- Morgan Stanley at Work concluded marquee workplace financial

benefits industry event, Thrive, with largest attendance numbers to

date

- Key takeaways show organizations placing greater value on

comprehensive financial benefits, including equity

solutions

- Voice of the Participant 2024 survey confirms equity

compensation remains key driver of loyalty despite knowledge

gaps

Morgan Stanley at Work today announced takeaways from its annual

Thrive conference and Voice of the Participant survey, which

together demonstrate increasing demand for and adoption of

workplace financial benefits among both companies and their

employees. Findings show equity plans in particular continue to

gain popularity as a strategic method to attract, retain and

motivate top talent.

Underscoring this trend, the largest-ever 2024 Thrive conference

in Phoenix, Arizona, saw record attendance from 1,000+ benefits

professionals across public, private, U.S., and Canadian markets.

Attendees came from a variety of sectors including Information,

Health, Energy, Finance and more. Thought leaders presented topics

ranging from financial reporting and automation to non-qualified

deferred compensation and donor advised funds, while attendees

enjoyed the option to earn continuing education credits at 85% of

sessions, witness platform demonstrations, participate in hands-on

labs, and access 11 invited industry partner exhibitors.

The conference also introduced a new charitable giving activity,

Thrive Gives Back, where attendees hand-crafted over 200 backpacks

and reading supplies for donation to local charity HandsOn Greater

Phoenix’s Reading Rocks program, which alongside other initiatives

provides assistance to regional children in transitional and foster

care.

For Thrive highlights, watch here.

Within this widening ecosystem of benefits solutions, research

from Morgan Stanley at Work found more companies are offering some

form of equity compensation benefits (76%, up 12% since 2021)1 as

employee attitudes continue to evolve. Insights from the 2024 Voice

of the Participant study, which expanded to a base of 2.3 million

global stock plan participants at both private and public

companies, reveal:

- Equity benefits and education drive employee satisfaction

and retention: Stock plan benefits are highly sought-after,

with 43% of participants saying equity was a reason they joined

their company, and once participating, most (76%) stock plan

participants are highly satisfied. What’s more, over half (56%) of

stock plan participants cite equity benefits as a reason they

continue to work for their company, and seven in 10 say equity

benefits are important for recognizing their accomplishments at

work—underlining how stock plans can contribute to retention as

well as a culture of ownership.

- Yet U.S. participants seek plan education: 61% of U.S.

stock plan participants say they do not understand how to try to

maximize the financial benefit from their stock plan, showcasing

the need for more comprehensive financial education support. Most

U.S. participants say they would be likely to attend sessions on

the topics of equity fundamentals (69%), retirement (67%), and

advanced investing (64%).2

- Taxes remain a bottleneck: While employees highly value

their equity compensation, many still do not understand more

nuanced aspects such as taxes. In fact, 62% of stock plan

participants say they do not understand the impact of taxes on

their stock plan benefit—which can erode the net value of their

holdings.

- Companies can close gaps and add value through guidance:

Fewer than half of stock plan participants (45%) say they know how

to reach someone if they have questions, and less than a third

(31%) said they have a personal financial plan in place. This

indicates an opportunity to invest in greater employee awareness

and expand access to education, support, and guidance to help

employees connect their equity to personal financial goals.

“We’ve seen a consistent story in the data over the years:

Equity benefits can help drive real outcomes both for companies and

their employees, and have taken on a starring role in company

culture,” said Scott Whatley, Head of Morgan Stanley at Work.

“That’s why it’s so important to strike the right balance between

digital tools and human guidance, and why we have been working hand

in hand with our clients to create bespoke solutions that help

deliver education and guidance throughout their participant

ranks—rising to meet the unique needs of increasingly diverse and

global participant populations.”

Morgan Stanley at Work serves over 24,000 corporate clients and

~12M workplace participants, encompassing over 40% of the S&P

500 and roughly 60% of the Nasdaq 100.3 As announced at Thrive, the

Firm delivered over 1,300 education sessions to more than 125,000

benefits participants around the world in 2023, and is continuing

to roll out tech enhancements and updates—such as expanding

application programming interface (API) integration with leading

real-time compensation benchmarking and planning solutions provider

Pave to Equity Edge Online®. The business remains focused on

delivering a more unified client experience while also bolstering

service levels and staffing for deeper client and participant

support.

“As economic headwinds and tailwinds shift, organizations and

their employees continue to tell us that workplace financial

benefits are both a strategic priority and an effective tool for

pursuing goals, driving results, and remaining competitive,” said

Brian McDonald, Head of Institutional and Direct Businesses, Morgan

Stanley. “Putting clients first is one of Morgan Stanley’s core

values, and for us that means an ongoing commitment to invest in

and deliver our full ecosystem of solutions for comprehensive

support at every stage of our clients’ corporate and individual

financial journeys.”

To learn more about Thrive go here.

Additional findings from the Third Annual Morgan Stanley at Work

Stock Plan Participant study are available here.

- State of the Workplace Study 2024 | Morgan Stanley at Work

- Non-U.S. participants excluded from participant education plan

numbers.

- Statistics refer to equity compensation administration services

for Shareworks and Equity Edge Online®. S&P 500® Companies

Represented includes companies for which Morgan Stanley at Work

provides equity compensation solutions as of March 2023.

Methodology: The data from the Morgan Stanley at Work 2023

Annual Stock Plan Participant Survey comes from an in-house survey

of 2.3 million active global Morgan Stanley stock plan participants

(1.3M U.S. and 980K non-U.S. participants received the survey

email). The survey was conducted on behalf of Morgan at Stanley at

Work using an online survey on September 14, 2023, plus one

reminder email.

About Morgan Stanley at Work

Morgan Stanley at Work provides workplace financial benefits

that build financial confidence and foster loyalty—helping

companies attract and retain top talent. Our end-to-end solutions

support your organization at any stage of growth through a powerful

combination of modern technology, insightful guidance, and

dedicated service; they include Equity, Retirement, Deferred

Compensation, Executive Services, and Saving and Giving solutions.

And while we’re fulfilling your company’s benefits needs, we’re

also enhancing your employees’ financial well-being. Each benefit

solution also includes our engaging Financial Wellness program,

which provides employees with knowledge, tools, and support to help

them make the most of their benefits and achieve their life

goals.

About Morgan Stanley Wealth Management

Morgan Stanley Wealth Management is a leading financial services

firm that provides access to a wide range of products and services

to individuals, businesses, and institutions, including brokerage

and investment advisory services, financial and wealth planning,

cash management and lending products and services, annuities and

insurance, retirement, and trust services.

About Morgan Stanley

Morgan Stanley is a leading global financial services firm

providing a wide range of investment banking, securities, wealth

management and investment management services. With offices in 42

countries, the Firm’s employees serve clients worldwide including

corporations, governments, institutions and individuals. For

further information about Morgan Stanley, please visit

www.morganstanley.com.

Content and services available to non-US participants may be

different than those available to US participants. Morgan Stanley

Wealth Management is the trade name of Morgan Stanley Smith Barney

LLC, a registered broker-dealer in the United States.

© 2024 Morgan Stanley at Work and Shareworks services are

provided by Morgan Stanley Smith Barney LLC, member SIPC, and its

affiliates, all wholly owned subsidiaries of Morgan Stanley.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240624582042/en/

Media Relations Contacts: Lynn Cocchiola,

lynn.cocchiola@morganstanley.com Jeanne Joe Perrone,

Jeanne.Perrone@morganstanley.com

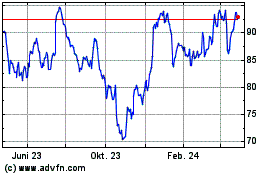

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Morgan Stanley (NYSE:MS)

Historical Stock Chart

Von Jan 2024 bis Jan 2025