UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-39147

ONECONNECT FINANCIAL TECHNOLOGY CO., LTD.

(Registrant’s Name)

21/24F, Ping An Finance Center

No. 5033 Yitian Road, Futian District

Shenzhen, Guangdong, 518000

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

OneConnect Announces Update

on Business Operations

On May 7, 2024, OneConnect Financial Technology

Co., Ltd. (“OneConnect” or the “Company”, together with its subsidiaries and

consolidated affiliated entities, the “Group”) was notified by certain Connected Customers (as defined below) that

they intend to cease to utilize the Group’s Cloud Services (as defined below) due to their adjustment of procurement strategies.

The Company is in discussion with these Connected Customers as to the effective time of such cessation and any transition arrangements.

These Connected Customers’ purchase of the Group’s Cloud Services contributed approximately 16.7% and 19.2%, respectively,

of the Group’s total revenue for each of the years ended December 31, 2022 and 2023.

There are uncertainties as to whether any of the

other Connected Customers will continue to utilize the Group’s Cloud Services at current levels or at all. The Company is actively monitoring the situation and will continue to follow up on the progress.

The Company has been providing cloud

services to financial institutions via its Gamma FinCloud platform since 2020 (the “Cloud Services”). For each of

the years ended December 31, 2022 and 2023, revenue from the Cloud Services was RMB1,316 million and RMB1,246 million,

accounting for approximately 29.5% and 34.0% of the total revenue of the Group for the respective years, of which RMB1,310 million

and RMB1,240 million, or approximately 99.6% and 99.5%, was from subsidiaries and associates of Ping An Insurance (Group) Company of

China, Ltd. (collectively, the “Connected Customers”).

The board of directors of the Company is evaluating

its business plans and further measures in response to the foregoing developments and corresponding financial impact.

The Company believes that the foregoing developments will not affect the operations of its other businesses, including its ongoing strategic

business relationship with Ping An Insurance (Group) Company of China, Ltd.

Safe Harbor Statement

This Form 6-K contains forward-looking statements.

These statements constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange

Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements

can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” “confident” and similar statements. Such statements

are based upon management’s current expectations and current market and operating conditions and relate to events that involve known

or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s

control. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s limited

operating history in the technology-as-a-service for financial institutions industry; its ability to achieve or sustain profitability;

the tightening of laws, regulations or standards in the financial services industry; the Company’s ability to comply with the evolving

regulatory requirements in the PRC and other jurisdictions where it operates; its ability to comply with existing or future laws and regulations

related to data protection or data security; its ability to maintain and enlarge the customer base or strengthen customer engagement;

its ability to maintain its relationship and engagement with Ping An Group and its associates, which are its strategic partner, most important

customer and largest supplier; its ability to compete effectively to serve China’s financial institutions; the effectiveness of

its technologies, its ability to maintain and improve technology infrastructure and security measures; its ability to protect its intellectual

property and proprietary rights; its ability to maintain or expand relationship with its business partners and the failure of its partners

to perform in accordance with expectations; its ability to protect or promote its brand and reputation; its ability to timely implement

and deploy its solutions; its ability to obtain additional capital when desired; litigation and negative publicity surrounding China-based

companies listed in the U.S.; disruptions in the financial markets and business and economic conditions; the Company’s ability to

pursue and achieve optimal results from acquisition or expansion opportunities; the duration of the COVID-19 outbreak, lagging effect

of businesses’ recovery and its potential impact on the Company’s business and financial performance; and assumptions underlying

or related to any of the foregoing. Further information regarding these and other risks is included in the Company’s filings with

the U.S. Securities and Exchange Commission. All information provided in this press release and in the attachments is as of the date of

this press release, and the Company undertakes no obligation to update any forward-looking statement, except as required under applicable

law.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

OneConnect Financial Technology Co., Ltd. |

| |

|

| |

By: |

/s/ Chongfeng Shen |

| |

Name: |

Chongfeng Shen |

| |

Title: |

Chairman of the Board and Chief Executive Officer |

| |

|

|

|

Date: May 7, 2024 |

|

|

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

OneConnect

Financial Technology Co., Ltd.

壹账通金融科技有限公司

(Incorporated

in the Cayman Islands with limited liability)

(Stock

Code: 6638)

(NYSE

Stock Ticker: OCFT)

INSIDE

INFORMATION

UPDATE

ON BUSINESS OPERATIONS

This

announcement is made by OneConnect Financial Technology Co., Ltd. (the “Company”, together with its subsidiaries and

consolidated affiliated entities, the “Group”) pursuant to Rule 13.09 of the Rules Governing the Listing of the Securities

on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and under Part XIVA of the Securities and Futures

Ordinance (Chapter 571 of the Laws of Hong Kong) (the “SFO”).

UPDATE

ON BUSINESS OPERATIONS

On May 7, 2024, the Company

was notified by certain Connected Customers (as defined below) that they intend to cease to utilize the Group’s Cloud Services

(as defined below) due to their adjustment of procurement strategies. The Company is in discussion with these Connected Customers as

to the effective time of such cessation and any transition arrangements. These Connected Customers’ purchase of the Group’s

Cloud Services contributed approximately 16.7% and 19.2%, respectively, of the Group’s total revenue for each of the years ended

December 31, 2022 and 2023.

There are uncertainties

as to whether any of the other Connected Customers will continue to utilize the Group’s Cloud Services at current levels or at

all. The Company is actively monitoring the situation and will continue to follow up on the progress.

The

Company has been providing cloud services to financial institutions via its Gamma FinCloud platform since 2020 (the “Cloud Services”).

For each of the years ended December 31, 2022 and 2023, revenue from the Cloud Services was RMB1,316 million and RMB1,246 million, accounting

for approximately 29.5% and 34.0% of the total revenue of the Group for the respective years, of which RMB1,310 million and RMB1,240

million, or approximately 99.6% and 99.5%, was from subsidiaries and associates of Ping An Insurance (Group) Company of China, Ltd. (collectively,

the “Connected Customers”).

The Board is evaluating

its business plans and further measures in response to the foregoing developments and corresponding financial impact. The Company will

make further announcement(s) in compliance with the Listing Rules and/or the SFO as and when appropriate.

The Company believes that

the foregoing developments will not affect the operations of its other businesses, including its ongoing strategic business relationship

with Ping An Insurance (Group) Company of China, Ltd.

Shareholders

and potential investors are advised to exercise caution when dealing in the shares of the Company.

| |

By order of the

Board |

| |

OneConnect Financial

Technology Co., Ltd. |

| |

Mr. Chongfeng Shen |

| |

Chairman of the Board and

Chief Executive Officer |

Hong

Kong, May 7, 2024

As

at the date of this announcement, the board of directors of the Company comprises Mr. Chongfeng Shen as the executive director, Mr. Michael

Guo, Ms. Xin Fu, Mr. Wenwei Dou and Ms. Wenjun Wang as the non-executive directors and Dr. Yaolin Zhang, Mr. Tianruo Pu, Mr. Wing Kin

Anthony Chow and Mr. Koon Wing Ernest Ip as the independent non-executive directors.

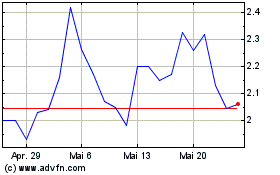

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024