UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed

by a Party other than the Registrant x

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting material Pursuant to §240.14a-12 |

Norfolk Southern Corporation

(Name of Registrant as Specified in Its Charter)

ANCORA CATALYST INSTITUTIONAL, LP

ANCORA ADVISORS, LLC

ANCORA ALTERNATIVES LLC

ANCORA BELLATOR FUND, LP

ANCORA CATALYST, LP

ANCORA FAMILY WEALTH ADVISORS, LLC

THE ANCORA GROUP LLC

ANCORA HOLDINGS GROUP, LLC

ANCORA IMPACT FUND LP

ANCORA IMPACT FUND LP SERIES AA

ANCORA IMPACT FUND LP SERIES BB

ANCORA MERLIN INSTITUTIONAL, LP

ANCORA MERLIN, LP

BETSY ATKINS

JAMES BARBER, JR.

WILLIAM CLYBURN, JR.

NELDA CONNORS

FREDERICK DISANTO

SAMEH FAHMY

INVERNESS HOLDINGS LLC

JOHN KASICH

GILBERT LAMPHERE

ALLISON LANDRY

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Ancora Alternatives LLC (“Ancora Alternatives”),

together with the other participants named herein, intend to file a preliminary proxy statement and accompanying proxy card with the Securities

and Exchange Commission to be used to solicit proxies for the election of their slate of director nominees at the 2024 annual meeting

of shareholders of Norfolk Southern Corporation, a Virginia corporation (“Norfolk Southern” or the “Company”).

On February 28, 2024, Ancora Alternatives posted the following materials

to its campaign website at www.movenscforward.com (the “Website”). Copies of the materials posted to the Website are reproduced

below. From time to time, Ancora Alternatives and the other participants named herein may refer shareholders of the Company to recent

articles, copies of which are reproduced as Exhibits 1, 2 and 3.

From time to time, Ancora or the other participants in the proxy solicitation

may publish the material, or portions thereof, on the Website in connection with the solicitation of the shareholders of Norfolk Southern.

Exhibit 1:

Norfolk Southern CEO received 37% raise

following derailment

CNN

By Chris Isidore

February 26, 2024

New York (CNN) -- Norfolk

Southern CEO Alan Shaw received a 37% increase in compensation last year, even after the company’s railroad was involved in a financially

and ecologically disastrous derailment in East Palestine, Ohio.

Shaw received $13.4 million in total compensation

in 2023, up from $9.8 million in 2022. His base salary rose $200,000 to $1.1 million, and his stock and option awards rose $2.2 million

to $10 million.

Last year was Shaw’s first full year

as CEO after starting on May 1, 2022, so part of the increase in compensation can be attributed to having worked more months on the job

last year than the year earlier. But he was president of the company in the first four months of 2022, and his promotion to that role

in late 2021 had already resulted in his compensation more than doubling in 2022 compared to 2021.

The accident

on February 3, 2023, did not result in any fatalities, but did cause a massive fire fueled by toxic chemicals and the

evacuation of much of the small Ohio town. And it cost the railroad $1.1 billion, according to its most recent

estimate.

The company’s overall net income fell

44% last year to $1.8 billion. Shares of Norfolk Southern (NSC) fell 22% in the two months following the accident, but the stock has since

recovered most of its value, and its current share price is slightly above its pre-derailment level.

Shaw’s changes in railroad procedures

have won the support of the Brotherhood of Locomotive Engineers, the union that represents the company’s engineers. But the problems

at Norfolk Southern have sparked a proxy battle, as an investor group led by Ohio-based Ancora Holdings is seeking to elect an alternative

slate of candidates to the company’s board of directors, with the goal of replacing Shaw.

“It’s alarming that the board

rewarded Mr. Shaw with a massive raise and total compensation of $13.4 million during the same year he presided over industry-worst operating

results, sustained underperformance and a tone-deaf response to the derailment in East Palestine,” the group told CNN in a statement.

“This failure of corporate governance … reinforces the need for sweeping changes to Norfolk Southern’s well paid board.”

The shareholder group said it wants to replace

Shaw with Jim Barber Jr., a former chief operating officer at UPS.

In a statement on its site, Norfolk Southern

said in the coming weeks it “will also provide details regarding how Ancora’s nominees and plan may not only hinder the successful

execution of a strategy that is yielding results, but also threaten Norfolk Southern’s progress on safety, its continued commitment

to the community of East Palestine, and its improved relationships with regulators and other stakeholders.”

The proxy filing from Norfolk Southern said

its board has “unanimous support for the company’s strategy that balances safe and reliable service, continuous productivity

improvement and smart growth under the leadership of CEO Alan Shaw.”

Norfolk Southern also announced the names

two of its 13 board member nominees — Richard H. Anderson, a former CEO of Amtrak and Delta Air Lines, and Mary Kathryn “Heidi”

Heitkamp, the former US senator of North Dakota — to fill the seats of two retiring board members and two who are not running for

re-election.

The opposition investor group said the company’s

new slate of board members won’t stop it from pushing its slate of eight candidates.

“Mr. Shaw and his boardroom allies have no credible plan and

no viable record to run on,” said the group.

Exhibit 2:

Investor group Ancora says safety is its 'top priority' at Norfolk

Southern

Progressive Railroading

February 23, 2024

Ancora Holdings Group LLC, the Ohio-based

activist investor group aiming to overhaul Norfolk Southern Corp.’s board and executive leadership, yesterday "reinforced"

its commitment to safety at the railroad.

Ancora issued a press release in response

to Federal Railroad Administration Administrator Amit Bose's Feb. 21 letter to NS President and CEO Alan Shaw in which the regulator

advised the company to stay focused on running a safe railroad, even as activist investors seek to replace top leadership.

"Any backsliding, as a result of a change

in leadership or otherwise, on the safety-oriented path you have laid out and communicated to us will likely attract renewed oversight

attention from my office as we pursue our safety mission," Bose's letter warned.

Earlier this week, Ancora, which holds a large

equity stake in NS, announced the nomination of eight independent candidates for election to the NS board. The group also announced two

proposed new leaders at NS: former United Parcel Service Inc. executive Jim Barber Jr. as CEO and former CSX executive Jamie Boychuk as

chief operating officer.

In its latest press release, the investor

group said it agrees with Bose’s statement that NS’s path to "immediate and long-term success is a relentless focus on

safety."

Ancora’s statement continued: "We

also share the agency’s concerns regarding ‘backsliding’ at the company. Despite making reactionary safety commitments

following the preventable derailment in East Palestine, Ohio, in 2023, Norfolk Southern’s board and management team have overseen

multiple derailments and the tragic death of an engineer in 2024. This is one of the primary reasons why our proposed management team

and slate of director candidates, which includes former policymakers with relevant expertise, continue to follow President Joe Biden’s

calls to hold Norfolk Southern accountable."

Ancora also called out NS Chair Amy Miles

and the current NS board for allowing Shaw to "allocate millions of dollars" to wide-ranging lobbying and public relations.

Ancora claimed that its efforts would include

the following:

| · | its scheduled network strategy would position NS to enhance safety and reduce risks by "shrinking the number of trains on the

track and reducing dangerous workloads that can lead to exhaustion-driven mistakes;" |

| · | its slate of candidates’ "top priority" is safety because NS cannot deliver sustained shareholder value without establishing

a safety-first culture; and |

| · | its slate of candidates will release a 100-day transition plan and detailed strategy overview after it is able to begin soliciting

support for proposals at the 2024 annual meeting. |

The group noted that as an Ohio-based entity,

its "employees and partners … have loved ones and family who have been directly impacted by the tragedy in East Palestine,

Ohio – meaning this campaign is about much more than financial returns to Ancora."

The Ancora press release can be read here.

Exhibit 3:

Activist Ancora Calls for Norfolk Southern CEO Change, Board

Overhaul

Bloomberg

By Thomas Black

February 20, 2024

| · | Ancora Holdings cites ‘industry-worst’ results under CEO Shaw |

| · | Investor nominates ex-Ohio governor, seven others to board |

Activist investment firm Ancora Holdings Group called for new management

and an overhaul of the board at Norfolk Southern Corp., the railroad that’s still reeling from a costly derailment last year in

Ohio.

Ancora will nominate eight directors, including former Ohio governor

John Kasich and a former executive with railroad Kansas City Southern, as part of its proxy fight with Norfolk Southern, according to

a statement Tuesday. The investor proposed Jim Barber, the ex-chief operating officer of United Parcel Service Inc., to replace Alan Shaw

as Norfolk Southern’s chief executive officer.

Norfolk Southern “has suffered for years due to its board’s

poor decisions,” Ancora, which recently took a stake in the company, said in the statement. After Shaw was named CEO the railroad

has had “industry-worst operating results, sustained share price underperformance and a tone-deaf response to the devastating East

Palestine, Ohio, derailment.”

Shaw, who vowed to improve customer service by not furloughing workers

so aggressively during drops in freight demand, had been on the job less than a year before the derailment in February 2023. Norfolk Southern

has paid out more than $1 billion for the accident, mostly for environmental remediation.

The CEO has been leading an effort among railroads to improve customer

and union relationships after several years of heavy cost-cutting that increased profit margins but resulted in spotty service and disgruntled

workers. Those plans to keep a buffer of workers during a freight downturn with the goal of maintaining service when volume rebounded

were derailed by the crash of a train carrying chemicals in East Palestine.

Norfolk Southern’s board members on the governance and nominating

committee evaluated and interviewed all of Ancora’s nominees as part of the negotiating process, the railroad said in a statement.

The company added two new board members last year and two others will step down this year at the annual shareholders meeting, which doesn’t

have a date yet. The annual meeting is usually held in May.

The company defended its operating record, saying it’s working

to recover from short-term impacts to profit margins. It also said that it’s operating on principles that are based on scheduled

railroading.

“Customers are seeing our progress,” the company said in

the statement. “They recognize our commitment to delivering consistent, reliable service and are awarding us new business.”

Norfolk Southern also defended it’s safety record and reaction

to the East Palestine derailment, saying it logged a 42% reduction in 2023 from the previous year for the accident rate on mainline tracks,

such as the route through East Palestine.

“We are proud of our response in East Palestine and the relationships

we’ve built throughout the community,” the company said.

Norfolk Southern’s shares rose less than 1% to $253.79 in New

York.

Board Nominees

Ancora’s board slate includes Sameh Fahmy, who is credited with

implementing at Kansas City Southern a strategy of cost cuts and operational improvements known as Precision Scheduled Railroading. William

Clyburn, another board candidate, has extensive rail experience, including with the Surface Transportation Board that regulates railroads.

Ancora also recruited Jamie Boychuk, an experienced railroader who just left Norfolk Southern’s main rival CSX Corp., to be chief

operating officer.

Norfolk Southern and the activist firm had been in talks, but hit an

impasse over keeping Shaw as CEO, according to Jim Chadwick, an executive with Ancora.

“The company has been, what I would describe as, blindly loyal

to him,” Chadwick said in an interview with CNBC.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking

statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or

current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,”

“anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,”

“forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations

on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking

statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein

is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if the underlying assumptions of Ancora (defined

below) or any of the other participants in the proxy solicitation described herein prove to be incorrect, the actual results may vary

materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation

by Ancora that the future plans, estimates or expectations contemplated will ever be achieved. You should not rely upon forward-looking

statements as a prediction of actual results and actual results may vary materially from what is expressed in or indicated by the forward-looking

statements. Except to the extent required by applicable law, neither Ancora nor any participant will undertake and specifically declines

any obligation to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein

to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated

or unanticipated events. Certain statements and information included herein have been sourced from third parties. Ancora does not make

any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may be

expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties.

Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Ancora Alternatives and the other

Participants (as defined below) intend to file a preliminary proxy statement and accompanying BLUE universal proxy card (the

“Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) to be used to solicit proxies

for, among other matters, the election of its slate of director nominees at the 2024 annual meeting of shareholders (the “2024

Annual Meeting”) of Norfolk Southern Corporation, a Virginia corporation (“Norfolk Southern” or the

“Corporation”).

The participants in the proxy solicitation

are currently anticipated to be Ancora Catalyst Institutional, LP (“Ancora”), Ancora Merlin Institutional, LP,

(“Ancora Merlin Institutional”), Ancora Merlin, LP (“Ancora Merlin”), Ancora Catalyst, LP (“Ancora

Catalyst”), Ancora Bellator Fund, LP (“Ancora Bellator”), Ancora Impact Fund LP Series AA (“Ancora Impact

AA”) and Ancora Impact Fund LP Series BB (“Ancora Impact BB”) (each of which is a series fund within Ancora Impact

Fund LP) (Ancora, Ancora Merlin Institutional, Ancora Merlin, Ancora Catalyst, Ancora Bellator, Ancora Impact AA and Ancora Impact

BB, collectively, the “Ancora Funds”), Ancora Advisors, LLC (“Ancora Advisors”), The Ancora Group LLC

(“Ancora Group”), Ancora Family Wealth Advisors, LLC (“Ancora Family Wealth”), Inverness Holdings LLC

(“Inverness Holdings”), Ancora Alternatives, Ancora Holdings Group LLC (“Ancora Holdings”) and Frederick

DiSanto (collectively, the “Ancora Parties”); and Betsy Atkins, James Barber, Jr., William Clyburn, Jr., Nelda Connors,

Sameh Fahmy, John Kasich, Gilbert Lamphere and Allison Landry (the “Ancora Nominees” and, collectively with the Ancora

Parties, the “Participants”).

Ancora Alternatives, as the general partner and

investment manager of each of the Ancora Funds and as the investment manager of the Ancora Alternatives separately managed accounts (each,

an “SMA”) may be deemed to beneficially own in the aggregate 913,180 shares of Common Stock (of which 830,380 shares of Common

Stock are directly and beneficially owned by the Ancora Funds, including the 123,500 shares of Common Stock underlying 1,235 American

call options held directly and beneficially in aggregate by the Ancora Funds, and of which 82,800 shares of Common Stock are held indirectly

and beneficially by the Ancora Alternatives SMAs). Ancora Advisors, as the investment advisor to the SMA of Ancora Advisors, may be deemed

to beneficially own all of the 270 shares of Common Stock held in the Ancora Advisors SMA. Ancora Group, as the sole member of Ancora

Advisors, may be deemed to beneficially own all of the 270 shares of Common Stock held in the Ancora Advisors SMA. Ancora Family Wealth,

as the investment advisor to the Ancora Family Wealth SMAs, may be deemed to beneficially own all of the 9,847.28 shares of Common Stock

held in the Ancora Family Wealth SMAs. Inverness Holdings, as the sole member of Ancora Family Wealth, may be deemed to beneficially own

all of the 9,847.28 shares of Common Stock held in the Ancora Family Wealth SMAs. Ancora, as the sole member of each of Ancora Alternatives,

Ancora Group and Inverness Holdings, may be deemed to beneficially own in the aggregate 923,297.28 shares of Common Stock held by the

Ancora Funds (including the 123,500 shares of Common Stock underlying 1,235 American call options), the Ancora Alternatives SMAs, the

Ancora Advisors SMA and the Ancora Family Wealth SMAs. Mr. DiSanto, as the Chairman and Chief Executive Officer of Ancora, may be deemed

to beneficially own in the aggregate 923,297.28 shares of Common Stock held by the Ancora Funds (including the 123,500 shares of Common

Stock underlying 1,235 American call options), the Ancora Alternatives SMAs, the Ancora Advisors SMA and the Ancora Family Wealth SMAs.

The Ancora Parties beneficially own 923,297.28 shares of Common Stock in the aggregate (including the 123,500 shares of Common Stock underlying

1,235 American call options). Gilbert Lamphere owns 1,200 shares of Common Stock and Sameh Fahmy owns 3,000 shares of Common Stock.

IMPORTANT INFORMATION AND WHERE TO FIND IT

ANCORA ALTERNATIVES STRONGLY ADVISES ALL SHAREHOLDERS

OF NORFOLK SOUTHERN TO READ THE PRELIMINARY PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT, THE DEFINITIVE PROXY

STATEMENT, AND OTHER PROXY MATERIALS FILED BY ANCORA ALTERNATIVES AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

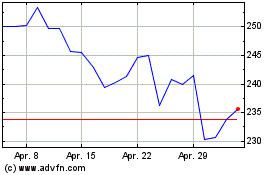

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024