0001595527FALSETRUE00015955272023-11-092023-11-090001595527us-gaap:CommonClassAMember2023-11-092023-11-090001595527us-gaap:PreferredClassAMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

American Strategic Investment Co.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-39448 | | 46-4380248 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

222 Bellevue Ave. Newport, Rhode Island 02840

________________________________________________________________________________________________________

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 415-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered |

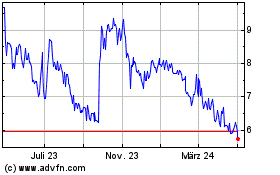

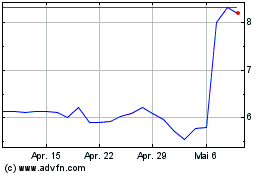

| Class A common stock, $0.01 par value per share | | NYC | | New York Stock Exchange |

| Class A Preferred Stock Purchase Rights | | | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2023, American Strategic Investment Co. (the “Company”) issued a press release announcing its results of operations for the quarter ended September 30, 2023, and supplemental financial information for the quarter ended September 30, 2023, attached hereto as Exhibits 99.1 and 99.2, respectively.

Item 7.01. Regulation FD Disclosure.

Press Release and Supplemental Information

As disclosed in Item 2.02 above, on November 9, 2023, the Company issued a press release announcing its results of operations for the quarter ended September 30, 2023, and supplemental financial information for the quarter ended September 30, 2023, attached hereto as Exhibits 99.1 and 99.2, respectively. The information set forth in Item 7.01 of this Current Report on Form 8-K and in the attached Exhibits 99.1 and 99.2 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

Forward-Looking Statements

The statements in this Current Report on Form 8-K that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results or events to be materially different. The words “may,” “will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans,” “intends,” “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include (a) the anticipated benefits of the Company’s election to terminate its status as a real estate investment trust, (b) whether the Company will be able to successfully acquire new assets or businesses, (c) the potential adverse effects of the geopolitical instability due to the ongoing military conflict between Russia and Ukraine and Israel and Hamas, including related sanctions and other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, and the global economy and financial markets, and (iii) inflationary conditions and higher interest rate environment (d) that any potential future acquisition is subject to market conditions and capital availability and may not be completed on favorable terms, or at all, and (e) that we may not be able to continue to meet the New York Stock Exchange's ("NYSE") continued listing requirements and rules, and the NYSE may delist the Company's common stock, which could negatively affect the Company, the price of the Company's common stock and shareholders' ability to sell the Company's common stock, as well as those risks and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 16, 2023 and all other filings with the Securities and Exchange Commission after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results, unless required to do so by law.

| | | | | | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits |

| | | | | | |

| Exhibit No. | Description |

| | Press Release dated November 9, 2023 |

| | Supplemental information for the quarter ended September 30, 2023 |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | American Strategic Investment Co. |

| | | |

| | | |

Date: November 9, 2023 | By: | /s/ Michael Anderson |

| | | Michael Anderson |

| | | Chief Executive Officer |

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

AMERICAN STRATEGIC INVESTMENT CO. ANNOUNCES THIRD QUARTER 2023 RESULTS

Company to Host Investor Webcast and Conference Call Today at 11:00 AM ET

New York, November 9, 2023 - American Strategic Investment Co. (NYSE: NYC) (“ASIC” or the “Company”), a company that owns a portfolio of commercial real estate located within the five boroughs of New York City, announced today its financial and operating results for the third quarter ended September 30, 2023.

Third Quarter 2023 and Subsequent Event Highlights

•Revenue was $16.0 million compared to $15.9 million in the third quarter 2022 and $15.8 million in the second quarter of 2023 as new leases began to commence

•Net loss attributable to common stockholders improved to $9.4 million, compared to $11.1 million in the third quarter 2022 and $10.9 million in the second quarter of 2023

•Cash net operating income (“NOI”) grew 4.9% to $6.5 million from $6.2 million in the third quarter 2022

•Adjusted EBITDA grew 18% to $3.4 million compared to $2.9 million in the third quarter 2022 and grew 13% compared to $3.0 million in the quarter prior

•Funds from Operations (“FFO”) improved $1.6 million to negative $2.5 million compared to negative $4.1 million in the third quarter 2022

•Core Funds from Operations (“Core FFO”) was negative $1.1 million compared to negative $1.9 million in the third quarter 2022, or negative $0.48 per share, compared to negative $1.12 in the third quarter of 2023 and negative $0.74 per share in the second quarter 2023

•79% of annualized straight-line rent from Top 10 tenants1 is derived from investment grade or implied investment grade2 rated tenants with a weighted-average remaining lease term of 8.9 years as of September 30, 2023

•Portfolio occupancy was 85% as of September 30, 2023, with weighted-average lease term3 of 6.6 years

•Portfolio debt is 100% fixed rate with no maturities through the end of 2023, 4.4% weighted-average interest rate and 3.4 years of weighted-average debt maturity

CEO Comments

“The Company made progress in our effort to increase value, as we benefited from the positive results that our ongoing leasing and tenant retention activities have yielded, including a 2.4% growth in portfolio occupancy year to date,” said Michael Anderson, CEO of American Strategic Investment Co. “Our results this quarter are highlighted by a 18% increase in Adjusted EBITDA and Cash NOI growth of 4.9% compared to the prior year, as well as an improvement of $0.64 per share in Core FFO. The growth was achieved through a reduction in expenses, coupled with our ongoing leasing success.”

Financial Results

| | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| (In thousands, except per share data) | | 2023 | | 2022 |

| Revenue from tenants | | $ | 16,015 | | | $ | 15,932 | |

| | | | | |

| Net loss attributable to common stockholders | | $ | (9,390) | | | $ | (11,074) | |

Net loss per common share (a) | | $ | (4.10) | | | $ | (6.40) | |

| | | | | |

FFO attributable to common stockholders | | $ | (2,529) | | | $ | (4,133) | |

FFO per common share (a) | | (1.11) | | | $ | (2.40) | |

| | | | | |

| Core FFO attributable to common stockholders | | $ | (1,088) | | | $ | (1,870) | |

Core FFO per common share (a) | | $ | (0.48) | | | $ | (1.12) | |

(a) All per share data based on 2,288,683 and 1,728,540 diluted weighted-average shares outstanding for the three months ended September 30, 2023 and 2022, respectively.

Real Estate Portfolio

The Company’s portfolio consisted of eight properties comprised of 1.2 million rentable square feet as of September 30, 2023. Portfolio metrics include:

•85.1% leased

•6.6 years remaining weighted-average lease term

•79% of annualized straight-line rent4 from top 10 tenants derived from investment grade or implied investment grade tenants with 8.9 years of weighted-average remaining lease term

•Diversified portfolio, comprised of 24% financial services tenants, 13% government and public administration tenants, 12% retail tenants, 10% non-profit and 41% all other industries, based on annualized straight-line rent

Capital Structure and Liquidity Resources

As of September 30, 2023, the Company had $5.1 million of cash and cash equivalents.5 The Company’s net debt6 to gross asset value7 was 41.7%, with net debt of $394.4 million.

All of the Company’s debt was fixed-rate as of September 30, 2023. The Company’s total combined debt had a weighted-average interest rate of 4.4%.8

Footnotes/Definitions

1 Top 10 tenants based on annualized straight-line rent as of September 30, 2023.

2 As used herein, investment grade includes both actual investment grade ratings of the tenant or guarantor, if available, or implied investment grade. Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of whether or not the parent has guaranteed the tenant’s obligation under the lease) or by using a proprietary Moody’s analytical tool, which generates an implied rating by measuring a company’s probability of default. The term “parent" for these purposes includes any entity, including any governmental entity, owning more than 50% of the voting stock in a tenant. Ratings information is as of September 30, 2023. Based on annualized straight-line rent, top 10 tenants are 59% actual investment grade rated and 20% implied investment grade rated.

3 The weighted-average remaining lease term (years) is weighted by annualized straight-line rent as of September 30, 2023.

4 Annualized straight-line rent is calculated using the most recent available lease terms as of September 30, 2023.

5 Under one of our mortgage loans, we are required to maintain minimum liquid assets (i.e. cash and cash equivalents and restricted cash) of $10.0 million.

6 Total debt of $399.5 million less cash and cash equivalents of $5.1 million as of September 30, 2023. Excludes the effect of deferred financing costs, net, mortgage premiums, net and includes the effect of cash and cash equivalents.

7 Defined as the carrying value of total assets of $770.2 million plus accumulated depreciation and amortization of $175.9 million as of September 30, 2023.

8 Weighted based on the outstanding principal balance of the debt.

Webcast and Conference Call

ASIC will host a webcast and call on November 9, 2023 at 11:00 a.m. ET to discuss its financial and operating results. This webcast will be broadcast live over the Internet and can be accessed by all interested parties through the ASIC website, www.americanstrategicinvestment.com, in the “Investor Relations” section.

Dial-in instructions for the conference call and the replay are outlined below.

To listen to the live call, please go to ASIC’s “Investor Relations” section of the website at least 15 minutes prior to the start of the call to register and download any necessary audio software. For those who are not able to listen to the live broadcast, a replay will be available shortly after the call on the ASIC website at www.americanstrategicinvestment.com.

Live Call

Dial-In (Toll Free): 1-888-330-3127

International Dial-In: 1-646-960-0855

Conference ID: 5954637

Conference Replay*

Domestic Dial-In (Toll Free): 1-800-770-2030

International Dial-In: 1-647-362-9199

Conference Number: 5954637

*Available from November 9, 2023 through February 7, 2024.

About American Strategic Investment Co.

American Strategic Investment Co. (NYSE: NYC) owns a portfolio of commercial real estate located within the five boroughs of New York City. Additional information about ASIC can be found on its website at www.americanstrategicinvestment.com.

Supplemental Schedules

The Company will file supplemental information packages with the Securities and Exchange Commission (the “SEC”) to provide additional disclosure and financial information. Once posted, the supplemental package can be found under the “Presentations” tab in the Investor Relations section of ASIC’s website at www.americanstrategicinvestment.com and on the SEC website at www.sec.gov.

Important Notice

The statements in this press release that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results or events to be materially different. The words “may,” “will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans,” “intends,” “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include (a) the anticipated benefits of the Company’s election to terminate its status as a real estate investment trust, (b) whether the Company will be able to successfully acquire new assets or businesses, (c) the potential adverse effects of the geopolitical instability due to the ongoing military conflict between Russia and Ukraine and Israel and Hamas, including related sanctions and other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, and the global economy and financial markets, and inflationary conditions and higher interest rate environment (d) that any potential future acquisition is subject to market conditions and capital availability and may not be completed on favorable terms, or at all, and (e) we may not be able to continue to meet the New York Stock Exchange’s (“NYSE”) continued listing requirements and rules, and the NYSE may delist our common stock, which could negatively affect our company, the price of our common stock and our shareholders’ ability to sell our common stock, as well as those risks and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 16, 2023 and all other filings with the SEC after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results, unless required to do so by law.

Contacts:

Investors and Media:

Email: investorrelations@americanstrategicinvestment.com

Phone: (866) 902-0063

American Strategic Investment Co.

Consolidated Balance Sheets

(In thousands. except share and per share data)

| | | | | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| ASSETS | | (Unaudited) | | |

| Real estate investments, at cost: | | | | |

Land | | $ | 188,935 | | | $ | 192,600 | |

Buildings and improvements | | 576,583 | | | 576,686 | |

Acquired intangible assets | | 61,989 | | | 71,848 | |

Total real estate investments, at cost | | 827,507 | | | 841,134 | |

Less accumulated depreciation and amortization | | (175,929) | | | (167,978) | |

Total real estate investments, net | | 651,578 | | | 673,156 | |

| Cash and cash equivalents | | 5,090 | | | 9,215 | |

| Restricted cash | | 7,911 | | | 6,902 | |

Operating lease right-of-use asset | | 54,792 | | | 54,954 | |

| Prepaid expenses and other assets | | 6,741 | | | 5,624 | |

| Derivative asset, at fair value | | 817 | | | 1,607 | |

| Straight-line rent receivable | | 29,903 | | | 29,116 | |

| Deferred leasing costs, net | | 9,190 | | | 9,881 | |

| Assets held for sale | | 4,130 | | | — | |

| Total assets | | $ | 770,152 | | | $ | 790,455 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Mortgage notes payable, net | | $ | 395,316 | | | $ | 394,159 | |

| Accounts payable, accrued expenses and other liabilities (including amounts due to related parties of $395 and $118 at September 30, 2023 and December 31, 2022, respectively) | | 15,074 | | | 12,787 | |

| Operating lease liability | | 54,672 | | | 54,716 | |

| Below-market lease liabilities, net | | 2,273 | | | 3,006 | |

| | | | |

| Deferred revenue | | 3,874 | | | 4,211 | |

| | | | |

Total liabilities | | 471,209 | | | 468,879 | |

| | | | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, none issued and outstanding at September 30, 2023 and December 31, 2022 | | — | | | — | |

| Common stock, $0.01 par value, 300,000,000 shares authorized, 2,324,201 and 1,886,298 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | 23 | | | 19 | |

| Additional paid-in capital | | 729,493 | | | 698,761 | |

| Accumulated other comprehensive income | | 829 | | | 1,637 | |

| Distributions in excess of accumulated earnings | | (431,402) | | | (399,355) | |

Total stockholders’ equity | | 298,943 | | | 301,062 | |

| Non-controlling interests | | — | | | 20,514 | |

| Total equity | | 298,943 | | | 321,576 | |

Total liabilities and equity | | $ | 770,152 | | | $ | 790,455 | |

American Strategic Investment Co.

Consolidated Statements of Operations (Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | |

| | | Three Months Ended September 30, |

| | 2023 | | 2022 |

| Revenue from tenants | | $ | 16,015 | | | $ | 15,932 | |

| | | | |

| Operating expenses: | | | | |

| Asset and property management fees to related parties | | 1,882 | | | 1,667 | |

| Property operating | | 8,792 | | | 8,947 | |

| Impairments of real estate investments | | 362 | | | — | |

| | | | |

| Equity-based compensation | | 1,208 | | | 2,263 | |

| General and administrative | | 1,931 | | | 2,435 | |

| Depreciation and amortization | | 6,499 | | | 6,941 | |

| Total operating expenses | | 20,674 | | | 22,253 | |

| Operating loss | | (4,659) | | | (6,321) | |

| Other income (expense): | | | | |

| Interest expense | | (4,739) | | | (4,755) | |

| Other income | | 8 | | | 2 | |

| Total other expense | | (4,731) | | | (4,753) | |

| | | | |

| | | | |

| Net loss and Net loss attributable to common stockholders | | $ | (9,390) | | | $ | (11,074) | |

| | | | |

| Net loss per share attributable to common stockholders — Basic and Diluted | | $ | (4.10) | | | $ | (6.40) | |

| Weighted-average shares outstanding — Basic and Diluted | | 2,288,683 | | | 1,728,540 | |

| | | | |

| | | | |

American Strategic Investment Co.

Quarterly Reconciliation of Non-GAAP Measures (Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 21, 2022 | | September 30, 2023 |

| EBITDA: | | | | | | | | | | |

| Net income | | $ | (9,390) | | | $ | (10,899) | | | $ | (11,758) | | | $ | (10,109) | | | $ | (32,047) | |

| Depreciation and amortization | | 6,499 | | | 6,749 | | | 6,952 | | | 7,703 | | | $ | 20,200 | |

| Interest expense | | 4,739 | | | 4,707 | | | 4,663 | | | 4,751 | | | $ | 14,109 | |

| Income tax (benefit) expense | | — | | | — | | | — | | | — | | | $ | — | |

| EBITDA | | 1,848 | | | 557 | | | (143) | | | 2,345 | | | 2,262 | |

| Impairment of real estate investments | | 362 | | | 151 | | | — | | | — | | | $ | 513 | |

| Acquisition and transaction related | | — | | | — | | | — | | | — | | | $ | — | |

| Equity-based compensation | | 1,208 | | | 2,304 | | | 2,200 | | | 2,198 | | | $ | 5,712 | |

| Other (income) loss | | (8) | | | (10) | | | (9) | | | (6) | | | $ | (27) | |

| Adjusted EBITDA | | 3,410 | | | 3,002 | | | 2,048 | | | 4,537 | | | 8,460 | |

| Asset and property management fees to related parties | | 1,882 | | | 1,988 | | | 1,884 | | | 1,708 | | | $ | 5,754 | |

| General and administrative | | 1,931 | | | 2,439 | | | 3,181 | | | 1,897 | | | $ | 7,551 | |

| NOI | | 7,223 | | | 7,429 | | | 7,113 | | | 8,142 | | | 21,765 | |

| Accretion of below- and amortization of above-market lease liabilities and assets, net | | (36) | | | (45) | | | 36 | | | 123 | | | $ | (45) | |

| Straight-line rent (revenue as a lessor) | | (703) | | | 120 | | | (204) | | | (263) | | | $ | (787) | |

| Straight-line ground rent (expense as lessee) | | 27 | | | 27 | | | 27 | | | 28 | | | $ | 81 | |

| Cash NOI | | 6,511 | | | 7,531 | | | 6,972 | | | 8,030 | | | $ | 21,014 | |

| | | | | | | | | | |

| Cash Paid for Interest: | | | | | | | | | | |

| Interest expense | | 4,739 | | | 4,707 | | | 4,663 | | | 4,751 | | | $ | 14,109 | |

| Amortization of deferred financing costs | | (386) | | | (385) | | | (386) | | | (386) | | | $ | (1,157) | |

| Total cash paid for interest | | $ | 4,353 | | | $ | 4,322 | | | $ | 4,277 | | | $ | 4,365 | | | $ | 12,952 | |

American Strategic Investment Co.

Quarterly Reconciliation of Non-GAAP Measures (Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended | | |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2023 | | December 21, 2022 | | September 30, 2023 | | |

| Net loss attributable to common stockholders | | $ | (9,390) | | | $ | (10,899) | | | $ | (11,758) | | | $ | (10,109) | | | $ | (32,047) | | | |

| Impairment of real estate invetsments | | 362 | | | 151 | | | — | | | — | | | 513 | | | |

| Depreciation and amortization | | 6,499 | | | 6,749 | | | 6,952 | | | 7,703 | | | 20,200 | | | |

| | | | | | | | | | | | |

| FFO attributable to common stockholders | | (2,529) | | | (3,999) | | | (4,806) | | | (2,406) | | | (11,334) | | | |

| | | | | | | | | | | | |

| Equity-based compensation | | 1,208 | | | 2,304 | | | 2,200 | | | 2,198 | | | 5,712 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Expenses attributable to 2023 Tender Offer | | 233 | | | $ | — | | | $ | — | | | $ | — | | | $ | 233 | | | |

| Core FFO attributable to common stockholders | | $ | (1,088) | | | $ | (1,695) | | | $ | (2,606) | | | $ | (208) | | | $ | (5,389) | | | |

(1) Includes expense related to the amortization of the Company's restricted common shares and units of limited partnership related to its multi-year outperformance agreement for all periods presented. Management has not added back the cost of the base management fee elected to be received by the Advisor in shares in lieu of cash or the cost of the Advisor’s base management fee used by the Advisor under the Side Letter to purchase shares or because such amounts are considered a normal operating expense. Such amount included in net loss were zero and $0.5 million for the three and nine months ended September 30, 2023 and $1.3 million and $3.6 million for the three and nine months ended September 30, 2022, respectively.

(2) Amount relates to costs that we incurred as it relates to the 2023 Tender Offer. We do not consider these expenses to be part of our normal operating performance and has, accordingly, increased its Core FFO for this amount.

Non-GAAP Financial Measures

This release discusses the non-GAAP financial measures we use to evaluate our performance, including Funds from Operations (“FFO”), Core Funds from Operations (“Core FFO”), Earnings before Interest, Taxes, Depreciation and Amortization (“ EBITDA”), Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”), Net Operating Income (“NOI”) and Cash Net Operating Income (“Cash NOI”) and Cash Paid for Interest. While NOI is a property-level measure, Core FFO is based on our total performance and therefore reflects the impact of other items not specifically associated with NOI such as, interest expense, general and administrative expenses and operating fees to related parties. A description of these non-GAAP measures and reconciliations to the most directly comparable GAAP measure, which is net income, is provided above.

In December 2022 we announced that we changed our business strategy and terminated our election to be taxed as a REIT effective January 1, 2023, however, our business and operations have not materially changed in the first quarter of 2023. Therefore, we did not change any of the non-GAAP metrics that we have historically used to evaluate performance.

Caution on Use of Non-GAAP Measures

FFO, Core FFO, EBITDA, Adjusted EBITDA, NOI, Cash NOI and Cash Paid for Interest should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income or in its applicability in evaluating our operating performance. The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non-GAAP measures.

Other companies may not define FFO in accordance with the current National Association of Real Estate Investment Trusts (“NAREIT”), an industry trade group, definition (as we do), or may interpret the current NAREIT definition differently than we do, or may calculate Core FFO differently than we do. Consequently, our presentation of FFO and Core FFO may not be comparable to other similarly titled measures presented by other REITs.

We consider FFO and Core FFO useful indicators of our performance. Because FFO and Core FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates), FFO and Core FFO presentations facilitate comparisons of operating performance between periods and between other companies that use these measures.

As a result, we believe that the use of FFO and Core FFO, together with the required GAAP presentations, provide a more complete understanding of our performance, including relative to our peers and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities. However, FFO and Core FFO are not indicative of cash available to fund ongoing cash needs, including the ability to pay cash dividends. Investors are cautioned that FFO and Core FFO should only be used to assess the sustainability of our operating performance excluding these activities, as they exclude certain costs that have a negative effect on our operating performance during the periods in which these costs are incurred.

Funds from Operations and Core Funds from Operations

Funds from Operations

Due to certain unique operating characteristics of real estate companies, as discussed below, the NAREIT, an industry trade group, has promulgated a performance measure known as FFO, which we believe to be an appropriate supplemental measure to reflect the operating performance of a company with a business similar to our current business. FFO is not equivalent to net income or loss as determined under GAAP.

We calculate FFO, a non-GAAP measure, consistent with the standards established over time by the Board of Governors of NAREIT, as restated in a White Paper and approved by the Board of Governors of NAREIT effective in December 2018 (the “White Paper”). The White Paper defines FFO as net income or loss computed in accordance with GAAP, excluding depreciation and amortization related to real estate, gains and losses from sales of certain real estate assets, gain and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. Adjustments for consolidated partially-owned entities (including our New York City Operating Partnership L.P.) and equity in earnings of unconsolidated affiliates are made to arrive at our proportionate share of FFO attributable to our stockholders. Our FFO calculation complies with NAREIT’s definition.

The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, and straight-line amortization of intangibles, which implies that the value of a real estate asset diminishes predictably over time. We believe that, because real estate values historically rise and fall with market conditions, including inflation, interest rates, unemployment and consumer spending, presentations of operating results for a company with a business similar to our current business using historical accounting for depreciation and certain other items may be less informative. Historical accounting for real estate involves the use of GAAP. Any other method of accounting for real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP. Nevertheless, we believe that the use of FFO, which excludes the impact of real estate related depreciation and amortization, among other things, provides a more complete understanding of our performance to investors and to management, and when compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net income.

Core Funds from Operations

Beginning in the third quarter 2020, following the listing of our Class A common stock on the NYSE, we began presenting Core FFO, also a non-GAAP metric. We believe that Core FFO is utilized by other publicly-traded companies with a business similar to our current business, although Core FFO presented by us may not be comparable to Core FFO reported by other companies that define Core FFO differently. In calculating Core FFO, we start with FFO, then we exclude the impact of discrete non-operating transactions and other events which we do not consider representative of the comparable operating results of our real estate operating portfolio, which is our core business platform. Specific examples of discrete non-operating items include acquisition and transaction related costs for dead deals, debt extinguishment costs, non-cash equity-based compensation and costs incurred for the 2022 proxy contest. We add back non-cash write-offs of deferred financing costs and prepayment penalties incurred with the early extinguishment of debt which are included in net income but are considered financing cash flows when paid in the statement of cash flows. We consider these write-offs and prepayment penalties to be capital transactions and not indicative of operations normal operating performance. Further, we do not consider the costs associated with the 2022 contested proxy, while paid in cash, to be indicative of normal operating performance. By excluding expensed acquisition and transaction dead deal costs as well as non-operating costs described above, we believe Core FFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties. In future periods, we may also exclude other items from Core FFO that we believe may help investors compare our results.

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, Net Operating Income, Cash Net Operating Income and Cash Paid for Interest.

We believe that EBITDA and Adjusted EBITDA, which is defined as earnings before interest, taxes, depreciation and amortization adjusted for acquisition and transaction-related expenses, fees related to the listing related costs and expenses, other non-cash items such as the vesting and conversion of the Class B Units, equity-based compensation expense and including our pro-rata share from unconsolidated joint ventures, is an appropriate measure of our ability to incur and service debt. Adjusted EBITDA should not be considered as an alternative to cash flows from operating activities, as a measure of our liquidity or as an alternative to net income as an indicator of our operating activities. Other companies may calculate Adjusted EBITDA differently and our calculation should not be compared to that of other companies.

NOI is a non-GAAP financial measure used by us to evaluate the operating performance of our real estate. NOI is equal to total revenues, excluding contingent purchase price consideration, less property operating and maintenance expense. NOI excludes all other items of expense and income included in the financial statements in calculating net income (loss). We believe NOI provides useful and relevant information because it reflects only those income and expense items that are incurred at the property level and presents such items on an unleveraged basis. We use NOI to assess and compare property level performance and to make decisions concerning the operations of the properties. Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating expenses and acquisition activity on an unleveraged basis, providing perspective not immediately apparent from net income (loss). NOI excludes certain items included in calculating net income (loss) in order to provide results that are more closely related to a property’s results of operations. For example, interest expense is not necessarily linked to the operating performance of a real estate asset. In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level. NOI presented by us may not be comparable to NOI reported by other companies that define NOI differently. We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements. NOI should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity or our ability to pay dividends.

Cash NOI, is a non-GAAP financial measure that is intended to reflect the performance of our properties. We define Cash NOI as NOI excluding amortization of above/below market lease intangibles and straight-line adjustments that are included in GAAP lease revenues. We believe that Cash NOI is a helpful measure that both investors and management can use to evaluate the current financial performance of our properties and it allows for comparison of our operating performance between periods and to other companies. Cash NOI should not be considered as an alternative to net income, as an indication of our financial performance, or to cash flows as a measure of liquidity or our ability to fund all needs. The method by which we calculate and present Cash NOI may not be directly comparable to the way other companies present Cash NOI.

Cash Paid for Interest is calculated based on the interest expense less non-cash portion of interest expense and amortization of mortgage (discount) premium, net. Management believes that Cash Paid for Interest provides useful information to investors to assess our overall solvency and financial flexibility. Cash Paid for Interest should not be considered as an alternative to interest expense as determined in accordance with GAAP or any other GAAP financial measures and should only be considered together with and as a supplement to our financial information prepared in accordance with GAAP.

EXHIBIT 99.2

American Strategic Investment Co.

Supplemental Information

Quarter ended September 30, 2023 (unaudited)

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

| | | | | | | | |

| Table of Contents | | |

| | |

| Item | | Page |

| Non-GAAP Definitions | | 3 |

| Key Metrics | | 5 |

| Consolidated Balance Sheets | | 6 |

| Consolidated Statements of Operations | | 7 |

| Non-GAAP Measures | | 8 |

| Debt Overview | | 10 |

| Future Minimum Lease Rents | | 11 |

| Top Ten Tenants | | 12 |

| Diversification by Property Type | | 13 |

| Diversification by Tenant Industry | | 14 |

| Lease Expirations | | 15 |

| | |

| Please note that totals may not add due to rounding. | | |

Forward-looking Statements:

This supplemental package of American Strategic Investment Co. (formerly known as New York City REIT, Inc.) (the “Company” or “ASIC”) includes statements that are not historical facts and may be forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results or events to be materially different. The words “may,” “will,” “seeks,” “anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans,” “intends,” “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include (a) the anticipated benefits of the Company’s election to terminate its status as a real estate investment trust, (b) whether the Company will be able to successfully acquire new assets or businesses, (c) the potential adverse effects of (i) the global COVID-19 pandemic, including actions taken to contain or treat COVID-19, (ii) the geopolitical instability due to the ongoing military conflict between Russia and Ukraine, including related sanctions and other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, and the global economy and financial markets, and (iii) inflationary conditions and higher interest rate environment and (d) that any potential future acquisition is subject to market conditions and capital availability and may not be completed on favorable terms, or at all, as well as those risks and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 16, 2023 and all other filings with the Securities and Exchange Commission after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results, unless required to do so by law.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Non-GAAP Financial Measures

This section discusses the non-GAAP financial measures we use to evaluate our performance, including Funds from Operations (“FFO”), Core Funds from Operations (“Core FFO”), Earnings before Interest, Taxes, Depreciation and Amortization (“ EBITDA”), Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”), Net Operating Income (“NOI”) and Cash Net Operating Income (“Cash NOI”) and Cash Paid for Interest. While NOI is a property-level measure, Core FFO is based on our total performance and therefore reflects the impact of other items not specifically associated with NOI such as, interest expense, general and administrative expenses and operating fees to related parties. A description of these non-GAAP measures and reconciliations to the most directly comparable GAAP measure, which is net income, is provided below.

In December 2022 we announced that that we changed our business strategy and terminated our election to be taxed as a REIT effective January 1, 2023, however, our business and operations operations have not materially changed in the first quarter of 2023. Therefore, we did not change any of the non-GAAP metrics that we have historically used to evaluate performance.

Caution on Use of Non-GAAP Measures

FFO, Core FFO, EBITDA, Adjusted EBITDA, NOI, Cash NOI and Cash Paid for Interest should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income or in its applicability in evaluating our operating performance. The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non-GAAP measures.

Other companies may not define FFO in accordance with the current National Association of Real Estate Investment Trusts (“NAREIT”), an industry trade group, definition (as we do), or may interpret the current NAREIT definition differently than we do, or may calculate Core FFO differently than we do. Consequently, our presentation of FFO and Core FFO may not be comparable to other similarly titled measures presented by other REITs.

We consider FFO and Core FFO useful indicators of our performance. Because FFO and Core FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates), FFO and Core FFO presentations facilitate comparisons of operating performance between periods and between other companies that use these measures.

As a result, we believe that the use of FFO and Core FFO, together with the required GAAP presentations, provide a more complete understanding of our performance, including relative to our peers and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities. However, FFO and Core FFO are not indicative of cash available to fund ongoing cash needs, including the ability to pay cash dividends. Investors are cautioned that FFO and Core FFO should only be used to assess the sustainability of our operating performance excluding these activities, as they exclude certain costs that have a negative effect on our operating performance during the periods in which these costs are incurred.

Funds from Operations and Core Funds from Operations

Funds from Operations

Due to certain unique operating characteristics of real estate companies, as discussed below, the NAREIT, an industry trade group, has promulgated a performance measure known as FFO, which we believe to be an appropriate supplemental measure to reflect the operating performance of a company with a business similar to our current business. FFO is not equivalent to net income or loss as determined under GAAP.

We calculate FFO, a non-GAAP measure, consistent with the standards established over time by the Board of Governors of NAREIT, as restated in a White Paper and approved by the Board of Governors of NAREIT effective in December 2018 (the “White Paper”). The White Paper defines FFO as net income or loss computed in accordance with GAAP, excluding depreciation and amortization related to real estate, gains and losses from sales of certain real estate assets, gain and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. Adjustments for consolidated partially-owned entities (including our New York City Operating Partnership L.P.) and equity in earnings of unconsolidated affiliates are made to arrive at our proportionate share of FFO attributable to our stockholders. Our FFO calculation complies with NAREIT’s definition.

The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, and straight-line amortization of intangibles, which implies that the value of a real estate asset diminishes predictably over time. We believe that, because real estate values historically rise and fall with market conditions, including inflation, interest rates, unemployment and consumer spending, presentations of operating results for a company with a business similar to our current business using historical accounting for depreciation and certain other items may be less informative. Historical accounting for real estate involves the use of GAAP. Any other method of accounting for real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP. Nevertheless, we believe that the use of FFO, which excludes the impact of real estate related depreciation and amortization, among other things, provides a more complete understanding of our performance to investors and to management, and when compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net income.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Core Funds from Operations

Beginning in the third quarter 2020, following the listing of our Class A common stock on the NYSE, we began presenting Core FFO, also a non-GAAP metric. We have presented prior periods on a comparable basis so that the metric is useful to the users of our financial statements. We believe that Core FFO is utilized by other publicly-traded companies with a business similar to our current business, although Core FFO presented by us may not be comparable to Core FFO reported by other companies that define Core FFO differently. In calculating Core FFO, we start with FFO, then we exclude the impact of discrete non-operating transactions and other events which we do not consider representative of the comparable operating results of our real estate operating portfolio, which is our core business platform. Specific examples of discrete non-operating items include acquisition and transaction related costs for dead deals, debt extinguishment costs, non-cash equity-based compensation and costs incurred for the 2022 contested proxy that were specifically related to the portion of our 2022 proxy contest. We add back non-cash write-offs of deferred financing costs and prepayment penalties incurred with the early extinguishment of debt which are included in net income but are considered financing cash flows when paid in the statement of cash flows. We consider these write-offs and prepayment penalties to be capital transactions and not indicative of operations normal operating performance. Further, we do not consider the costs associated with the 2022 contested proxy, while paid in cash, to be indicative of normal operating performance. By excluding expensed acquisition and transaction dead deal costs as well as non-operating costs described above, we believe Core FFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties. In future periods, we may also exclude other items from Core FFO that we believe may help investors compare our results.

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, Net Operating Income, Cash Net Operating Income and Cash Paid for Interest.

We believe that EBITDA and Adjusted EBITDA, which is defined as earnings before interest, taxes, depreciation and amortization adjusted for acquisition and transaction-related expenses, fees related to the listing related costs and expenses, other non-cash items such as the vesting and conversion of the Class B Units, equity-based compensation expense and including our pro-rata share from unconsolidated joint ventures, is an appropriate measure of our ability to incur and service debt. Adjusted EBITDA should not be considered as an alternative to cash flows from operating activities, as a measure of our liquidity or as an alternative to net income as an indicator of our operating activities. Other companies may calculate Adjusted EBITDA differently and our calculation should not be compared to that of other companies.

NOI is a non-GAAP financial measure used by us to evaluate the operating performance of our real estate. NOI is equal to total revenues, excluding contingent purchase price consideration, less property operating and maintenance expense. NOI excludes all other items of expense and income included in the financial statements in calculating net income (loss). We believe NOI provides useful and relevant information because it reflects only those income and expense items that are incurred at the property level and presents such items on an unleveraged basis. We use NOI to assess and compare property level performance and to make decisions concerning the operations of the properties. Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating expenses and acquisition activity on an unleveraged basis, providing perspective not immediately apparent from net income (loss). NOI excludes certain items included in calculating net income (loss) in order to provide results that are more closely related to a property’s results of operations. For example, interest expense is not necessarily linked to the operating performance of a real estate asset. In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level. NOI presented by us may not be comparable to NOI reported by other companies that define NOI differently. We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements. NOI should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity or our ability to pay dividends.

Cash NOI, is a non-GAAP financial measure that is intended to reflect the performance of our properties. We define Cash NOI as NOI excluding amortization of above/below market lease intangibles and straight-line adjustments that are included in GAAP lease revenues. We believe that Cash NOI is a helpful measure that both investors and management can use to evaluate the current financial performance of our properties and it allows for comparison of our operating performance between periods and to other companies. Cash NOI should not be considered as an alternative to net income, as an indication of our financial performance, or to cash flows as a measure of liquidity or our ability to fund all needs. The method by which we calculate and present Cash NOI may not be directly comparable to the way other companies present Cash NOI.

Cash Paid for Interest is calculated based on the interest expense less non-cash portion of interest expense and amortization of mortgage (discount) premium, net. Management believes that Cash Paid for Interest provides useful information to investors to assess our overall solvency and financial flexibility. Cash Paid for Interest should not be considered as an alternative to interest expense as determined in accordance with GAAP or any other GAAP financial measures and should only be considered together with and as a supplement to our financial information prepared in accordance with GAAP.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Key Metrics

As of and for the three months ended September 30, 2023

Amounts in thousands, except per share data, ratios and percentages

| | | | | | | | |

Financial Results (Amounts in thousands, except per share data) | | |

Revenue from tenants | | $ | 16,015 | |

| Net loss attributable to common stockholders | | $ | (9,390) | |

| Basic and diluted net loss per share attributable to common stockholders | | $ | (4.10) | |

Cash NOI [1] | | $ | 6,511 | |

Adjusted EBITDA [1] | | $ | 3,410 | |

Core FFO attributable to common stockholders [1] | | $ | (1,088) | |

| | |

Balance Sheet and Capitalization (Amounts in thousands, except ratios and percentages) | | |

Gross asset value [2] | | $ | 946,081 | |

Net debt [3] [4] | | $ | 394,410 | |

Total consolidated debt [4] | | $ | 399,500 | |

Total assets | | $ | 770,152 | |

Cash and cash equivalents [5] | | $ | 5,090 | |

| | |

| Common shares outstanding as of Sept 30, 2023 | | 2,324 | |

| | |

| Net debt to gross asset value | | 41.7 | % |

Net debt to annualized adjusted EBITDA [1] (annualized based on quarterly results) | | 28.9 | x |

| | |

Weighted-average interest rate cost [6] | | 4.4 | % |

Weighted-average debt maturity (years) [7] | | 3.4 | |

Interest Coverage Ratio [8] | | 0.8 | x |

| | |

| Real Estate Portfolio | | |

Number of properties | | 8 | |

Number of tenants | | 75 | |

| | |

Square footage (millions) | | 1.2 | |

Leased | | 85.1 | % |

Weighted-average remaining lease term (years) [9] | | 6.6 |

______

[1] This Non-GAAP metric is reconciled below.

[2] Defined as total assets of $770.2 million plus accumulated depreciation and amortization of $175.9 million as of September 30, 2023.

[3] Represents total debt outstanding of $399.5 million, less cash and cash equivalents of $5.1 million.

[4] Excludes the effect of deferred financing costs, net.

[5] Under the terms of one of the Company’s mortgage loans, the Company is required to maintain minimum liquid assets (i.e. cash and cash equivalents and restricted cash) of $10.0 million and a minimum net worth in excess of $175.0 million..

[6] The weighted average interest rate cost is based on the outstanding principal balance of the debt.

[7] The weighted average debt maturity is based on the outstanding principal balance of the debt.

[8] The interest coverage ratio is calculated by dividing adjusted EBITDA for the applicable quarter by cash paid for interest (calculated based on the interest expense less non-cash portion of interest expense and amortization of mortgage (discount) premium, net). Management believes that Interest Coverage Ratio is a useful supplemental measure of our ability to service our debt obligations. Adjusted EBITDA and cash paid for interest are Non-GAAP metrics and are reconciled below.

[9] Based on annualized straight-line rent as of September 30, 2023.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 |

Consolidated Balance Sheets

Amounts in thousands, except share and per share data

| | | | | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| ASSETS | | (Unaudited) | | |

| Real estate investments, at cost: | | | | |

| Land | | $ | 188,935 | | | $ | 192,600 | |

| Buildings and improvements | | 576,583 | | | 576,686 | |

| Acquired intangible assets | | 61,989 | | | 71,848 | |

| Total real estate investments, at cost | | 827,507 | | | 841,134 | |

| Less accumulated depreciation and amortization | | (175,929) | | | (167,978) | |

| Total real estate investments, net | | 651,578 | | | 673,156 | |

| Cash and cash equivalents | | 5,090 | | | 9,215 | |

| Restricted cash | | 7,911 | | | 6,902 | |

| Operating lease right-of-use asset | | 54,792 | | | 54,954 | |

| Prepaid expenses and other assets | | 6,741 | | | 5,624 | |

| Derivative asset, at fair value | | 817 | | | 1,607 | |

| Straight-line rent receivable | | 29,903 | | | 29,116 | |

| Deferred leasing costs, net | | 9,190 | | | 9,881 | |

| Assets held for sale | | 4,130 | | | — | |

| Total assets | | $ | 770,152 | | | $ | 790,455 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Mortgage notes payable, net | | $ | 395,316 | | | $ | 394,159 | |

| Accounts payable, accrued expenses and other liabilities (including amounts due to related parties of $395 and $118 at September 30, 2023 and December 31, 2022, respectively) | | 15,074 | | | 12,787 | |

| Operating lease liability | | 54,672 | | | 54,716 | |

| Below-market lease liabilities, net | | 2,273 | | | 3,006 | |

| | | | |

| Deferred revenue | | 3,874 | | | 4,211 | |

| | | | |

| Total liabilities | | 471,209 | | | 468,879 | |

| | | | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, none issued and outstanding at September 30, 2023 and December 31, 2022 | | — | | | — | |

| Common stock, $0.01 par value, 300,000,000 shares authorized, 2,324,201 and 1,886,298 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | 23 | | | 19 | |

| Additional paid-in capital | | 729,493 | | | 698,761 | |

| Accumulated other comprehensive income | | 829 | | | 1,637 | |

| Distributions in excess of accumulated earnings | | (431,402) | | | (399,355) | |

| Total stockholders’ equity | | 298,943 | | | 301,062 | |

| Non-controlling interests | | — | | | 20,514 | |

| Total equity | | 298,943 | | | 321,576 | |

| Total liabilities and equity | | $ | 770,152 | | | $ | 790,455 | |

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Consolidated Statements of Operations

Amounts in thousands, except share and per share data

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | September 30,

2023 | | June 30,

2023 | | March 31, 2023 | | December 31,

2022 |

| Revenue from tenants | | $ | 16,015 | | | $ | 15,782 | | | $ | 15,534 | | | $ | 16,196 | |

| | | | | | | | |

| Expenses: | | | | | | | | |

| Asset and property management fees to related parties | | 1,882 | | | 1,988 | | | 1,884 | | | 1,708 | |

| Property operating | | 8,792 | | | 8,353 | | | 8,421 | | | 8,054 | |

| Impairment of real estate investments | | 362 | | | 151 | | | — | | | — | |

| | | | | | | | |

| Equity-based compensation | | 1,208 | | | 2,304 | | | 2,200 | | | 2,198 | |

| General and administrative | | 1,931 | | | 2,439 | | | 3,181 | | | 1,897 | |

| Depreciation and amortization | | 6,499 | | | 6,749 | | | 6,952 | | | 7,703 | |

| Total expenses | | 20,674 | | | 21,984 | | | 22,638 | | | 21,560 | |

| Operating loss | | (4,659) | | | (6,202) | | | (7,104) | | | (5,364) | |

| Other income (expense): | | | | | | | | |

| Interest expense | | (4,739) | | | (4,707) | | | (4,663) | | | (4,751) | |

| Other income | | 8 | | | 10 | | | 9 | | | 6 | |

| Total other expense, net | | (4,731) | | | (4,697) | | | (4,654) | | | (4,745) | |

| | | | | | | | |

| | | | | | | | |

| Net loss and Net loss attributable to common stockholders | | $ | (9,390) | | | $ | (10,899) | | | $ | (11,758) | | | $ | (10,109) | |

| | | | | | | | |

| Basic and Diluted Net Loss Per Share: | | | | | | | | |

| Net loss per share attributable to common stockholders — Basic and Diluted | | $ | (4.10) | | | $ | (4.77) | | | $ | (5.77) | | | $ | (5.48) | |

| Weighted average shares outstanding —Basic and Diluted | | 2,288,683 | | | 2,286,797 | | | 2,038,880 | | | 1,844,864 | |

| | | | | | | | |

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Non-GAAP Measures

Amounts in thousands

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | September 30,

2023 | | June 30,

2023 | | March 31, 2023 | | December 31, 2022 |

| EBITDA: | | | | | | | | |

| Net loss and Net loss attributable to common stockholders | | $ | (9,390) | | | $ | (10,899) | | | $ | (11,758) | | | $ | (10,109) | |

| Depreciation and amortization | | 6,499 | | | 6,749 | | | 6,952 | | | 7,703 | |

| Interest expense | | 4,739 | | | 4,707 | | | 4,663 | | | 4,751 | |

| | | | | | | | |

| EBITDA | | 1,848 | | | 557 | | | (143) | | | 2,345 | |

| Impairment of real estate investments | | 362 | | | 151 | | | — | | | — | |

| | | | | | | | |

| Equity-based compensation | | 1,208 | | | 2,304 | | | 2,200 | | | 2,198 | |

| Other income | | (8) | | | (10) | | | (9) | | | (6) | |

| Adjusted EBITDA | | 3,410 | | | 3,002 | | | 2,048 | | | 4,537 | |

| Asset and property management fees to related parties | | 1,882 | | | 1,988 | | | 1,884 | | | 1,708 | |

| General and administrative | | 1,931 | | | 2,439 | | | 3,181 | | | 1,897 | |

| NOI | | 7,223 | | | 7,429 | | | 7,113 | | | 8,142 | |

| Accretion of below- and amortization of above-market lease liabilities and assets, net | | (36) | | | (45) | | | 36 | | | 123 | |

| Straight-line rent (revenue as a lessor) | | (703) | | | 120 | | | (204) | | | (263) | |

| Straight-line ground rent (expense as lessee) | | 27 | | | 27 | | | 27 | | | 28 | |

| Cash NOI | | $ | 6,511 | | | $ | 7,531 | | | $ | 6,972 | | | $ | 8,030 | |

| | | | | | | | |

| Cash Paid for Interest: | | | | | | | | |

| Interest expense | | $ | 4,739 | | | $ | 4,707 | | | $ | 4,663 | | | $ | 4,751 | |

| Amortization of deferred financing costs | | (386) | | | (385) | | | (386) | | | (386) | |

| Total cash paid for interest | | $ | 4,353 | | | $ | 4,322 | | | $ | 4,277 | | | $ | 4,365 | |

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Non-GAAP Measures

Amounts in thousands, except per share data

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | September 30,

2023 | | June 30,

2023 | | March 31, 2023 | | December 31,

2022 |

| Funds from operations (FFO): | | | | | | | | |

Net loss and Net loss attributable to common stockholders | | $ | (9,390) | | | $ | (10,899) | | | $ | (11,758) | | | $ | (10,109) | |

| Impairment of real estate investments | | 362 | | | 151 | | | — | | | — | |

| Depreciation and amortization | | 6,499 | | | 6,749 | | | 6,952 | | | 7,703 | |

| | | | | | | | |

| FFO attributable to common stockholders | | (2,529) | | | (3,999) | | | (4,806) | | | (2,406) | |

| Acquisition and transaction related | | — | | | — | | | — | | | — | |

Equity-based compensation [1] | | 1,208 | | | 2,304 | | | 2,200 | | | 2,198 | |

| | | | | | | | |

| | | | | | | | |

Expenses attributable to 2023 Tender Offer [2] | | 233 | | | — | | | — | | | — | |

| Core FFO attributable to common stockholders | | $ | (1,088) | | | $ | (1,695) | | | $ | (2,606) | | | $ | (208) | |

| | | | | | | | |

| Weighted average common shares outstanding — Basic and Diluted | | 2,289 | | | 2,287 | | | 2,039 | | | 1,845 | |

| Weighted average common shares outstanding - Diluted | | 2,289 | | | 2,287 | | | 2,039 | | | 1,845 | |

| Net loss per share attributable to common shareholders — Basic and Diluted | | $ | (4.10) | | | $ | (4.77) | | | $ | (5.77) | | | $ | (5.48) | |

| FFO per common share | | $ | (1.11) | | | $ | (1.75) | | | $ | (2.36) | | | $ | (1.30) | |

| Core FFO per common share | | $ | (0.48) | | | $ | (0.74) | | | $ | (1.28) | | | $ | (0.11) | |

________

Footnotes:

[1] Includes expenses related to the amortization of the Company's restricted common shares and units of limited partnership related to its multi-year outperformance agreement for all periods presented. Management has not added back the cost of the Advisor’s base management fee used by the Advisor under the Side Letter to purchase shares or the cost of the base management fee elected to be received by the Advisor in shares in lieu of cash because such amounts are considered a normal operating expense. Such amounts included in net loss were $0.5 million and $1.4 million for the three months ended March 31, 2023 and December 31, 2022, respectively.

[2] Amount relates to costs that we incurred as it relates to the 2023 Tender Offer. We do not consider these expenses to be part of our normal operating performance and has, accordingly, increased its Core FFO for this amount.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Debt Overview

As of September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year of Maturity | | Number of Encumbered Properties | | Weighted-Average Debt Maturity (Years) [1] | | Weighted-Average Interest Rate [1] [2] | | Total Outstanding Balance [3] |

| | | | | | | | (In thousands) |

| 2023 (remainder) | | — | | | — | | | — | % | | $ | — | |

| 2024 | | 1 | | | 0.6 | | | 3.7 | % | | 49,500 | |

| 2025 | | — | | | — | | | — | % | | — | |

| 2026 | | 1 | | | 2.8 | | | 4.2 | % | | 99,000 | |

| 2027 | | 1 | | | 3.4 | | | 4.7 | % | | 140,000 | |

| 2028 | | 3 | | | 5.2 | | | 4.7 | % | | 60,000 | |

| Thereafter | | 1 | | | 5.8 | | | 3.9 | % | | 51,000 | |

| Total Debt | | 7 | | | 3.4 | | | 4.4 | % | | $ | 399,500 | |

______

[1] Weighted based on the outstanding principal balance of the debt.

[2] All of the Company’s debt is fixed rate as of September 30, 2023.

[3] Excludes the effect of deferred financing costs, net. Current balances as of September 30, 2023 are shown in the year the debt matures.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Future Minimum Lease Rents

As of September 30, 2023

Amounts in thousands

| | | | | | | | |

| | Future Minimum

Base Rent Payments [1] |

| 2023 (remainder) | | $ | 13,292 | |

| 2024 | | 55,142 | |

| 2025 | | 47,476 | |

| 2026 | | 42,628 | |

| 2027 | | 39,249 | |

| 2028 | | 34,884 | |

| Thereafter | | 171,316 | |

| Total | | $ | 403,987 | |

——

[1] Represents future minimum base rent payments on a cash basis due to the Company over the next five years and thereafter. These amounts exclude contingent rent payments, as applicable, that may be collected from certain tenants based on provisions related to sales thresholds and increases in annual rent based on exceeding certain economic indexes among other items.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Top Ten Tenants

As of September 30, 2023

Amounts in thousands, except percentages

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tenant / Lease Guarantor | | Property Type | | Tenant Industry | | Annualized SL Rent [1] | | SL Rent Percent | Remaining Lease Term [2] | | Investment Grade [3] |

| City National Bank | | Office / Retail | | Financial Services | | $ | 4,356 | | | 7 | % | 9.8 | | | Yes |

| Equinox | | Retail | | Fitness | | 3,448 | | | 6 | % | 15.2 | | | No |

| Planned Parenthood Federation of America, Inc. | | Office | | Non-Profit | | 3,385 | | | 6 | % | 7.7 | | | Yes |

| Cornell University | | Office | | Healthcare Services | | 2,476 | | | 4 | % | 0.8 | | | Yes |

| The City of New York - Dept. of Youth & Community Development | | Office | | Government/Public Administration | | 2,215 | | | 4 | % | 14.3 | | | Yes |

| CVS | | Retail | | Retail | | 2,161 | | | 4 | % | 10.9 | | | Yes |

| USA General Services Administration | | Office | | Government/Public Administration | | 2,015 | | | 3 | % | 3.7 | | | Yes |

| I Love NY Gifts | | Retail | | Retail | | 1,932 | | | 3 | % | 12.7 | | | No |

| NYS Licensing | | Office | | Government/Public Administration | | 1,833 | | | 3 | % | 3.8 | | | Yes |

| Marshalls | | Retail | | Retail | | 1,641 | | | 3 | % | 5.1 | | | Yes |

| Subtotal | | | | | | 25,462 | | | 43 | % | 8.9 | | | |

| | | | | | | | | | | |

| Remaining portfolio | | | | | | 33,572 | | | 57 | % | | | |

| | | | | | | | | | | |

| Total Portfolio | | | | | | $ | 59,034 | | | 100 | % | | | |

——

[1] Calculated using the most recent available lease terms as of September 30, 2023.

[2] Based on straight-line rent as of September 30, 2023.

[3] As used herein, investment grade includes both actual investment grade ratings of the tenant or guarantor, if available, or implied investment grade. Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of whether or not the parent has guaranteed the tenant’s obligation under the lease) or by using a proprietary Moody’s analytical tool, which generates an implied rating by measuring a company’s probability of default. The term "parent" for these purposes includes any entity, including any governmental entity, owning more than 50% of the voting stock in a tenant. Ratings information is as of September 30, 2023. Top 10 tenants are 59% actual investment grade rated and 20% implied investment grade rated.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Diversification by Property Type

As of September 30, 2023

Amounts in thousands, except percentages

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Portfolio |

| Property Type | | Annualized SL Rent [1] | | SL Rent Percent | | Square Feet | | Sq. ft. Percent |

| Office | | $ | 42,620 | | | 72 | % | | 802 | | | 81 | % |

| Retail | | 15,105 | | | 26 | % | | 172 | | | 17 | % |

| Other | | 1,309 | | | 2 | % | | 16 | | | 2 | % |

| Total | | $ | 59,034 | | | 100 | % | | 990 | | | 100 | % |

——

[1] Calculated using the most recent available lease terms as of September 30, 2023.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Diversification by Tenant Industry

As of September 30, 2023

Amounts in thousands, except percentages

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Portfolio |

| Industry Type | | Annualized SL Rent [1] | | SL Rent Percent | | Square Feet | | Sq. ft. Percent |

| Financial Services | | $ | 14,000 | | | 24 | % | | 180 | | | 18 | % |

| Government / Public Administration | | 7,687 | | | 13 | % | | 173 | | | 18 | % |

| Retail | | 7,043 | | | 12 | % | | 53 | | | 5 | % |

| Non-profit | | 6,005 | | | 10 | % | | 134 | | | 14 | % |

| Services | | 3,957 | | | 7 | % | | 70 | | | 7 | % |

| Office Space | | 3,550 | | | 6 | % | | 71 | | | 7 | % |

| Fitness | | 3,448 | | | 6 | % | | 30 | | | 3 | % |

| Healthcare Services | | 3,138 | | | 5 | % | | 43 | | | 4 | % |

| Professional Services | | 2,833 | | | 5 | % | | 62 | | | 6 | % |

| Technology | | 2,596 | | | 4 | % | | 46 | | | 5 | % |

Other [2] | | 4,777 | | | 8 | % | | 128 | | | 13 | % |

| Total | | $ | 59,034 | | | 100 | % | | 990 | | | 100 | % |

——

[1] Calculated using the most recent available lease terms as of September 30, 2023.

[2] Other includes nine industry types as of September 30, 2023.

| | | | | | | | |

| American Strategic Investment Co. |

| Supplemental Information |

Quarter ended September 30, 2023 (Unaudited) |

Lease Expirations

As of September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year of Expiration | | Number of Leases Expiring | | Annualized SL Rent [1] | | Annualized SL Rent Percent | | Leased Rentable Square Feet | | Percent of Rentable Square Feet Expiring |

| | | | (In thousands) | | | | (In thousands) | | |

| 2023 (Remaining) | | 10 | | $ | 1,596 | | | 2.7 | % | | 34 | | | 3.5 | % |

| 2024 | | 11 | | 7,484 | | | 12.7 | % | | 123 | | | 12.4 | % |

| 2025 | | 12 | | 5,762 | | | 9.8 | % | | 104 | | | 10.5 | % |

| 2026 | | 10 | | 3,787 | | | 6.4 | % | | 73 | | | 7.4 | % |

| 2027 | | 12 | | 6,004 | | | 10.2 | % | | 131 | | | 13.2 | % |

| 2028 | | 7 | | 3,407 | | | 5.8 | % | | 56 | | | 5.7 | % |

| 2029 | | 7 | | 3,348 | | | 5.7 | % | | 58 | | | 5.8 | % |

| 2030 | | 4 | | 2,310 | | | 3.9 | % | | 42 | | | 4.3 | % |

| 2031 | | 7 | | 5,374 | | | 9.1 | % | | 92 | | | 9.3 | % |

| 2032 | | 3 | | 789 | | | 1.3 | % | | 14 | | | 1.5 | % |

| 2033 | | 8 | | 4,967 | | | 8.4 | % | | 47 | | | 4.7 | % |

| 2034 | | 4 | | 3,424 | | | 5.8 | % | | 30 | | | 3.0 | % |

| 2035 | | 3 | | 640 | | | 1.1 | % | | 4 | | | 0.4 | % |

| 2036 | | 4 | | 2,298 | | | 3.9 | % | | 17 | | | 1.7 | % |

| 2037 | | 4 | | 4,048 | | | 6.9 | % | | 128 | | | 12.9 | % |

| 2038 | | 2 | | 3,450 | | | 5.8 | % | | 30 | | | 3.1 | % |

| Thereafter (>2038) | | 2 | | 346 | | | 0.4 | % | | 7 | | | 0.6 | % |

| Total | | 110 | | $ | 59,034 | | | 100 | % | | 990 | | | 100 | % |

——

[1] Calculated using the most recent available lease terms as of September 30, 2023. Includes tenant concessions, such as free rent, as applicable.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |