FALSE0001941365877622-47823300 Enterprise Parkway, Suite 300BeachwoodOhio00019413652024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

________________________

MasterBrand, Inc.

(Exact name of registrant as specified in its Charter)

________________________

| | | | | | | | |

| Delaware | 001-41545 | 88-3479920 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

3300 Enterprise Parkway, Suite 300 Beachwood, Ohio | | 44122 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

877-622-4782 |

(Registrant’s telephone number, including area code) |

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | MBC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

MasterBrand, Inc. (the “Company”) issued an earnings release on August 6, 2024, announcing certain financial and operational results for the fiscal quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 2.02 and Item 9.01, including the press release furnished as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MasterBrand, Inc. |

| (Registrant) |

| | | |

Date: August 6, 2024 | | By: | /s/ R. David Banyard, Jr. |

| | Name: | R. David Banyard, Jr. |

| | Title: | President & Chief Executive Officer |

MasterBrand Reports Second Quarter 2024 Financial Results

•Net sales decreased 2.7% year-over-year to $676.5 million

•Net income was $45.3 million compared to $51.2 million in the prior year, with net income margin of 6.7% and 7.4%, respectively

•Adjusted EBITDA margin1 increased 20 basis points year-over-year to 15.5%

•Diluted earnings per share was $0.35 compared to $0.39 in the prior year quarter; adjusted diluted earnings per share1 was $0.45 compared to $0.44 in the prior year quarter

•Operating cash flow for the twenty-six weeks ended June 30, 2024 was $96.1 million with free cash flow1 of $77.8 million

•Increases 2024 financial outlook following the closing of Supreme Cabinetry Brands acquisition

BEACHWOOD, Ohio.--(BUSINESS WIRE)--August 6, 2024-- MasterBrand, Inc. (NYSE: MBC, the “Company,” or “MasterBrand”), the largest residential cabinet manufacturer in North America, today announced second quarter 2024 financial results.

“MasterBrand delivered another solid quarter of financial performance, with continued year-over-year adjusted EBITDA margin expansion and strong free cash flow,” said Dave Banyard, President and Chief Executive Officer. “Our performance is again the result of our associates’ dedication to The MasterBrand Way and their execution on our strategy. Further investments in our strategic initiatives, complemented by acquisitions such as Supreme Cabinetry Brands, give us confidence in our ability to outperform the market, achieve our long-term financial targets, and deliver sustained shareholder value.”

Second Quarter 2024

Net sales were $676.5 million, compared to $695.1 million in the second quarter of 2023, a decrease of 2.7%. Gross profit was $231.0 million, compared to $236.2 million in the prior year. Gross profit margin expanded 10 basis points to 34.1%, as additional cost savings from strategic initiatives, specifically quality processes, and continuous improvement efforts more than offset lower average selling price due primarily to product trade downs, the return of normal seasonal promotional activities, and personnel inflation.

Net income was $45.3 million, compared to $51.2 million in the second quarter of 2023, a decrease of 11.5%, due to lower net sales, higher interest expense, the result of a non-recurring expense related to the restructuring of debt, and acquisition and transaction related costs, slightly offset by a lower effective tax rate. Net income margin was 6.7% compared to 7.4% in the prior year.

Adjusted EBITDA1 was $105.1 million, compared to $106.3 million in the second quarter of 2023. Adjusted EBITDA margin1 expanded 20 basis points to 15.5%, on improved gross profit margin performance.

Diluted earnings per share were $0.35 compared to $0.39 in the second quarter of 2023. Adjusted diluted earnings per share1 were $0.45 compared to $0.44 in the second quarter of 2023. In the second quarter of 2024, adjusted diluted earnings per share1 has been revised to exclude amortization expense, including those related to acquisitions. Prior period information has been recast to reflect the updated presentation.

1 - See "Non-GAAP Financial Measures" and the corresponding financial tables at the end of this press release for definitions and reconciliations of non-GAAP measures.

1

Balance Sheet, Cash Flow and Share Repurchases

As of June 30, 2024, the Company had $189.4 million in cash and $727.3 million of availability under its new revolving credit facility. Total debt was $688.9 million and our ratio of total debt to net income from the most recent four quarters was 3.9x as of June 30, 2024. Net debt1 was $499.5 million and net debt to adjusted EBITDA1 was 1.3x.

Operating cash flow was $96.1 million for the twenty-six weeks ended June 30, 2024, compared to $194.0 million in the twenty-six weeks ended June 25, 2023. This decline was due to a benefit in the prior year from a strategic inventory build release. Free cash flow1 was $77.8 million for the twenty-six weeks ended June 30, 2024, compared to $182.6 million for the twenty-six weeks ended June 25, 2023.

During the twenty-six weeks ended June 30, 2024, the Company repurchased approximately 371 thousand shares of common stock for approximately $6.5 million.

Supreme Cabinetry Brands Acquisition

Subsequent to the quarter ended June, 30, 2024, the Company closed the acquisition of Supreme Cabinetry Brands for a net cash payment of $520 million, subject to customary adjustments as set forth in the merger agreement. Total pre-tax acquisition-related charges in the second quarter of 2024, due to transaction costs, were $4.4 million. MasterBrand expects to deliver $28 million of annual run-rate cost synergies by the end of year three, and anticipates commercial synergies across the combined Company’s complementary channels and product lines. The transaction is expected to be accretive to adjusted EBITDA margin1 and to adjusted diluted earnings per share1 in 2024, exclusive of acquisition-related charges.

2024 Financial Outlook

For full year 2024, the Company has increased its outlook following the closing of the Supreme Cabinetry Brands acquisition. On a consolidated basis the Company expects:

•Net sales year-over-year increase of low single-digit percentage

◦Organic decline of low single-digit percentage

◦Acquisition-related increase of mid single-digit percentage

•Adjusted EBITDA1,2 in the range of $385 million to $405 million, with related adjusted EBITDA margin1,2 of roughly 14.0% to 14.5%

•Adjusted Diluted EPS1,2 in the range of $1.50 to $1.62

The Company expects organic net sales performance to be in line to slightly better than the underlying market demand, as new products and channel specific offerings gain traction.

“We are pleased with our second quarter financial performance, as end market demand remained mixed,” said Andi Simon, Executive Vice President and Chief Financial Officer. “Feedback from our channels and recent macroeconomic indicators, suggests end market demand will trend towards the lower end of our original range for the legacy MasterBrand business. Despite this end market softness, we believe we will now deliver year-on-year net sales growth and increased profitability, following the successful closing of the Supreme acquisition.”

1 - See "Non-GAAP Financial Measures" and the corresponding financial tables at the end of this press release for definitions and reconciliations of non-GAAP measures.

2 - We have not provided a reconciliation of our fiscal 2024 adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS guidance because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred and which may be excluded from adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS. Additionally, estimating such GAAP measures and providing a meaningful reconciliation for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions used for historical non-GAAP measures.

2

Conference Call Details

The Company will hold a live conference call and webcast at 4:30 p.m. ET today, August 6, 2024, to discuss the financial results and business outlook. Telephone access to the live call will be available at (877) 407-4019 (U.S.) or by dialing (201) 689-8337 (international). The live audio webcast can be accessed on the “Investors” section of the MasterBrand website www.masterbrand.com.

A telephone replay will be available approximately one hour following completion of the call through August 20, 2024. To access the replay, please dial 877-660-6853 (U.S.) or 201-612-7415 (international). The replay passcode is 13747550. An archived webcast of the conference call will also be available on the "Investors" page of the Company's website.

Non-GAAP Financial Measures

To supplement the financial information presented in accordance with generally accepted accounting principles in the United States (“GAAP”) in this earnings release, certain non-GAAP financial measures as defined under SEC rules have been included. It is our intent to provide non-GAAP financial information to enhance understanding of our financial information as prepared in accordance with GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for, other financial measures prepared in accordance with GAAP. Our methods of determining these non-GAAP financial measures may differ from the methods used by other companies for these or similar non-GAAP financial measures. Accordingly, these non-GAAP financial measures may not be comparable to measures used by other companies.

We use EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income margin, adjusted diluted earnings per share (“adjusted diluted EPS”), free cash flow, net debt, and net debt to adjusted EBITDA, which are all non-GAAP financial measures. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. We evaluate the performance of our business based on income before income taxes, but also look to EBITDA as a performance evaluation measure because interest expense is related to corporate functions, as opposed to operations. For that reason, we believe EBITDA is a useful metric to investors in evaluating our operating results. Adjusted EBITDA is calculated by removing the impact of non-operational results and special items from EBITDA. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net sales. Adjusted net income is calculated by removing the impact of non-operational results, including non-cash amortization expense, which is not deemed to be indicative of the results of current or future operations, and special items from net income. Adjusted net income margin is calculated as adjusted net income divided by net sales. Adjusted diluted EPS is a measure of our diluted earnings per share excluding non-operational results and special items. These non-GAAP measures are useful to investors as they are representative of our core operations and are used in the management of our business, including decisions concerning the allocation of resources and assessment of performance.

Free cash flow is defined as cash flow from operations less capital expenditures. We believe that free cash flow is a useful measure to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of our business strategy, and is used in the management of our business, including decisions concerning the allocation of resources and assessment of performance. Net debt is defined as total balance sheet debt less cash and cash equivalents. We believe this measure is useful to investors as it provides a measure to compare debt less cash and cash equivalents across periods on a consistent basis. Net debt to adjusted EBITDA is calculated by dividing net debt by the trailing twelve months adjusted EBITDA. Net debt to adjusted EBITDA is used by management to assess our financial leverage and ability to service our debt obligations.

As required by SEC rules, see the financial statement section of this earnings release for detailed reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure. We have not provided a reconciliation of our fiscal 2024 adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS guidance because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred, including gains and losses associated with our defined benefit plans and restructuring and other charges, which are excluded from adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income margin, and adjusted diluted EPS. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with the Company’s accounting policies for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions used for historical non-GAAP measures.

About MasterBrand:

MasterBrand, Inc. (NYSE: MBC) is the largest manufacturer of residential cabinets in North America and offers a comprehensive portfolio of leading residential cabinetry products for the kitchen, bathroom and other parts of the home. MasterBrand products are available in a wide variety of designs, finishes and styles and span the most attractive categories of the cabinets market: stock, semi-custom and premium cabinetry. These products are delivered through an industry-leading distribution network of over 6,000 dealers, major retailers and builders. MasterBrand employs over 13,000 associates across more than 20 manufacturing facilities and offices. Additional information can be found at www.masterbrand.com.

Forward-Looking Statements:

Certain statements contained in this Press Release, other than purely historical information, including, but not limited to estimates, projections, statements relating to our business plans objectives and expected operating results, and the assumptions upon which those statements are based, are forward-looking statements. Statements preceded by, followed by or that otherwise include the word “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “may increase,” “may fluctuate,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could,” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our management. Although we believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those indicated in such statements. These factors include those listed under “Risk Factors” in Part I, Item 1A of our Form 10-K for the fiscal year ended December 31, 2023, and other filings with the SEC.

The forward-looking statements included in this document are made as of the date of this Press Release and, except pursuant to any obligations to disclose material information under the federal securities laws, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect events, new information or circumstances occurring after the date of this Press Release.

Some of the important factors that could cause our actual results to differ materially from those projected in any such forward-looking statements include:

◦Our ability to develop and expand our business;

◦Our ability to develop new products or respond to changing consumer preferences and purchasing practices;

◦Our anticipated financial resources and capital spending;

◦Our ability to manage costs;

◦Our ability to effectively manage manufacturing operations, and capacity or an inability to maintain the quality of our products;

◦The impact of our dependence on third parties to source raw materials and our ability to obtain raw materials in a timely manner or fluctuations in raw material costs;

◦Our ability to accurately price our products;

◦Our projections of future performance, including future revenues, capital expenditures, gross margins, and cash flows;

◦The effects of competition and consolidation of competitors in our industry;

◦Costs of complying with evolving tax and other regulatory requirements and the effect of actual or alleged violations of tax, environmental or other laws;

◦The effect of climate change and unpredictable seasonal and weather factors;

◦Conditions in the housing market in the United States and Canada;

◦The expected strength of our existing customers and consumers and any loss or reduction in business from one or more of our key customers or increased buying power of large customers;

◦Information systems interruptions or intrusions or the unauthorized release of confidential information concerning customers, employees, or other third parties;

◦Worldwide economic, geopolitical and business conditions and risks associated with doing business on a global basis;

◦The effects of a public health crisis or other unexpected event;

◦The inability to recognize or delays in obtaining, anticipated benefits of the acquisition of Supreme Cabinetry Brands, Inc. (the “Acquisition”), including synergies, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain key employees;

◦The impact of our current and any additional future debt obligations on our business, current and future operations, profitability and our ability to meet other obligations;

◦Business disruption following the Acquisition;

◦Diversion of management time on Acquisition-related issues;

◦The reaction of customers and other persons to the Acquisition; and

◦Other statements contained in this Press Release regarding items that are not historical facts or that involve predictions.

Investor Relations:

Investorrelations@masterbrand.com

Media Contact:

Media@masterbrand.com

Source: MasterBrand, Inc.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| (Unaudited) |

| | | | | | | | |

| | 13 Weeks Ended | | 26 Weeks Ended |

| (U.S. Dollars presented in millions, except per share amounts) | | June 30,

2024 | | June 25,

2023 | | June 30,

2024 | | June 25,

2023 |

| NET SALES | | $ | 676.5 | | | $ | 695.1 | | | $ | 1,314.6 | | | $ | 1,371.8 | |

| Cost of products sold | | 445.5 | | | 458.9 | | | 878.9 | | | 931.0 | |

| GROSS PROFIT | | 231.0 | | | 236.2 | | | 435.7 | | | 440.8 | |

| Gross Profit Margin | | 34.1 | % | | 34.0 | % | | 33.1 | % | | 32.1 | % |

| Selling, general and administrative expenses | | 146.7 | | | 141.7 | | | 284.5 | | | 277.0 | |

| Amortization of intangible assets | | 3.7 | | | 4.0 | | | 7.4 | | | 8.0 | |

| | | | | | | | |

| Restructuring charges | | 2.8 | | | 3.1 | | | 3.2 | | | 2.7 | |

| OPERATING INCOME | | 77.8 | | | 87.4 | | | 140.6 | | | 153.1 | |

| | | | | | | | |

| Interest expense | | 20.6 | | | 17.2 | | | 34.7 | | | 34.6 | |

| Other (income) expense, net | | (2.9) | | | 0.5 | | | (3.2) | | | 0.9 | |

| INCOME BEFORE TAXES | | 60.1 | | | 69.7 | | | 109.1 | | | 117.6 | |

| Income tax expense | | 14.8 | | | 18.5 | | | 26.3 | | | 31.4 | |

| NET INCOME | | $ | 45.3 | | | $ | 51.2 | | | $ | 82.8 | | | $ | 86.2 | |

| Average Number of Shares of Common Stock Outstanding | | | | | | | | |

| Basic | | 127.0 | | | 128.4 | | | 127.0 | | | 128.3 | |

| Diluted | | 130.7 | | | 129.9 | | | 130.8 | | | 129.7 | |

| Earnings Per Common Share | | | | | | | | |

| Basic | | $ | 0.36 | | | $ | 0.40 | | | $ | 0.65 | | | $ | 0.67 | |

| Diluted | | $ | 0.35 | | | $ | 0.39 | | | $ | 0.63 | | | $ | 0.66 | |

| | | | | | | | | | | | | | |

| SUPPLEMENTAL INFORMATION - Quarter-to-date |

| (Unaudited) |

|

| 13 Weeks Ended |

| June 30, | | June 25, |

| (U.S. Dollars presented in millions, except per share amounts and percentages) | 2024 | | 2023 |

1. Reconciliation of Net Income to EBITDA to ADJUSTED EBITDA | | | |

| Net income (GAAP) | $ | 45.3 | | | $ | 51.2 | |

| | | |

| Interest expense | 20.6 | | | 17.2 | |

| Income tax expense | 14.8 | | | 18.5 | |

| Depreciation expense | 13.5 | | | 11.7 | |

| Amortization expense | 3.7 | | | 4.0 | |

| EBITDA (Non-GAAP Measure) | $ | 97.9 | | | $ | 102.6 | |

| | | |

| [1] Separation costs | — | | | 0.6 | |

| [2] Restructuring charges | 2.8 | | | 3.1 | |

| | | |

| [4] Acquisition-related costs | 4.4 | | | — | |

| | | |

| | | |

| Adjusted EBITDA (Non-GAAP Measure) | $ | 105.1 | | | $ | 106.3 | |

|

2. Reconciliation of Net Income to Adjusted Net Income | | | |

| Net Income (GAAP) | $ | 45.3 | | | $ | 51.2 | |

| | | |

| [1] Separation costs | — | | | 0.6 | |

| [2] Restructuring charges | 2.8 | | | 3.1 | |

| | | |

| [4] Acquisition-related costs | 4.4 | | | — | |

| [5] Non-recurring components of interest expense | 6.5 | | | — | |

| | | |

| | | |

| [6] Amortization expense | 3.7 | | | 4.0 | |

| [7] Income tax impact of adjustments | (4.4) | | | (1.9) | |

| Adjusted Net Income (Non-GAAP Measure) | $ | 58.3 | | | $ | 57.0 | |

|

3. Earnings per Share Summary | | | |

| Diluted EPS (GAAP) | $ | 0.35 | | | $ | 0.39 | |

| Impact of adjustments | $ | 0.10 | | | $ | 0.05 | |

| Adjusted Diluted EPS (Non-GAAP Measure) | $ | 0.45 | | | $ | 0.44 | |

|

| Weighted average diluted shares outstanding | 130.7 | | | 129.9 | |

| | | |

4. Profit Margins | | | |

| Net Sales (GAAP) | $ | 676.5 | | | $ | 695.1 | |

| Net Income Margin % (GAAP) | 6.7 | % | | 7.4 | % |

| Adjusted Net Income Margin % (Non-GAAP Measure) | 8.6 | % | | 8.2 | % |

| Adjusted EBITDA Margin % (Non-GAAP Measure) | 15.5 | % | | 15.3 | % |

| | | | | | | | | | | | | | |

| SUPPLEMENTAL INFORMATION - Year-to-date |

| (Unaudited) |

|

| 26 Weeks Ended |

| June 30, | | June 25, |

| (U.S. Dollars presented in millions, except per share amounts and percentages) | 2024 | | 2023 |

| 1. Reconciliation of Net Income to EBITDA to Adjusted EBITDA | | | |

| Net income (GAAP) | $ | 82.8 | | | $ | 86.2 | |

| | | |

| Interest expense | 34.7 | | | 34.6 | |

| Income tax expense | 26.3 | | | 31.4 | |

| Depreciation expense | 25.7 | | | 23.0 | |

| Amortization expense | 7.4 | | | 8.0 | |

| EBITDA (Non-GAAP Measure) | $ | 176.9 | | | $ | 183.2 | |

| | | |

| [1] Separation costs | — | | | 2.2 | |

| [2] Restructuring charges | 3.2 | | | 2.7 | |

| [3] Restructuring-related adjustments | — | | | (0.3) | |

| [4] Acquisition-related costs | | 4.4 | | | — | |

| | | |

| | | |

| Adjusted EBITDA (Non-GAAP Measure) | $ | 184.5 | | | $ | 187.8 | |

|

2. Reconciliation of Net Income to Adjusted Net Income | | | |

| Net Income (GAAP) | $ | 82.8 | | | $ | 86.2 | |

| | | |

| [1] Separation costs | — | | | 2.2 | |

| [2] Restructuring charges | 3.2 | | | 2.7 | |

| [3] Restructuring-related adjustments | — | | | (0.3) | |

| [4] Acquisition-related costs | 4.4 | | | — | |

| [5] Non-recurring components of interest expense | 6.5 | | | — | |

| | | |

| | | |

| [6] Amortization expense | | 7.4 | | | 8.0 | |

| [7] Income tax impact of adjustments | (5.4) | | | (3.2) | |

| Adjusted Net Income (Non-GAAP Measure) | $ | 98.9 | | | $ | 95.6 | |

|

3. Earnings per Share Summary | | | |

| Diluted EPS (GAAP) | $ | 0.63 | | | $ | 0.66 | |

| Impact of adjustments | $ | 0.13 | | | $ | 0.08 | |

| Adjusted Diluted EPS (Non-GAAP Measure) | $ | 0.76 | | | $ | 0.74 | |

|

| Weighted average diluted shares outstanding | 130.8 | | | 129.7 | |

| | | |

4. Profit Margins | | | |

Net Sales (GAAP) | $ | 1,314.6 | | | $ | 1,371.8 | |

| Net Income Margin % (GAAP) | 6.3 | % | | 6.3 | % |

| Adjusted Net Income Margin % (Non-GAAP Measure) | 7.5 | % | | 7.0 | % |

| Adjusted EBITDA Margin % (Non-GAAP Measure) | 14.0 | % | | 13.7 | % |

TICK LEGEND:

[1] Separation costs represent one-time costs incurred directly by MasterBrand related to the separation from Fortune Brands.

[2] Restructuring charges are nonrecurring costs incurred to implement significant cost reduction initiatives and may consist of workforce reduction costs, facility closure costs, and other costs to maintain certain facilities where operations have ceased, but which we are still responsible for. The restructuring charges for all periods presented are mainly comprised of workforce reduction costs and other costs to maintain facilities that have been closed, but not yet sold.

[3] Restructuring-related charges are expenses directly related to restructuring initiatives that do not represent normal, recurring expenses necessary to operate the business, but cannot be reported as restructuring under GAAP. Such costs may include losses on disposal of inventories from exiting product lines, accelerated depreciation expense, and gains/losses on the sale of facilities closed as a result of restructuring actions. Restructuring-related adjustments are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods. The restructuring-related adjustments for the first half of fiscal 2023 are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods.

[4] Acquisition-related costs are transaction and integration costs, including legal, accounting and other professional fees, severance, stock-based compensation, and other integration related costs. These charges are primarily recorded within selling, general and administrative expenses within the Condensed Consolidated Statements of Income. Acquisition-related costs may also include expenses associated with fair value adjustments required under GAAP at the close of a transaction. Acquisition-related costs are significantly impacted by the timing and complexity of the underlying acquisition related activities and are not indicative of the Company’s ongoing operating performance. The acquisition-related costs in the second quarter of fiscal 2024 are comprised primarily of professional fees associated with the acquisition of Supreme Cabinetry Brands, Inc., which was announced in the second quarter of fiscal 2024 and closed early in the third quarter of fiscal 2024.

[5] Non-recurring components of interest expense are one-time costs associated with the refinancing of debt facilities and usage of temporary debt facilities. The non-recurring components of interest expense in the second quarter of fiscal 2024 relate primarily to non-recurring write-offs of deferred financing costs resulting from the debt restructuring transaction. These charges are classified as interest expense within the Condensed Consolidated Statements of Income and are not indicative of the Company’s ongoing operating performance.

[6] Beginning in the second quarter of fiscal 2024 reporting, management began adding back amortization of intangible assets in calculating adjusted net income and adjusted diluted EPS for all periods presented. Non-cash amortization expenses are not indicative of the Company’s ongoing operations. Prior period information has been recast to reflect the updated presentation.

[7] In order to calculate Adjusted Net Income, each of the items described in Items [1] - [6] above were tax effected based upon an estimated annual effective income tax rate of 25.0 percent, inclusive of recurring permanent differences and the net effect of state income taxes and excluding the impact of discrete income tax items. Discrete items are recorded in the relevant period identified and include, but are not limited to, changes in judgment or estimates of uncertain tax positions related to prior periods, return-to-provision adjustments, the tax effect of relevant stock-based compensation items, certain changes in the valuation allowance for the realizability of deferred tax assets, or enacted changes in tax law. Management believes this approach assists investors in understanding the income tax provision and the estimated annual effective income tax rate related to ongoing operations.

| | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| | | | |

| | June 30, | | June 25, |

| (U.S. Dollars presented in millions) | | 2024 | | 2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 189.4 | | | $ | 110.2 | |

| Accounts receivable, net | | 213.5 | | | 235.7 | |

| Inventories | | 270.0 | | | 319.6 | |

| Other current assets | | 72.4 | | | 62.7 | |

| TOTAL CURRENT ASSETS | | 745.3 | | | 728.2 | |

| Property, plant and equipment, net | | 343.0 | | | 341.9 | |

| Operating lease right-of-use assets, net | | 57.2 | | | 59.7 | |

| Goodwill | | 924.0 | | | 925.2 | |

| Other intangible assets, net | | 326.8 | | | 342.9 | |

| | | | |

| Other assets | | 30.8 | | | 26.1 | |

| TOTAL ASSETS | | $ | 2,427.1 | | | $ | 2,424.0 | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 173.6 | | | $ | 182.2 | |

| Current portion of long-term debt | | — | | | 26.9 | |

| Current operating lease liabilities | | 15.7 | | | 14.1 | |

| Other current liabilities | | 142.9 | | | 151.2 | |

| TOTAL CURRENT LIABILITIES | | 332.2 | | | 374.4 | |

| Long-term debt | | 688.9 | | | 788.3 | |

| Deferred income taxes | | 81.8 | | | 85.2 | |

| Pension and other postretirement plan liabilities | | 8.3 | | | 12.3 | |

| Operating lease liabilities | | 43.8 | | | 47.9 | |

| Other non-current liabilities | | 13.0 | | | 8.3 | |

| TOTAL LIABILITIES | | 1,168.0 | | | 1,316.4 | |

| Stockholders' equity | | 1,259.1 | | | 1,107.6 | |

| TOTAL EQUITY | | 1,259.1 | | | 1,107.6 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 2,427.1 | | | $ | 2,424.0 | |

| | | | |

| Reconciliation of Net Debt | | | | |

| Current portion of long-term debt | | $ | — | | | $ | 26.9 | |

| Long-term debt | | 688.9 | | | 788.3 | |

| LESS: Cash and cash equivalents | | (189.4) | | | (110.2) | |

| Net Debt | | $ | 499.5 | | | $ | 705.0 | |

| Adjusted EBITDA for Prior Fiscal Year | | 383.4 | | | 411.4 | |

LESS: Adjusted EBITDA for 26 weeks ended June 25, 2023 | | (187.8) | | | (187.8) | |

PLUS: Adjusted EBITDA for 26 weeks ended June 30, 2024 | | 184.5 | | | 187.8 | |

| Adjusted EBITDA (trailing twelve months) | | $ | 380.1 | | | $ | 411.4 | |

| Net Debt to Adjusted EBITDA | | 1.3x | | 1.7x |

| | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited) |

| | 26 Weeks Ended |

| | June 30, | | June 25, |

| (U.S. Dollars presented in millions) | | 2024 | | 2023 |

| OPERATING ACTIVITIES | | | | |

| Net income | | $ | 82.8 | | | $ | 86.2 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation | | 25.7 | | | 23.0 | |

| Amortization of intangibles | | 7.4 | | | 8.0 | |

| Restructuring charges, net of cash payments | | 0.1 | | | (12.1) | |

| Write-off and amortization of finance fees | | 7.5 | | | 1.0 | |

| Stock-based compensation | | 11.1 | | | 8.9 | |

| | | | |

| | | | |

| | | | |

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable | | (11.2) | | | 58.6 | |

| Inventories | | (20.7) | | | 54.0 | |

| Other current assets | | (9.1) | | | 4.1 | |

| Accounts payable | | 21.8 | | | (39.6) | |

| Accrued expenses and other current liabilities | | (22.9) | | | (1.7) | |

| Other items | | 3.6 | | | 3.6 | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | | 96.1 | | | 194.0 | |

| INVESTING ACTIVITIES | | | | |

| Capital expenditures | | (18.3) | | | (11.4) | |

| Proceeds from the disposition of assets | | 6.4 | | | 0.2 | |

| NET CASH USED IN INVESTING ACTIVITIES | | (11.9) | | | (11.2) | |

| FINANCING ACTIVITIES | | | | |

| Issuance of long-term and short-term debt | | 700.0 | | | 55.0 | |

| Repayments of long-term and short-term debt | | (712.5) | | | (219.4) | |

| Payment of financing fees | | (15.2) | | | — | |

| Repurchase of common stock | | (6.5) | | | (4.1) | |

| Payments of employee taxes withheld from share-based awards | | (5.1) | | | (2.9) | |

| | | | |

| | | | |

| | | | |

| Other items | | (1.0) | | | (0.6) | |

| | | | |

| NET CASH USED IN FINANCING ACTIVITIES | | (40.3) | | | (172.0) | |

| Effect of foreign exchange rate changes on cash and cash equivalents | | (3.2) | | | (1.7) | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | $ | 40.7 | | | $ | 9.1 | |

| Cash and cash equivalents at beginning of period | | $ | 148.7 | | | $ | 101.1 | |

| Cash and cash equivalents at end of period | | $ | 189.4 | | | $ | 110.2 | |

| | | | |

| Reconciliation of Free Cash Flow | | | | |

| Net cash provided by operating activities | | $ | 96.1 | | | $ | 194.0 | |

| Less: Capital expenditures | | (18.3) | | | (11.4) | |

| Free cash flow | | $ | 77.8 | | | $ | 182.6 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

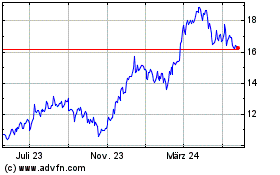

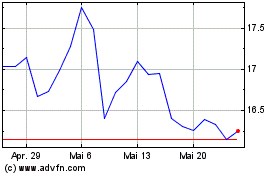

Masterbrand (NYSE:MBC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Masterbrand (NYSE:MBC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024