0001078207false00010782072023-09-212023-09-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: September 21, 2023

(Date of earliest event reported)

_________________________________________

NAUTILUS, INC.

(Exact name of registrant as specified in its charter)

__________________________________________

| | | | | | | | |

| Washington | 001-31321 | 94-3002667 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

17750 S.E. 6th Way

Vancouver, Washington 98683

(Address of principal executive offices, including zip code)

(360) 859-2900

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, no par value | NLS | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

NAUTILUS, INC.

FORM 8-K

| | | | | | | | |

| Item 3.01 | | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard: Transfer of Listing. |

On September 21, 2023, Nautilus, Inc. (the “Company”) received notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that the Company was not in compliance with the continued listing standard set forth in Section 802.01C of the NYSE’s Listed Company Manual (“Section 802.01C”) because the average closing price of the Company’s Common Stock (the “Common Stock”) was less than $1.00 per share over a consecutive 30 trading-day period (the “minimum share price requirement”). The Notice has no immediate impact on the listing of the Common Stock on the NYSE, subject to the Company’s compliance with the NYSE’s other continued listing requirements.

Pursuant to Section 802.01C, the Company has a period of six months following the receipt of the Notice to regain compliance with the minimum share price requirement. The Company may regain compliance at any time during the six-month cure period if on the last trading day of any calendar month during the six-month cure period the Common Stock has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month. If the Company is unable to regain compliance with the minimum share price requirement within the cure period, the NYSE will initiate procedures to suspend and delist the Common Stock. However, if the Company determines that it will cure the minimum share price requirement by taking an action that will require shareholder approval, the Company must so inform the NYSE and must obtain shareholder approval no later than its next annual meeting, and must implement the action promptly thereafter.

Section 802.01C requires the Company to notify the NYSE, within 10 business days of receipt of the Notice, of its intent to cure this deficiency. The Company intends to notify the NYSE of its intent to regain compliance with the requirements of Section 802.01C.

The Notice does not affect the Company’s business operations or its reporting obligations with the Securities and Exchange Commission.

Item 7.01 Regulation FD Disclosure

On September 27, 2023, the Company issued a press release related to the foregoing. A copy of the press release is attached as Exhibit 99.1 to this Current Report and is incorporated by reference to this Item 7.01.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated by reference into any filing by Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language contained in such filing, unless otherwise expressly stated in such filing.

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s ability to maintain the listing of its Common Stock on the NYSE and the Company’s anticipated business and financial performance. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company’s actual expectations to differ materially from these forward-looking statements also include: weaker than expected demand for new or existing products; our ability to timely acquire inventory that meets our quality control standards from sole source foreign manufacturers at acceptable costs; risks associated with current and potential delays, work stoppages, or supply chain disruptions, including shipping delays due to the severe shortage of shipping containers; an inability to pass along or otherwise mitigate the impact of raw material price increases and other cost pressures, including unfavorable currency exchange rates and increased shipping costs; experiencing delays and/or greater than anticipated costs in connection with launch of new products, entry into new markets, or strategic initiatives; our ability to hire and retain key management personnel; changes in consumer fitness trends; changes in the media consumption habits of our target consumers or the effectiveness of our media advertising; a decline in consumer spending due to unfavorable economic conditions; risks related to the impact on our business of the COVID-19 pandemic or similar public health crises; softness in the retail marketplace;

availability and timing of capital for financing our strategic initiatives, including being able to raise capital on favorable terms or at all; changes in the financial markets, including changes in credit markets and interest rates that affect our ability to access those markets on favorable terms and the impact of any future impairment. Additional assumptions, risks and uncertainties that could cause actual results to differ materially from those contemplated in these forward-looking statements are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| Press Release dated September 27, 2023 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | NAUTILUS, INC. |

| | (Registrant) |

| | | |

| September 27, 2023 | | By: | /s/ Aina E. Konold |

| Date | | | Aina E. Konold |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

BowFlex Parent, Nautilus, Inc. Announces Receipt of Notice of Non-Compliance with NYSE Trading Share Price Listing Rule

VANCOUVER, Wash. –– Sep. 27, 2023 ––Nautilus, Inc. (NYSE: NLS) (“Nautilus” or the “Company”) today announced that on September 21, 2023, it received notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that the Company is not in compliance with applicable price criteria in the NYSE’s continued listing standard set forth in the NYSE Listed Company Manual because the average closing price of the Company’s Common Stock (the “Common Stock”) was less than $1.00 per share over a consecutive 30 trading-day period. The Notice does not result in the immediate delisting of the Company’s common stock from the NYSE.

The Company intends to respond to the NYSE within ten business days of receipt of the Notice of its intent to cure the deficiency. In accordance with NYSE rules, Nautilus has a period of six months following the receipt of the Notice to regain compliance with the minimum share price requirement. The Company may regain compliance at any time within the six-month cure period if on the last trading day of any calendar month during the cure period the Company has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month.

Under the NYSE’s rules, if the Company determines that it will cure the stock price deficiency by taking an action that will require shareholder approval at its next annual meeting of shareholders, the price condition will be deemed cured if the price promptly exceeds $1.00 per share, and the price remains above that level for at least the following 30 trading days.

The Company’s Common Stock will continue to be listed and trade on the NYSE during this period, subject to the Company’s compliance with other NYSE continued listing standards. The receipt of the Notice does not affect the Company’s business, operations or reporting requirements with the Securities and Exchange Commission.

About Nautilus, Inc.

Nautilus, Inc. (NYSE:NLS) is a global leader in digitally connected home fitness solutions. The Company’s brand family includes BowFlex®, Nautilus®, Schwinn®, and JRNY®, its digital fitness platform. With a broad selection of exercise bikes, cardio equipment, and strength training products, Nautilus, Inc. empowers healthier living through individualized connected fitness experiences, and in doing so, envisions building a healthier world, one person at a time.

Headquartered in Vancouver, Washington, the company’s products are sold direct to consumer on brand websites and through retail partners and are available throughout the U.S. and internationally. Nautilus, Inc. uses the investor relations page of its website (www.nautilusinc.com/investors) to make information available to its investors and the market.

Forward-Looking Statements

This press release includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s ability to maintain the listing of its Common Stock on the NYSE and the Company’s anticipated business and financial performance. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause Nautilus, Inc.’s actual expectations to differ materially from these forward-looking statements also include: weaker than expected demand for new or existing products; our ability to timely acquire inventory that meets our quality control standards from sole source foreign manufacturers at acceptable costs; risks associated with current and potential delays, work stoppages, or supply chain disruptions, including shipping delays due to the severe shortage of shipping containers; an inability to pass along or otherwise mitigate the impact of raw material price increases and other cost pressures, including unfavorable currency exchange rates and increased shipping costs; experiencing delays and/or greater than anticipated costs in connection with launch of new products, entry into new markets, or strategic initiatives; our ability to hire and retain key management personnel; changes in consumer fitness trends; changes in the media consumption habits of our target consumers or the effectiveness of our media advertising; a decline in consumer spending due to unfavorable economic conditions; risks related to the impact on our business of the COVID-19 pandemic or similar public health crises; softness in the retail marketplace; availability and timing of capital for financing our strategic initiatives, including being able to raise capital on favorable terms or at all; changes in the financial markets, including changes in credit markets and interest rates that affect our ability to access those markets on favorable terms and the impact of any future impairment. Additional assumptions, risks and uncertainties are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. We undertake no obligation to

publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

Investor Relations:

John Mills

ICR, LLC

646-277-1254

John.Mills@icrinc.com

Media:

John Fread

Nautilus, Inc.

360-859-5815

jfread@nautilus.com

Alexa Weber

Action Mary

425-760-6590

alexa.weber@actionmary.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

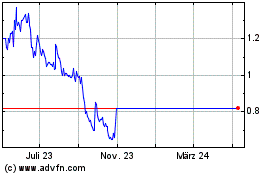

Nautilus (NYSE:NLS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

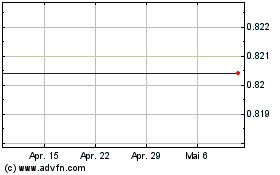

Nautilus (NYSE:NLS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024