OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2013

Estimated average burden

hours per response.....18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21321

Pioneer Municipal High Income Trust

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Terrence J. Cullen, Pioneer Investment Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 742-7825

Date of fiscal year end: April 30

Date of reporting period: May 1, 2011 through October 31, 2011

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW,

Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO SHAREOWNERS.

Pioneer Municipal High

Income Trust

Semiannual Report | October 31, 2011

Ticker Symbol: MHI

[LOGO]PIONEER

Investments(R)

visit us: us.pioneerinvestments.com

Table of Contents

Letter to Shareowners 2

Portfolio Management Discussion 4

Portfolio Summary 10

Prices and Distributions 11

Performance Update 12

Schedule of Investments 13

Financial Statements 23

Financial Highlights 26

Notes to Financial Statements 28

Trustees, Officers and Service Providers 36

|

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 1

President's Letter

Dear Shareowner,

During the first three quarters of 2011, the U.S. economy struggled to gain

solid footing. The economy went through a soft patch in the first half, and the

second half, so far, has been highlighted by the U.S. government's battle over

the debt ceiling and Standard & Poor's downgrade of the U.S. Treasury's credit

rating from the top rating of "AAA" for the first time in history. After

rallying nicely in the first half, U.S. equity markets reacted sharply this

summer to the political stalemate and the downgrade. There has been continued

pressure on equities due to concerns about the growing European sovereign-debt

crisis and its potential impact on the global economy.

Despite legitimate reasons for concern, we believe there are also reasons for

optimism that the U.S. economy will continue to exhibit modest growth and is not

headed into a severe recession. Corporations continue to post solid earnings

and, for the most part, are maintaining their positive earnings outlooks. They

also have strong balance sheets with improved net leverage and high cash levels.

Auto production has rebounded following the Japanese supply-chain interruptions

caused by the earthquake and tsunami last spring. Retail sales growth

year-over-year has remained steady despite low consumer confidence. And despite

high unemployment in the U.S., private sector employment has grown consistently,

albeit modestly, since February 2010. There are certainly risks to our outlook,

including possible contagion from the European sovereign-debt and banking

crisis, the fiscal drag from federal and state budget cuts in the U.S., as well

as potential "negative feedback loops" from capital-market volatility. But

broadly speaking, we think the subpar economic recovery is consistent with

recoveries from other "balance sheet"-caused recessions.

The difficult recovery process has been accompanied by wide market swings. While

this is a challenging environment, our investment professionals continue to

focus on finding good opportunities to invest in both equity and bond markets

using the same disciplined approach Pioneer has used since 1928. Our approach is

to identify undervalued individual securities with the greatest potential for

success, carefully weighing risk against reward. Our teams of investment

professionals continually monitor and analyze the relative valuations of

different sectors and securities globally to help build portfolios that we

believe can help you achieve your investment goals.

2 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

At Pioneer, we have long advocated the benefits of staying diversified and

investing for the long term. The strategy has generally performed well for many

investors. Our advice, as always, is to work closely with a trusted financial

advisor to discuss your goals and work together to develop an investment

strategy that meets your individual needs. There is no single best strategy that

works for every investor.

We invite you to learn more about Pioneer and our time-tested approach to

investing by consulting with your financial advisor or visiting us online at

us.pioneerinvestments.com. We greatly appreciate your trust in us and we thank

you for investing with Pioneer.

Sincerely,

/s/Daniel K. Kingsbury

Daniel K. Kingsbury

President and CEO

Pioneer Investment Management USA, Inc.

|

Any information in this shareowner report regarding market or economic trends or

the factors influencing the Trust's historical or future performance are

statements of opinion as of the date of this report. These statements should not

be relied upon for any other purposes. Past performance is no guarantee of

future results, and there is no guarantee that market forecasts discussed will

be realized.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 3

Portfolio Management Discussion | 10/31/11

Municipal bonds posted relatively strong returns during the six months ended

October 31, 2011, as investor demand was strong in an environment in which

supply was muted and bond valuations were attractive. In the following

interview, David Eurkus discusses the factors that affected the performance of

Pioneer Municipal High Income Trust during the six months ended October 31,

2011. Mr. Eurkus, senior vice president and portfolio manager at Pioneer, is a

member of Pioneer's fixed-income team, and is responsible for the daily

management of the Trust.

Q How did Pioneer Municipal High Income Trust perform during the six months

ended October 31, 2011?

A Pioneer Municipal High Income Trust returned 9.95% at net asset value and

11.73% at market price over the six months ended October 31, 2011, with

|

common shares of the Trust selling at a 4.7% premium to net asset value at

the end of the period. During the same six-month period, the Trust's

benchmarks, the Barclays Capital High Yield Municipal Bond Index and the

Barclays Capital Municipal Bond Index, returned 6.74% and 5.56%,

respectively. The Barclays Capital High Yield Municipal Bond Index is

designed to track the performance of lower-rated municipal bonds, while

the Barclays Capital Municipal Bond Index is designed to track the

performance of investment-grade municipal bonds. Unlike the Trust, the two

Barclays Capital indices do not use leverage. While the use of leverage

can increase investment opportunity, it can also increase investment risk.

Also over the same six-month period, the average rate of return at market

price of the 14 closed end funds in Lipper's Closed End Funds High Yield

Municipal Debt Funds (leveraged) category was 9.48%.

On October 31, 2011, the 30-day SEC yield on the Trust's shares was 8.23%.

Q How would you describe the investment environment during the six months

ended October 31, 2011?

A After struggling in the first quarter of 2011, the municipal bond market

changed course, as investors returned to the market, recognizing the value

that municipal bonds offered. From an interest-rate and income

perspective, investors were attracted to the relatively high tax-free

yields that municipal bonds provided -- yields that were higher than those

of taxable bonds and money market funds, which were nearly zero. Strong

investor demand and very light supply relative to historical norms were

big factors in the positive performance of the municipal bond market over

the six months. Year-over-year issuance of new bonds declined by

approximately

4 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

40%, largely because heavy new-bond issuance occurred in the final quarter

of 2010, when the U.S. government ended the Build America Bonds (BAB)

program, which had authorized the issuance of taxable municipal securities

subsidized by the U.S. Treasury. To take advantage of the BAB program

before it expired, municipalities issued a significant supply of new

bonds; as a result, the municipalities did not have to issue as many new

bonds in 2011.

Over the six-month period ended October 31, 2011, both high-yield and

investment-grade municipal bonds generated relatively strong returns, with

higher-yielding bonds outperforming higher-quality securities. The Trust

outperformed both the Barclays Capital Municipal Bond Index, which

measures the performance of the general municipal bond market, and the

Barclays Capital High Yield Municipal Bond Index, which tracks the

high-yield segment of the municipal market, over the period. Performance

over the six-month period was consistent with the Trust's overall

portfolio positioning, with exposure to both high-yield and

investment-grade municipals. At the end of the period on October 31, 2011,

64.6% of the Trust's total investment portfolio was invested in

high-yield, below-investment-grade debt, and 35.4% of the Trust's total

investment portfolio was invested in investment-grade municipal bonds. The

Trust had 134 issues in 36 states as of October 31, 2011.

Q How did you position the Trust over the six months ended October 31, 2011?

A We are long-term investors, and so during the six-month period we

maintained a consistent positioning, keeping the Trust's portfolio fully

invested, well diversified and with an emphasis on credit-worthy assets.

We focus on trying to produce generous current income for the Trust's

shareowners through investments in securities that we believe, as a result

of our credit research, are backed by issuers with the ability to pay out

consistent, reliable income. Most of the Trust's portfolio continued to be

invested in revenue bonds over the period, bonds which rely on revenues

from specific funding sources, such as hospital/health care facilities,

colleges and universities, or water treatment plants that produce their

own fees and revenues. In contrast, general obligation bonds require a

dedicated stream of tax revenues to cover the specific debt issuance and

are more likely to experience downgrades in credit quality by various

rating agencies due to the financial problems currently facing many state

and local governments. At the end of the six-month period on October 31,

2011, approximately 1.0% of the Trust's total investment portfolio was

invested in general obligation bonds.

In selecting bonds for the Trust's portfolio, we maintained our emphasis

on sectors that are vital to the domestic economy, such as

hospitals/health care, public/private educational institutions,

power/energy generation and transportation/airports. At 30.1% of the

Trust's total investment portfolio,

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 5

hospitals/health care represented the largest group in the Trust as of

October 31, 2011, followed by transportation facilities, including

airports, at 11.6% of the Trust's total investment portfolio. Other

sectors included tobacco settlement bonds and public/private educational

institutions, which accounted for 11.1% and 6.0%, respectively, of the

Trust's total investment portfolio. In general, most of the Trust's pool

of assets provided positive returns over the six-month period, and the

Trust outperformed its benchmarks.

Q Were there any specific sectors or individual investments that affected

the Trust's performance over the six months ended October 31, 2011, either

positively or negatively?

A The Trust's exposure to the airline sector detracted from results due to

rumors of a possible American Airlines bankruptcy. Approximately 2.0% of

the Trust's total investment portfolio was invested in both secured and

unsecured debt backed by American Airlines industrial revenue bonds during

the period. In addition to American Airlines, underperforming holdings in

the Trust's portfolio during the 12-month period included bonds issued by

Massachusetts Health and Educational Facilities Authority (for Quincy

Medical Center), and Pennsylvania Economic Development Authority (for U.S.

Gypsum).

Contributor holdings in the Trust's portfolio during the 12-month period

were many, but among the top performers were bonds issued by Atlanta

(Georgia) Water and Sewer Authority, New York State Dormitory Authority

(for Columbia University), and State of Texas inverse floating-rate

securities.

Q Could you describe how leverage is used in managing the Trust?

A The Trust employs leverage provided by auction preferred shares to invest

the Trust in additional longer-maturity municipal securities that

typically pay higher dividends than the dividend rates payable on the

preferred shares, thereby increasing the Trust's yield. The use of

leverage can increase the Trust's potential to pay higher yields to its

shareowners than would generally be paid by an unleveraged portfolio.

During periods of low market interest rates and modest borrowing costs,

the use of leverage can have a significant positive effect on the Trust's

yield. However, just as the use of leverage provides the potential to

enhance yield, it also can increase investment risk. During periods when

municipal bond prices tend to change, the use of leverage can magnify the

effect of changing prices on the Trust's total return, which is the

combination of yield and price change. When bond prices rise, the use of

leverage can further enhance the Trust's total return; when bond prices

decline, the use of leverage can magnify the price loss to the Trust.

6 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

|

Q How did the levels of leverage used by the Trust change during the period?

A At the end of the six-month period (on October 31, 2011), 24.7% of the

Trust's total managed assets were financed by leverage, compared with

25.8% of the Trust's total managed assets being financed by leverage at

the beginning of the six-month period on May 1, 2011.

Q What is your investment outlook?

A The municipal bond market continues to exhibit many strong qualities,

including attractive valuations relative to Treasuries, relatively high

yields in comparison to their taxable counterparts, and declining

defaults. While there may be an occasional burst of supply to the market,

supply remains muted and demand has been strong, which is one of the

dynamics that should continue to help provide positive returns. States and

municipalities continue to work to balance their budgets by increasing

revenues and managing costs through personnel cuts, cancellation of

capital projects and reduction in some benefits. We believe that municipal

bonds continue to represent good value, both from a market standpoint and,

fundamentally, from a credit perspective. We think municipals should

remain an attractive option for investors, especially in the face of what

appears to be limited supply in a continued low-interest-rate environment.

Despite our positive outlook for the municipal bond market, we cannot

ignore the macroeconomic issues currently in play on a global scale. We do

not anticipate a double-dip recession in the United States; however, we

expect economic growth to be slow. The Federal Reserve System (the Fed)

has stated that it will keep short-term interest rates low (in the 0.00%

to 0.25% range) until the summer of 2013, and we expect inflation to be

relatively subdued.

As we manage the Trust in the months ahead, our investment discipline will

continue to be based on independent fundamental analysis. Before a

security is added to the Trust's portfolio, we will maintain our practice

of analyzing both the credit-worthiness of the issuer and the reliability

and sustainability of the security's revenue stream. We believe there is

value in the high-yield municipal bond market, as the tax-advantaged

yields of municipal securities compare favorably with yields provided by

taxable bonds.

Please refer to the Schedule of Investments on pages 13-22 for a full listing of

Trust securities.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 7

Investments in high-yield or lower-rated securities are subject to

greater-than-average risk.

The Trust may invest in securities of issuers that are in default or that are in

bankruptcy.

A portion of income may be subject to state, federal, and/or alternative minimum

tax. Capital gains, if any, are subject to a capital gains tax.

When interest rates rise, the prices of debt securities held by the Trust will

generally fall. Conversely, when interest rates fall the prices of debt

securities held by the Trust generally will rise.

By concentrating in municipal securities, the Trust is more susceptible to

adverse economic, political or regulatory developments than is a portfolio that

invests more broadly.

Investments in the Trust are subject to possible loss due to the financial

failure of the issuers of the underlying securities and the issuers' inability

to meet their debt obligations.

The Trust may invest up to 20% of its total assets in illiquid securities.

Illiquid securities may be difficult to dispose of at a fair price at the times

when the Trust believes it is desirable to do so, and their market price is

generally more volatile than that of more liquid securities. Illiquid securities

are also more difficult to value and investment of the Trust's assets in

illiquid securities may restrict the Trust's ability to take advantage of market

opportunities.

The Trust uses leverage through the issuance of preferred shares. Leverage

creates significant risks, including the risk that the Trust's incremental

income or capital appreciation will not be sufficient to cover the cost of

leverage, which may adversely affect the return for the holders of common

shares. Since February of 2008, regularly scheduled auctions for the Trust's

preferred shares have failed and preferred shareowners have not been able to

sell their shares at auction. The Board of Trustees of the Trust has considered,

and continues to consider, this issue.

The Trust is required to maintain certain regulatory and rating agency asset

coverage requirements in connection with its outstanding preferred shares. In

order to maintain required asset coverage levels, the Trust may be required to

alter the composition of its investment portfolio or take other actions, such as

redeeming preferred shares with the proceeds from portfolio transactions, at

what might be inopportune times in the market. Such actions could reduce the net

earnings or returns to holders of the Trust's common shares over time.

Risks of investing in the Trust are discussed in greater detail in the Trust's

original offering prospectus and in shareowner reports issued from time to time.

These risks may increase share price volatility.

8 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

Past performance is no guarantee of future results, and there is no guarantee

that market forecasts discussed will be realized.

Any information in this shareowner report regarding market or economic trends or

the factors influencing the Trust's historical or future performance are

statements of opinion as of the date of this report. These statements should not

be relied upon for any other purposes.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 9

Portfolio Summary | 10/31/11

Portfolio Diversification

(As a percentage of total investment portfolio)

[THE FOLLOWING DATA IS A REPRESENTATION OF A PIE CHART IN THE PRINTED MATERIAL]

Health Revenue 30.1%

Insured 13.3%

Other Revenue 13.2%

Tobacco Revenue 11.1%

Airport Revenue 8.5%

Development Revenue 7.0%

Education Revenue 6.0%

Facilities Revenue 3.0%

Pollution Control Revenue 2.9%

Transportation Revenue 2.6%

Gaming Authority Revenue 1.6%

Airline Revenue 0.5%

Housing Revenue 0.2%

Utilities Revenue*

|

* Amount is less than 0.1%

Portfolio Quality

(As a percentage of total investment portfolio; based on S&P ratings)

[THE FOLLOWING DATA IS A REPRESENTATION OF A PIE CHART IN THE PRINTED MATERIAL]

AAA 3.5%

AA 11.0%

A 5.9%

BBB 15.0%

BB 6.0%

B 8.0%

CCC 1.6%

CC 0.2%

Not Rated 48.8%

|

Bond ratings are ordered highest to lowest in portfolio. Based on Standard &

Poor's measures, AAA (highest possible rating) through BBB are considered

investment grade; BB or lower ratings are considered non-investment grade. Cash

equivalents and some bonds may not be rated.

The portfolio is actively managed and current holdings may be different.

10 Largest Holdings

(As a percentage of long-term holdings)*

1. Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue, 0.0%, 6/15/22 3.5%

2. Connecticut Health & Educational Facilities Authority Revenue, RIB, 11.729%,

7/1/42 (144A) 3.0

3. North Texas Tollway Authority Revenue, 5.75%, 1/1/33 2.6

4. Washington State General Obligation, 0.0%, 6/1/22 2.5

5. New York State Dormitory Authority Revenue, RIB, 13.299%, 7/1/26 (144A) 2.4

6. New Jersey Economic Development Authority Revenue, 6.25%, 9/15/29 2.4

7. Texas State, RIB, 12.47%, 4/1/30 (144A) 2.2

8. Tobacco Settlement Financing Corp., 6.75%, 6/1/39 2.2

9. California State University Revenue, RIB, 10.153%, 11/1/39 (144A) 2.1

10. Massachusetts Development Finance Agency Revenue, 5.75%, 1/1/42 2.0

|

* This list excludes temporary cash investments. The portfolio is actively

managed, and current holdings may be different. The holdings listed should

not be considered recommendations to buy or sell any security listed.

10 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

Prices and Distributions | 10/31/11

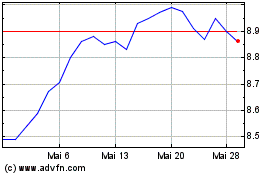

Market Value per Common Share

--------------------------------------------------------------------------------

10/31/11 4/30/11

--------------------------------------------------------------------------------

$14.36 $13.40

--------------------------------------------------------------------------------

Premium 4.7% 3.1%

--------------------------------------------------------------------------------

|

Net Asset Value per Common Share

--------------------------------------------------------------------------------

10/31/11 4/30/11

--------------------------------------------------------------------------------

$13.71 $13.00

--------------------------------------------------------------------------------

|

Distributions per Common Share: 5/1/11-10/31/11

--------------------------------------------------------------------------------

Net

Investment Short-Term Long-Term

Income Capital Gains Capital Gains

--------------------------------------------------------------------------------

$ 0.5700 $ -- $ --

|

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 11

Performance Update | 10/31/11

Investment Returns

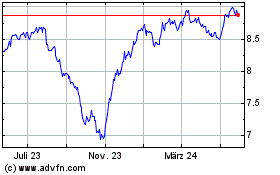

The mountain chart on the right shows the change in market value, including

reinvestment of dividends and distributions, of a $10,000 investment made in

common shares of Pioneer Municipal High Income Trust, compared to that of the

Barclays Capital Municipal Bond Index and Barclays Capital High Yield Municipal

Bond Index.

Cumulative Total Returns

(As of October 31, 2011)

--------------------------------------------------------------------------------

Net Asset Market

Period Value (NAV) Price

--------------------------------------------------------------------------------

Life-of-Trust

(7/17/2003) 70.32% 70.43%

5 Years 22.95 42.13

1 Year 4.16 3.04

--------------------------------------------------------------------------------

|

[THE FOLLOWING DATA IS A REPRESENTATION OF A MOUNTAIN CHART IN THE PRINTED

MATERIAL]

Value of $10,000 Investment

Pioneer Municipal High Barclays Capital Barclays Capital High Yield

Income Trust Municipal Bond Index Municipal Bond Index

7/03 $10,000 $10,000 $10,000

10/03 $10,097 $10,319 $10,419

$10,504 $10,941 $11,446

10/05 $11,261 $11,219 $12,522

$11,991 $11,863 $14,009

10/07 $12,789 $12,209 $14,326

$ 8,865 $11,805 $11,614

10/09 $13,395 $13,411 $13,303

$16,540 $14,454 $15,147

10/11 $17,043 $15,001 $15,656

|

Call 1-800-225-6292 or visit us.pioneerinvestments.com for the most recent

month-end performance results. Current performance may be lower or higher than

the performance data quoted.

Performance data shown represents past performance. Past performance is no

guarantee of future results. Investment return and market price will fluctuate,

and your shares may trade below NAV due to such factors as interest rate changes

and the perceived credit quality of borrowers.

Total investment return does not reflect broker sales charges or commissions.

All performance is for common shares of the Trust.

Closed-end funds, unlike open-end funds, are not continuously offered. There is

a one-time public offering and once issued, shares of closed-end funds are sold

in the open market through a stock exchange and frequently trade at prices lower

than their NAV. NAV is total assets less total liabilities which includes

preferred shares, divided by the number of common shares outstanding.

When NAV is lower than market price, dividends are assumed to be reinvested at

the greater of NAV or 95% of the market price. When NAV is higher, dividends are

assumed to be reinvested at prices obtained under the Trust's dividend

reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes

that a shareowner would pay on Trust distributions or the sale of Trust shares.

The Barclays Capital Municipal Bond Index is a broad measure of the municipal

bond market. The Barclays Capital High Yield Municipal Bond Index totals over

$26 billion in market value and maintains over 1300 securities. Municipal bonds

in this index have the following requirements: maturities of one year or

greater, sub investment grade (below Baa or non-rated), fixed coupon rate,

issued after 12/31/90, deal size over $20 million, and maturity size of at least

$3 million. Index returns are calculated monthly, assume reinvestment of

dividends and, unlike Trust returns, do not reflect any fees, expenses or sales

charges. The indices are not leveraged. You cannot invest directly in the

indices.

12 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

Schedule of Investments | 10/31/11 (unaudited)

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

TAX EXEMPT OBLIGATIONS -- 127.5% of Net Assets

Alabama -- 2.1%

2,500,000 B-/B2 Alabama Industrial Development Authority Solid

Waste Disposal Revenue, 6.45%, 12/1/23 $ 2,160,525

1,000,000 NR/NR Huntsville-Redstone Village Special Care Facilities

Financing Authority, 5.5%, 1/1/28 877,130

4,500,000 NR/NR Huntsville-Redstone Village Special Care Facilities

Financing Authority, 5.5%, 1/1/43 3,356,640

--------------

$ 6,394,295

----------------------------------------------------------------------------------------------------------

Arizona -- 2.4%

5,000,000 BBB-/Baa3 Apache County Industrial Development Authority,

5.85%, 3/1/28 $ 4,999,900

994,000 NR/Baa3 Pima County Industrial Development Authority,

6.75%, 7/1/31 951,725

950,000 NR/Baa3 Pima County Industrial Development Authority,

7.25%, 7/1/31 950,561

500,000 NR/Baa2 Yavapai County Industrial Development Authority,

6.0%, 8/1/33 501,175

--------------

$ 7,403,361

----------------------------------------------------------------------------------------------------------

California -- 9.5%

3,000,000 NR/A1 ABAG Finance Authority for Nonprofit Corp., Revenue

Bonds, 5.75%, 7/1/37 $ 3,037,290

1,000,000 NR/NR California Enterprise Development Authority Recovery

Zone Facility Revenue, 8.5%, 4/1/31 1,039,620

7,885,000(a) AA+/NR California State University Revenue, RIB, 10.153%,

11/1/39 (144A) 8,588,658

3,000,000 BB+/NR California Statewide Communities Development

Authority, 7.25%, 10/1/38 (144A) 3,036,210

568,006(b) NR/NR California Statewide Communities Development

Authority Environmental Facilities Revenue,

9.0%, 12/1/38 5,674

5,150,000+ AA+/Aaa Golden State Tobacco Securitization Corp.,

7.8%, 6/1/42 5,731,744

7,000,000+ AA+/Aaa Golden State Tobacco Securitization Corp.,

7.875%, 6/1/42 7,798,630

--------------

$ 29,237,826

----------------------------------------------------------------------------------------------------------

Colorado -- 0.9%

2,000,000 BBB+/NR Colorado Health Facilities Authority Revenue,

5.25%, 5/15/42 $ 1,801,320

1,000,000 NR/NR Kremmling Memorial Hospital District,

7.125%, 12/1/45 1,011,360

--------------

$ 2,812,680

----------------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 13

Schedule of Investments | 10/31/11 (unaudited) (continued)

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

Connecticut -- 5.6%

10,335,000(a) NR/Aaa Connecticut Health & Educational Facilities Authority

Revenue, RIB, 11.729%, 7/1/42 (144A) $ 12,202,121

1,000,000 NR/NR Hamden Facility Revenue Bonds, Series 2009A,

7.75%, 1/1/43 1,038,360

5,000,000 CCC+/NR Mohegan Tribe Indians Gaming Authority,

6.25%, 1/1/31 3,975,900

--------------

$ 17,216,381

----------------------------------------------------------------------------------------------------------

District of Columbia -- 3.6%

5,000,000 BBB/Baa1 District of Columbia Tobacco Settlement Financing

Corp., 6.5%, 5/15/33 $ 5,195,000

6,000,000 BBB/Baa1 District of Columbia Tobacco Settlement Financing

Corp., 6.75%, 5/15/40 5,888,160

--------------

$ 11,083,160

----------------------------------------------------------------------------------------------------------

Florida -- 7.2%

1,500,000 NR/NR Alachua County Health Facilities Authority Revenue,

8.125%, 11/15/41 $ 1,491,225

1,500,000 NR/NR Alachua County Health Facilities Authority Revenue,

8.125%, 11/15/46 1,473,975

1,600,000 NR/NR Beacon Lakes Community Development,

6.9%, 5/1/35 1,612,000

1,000,000 NR/Ba3 Capital Trust Agency Revenue Bonds,

7.75%, 1/1/41 1,029,940

1,000,000 NR/NR Florida Development Finance Corp., Educational

Facilities Revenue, 6.0%, 9/15/40 930,220

2,000,000 NR/NR Florida Development Finance Corp., Educational

Facilities Revenue, 7.625%, 6/15/41 2,036,800

1,000,000+ NR/WR Hillsborough County Industrial Development Authority

Revenue, 8.0%, 8/15/32 1,396,380

2,330,000 NR/NR Liberty County Subordinate Revenue,

8.25%, 7/1/28 2,298,102

2,500,000 A-/A2 Miami-Dade County Florida Aviation Revenue, 5.5%,

10/1/41 2,590,700

1,000,000 NR/NR St. Johns County Industrial Development Authority

Revenue, 5.25%, 1/1/26 856,280

2,000,000 NR/NR St. Johns County Industrial Development Authority

Revenue, 5.375%, 1/1/40 1,550,560

5,000,000 NR/Baa1 Tallahassee Health Facilities Revenue,

6.375%, 12/1/30 5,002,050

--------------

$ 22,268,232

----------------------------------------------------------------------------------------------------------

Georgia -- 2.4%

4,240,000(a) NR/Aa3 Atlanta Georgia Water and Wastewater Revenue, RIB,

10.153%, 11/1/43 (144A) $ 4,370,592

500,000 CCC+/NR Clayton County Development Authority Revenue,

9.0%, 6/1/35 537,350

|

The accompanying notes are an integral part of these financial statements.

14 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

Georgia -- (continued)

2,400,000 NR/NR Fulton County Residential Care Facilities Revenue,

5.0%, 7/1/27 $ 1,826,640

1,100,000 NR/NR Fulton County Residential Care Facilities Revenue,

5.125%, 7/1/42 746,350

--------------

$ 7,480,932

----------------------------------------------------------------------------------------------------------

Idaho -- 1.6%

5,000,000 BBB+/Baa1 Power County Industrial Development Corp.,

6.45%, 8/1/32 $ 5,004,050

----------------------------------------------------------------------------------------------------------

Illinois -- 17.3%

2,000,000(c) NR/NR Centerpoint Intermodal Center, 8.5%,

6/15/23 (144A) $ 2,000,080

12,000,000 NR/Caa2 Chicago O'Hare International Airport Special Facility

Revenue Refunding Bonds, 5.5%, 12/1/30 6,720,000

1,000,000(b) NR/NR Illinois Finance Authority Revenue, 6.0%, 11/15/27 598,380

3,865,000 BBB+/NR Illinois Finance Authority Revenue, 6.0%, 8/15/38 3,907,283

2,000,000 AA+/Aa2 Illinois Finance Authority Revenue, 6.0%, 8/15/39 2,189,620

4,000,000(b) NR/NR Illinois Finance Authority Revenue, 6.0%, 11/15/39 2,393,520

2,450,000 NR/NR Illinois Finance Authority Revenue, 6.375%, 5/15/17 2,450,588

2,500,000 NR/Baa2 Illinois Finance Authority Revenue, 6.5%, 4/1/39 2,612,575

500,000 NR/NR Illinois Finance Authority Revenue, 7.0%, 5/15/18 500,375

1,700,000 NR/NR Illinois Finance Authority Revenue, 7.625%, 5/15/25 1,715,793

600,000 NR/NR Illinois Finance Authority Revenue, 7.75%, 5/15/30 602,934

2,000,000 NR/NR Illinois Finance Authority Revenue, 8.0%, 5/15/40 2,030,700

3,200,000 NR/NR Illinois Finance Authority Revenue, 8.0%, 5/15/46 3,249,120

4,000,000 NR/NR Illinois Finance Authority Revenue, 8.25%, 5/15/45 3,928,440

2,500,000 NR/NR Illinois Finance Authority Revenue, 8.25%, 2/15/46 2,528,575

1,500,000(b) NR/NR Illinois Health Facilities Authority Revenue,

6.9%, 11/15/33 524,595

16,880,000(d) AAA/A2 Metropolitan Pier & Exposition Authority Dedicated

State Tax Revenue, 0.0%, 6/15/22 14,020,191

1,540,000 NR/NR Southwestern Illinois Development Authority

Revenue, 5.625%, 11/1/26 1,145,652

--------------

$ 53,118,421

----------------------------------------------------------------------------------------------------------

Indiana -- 1.7%

3,000,000 A+/A1 Indiana Health & Educational Facility Financing

Authority Hospital Revenue, 5.0%, 2/15/39 $ 2,900,070

2,570,000 NR/NR Vigo County Hospital Authority Revenue, 5.8%,

9/1/47 (144A) 2,328,137

--------------

$ 5,228,207

----------------------------------------------------------------------------------------------------------

Louisiana -- 2.1%

1,500,000 BBB-/Baa3 Louisiana Local Government Environmental Facilities

Revenue, 6.75%, 11/1/32 $ 1,565,265

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 15

Schedule of Investments | 10/31/11 (unaudited) (continued)

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

Louisiana -- (continued)

5,000,000 NR/Baa1 Louisiana Public Facilities Authority Revenue,

5.5%, 5/15/47 $ 4,772,950

--------------

$ 6,338,215

----------------------------------------------------------------------------------------------------------

Maine -- 0.5%

1,500,000 NR/Baa3 Maine Health & Higher Educational Facilities

Authority Revenue, 7.5%, 7/1/32 $ 1,641,165

----------------------------------------------------------------------------------------------------------

Massachusetts -- 6.9%

2,305,000 NR/NR Massachusetts Development Finance Agency

Revenue, 7.1%, 7/1/32 $ 2,013,026

7,100,000 A/WR Massachusetts Development Finance Agency

Revenue, 5.75%, 1/1/42 7,829,667

910,000 AA/NR Massachusetts Educational Financing Authority

Revenue, 6.0%, 1/1/28 993,911

1,000,000 NR/Caa1 Massachusetts Health & Educational Facilities

Authority Revenue, 6.0%, 10/1/23 828,610

3,500,000+ NR/NR Massachusetts Health & Educational Facilities

Authority Revenue, 6.25%, 7/1/22 3,674,475

4,500,000(b) NR/NR Massachusetts Health & Educational Facilities

Authority Revenue, 6.5%, 1/15/38 855,000

5,000,000 BB-/NR Massachusetts Health & Educational Facilities

Authority Revenue, 6.75%, 10/1/33 4,962,900

--------------

$ 21,157,589

----------------------------------------------------------------------------------------------------------

Michigan -- 3.0%

935,000 NR/NR Doctor Charles Drew Academy, 5.7%, 11/1/36 $ 611,649

1,500,000 BB-/NR John Tolfree Health System Corp., 6.0%, 9/15/23 1,272,600

2,000,000 BB+/NR Kent Hospital Finance Authority Revenue,

6.25%, 7/1/40 1,913,920

5,830,000 BB/NR Michigan Tobacco Settlement Finance Authority,

6.0%, 6/1/48 4,077,036

1,430,000 BBB/NR Star International Academy Certificates of

Participation, 6.125%, 3/1/37 1,266,994

--------------

$ 9,142,199

----------------------------------------------------------------------------------------------------------

Minnesota -- 0.9%

1,675,000 BB-/NR Duluth Economic Development Authority Health Care

Facilities Revenue, 7.25%, 6/15/32 $ 1,681,750

1,000,000 NR/NR Port Authority of the City of Bloomington Minnesota

Facility Revenue Bonds, 9.0%, 12/1/35 1,025,530

--------------

$ 2,707,280

----------------------------------------------------------------------------------------------------------

Montana -- 0.1%

1,600,000(b)(e) NR/NR Two Rivers Authority, Inc., Correctional Facility

Improvement Revenue, 7.375%, 11/1/27 $ 312,032

----------------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

16 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

Nebraska -- 0.2%

2,000,000(b)(e) NR/NR Grand Island Solid Waste Disposal Facilities

Revenue, 7.0%, 6/1/23 $ 560,760

----------------------------------------------------------------------------------------------------------

Nevada -- 0.0%*

2,000,000(b)(e) NR/NR Nevada State Department of Business & Industry,

7.25%, 1/1/23 $ 2,980

----------------------------------------------------------------------------------------------------------

New Jersey -- 7.9%

10,000,000 B/B3 New Jersey Economic Development Authority

Revenue, 6.25%, 9/15/29 $ 9,454,700

6,150,000(c) B/B3 New Jersey Economic Development Authority

Revenue, 7.0%, 11/15/30 6,149,016

8,000,000+ AA+/Aaa Tobacco Settlement Financing Corp.,

6.75%, 6/1/39 8,801,360

--------------

$ 24,405,076

----------------------------------------------------------------------------------------------------------

New Mexico -- 1.2%

1,500,000 NR/NR Otero County New Mexico Project Revenue, 6.0%,

4/1/23 $ 1,311,585

2,960,000 NR/NR Otero County New Mexico Project Revenue, 6.0%,

4/1/28 2,395,025

--------------

$ 3,706,610

----------------------------------------------------------------------------------------------------------

New York -- 9.0%

3,000,000 NR/NR Dutchess County Industrial Development Agency

Revenue, 7.5%, 3/1/29 $ 2,968,050

2,000,000 BBB+/NR Hempstead Local Development Corp. Revenue

Bonds, 5.75%, 7/1/39 2,080,200

2,050,000 NR/NR Nassau County New York Industrial Development

Agency Revenue, 6.7%, 1/1/43 1,860,354

990,000 CCC+/Caa2 New York City Industrial Development Agency, 6.9%,

8/1/24 594,020

2,000,000 BB-/B1 New York City Industrial Development Agency,

7.625%, 12/1/32 2,007,960

2,000,000 B-/Caa2 New York City Industrial Development Agency, 8.0%,

8/1/12 1,995,780

1,000,000 NR/Ba1 New York State Dormitory Authority Revenue,

6.125%, 12/1/29 1,004,030

7,040,000(a) NR/Aaa New York State Dormitory Authority Revenue, RIB,

13.299%, 7/1/26 (144A) 9,786,938

2,750,000 BB/NR Seneca Nation Indians Capital Improvement

Authority Revenue, 5.25%, 12/1/16 (144A) 2,574,000

3,000,000 NR/NR Suffolk County Industrial Development Agency,

7.25%, 1/1/30 2,920,020

--------------

$ 27,791,352

----------------------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 17

Schedule of Investments | 10/31/11 (unaudited) (continued)

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

North Carolina -- 2.9%

4,785,000 NR/NR Charlotte North Carolina Special Facilities Revenue,

5.6%, 7/1/27 $ 4,221,566

4,795,000 NR/NR Charlotte North Carolina Special Facilities Revenue,

7.75%, 2/1/28 4,800,994

--------------

$ 9,022,560

----------------------------------------------------------------------------------------------------------

Oklahoma -- 1.8%

1,225,000 B-/Caa2 Tulsa Municipal Airport Revenue, 6.25%, 6/1/20 $ 1,036,852

4,350,000 B-/Caa2 Tulsa Municipal Airport Revenue, 7.35%, 12/1/11 4,340,300

--------------

$ 5,377,152

----------------------------------------------------------------------------------------------------------

Pennsylvania -- 2.5%

1,550,000 NR/Baa2 Allegheny County Hospital Development Authority

Revenue, 5.125%, 5/1/25 $ 1,449,405

1,000,000 CC/NR Columbia County Hospital Authority Health Care

Revenue, 5.9%, 6/1/29 828,490

665,000 BBB+/Ba1 Hazleton Health Services Authority Hospital Revenue,

5.625%, 7/1/17 664,993

1,280,000(b) NR/Ca Langhorne Manor Borough Higher Education &

Health Authority Revenue, 7.35%, 7/1/22 384,000

5,000,000 B-/Caa2 Pennsylvania Economic Development Financing

Authority Solid Waste Disposal Revenue,

6.0%, 6/1/31 3,797,750

500,000 BBB+/NR Pennsylvania Higher Educational Facilities Authority

Revenue, 5.4%, 7/15/36 503,760

--------------

$ 7,628,398

----------------------------------------------------------------------------------------------------------

Rhode Island -- 2.0%

6,000,000(e) NR/NR Central Falls Detention Facilities Revenue,

7.25%, 7/15/35 $ 4,684,980

1,500,000 NR/NR Rhode Island Health & Educational Building Corp.,

Revenue, 8.375%, 1/1/46 1,542,435

--------------

$ 6,227,415

----------------------------------------------------------------------------------------------------------

South Carolina -- 1.4%

3,185,000+ BBB+/Baa1 South Carolina Jobs Economic Development

Authority Revenue, 6.375%, 8/1/34 $ 3,509,583

665,000+ BBB+/Baa1 South Carolina Jobs Economic Development

Authority Revenue, 6.375%, 8/1/34 732,770

--------------

$ 4,242,353

----------------------------------------------------------------------------------------------------------

Tennessee -- 4.7%

7,000,000+ NR/A2 Johnson City Health & Educational Facilities Board

Hospital Revenue, 7.5%, 7/1/33 $ 7,467,530

2,480,000 NR/A1 Knox County Health, Educational & Housing Facilities

Board Hospital Revenue, 6.375%, 4/15/22 2,554,822

|

The accompanying notes are an integral part of these financial statements.

18 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

Tennessee -- (continued)

4,600,000 BBB+/NR Sullivan County Health, Educational & Housing

Facilities Board Hospital Revenue, 5.25%, 9/1/36 $ 4,320,596

--------------

$ 14,342,948

----------------------------------------------------------------------------------------------------------

Texas -- 14.2%

1,345,000 NR/B3 Bexar County Housing Finance Corp.,

8.0%, 12/1/36 $ 932,919

2,500,000 BB+/Ba1 Central Texas Regional Mobility Authority Revenue,

6.75%, 1/1/41 2,472,050

2,000,000 CCC+/Caa2 Dallas-Fort Worth International Airport Revenue,

6.0%, 11/1/14 1,220,020

4,000,000 NR/NR Decatur Hospital Authority Revenue, 7.0%, 9/1/25 4,024,880

725,078(b)(e) NR/NR Gulf Coast Industrial Development Authority,

7.0%, 12/1/36 7,243

3,750,000 B-/B3 Houston Airport System Special Facilities Revenue,

5.7%, 7/15/29 3,297,075

5,340,000 NR/NR Lubbock Health Facilities Development Corp.,

6.625%, 7/1/36 4,957,282

10,000,000 BBB+/A3 North Texas Tollway Authority Revenue,

5.75%, 1/1/33 10,403,800

2,810,000(a) NR/Aaa Northside Independent School District, RIB,

11.522%, 6/15/33 (144A) 3,012,517

1,000,000 NR/NR Tarrant County Cultural Education Facilities Finance

Corp., 8.125%, 11/15/39 994,250

1,500,000 NR/NR Tarrant County Cultural Education Facilities Finance

Corp., 8.25%, 11/15/44 1,499,070

2,000,000 NR/NR Tarrant County Cultural Education Facilities Finance

Corp., 8.0%, 11/15/34 1,991,560

7,040,000(a) NR/Aaa Texas State, RIB, 12.47%, 4/1/30 (144A) 8,894,477

--------------

$ 43,707,143

----------------------------------------------------------------------------------------------------------

Utah -- 0.2%

800,000 NR/NR Spanish Fork City Charter School Revenue, 5.55%,

11/15/26 (144A) $ 665,120

----------------------------------------------------------------------------------------------------------

Vermont -- 0.5%

1,500,000 A-/Baa1 Vermont Educational & Health Buildings Financing

Agency Revenue, 6.0%, 10/1/28 $ 1,524,285

----------------------------------------------------------------------------------------------------------

Virginia -- 0.3%

1,000,000 BBB/Baa2 Peninsula Ports Authority, 6.0%, 4/1/33 $ 1,018,120

----------------------------------------------------------------------------------------------------------

Washington -- 9.6%

4,710,000 A+/Aa3 Spokane Public Facilities District Hotel/Motel Tax &

Sales, 5.75%, 12/1/27 $ 4,998,205

7,025,000 BBB/Baa1 Tobacco Settlement Authority Revenue,

6.625%, 6/1/32 7,108,878

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 19

Schedule of Investments | 10/31/11 (unaudited) (continued)

----------------------------------------------------------------------------------------------------------

Principal

Amount S&P/Moody's

USD ($) Ratings Value

----------------------------------------------------------------------------------------------------------

Washington -- (continued)

14,315,000 AA+/Aa1 Washington State General Obligation, 0.0%, 6/1/22 $ 9,984,856

3,795,000 A/A2 Washington State Health Care Facilities Authority

Revenue, 6.0%, 1/1/33 3,943,309

5,000,000 NR/NR Washington State Housing Finance Committee

Nonprofit Revenue, 5.625%, 1/1/27 3,585,100

--------------

$ 29,620,348

----------------------------------------------------------------------------------------------------------

West Virginia -- 0.5%

1,495,000 NR/NR West Virginia Hospital Finance Authority Hospital

Revenue Bonds, 9.125%, 10/1/41 $ 1,563,037

----------------------------------------------------------------------------------------------------------

Wisconsin -- 0.8%

2,500,000 NR/NR Wisconsin Public Finance Authority Continuing Care

Retirement Community Revenue, 8.25%, 6/1/46 $ 2,564,375

----------------------------------------------------------------------------------------------------------

TOTAL TAX EXEMPT OBLIGATIONS

(Cost $384,719,310) $ 392,516,057

----------------------------------------------------------------------------------------------------------

MUNICIPAL COLLATERALIZED DEBT

OBLIGATION -- 2.0% of Net Assets

10,000,000(c)(e) NR/NR Non-Profit Preferred Funding Trust I, 12.0%,

9/15/37 (144A) $ 6,098,600

----------------------------------------------------------------------------------------------------------

TOTAL MUNICIPAL COLLATERALIZED

DEBT OBLIGATION

(Cost $10,000,000) $ 6,098,600

----------------------------------------------------------------------------------------------------------

Shares

----------------------------------------------------------------------------------------------------------

COMMON STOCK -- 0.7%

251,078(f) Delta Air Lines, Inc. $ 2,139,185

----------------------------------------------------------------------------------------------------------

TOTAL COMMON STOCK

(Cost $6,612,756) $ 2,139,185

----------------------------------------------------------------------------------------------------------

TOTAL INVESTMENTS IN SECURITIES -- 130.2%

(Cost $401,332,066) (g)(h) $ 400,753,842

----------------------------------------------------------------------------------------------------------

OTHER ASSETS AND LIABILITIES -- 2.6% $ 7,998,966

----------------------------------------------------------------------------------------------------------

PREFERRED SHARES AT REDEMPTION VALUE,

INCLUDING DIVIDENDS PAYABLE -- (32.8)% $ (101,003,489)

----------------------------------------------------------------------------------------------------------

NET ASSETS APPLICABLE TO COMMON

SHAREOWNERS -- 100.0% $ 307,749,319

==========================================================================================================

|

(144A) Security is exempt from registration under Rule 144A of the Securities

Act of 1933. Such securities may be resold normally to qualified

institutional buyers in a transaction exempt from registration. At

October 31, 2011, the value of these securities amounted to $63,557,450

or 20.7% of total net assets applicable to common shareowners.

RIB Residual Interest Bonds.

NR Security not rated by either S&P or Moody's.

|

The accompanying notes are an integral part of these financial statements.

20 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

WR Rating withdrawn by either S&P or Moody's.

+ Prerefunded bonds have been collateralized by U.S. Treasury or U.S.

Government Agency securities which are held in escrow to pay interest and

principal on the tax exempt issue and to retire the bonds in full at the

earliest refunding date.

* Amount rounds to less than 0.1%.

(a) The interest rate is subject to change periodically and inversely based

upon prevailing market rates. The interest rate shown is the coupon rate

at October 31, 2011.

(b) Security is in default and is non-income producing.

(c) The interest rate is subject to change periodically. The interest rate

shown is the coupon rate at October 31, 2011.

(d) Debt obligation initially issued at one coupon which converts to a higher

coupon at a specific date. The rate shown is the rate at October 31,

2011.

(e) Indicates a security that has been deemed illiquid. The aggregate cost of

illiquid securities is $22,081,762. The aggregate fair value of

$11,666,595 represents 3.8% of the total net assets applicable to common

shareowners.

(f) Non-income producing.

(g) The concentration of investments by type of obligation/market sector is

as follows:

Insured:

NATL-RE 7.3%

FSA 3.2

AMBAC 2.0

PSF 0.8

Revenue Bonds:

Health Revenue 30.3

Other Revenue 13.2

Tobacco Revenue 11.2

Airport Revenue 8.6

Development Revenue 7.1

Education Revenue 6.0

Facilities Revenue 3.0

Pollution Control Revenue 2.9

Transportation Revenue 2.6

Gaming Revenue 1.6

Housing Revenue 0.2

Utilities Revenue** --

-----

100.0%

=====

|

** Amount is less than 0.1%

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 21

Schedule of Investments | 10/31/11 (unaudited) (continued)

(h) At October 31, 2011, the net unrealized loss on investments based on cost

for federal income tax purposes of $402,468,749 was as follows:

Aggregate gross unrealized gain in which there is an excess of value over

tax cost $27,762,654

Aggregate gross unrealized loss in which there is an excess of tax cost

over value (29,477,561)

-----------

Net unrealized loss $(1,714,907)

===========

|

For financial reporting purposes net unrealized loss on investments was $578,224

and cost of investments aggregated $401,332,066.

Purchases and sales of securities (excluding temporary cash investments) for the

six months ended October 31, 2011 aggregated $24,463,175 and $21,757,103,

respectively.

Various inputs are used in determining the value of the Trust's investments.

These inputs are summarized in the three broad levels listed below.

Level 1 -- quoted prices in active markets for identical securities

Level 2 -- other significant observable inputs (including quoted prices for

similar securities, interest rates, prepayment speeds, credit risk,

etc.)

Level 3 -- significant unobservable inputs (including the Trust's own

assumptions in determining fair value of investments)

Generally, equity securities are categorized as Level 1, fixed income

securities and senior loans are categorized as Level 2 and securities valued

using fair value methods are categorized as Level 3.

The following is a summary of the inputs used as of October 31, 2011, in

valuing the Trust's investments:

-------------------------------------------------------------------------------------------------

Level 1 Level 2 Level 3 Total

-------------------------------------------------------------------------------------------------

Tax exempt obligations $ -- $392,516,057 $-- $392,516,057

Municipal collateralized debt obligation -- 6,098,600 -- 6,098,600

Common stock 2,139,185 -- -- 2,139,185

-------------------------------------------------------------------------------------------------

Total $2,139,185 $398,614,657 $-- $400,753,842

=================================================================================================

|

The accompanying notes are an integral part of these financial statements.

22 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

Statement of Assets and Liabilities | 10/31/11 (unaudited)

ASSETS:

Investments in securities, at value (cost $401,332,066) $400,753,842

Cash 1,606,585

Receivables --

Investment securities sold 65,000

Interest 9,573,754

Prepaid expenses 22,854

Other assets 145,573

---------------------------------------------------------------------------------

Total assets $412,167,608

---------------------------------------------------------------------------------

Liabilities:

Payable --

Investment securities purchased $ 2,965,950

Due to affiliates 216,189

Administration fee payable 92,938

Accrued expenses 139,723

---------------------------------------------------------------------------------

Total liabilities $ 3,414,800

---------------------------------------------------------------------------------

PREFERRED SHARES AT REDEMPTION VALUE:

$25,000 liquidation value per share applicable to 4,040 shares,

including dividends payable of $3,489 $101,003,489

---------------------------------------------------------------------------------

NET ASSETS APPLICABLE TO COMMON SHAREOWNERS:

Paid-in capital $319,605,260

Undistributed net investment income 11,758,418

Accumulated net realized loss on investments (23,036,135)

Net unrealized loss on investments (578,224)

---------------------------------------------------------------------------------

Net assets applicable to common shareowners $307,749,319

---------------------------------------------------------------------------------

NET ASSET VALUE PER COMMON SHARE:

No par value (unlimited number of shares authorized)

Based on $307,749,319/22,450,607 common shares $ 13.71

---------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 23

Statement of Operations (unaudited)

For the Six Months Ended 10/31/11

INVESTMENT INCOME:

Interest $14,551,281

---------------------------------------------------------------------------------------------

EXPENSES:

Management fees $ 1,223,371

Administration fees 142,643

Transfer agent fees and expenses 7,450

Shareowner communications expense 18,229

Auction agent fees 133,805

Custodian fees 52,611

Registration fees 10,281

Professional fees 47,519

Printing expense 21,964

Trustees' fees 5,504

Pricing fee 9,037

Miscellaneous 27,618

---------------------------------------------------------------------------------------------

Total expenses $ 1,700,032

---------------------------------------------------------------------------------------------

Net investment income $12,851,249

---------------------------------------------------------------------------------------------

REALIZED AND UNREALIZED GAIN ON INVESTMENTS:

Net realized gain from investments $ 1,444,850

Change in net unrealized gain (loss) on investments 14,356,646

---------------------------------------------------------------------------------------------

Net gain on investments $15,801,496

---------------------------------------------------------------------------------------------

DISTRIBUTIONS TO PREFERRED SHAREOWNERS FROM NET

INVESTMENT INCOME: $ (123,574)

---------------------------------------------------------------------------------------------

Net increase in net assets applicable to common shareowners

resulting from operations $28,529,171

---------------------------------------------------------------------------------------------

|

The accompanying notes are an integral part of these financial statements.

24 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

Statement of Changes in Net Assets

Six Months

Ended Year

10/31/11 Ended

(unaudited) 4/30/11

FROM OPERATIONS:

Net investment income $ 12,851,249 $ 25,037,310

Net realized gain (loss) on investments 1,444,850 (668,700)

Change in unrealized gain (loss) on investments 14,356,646 (19,362,413)

Distributions to preferred shareowners from net investment

income (123,574) (421,969)

----------------------------------------------------------------------------------------------

Net increase in net assets applicable to common

shareowners resulting from operations $ 28,529,171 $ 4,584,228

----------------------------------------------------------------------------------------------

DISTRIBUTIONS TO COMMON SHAREOWNERS:

Net investment income

($0.57 and $1.065 per share, respectively) $(12,774,655) $(23,762,562)

----------------------------------------------------------------------------------------------

Total distributions to common shareowners $(12,774,655) $(23,762,562)

----------------------------------------------------------------------------------------------

FROM TRUST SHARE TRANSACTIONS:

Reinvestment in distributions $ 941,443 $ 1,775,707

----------------------------------------------------------------------------------------------

Net increase in net assets applicable to common

shareowners from Trust share transactions $ 941,443 $ 1,775,707

----------------------------------------------------------------------------------------------

Net increase (decrease) in net assets applicable to

common shareowners $ 16,695,959 $(17,402,627)

NET ASSETS APPLICABLE TO COMMON SHAREOWNERS:

Beginning of period 291,053,360 308,455,987

----------------------------------------------------------------------------------------------

End of period $307,749,319 $291,053,360

----------------------------------------------------------------------------------------------

Undistributed net investment income $ 11,758,418 $ 11,805,398

==============================================================================================

|

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 25

Financial Highlights

-----------------------------------------------------------------------------------------------------------------------------------

Six Months

Ended Year Year Year Year Year

10/31/11 Ended Ended Ended Ended Ended

(Unaudited) 4/30/11 4/30/10 4/30/09 4/30/08 4/30/07

-----------------------------------------------------------------------------------------------------------------------------------

Per Common Share Operating Performance

Net asset value, beginning of period $ 13.00 $ 13.86 $ 11.18 $ 14.07 $ 16.02 $ 15.15

-----------------------------------------------------------------------------------------------------------------------------------

Increase (decrease) from investment operations: (a)

Net investment income $ 0.57 $ 1.12 $ 1.17 $ 1.12 $ 1.08 $ 1.02

Net realized and unrealized gain (loss) on

investments and interest rate swaps 0.72 (0.89) 2.50 (3.05) (2.03) 0.78

Dividends and distributions to preferred

shareowners from:

Net investment income (0.01) (0.02) (0.02) (0.11) (0.17) (0.16)

-----------------------------------------------------------------------------------------------------------------------------------

Net increase (decrease) from investment operations $ 1.28 $ 0.21 $ 3.65 $ (2.04) $ (1.12) $ 1.64

Dividends and distributions to common shareowners

from:

Net investment income (0.57) (1.07) (0.97) (0.85) (0.83) (0.77)

-----------------------------------------------------------------------------------------------------------------------------------

Net increase (decrease) in net asset value $ 0.71 $ (0.86) $ 2.68 $ (2.89) $ (1.95) $ 0.87

-----------------------------------------------------------------------------------------------------------------------------------

Net asset value, end of period (b) $ 13.71 $ 13.00 $ 13.86 $ 11.18 $ 14.07 $ 16.02

-----------------------------------------------------------------------------------------------------------------------------------

Market value, end of period (b) $ 14.36 $ 13.40 $ 14.34 $ 10.40 $ 13.88 $ 15.05

===================================================================================================================================

Total return at market value (c) 11.73% 1.04% 48.69% (18.85)% (2.28)% 20.04%

Ratios to average net assets of common shareowners

Net expenses (d) 0.83%(f) 1.12% 1.14% 1.19% 1.03% 1.06%

Net investment income before preferred share

dividends 6.28%(f) 8.26% 9.07% 9.36% 7.17% 6.49%

Preferred share dividends 0.08%(f) 0.14% 0.16% 0.95% 1.13% 1.01%

Net investment income available to common

shareowners 6.20%(f) 8.12% 8.91% 8.41% 6.04% 5.48%

|

The accompanying notes are an integral part of these financial statements.

26 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

-----------------------------------------------------------------------------------------------------------------------------------

Six Months

Ended Year Year Year Year Year

10/31/11 Ended Ended Ended Ended Ended

(Unaudited) 4/30/11 4/30/10 4/30/09 4/30/08 4/30/07

-----------------------------------------------------------------------------------------------------------------------------------

Portfolio turnover 5% 10% 11% 16% 17% 18%

Net assets of common shareowners, end of period (in

thousands) $307,749 $291,053 $308,456 $247,560 $311,231 $354,486

Preferred shares outstanding (in thousands) $101,000 $101,000 $101,000 $101,000 $101,000 $101,000

Asset coverage per preferred share, end of period (e) $101,176 $ 97,044 $101,351 $ 86,278 $102,047 $112,759

Average market value per preferred share $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000

Liquidation value, including dividends payable, per

preferred share $ 25,001 $ 25,001 $ 25,001 $ 25,001 $ 25,010 $ 25,014

Ratios to average net assets of common shareowners

before waivers and reimbursements of expenses

Net expenses (d) 0.83%(f) 1.12% 1.14% 1.19% 1.03% 1.06%

Net investment income before preferred share

dividends 6.28%(f) 8.26% 9.07% 9.36% 7.17% 6.49%

Preferred share dividends 0.08%(f) 0.14% 0.16% 0.95% 1.13% 1.01%

Net investment income available to common

shareowners 6.20%(f) 8.12% 8.91% 8.41% 6.04% 5.48%

===================================================================================================================================

|

(a) The per common share data presented above is based upon the average common

shares outstanding for the periods presented.

(b) Net asset value and market value are published in Barron's on Saturday,

The Wall Street Journal on Monday and The New York Times on Monday and

Saturday.

(c) Total investment return is calculated assuming a purchase of common shares

at the current market value on the first day and a sale at the current

market value on the last day of the periods reported. Dividends and

distributions, if any, are assumed for purposes of this calculation to be

reinvested at prices obtained under the Trust's dividend reinvestment

plan. Total investment return does not reflect brokerage commissions. Past

performance is not a guarantee of future results.

(d) Expense ratios do not reflect the effect of dividend payments to preferred

shareowners.

(e) Market value is redemption value without an active market.

(f) Annualized.

The information above represents the operating performance data for a common

share outstanding, total investment return, ratios to average net assets and

other supplemental data for the periods indicated. This information has been

determined based upon financial information provided in the financial statements

and market value data for the Trust's common shares.

The accompanying notes are an integral part of these financial statements.

Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11 27

Notes to Financial Statements | 10/31/11 (unaudited)

1. Organization and Significant Accounting Policies

Pioneer Municipal High Income Trust (the Trust) was organized as a Delaware

statutory trust on March 13, 2003. Prior to commencing operations on July 21,

2003, the Trust had no operations other than matters relating to its

organization and registration as a diversified, closed-end management investment

company under the Investment Company Act of 1940, as amended. The primary

investment objective of the Trust is to seek a high level of current income

exempt from regular federal income tax and, as a secondary investment objective,

the Trust may seek capital appreciation to the extent consistent with its

primary investment objective.

The Trust's financial statements have been prepared in conformity with U.S.

generally accepted accounting principles that require the management of the

Trust to, among other things, make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets

and liabilities at the date of the financial statements, and the reported

amounts of income, expenses and gain or loss on investments during the reporting

period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the

Trust in the preparation of its financial statements, which are consistent with

those policies generally accepted in the investment company industry:

A. Security Valuation

Security transactions are recorded as of trade date. Fixed income

securities with remaining maturity of more than sixty days are valued at

prices supplied by independent pricing services, which consider such

factors as market prices, market events, quotations from one or more

brokers, Treasury spreads, yields, maturities and ratings. Valuations may

be supplemented by dealers and other sources, as required. Equity

securities that have traded on an exchange are valued at the last sale

price on the principal exchange where they are traded. Equity securities

that have not traded on the date of valuation, or securities for which

sale prices are not available, generally are valued using the mean between

the last bid and asked prices. The values of interest rate swaps are

determined by obtaining dealer quotations.

Securities for which independent pricing services are unable to supply

prices or for which market prices and/or quotations are not readily

available or are considered to be unreliable are valued using fair value

methods pursuant to procedures adopted by the Board of Trustees. The Trust

may use fair value methods if it is determined that a significant event

has occurred after the

28 Pioneer Municipal High Income Trust | Semiannual Report | 10/31/11

close of the exchange or market on which the security trades and prior to

the determination of the Trust's net asset value. Examples of a

significant event might include political or economic news, corporate

restructurings, natural disasters, terrorist activity or trading halts.

Thus, the valuation of the Trust's securities may differ from exchange

prices.

At October 31, 2011, there were no securities that were valued using fair

value methods (other than securities valued using prices supplied by

independent pricing services). Inputs used when applying fair value

methods to value a security may include credit ratings, the financial

condition of the company, current market conditions and comparable

securities. Short-term fixed income securities with remaining maturities

of sixty days or less generally are valued at amortized cost. Money market

mutual funds are valued at net asset value.

Discount and premium on debt securities are accreted or amortized,

respectively, daily into interest income on a yield-to-maturity basis with

a corresponding increase or decrease in the cost basis of the security.

Interest income, including interest-bearing cash accounts, is recorded on

an accrual basis.

Dividend income is recorded on the ex-dividend date, except that certain

dividends from foreign securities where the ex-dividend date may have

passed are recorded as soon as the Trust becomes aware of the ex-dividend

data in the exercise of reasonable diligence.

Gains and losses on sales of investments are calculated on the identified

cost method for both financial reporting and federal income tax purposes.

B. Federal Income Taxes

It is the Trust's policy to comply with the requirements of the Internal

Revenue Code applicable to regulated investment companies and to

distribute all of its taxable income and net realized capital gains, if

any, to its shareowners. Therefore, no federal income tax provision is

required. Tax years for the prior three fiscal years remain subject to

examination by federal and state tax authorities.

The amounts and characterizations of distributions to shareowners for

financial reporting purposes are determined in accordance with federal

income tax rules. Therefore, the sources of the Trust's distributions may

be shown in the accompanying financial statements as from or in excess of

net investment income or as from net realized gain (loss) on investment

transactions, or as from paid-in capital, depending on the type of

book/tax differences that may exist.

The tax character of current year distributions payable to common and

preferred shareowners will be determined at the end of the current taxable