false000089394900008939492024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 01, 2024 |

Pediatrix Medical Group, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Florida |

001-12111 |

26-3667538 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1301 Concord Terrace |

|

Sunrise, Florida |

|

33323 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 954 384-0175 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $.01 per share |

|

MD |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Pediatrix Medical Group, Inc., a Florida corporation (the “Company”), issued a press release announcing the results of its operations for the three months and six months ended June 30, 2024 (the “Second Quarter Release”). A copy of the Second Quarter Release is attached hereto as Exhibit 99.1 and is hereby incorporated in this Current Report by reference. The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” with the Securities and Exchange Commission nor incorporated by reference in any registration statement or other document filed by the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Chief Financial Officer Transition

On August 6, 2024, the Company announced that its board of directors (the “Board”) has appointed Ms. Kasandra Rossi, who currently serves as the Company’s Senior Vice President, Financial Reporting and Assistant Treasurer, to succeed Mr. C. Marc Richards as Executive Vice President, Chief Financial Officer (“CFO”) and Treasurer of the Company.

The transition will be effective on or about October 1, 2024, following the anticipated completion of the next phase of the Company’s previously announced transition of its outsourced enterprise revenue cycle management services and the advancement of the Company’s planned portfolio management activities.

Ms. Rossi, 51, joined the Company in December 2009 and has served in various senior-level accounting, finance and treasury roles. She was appointed to her current role as Senior Vice President, Financial Reporting and Assistant Treasurer in November 2021.

In recognition of her appointment as CFO, Ms. Rossi will receive an increase in her annual base salary to $425,000 and an increase in her annual bonus opportunity to 75% of her annual base salary.

There are no arrangements or understandings between Ms. Rossi and any other person pursuant to which she was appointed as CFO of the Company and no family relationships between Ms. Rossi and any director or executive officer of the Company. Other than as described in this Current Report on Form 8-K, since the beginning of the Company’s last fiscal year, the Company has not engaged in any transactions, and there are no proposed transactions, or series of similar transactions, in which the Company was or is to be a participant and in which Ms. Rossi had a direct or indirect material interest in which the amount involved exceeds or exceeded $120,000.

Mr. Richards’ transition from his role as Executive Vice President, CFO and Treasurer is a termination without “Cause” pursuant to that certain Amended and Restated Employment Agreement, dated April 26, 2023, by and between Mr. Richards and a wholly-owned subsidiary of the Company, and Mr. Richards will receive the benefits thereunder following the execution of a general release of claims in favor of the Company.

Chief Administrative Officer Appointment

The Company also announced that the Board has appointed Ms. Mary Ann E. Moore to serve as the Company’s Chief Administrative Officer, in addition to her existing roles as the Company’s Executive Vice President, General Counsel and Secretary, effective as of August 1, 2024.

In addition, the Company announced that Curtis B. Pickert, M.D. has transitioned from his role as the Company’s Executive Vice President, Chief Operating Officer and will now serve as Pediatrix’s Executive Vice President, Chief Physician Executive, effective as of August 1, 2024. As a result of this transition, Dr. Pickert will no longer serve as an executive officer of the Company.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Index

99.1— Press Release of Pediatrix Medical Group, Inc. dated August 6, 2024.

104 — Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Pediatrix Medical Group, Inc. |

|

|

|

|

Date: |

August 6, 2024 |

By: |

/s/ C. Marc Richards |

|

|

|

C. Marc Richards

Chief Financial Officer |

FOR MORE INFORMATION:

Charles Lynch

Senior Vice President, Finance and Strategy

954-384-0175, x 5692

charles.lynch@pediatrix.com

FOR IMMEDIATE RELEASE

Pediatrix Medical Group Reports Second Quarter Results

FORT LAUDERDALE, Fla., August 6, 2024 - Pediatrix Medical Group, Inc. (NYSE: MD), a leading provider of physician services, today reported a loss of $1.84 per share for the three months ended June 30, 2024. On a non-GAAP basis, Pediatrix reported Adjusted EPS of $0.34.

For the 2024 second quarter, Pediatrix reported the following results:

•Net revenue of $504 million;

•Net loss of $153 million; and

•Adjusted EBITDA of $58 million.

“Our second quarter operating results exceeded our expectations and reflected stable patient volumes, improved payor mix, and operating efficiencies,” said James D. Swift, M.D., Chief Executive Officer of Pediatrix Medical Group. “Our previously discussed portfolio management plans are well underway and we expect to complete these plans by the end of 2024. We believe that these operating plans, our strengthening financial position, and our focus on hospital-based care and maternal-fetal medicine will benefit all of our stakeholders.”

Operating Results– Three Months Ended June 30, 2024

Pediatrix’s net revenue for the three months ended June 30, 2024 was $504.3 million, compared to $500.6 million for the prior-year period. This increase reflected growth in same-unit revenue of 2.8 percent, partially offset by the impact of non-same unit activity, primarily practice dispositions.

Same-unit revenue from net reimbursement-related factors increased by 2.4 percent for the 2024 second quarter as compared to the prior-year period. This increase primarily reflects improved payor mix and modest improvements in hospital contract administrative fees. The percentage of services reimbursed by commercial and other non-government payors increased by approximately 230 basis points compared to the prior year period.

Same-unit revenue attributable to patient volume increased by 0.4 percent for the 2024 second quarter as compared to the prior-year period. Shown below are year-over-year percentage changes in certain same-unit volume statistics for the three and six months ended June 30, 2024. (Note: figures in the below table reflect contributions only to net patient service revenue and exclude other contributions to total same-unit revenue, including contract and administrative fees.)

|

|

|

|

|

|

|

Three Months Ended

June 30, 2024 |

|

Six Months Ended

June 30, 2024 |

Hospital-based patient services |

|

1.0% |

|

1.7% |

Office-based patient services |

|

(1.2)% |

|

0.7% |

|

|

|

|

|

Neonatology services

(within hospital-based services): |

|

|

|

|

Neonatal intensive care unit (NICU) days |

|

(0.8)% |

|

0.9% |

For the 2024 second quarter, practice salaries and benefits expense was $357.8 million, compared to $354.0 million for the prior-year period. This comparison primarily reflects increases in same-unit clinical compensation costs, partially offset by the impact of non-same unit activity, primarily practice dispositions.

For the 2024 second quarter, general and administrative expenses were $56.6 million, as compared to $58.0 million for the prior-year period. This decline primarily reflects net staffing reductions that more than offset increased internal staffing as part of the Company’s ongoing development of its hybrid revenue cycle management structure.

For 2024 second quarter, transformational and restructuring related expenses totaled $13.6 million. These expenses related primarily to practice dispositions and revenue cycle management transition activities.

Adjusted EBITDA, which is defined as earnings before interest, taxes, depreciation and amortization, transformational and restructuring related expenses, and loss on disposal of businesses and impairment losses, was $57.9 million for the 2024 second quarter, compared to $59.1 million for the prior-year period.

Depreciation and amortization expense was $8.8 million for the second quarter of 2024, compared to $8.9 million for the prior-year period.

Interest expense was $10.3 million for the second quarter of 2024, compared to $11.2 million for the second quarter of 2023, reflecting lower outstanding borrowings.

During the second quarter of 2024, the Company recorded an aggregate non-cash impairment loss of $192.9 million related to goodwill and long-lived assets related to the Company’s portfolio management plan.

Pediatrix generated a net loss of $153.0 million, or $1.84 per diluted share, for the 2024 second quarter, based on a weighted average 83.3 million shares outstanding. This compares with net income of $28.3 million, or $0.34 per diluted share, for the 2023 second quarter, based on a weighted average 82.7 million shares outstanding.

For the second quarter of 2024, Pediatrix reported Adjusted EPS of $0.34, compared to $0.39 for the second quarter of 2023. For these periods, Adjusted EPS is defined as diluted income per common and common equivalent share excluding non-cash amortization expense, stock-based compensation expense, transformational and restructuring related expenses, loss on disposal of businesses and impairment losses, and discrete tax events.

Operating Results – Six Months Ended June 30, 2024

For the six months ended June 30, 2024, Pediatrix generated revenue of $999.4 million, compared to $991.6 million for the prior-year period. Pediatrix generated a net loss of $149.0 million, or $1.79 per share, for the six months ended June 30, 2024, based on a weighted average 83.1 million shares outstanding, which compares to income of $42.5 million, or $0.52 per share, based on a weighted average 82.4 million shares outstanding for the first six months of 2023. Adjusted EBITDA for the six months ended June 30, 2024 was $95.1 million, compared to $99.2 million for the prior year. For the six months ended June 30, 2024, Pediatrix reported Adjusted EPS of $0.54, compared to $0.62 in the same period of 2023.

Financial Position and Cash Flow – Continuing Operations

Pediatrix had cash and cash equivalents of $19.4 million at June 30, 2024, compared to $73.3 million on December 31, 2023, and net accounts receivable were $274.2 million.

For the second quarter of 2024, Pediatrix generated cash from continuing operations of $109.3 million, compared to $92.6 million during the second quarter of 2023. During the second quarter of 2024, the Company used $7.0 million to fund capital expenditures.

At June 30, 2024, Pediatrix had total debt outstanding of $622 million, consisting of its $400 million in 5.375% Senior Notes due 2030 and $222 million in borrowings under its Term A Loan. At June 30, 2024, the Company had no outstanding borrowings under its $450 million revolving line of credit.

Portfolio Management Update

As previously disclosed, during the second quarter of 2024, Pediatrix formalized its practice portfolio management plans, resulting in a decision to exit almost all of its affiliated office-based practices, other than maternal-fetal medicine. The Company expects to complete these exits prior to the end of 2024. In addition, Pediatrix previously disclosed its intent to exit its primary and urgent care service line. During and subsequent to the end of the 2024 second quarter, the Company completed the exit of its primary and urgent care service line through two separate transactions.

In aggregate, the office-based practices that the Company intends to exit and the primary and urgent care clinics that have been divested contributed net revenue of approximately $200 million in 2023. As previously disclosed, Pediatrix expects that the annualized favorable impact

to Adjusted EBITDA resulting from its portfolio management plans to be approximately $30 million.

Leadership Transitions

Chief Financial Officer Transition

Pediatrix announced today that its board of directors has appointed Ms. Kasandra Rossi, who currently serves as the Company’s Senior Vice President, Financial Reporting and Assistant Treasurer, to succeed Mr. C. Marc Richards as Executive Vice President, Chief Financial Officer and Treasurer of the Company. The transition will be effective on or about October 1, 2024, following the anticipated completion of the next phase of the Company’s previously announced transition of its outsourced enterprise revenue cycle management services and the advancement of the Company’s planned portfolio management activities.

Chief Administrative Officer Appointment

The Company also announced today that its board of directors has appointed Ms. Mary Ann E. Moore to serve as the Company’s Chief Administrative Officer, in addition to her existing roles as the Company’s Executive Vice President, General Counsel and Secretary, effective as of August 1, 2024.

In addition, Pediatrix announced that Curtis B. Pickert, M.D. has transitioned from his role as the Company’s Executive Vice President, Chief Operating Officer and will now serve as Pediatrix’s Executive Vice President, Chief Physician Executive, effective as of August 1, 2024.

2024 Outlook

As previously disclosed, Pediatrix anticipates that its 2024 Adjusted EBITDA, as defined below, will be in a range of $200 million to $220 million.

Non-GAAP Measures

A reconciliation of Adjusted EBITDA and Adjusted EPS to the most directly comparable GAAP measures for the three and six months ended June 30, 2024 and 2023 is provided in the financial tables of this press release.

Earnings Conference Call

Pediatrix will host an investor conference call to discuss the quarterly results at 9 a.m., ET today. The conference call Webcast may be accessed from the Company’s Website, www.pediatrix.com. A telephone replay of the conference call will be available from 12:45 p.m. ET today through midnight ET August 20, 2024 by dialing 1-866-207-1041, access code 7909485. The replay will also be available at www.pediatrix.com.

ABOUT PEDIATRIX MEDICAL GROUP

Pediatrix® Medical Group, Inc. (NYSE:MD) is a leading provider of physician services. Pediatrix-affiliated clinicians are committed to providing coordinated, compassionate and clinically excellent services to women, babies and children across the continuum of care, both in hospital settings and office-based practices. Specialties include obstetrics, maternal-fetal medicine and neonatology complemented by multiple pediatric subspecialties. The group’s high-quality, evidence-based care is bolstered by significant investments in research, education, quality-improvement and safety initiatives. The physician-led company was founded in 1979 as a single neonatology practice and today provides its highly specialized and often critical care services through more than 5,000 affiliated physicians and other clinicians. To learn more about Pediatrix, visit www.pediatrix.com or follow us on Facebook, Instagram, LinkedIn, Twitter and the Pediatrix blog. Investment information can be found at www.pediatrix.com/investors.

Certain statements and information in this press release may be deemed to contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may include, but are not limited to, statements relating to the Company’s objectives, plans and strategies, and all statements, other than statements of historical facts, that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future. These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions, and are based on assumptions and assessments made by the Company’s management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. Any forward-looking statements in this press release are made as of the date hereof, and the Company undertakes no duty to update or revise any such statements, whether as a result of new information, future events or otherwise. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. Important factors that could cause actual results, developments, and business decisions to differ materially from forward-looking statements are described in the Company’s most recent Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q, including the sections entitled “Risk Factors”, as well the Company’s current reports on Form 8-K, filed with the Securities and Exchange Commission, and include the impact of the Company’s practice portfolio management plans and whether the Company is able to achieve the expected favorable impact to Adjusted EBITDA therefrom; the impact of the Company’s termination of its then third-party revenue cycle management provider and transition to a hybrid revenue cycle management model with one or more new third-party service providers, including any transition costs associated therewith; the impact of surprise billing legislation; the effects of economic conditions on the Company’s business; the effects of the Affordable Care Act and potential healthcare reform; the Company’s relationships with government-sponsored or funded healthcare programs, including Medicare and Medicaid, and with managed care organizations and commercial health insurance payors; the Company’s ability to comply with the terms of its debt financing arrangements; the impact of the COVID-19 pandemic on the Company and its financial condition and results of operations; the impact of the divestiture of the Company’s anesthesiology and radiology medical groups; the impact of management transitions; the timing and contribution of future acquisitions or organic growth initiatives; the effects of share repurchases; and the effects of the Company’s transformation initiatives, including its reorientation on, and growth strategy for, its pediatrics and obstetrics business.

###

Pediatrix Medical Group, Inc.

Consolidated Statements of Income and Comprehensive Income

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net revenue |

|

$ |

504,296 |

|

|

$ |

500,577 |

|

|

$ |

999,397 |

|

|

$ |

991,585 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Practice salaries and benefits |

|

|

357,808 |

|

|

|

354,032 |

|

|

|

726,946 |

|

|

|

716,267 |

|

Practice supplies and other operating expenses |

|

|

32,369 |

|

|

|

31,089 |

|

|

|

63,454 |

|

|

|

61,809 |

|

General and administrative expenses |

|

|

56,565 |

|

|

|

58,013 |

|

|

|

116,763 |

|

|

|

117,072 |

|

Depreciation and amortization |

|

|

8,791 |

|

|

|

8,945 |

|

|

|

19,099 |

|

|

|

17,898 |

|

Transformational and restructuring related expenses |

|

|

13,579 |

|

|

|

— |

|

|

|

22,059 |

|

|

|

— |

|

Goodwill impairment |

|

|

154,243 |

|

|

|

— |

|

|

|

154,243 |

|

|

|

— |

|

Fixed assets impairments |

|

|

20,112 |

|

|

|

— |

|

|

|

20,112 |

|

|

|

— |

|

Intangible assets impairments |

|

|

7,679 |

|

|

|

— |

|

|

|

7,679 |

|

|

|

— |

|

Loss on disposal of businesses |

|

|

10,873 |

|

|

|

— |

|

|

|

10,873 |

|

|

|

— |

|

Total operating expenses |

|

|

662,019 |

|

|

|

452,079 |

|

|

|

1,141,228 |

|

|

|

913,046 |

|

(Loss) income from operations |

|

|

(157,723 |

) |

|

|

48,498 |

|

|

|

(141,831 |

) |

|

|

78,539 |

|

Investment and other (loss) income |

|

|

(161 |

) |

|

|

1,189 |

|

|

|

1,852 |

|

|

|

1,823 |

|

Interest expense |

|

|

(10,308 |

) |

|

|

(11,230 |

) |

|

|

(20,907 |

) |

|

|

(21,620 |

) |

Equity in earnings of unconsolidated affiliate |

|

|

464 |

|

|

|

490 |

|

|

|

982 |

|

|

|

917 |

|

Total non-operating expenses |

|

|

(10,005 |

) |

|

|

(9,551 |

) |

|

|

(18,073 |

) |

|

|

(18,880 |

) |

(Loss) income before income taxes |

|

|

(167,728 |

) |

|

|

38,947 |

|

|

|

(159,904 |

) |

|

|

59,659 |

|

Income tax benefit (provision) |

|

|

14,703 |

|

|

|

(10,665 |

) |

|

|

10,914 |

|

|

|

(17,171 |

) |

Net (loss) income |

|

$ |

(153,025 |

) |

|

$ |

28,282 |

|

|

$ |

(148,990 |

) |

|

$ |

42,488 |

|

Other comprehensive (loss) income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized holding gain (loss) on investments, net of tax of $66, $126, $86 and $353 |

|

|

200 |

|

|

|

(387 |

) |

|

|

260 |

|

|

|

217 |

|

Total comprehensive (loss) income |

|

$ |

(152,825 |

) |

|

$ |

27,895 |

|

|

$ |

(148,730 |

) |

|

$ |

42,705 |

|

Per common and common equivalent share data (diluted): |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income: |

|

$ |

(1.84 |

) |

|

$ |

0.34 |

|

|

$ |

(1.79 |

) |

|

$ |

0.52 |

|

Weighted average common shares |

|

|

83,332 |

|

|

|

82,664 |

|

|

|

83,074 |

|

|

|

82,377 |

|

Pediatrix Medical Group, Inc.

Reconciliation of Net (Loss) Income to Adjusted EBITDA

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net (loss) income |

|

$ |

(153,025 |

) |

|

$ |

28,282 |

|

|

$ |

(148,990 |

) |

|

$ |

42,488 |

|

Interest expense |

|

|

10,308 |

|

|

|

11,230 |

|

|

|

20,907 |

|

|

|

21,620 |

|

Income tax (benefit) provision |

|

|

(14,703 |

) |

|

|

10,665 |

|

|

|

(10,914 |

) |

|

|

17,171 |

|

Depreciation and amortization expense |

|

|

8,791 |

|

|

|

8,945 |

|

|

|

19,099 |

|

|

|

17,898 |

|

Transformational and restructuring related expenses |

|

|

13,579 |

|

|

|

— |

|

|

|

22,059 |

|

|

|

— |

|

Goodwill impairment |

|

|

154,243 |

|

|

|

— |

|

|

|

154,243 |

|

|

|

— |

|

Fixed assets impairments |

|

|

20,112 |

|

|

|

— |

|

|

|

20,112 |

|

|

|

— |

|

Intangible assets impairments |

|

|

7,679 |

|

|

|

— |

|

|

|

7,679 |

|

|

|

— |

|

Loss on disposal of businesses |

|

|

10,873 |

|

|

|

— |

|

|

|

10,873 |

|

|

|

— |

|

Adjusted EBITDA |

|

$ |

57,857 |

|

|

$ |

59,122 |

|

|

$ |

95,068 |

|

|

$ |

99,177 |

|

Pediatrix Medical Group, Inc.

Reconciliation of Diluted Net Income per Share

to Adjusted (Loss) Income per Diluted Share (“Adjusted EPS”)

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

Weighted average diluted shares outstanding |

|

83,332 |

|

|

82,664 |

|

Net (loss) income and diluted net (loss) income per share |

|

$ |

(153,025 |

) |

|

$ |

(1.84 |

) |

|

$ |

28,282 |

|

|

$ |

0.34 |

|

Adjustments (1): |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization (net of tax of $533 and $512) |

|

|

1,599 |

|

|

|

0.02 |

|

|

|

1,533 |

|

|

|

0.02 |

|

Stock-based compensation (net of tax of $500 and $782) |

|

|

1,501 |

|

|

|

0.02 |

|

|

|

2,344 |

|

|

|

0.03 |

|

Transformational and restructuring expenses (net of tax of $3,395) |

|

|

10,184 |

|

|

|

0.12 |

|

|

|

— |

|

|

|

— |

|

Goodwill impairment (net of tax of $15,490) |

|

|

138,753 |

|

|

|

1.67 |

|

|

|

— |

|

|

|

— |

|

Fixed assets impairments (net of tax of $5,028) |

|

|

15,084 |

|

|

|

0.18 |

|

|

|

— |

|

|

|

— |

|

Intangible assets impairments (net of tax of $1,920) |

|

|

5,759 |

|

|

|

0.07 |

|

|

|

— |

|

|

|

— |

|

Loss on disposal of businesses (net of tax of $2,718) |

|

|

8,155 |

|

|

|

0.10 |

|

|

|

— |

|

|

|

— |

|

Net impact from discrete tax events |

|

|

328 |

|

|

|

— |

|

|

|

150 |

|

|

|

— |

|

Adjusted income and diluted EPS |

|

$ |

28,338 |

|

|

$ |

0.34 |

|

|

$ |

32,309 |

|

|

$ |

0.39 |

|

(1) A blended tax rate of 25% was used to calculate the tax effects of the adjustments for the three months ended June 30, 2024 and 2023, other than for goodwill impairment for the relevant period. Tax effects for the goodwill impairment approximate 10% due to a portion of the expense being non-deductible.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

Weighted average diluted shares outstanding |

|

83,074 |

|

|

82,377 |

|

Net (loss) income and diluted net (loss) income per share |

|

$ |

(148,990 |

) |

|

$ |

(1.79 |

) |

|

$ |

42,488 |

|

|

$ |

0.52 |

|

Adjustments (1): |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization (net of tax of $1,396 and $1,010) |

|

|

4,188 |

|

|

|

0.05 |

|

|

|

3,029 |

|

|

|

0.04 |

|

Stock-based compensation (net of tax of $1,215 and $1,534) |

|

|

3,647 |

|

|

|

0.04 |

|

|

|

4,601 |

|

|

|

0.06 |

|

Transformational and restructuring expenses (net of tax of $5,515) |

|

|

16,544 |

|

|

|

0.20 |

|

|

|

— |

|

|

|

— |

|

Goodwill impairment (net of tax of $15,490) |

|

|

138,753 |

|

|

|

1.67 |

|

|

|

— |

|

|

|

— |

|

Fixed assets impairments (net of tax of $5,028) |

|

|

15,084 |

|

|

|

0.18 |

|

|

|

— |

|

|

|

— |

|

Intangible assets impairments (net of tax of $1,920) |

|

|

5,759 |

|

|

|

0.07 |

|

|

|

— |

|

|

|

— |

|

Loss on disposal of businesses (net of tax of $2,718) |

|

|

8,155 |

|

|

|

0.10 |

|

|

|

— |

|

|

|

— |

|

Net impact from discrete tax events |

|

|

2,004 |

|

|

|

0.02 |

|

|

|

870 |

|

|

|

— |

|

Adjusted income and diluted EPS |

|

$ |

45,144 |

|

|

$ |

0.54 |

|

|

$ |

50,988 |

|

|

$ |

0.62 |

|

(1) A blended tax rate of 25% was used to calculate the tax effects of the adjustments for the six months ended June 30, 2024 and 2023, other than for goodwill impairment for the relevant period. Tax effects for the goodwill impairment approximate 10% due to a portion of the expense being non-deductible.

Pediatrix Medical Group, Inc.

Balance Sheet Highlights

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

As of

June 30, 2024 |

|

|

As of

December 31, 2023 |

|

Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

19,402 |

|

|

$ |

73,258 |

|

Investments |

|

|

113,795 |

|

|

|

104,485 |

|

Accounts receivable, net |

|

|

274,164 |

|

|

|

272,313 |

|

Other current assets |

|

|

21,851 |

|

|

|

33,398 |

|

Intangible assets, net |

|

|

10,193 |

|

|

|

21,240 |

|

Operating and finance lease right-of-use assets |

|

|

65,392 |

|

|

|

70,294 |

|

Goodwill, other assets, property and equipment |

|

|

1,490,554 |

|

|

|

1,644,822 |

|

Total assets |

|

$ |

1,995,351 |

|

|

$ |

2,219,810 |

|

Liabilities and shareholders' equity: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

267,333 |

|

|

$ |

350,798 |

|

Total debt, including finance leases, net |

|

|

630,370 |

|

|

|

633,334 |

|

Operating lease liabilities |

|

|

67,940 |

|

|

|

68,314 |

|

Other liabilities |

|

|

323,247 |

|

|

|

318,303 |

|

Total liabilities |

|

|

1,288,890 |

|

|

|

1,370,749 |

|

Total shareholders' equity |

|

|

706,461 |

|

|

|

849,061 |

|

Total liabilities and shareholders' equity |

|

$ |

1,995,351 |

|

|

$ |

2,219,810 |

|

Pediatrix Medical Group, Inc.

Reconciliation of Net Loss to Forward-Looking Adjusted EBITDA

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2024 |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(112,507 |

) |

|

$ |

(97,907 |

) |

Interest expense |

|

|

40,020 |

|

|

|

40,020 |

|

Income tax provision |

|

|

2,580 |

|

|

|

7,980 |

|

Depreciation and amortization expense |

|

|

37,000 |

|

|

|

37,000 |

|

Transformational and restructuring related expenses |

|

|

40,000 |

|

|

|

40,000 |

|

Goodwill and long-lived asset impairments |

|

|

182,034 |

|

|

|

182,034 |

|

Loss on disposal of businesses |

|

|

10,873 |

|

|

|

10,873 |

|

Adjusted EBITDA |

|

$ |

200,000 |

|

|

$ |

220,000 |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

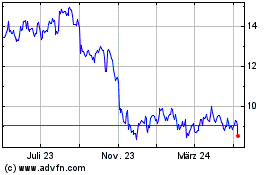

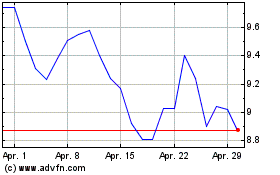

Pediatrix Medical (NYSE:MD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Pediatrix Medical (NYSE:MD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024