Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 September 2023 - 10:35PM

Edgar (US Regulatory)

Pioneer Municipal High Income

Opportunities Fund, Inc.

Schedule of

Investments | July 31, 2023

Schedule of Investments | 7/31/23

(unaudited)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| UNAFFILIATED ISSUERS — 110.9%

|

|

|

| Municipal Bonds — 110.9% of Net Assets(a)

|

|

|

| Arizona — 3.0%

|

|

| 1,675,000

| Arizona Industrial Development Authority, Doral Academy Nevada Fire Mesa, Series A, 5.00%, 7/15/49

| $ 1,520,766

|

| 1,000,000

| Arizona Industrial Development Authority, Doral Academy Of Northern Nevada Project, Series A, 4.00%, 7/15/51 (144A)

|

746,640

|

| 950,000

| Arizona Industrial Development Authority, Doral Academy Of Northern Nevada Project, Series A, 4.00%, 7/15/56 (144A)

|

685,102

|

| 4,000,000

| Maricopa County Industrial Development Authority, Commercial Metals Company, 4.00%, 10/15/47 (144A)

| 3,462,360

|

|

| Total Arizona

| $6,414,868

|

|

|

|

|

|

| Arkansas — 4.9%

|

|

| 9,500,000

| Arkansas Development Finance Authority, Big River Steel Project, 4.50%, 9/1/49 (144A)

| $ 8,708,175

|

| 1,750,000

| Arkansas Development Finance Authority, Green Bond, 5.45%, 9/1/52

| 1,729,298

|

|

| Total Arkansas

| $10,437,473

|

|

|

|

|

|

| California — 8.2%

|

|

| 1,000,000

| California County Tobacco Securitization Agency, Golden Gate Tobacco Settlement, Series A, 5.00%, 6/1/47

| $ 927,100

|

| 1,000,000

| California Statewide Communities Development Authority, Baptist University, Series A, 5.00%, 11/1/41 (144A)

|

994,070

|

| 1,500,000

| California Statewide Communities Development Authority, Loma Linda University Medical Center, Series A, 5.00%, 12/1/46 (144A)

| 1,470,000

|

| 3,315,000

| California Statewide Communities Development Authority, Loma Linda University Medical Center, Series A, 5.25%, 12/1/56 (144A)

| 3,319,973

|

| 750,000

| City of Oroville, Oroville Hospital, 5.25%, 4/1/39

|

664,875

|

| 3,865,000

| City of Oroville, Oroville Hospital, 5.25%, 4/1/49

| 3,197,630

|

| 8,550,000

| City of Oroville, Oroville Hospital, 5.25%, 4/1/54

| 6,806,056

|

|

| Total California

| $17,379,704

|

|

|

|

|

|

| Colorado — 8.9%

|

|

| 5,180,000

| Aerotropolis Regional Transportation Authority, 4.25%, 12/1/41

| $ 4,382,850

|

| 2,660,000

| Aerotropolis Regional Transportation Authority, 5.00%, 12/1/51

| 2,344,923

|

1Pioneer Municipal High Income Opportunities Fund, Inc. | | 7/31/23

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Colorado — (continued)

|

|

| 1,900,000(b)

| Cottonwood Highlands Metropolitan District No. 1, Series A, 5.00%, 12/1/49

| $ 1,773,422

|

| 7,000,000

| Dominion Water & Sanitation District, 5.875%, 12/1/52

| 6,952,820

|

| 3,475,000

| Prairie Center Metropolitan District No 3, Series A, 5.00%, 12/15/41 (144A)

| 3,417,801

|

|

| Total Colorado

| $18,871,816

|

|

|

|

|

|

| Delaware — 0.3%

|

|

| 1,015,000

| Delaware State Economic Development Authority, Aspira of Delaware Charter, 4.00%, 6/1/57

| $ 748,228

|

|

| Total Delaware

| $748,228

|

|

|

|

|

|

| Florida — 0.9%

|

|

| 2,425,000

| Florida Development Finance Corp., Glenridge On Palmer Ranch Project, 5.00%, 6/1/51 (144A)

| $ 1,931,319

|

|

| Total Florida

| $1,931,319

|

|

|

|

|

|

| Georgia — 2.5%

|

|

| 8,440,000(c)

| Tender Option Bond Trust Receipts/Certificates, Series 2021, 7/15/50 (ST GTD) (144A)

| $ 5,355,537

|

|

| Total Georgia

| $5,355,537

|

|

|

|

|

|

| Illinois — 10.5%

|

|

| 4,260,000(b)

| Chicago Board of Education, Series A, 5.00%, 12/1/42

| $ 4,173,948

|

| 2,000,000(b)

| Chicago Board of Education, Series D, 5.00%, 12/1/46

| 1,971,620

|

| 5,000,000(b)

| Chicago Board of Education, Series D, 5.00%, 12/1/46

| 4,929,050

|

| 2,255,000(b)

| City of Chicago, Series A, 5.50%, 1/1/33

| 2,294,327

|

| 9,500,000

| Metropolitan Pier & Exposition Authority, McCormick Place Expansion, 4.00%, 6/15/50

| 8,847,350

|

|

| Total Illinois

| $22,216,295

|

|

|

|

|

|

| Iowa — 3.9%

|

|

| 8,600,000

| Iowa Finance Authority, Alcoa Inc. Projects, 4.75%, 8/1/42

| $ 8,394,460

|

|

| Total Iowa

| $8,394,460

|

|

|

|

|

|

| Kentucky — 0.5%

|

|

| 1,010,000

| City of Henderson, 4.70%, 1/1/52 (144A)

| $ 963,227

|

|

| Total Kentucky

| $963,227

|

|

|

|

|

Pioneer Municipal High Income Opportunities Fund,

Inc. | | 7/31/232

Schedule of Investments | 7/31/23

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Massachusetts — 0.9%

|

|

| 2,000,000

| Massachusetts Development Finance Agency, Lowell General Hospital, Series G, 5.00%, 7/1/44

| $ 1,936,800

|

|

| Total Massachusetts

| $1,936,800

|

|

|

|

|

|

| Minnesota — 0.6%

|

|

| 1,430,000

| City of Rochester, Rochester Math & Science Academy, Series A, 5.125%, 9/1/38

| $ 1,371,341

|

|

| Total Minnesota

| $1,371,341

|

|

|

|

|

|

| New Jersey — 0.9%

|

|

| 1,865,000

| Tobacco Settlement Financing Corp., Series B, 5.00%, 6/1/46

| $ 1,859,405

|

|

| Total New Jersey

| $1,859,405

|

|

|

|

|

|

| New York — 24.1%

|

|

| 5,300,000

| Chautauqua Tobacco Asset Securitization Corp., 5.00%, 6/1/48

| $ 4,964,033

|

| 1,000,000

| Dutchess County Local Development Corp., Health Quest Systems Inc., Series B, 5.00%, 7/1/46

| 1,001,990

|

| 8,885,000

| Erie Tobacco Asset Securitization Corp., Asset-Backed, Series A, 5.00%, 6/1/45

| 8,397,213

|

| 3,505,000

| Nassau County Tobacco Settlement Corp., Asset-Backed, Series A-3, 5.00%, 6/1/35

| 3,252,430

|

| 2,895,000

| Nassau County Tobacco Settlement Corp., Asset-Backed, Series A-3, 5.125%, 6/1/46

| 2,669,393

|

| 1,730,000

| New York Counties Tobacco Trust IV, Series A, 5.00%, 6/1/42

| 1,636,182

|

| 7,915,000

| New York Counties Tobacco Trust IV, Settlement pass through, Series A, 5.00%, 6/1/45

| 7,403,533

|

| 12,325,000

| TSASC, Inc., Series B, 5.00%, 6/1/48

| 11,558,631

|

| 8,000,000

| Westchester County Local Development Corp., Purchase Senior Learning Community, 4.50%, 7/1/56 (144A)

| 5,681,040

|

| 5,775,000

| Westchester County Local Development Corp., Purchase Senior Learning Community, 5.00%, 7/1/56 (144A)

| 4,562,250

|

|

| Total New York

| $51,126,695

|

|

|

|

|

|

| Ohio — 5.1%

|

|

| 11,600,000

| Buckeye Tobacco Settlement Financing Authority, Senior Class 2, Series B2, 5.00%, 6/1/55

| $ 10,814,216

|

|

| Total Ohio

| $10,814,216

|

|

|

|

|

3Pioneer Municipal High Income Opportunities Fund, Inc. | | 7/31/23

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Oklahoma — 2.8%

|

|

| 5,900,000

| Tulsa Airports Improvement Trust, Series C, 5.50%, 12/1/35

| $ 5,903,658

|

|

| Total Oklahoma

| $5,903,658

|

|

|

|

|

|

| Pennsylvania — 0.3%

|

|

| 750,000

| Philadelphia Authority for Industrial Development, 4.00%, 6/1/41

| $ 619,980

|

|

| Total Pennsylvania

| $619,980

|

|

|

|

|

|

| Puerto Rico — 19.9%

|

|

| 7,673,960(b)

| Commonwealth of Puerto Rico, Restructured Series A1, 4.00%, 7/1/37

| $ 6,956,368

|

| 1,796,000(b)

| Commonwealth of Puerto Rico, Restructured Series A1, 4.00%, 7/1/41

| 1,544,560

|

| 3,624,000(b)

| Commonwealth of Puerto Rico, Restructured Series A1, 4.00%, 7/1/46

| 3,072,971

|

| 3,220,000

| Puerto Rico Commonwealth Aqueduct & Sewer Authority, Series A, 5.00%, 7/1/37 (144A)

| 3,238,193

|

| 8,500,000

| Puerto Rico Commonwealth Aqueduct & Sewer Authority, Series A, 5.00%, 7/1/47 (144A)

| 8,382,870

|

| 9,000,000

| Puerto Rico Highway & Transportation Authority, Restructured Series A, 5.00%, 7/1/62

| 8,842,500

|

| 10,844,000

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-1, 4.75%, 7/1/53

| 10,317,415

|

|

| Total Puerto Rico

| $42,354,877

|

|

|

|

|

|

| Texas — 1.3%

|

|

| 3,000,000

| City of Houston Airport System Revenue, 4.00%, 7/15/41

| $ 2,685,330

|

|

| Total Texas

| $2,685,330

|

|

|

|

|

|

| Virginia — 3.1%

|

|

| 7,315,000

| Tobacco Settlement Financing Corp., Series A-1, 6.706%, 6/1/46

| $ 6,536,026

|

|

| Total Virginia

| $6,536,026

|

|

|

|

|

|

| West Virginia — 5.5%

|

|

| 15,000,000

| Tobacco Settlement Finance Authority, Series A, 4.306%, 6/1/49

| $ 11,670,600

|

|

| Total West Virginia

| $11,670,600

|

|

|

|

|

Pioneer Municipal High Income Opportunities Fund,

Inc. | | 7/31/234

Schedule of Investments | 7/31/23

(unaudited) (continued)

Principal

Amount

USD ($)

|

|

|

|

|

| Value

|

|

| Wisconsin — 2.8%

|

|

| 8,000,000

| Public Finance Authority, Searstone CCRC Project, 4.00%, 6/1/41 (144A)

| $ 6,043,440

|

|

| Total Wisconsin

| $6,043,440

|

|

|

|

|

|

| Total Municipal Bonds

(Cost $237,500,350)

| $235,635,295

|

|

|

|

|

|

| TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 110.9%

(Cost $237,500,350)

| $235,635,295

|

|

| OTHER ASSETS AND LIABILITIES — (10.9)%

| $(23,173,496)

|

|

| net assets — 100.0%

| $212,461,799

|

|

|

|

|

|

|

|

|

| ST GTD

| State Guaranteed.

|

| (144A)

| The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At July 31, 2023,

the value of these securities amounted to $58,961,997, or 27.8% of net assets.

|

| (a)

| Consists of Revenue Bonds unless otherwise indicated.

|

| (b)

| Represents a General Obligation Bond.

|

| (c)

| The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at July 31, 2023.

|

FUTURES

CONTRACTS

FIXED INCOME INDEX FUTURES CONTRACTS

Number of

Contracts

Long

| Description

| Expiration

Date

| Notional

Amount

| Market

Value

| Unrealized

(Depreciation)

|

| 38

| U.S. Ultra Bond (CBT)

| 9/20/23

| $5,138,416

| $5,024,313

| $(114,103)

|

| TOTAL FUTURES CONTRACTS

| $5,138,416

| $5,024,313

| $(114,103)

|

5Pioneer Municipal High Income Opportunities Fund, Inc. | | 7/31/23

Various inputs are used in

determining the value of the Fund's investments. These inputs are summarized in the three broad levels below.

| Level 1

| –

| unadjusted quoted prices in active markets for identical securities.

|

| Level 2

| –

| other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

|

| Level 3

| –

| significant unobservable inputs (including the Adviser's own assumptions in determining fair value of investments).

|

The following is a summary of the

inputs used as of July 31, 2023, in valuing the Fund's investments:

|

| Level 1

| Level 2

| Level 3

| Total

|

| Municipal Bonds

| $—

| $235,635,295

| $—

| $235,635,295

|

| Total Investments in Securities

| $—

| $235,635,295

| $—

| $235,635,295

|

| Other Financial Instruments

|

|

|

|

|

| Net unrealized depreciation on futures contracts

| $(114,103)

| $—

| $—

| $(114,103)

|

| Total Other Financial Instruments

| $(114,103)

| $—

| $—

| $(114,103)

|

During the period ended July 31,

2023, there were no transfers in or out of Level 3.

Pioneer Municipal High Income Opportunities Fund,

Inc. | | 7/31/236

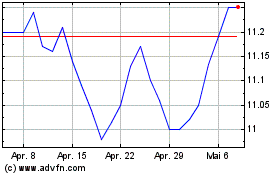

Pioneer Municipal High I... (NYSE:MIO)

Historical Stock Chart

Von Mär 2024 bis Mai 2024

Pioneer Municipal High I... (NYSE:MIO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024