0000074303false00000743032023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2023

OLIN CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Virginia | 1-1070 | 13-1872319 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 190 Carondelet Plaza, | Suite 1530 | Clayton, | MO | 63105 |

| (Address of principal executive offices) | (Zip Code) |

(314) 480-1400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $1.00 par value per share | | OLN | | New York Stock Exchange |

| | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | | | |

| ☐ | Emerging growth company |

| | | | | | | |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 2.02. Results of Operations and Financial Condition.

On October 26, 2023, Olin Corporation (“Olin”) issued a press release announcing financial results for the third quarter ended September 30, 2023. Attached as Exhibit 99.1, and incorporated by reference into this Item 2.02, is a copy of Olin’s press release dated October 26, 2023.

Item 7.01. Regulation FD Disclosure.

On October 26, 2023, Olin’s Board of Directors declared a quarterly dividend of $0.20 on each share of Olin common stock. The dividend is payable on December 8, 2023 to shareholders of record at the close of business on November 9, 2023. This marks Olin’s 388th consecutive quarterly dividend.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

(d) Exhibit No. | Exhibit |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| OLIN CORPORATION |

| By: | /s/ Dana O’Brien |

| | Name: | Dana O’Brien |

| | Title: | Senior Vice President, General Counsel and Secretary |

Date: October 26, 2023

Exhibit 99.1

Investor Contact: Steve Keenan

(314) 719-1755

InvestorRelations@Olin.com

News

NewsOlin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105

Olin Announces Third Quarter 2023 Results

Highlights

•Third quarter 2023 net income of $104.1 million, or $0.82 per diluted share

•Quarterly adjusted EBITDA of $314.8 million

•Share repurchases of $202.1 million in third quarter 2023

•Fourth quarter 2023 focus on actions to improve 2024

Clayton, MO, October 26, 2023 – Olin Corporation (NYSE: OLN) announced financial results for the third quarter ended September 30, 2023. Third quarter 2023 reported net income was $104.1 million, or $0.82 per diluted share, which compares to third quarter 2022 reported net income of $315.2 million, or $2.18 per diluted share. Third quarter 2023 adjusted EBITDA of $314.8 million excludes depreciation and amortization expense of $131.0 million and restructuring charges of $11.9 million. Third quarter 2022 adjusted EBITDA was $547.8 million. Sales in the third quarter 2023 were $1,671.4 million, compared to $2,321.7 million in the third quarter 2022.

Scott Sutton, Chairman, President, and Chief Executive Officer, said, “Despite the contracting demand environment over the last six quarters, Olin’s team continues to prove our model’s resilience and the ability to deliver higher trough level adjusted EBITDA and corresponding cash flows than the previous cycles’ peak results. We continue to prioritize share repurchases from excess cash flow with approximately 8% of outstanding shares repurchased so far in 2023.

"Although electrochemical unit (“ECU”) values have been declining in 2023, we believe the global conditions for our Chlor Alkali Products and Vinyls business are approaching a favorable inflection point. Therefore, our team has taken the dramatic step to considerably reduce our operating rates; thereby, further reducing our market participation and accelerating the favorable inflection point, as we remain disciplined in our approach to ECU values. We have idled our St. Gabriel, Louisiana, facility and our largest chlor alkali plant at our Freeport, Texas facility. This ‘value accelerator initiative’ is expected to reduce our fourth quarter 2023 adjusted EBITDA outlook by approximately $100 million compared to our previous expectation; however, we anticipate it should deliver an improved 2024 adjusted EBITDA compared to 2023. We expect Winchester segment fourth

quarter results to be similar to third quarter 2023 levels even as we perform our holiday shutdowns. Overall, we expect Olin’s fourth quarter 2023 adjusted EBITDA to be in the $200 million range.”

SEGMENT REPORTING

Olin defines segment earnings as income (loss) before interest expense, interest income, other operating income (expense), non-operating pension income, other income, and income taxes.

CHLOR ALKALI PRODUCTS AND VINYLS

In first quarter 2023, the Blue Water Alliance joint venture began operations and is consolidated in our Chlor Alkali Products and Vinyls segment. Chlor Alkali Products and Vinyls sales for the third quarter 2023 were $969.6 million, compared to $1,263.5 million in the third quarter 2022. The decrease in Chlor Alkali Products and Vinyls sales was primarily due to 6% lower volumes, lower pricing, and a less favorable mix. Third quarter 2023 segment earnings were $172.3 million, compared to $253.9 million in the third quarter 2022. The $81.6 million decrease in segment earnings was primarily due to lower volumes and lower pricing, primarily caustic soda, partially offset by lower raw material and operating costs. The Chlor Alkali Products and Vinyls third quarter 2023 segment results were also negatively impacted by higher costs and reduced profit from lost sales associated with operating issues, related to the previous quarter’s maintenance turnaround at our vinyl chloride monomer plant at the Freeport, Texas facility. The vinyl chloride monomer plant resumed normal operations in the latter half of the third quarter. Chlor Alkali Products and Vinyls third quarter 2023 results included depreciation and amortization expense of $107.6 million compared to $121.1 million in the third quarter 2022.

EPOXY

Epoxy sales for the third quarter 2023 were $321.6 million, compared to $644.1 million in the third quarter 2022. The decrease in Epoxy sales was primarily due to lower product pricing, lower resin and systems volumes, and $163.8 million of lower cumene and bisphenol A sales. As part of the Epoxy business restructuring actions to right-size our global asset footprint to the most cost-effective asset base to support our strategic operating model, the Epoxy business ceased operations at our cumene facility in Terneuzen, Netherlands in first quarter 2023 and one of our bisphenol A production lines at our Stade, Germany facility in fourth quarter 2022. Third quarter 2023 segment loss was ($28.8) million, compared to segment earnings of $80.1 million in the third quarter 2022. The $108.9 million decrease in Epoxy segment earnings was primarily due to lower pricing and incremental costs associated with inventory reduction, partially offset by lower raw material and operating costs, mainly decreased natural gas and electrical power costs, and an improved product mix. Epoxy third quarter 2023 results included depreciation and amortization expense of $14.7 million compared to $20.1 million in the third quarter 2022.

WINCHESTER

Winchester sales for the third quarter 2023 were $380.2 million, compared to $414.1 million in the third quarter 2022. The decrease in Winchester sales was primarily due to lower commercial ammunition shipments and

pricing, partially offset by higher domestic and international military sales. Third quarter 2023 segment earnings were $64.5 million, compared to $89.0 million in the third quarter 2022. The $24.5 million decrease in segment earnings was primarily due to lower commercial ammunition shipments and pricing, partially offset by higher military sales and lower operating costs. Winchester third quarter 2023 results included depreciation and amortization expense of $6.6 million compared to $6.1 million in the third quarter 2022.

CORPORATE AND OTHER COSTS

Other corporate and unallocated costs in third quarter of 2023 decreased $4.6 million compared to third quarter 2022 primarily due to lower legal-related costs.

LIQUIDITY AND SHARE REPURCHASES

The cash balance on September 30, 2023, was $158.3 million and Olin ended third quarter 2023 with net debt of approximately $2.6 billion and a net debt to adjusted EBITDA ratio of 1.7 times. On September 30, 2023, Olin had approximately $1.2 billion of available liquidity.

During third quarter 2023, approximately 3.7 million shares of common stock were repurchased at a cost of $202.1 million. During the first nine months of 2023, approximately 10.8 million shares of common stock were repurchased at a cost of $595.1 million. On September 30, 2023, Olin had approximately $1.1 billion available under its current share repurchase authorization.

CONFERENCE CALL INFORMATION

Olin senior management will host a conference call to discuss third quarter 2023 financial results at 9:00 a.m. Eastern time on Friday, October 27, 2023. Remarks will be followed by a question-and-answer session. Associated slides, which will be available the evening before the call, and the conference call webcast will be accessible via Olin’s website, www.olin.com, under the third quarter conference call icon. An archived replay of the webcast will also be available in the Investor Relations section of Olin’s website beginning at 12:00 p.m. Eastern time. A final transcript of the call will be posted the next business day.

COMPANY DESCRIPTION

Olin Corporation is a leading vertically-integrated global manufacturer and distributor of chemical products and a leading U.S. manufacturer of ammunition. The chemical products produced include chlorine and caustic soda, vinyls, epoxies, chlorinated organics, bleach, hydrogen, and hydrochloric acid. Winchester’s principal manufacturing facilities produce and distribute sporting ammunition, law enforcement ammunition, reloading components, small caliber military ammunition and components, industrial cartridges, and clay targets.

Visit www.olin.com for more information on Olin.

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements. These statements relate to analyses and other information that are based on management's beliefs, certain assumptions made by management, forecasts of future results, and current expectations, estimates and projections about the markets and economy in which we and our various segments operate. The statements contained in this communication that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words "anticipate," "intend," "may," "expect," "believe," "should," "plan," "outlook," "project," "estimate," "forecast," "optimistic," “target,” and variations of such words and similar expressions in this communication to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the Company’s intent to repurchase, from time to time, the Company’s common stock. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. We undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The payment of cash dividends is subject to the discretion of our board of directors and will be determined in light of then-current conditions, including our earnings, our operations, our financial conditions, our capital requirements and other factors deemed relevant by our board of directors. In the future, our board of directors may change our dividend policy, including the frequency or amount of any dividend, in light of then-existing conditions.

The risks, uncertainties and assumptions involved in our forward-looking statements, many of which are discussed in more detail in our filings with the SEC, including without limitation the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2022, and our Quarterly Reports on Form 10-Q and other reports furnished or filed with the SEC, include, but are not limited to, the following:

Business, Industry and Operational Risks

•sensitivity to economic, business and market conditions in the United States and overseas, including economic instability or a downturn in the sectors served by us;

•declines in average selling prices for our products and the supply/demand balance for our products, including the impact of excess industry capacity or an imbalance in demand for our chlor alkali products;

•unsuccessful execution of our strategic operating model, which prioritizes Electrochemical Unit (ECU) margins over sales volumes;

•failure to control costs and inflation impacts or failure to achieve targeted cost reductions;

•our reliance on a limited number of suppliers for specified feedstock and services and our reliance on third-party transportation;

•the occurrence of unexpected manufacturing interruptions and outages, including those occurring as a result of labor disruptions, production hazards and weather-related events;

•availability of and/or higher-than-expected costs of raw material, energy, transportation, and/or logistics;

•the failure or an interruption of our information technology systems;

•failure to identify, attract, develop, retain and motivate qualified employees throughout the organization;

•our inability to complete future acquisitions or joint venture transactions or successfully integrate them into our business;

•risks associated with our international sales and operations, including economic, political or regulatory changes;

•the negative impact from a public health crisis, such as a pandemic, epidemic or outbreak of infectious disease, including the COVID-19 pandemic and the global response to the pandemic, including without limitation adverse impacts in complying with governmental mandates;

•our indebtedness and debt service obligations;

•weak industry conditions affecting our ability to comply with the financial maintenance covenants in our senior credit facility;

•adverse conditions in the credit and capital markets, limiting or preventing our ability to borrow or raise capital;

•the effects of any declines in global equity markets on asset values and any declines in interest rates or other significant assumptions used to value the liabilities in, and funding of, our pension plans;

•our long-range plan assumptions not being realized causing a non-cash impairment charge of long-lived assets;

Legal, Environmental and Regulatory Risks

•changes in, or failure to comply with, legislation or government regulations or policies, including changes regarding our ability to manufacture or use certain products and changes within the international markets in which we operate;

•new regulations or public policy changes regarding the transportation of hazardous chemicals and the security of chemical manufacturing facilities;

•unexpected outcomes from legal or regulatory claims and proceedings;

•costs and other expenditures in excess of those projected for environmental investigation and remediation or other legal proceedings;

•various risks associated with our Lake City U.S. Army Ammunition Plant contract and performance under other governmental contracts; and

•failure to effectively manage environmental, social and governance (ESG) issues and related regulations, including climate change and sustainability.

All of our forward-looking statements should be considered in light of these factors. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of our forward-looking statements.

2023-15

Olin Corporation

Consolidated Statements of Operations(a)

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | Nine Months Ended

September 30, |

| (In millions, except per share amounts) | 2023 | | 2022 | 2023 | | 2022 |

| Sales | $ | 1,671.4 | | | $ | 2,321.7 | | $ | 5,218.4 | | | $ | 7,399.2 | |

| Operating Expenses: | | | | | | |

| Cost of Goods Sold | 1,402.3 | | | 1,840.9 | | 4,236.6 | | | 5,599.8 | |

| Selling and Administration | 90.9 | | | 92.7 | | 303.9 | | | 296.0 | |

Restructuring Charges(b) | 11.9 | | | 7.6 | | 92.0 | | | 14.3 | |

Other Operating (Expense) Income(c) | (0.3) | | | 13.0 | | 27.2 | | | 16.3 | |

| Operating Income | 166.0 | | | 393.5 | | 613.1 | | | 1,505.4 | |

| Interest Expense | 46.2 | | | 36.0 | | 133.9 | | | 103.4 | |

| Interest Income | 1.0 | | | 0.5 | | 3.2 | | | 1.2 | |

| Non-operating Pension Income | 5.9 | | | 9.9 | | 17.0 | | | 29.0 | |

| Income before Taxes | 126.7 | | | 367.9 | | 499.4 | | | 1,432.2 | |

Income Tax Provision(d) | 22.2 | | | 52.7 | | 96.2 | | | 301.9 | |

| Net Income | 104.5 | | | 315.2 | | 403.2 | | | 1,130.3 | |

| Net Income (Loss) Attributable to Noncontrolling Interests | 0.4 | | | — | | (4.1) | | | — | |

| Net Income Attributable to Olin Corporation | $ | 104.1 | | | $ | 315.2 | | $ | 407.3 | | | $ | 1,130.3 | |

| Net Income Attributable to Olin Corporation Per Common Share: | | | | | | |

| Basic | $ | 0.84 | | | $ | 2.23 | | $ | 3.19 | | | $ | 7.62 | |

| Diluted | $ | 0.82 | | | $ | 2.18 | | $ | 3.12 | | | $ | 7.44 | |

| Dividends Per Common Share | $ | 0.20 | | | $ | 0.20 | | $ | 0.60 | | | $ | 0.60 | |

| Average Common Shares Outstanding - Basic | 124.2 | | | 141.2 | | 127.5 | | | 148.3 | |

| Average Common Shares Outstanding - Diluted | 127.0 | | | 144.3 | | 130.6 | | | 151.9 | |

(a)Unaudited.

(b)Restructuring charges for the nine months ended September 30, 2023 were primarily associated with our actions to configure our global Epoxy asset footprint to optimize the most productive and cost effective assets to support our strategic operating model of which $17.7 million were non-cash impairment charges for equipment and facilities.

(c)Other operating (expense) income for the nine months ended September 30, 2023 included a gain of $27.0 million for the sale of Olin's domestic private trucking fleet and operations. Other operating (expense) income for both the three and nine months ended September 30, 2022 included $13.0 million of gains for the sale of two former manufacturing facilities.

(d)Income tax provision for both the three and nine months ended September 30, 2022 included a benefit of $36.6 million primarily associated with the release of deferred tax liabilities as a result of a legal entity liquidation.

Olin Corporation

Segment Information(a)

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | Nine Months Ended

September 30, |

| (In millions) | 2023 | | 2022 | 2023 | | 2022 |

| Sales: | | | | | | |

| Chlor Alkali Products and Vinyls | $ | 969.6 | | | $ | 1,263.5 | | $ | 3,089.0 | | | $ | 3,912.2 | |

| Epoxy | 321.6 | | | 644.1 | | 1,016.1 | | | 2,206.3 | |

| Winchester | 380.2 | | | 414.1 | | 1,113.3 | | | 1,280.7 | |

| Total Sales | $ | 1,671.4 | | | $ | 2,321.7 | | $ | 5,218.4 | | | $ | 7,399.2 | |

| Income before Taxes: | | | | | | |

Chlor Alkali Products and Vinyls | $ | 172.3 | | | $ | 253.9 | | $ | 598.3 | | | $ | 929.0 | |

Epoxy | (28.8) | | | 80.1 | | (7.9) | | | 358.0 | |

Winchester | 64.5 | | | 89.0 | | 190.2 | | | 327.2 | |

| Corporate/Other: | | | | | | |

| Environmental Expense | (6.9) | | | (7.4) | | (23.1) | | | (18.0) | |

| Other Corporate and Unallocated Costs | (22.9) | | | (27.5) | | (79.6) | | | (92.8) | |

Restructuring Charges(b) | (11.9) | | | (7.6) | | (92.0) | | | (14.3) | |

Other Operating (Expense) Income(c) | (0.3) | | | 13.0 | | 27.2 | | | 16.3 | |

| Interest Expense | (46.2) | | | (36.0) | | (133.9) | | | (103.4) | |

| Interest Income | 1.0 | | | 0.5 | | 3.2 | | | 1.2 | |

| Non-operating Pension Income | 5.9 | | | 9.9 | | 17.0 | | | 29.0 | |

| Income before Taxes | $ | 126.7 | | | $ | 367.9 | | $ | 499.4 | | | $ | 1,432.2 | |

(a)Unaudited.

(b)Restructuring charges for the nine months ended September 30, 2023 were primarily associated with our actions to configure our global Epoxy asset footprint to optimize the most productive and cost effective assets to support our strategic operating model of which $17.7 million were non-cash impairment charges for equipment and facilities.

(c)Other operating (expense) income for the nine months ended September 30, 2023 included a gain of $27.0 million for the sale of Olin's domestic private trucking fleet and operations. Other operating (expense) income for both the three and nine months ended September 30, 2022 included $13.0 million of gains for the sale of two former manufacturing facilities.

Olin Corporation

Consolidated Balance Sheets(a)

| | | | | | | | | | | | | | | | | |

| September 30, | | December 31, | | September 30, |

| (In millions, except per share data) | 2023 | | 2022 | | 2022 |

| Assets: | | | | | |

| Cash and Cash Equivalents | $ | 158.3 | | | $ | 194.0 | | | $ | 163.6 | |

| Accounts Receivable, Net | 894.2 | | | 924.6 | | | 1,075.4 | |

| Income Taxes Receivable | 28.0 | | | 43.2 | | | 26.0 | |

| Inventories, Net | 977.7 | | | 941.9 | | | 945.1 | |

| Other Current Assets | 42.8 | | | 52.7 | | | 74.9 | |

| Total Current Assets | 2,101.0 | | | 2,156.4 | | | 2,285.0 | |

| Property, Plant and Equipment (Less Accumulated Depreciation of $4,724.6, $4,413.1 and $4,296.5) | 2,490.2 | | | 2,674.1 | | | 2,690.8 | |

| Operating Lease Assets, Net | 331.0 | | | 356.0 | | | 371.4 | |

| Deferred Income Taxes | 106.1 | | | 60.5 | | | 81.9 | |

| Other Assets | 1,117.3 | | | 1,102.5 | | | 1,090.7 | |

| Intangibles, Net | 248.6 | | | 273.8 | | | 279.2 | |

| Goodwill | 1,421.0 | | | 1,420.9 | | | 1,421.2 | |

| Total Assets | $ | 7,815.2 | | | $ | 8,044.2 | | | $ | 8,220.2 | |

| Liabilities and Shareholders’ Equity: | | | | | |

| Current Installments of Long-term Debt | $ | 78.9 | | | $ | 9.7 | | | $ | 1.0 | |

| Accounts Payable | 717.6 | | | 837.7 | | | 892.6 | |

| Income Taxes Payable | 171.5 | | | 133.4 | | | 183.2 | |

| Current Operating Lease Liabilities | 68.3 | | | 71.8 | | | 74.3 | |

| Accrued Liabilities | 361.0 | | | 508.8 | | | 467.6 | |

| Total Current Liabilities | 1,397.3 | | | 1,561.4 | | | 1,618.7 | |

| Long-term Debt | 2,711.2 | | | 2,571.0 | | | 2,580.4 | |

| Operating Lease Liabilities | 270.4 | | | 292.5 | | | 305.1 | |

| Accrued Pension Liability | 212.7 | | | 234.5 | | | 286.3 | |

| Deferred Income Taxes | 500.7 | | | 507.3 | | | 546.8 | |

| Other Liabilities | 355.4 | | | 333.9 | | | 333.2 | |

| Total Liabilities | 5,447.7 | | | 5,500.6 | | | 5,670.5 | |

| Commitments and Contingencies | | | | | |

| Shareholders’ Equity: | | | | | |

| Common Stock, $1.00 Par Value Per Share; Authorized 240.0 Shares; Issued and Outstanding 122.5, 132.3 and 137.0 Shares | 122.5 | | | 132.3 | | | 137.0 | |

| Additional Paid-in Capital | 130.1 | | | 682.7 | | | 920.3 | |

| Accumulated Other Comprehensive Loss | (480.3) | | | (495.9) | | | (562.3) | |

| Retained Earnings | 2,555.2 | | | 2,224.5 | | | 2,054.7 | |

| Olin Corporation’s Shareholder’s Equity | 2,327.5 | | | 2,543.6 | | | 2,549.7 | |

| Noncontrolling Interests | 40.0 | | | — | | | — | |

| Total Equity | 2,367.5 | | | 2,543.6 | | | 2,549.7 | |

| Total Liabilities and Equity | $ | 7,815.2 | | | $ | 8,044.2 | | | $ | 8,220.2 | |

(a)Unaudited.

Olin Corporation

Consolidated Statements of Cash Flows(a)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| (In millions) | 2023 | | 2022 |

| Operating Activities: | | | |

| Net Income | $ | 403.2 | | | $ | 1,130.3 | |

| Gains on Disposition of Property, Plant and Equipment | (27.0) | | | (13.0) | |

| Stock-based Compensation | 13.2 | | | 10.4 | |

| Depreciation and Amortization | 404.9 | | | 450.3 | |

| Deferred Income Taxes | (60.6) | | | (3.7) | |

| Write-off of Equipment and Facility included in Restructuring Charges | 17.7 | | | — | |

| Qualified Pension Plan Contributions | (1.6) | | | (0.9) | |

| Qualified Pension Plan Income | (15.0) | | | (24.7) | |

| Changes in: | | | |

| Receivables | 28.4 | | | (25.8) | |

| Income Taxes Receivable/Payable | 55.3 | | | 75.5 | |

| Inventories | (43.4) | | | (102.9) | |

| Other Current Assets | 9.8 | | | 5.8 | |

| Accounts Payable and Accrued Liabilities | (222.7) | | | 31.7 | |

| Other Assets | (27.2) | | | (17.5) | |

| Other Noncurrent Liabilities | 29.5 | | | (9.1) | |

| Other Operating Activities | (6.8) | | | 3.3 | |

| Net Operating Activities | 557.7 | | | 1,509.7 | |

| Investing Activities: | | | |

| Capital Expenditures | (173.0) | | | (168.4) | |

| Payments under Other Long-Term Supply Contracts | (46.2) | | | — | |

| Proceeds from Disposition of Property, Plant and Equipment | 28.8 | | | 14.9 | |

| Other Investing Activities | (3.6) | | | — | |

| Net Investing Activities | (194.0) | | | (153.5) | |

| Financing Activities: | | | |

| Long-term Debt Borrowings (Repayments), Net | 206.6 | | | (200.9) | |

| Common Stock Repurchased and Retired | (595.1) | | | (1,100.6) | |

| Stock Options Exercised | 22.3 | | | 21.3 | |

| Dividends Paid | (76.6) | | | (89.4) | |

| Contributions Received from Noncontrolling Interests | 44.1 | | | — | |

| Net Financing Activities | (398.7) | | | (1,369.6) | |

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | (0.7) | | | (3.5) | |

| Net Decrease in Cash and Cash Equivalents | (35.7) | | | (16.9) | |

| Cash and Cash Equivalents, Beginning of Year | 194.0 | | | 180.5 | |

| Cash and Cash Equivalents, End of Period | $ | 158.3 | | | $ | 163.6 | |

(a)Unaudited.

Olin Corporation

Non-GAAP Financial Measures - Adjusted EBITDA(a)

Olin's definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net income (loss) plus an add-back for depreciation and amortization, interest expense (income), income tax provision (benefit), other expense (income), restructuring charges and certain other non-recurring items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors as a supplemental financial measure to assess the financial performance without regard to financing methods, capital structures, taxes or historical cost basis. The use of non-GAAP financial measures is not intended to replace any measures of performance determined in accordance with GAAP and Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. Reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are omitted from this release because Olin is unable to provide such reconciliations without the use of unreasonable efforts. This inability results from the inherent difficulty in forecasting generally and quantifying certain projected amounts that are necessary for such reconciliations. In particular, sufficient information is not available to calculate certain adjustments required for such reconciliations, including interest expense (income), income tax provision (benefit), other expense (income) and restructuring charges. Because of our inability to calculate such adjustments, forward-looking net income guidance is also omitted from this release. We expect these adjustments to have a potentially significant impact on our future GAAP financial results.

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | Nine Months Ended

September 30, |

| (In millions) | 2023 | | 2022 | 2023 | | 2022 |

| Reconciliation of Net Income to Adjusted EBITDA: | | | | | | |

| Net Income | $ | 104.5 | | | $ | 315.2 | | $ | 403.2 | | | $ | 1,130.3 | |

Add Back: | | | | | | |

Interest Expense | 46.2 | | | 36.0 | | 133.9 | | | 103.4 | |

Interest Income | (1.0) | | | (0.5) | | (3.2) | | | (1.2) | |

| Income Tax Provision | 22.2 | | | 52.7 | | 96.2 | | | 301.9 | |

Depreciation and Amortization | 131.0 | | | 149.8 | | 404.9 | | | 450.3 | |

| EBITDA | 302.9 | | | 553.2 | | 1,035.0 | | | 1,984.7 | |

Add Back: | | | | | | |

| Restructuring Charges | 11.9 | | | 7.6 | | 92.0 | | | 14.3 | |

Certain Non-recurring Items (b) | — | | | (13.0) | | (27.0) | | | (13.0) | |

| Adjusted EBITDA | $ | 314.8 | | | $ | 547.8 | | $ | 1,100.0 | | | $ | 1,986.0 | |

(a)Unaudited.

(b)Certain non-recurring items for the nine months ended September 30, 2023 included a gain of $27.0 million for the sale of Olin's domestic private trucking fleet and operations. Certain non-recurring items for both the three and nine months ended September 30, 2022 included $13.0 million of gains for the sale of two former manufacturing facilities.

Olin Corporation

Non-GAAP Financial Measures - Net Debt to Adjusted EBITDA(a)

Olin's definition of Net Debt to Adjusted EBITDA is Net Debt divided by the Trailing Twelve Months Adjusted EBITDA. Net Debt at the end of any reporting period is defined as the sum of our current installments of long-term debt and long-term debt less cash and cash equivalents. Trailing Twelve Months Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net income (loss) plus an add-back for depreciation and amortization, interest expense (income), income tax provision (benefit), other expense (income), restructuring charges and certain other non-recurring items for the previous twelve months. Net Debt to Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors as a measure of our ability to manage our indebtedness. The use of non-GAAP financial measures is not intended to replace any measures of indebtedness or liquidity determined in accordance with GAAP and Net Debt or Net Debt to Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

| | | | | | | | | | | | | | | | | |

| September 30, | | December 31, | | September 30, |

| (In millions) | 2023 | | 2022 | | 2022 |

| Current Installments of Long-term Debt | $ | 78.9 | | | $ | 9.7 | | | $ | 1.0 | |

| Long-term Debt | 2,711.2 | | | 2,571.0 | | | 2,580.4 | |

| Total Debt | 2,790.1 | | | 2,580.7 | | | 2,581.4 | |

| Less: Cash and Cash Equivalents | (158.3) | | | (194.0) | | | (163.6) | |

| Net Debt | $ | 2,631.8 | | | $ | 2,386.7 | | | $ | 2,417.8 | |

| | | | | |

Trailing Twelve Months Adjusted EBITDA (b) | $ | 1,541.8 | | | $ | 2,427.8 | | | $ | 2,672.7 | |

| | | | | |

| Net Debt to Adjusted EBITDA | 1.7 | | | 1.0 | | | 0.9 | |

(a)Unaudited.

(b)Trailing Twelve Months Adjusted EBITDA as of September 30, 2023 is calculated as the nine months ended September 30, 2023 plus the year ended December 31, 2022 less the nine months ended September 30, 2022. Trailing Twelve Months Adjusted EBITDA as of September 30, 2022 is calculated as the nine months ended September 30, 2022 plus the year ended December 31, 2021 less the nine months ended September 30, 2021.

v3.23.3

Document and Entity Information

|

Oct. 26, 2023 |

| Cover [Abstract] |

|

| Entity Registrant Name |

OLIN CORPORATION

|

| Entity Central Index Key |

0000074303

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 26, 2023

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity File Number |

1-1070

|

| Entity Tax Identification Number |

13-1872319

|

| Entity Address, Address Line One |

190 Carondelet Plaza,

|

| Entity Address, Address Line Two |

Suite 1530

|

| Entity Address, City or Town |

Clayton,

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63105

|

| City Area Code |

314

|

| Local Phone Number |

480-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 par value per share

|

| Trading Symbol |

OLN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

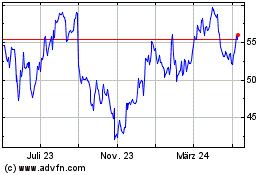

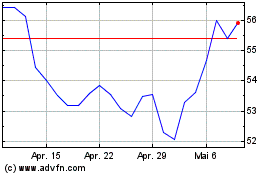

Olin (NYSE:OLN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Olin (NYSE:OLN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024