New: JPMorganChase Institute Research Shows More Than 90% of U.S. Households Are Able to Cover a $400 Emergency Shock

30 Juli 2024 - 3:00PM

Business Wire

Report Offers Unique, National Data-Driven

Insights into the Share of Americans Living

Paycheck-to-Paycheck

Today, the JPMorganChase Institute released new research

examining Americans’ resilience to unexpected expenses. Leveraging

aggregated data on cash balances, income, spending and credit

access from 5.9 million households, the Institute’s report offers a

more nuanced and comprehensive view of how households can manage

unexpected expenses than survey-based reporting on American

households’ financial health in recent years.

Economic context: There is a growing disconnect between

American households’ perception of their financial health and the

U.S. economy and the data undergirding it. Though the

economy remains healthy by most measures and inflation is well

below its peak, many Americans have a pessimistic view of the

economy, with more than 50% believing that the U.S. is in a

recession. Assessing the economy through a cost-of-living lens can

provide insights into this discussion, especially in light of the

fact that costs for many essential items continue to hover above

pre-pandemic levels.

“Recent economic data has revealed conflicting perspectives

about how Americans are faring financially, and how they view the

health of the U.S. economy,” said Chris Wheat, president of the

JPMorganChase Institute. “Understanding the full picture of

household liquidity is essential to accurately evaluating the

financial resiliency of both consumers and communities.”

A Closer Look at the Data: The report finds that most

households have sufficient liquidity to weather moderate expense

shocks, and that sources of liquidity beyond cash savings are the

key to many households’ ability to weather an emergency expense.

Key report findings include:

- American households are generally financially resilient in

the face of unexpected major expenses. 92% of households are

able to cover a $400 unexpected expense, including 77% of

households in the lowest income quartile.

- Access to credit is crucial for households dealing with

unexpected major expenses. 43% of low-income households that

are unable to weather small unexpected expenses might be able to

pay off such shocks with more available credit.

- Black and Hispanic households are more reliant on disposable

income and credit to cover $400 expenses. Asian and White

households are 10 percentage points more likely than Black and

Hispanic households to be able to cover a $400 expense shock using

just available cash.

Why It Matters: Determining the factors that impact a

household’s ability to pay, and then setting households up with the

proper tools and access, is critical to ensuring Americans can

weather emergency expenses.

The JPMorganChase Institute aims to provide decisionmakers with

timely data and thoughtful analysis to make more informed decisions

that advance prosperity for all. For more insights on the inner

workings of the economy, including on topics related to business

growth and entrepreneurship, careers and skills, community

development and financial health and wealth creation, visit

https://www.jpmorganchase.com/institute.

About JPMorganChase

JPMorganChase (NYSE: JPM) is a leading financial services firm

based in the United States of America (“U.S.”), with operations

worldwide. JPMorganChase had $4.1 trillion in assets and $337

billion in stockholders’ equity as of March 31, 2024. The Firm is a

leader in investment banking, financial services for consumers and

small businesses, commercial banking, financial transaction

processing and asset management. Under the J.P. Morgan and Chase

brands, the Firm serves millions of customers in the U.S., and many

of the world’s most prominent corporate, institutional and

government clients globally. Information about JPMorganChase is

available at www.jpmorganchase.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730027261/en/

Media contact: Julia Decerega,

julia.decerega@jpmchase.com

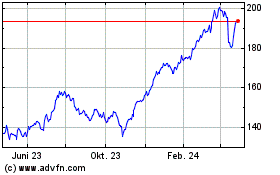

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

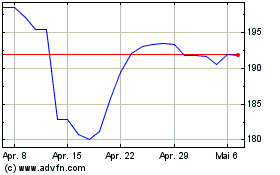

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025