UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File No. 001-40387

THE LION ELECTRIC COMPANY

(Translation of registrant’s name into English)

921 chemin de la Rivière-du-Nord

Saint-Jérôme (Québec) J7Y 5G2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

| | | | | | | | |

Exhibit Number | | Description of Exhibit |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| THE LION ELECTRIC COMPANY |

| Date: July 19, 2023 | By: | /s/ Nicolas Brunet |

| Name: | Nicolas Brunet |

| Title: | Executive Vice President & Chief Financial Officer |

For immediate release

LION ELECTRIC CLOSES PREVIOUSLY ANNOUNCED FINANCING TRANSACTIONS

MONTREAL, July 19, 2023 - The Lion Electric Company (NYSE: LEV) (TSX: LEV) (“Lion” or the “Company”), a leading manufacturer of all-electric medium and heavy-duty urban vehicles, announced today that the Company has closed the previously announced financing transactions, resulting in aggregate gross proceeds to the Company of approximately US$142 million (the “Financing”).

The Financing consisted in (i) the issuance by way of private placement to a group of subscribers comprised of Investissement Québec, Fonds de solidarité des travailleurs du Québec (F.T.Q.) and Fondaction of 13% senior unsecured debentures that are convertible in accordance with the terms thereof into common shares of the Company at a conversion price of US$2.58, for aggregate gross proceeds to the Company of approximately US$74 million, (ii) the issuance by way of private placement to a group of subscribers led by Mach Group and the Mirella & Lino Saputo Foundation of 11% senior secured non-convertible debentures, for aggregate gross proceeds to the Company of C$90 million, and (iii) the issuance by way of private placement to the holders of non-convertible debentures of a number of common share purchase warrants entitling them to purchase in accordance with the terms thereof a total of 22,500,000 common shares in the capital of the Company at an exercise price of C$2.81 per share.

The Company intends to use the net proceeds from the Financing to fund working capital, strengthen its financial position, and allow it to continue to pursue its growth strategy, including the Company’s capacity expansion projects in Mirabel, Quebec and Joliet, Illinois.

ABOUT LION ELECTRIC

Lion Electric is an innovative manufacturer of zero-emission vehicles. The company creates, designs and manufactures all-electric class 5 to class 8 commercial urban trucks and all-electric buses and minibuses for the school, paratransit and mass transit segments. Lion is a North American leader in electric transportation and designs, builds and assembles many of its vehicles’ components, including chassis, battery packs, truck cabins and bus bodies.

Always actively seeking new and reliable technologies, Lion vehicles have unique features that are specifically adapted to its users and their everyday needs. Lion believes that transitioning to all-electric vehicles will lead to major improvements in our society, environment and overall quality of life. Lion shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol LEV.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws and within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). Any statements contained in this press release that are not statements of historical fact, including statements regarding the use of proceeds from the Financing, are forward-looking statements and should be evaluated as such.

Forward-looking statements may be identified by the use of words such as “believe,” “may,” “will,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “project,” “potential,” “seem,” “seek,” “future,” “target” or other similar expressions and any other statements that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements may contain such identifying words. Such forward-looking statements are based on a number of estimates and assumptions that the Company believes are reasonable when made and inherently involve numerous risks and uncertainties, known and unknown, including economic factors. Such

estimates and assumptions are made by the Company in light of the experience of management and their perception of historical trends, current conditions and expected future developments, as well as other factors believed to be appropriate and reasonable in the circumstances. However, there can be no assurance that such estimates and assumptions will prove to be correct. A number of risks, uncertainties and other factors may cause actual results to differ materially from the forward-looking statements contained in this press release, including, among other factors, those described in in section 23.0 entitled “Risk Factors” of the Company’s annual MD&A for the fiscal year 2022 and in other documents filed with the applicable Canadian regulatory securities authorities and the Securities and Exchange Commission. Readers are cautioned to consider these and other factors carefully when making decisions with respect to the Financing and not to place undue reliance on forward-looking statements. Forward-looking statements contained in this press release are not guarantees of future performance and, while forward-looking statements are based on certain assumptions that the Company considers reasonable, actual events and results could differ materially from those expressed or implied by forward-looking statements made by the Company. Except as may be expressly required by applicable law, the Company does not undertake any obligation to update publicly or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. All of the forward-looking statements contained in this press release are expressly qualified by the foregoing cautionary statements.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and may not be offered or sold to, or for the account or benefit of, persons in the United States or U.S. persons absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. “United States” and “U.S. person” are as defined in Regulation S under the U.S. Securities Act.

CONTACTS

MEDIA

Dominik Beckman

Vice President, Marketing and Communications

Dominik.Beckman@thelionelectric.com

450-432-5466, extension 4283

INVESTORS

Isabelle Adjahi

Vice President, Investor Relations and Sustainable Development

Isabelle.Adjahi@thelionelectric.com

450-432-5466, extension 171

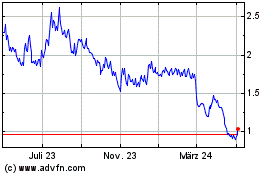

Lion Electric (NYSE:LEV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

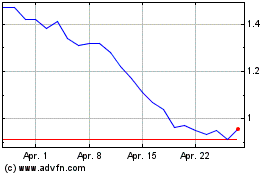

Lion Electric (NYSE:LEV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024