Form 8-K - Current report

01 Oktober 2024 - 10:33PM

Edgar (US Regulatory)

0001104657false00011046572024-10-012024-10-01

| | | | | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM 8-K

| | | | | | | | | | | | | | |

| Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | | | |

Date of Report (Date of earliest event reported) October 1, 2024

MATERION CORPORATION

| | | | | | | | | | | | | | |

| (Exact name of registrant as specified in its charter) |

Ohio 001-15885 34-1919973

| | | | | | | | |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

6070 Parkland Blvd., Mayfield Hts., Ohio 44124

| | | | | | | | |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (216) 486-4200

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, no par value MTRN New York Stock Exchange

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§204.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 7.01 Regulation FD Disclosure.

Materion Corporation (“Materion” or the “Company”) is revising its 2024 full year adjusted earnings per share guidance to the range of $5.20 to $5.40, as a result of lower than expected incoming order rates for the second half of 2024.

The Company previously anticipated that semiconductor and industrial orders would continue the improved trajectory seen through the second quarter of 2024, but incoming order rates have developed slower than expected. The impact from a recovery in the semiconductor market is taking longer than planned, with customer inventories remaining at high levels, and the anticipated rebound in the industrial end markets has not yet materialized. The outlooks for aerospace and automotive have also been reduced due to the continued reductions in customer build rates.

In total, value-added sales for the second half of 2024 are expected to be approximately 5% lower than our previous expectations.

The Company has implemented additional cost control actions to mitigate the impact of lower value-added sales and expects to deliver strong adjusted EBITDA margins above the 20% mid-term target.

The Company is presenting full year adjusted earnings per share guidance, which is a non-GAAP financial measure that adjusts for certain special items. Internally, management reviews the results of operations without the impact of these special items in order to assess the profitability from ongoing activities. The Company is providing this information because it believes it will assist investors in analyzing its financial results and, when viewed in conjunction with the GAAP results, provide a more comprehensive understanding of the factors and trends affecting its operations. It is not possible for the Company to identify the amount or significance of future adjustments associated with potential insurance and litigation claims, legacy environmental costs, acquisition and integration costs, certain income tax items, or other non-routine costs that the Company adjusts in the presentation of adjusted earnings guidance. These items are dependent on future events that are not reasonably estimable at this time. Accordingly, the Company is unable to reconcile without unreasonable effort the forecasted range of adjusted earnings guidance for the full year to a comparable GAAP range.

Forward-Looking Statements

Portions of the narrative set forth in this Current Report on Form 8-K that are not statements of historical or current facts are forward-looking statements, including, without limitation, our adjusted EPS guidance for the full year 2024 and our expected value-added sales for the second half of 2024. Our actual future performance may materially differ from that contemplated by the forward-looking statements as a result of a variety of factors. These factors include, in addition to those mentioned elsewhere herein: the global economy, including inflationary pressures, potential future recessionary conditions and the impact of tariffs and trade agreements; the impact of any U.S. Federal Government shutdowns or sequestrations; the condition of the markets which we serve, whether defined geographically or by segment; changes in product mix and the financial condition of customers; our success in developing and introducing new products and new product ramp-up rates; our success in passing through the costs of raw materials to customers or otherwise mitigating fluctuating prices for those materials, including the impact of fluctuating prices on inventory values; our success in identifying acquisition candidates and in acquiring and integrating such businesses; the impact of the results of acquisitions on our ability to fully achieve the strategic and financial objectives related to these acquisitions; our success in implementing our strategic plans and the timely and successful start-up and completion of any capital projects; other financial and economic factors, including the cost and availability of raw materials (both base and precious metals), physical inventory valuations, metal consignment fees, tax rates, exchange rates, interest rates, pension costs and required cash contributions and other employee benefit costs, energy costs, regulatory compliance costs, the cost and availability of insurance, credit availability, and the impact of the Company’s stock price on the cost of incentive compensation plans; the uncertainties related to the impact of war, terrorist activities, and acts of God; changes in government regulatory requirements and the enactment of new legislation that impacts our obligations and operations; the conclusion of pending litigation matters in accordance with our expectation that there will be no material adverse effects; the disruptions in operations from, and other effects of, catastrophic and other extraordinary events including outbreaks from infectious diseases and the conflict between Russia and Ukraine and other hostilities; realization of expected financial benefits expected from the Inflation Reduction Act of 2022; and the risk factors set forth in Part 1, Item 1A of the Company's 2023 Annual Report on Form 10-K and in other reports that we file with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Materion Corporation |

| | |

| October 1, 2024 | By: | /s/ Shelly M. Chadwick |

| | Shelly M. Chadwick |

| | Vice President, Finance and Chief Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

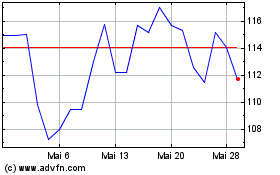

Materion (NYSE:MTRN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

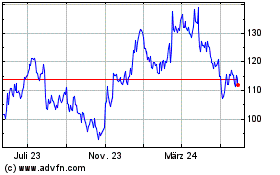

Materion (NYSE:MTRN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024