines FFO as net income or loss computed in accordance

with GAAP adjusted for gains or losses from disposition of real

estate assets, depreciation and amortization of real estate assets,

impairment write-downs on real estate, and our pro rata share of

FFO adjustments related to the Unconsolidated Joint Venture. We

calculate FFO in accordance with Nareit's definition described

above.

In addition to FFO, we use Core FFO as a non-GAAP supplemental

financial performance measure to evaluate the operating performance

of the Company. Core FFO, as defined by the Company, excludes from

FFO items that we believe do not reflect the ongoing operating

performance of our business such as transaction related expenses,

spin related expenses, amortization of deferred lease incentives,

amortization of deferred financing costs, equity-based

compensation, amortization of premiums and discounts on debt, net

and gains or losses on extinguishment of swaps and/or debt, and our

pro rata share of Core FFO adjustments related to the

Unconsolidated Joint Venture.

We believe that FFO and Core FFO allow for a comparison of the

performance of our operations with other publicly-traded REITs, as

FFO and Core FFO, or an equivalent measure, are routinely reported

by publicly-traded REITs, each adjust for items that we believe do

not reflect the ongoing operating performance of our business and

we believe are often used by analysts and investors for comparison

purposes.

For all of these reasons, we believe FFO and Core FFO, in

addition to net income (loss), as defined by GAAP, are helpful

supplemental performance measures and useful in understanding the

various ways in which our management evaluates the performance of

the Company over time. However, not all REITs calculate FFO and

Core FFO the same way, so comparisons with other REITs may not be

meaningful. FFO and Core FFO should not be considered as

alternatives to net income (loss) and are not intended to be used

as a liquidity measure indicative of cash flow available to fund

our cash needs. Neither the SEC, Nareit, nor any other regulatory

body has evaluated the acceptability of the exclusions used to

adjust FFO in order to calculate Core FFO and its use as a non-GAAP

financial performance measure.

GAAP is an abbreviation for generally accepted accounting

principles in the United States.

Gross Lease is a lease under which the landlord is

responsible for all expenses associated with the property (e.g.,

real estate taxes, insurance, maintenance and repairs).

Gross Real Estate Investments represent total gross real

estate and related assets of Operating Properties and the Company's

pro rata share of such amounts related to properties owned by the

Unconsolidated Joint Venture, net of gross intangible lease

liabilities. Gross Real Estate Investments should not be considered

as an alternative to the Company's real estate investments balance

as determined in accordance with GAAP or any other GAAP financial

measures and should only be considered together with, and as a

supplement to, the Company's financial information prepared in

accordance with GAAP.

GSA CPI refers to a General Services Administration

("GSA") lease that includes a contractually obligated operating

cost component of rent which is adjusted annually based on changes

in a consumer price index.

Implied Equity Market Capitalization equals shares of

common stock outstanding as of an applicable date, multiplied by

the closing sale price of the Company's stock as reported on the

New York Stock Exchange on such date.

Industry is derived from the Global Industry

Classification Standard ("GICS") Methodology that was developed by

Morgan Stanley Capital International ("MSCI") in collaboration with

S&P Dow Jones Indices to establish a global, accurate, complete

and widely accepted approach to defining industries and classifying

securities by industry.

Interest Coverage Ratio equals Adjusted EBITDA divided by

Interest Expense, excluding non-cash amortization. Management

believes that Interest Coverage Ratio is a useful supplemental

measure of our ability to service our debt obligations.

Interest Expense, excluding non-cash amortization is a

non-GAAP measure that represents interest expense incurred on the

outstanding principal balance of our debt and the Company's pro

rata share of the Unconsolidated Joint Venture's interest expense

incurred on its outstanding principal balance. This measure

excludes the amortization of deferred financing costs, premiums and

discounts, which is included in interest expense in accordance with

GAAP. Interest Expense, excluding non-cash amortization should not

be considered as an alternative to the Company's interest expense

as determined in accordance with GAAP or any other GAAP financial

measures and should only be considered together with and as a

supplement to the Company's financial information prepared in

accordance with GAAP.

Investment-Grade Tenants are those with a Credit Rating

of BBB- or higher from Standard & Poor’s or a Credit Rating of

Baa3 or higher from Moody’s. The ratings may reflect those assigned

by Standard & Poor’s or Moody’s to the lease guarantor or the

parent company, as applicable.

Leased Square Feet is Rentable Square Feet leased and

includes such amounts related to the Unconsolidated Joint

Venture.

Modified Gross Lease is a lease under which the landlord

is responsible for most expenses associated with the property

(e.g., real estate taxes, insurance, maintenance and repairs), but

passes through some operating expenses to the tenant.

Month-to-Month refers to a lease that is outside of the

contractual lease expiration, but the tenant has not vacated and

continues to pay rent which may also include holdover rent if

applicable.

Net Debt, Principal Outstanding and Adjusted Principal

Outstanding

Principal Outstanding is a non-GAAP measure that represents the

Company's outstanding principal debt balance, excluding certain

GAAP adjustments, such as premiums and discounts, financing and

issuance costs, and related accumulated amortization. Adjusted

Principal Outstanding includes the Company's pro rata share of the

Unconsolidated Joint Venture's outstanding principal debt balance.

We believe that the presentation of Principal Outstanding and

Adjusted Principal Outstanding, which show our contractual debt

obligations, provides useful information to investors to assess our

overall financial flexibility, capital structure and leverage.

Principal Outstanding and Adjusted Principal Outstanding should not

be considered as alternatives to the Company's consolidated debt

balance as determined in accordance with GAAP or any other GAAP

financial measures and should only be considered together with, and

as a supplement to, the Company's financial information prepared in

accordance with GAAP.

Net Debt is a non-GAAP measure used to show the Company's

Adjusted Principal Outstanding, less all cash and cash equivalents

and the Company's pro rata share of the Unconsolidated Joint

Venture's cash and cash equivalents, and less cash deposited with

the credit facility lenders that will, in accordance with the terms

of the credit facility revolver, be used to prepay borrowings upon

expiration or termination of the Company’s interest rate swap

agreements. We believe that the presentation of Net Debt provides

useful information to investors because our management reviews Net

Debt as part of its management of our overall liquidity, financial

flexibility, capital structure and leverage.

Net Debt Leverage Ratio equals Net Debt divided by Gross

Real Estate Investments.

Net Operating Income ("NOI") and Cash NOI

NOI is a non-GAAP performance measure used to evaluate the

operating performance of a real estate company. NOI represents

total revenues less property operating expenses and excludes fee

revenue earned for services to the Unconsolidated Joint Venture,

impairment, depreciation and amortization, general and

administrative expenses, transaction related expenses and spin

related expenses. Cash NOI excludes the impact of certain GAAP

adjustments included in rental revenue, such as straight-line rent

adjustments and amortization of above-market intangible lease

assets and below-market lease intangible liabilities. Cash NOI

includes the pro rata share of such amounts from properties owned

by the Unconsolidated Joint Venture. It is management's view that

NOI and Cash NOI provide investors relevant and useful information

because it reflects only income and operating expense items that

are incurred at the property level and presents them on an

unleveraged basis. NOI and Cash NOI should not be considered as an

alternative to operating income in accordance with GAAP. Further,

NOI and Cash NOI may not be comparable to similarly titled measures

of other companies.

Occupancy Rate equals the sum of Leased Square Feet

divided by Rentable Square Feet and includes the Company's pro rata

share of such amounts related to the Unconsolidated Joint Venture,

in each case, as of an applicable date.

Operating Properties refers to all properties owned and

consolidated by the Company as of the applicable date.

Property Operating Expense includes reimbursable and

non-reimbursable costs to operate a property, including real estate

taxes, utilities, insurance, repairs, maintenance, legal, property

management fees, etc.

Rentable Square Feet is leasable square feet of Operating

Properties and the Company's pro rata share of leasable square feet

of properties owned by the Unconsolidated Joint Venture.

Triple Net Lease ("NNN") is a lease under which the

tenant agrees to pay all expenses associated with the property

(e.g., real estate taxes, insurance, maintenance and repairs in

accordance with the lease terms).

Unconsolidated Joint Venture means the Company's

investment in the unconsolidated joint venture with an affiliate of

Arch Street Capital Partners, LLC.

Unencumbered Asset Ratio equals Unencumbered Gross Real

Estate Investments divided by Gross Real Estate Investments.

Management believes that Unencumbered Asset Ratio is a useful

supplemental measure of our overall liquidity and leverage.

Unencumbered Gross Real Estate Investments equals Gross

Real Estate Investments, excluding Gross Real Estate Investments

related to properties serving as collateral for the Company's CMBS

Loan and the Company's pro rata share of properties owned by the

Unconsolidated Joint Venture that are pledged as collateral under

mortgage debt. Unencumbered Gross Real Estate Investments includes

otherwise unencumbered properties which are part of the

unencumbered property pool under our credit facility and therefore

generally are not available to simultaneously serve as collateral

under other borrowings.

Weighted Average Remaining Lease Term is the number of

years remaining on each respective lease as of the applicable date,

weighted based on Annualized Base Rent and includes the years

remaining on each of the respective leases of the Unconsolidated

Joint Venture, weighted based on the Company's pro rata share of

Annualized Base Rent related to the Unconsolidated Joint

Venture.

Forward-Looking Statements

Information set forth in this press release includes

“forward-looking statements” which reflect the Company's

expectations and projections regarding future events and plans,

future financial condition, results of operations, liquidity and

business, including leasing and occupancy, acquisitions,

dispositions, rent receipts, expected borrowings and financing

costs and the payment of future dividends. Generally, the words

"anticipates," "assumes," "believes," "continues," "could,"

"estimates," "expects," "goals," "intends," "may," "plans,"

"projects," "seeks," "should," "targets," "will," "guidance,"

variations of such words and similar expressions identify

forward-looking statements. These forward-looking statements are

based on information currently available to the Company and involve

a number of known and unknown assumptions and risks, uncertainties

and other factors, which may be difficult to predict and beyond the

Company's control, that could cause actual events and plans or

could cause the Company's business, financial condition, liquidity

and results of operations to differ materially from those expressed

or implied in the forward-looking statements. Further, information

regarding historical rent collections should not serve as an

indication of future rent collections.

The following factors, among others, could cause actual results

to differ materially from those set forth in the forward-looking

statements:

- the risk of rising interest rates, including that our borrowing

costs may increase and we may be unable to refinance our debt

obligations on favorable terms and in a timely manner, or at

all;

- the risk of inflation, including that our operating costs, such

as insurance premiums, utilities, real estate taxes, capital

expenditures and repair and maintenance costs, may rise;

- conditions associated with the global market, including an

oversupply of office space, tenant credit risk and general economic

conditions;

- the extent to which changes in workplace practices and office

space utilization, including remote work arrangements, will

continue and the impact that may have on demand for office space at

our properties;

- our ability to acquire new properties and sell non-core assets

on favorable terms and in a timely manner, or at all;

- our ability to comply with the terms of our credit agreements

or to meet the debt obligations on our properties, including our

ability to satisfy the conditions to extend our credit facility

revolver;

- our ability to access the capital markets to raise additional

equity or refinance maturing debt on favorable terms and in a

timely manner, or at all;

- changes in the real estate industry and in performance of the

financial markets and interest rates and our ability to effectively

hedge against interest rate changes;

- the risk of tenants defaulting on their lease obligations,

which is heightened due to our focus on single tenant

properties;

- our ability to renew leases with existing tenants or re-let

vacant space to new tenants on favorable terms and in a timely

manner, or at all;

- the cost of rent concessions, tenant improvement allowances and

leasing commissions;

- the potential for termination of existing leases pursuant to

tenant termination rights;

- the amount, growth and relative inelasticity of our

expenses;

- risks associated with the ownership and development of real

property;

- risks accompanying the management of OAP/VER Venture, LLC (the

“Arch Street Joint Venture”), our unconsolidated joint venture, in

which we hold a non-controlling interest;

- our ability to close pending real estate transactions, which

may be subject to conditions that are outside of our control;

- risks associated with acquisitions, including the risk that we

may not be in a position, or have the opportunity in the future, to

make suitable property acquisitions on advantageous terms and/or

that such acquisitions will fail to perform as expected;

- risks associated with the fact that we have a limited operating

history and our future performance is difficult to predict;

- our properties may be subject to impairment charges;

- risks resulting from losses in excess of insured limits or

uninsured losses;

- risks associated with the potential volatility of our common

stock; and

- the risk that we may fail to maintain our qualification as a

REIT.

Additional factors that may affect future results are contained

in the Company's filings with the SEC, which are available at the

SEC’s website at www.sec.gov. The Company disclaims any obligation

to publicly update or revise any forward-looking statements,

whether as a result of changes in underlying assumptions or

factors, new information, future events or otherwise, except as

required by law.

ORION OFFICE REIT INC.

CONSOLIDATED BALANCE SHEETS (In thousands)

(Unaudited)

June 30, 2023

December 31, 2022

Assets

Real estate investments, at cost:

Land

$

229,105

$

238,225

Buildings, fixtures and improvements

1,111,646

1,128,400

Total real estate investments, at cost

1,340,751

1,366,625

Less: accumulated depreciation

149,147

133,379

Total real estate investments, net

1,191,604

1,233,246

Accounts receivable, net

24,960

21,641

Intangible lease assets, net

161,885

202,832

Cash and cash equivalents

42,209

20,638

Real estate assets held for sale, net

16,251

2,502

Other assets, net

90,998

90,214

Total assets

$

1,527,907

$

1,571,073

Liabilities and Equity

Mortgages payable, net

$

352,509

$

352,167

Credit facility term loan, net

—

173,815

Credit facility revolver

175,000

—

Accounts payable and accrued expenses

22,326

26,161

Below-market lease liabilities, net

10,996

14,068

Distributions payable

5,670

5,664

Other liabilities, net

23,682

23,340

Total liabilities

590,183

595,215

Common stock

57

57

Additional paid-in capital

1,148,155

1,147,014

Accumulated other comprehensive income

3,026

6,308

Accumulated deficit

(214,929

)

(178,910

)

Total stockholders' equity

936,309

974,469

Non-controlling interest

1,415

1,389

Total equity

937,724

975,858

Total liabilities and equity

$

1,527,907

$

1,571,073

ORION OFFICE REIT INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except

for per share data) (Unaudited)

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Revenues:

Rental

$

51,824

$

52,659

$

101,814

$

105,676

Fee income from unconsolidated joint

venture

200

190

400

379

Total revenues

52,024

52,849

102,214

106,055

Operating expenses:

Property operating

15,487

15,156

30,831

30,470

General and administrative

4,565

3,291

8,874

6,808

Depreciation and amortization

27,877

33,828

56,043

68,181

Impairments

11,819

7,758

15,573

9,360

Transaction related

150

141

255

204

Spin related

—

208

—

964

Total operating expenses

59,898

60,382

111,576

115,987

Other (expense) income:

Interest expense, net

(7,222

)

(7,867

)

(14,361

)

(14,714

)

Loss on extinguishment of debt, net

(504

)

—

(504

)

(468

)

Other income, net

165

48

201

87

Equity in loss of unconsolidated joint

venture

(95

)

(54

)

(218

)

(95

)

Total other (expenses) income,

net

(7,656

)

(7,873

)

(14,882

)

(15,190

)

Loss before taxes

(15,530

)

(15,406

)

(24,244

)

(25,122

)

Provision for income taxes

(185

)

(164

)

(345

)

(330

)

Net loss

(15,715

)

(15,570

)

(24,589

)

(25,452

)

Net income attributable to non-controlling

interest

(15

)

(1

)

(26

)

(25

)

Net loss attributable to common

stockholders

$

(15,730

)

$

(15,571

)

$

(24,615

)

$

(25,477

)

Weighted-average shares outstanding -

basic and diluted

56,680

56,629

56,661

56,628

Basic and diluted net loss per share

attributable to common stockholders

$

(0.28

)

$

(0.27

)

$

(0.43

)

$

(0.45

)

ORION OFFICE REIT INC.

FFO, CORE FFO and FAD (In thousands, except for per share

data) (Unaudited)

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Net loss attributable to common

stockholders

$

(15,730

)

$

(15,571

)

$

(24,615

)

$

(25,477

)

Adjustments:

Depreciation and amortization of real

estate assets

27,852

33,811

55,994

68,148

Impairment of real estate

11,819

7,758

15,573

9,360

Proportionate share of Unconsolidated

Joint Venture adjustments for items above, as applicable

463

461

925

922

FFO attributable to common

stockholders

$

24,404

$

26,459

$

47,877

$

52,953

Transaction related

150

141

255

204

Spin related

—

208

—

964

Amortization of deferred financing

costs

1,059

1,057

2,108

2,228

Amortization of deferred lease

incentives

100

—

201

—

Equity-based compensation

689

439

1,215

709

Loss on extinguishment of debt, net

504

—

504

468

Proportionate share of Unconsolidated

Joint Venture adjustments for items above, as applicable

29

54

58

121

Core FFO attributable to common

stockholders

$

26,935

$

28,358

$

52,218

$

57,647

Amortization of above and below market

leases, net

(274

)

(315

)

(489

)

(635

)

Straight-line rental revenue

(2,275

)

(547

)

(4,959

)

(1,443

)

Unconsolidated Joint Venture basis

difference amortization

114

259

247

517

Capital expenditures and leasing costs

(2,172

)

(2,381

)

(5,510

)

(4,782

)

Other adjustments, net

74

63

205

126

Proportionate share of Unconsolidated

Joint Venture adjustments for items above, as applicable

(41

)

(59

)

(81

)

(117

)

Funds available for

distribution

$

22,361

$

25,378

$

41,631

$

51,313

Weighted-average shares outstanding -

basic

56,680

56,629

56,661

56,628

Effect of weighted-average dilutive

securities (1)

11

—

12

—

Weighted-average shares outstanding -

diluted

56,691

56,629

56,673

56,628

FFO attributable to common stockholders

per diluted share

$

0.43

$

0.47

$

0.84

$

0.94

Core FFO attributable to common

stockholders per diluted share

$

0.48

$

0.50

$

0.92

$

1.02

FAD per diluted share

$

0.39

$

0.45

$

0.73

$

0.91

____________________________________

(1)

Dilutive securities include unvested

restricted stock units net of assumed repurchases in accordance

with the treasury stock method and exclude performance-based

restricted stock units for which the performance thresholds have

not been met by the end of the applicable reporting period. Such

dilutive securities are not included when calculating net loss per

diluted share applicable to the Company for the three and six

months ended June 30, 2023 and 2022, as the effect would be

antidilutive.

ORION OFFICE REIT INC.

EBITDA, EBITDAre AND ADJUSTED EBITDA (In thousands)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Net loss attributable to common

stockholders

$

(15,730

)

$

(15,571

)

$

(24,615

)

$

(25,477

)

Adjustments:

Interest expense

7,222

7,867

14,361

14,714

Depreciation and amortization

27,877

33,828

56,043

68,181

Provision for income taxes

185

164

345

330

Proportionate share of Unconsolidated

Joint Venture adjustments for items above, as applicable

861

672

1,715

1,315

EBITDA

$

20,415

$

26,960

$

47,849

$

59,063

Impairment of real estate

11,819

7,758

15,573

9,360

EBITDAre

$

32,234

$

34,718

$

63,422

$

68,423

Transaction related

150

141

255

204

Spin related

—

208

—

964

Amortization of above and below market

leases, net

(274

)

(315

)

(489

)

(635

)

Amortization of deferred lease

incentives

100

—

201

—

Loss on extinguishment and forgiveness of

debt, net

504

—

504

468

Proportionate share of Unconsolidated

Joint Venture adjustments for items above, as applicable

(8

)

(8

)

(15

)

(15

)

Adjusted EBITDA

$

32,706

$

34,744

$

63,878

$

69,409

ORION OFFICE REIT INC.

FINANCIAL AND OPERATIONS STATISTICS AND RATIOS (Dollars in

thousands) (Unaudited)

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Interest expense - as reported

$

7,222

$

7,867

$

14,361

$

14,714

Adjustments:

Amortization of deferred financing costs

and other non-cash charges

(1,059

)

(1,057

)

(2,108

)

(2,228

)

Proportionate share of Unconsolidated

Joint Venture Interest Expense, excluding non-cash amortization

366

155

729

271

Interest Expense, excluding non-cash

amortization

$

6,529

$

6,965

$

12,982

$

12,757

Three Months Ended

Six Months Ended

Interest Coverage Ratio

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Interest Expense, excluding non-cash

amortization (1)

$

6,529

$

6,965

$

12,982

$

12,757

Adjusted EBITDA (2)

32,706

34,744

63,878

69,409

Interest Coverage Ratio

5.01x

4.99x

4.92x

5.44x

Fixed Charge Coverage Ratio

Interest Expense, excluding non-cash

amortization (1)

$

6,529

$

6,965

$

12,982

$

12,757

Secured debt principal amortization

—

—

—

—

Total fixed charges

6,529

6,965

12,982

12,757

Adjusted EBITDA (2)

32,706

34,744

63,878

69,409

Fixed Charge Coverage Ratio

5.01x

4.99x

4.92x

5.44x

____________________________________

(1)

Refer to the Statement of Operations for

interest expense calculated in accordance with GAAP and to the

Supplemental Information Package for the required reconciliation to

the most directly comparable GAAP financial measure.

(2)

Refer to the Statement of Operations for

net income calculated in accordance with GAAP and to the EBITDAre

and Adjusted EBITDA table in the Supplemental Information Package

for the required reconciliation to the most directly comparable

GAAP financial measure.

Net Debt

June 30, 2023

December 31, 2022

Mortgages payable, net

$

352,509

$

352,167

Credit facility term loan, net

—

173,815

Credit facility revolver

175,000

—

Total debt - as reported

527,509

525,982

Deferred financing costs, net

2,491

4,018

Principal Outstanding

530,000

530,000

Proportionate share of Unconsolidated

Joint Venture Principal Outstanding

27,332

27,332

Adjusted Principal Outstanding

$

557,332

$

557,332

Cash and cash equivalents

(42,209

)

(20,638

)

Proportionate share of Unconsolidated

Joint Venture cash and cash equivalents

(705

)

(572

)

Net Debt

$

514,418

$

536,122

ORION OFFICE REIT INC.

FINANCIAL AND OPERATIONS STATISTICS AND RATIOS (Dollars in

thousands) (Unaudited)

June 30, 2023

December 31, 2022

Total real estate investments, at cost

- as reported

$

1,340,751

$

1,366,625

Adjustments:

Gross intangible lease assets

345,416

360,690

Gross intangible lease liabilities

(31,317

)

(31,317

)

Gross assets held for sale

16,293

2,544

Proportionate share of Unconsolidated

Joint Venture Gross Real Estate Investments

45,451

45,427

Gross Real Estate Investments

$

1,716,594

$

1,743,969

June 30, 2023

December 31, 2022

Net Debt Ratios

Net Debt (1)

$

514,418

$

536,122

Adjusted EBITDA (2)

130,824

132,210

Net Debt to Adjusted EBITDA Ratio (2)

3.93x

4.06x

Net Debt (1)

$

514,418

$

536,122

Gross Real Estate Investments (1)

1,716,594

1,743,969

Net Debt Leverage Ratio

30.0

%

30.7

%

Unencumbered Assets/Real Estate

Assets

Unencumbered Gross Real Estate

Investments

$

1,112,811

$

1,141,035

Gross Real Estate Investments (1)

1,716,594

1,743,969

Unencumbered Asset Ratio

64.8

%

65.4

%

____________________________________

(1)

Refer to the Balance Sheets for total debt

and real estate investments, at cost calculated in accordance with

GAAP and to the table above for the required reconciliation to the

most directly comparable GAAP financial measure.

(2)

Adjusted EBITDA for the quarter ended June

30, 2023 has been annualized for the purpose of this

calculation.

ORION OFFICE REIT INC. CORE FUNDS

FROM OPERATIONS PER DILUTED SHARE - 2023 GUIDANCE

(Unaudited)

The Company expects its 2023 Core FFO per diluted share to be in

a range between $1.59 and $1.63. This guidance assumes:

- General & Administrative Expenses: $18.25 million to $18.75

million

- Net Debt to Adjusted EBITDA: 4.3x to 5.0x

The estimated net income per diluted share is not a projection

and is provided solely to satisfy the disclosure requirements of

the U.S. Securities and Exchange Commission.

The Company does not provide a reconciliation of Net Debt to

Adjusted EBITDA guidance to the most directly comparable GAAP

measure, due to the inherent difficulty and uncertainty in

quantifying certain adjustments principally related to the

Company’s investment in the unconsolidated joint venture.

Low

High

Diluted net income per share attributable

to common stockholders

$

(0.55

)

$

(0.51

)

Depreciation and amortization of real

estate assets

1.94

1.94

Proportionate share of adjustments for

Unconsolidated Joint Venture

0.05

0.05

FFO attributable to common stockholders

per diluted share

1.44

1.48

Adjustments (1)

0.15

0.15

Core FFO attributable to common

stockholders per diluted share

$

1.59

$

1.63

____________________________________

(1)

Includes transaction related expenses,

amortization of deferred lease incentives, amortization of deferred

financing costs, equity-based compensation, and our proportionate

share of such adjustments for the Unconsolidated Joint Venture.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230809222558/en/

Investor Relations: Email: investors@onlreit.com Phone:

602-675-0338

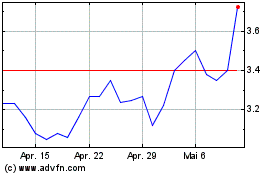

Orion Properties (NYSE:ONL)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Orion Properties (NYSE:ONL)

Historical Stock Chart

Von Apr 2024 bis Apr 2025