false

0000712770

0000712770

2024-05-07

2024-05-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 7, 2024

ONE LIBERTY PROPERTIES, INC.

(Exact

name of Registrant as specified in charter)

| Maryland |

|

001-09279 |

|

13-3147497 |

(State or other jurisdiction

of incorporation) |

|

(Commission file No.) |

|

(IRS Employer

I.D. No.) |

| 60 Cutter Mill Road, Suite 303, Great Neck, New York |

|

11021 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s

telephone number, including area code: 516-466-3100

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

OLP |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405)

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

May 7, 2024, we issued a press release announcing our results of operations for the quarter ended March 31, 2024. The press release is

attached as Exhibit 99.1 to this Current Report on Form 8-K.

This

information and the exhibit attached hereto are being furnished pursuant to Item 2.02 of Form 8-K and are not to be considered "filed"

under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and shall not be incorporated by reference into

any previous or future filing by the registrant under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit No. |

|

Description

of Exhibit |

| 99.1 |

|

Press release dated May 7, 2024. |

| 101 |

|

Cover

Page Interactive Data File - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded

within the Inline XBRL document. |

| 104 |

|

Cover

Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ONE LIBERTY PROPERTIES, INC. |

| |

|

|

| Date: May 7, 2024 |

By: |

/s/ Isaac Kalish |

| |

|

Isaac Kalish, |

| |

|

Senior Vice President and |

| |

|

Chief Financial Officer |

2

Exhibit 99.1

ONE LIBERTY PROPERTIES REPORTS FIRST QUARTER

2024

RESULTS

— Closes Acquisition

of Industrial Property—

— Sells Two Assets and Secures Contracts for Three Additional Sales —

GREAT NECK, New York, May 7, 2024 —

One Liberty Properties, Inc. (the “Company” or “One Liberty”) (NYSE: OLP), a real estate investment trust focused

on net leased properties, today announced operating results for the quarter ended March 31, 2024.

“We remained focused on the goal of transforming

our portfolio towards industrial ownership in the first quarter, working to execute on targeted and opportunistic sales and strategic

acquisitions. These efforts led to the sale during the quarter of a restaurant, and subsequent to quarter end, to the addition of an industrial

property, along with the sales and pending sales of four assets, including the sales of two retail properties and a restaurant,”

stated Patrick J. Callan, Jr., One Liberty’s President and Chief Executive Officer. “While the macro-economic outlook remains

uncertain, we believe our thoughtful and disciplined approach will allow us over-time to continue strengthening our portfolio and sustainably

growing our cashflow.”

Operating Results:

Rental income was $22.4 million in the first quarter

of 2024 compared to $23.0 million in the same prior year quarter. The change is due primarily to the sale of properties in 2023.

Total operating expenses were relatively flat at

$14.5 million in the first quarter of 2024 compared to $14.4 million in 2023.

Net income attributable to

One Liberty in the first quarter of 2024 was $5.2 million, or $0.23 per diluted share, compared to $5.4 million, or $0.25 per

diluted share, in the first quarter of 2023. Net income for the 2024 quarter includes a $1.8 million, or $0.08 per diluted share,

gain on sale of real estate. Net income for the 2023 quarter includes a $1.5 million, or $0.07 per diluted share, gain on sale of

real estate.

Funds from Operations, or FFO1,

was $9.6 million, or $0.45 per diluted share, for the first quarter of 2024, compared to $10.1 million, or $0.47 per diluted share, in

the first quarter of 2023. The change is due primarily to a decrease in rental income; the Company had previously communicated that it

anticipated such reduction due to the sale of 11 assets in 2023.

Adjusted Funds from Operations, or AFFO, was $10.2

million, or $0.48 per diluted share, for the quarter ended March 31, 2024, compared to $10.8 million, or $0.50 per diluted share, for

the corresponding quarter in the prior year. The change in AFFO is due primarily to the factors contributing to the changes in FFO.

| 1. | A description and reconciliation of non-GAAP financial measures (i.e., FFO and AFFO)

to GAAP financial measures is presented later in this release. |

Balance Sheet:

At March 31, 2024, the Company had $27.4 million

of cash and cash equivalents, total assets of $755.7 million, total debt of $416.5 million, and total One Liberty Properties, Inc. stockholders’

equity of $304.8 million.

At May 1, 2024, One Liberty’s available liquidity

was $115.1 million, including $15.1 million of cash and cash equivalents and $100.0 million available under the credit facility.

Transactions:

Dispositions

During the quarter, the Company sold a pad site

at a multi-tenant retail shopping center in Lakewood, Colorado, which it owned through a consolidated joint venture, for $2.9 million,

and recognized its $1.6 million share of the gain on the sale.

Subsequent to quarter end, the Company sold a restaurant

for a sales price of $2.8 million and an expected gain of approximately $1.0 million. In addition, the sale of two retail properties,

one of which is vacant, and an industrial property are expected to be completed in the second quarter for a sales price of $16.1 million

and an anticipated gain of $5.4 million. The sale of these four properties, after the repayment of mortgage debt, will generate net proceeds

of approximately $13 million to $14 million. During 2023, these four properties contributed $1.1 million of rental income and $557,000

of operating expenses, including $477,000 of depreciation and amortization expense.

Acquisition

On April 24, 2024, the Company acquired a 63,421

square foot industrial property located on a 5.28-acre lot in Albuquerque, New Mexico for $6.5 million. The lease currently provides for

an annual base rent of $431,000, with annual increases of 1.5%. The property is well-located 0.5 miles from I-25 and 1.5 miles from Albuquerque

Sunport, the largest airport in New Mexico. The building has high clear heights of 25 feet to 32 feet and ample loading with 17 dock doors.

The property is triple-net leased through 2031 to Quality Custom Distribution Services, Inc, a nationwide distributor of products to quick

service restaurants and the lease is guaranteed by Golden State Enterprises Inc.

Non-GAAP Financial Measures:

One Liberty computes FFO in accordance with the

“White Paper on Funds from Operations” issued by the National Association of Real Estate Investment Trusts (“NAREIT”)

and NAREIT’s related guidance. FFO is defined in the White Paper as net income (calculated in accordance with GAAP), excluding depreciation

and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in

control, impairment write-downs of certain real estate assets and investments in entities where the impairment is directly attributable

to decreases in the value of depreciable real estate held by the entity. Adjustments for unconsolidated partnerships and joint ventures

are calculated to reflect FFO on the same basis. In computing FFO, management does not add back to net income the amortization of costs

in connection with its financing activities or depreciation of non-real estate assets.

One Liberty computes AFFO by adjusting from FFO

for straight-line rent accruals and amortization of lease intangibles, deducting from income additional rent from ground lease tenant,

income on settlement of litigation, income on insurance recoveries from casualties, lease termination and assignment fees, and adding

back amortization of restricted stock and restricted stock unit compensation expense, amortization of costs in connection with its financing

activities (including its share of its unconsolidated joint ventures), debt prepayment costs and amortization of lease incentives and

mortgage intangible assets. Since the NAREIT White Paper does not provide guidelines for computing AFFO, the computation of AFFO varies

from one REIT to another.

One Liberty believes that FFO and AFFO are useful

and standard supplemental measures of the operating performance for equity REITs and are used frequently by securities analysts, investors

and other interested parties in evaluating equity REITs, many of which present FFO and AFFO when reporting their operating results. FFO

and AFFO are intended to exclude GAAP historical cost depreciation and amortization of real estate assets, which assumes that the value

of real estate assets diminish predictability over time. In fact, real estate values have historically risen and fallen with market conditions.

As a result, management believes that FFO and AFFO provide a performance measure that when compared year-over-year, should reflect the

impact to operations from trends in occupancy rates, rental rates, operating costs, interest costs and other matters without the inclusion

of depreciation and amortization, providing a perspective that may not be necessarily apparent from net income. Management also considers

FFO and AFFO to be useful in evaluating potential property acquisitions.

FFO and AFFO do not represent net income or cash

flows from operating, investing or financing activities as defined by GAAP. FFO and AFFO should not be considered an alternative to net

income as a reliable measure of our operating performance nor as an alternative to cash flows from operating, investing or financing activities

as measures of liquidity. FFO and AFFO do not measure whether cash flow is sufficient to fund all of the Company’s cash needs, including

principal amortization, capital improvements and distributions to stockholders.

Management recognizes that there are limitations

in the use of FFO and AFFO. In evaluating the Company’s performance, management is careful to examine GAAP measures such as net

income and cash flows from operating, investing and financing activities.

Forward Looking Statement:

Certain information contained in this press release,

together with other statements and information publicly disseminated by One Liberty Properties, Inc. is forward looking within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. We intend

such forward looking statements to be covered by the safe harbor provision for forward looking statements contained in the Private Securities

Litigation Reform Act of 1995 and include this statement for the purpose of complying with these safe harbor provisions. Forward looking

statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identifiable

by use of the words “may,” “will,” “could,” “believe,” “expect,” “intend,”

“anticipate,” “estimate,” “project,” or similar expressions or variations thereof. Information regarding

important factors that could cause actual outcomes or other events to differ materially from any such forward looking statements appear

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and the reports filed with the Securities and Exchange

Commission thereafter; in particular, the sections of such reports entitled “Cautionary Note Regarding Forward Looking Statements”,

“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”,

included therein. In addition, estimates of base rent or rental income for 2024 or thereafter excludes any related variable rent, anticipated

property purchases and/or sales may not be completed during the period indicated or at all, and estimates of gains from property sales

are subject to adjustment, among other things, because actual closing costs may differ from the estimated costs. You should not rely on

forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond

the Company’s control and which could materially affect the Company’s actual results, financial condition, cash flows, performance

or future achievements.

About One Liberty Properties:

One Liberty is a self-administered and self-managed

real estate investment trust incorporated in Maryland in 1982. The Company acquires, owns and manages a geographically diversified portfolio

consisting primarily of industrial properties. Many of these properties are subject to long-term net leases under which the tenant is

typically responsible for the property’s real estate taxes, insurance and ordinary maintenance and repairs.

Contact:

One Liberty Properties

Investor Relations

Phone: (516) 466-3100

www.onelibertyproperties.com

ONE LIBERTY PROPERTIES, INC.

CONDENSED BALANCE SHEETS

(Amounts in Thousands)

| | |

(Unaudited) | | |

| |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Real estate investments, at cost | |

$ | 864,624 | | |

$ | 864,655 | |

| Accumulated depreciation | |

| (187,346 | ) | |

| (182,705 | ) |

| Real estate investments, net | |

| 677,278 | | |

| 681,950 | |

| | |

| | | |

| | |

| Investment in unconsolidated joint ventures | |

| 2,104 | | |

| 2,051 | |

| Cash and cash equivalents | |

| 27,373 | | |

| 26,430 | |

| Unbilled rent receivable | |

| 16,872 | | |

| 16,661 | |

| Unamortized intangible lease assets, net | |

| 13,650 | | |

| 14,681 | |

| Other assets | |

| 18,392 | | |

| 19,833 | |

| Total assets | |

$ | 755,669 | | |

$ | 761,606 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Mortgages payable, net | |

$ | 416,539 | | |

$ | 418,347 | |

| Line of credit | |

| — | | |

| — | |

| Unamortized intangible lease liabilities, net | |

| 9,679 | | |

| 10,096 | |

| Other liabilities | |

| 23,401 | | |

| 25,418 | |

| Total liabilities | |

| 449,619 | | |

| 453,861 | |

| | |

| | | |

| | |

| Total One Liberty Properties, Inc. stockholders’ equity | |

| 304,834 | | |

| 306,703 | |

| Non-controlling interests in consolidated joint ventures | |

| 1,216 | | |

| 1,042 | |

| Total equity | |

| 306,050 | | |

| 307,745 | |

| Total liabilities and equity | |

$ | 755,669 | | |

$ | 761,606 | |

ONE LIBERTY PROPERTIES, INC. (NYSE: OLP)

(Amounts in Thousands, Except Per Share Data)

(Unaudited)

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Revenues: | |

| | |

| |

| Rental income, net | |

$ | 22,446 | | |

$ | 22,952 | |

| Lease termination fee | |

| 250 | | |

| — | |

| Total revenues | |

| 22,696 | | |

| 22,952 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Depreciation and amortization | |

| 6,021 | | |

| 6,145 | |

| General and administrative | |

| 3,923 | | |

| 4,039 | |

| Real estate expenses | |

| 4,470 | | |

| 4,124 | |

| State taxes | |

| 63 | | |

| 68 | |

| Total operating expenses | |

| 14,477 | | |

| 14,376 | |

| | |

| | | |

| | |

| Other operating income | |

| | | |

| | |

| Gain on sale of real estate, net | |

| 1,784 | | |

| 1,534 | |

| Operating income | |

| 10,003 | | |

| 10,110 | |

| | |

| | | |

| | |

| Other income and expenses: | |

| | | |

| | |

| Equity in earnings of unconsolidated joint ventures | |

| 53 | | |

| 85 | |

| Other income | |

| 267 | | |

| 15 | |

| Interest: | |

| | | |

| | |

| Expense | |

| (4,717 | ) | |

| (4,600 | ) |

| Amortization and write-off of deferred financing costs | |

| (226 | ) | |

| (202 | ) |

| | |

| | | |

| | |

| Net income | |

| 5,380 | | |

| 5,408 | |

| Net income attributable to non-controlling interests | |

| (225 | ) | |

| (22 | ) |

| Net income attributable to One Liberty Properties, Inc. | |

$ | 5,155 | | |

$ | 5,386 | |

| | |

| | | |

| | |

| Net income per share attributable to common stockholders - diluted | |

$ | .23 | | |

$ | .25 | |

| | |

| | | |

| | |

| Funds from operations - Note 1 | |

$ | 9,559 | | |

$ | 10,113 | |

| Funds from operations per common share - diluted - Note 2 | |

$ | .45 | | |

$ | .47 | |

| | |

| | | |

| | |

| Adjusted funds from operations - Note 1 | |

$ | 10,210 | | |

$ | 10,803 | |

| Adjusted funds from operations per common share - diluted - Note 2 | |

$ | .48 | | |

$ | .50 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | |

| Basic | |

| 20,509 | | |

| 20,514 | |

| Diluted | |

| 20,579 | | |

| 20,579 | |

ONE LIBERTY PROPERTIES, INC. (NYSE: OLP)

(Amounts in Thousands, Except Per Share Data)

(Unaudited)

| | |

Three Months Ended | |

| | |

March 31, | |

| Note 1: | |

2024 | | |

2023 | |

| NAREIT funds from operations is summarized in the following table: | |

| | |

| |

| GAAP net income attributable to One Liberty Properties, Inc. | |

$ | 5,155 | | |

$ | 5,386 | |

| Add: depreciation and amortization of properties | |

| 5,832 | | |

| 5,969 | |

| Add: our share of depreciation and amortization of unconsolidated joint ventures | |

| 6 | | |

| 130 | |

| Add: amortization of deferred leasing costs | |

| 189 | | |

| 176 | |

| Add: our share of amortization of deferred leasing costs of unconsolidated joint ventures | |

| — | | |

| 4 | |

| Deduct: gain on sale of real estate, net | |

| (1,784 | ) | |

| (1,534 | ) |

| Adjustments for non-controlling interests | |

| 161 | | |

| (18 | ) |

| NAREIT funds from operations applicable to common stock | |

| 9,559 | | |

| 10,113 | |

| Deduct: straight-line rent accruals and amortization of lease intangibles | |

| (661 | ) | |

| (893 | ) |

| Deduct: our share of straight-line rent accruals and amortization of lease intangibles of unconsolidated joint ventures | |

| (1 | ) | |

| (5 | ) |

| Deduct: lease termination fee income | |

| (250 | ) | |

| — | |

| Deduct: other income | |

| (27 | ) | |

| — | |

| Add: amortization of restricted stock and RSU compensation | |

| 1,272 | | |

| 1,328 | |

| Add: amortization and write-off of deferred financing costs | |

| 226 | | |

| 202 | |

| Add: amortization of lease incentives | |

| 30 | | |

| 31 | |

| Add: amortization of mortgage intangible assets | |

| 34 | | |

| 23 | |

| Add: our share of amortization of deferred financing costs of unconsolidated joint venture | |

| — | | |

| 4 | |

| Adjustments for non-controlling interests | |

| 28 | | |

| — | |

| Adjusted funds from operations applicable to common stock | |

$ | 10,210 | | |

$ | 10,803 | |

| | |

| | | |

| | |

| Note 2: | |

| | | |

| | |

| NAREIT funds from operations is summarized in the following table: | |

| | | |

| | |

| GAAP net income attributable to One Liberty Properties, Inc. | |

$ | .23 | | |

$ | .25 | |

| Add: depreciation and amortization of properties | |

| .28 | | |

| .27 | |

| Add: our share of depreciation and amortization of unconsolidated joint ventures | |

| — | | |

| .01 | |

| Add: amortization of deferred leasing costs | |

| .01 | | |

| .01 | |

| Add: our share of amortization of deferred leasing costs of unconsolidated joint ventures | |

| — | | |

| — | |

| Deduct: gain on sale of real estate, net | |

| (.08 | ) | |

| (.07 | ) |

| Adjustments for non-controlling interests | |

| .01 | | |

| — | |

| NAREIT funds from operations per share of common stock - diluted (a) | |

| .45 | | |

| .47 | |

| Deduct: straight-line rent accruals and amortization of lease intangibles | |

| (.03 | ) | |

| (.04 | ) |

| Deduct: our share of straight-line rent accruals and amortization of lease intangibles of unconsolidated joint ventures | |

| — | | |

| — | |

| Deduct: lease termination fee income | |

| (.01 | ) | |

| — | |

| Deduct: other income | |

| — | | |

| — | |

| Add: amortization of restricted stock and RSU compensation | |

| .06 | | |

| .06 | |

| Add: amortization and write-off of deferred financing costs | |

| .01 | | |

| .01 | |

| Add: amortization of lease incentives | |

| — | | |

| — | |

| Add: amortization of mortgage intangible assets | |

| — | | |

| — | |

| Add: our share of amortization of deferred financing costs of unconsolidated joint venture | |

| — | | |

| — | |

| Adjustments for non-controlling interests | |

| — | | |

| — | |

| Adjusted funds from operations per share of common stock - diluted (a) | |

$ | .48 | | |

$ | .50 | |

| (a) |

The weighted average

number of diluted common shares used to compute FFO and AFFO applicable to common stock includes unvested restricted shares that are

excluded from the computation of diluted EPS. |

7

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

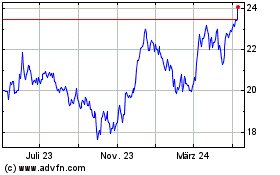

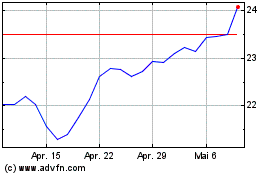

One Liberty Properties (NYSE:OLP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

One Liberty Properties (NYSE:OLP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024