FALSE000130774800013077482023-02-142023-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February 13, 2024

Date of Report (Date of earliest event reported)

___________________________________

INVENTRUST PROPERTIES CORP.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Maryland (State or other jurisdiction of incorporation) | 001-40896 (Commission File Number) | 34-2019608 (I.R.S. Employer Identification No.) |

3025 Highland Parkway, Suite 350 Downers Grove, Illinois 60515 |

(Address of principal executive offices and zip code) |

(855) 377-0510 |

(Registrant's telephone number, including area code) |

| N/A |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

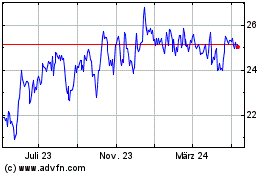

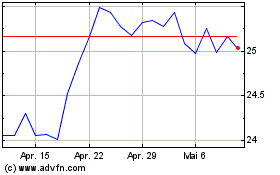

Common stock, $0.001 par value | IVT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On February 13, 2024, InvenTrust Properties Corp. (the "Company") issued a press release announcing its results for the quarter and year ended December 31, 2023. The full text of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

On February 13, 2024, the Company posted on its website, at https://www.inventrustproperties.com/investor-relations/, certain supplemental information for the quarter and year ended December 31, 2023 (the "Fourth Quarter Supplemental"). A copy of the Fourth Quarter Supplemental is attached as Exhibit 99.2 to this Form 8-K and is incorporated herein by reference.

The information furnished under this Item 2.02, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, or the Exchange Act, except as set forth by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: | February 13, 2024 | | INVENTRUST PROPERTIES CORP. |

| | | | |

| | | By: | /s/ Christy L. David |

| | | Name: | Christy L. David |

| | | Title: | Executive Vice President, Chief Operating Officer, General Counsel & Secretary |

CONTACT:

Dan Lombardo

Vice President of Investor Relations

630-570-0605

dan.lombardo@inventrustproperties.com

InvenTrust Properties Corp. Reports 2023 Fourth Quarter and Full Year Results

DOWNERS GROVE, Ill – February 13, 2024 – InvenTrust Properties Corp. (“InvenTrust” or the “Company”) (NYSE: IVT) today reported financial and operating results for the fourth quarter and full year ended December 31, 2023 and provided initial guidance for 2024. For the three months ended December 31, 2023 and 2022, the Company reported Net Income of $2.9 million, or $0.04 per diluted share, compared to a Net Loss of $0.1 million, or $0.00 per diluted share, respectively. For the years ended December 31, 2023 and 2022, the Company reported Net Income of $5.3 million, or $0.08 per diluted share, compared to $52.2 million, or $0.77 per diluted share, respectively.

Fourth Quarter and Full Year 2023 Highlights:

•NAREIT FFO for the fourth quarter of $0.45 per diluted share, and $1.70 per diluted share for the full year

•Core FFO for the fourth quarter of $0.41 per diluted share, and $1.65 per diluted share for the full year

•Same Property Net Operating Income (“NOI”) growth of 6.4% for the fourth quarter and 4.9% for the full year

•Leased Occupancy as of December 31, 2023 of 96.2%, a fourth quarter sequential increase of 110 basis points and a full year increase of 10 basis points

•Executed 86 leases in the fourth quarter, totaling approximately 553,000 square feet of GLA, of which 429,000 was executed at a blended comparable lease spread of 13.9%, and 299 leases for the full year, totaling approximately 1,418,000 square feet of GLA, of which 974,000 was executed at a blended comparable lease spread of 9.8%

•New leases for anchor tenants were executed at a comparable lease spread of 35.2% for the full year

•Raised $5.4 million of net proceeds under the at-the-market equity offering program (the “ATM Program”)

•The Board of Directors approved a 5% increase to the Company’s dividends starting in April 2024

”We are pleased to report another year of outstanding performance driven by our simple and focused business plan; that is, owning high quality open-air retail centers in Sun Belt markets,” commented DJ Busch, CEO and President. “Significant tenant demand for our space has continued into the early part of 2024. Meanwhile, our low levered balance sheet allows us to remain flexible and opportunistic. To that end, subsequent to the quarter end, we strategically expanded our footprint into the Phoenix MSA through the acquisition of a premier essential retail center.”

NET INCOME (LOSS)

•Net Income for the three months ended December 31, 2023 was $2.9 million, or $0.04 per diluted share, compared to a Net Loss of $0.1 million, or $0.00 per diluted share, for the same period in 2022.

•Net Income for the year ended December 31, 2023 was $5.3 million, or $0.08 per diluted share, compared to $52.2 million, or $0.77 per diluted share, for the same period in 2022.

NAREIT FFO

•NAREIT FFO for the three months ended December 31, 2023 was $30.8 million, or $0.45 per diluted share, as compared to $23.8 million, or $0.35 per diluted share, for the same period in 2022.

•NAREIT FFO for the year ended December 31, 2023 was $115.5 million, or $1.70 per diluted share, as compared to $112.0 million, or $1.66 per diluted share, for the same period in 2022.

| | | | | | | | |

1 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

CORE FFO

•Core FFO for the three months ended December 31, 2023 was $27.8 million, or $0.41 per diluted share, compared to $23.1 million, or $0.34 per diluted share, for the same period in 2022.

•Core FFO for the year ended December 31, 2023 was $111.9 million, or $1.65 per diluted share, compared to $106.0 million, or $1.57 per diluted share, for the same period in 2022.

SAME PROPERTY NOI

•Same Property NOI for the three months ended December 31, 2023 was $38.7 million, a 6.4% increase, compared to the same period in 2022.

•Same Property NOI for the year ended December 31, 2023 was $142.1 million, a 4.9% increase, compared to the same period in 2022.

DIVIDEND

•For the quarter ending December 31, 2023, the Board of Directors declared a quarterly cash distribution of $0.2155 per share, payable on January 15, 2024.

•The Board of Directors approved an increase of 5% to the Company’s cash dividend. The new annual rate of $0.9052 will be reflected in the next quarterly dividend of $0.2263 expected to be paid in April 2024.

PORTFOLIO PERFORMANCE & INVESTMENT ACTIVITY

•As of December 31, 2023, the Company’s Leased Occupancy was 96.2%.

◦Anchor Leased Occupancy, which includes spaces greater than or equal to 10,000 square feet, was 98.2% and Small Shop Leased Occupancy was 92.5%. Anchor Leased Occupancy increased by 160 basis points and Small Shop Leased Occupancy increased by 10 basis points on a sequential basis compared to the previous quarter.

◦Leased to Economic Occupancy spread of 290 basis points, which equates to approximately $7.4 million of base rent on an annualized basis.

•Blended re-leasing spreads for comparable new and renewal leases signed in the fourth quarter and full year were 13.9% and 9.8%, respectively.

•Annualized Base Rent PSF (“ABR”) as of December 31, 2023 was $19.48, an increase of 2.1% compared to the same period in 2022. Anchor Tenant ABR PSF was $12.49 and Small Shop ABR PSF was $32.74 for the fourth quarter.

LIQUIDITY AND CAPITAL STRUCTURE

•During the three months ended December 31, 2023, the Company raised $5.4 million of net proceeds under the ATM Program, after $0.1 million in commissions, through the issuance of 208,040 shares of common stock at a weighted average price of $26.13 per share.

•On October 17, 2023, the Company extended the maturity of its $92.5 million of cross-collateralized mortgage debt maturing in 2023 by exercising one of its two 12-month extension options. The maturity date of the debt is now November 2, 2024. On December 21, 2023, the Company partially paid down the cross-collateralized mortgage debt by $20.0 million, resulting in an outstanding balance of $72.5 million as of December 31, 2023.

•InvenTrust had $446.4 million of total liquidity, as of December 31, 2023 comprised of $96.4 million of cash and cash equivalents and $350.0 million of availability under its Revolving Credit Facility.

•InvenTrust has $88.2 million of debt maturing in 2024 and $22.9 million of debt maturing in 2025.

•The Company's weighted average interest rate on its debt as of December 31, 2023 was 4.29% and the weighted average remaining term was 4.0 years.

SUBSEQUENT EVENTS

•On February 1, 2024, the Company acquired The Plant, a 57,000 square foot neighborhood center anchored by Sprouts Farmers Market in Chandler, Arizona for a gross acquisition price of $29.5 million. The Company used cash on hand and assumed $13.0 million of existing mortgage debt to fund the acquisition.

| | | | | | | | |

2 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

FULL YEAR 2024 OUTLOOK AND INITIAL GUIDANCE

The Company has provided initial 2024 guidance, as summarized in the table below.

| | | | | | | | | | | | | | | | | |

| (Unaudited, dollars in thousands, except per share amounts) | Initial 2024 Guidance(1)(2) | | 2023 Actual |

| Net Income per diluted share | $0.04 | — | $0.10 | | $0.08 |

| NAREIT FFO per diluted share | $1.69 | — | $1.75 | | $1.70 |

Core FFO per diluted share (3) | $1.66 | — | $1.70 | | $1.65 |

| Same Property NOI (“SPNOI”) Growth | 2.25% | — | 3.25% | | 4.9% |

| General and administrative | $33,000 | — | $34,250 | | $31,797 |

Interest expense, net (4) | $35,000 | — | $35,750 | | $34,025 |

Net investment activity (5) | ~ $75,000 | | $110,670 |

(1)The Company’s initial 2024 guidance excludes projections related to gains or losses on dispositions, gains or losses on debt transactions, or depreciation, amortization, and straight-line rent adjustments related to acquisitions.

(2)The Company’s initial 2024 guidance includes an expectation of uncollectibility, reflected as 50-100 basis points of expected total revenue.

(3)Core FFO per diluted share excludes certain remaining amortization assumptions within NAREIT FFO, debt extinguishment charges, straight-line rent adjustments, and non-routine items which, in management’s judgement, are not pertinent to measuring on-going operating performance.

(4)Interest expense, net, excludes amortization of debt discounts and financing costs, and expected interest income of approximately $1.0 million.

(5)Net investment activity represents anticipated acquisition activity less disposition activity.

In addition to the foregoing, the Company's initial 2024 Guidance incorporates a number of other assumptions that are subject to change and may be outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurances that InvenTrust will achieve these results.

The following table provides a reconciliation of the range of the Company's 2024 estimated net income per diluted share to estimated NAREIT FFO and Core FFO per diluted share:

| | | | | | | | | | | |

| (Unaudited) | Low End | | High End |

| Net income per diluted share | $ | 0.04 | | | $ | 0.10 | |

| Depreciation and amortization related to investment properties | 1.65 | | | 1.65 | |

| | | |

| NAREIT FFO per diluted share | 1.69 | | | 1.75 | |

| Amortization of market-lease intangibles and inducements, net | (0.02) | | | (0.03) | |

| Straight-line rent adjustments, net | (0.04) | | | (0.05) | |

| Amortization of debt discounts and financing costs | 0.03 | | | 0.03 | |

| | | |

| Core FFO per diluted share | $ | 1.66 | | | $ | 1.70 | |

This press release does not include a reconciliation of forward-looking SPNOI to forward-looking GAAP Net Income because the Company is unable, without making unreasonable efforts, to provide a meaningful or reasonably accurate calculation or estimation of certain reconciling items which could be significant to the Company’s results.

CONFERENCE CALL INFORMATION

Date: Wednesday, February 14, 2024

Time: 10:00 a.m. ET

Dial-in: (833) 470-1428 / Access Code: 861039

Webcast & Replay Link: https://events.q4inc.com/attendee/254590774

Webcast Archive: https://www.inventrustproperties.com/investor-relations/

| | | | | | | | |

3 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

NON-GAAP FINANCIAL MEASURES

This Press Release includes certain non-GAAP financial measures and other terms that management believes are helpful in understanding the Company’s business. These measures should not be considered as alternatives to, or more meaningful than, net income (calculated in accordance with GAAP) or other GAAP financial measures, as an indicator of financial performance and are not alternatives to, or more meaningful than, cash flow from operating activities (calculated in accordance with GAAP) as a measure of liquidity. Non-GAAP performance measures have limitations as they do not include all items of income and expense that affect operations, and accordingly, should always be considered as supplemental financial results to those calculated in accordance with GAAP. The Company's computation of these non-GAAP performance measures may differ in certain respects from the methodology utilized by other REITs and, therefore, may not be comparable to similarly titled measures presented by such other REITs. Investors are cautioned that items excluded from these non-GAAP performance measures are relevant to understanding and addressing financial performance. A reconciliation of the Company’s non-GAAP measures to the most directly comparable GAAP financials measures are included herein.

SAME PROPERTY NOI or SPNOI

Information provided on a same property basis includes the results of properties that were owned and operated for the entirety of both periods presented. NOI excludes general and administrative expenses, depreciation and amortization, other income and expense, net, gains (losses) from sales of properties, gains (losses) on extinguishment of debt, interest expense, net, equity in earnings (losses) from unconsolidated entities, lease termination income and expense, and GAAP rent adjustments such as amortization of market lease intangibles, amortization of lease incentives, and straight-line rent adjustments ("GAAP Rent Adjustments"). NOI from other investment properties includes adjustments for the Company's captive insurance company.

NAREIT FUNDS FROM OPERATIONS (NAREIT FFO) and CORE FFO

The Company’s non-GAAP measure of NAREIT Funds from Operations ("NAREIT FFO"), based on the National Association of Real Estate Investment Trusts ("NAREIT") definition, is net income (or loss) in accordance with GAAP, excluding gains (or losses) resulting from dispositions of properties, plus depreciation and amortization and impairment charges on depreciable real property. Adjustments for the Company’s unconsolidated joint venture are calculated to reflect the Company’s proportionate share of the joint venture's NAREIT FFO on the same basis. Core Funds From Operations (“Core FFO”) is an additional supplemental non-GAAP financial measure of the Company’s operating performance. In particular, Core FFO provides an additional measure to compare the operating performance of different REITs without having to account for certain remaining amortization assumptions within NAREIT FFO and other unique revenue and expense items which some may consider not pertinent to measuring a particular company’s on-going operating performance.

ADJUSTED EBITDA

The Company’s non-GAAP measure of Adjusted EBITDA excludes gains (or losses) resulting from debt extinguishments, straight-line rent adjustments, amortization of above and below market leases and lease inducements, and other unique revenue and expense items which some may consider not pertinent to measuring a particular company’s on-going operating performance. Adjustments for the Company’s unconsolidated joint venture are calculated to reflect the Company’s proportionate share of the joint venture's Adjusted EBITDA on the same basis.

NET DEBT-TO-ADJUSTED EBITDA

Net Debt-to-Adjusted EBITDA is Net Debt divided by trailing twelve month Adjusted EBITDA.

PRO RATA FINANCIAL INFORMATION

On January 18, 2023, the Company acquired the four remaining retail properties from its unconsolidated joint venture, IAGM Retail Fund I, LLC (“IAGM” or “JV”), a joint venture partnership between the Company and PGGM Private Real Estate Fund (“PGGM”), in which it held a 55% ownership share. Throughout this Press Release, the Company has included the results from its ownership share of its joint venture properties when combined with the Company's wholly owned properties, defined as "Pro Rata," with the exception of property and lease count, as of and for the three months and year ended December 31, 2022.

| | | | | | | | |

4 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

Consolidated Balance Sheets

In thousands, except share amounts

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 |

| Assets | (unaudited) | | |

| Investment properties | | | |

| Land | $ | 694,668 | | | $ | 650,764 | |

| Building and other improvements | 1,956,117 | | | 1,825,893 | |

| Construction in progress | 5,889 | | | 5,005 | |

| Total | 2,656,674 | | | 2,481,662 | |

| Less accumulated depreciation | (461,352) | | | (389,361) | |

| Net investment properties | 2,195,322 | | | 2,092,301 | |

| Cash, cash equivalents and restricted cash | 99,763 | | | 137,762 | |

| Investment in unconsolidated entities | — | | | 56,131 | |

| Intangible assets, net | 114,485 | | | 101,167 | |

| Accounts and rents receivable | 35,353 | | | 34,528 | |

| Deferred costs and other assets, net | 42,408 | | | 51,145 | |

| Total assets | $ | 2,487,331 | | | $ | 2,473,034 | |

| | | |

| Liabilities | | | |

| Debt, net | $ | 814,568 | | | $ | 754,551 | |

| Accounts payable and accrued expenses | 44,583 | | | 42,792 | |

| Distributions payable | 14,594 | | | 13,837 | |

| Intangible liabilities, net | 30,344 | | | 29,658 | |

| Other liabilities | 29,198 | | | 28,287 | |

| Total liabilities | 933,287 | | | 869,125 | |

| Commitments and contingencies | | | |

| | | |

| Stockholders' Equity | | | |

| Preferred stock, $0.001 par value, 40,000,000 shares authorized, none outstanding | — | | | — | |

Common stock, $0.001 par value, 146,000,000 shares authorized,

67,807,831 shares issued and outstanding as of December 31, 2023 and

67,472,553 shares issued and outstanding as of December 31, 2022 | 68 | | | 67 | |

| Additional paid-in capital | 5,468,728 | | | 5,456,968 | |

| Distributions in excess of accumulated net income | (3,932,826) | | | (3,879,847) | |

| Accumulated comprehensive income | 18,074 | | | 26,721 | |

| Total stockholders' equity | 1,554,044 | | | 1,603,909 | |

| Total liabilities and stockholders' equity | $ | 2,487,331 | | | $ | 2,473,034 | |

| | | | | | | | |

5 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

Consolidated Statements of Operations and Comprehensive (Loss) Income

In thousands, except share and per share amounts, unaudited

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Income | | | | | | | |

| Lease income, net | $ | 64,332 | | | $ | 58,418 | | | $ | 257,146 | | | $ | 232,980 | |

| Other property income | 390 | | | 275 | | | 1,450 | | | 1,161 | |

| Other fee income | — | | | 578 | | | 80 | | | 2,566 | |

| Total income | 64,722 | | | 59,271 | | | 258,676 | | | 236,707 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Depreciation and amortization | 28,091 | | | 23,897 | | | 113,430 | | | 94,952 | |

| Property operating | 11,776 | | | 11,983 | | | 42,832 | | | 40,239 | |

| Real estate taxes | 7,448 | | | 7,330 | | | 34,809 | | | 32,925 | |

| General and administrative | 8,408 | | | 10,103 | | | 31,797 | | | 33,342 | |

| Total operating expenses | 55,723 | | | 53,313 | | | 222,868 | | | 201,458 | |

| | | | | | | |

| Other (expense) income | | | | | | | |

| Interest expense, net | (9,697) | | | (8,648) | | | (38,138) | | | (26,777) | |

| Loss on extinguishment of debt | (15) | | | (85) | | | (15) | | | (181) | |

| | | | | | | |

| Gain on sale of investment properties | — | | | 1,393 | | | 2,691 | | | 38,249 | |

| Equity in (losses) earnings of unconsolidated entities | (110) | | | (121) | | | (557) | | | 3,663 | |

| Other income and expense, net | 3,713 | | | 1,378 | | | 5,480 | | | 2,030 | |

| Total other (expense) income, net | (6,109) | | | (6,083) | | | (30,539) | | | 16,984 | |

| | | | | | | |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| | | | | | | |

| Weighted-average common shares outstanding, basic | 67,563,908 | | | 67,428,549 | | | 67,531,898 | | | 67,406,233 | |

| Weighted-average common shares outstanding, diluted | 68,090,912 | | | 67,428,549 | | | 67,813,180 | | | 67,525,935 | |

| | | | | | | |

| Net income (loss) per common share - basic | $ | 0.04 | | | $ | — | | | $ | 0.08 | | | $ | 0.77 | |

| Net income (loss) per common share - diluted | $ | 0.04 | | | $ | — | | | $ | 0.08 | | | $ | 0.77 | |

| | | | | | | |

| Distributions declared per common share outstanding | $ | 0.22 | | | $ | 0.21 | | | $ | 0.86 | | | $ | 0.82 | |

| Distributions paid per common share outstanding | $ | 0.22 | | | $ | 0.21 | | | $ | 0.85 | | | $ | 0.82 | |

| | | | | | | |

| Comprehensive (loss) income | | | | | | | |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| Unrealized (loss) gain on derivatives | (7,268) | | | (860) | | | 6,228 | | | 32,052 | |

| Reclassification (to) from net income (loss) | (3,786) | | | (1,756) | | | (14,875) | | | (1,009) | |

| Comprehensive (loss) income | $ | (8,164) | | | $ | (2,741) | | | $ | (3,378) | | | $ | 83,276 | |

| | | | | | | | |

6 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

| | | | | |

| Reconciliation of Non-GAAP Measures In thousands |

|

Same Property NOI

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Income | | | | | | | |

| Base rent | $ | 36,739 | | | $ | 35,889 | | | $ | 135,732 | | | $ | 130,613 | |

| Real estate tax recoveries | 6,345 | | | 6,655 | | | 25,821 | | | 26,244 | |

| CAM, insurance, and other recoveries | 7,413 | | | 7,187 | | | 24,829 | | | 24,119 | |

| Ground rent income | 3,683 | | | 3,690 | | | 13,535 | | | 13,319 | |

| Short-term and other lease income | 1,763 | | | 1,462 | | | 4,244 | | | 4,203 | |

| Provision for uncollectible billed rent and recoveries | (662) | | | (286) | | | (1,325) | | | (814) | |

| Reversal of uncollectible billed rent and recoveries | — | | | 11 | | | 395 | | | 1,279 | |

| Other property income | 339 | | | 277 | | | 1,212 | | | 1,127 | |

| Total income | 55,620 | | | 54,885 | | | 204,443 | | | 200,090 | |

| | | | | | | |

| Operating Expenses | | | | | | | |

| Property operating expenses | 10,271 | | | 11,537 | | | 33,841 | | | 35,695 | |

| Real estate taxes | 6,640 | | | 6,969 | | | 28,478 | | | 28,852 | |

| Total operating expenses | 16,911 | | | 18,506 | | | 62,319 | | | 64,547 | |

| | | | | | | |

| Same Property NOI | $ | 38,709 | | | $ | 36,379 | | | $ | 142,124 | | | $ | 135,543 | |

Net Income (Loss) to Same Property NOI

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| Adjustments to reconcile to non-GAAP metrics: | | | | | | | |

| Other income and expense, net | (3,713) | | | (1,378) | | | (5,480) | | | (2,030) | |

| Equity in losses (earnings) of unconsolidated entities | 110 | | | 121 | | | 557 | | | (3,663) | |

| Interest expense, net | 9,697 | | | 8,648 | | | 38,138 | | | 26,777 | |

| Loss on extinguishment of debt | 15 | | | 85 | | | 15 | | | 181 | |

| Gain on sale of investment properties | — | | | (1,393) | | | (2,691) | | | (38,249) | |

| | | | | | | |

| Depreciation and amortization | 28,091 | | | 23,897 | | | 113,430 | | | 94,952 | |

| General and administrative | 8,408 | | | 10,103 | | | 31,797 | | | 33,342 | |

| Other fee income | — | | | (578) | | | (80) | | | (2,566) | |

| Adjustments to NOI (a) | (1,500) | | | (1,671) | | | (7,528) | | | (9,743) | |

| NOI | 43,998 | | | 37,709 | | | 173,427 | | | 151,234 | |

| NOI from other investment properties | (5,289) | | | (1,330) | | | (31,303) | | | (15,691) | |

| Same Property NOI | $ | 38,709 | | | $ | 36,379 | | | $ | 142,124 | | | $ | 135,543 | |

(a)Adjustments to NOI include termination fee income and expense and GAAP Rent Adjustments.

| | | | | | | | |

7 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

| | | | | |

| Reconciliation of Non-GAAP Measures In thousands |

|

NAREIT FFO and Core FFO

The following table presents a reconciliation of Net Income (Loss) to NAREIT FFO and Core FFO Attributable to Common Shares and Dilutive Securities, and provides additional information related to its operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| Depreciation and amortization related to investment properties | 27,864 | | | 23,698 | | | 112,578 | | | 94,142 | |

| | | | | | | |

| Gain on sale of investment properties | — | | | (1,393) | | | (2,691) | | | (38,249) | |

Unconsolidated joint venture adjustments (a) | — | | | 1,595 | | | 342 | | | 3,850 | |

| NAREIT FFO Applicable to Common Shares and Dilutive Securities | 30,754 | | | 23,775 | | | 115,498 | | | 111,976 | |

| Amortization of market-lease intangibles and inducements, net | (626) | | | (995) | | | (3,343) | | | (5,589) | |

| Straight-line rent adjustments, net | (857) | | | (690) | | | (3,349) | | | (3,815) | |

| Amortization of debt discounts and financing costs | 827 | | | 741 | | | 4,113 | | | 2,816 | |

Adjusting items, net (b) | (2,385) | | | (36) | | | (969) | | | (18) | |

Unconsolidated joint venture adjusting items, net (c) | 80 | | | 282 | | | (92) | | | 582 | |

| Core FFO Applicable to Common Shares and Dilutive Securities | $ | 27,793 | | | $ | 23,077 | | | $ | 111,858 | | | $ | 105,952 | |

| | | | | | | |

| Weighted average common shares outstanding - basic | 67,563,908 | | | 67,428,549 | | | 67,531,898 | | | 67,406,233 | |

Dilutive effect of unvested restricted shares (d) | 527,004 | | | — | | | 281,282 | | | 119,702 | |

| Weighted average common shares outstanding - diluted | 68,090,912 | | | 67,428,549 | | | 67,813,180 | | | 67,525,935 | |

| | | | | | | |

| NAREIT FFO per diluted share | $ | 0.45 | | | $ | 0.35 | | | $ | 1.70 | | | $ | 1.66 | |

| Core FFO per diluted share | $ | 0.41 | | | $ | 0.34 | | | $ | 1.65 | | | $ | 1.57 | |

(a)Represents the Company's share of depreciation, amortization and gain on sale related to investment properties held in IAGM.

(b)Adjusting items, net, are primarily loss on extinguishment of debt, depreciation and amortization of corporate assets, and non-operating income and expenses, net, which includes items which are not pertinent to measuring on-going operating performance, such as basis difference recognition arising from acquiring the four remaining properties of the Company's joint venture, and miscellaneous and settlement income.

(c)Represents the Company's share of amortization of market lease intangibles and inducements, net, straight line rent adjustments, net and adjusting items, net related to IAGM.

(d)For purposes of calculating non-GAAP per share metrics, the same denominator is used as that which would be used in calculating diluted earnings per share in accordance with GAAP.

| | | | | | | | |

8 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

| | | | | |

| Reconciliation of Non-GAAP Measures In thousands |

|

EBITDA and Adjusted EBITDA

The following table presents a reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA, and provides additional information related to its operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| Interest expense, net | 9,697 | | | 8,648 | | | 38,138 | | | 26,777 | |

| Income tax expense | 129 | | | 94 | | | 517 | | | 363 | |

| Depreciation and amortization | 28,091 | | | 23,897 | | | 113,430 | | | 94,952 | |

| Unconsolidated joint venture adjustments (a) | — | | | 2,054 | | | 417 | | | 8,075 | |

| EBITDA | 40,807 | | | 34,568 | | | 157,771 | | | 182,400 | |

| | | | | | | |

| Gain on sale of investment properties | — | | | (1,393) | | | (2,691) | | | (38,249) | |

| Amortization of market-lease intangibles and inducements, net | (626) | | | (995) | | | (3,343) | | | (5,589) | |

| Straight-line rent adjustments, net | (857) | | | (690) | | | (3,349) | | | (3,815) | |

Adjusting items, net (b) | (2,612) | | | (235) | | | (1,821) | | | (828) | |

| Unconsolidated joint venture adjusting items, net (c) | 80 | | | 367 | | | (108) | | | (1,551) | |

| Adjusted EBITDA | $ | 36,792 | | | $ | 31,622 | | | $ | 146,459 | | | $ | 132,368 | |

(a)Represents IVT's share of depreciation, amortization, interest expense, net, and income tax expense related to IAGM.

(b)Adjusting items, net, are primarily loss on extinguishment of debt and non-operating income and expenses, net, which includes items which are not pertinent to measuring on-going operating performance, such as basis difference recognition arising from acquiring the four remaining properties of the Company's joint venture, and miscellaneous and settlement income.

(c)Represents IVT's share of loss on extinguishment of debt, amortization of market lease intangibles and inducements, net, straight line rent adjustments, net and non-operating income and expense, net, related to IAGM.

Financial Leverage Ratios

Dollars in thousands

The following table presents the calculation of net debt and Net Debt-to-Adjusted EBITDA:

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 (a) |

| Net Debt: | | | |

| Outstanding Debt, net | $ | 814,568 | | | $ | 805,253 | |

| Less: Cash and cash equivalents | (96,385) | | | (164,448) | |

| Net Debt | $ | 718,183 | | | $ | 640,805 | |

| | | |

| Net Debt-to-Adjusted EBITDA (trailing 12 months): | | | |

| Net Debt | $ | 718,183 | | | $ | 640,805 | |

| Adjusted EBITDA (trailing 12 months) | 146,459 | | | 132,368 | |

| Net Debt-to-Adjusted EBITDA (a) | 4.9x | | 4.8x |

(a) Outstanding debt, net, Cash and cash equivalents, and Net Debt as of December 31, 2022 are Pro-Rata.

| | | | | | | | |

9 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

About InvenTrust Properties Corp.

InvenTrust Properties Corp. (the “Company,” "IVT," or "InvenTrust") is a premier Sun Belt, multi-tenant essential retail REIT that owns, leases, redevelops, acquires and manages grocery-anchored neighborhood and community centers as well as high-quality power centers that often have a grocery component. Management pursues the Company's business strategy by acquiring retail properties in Sun Belt markets, opportunistically disposing of retail properties, maintaining a flexible capital structure, and enhancing environmental, social and governance ("ESG") practices and standards. A trusted, local operator bringing real estate expertise to its tenant relationships, IVT has built a strong reputation with market participants across its portfolio. IVT is committed to leadership in ESG practices and has been a Global Real Estate Sustainability Benchmark (“GRESB”) member since 2013. For more information, please visit inventrustproperties.com.

The enclosed information should be read in conjunction with the Company's filings with the U.S. Securities and Exchange Commission (“SEC”), including, but not limited to, the Company's Form 10-Qs filed quarterly and Form 10-Ks filed annually. Additionally, the enclosed information does not purport to disclose all items required under Generally Accepted Accounting Principles (“GAAP”). The information provided in this press release is unaudited and includes non-GAAP measures (as discussed below), and there can be no assurance that the information will not vary from the final information in the Company’s Form 10-K for the year-ended December 31, 2023. IVT may, but assumes no obligation to, update information in this press release.

Forward-Looking Statements Disclaimer

Forward-Looking Statements in this press release, or made during the earnings call, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, including statements about the Company's 2024 guidance, the amount and timing of payment of the Company's next quarterly dividend, the Company's expectation for continued tenant demand for its centers, strength of and anticipated opportunities based on IVT's low leverage levels, or regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future, are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” "continue," “likely,” “will,” “would,” "outlook," "guidance," and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. The following factors, among others, could cause actual results, financial position and timing of certain events to differ materially from those described in the forward-looking statements: interest rate movements; local, regional, national and global economic performance; the impact of inflation on the Company and on its tenants; competitive factors; the impact of e-commerce on the retail industry; future retailer store closings; retailer consolidation; retailers reducing store size; retailer bankruptcies; government policy changes; and any material market changes and trends that could affect the Company’s business strategy. For further discussion of factors that could materially affect the outcome of management's forward-looking statements and IVT's future results and financial condition, see the Risk Factors included in the Company's most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the SEC. InvenTrust intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. IVT cautions you not to place undue reliance on any forward-looking statements, which are made as of the date of this press release. IVT undertakes no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If IVT updates one or more forward-looking statements, no inference should be drawn that IVT will make additional updates with respect to those or other forward-looking statements.

Availability of Information on InvenTrust Properties Corp.'s Website and Social Media Channels

Investors and others should note that InvenTrust routinely announces material information to investors and the marketplace using U.S. Securities and Exchange Commission filings, press releases, public conference calls, webcasts and the InvenTrust investor relations website. The Company uses these channels as well as social media channels (e.g., the InvenTrust X account (twitter.com/inventrustprop); and the InvenTrust LinkedIn account (linkedin.com/company/inventrustproperties) as a means of disclosing information about the Company's business to colleagues, investors, and the public. While not all of the information that the Company posts to the InvenTrust investor relations website or on the Company’s social media channels is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media and others interested in InvenTrust to review the information that it shares on inventrustproperties.com/investor-relations and on the Company’s social media channels.

| | | | | | | | |

10 - Earnings Release - Quarter and Full Year Ended December 31, 2023 | | |

| | | | | | | | |

| | Page No. |

| | |

| Introductory Notes | | i |

| | |

| Earnings Release | | iii |

| | |

| Financial Information | | |

| Summary Financial Information | | |

| Consolidated Balance Sheets | | |

| Consolidated Statements of Operations and Comprehensive (Loss) Income | | |

| Consolidated Supplemental Details of Assets and Liabilities | | |

| Consolidated Supplemental Details of Operations | | |

| Reconciliation of Non-GAAP Measures | | |

| Same Property Net Operating Income | | |

| NAREIT FFO and Core FFO | | |

| EBITDA and Adjusted EBITDA | | |

| Summary of Outstanding Debt | | |

Consolidated Debt Covenants, Interest Rate Swaps, and Capital Expenditures | | |

| | |

| Portfolio and Leasing Overview | | |

Markets and Tenant Size | | |

| Top 25 Tenants by ABR and Tenant Merchandise Mix | | |

Comparable & Non-Comparable Lease Statistics | | |

| Tenant Lease Expirations | | |

| | |

| Investment Summary | | |

| Acquisitions and Dispositions | | |

| Development Pipeline | | |

| Property Summary | | |

| | |

| Components of NAV as of December 31, 2023 | | |

| | |

| Glossary of Terms | | |

About InvenTrust Properties Corp.

InvenTrust Properties Corp. (the “Company,” "IVT," or "InvenTrust") is a premier Sun Belt, multi-tenant essential retail REIT that owns, leases, redevelops, acquires and manages grocery-anchored neighborhood and community centers as well as high-quality power centers that often have a grocery component. Management pursues the Company's business strategy by acquiring retail properties in Sun Belt markets, opportunistically disposing of retail properties, maintaining a flexible capital structure, and enhancing environmental, social and governance ("ESG") practices and standards. A trusted, local operator bringing real estate expertise to its tenant relationships, IVT has built a strong reputation with market participants across its portfolio. IVT is committed to leadership in ESG practices and has been a Global Real Estate Sustainability Benchmark (“GRESB”) member since 2013. For more information, please visit inventrustproperties.com.

The enclosed information should be read in conjunction with the Company's filings with the U.S. Securities and Exchange Commission (“SEC”), including, but not limited to, the Company's Form 10-Qs filed quarterly and Form 10-Ks filed annually. Additionally, the enclosed information does not purport to disclose all items required under Generally Accepted Accounting Principles (“GAAP”). The information provided in this supplemental is unaudited and includes non-GAAP measures (as discussed below), and there can be no assurance that the information will not vary from the final information in the Company’s Form 10-K for the year-ended December 31, 2023. IVT may, but assumes no obligation to, update information in this supplemental.

Forward-Looking Statements Disclaimer

Forward-Looking Statements in this supplemental, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, including statements about the Company's 2024 guidance, the amount and timing of payment of the Company's next quarterly dividend, the Company's expectation for continued tenant demand for its centers, strength of and anticipated opportunities based on IVT's low leverage levels, or regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future, are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” "continue," “likely,” “will,” “would,” "outlook," "guidance," and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. The following factors, among others, could cause actual results, financial position and timing of certain events to differ materially from those described in the forward-looking statements: interest rate movements; local, regional, national and global economic performance; the impact of inflation on the Company and on its tenants; competitive factors; the impact of e-commerce on the retail industry; future retailer store closings; retailer consolidation; retailers reducing store size; retailer bankruptcies; government policy changes; and any material market changes and trends that could affect the Company’s business strategy. For further discussion of factors that could materially affect the outcome of management's forward-looking statements and IVT's future results and financial condition, see the Risk Factors included in the Company's most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the SEC. InvenTrust intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. IVT cautions you not to place undue reliance on any forward-looking statements, which are made as of the date of this supplemental. IVT undertakes no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If IVT updates one or more forward-looking statements, no inference should be drawn that IVT will make additional updates with respect to those or other forward-looking statements.

Notice Regarding Non-GAAP Financial Measures

In addition to GAAP measures, this supplemental contains and refers to certain non-GAAP measures. Management does not consider the Company's non-GAAP measures included in the Glossary of Terms to be alternatives to measures required in accordance with GAAP. Certain non-GAAP measures should not be viewed as an alternative measure of IVT's financial performance as they may not reflect the operations of the entire portfolio, and they may not reflect the impact of general and administrative expenses, depreciation and amortization, interest expense, other income (expense), or the level of capital expenditures and leasing costs necessary to maintain the operating performance of IVT's properties that could materially impact IVT's results from operations. Additionally, certain non-GAAP measures should not be considered as an indication of IVT's liquidity, nor as an indication of funds available to cover IVT's cash needs, including IVT's ability to fund distributions, and may not be a useful measure of the impact of long-term operating performance on value if management does not continue to operate the business in the manner currently contemplated. Accordingly, non-GAAP measures should be reviewed in connection with other GAAP measurements, and should not be viewed as more prominent measures of performance than net income (loss) or cash flows from operations prepared in accordance with GAAP. Other REITs may use different methodologies for calculating similar non-GAAP measures, and accordingly, IVT's non-GAAP measures may not be comparable to other REITs. Reconciliations of the Company's non-GAAP measures to the most directly comparable GAAP financial measures are included on pages 6 and 7 and definitions of the Company's non-GAAP measures are included in the Glossary of Terms on page 19.

| | | | | | | | |

i Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

Pro Rata Financial Information

As of December 31, 2022, the Company owned a 55% interest in IAGM Retail Fund I, LLC (“IAGM” or “JV”), a joint venture partnership between the Company and PGGM Private Real Estate Fund (“PGGM”). IAGM was formed on April 17, 2013 for the purpose of acquiring, owning, managing, and disposing of retail properties and sharing in the profits and losses from those retail properties and their activities. As of December 31, 2022, IAGM was the Company’s sole joint venture and was unconsolidated.

On January 18, 2023, the Company acquired the four remaining retail properties from IAGM for an aggregate purchase price of $222.3 million by acquiring 100% of the membership interests in each of IAGM's wholly owned subsidiaries. The Company assumed aggregate mortgage debt of $92.5 million and funded the remaining balance with its available liquidity.

Throughout this supplemental, the Company has included the results from its 55% ownership share of its joint venture properties when combined with the Company's wholly owned properties, defined as "Pro Rata," with the exception of property and lease count, as of and for the three months and year ended December 31, 2022.

The presentation of pro rata financial information has limitations as an analytical tool, which include but are not limited to: (i) amounts shown on individual line items were calculated by applying the Company's overall economic ownership interest percentage determined when applying the equity method of accounting, and may not represent the Company's legal claim to the assets and liabilities, or the revenues and expenses; and (ii) other REITs may use different methodologies for calculating their pro rata interest. Accordingly, pro rata financial information should be reviewed in connection with other GAAP measurements, and should not be viewed as more prominent measures of performance than net income (loss) or cash flows from operations prepared in accordance with GAAP. For additional detail regarding properties previously owned by the JV, see the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case as filed with the SEC.

Reduction of Authorized Shares

On April 28, 2022, the Company filed an amendment to its charter to decrease the number of authorized shares of common stock from 1,460,000,000 to 146,000,000, in proportion with the one-for-ten reverse stock split effected by the Company on August 5, 2021. The authorized shares of preferred stock remain at 40,000,000.

Availability of Information on InvenTrust Properties Corp.'s Website and Social Media Channels

Investors and others should note that InvenTrust routinely announces material information to investors and the marketplace using U.S. Securities and Exchange Commission filings, press releases, public conference calls, webcasts and the InvenTrust investor relations website. The Company uses these channels as well as social media channels (e.g., the InvenTrust X account (twitter.com/inventrustprop); and the InvenTrust LinkedIn account (linkedin.com/company/inventrustproperties) as a means of disclosing information about the Company's business to colleagues, investors, and the public. While not all of the information that the Company posts to the InvenTrust investor relations website or on the Company’s social media channels is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media and others interested in InvenTrust to review the information that it shares on inventrustproperties.com/investor-relations and on the Company’s social media channels.

| | | | | | | | |

ii Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

CONTACT:

Dan Lombardo

Vice President of Investor Relations

630-570-0605

dan.lombardo@inventrustproperties.com

InvenTrust Properties Corp. Reports 2023 Fourth Quarter and Full Year Results

DOWNERS GROVE, Ill – February 13, 2024 – InvenTrust Properties Corp. (“InvenTrust” or the “Company”) (NYSE: IVT) today reported financial and operating results for the fourth quarter and full year ended December 31, 2023 and provided initial guidance for 2024. For the three months ended December 31, 2023 and 2022, the Company reported Net Income of $2.9 million, or $0.04 per diluted share, compared to a Net Loss of $0.1 million, or $0.00 per diluted share, respectively. For the years ended December 31, 2023 and 2022, the Company reported Net Income of $5.3 million, or $0.08 per diluted share, compared to $52.2 million, or $0.77 per diluted share, respectively.

Fourth Quarter and Full Year 2023 Highlights:

•NAREIT FFO for the fourth quarter of $0.45 per diluted share, and $1.70 per diluted share for the full year

•Core FFO for the fourth quarter of $0.41 per diluted share, and $1.65 per diluted share for the full year

•Same Property Net Operating Income (“NOI”) growth of 6.4% for the fourth quarter and 4.9% for the full year

•Leased Occupancy as of December 31, 2023 of 96.2%, a fourth quarter sequential increase of 110 basis points and a full year increase of 10 basis points

•Executed 86 leases in the fourth quarter, totaling approximately 553,000 square feet of GLA, of which 429,000 was executed at a blended comparable lease spread of 13.9%, and 299 leases for the full year, totaling approximately 1,418,000 square feet of GLA, of which 974,000 was executed at a blended comparable lease spread of 9.8%

•New leases for anchor tenants were executed at a comparable lease spread of 35.2% for the full year

•Raised $5.4 million of net proceeds under the at-the-market equity offering program (the “ATM Program”)

•The Board of Directors approved a 5% increase to the Company’s dividends starting in April 2024

”We are pleased to report another year of outstanding performance driven by our simple and focused business plan; that is, owning high quality open-air retail centers in Sun Belt markets,” commented DJ Busch, CEO and President. “Significant tenant demand for our space has continued into the early part of 2024. Meanwhile, our low levered balance sheet allows us to remain flexible and opportunistic. To that end, subsequent to the quarter end, we strategically expanded our footprint into the Phoenix MSA through the acquisition of a premier essential retail center.”

NET INCOME (LOSS)

•Net Income for the three months ended December 31, 2023 was $2.9 million, or $0.04 per diluted share, compared to a Net Loss of $0.1 million, or $0.00 per diluted share, for the same period in 2022.

•Net Income for the year ended December 31, 2023 was $5.3 million, or $0.08 per diluted share, compared to $52.2 million, or $0.77 per diluted share, for the same period in 2022.

NAREIT FFO

•NAREIT FFO for the three months ended December 31, 2023 was $30.8 million, or $0.45 per diluted share, as compared to $23.8 million, or $0.35 per diluted share, for the same period in 2022.

•NAREIT FFO for the year ended December 31, 2023 was $115.5 million, or $1.70 per diluted share, as compared to $112.0 million, or $1.66 per diluted share, for the same period in 2022.

| | | | | | | | |

iii Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

CORE FFO

•Core FFO for the three months ended December 31, 2023 was $27.8 million, or $0.41 per diluted share, compared to $23.1 million, or $0.34 per diluted share, for the same period in 2022.

•Core FFO for the year ended December 31, 2023 was $111.9 million, or $1.65 per diluted share, compared to $106.0 million, or $1.57 per diluted share, for the same period in 2022.

SAME PROPERTY NOI

•Same Property NOI for the three months ended December 31, 2023 was $38.7 million, a 6.4% increase, compared to the same period in 2022.

•Same Property NOI for the year ended December 31, 2023 was $142.1 million, a 4.9% increase, compared to the same period in 2022.

DIVIDEND

•For the quarter ending December 31, 2023, the Board of Directors declared a quarterly cash distribution of $0.2155 per share, payable on January 15, 2024.

•The Board of Directors approved an increase of 5% to the Company’s cash dividend. The new annual rate of $0.9052 will be reflected in the next quarterly dividend of $0.2263 expected to be paid in April 2024.

PORTFOLIO PERFORMANCE & INVESTMENT ACTIVITY

•As of December 31, 2023, the Company’s Leased Occupancy was 96.2%.

◦Anchor Leased Occupancy, which includes spaces greater than or equal to 10,000 square feet, was 98.2% and Small Shop Leased Occupancy was 92.5%. Anchor Leased Occupancy increased by 160 basis points and Small Shop Leased Occupancy increased by 10 basis points on a sequential basis compared to the previous quarter.

◦Leased to Economic Occupancy spread of 290 basis points, which equates to approximately $7.4 million of base rent on an annualized basis.

•Blended re-leasing spreads for comparable new and renewal leases signed in the fourth quarter and full year were 13.9% and 9.8%, respectively.

•Annualized Base Rent PSF (“ABR”) as of December 31, 2023 was $19.48, an increase of 2.1% compared to the same period in 2022. Anchor Tenant ABR PSF was $12.49 and Small Shop ABR PSF was $32.74 for the fourth quarter.

LIQUIDITY AND CAPITAL STRUCTURE

•During the three months ended December 31, 2023, the Company raised $5.4 million of net proceeds under the ATM Program, after $0.1 million in commissions, through the issuance of 208,040 shares of common stock at a weighted average price of $26.13 per share.

•On October 17, 2023, the Company extended the maturity of its $92.5 million of cross-collateralized mortgage debt maturing in 2023 by exercising one of its two 12-month extension options. The maturity date of the debt is now November 2, 2024. On December 21, 2023, the Company partially paid down the cross-collateralized mortgage debt by $20.0 million, resulting in an outstanding balance of $72.5 million as of December 31, 2023.

•InvenTrust had $446.4 million of total liquidity, as of December 31, 2023 comprised of $96.4 million of cash and cash equivalents and $350.0 million of availability under its Revolving Credit Facility.

•InvenTrust has $88.2 million of debt maturing in 2024 and $22.9 million of debt maturing in 2025.

•The Company's weighted average interest rate on its debt as of December 31, 2023 was 4.29% and the weighted average remaining term was 4.0 years.

SUBSEQUENT EVENTS

•On February 1, 2024, the Company acquired The Plant, a 57,000 square foot neighborhood center anchored by Sprouts Farmers Market in Chandler, Arizona for a gross acquisition price of $29.5 million. The Company used cash on hand and assumed $13.0 million of existing mortgage debt to fund the acquisition.

| | | | | | | | |

iv Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

FULL YEAR 2024 OUTLOOK AND INITIAL GUIDANCE

The Company has provided initial 2024 guidance, as summarized in the table below.

| | | | | | | | | | | | | | | | | |

| (Unaudited, dollars in thousands, except per share amounts) | Initial 2024 Guidance(1)(2) | | 2023 Actual |

| Net Income per diluted share | $0.04 | — | $0.10 | | $0.08 |

| NAREIT FFO per diluted share | $1.69 | — | $1.75 | | $1.70 |

Core FFO per diluted share (3) | $1.66 | — | $1.70 | | $1.65 |

| Same Property NOI (“SPNOI”) Growth | 2.25% | — | 3.25% | | 4.9% |

| General and administrative | $33,000 | — | $34,250 | | $31,797 |

Interest expense, net (4) | $35,000 | — | $35,750 | | $34,025 |

| | | | | |

Net investment activity (5) | ~ $75,000 | | $110,670 |

(1)The Company’s initial 2024 guidance excludes projections related to gains or losses on dispositions, gains or losses on debt transactions, or depreciation, amortization, and straight-line rent adjustments related to acquisitions.

(2)The Company’s initial 2024 guidance includes an expectation of uncollectibility, reflected as 50-100 basis points of expected total revenue.

(3)Core FFO per diluted share excludes certain remaining amortization assumptions within NAREIT FFO, debt extinguishment charges, straight-line rent adjustments, and non-routine items which, in management’s judgement, are not pertinent to measuring on-going operating performance.

(4)Interest expense, net, excludes amortization of debt discounts and financing costs, and expected interest income of approximately $1.0 million.

(5)Net investment activity represents anticipated acquisition activity less disposition activity.

In addition to the foregoing, the Company's initial 2024 Guidance incorporates a number of other assumptions that are subject to change and may be outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurances that InvenTrust will achieve these results.

The following table provides a reconciliation of the range of the Company's 2024 estimated net income per diluted share to estimated NAREIT FFO and Core FFO per diluted share:

| | | | | | | | | | | |

| (Unaudited) | Low End | | High End |

| Net income per diluted share | $ | 0.04 | | | $ | 0.10 | |

| Depreciation and amortization related to investment properties | 1.65 | | | 1.65 | |

| NAREIT FFO per diluted share | 1.69 | | | 1.75 | |

| Amortization of market-lease intangibles and inducements, net | (0.02) | | | (0.03) | |

| Straight-line rent adjustments, net | (0.04) | | | (0.05) | |

| Amortization of debt discounts and financing costs | 0.03 | | | 0.03 | |

| | | |

| Core FFO per diluted share | $ | 1.66 | | | $ | 1.70 | |

This press release does not include a reconciliation of forward-looking SPNOI to forward-looking GAAP Net Income because the Company is unable, without making unreasonable efforts, to provide a meaningful or reasonably accurate calculation or estimation of certain reconciling items which could be significant to the Company’s results.

| | | | | | | | |

v Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

| | | | | |

| Summary Financial Information |

| In thousands, except share information and per square foot amounts |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Financial Results | | | | | | | |

| | | | | | | |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| Net income (loss) per common share - basic | 0.04 | | | — | | | 0.08 | | | 0.77 | |

| Net income (loss) per common share - diluted | 0.04 | | | — | | | 0.08 | | | 0.77 | |

| | | | | | | |

| NAREIT FFO (page 7) | 30,754 | | | 23,775 | | | 115,498 | | | 111,976 | |

| NAREIT FFO per diluted share | 0.45 | | | 0.35 | | | 1.70 | | | 1.66 | |

| | | | | | | |

| Core FFO (page 7) | 27,793 | | | 23,077 | | | 111,858 | | | 105,952 | |

| Core FFO per diluted share | 0.41 | | | 0.34 | | | 1.65 | | | 1.57 | |

| | | | | | | |

| Same Property NOI (page 6) | 38,709 | | | 36,379 | | | 142,124 | | | 135,543 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Same Property NOI growth | 6.4 | % | | | | 4.9 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA (page 7) | 36,792 | | | 31,622 | | | 146,459 | | | 132,368 | |

| | | | | | | |

| Distributions declared per common share - basic | 0.22 | | | 0.21 | | | 0.86 | | | 0.82 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Aggregate distributions declared (as a % of Core FFO) | 52.5 | % | | 60.0 | % | | 52.1 | % | | 52.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of

Dec. 31, 2023 | | As of

Dec. 31, 2022 (a) | | As of

Dec.31, 2021 (a) | | As of

Dec. 31, 2020 (a) |

| Capital Information | | | | | | | |

| Shares outstanding | 67,807,831 | | 67,472,553 | | 67,344,374 | | 71,998,654 |

| | | | | | | |

| Outstanding Debt, net | $ | 814,568 | | | $ | 805,253 | | | $ | 624,289 | | | $ | 688,422 | |

| Less: Cash and cash equivalents | (96,385) | | | (164,448) | | | (79,628) | | | (249,854) | |

| Net Debt | $ | 718,183 | | | $ | 640,805 | | | $ | 544,661 | | | $ | 438,568 | |

| | | | | | | |

| (a) Outstanding debt, net, Cash and cash equivalents, and Net Debt as of December 31, 2022, 2021 and 2020 are Pro-Rata. |

| | | | | | | |

| Debt Metrics (trailing 12 months) | | | | | | | |

| Adjusted EBITDA (trailing 12 months) | $ | 146,459 | | | $ | 132,368 | | | $ | 117,273 | | | $ | 117,078 | |

| Net Debt-to-Adjusted EBITDA (a) | 4.9x | | 4.8x | | 4.6x | | 3.7x |

| Fixed charge coverage | 4.3x | | 5.0x | | 6.4x | | 5.9x |

| Net debt to real estate assets, excl property acc depr. | 27.0 | % | | 24.7 | % | | 22.0 | % | | 17.7 | % |

| Net debt to total assets, excl property acc depr. | 24.4 | % | | 21.3 | % | | 19.3 | % | | 14.6 | % |

| (a) Net Debt-to-Adjusted EBITDA as of December 31, 2022, 2021 and 2020 are Pro-Rata. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividend Paid Per Share | | | | Liquidity and Credit Facility |

| Q4 2023 | | $0.21550 | | | | Cash and cash equivalents | | $ | 96,385 | |

| Q3 2023 | | $0.21550 | | | | Available under credit facility | | 350,000 | |

| Q2 2023 | | $0.21550 | | | | Total | | $ | 446,385 | |

| Q1 2023 | | $0.20520 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Property | | Same Property | | Total |

| Three Months Ended December 31 | | Year Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 (a) |

| Portfolio Metrics | | | | | | | | | | | |

| No. of properties | 55 | | 55 | | 51 | | 51 | | 62 | | 62 |

| GLA | 8,794 | | 8,794 | | 8,029 | | 8,029 | | 10,324 | | 9,790 |

| Economic Occupancy | 93.8 | % | | 94.3 | % | | 93.4 | % | | 94.1 | % | | 93.3 | % | | 93.9 | % |

| Leased Occupancy | 96.5 | % | | 96.5 | % | | 96.3 | % | | 96.3 | % | | 96.2 | % | | 96.1 | % |

| ABR PSF | $19.81 | | $19.23 | | $20.15 | | $19.54 | | $19.48 | | $19.08 |

| | | | | | | | | | | |

| (a) Total Portfolio metrics for the three months and year ended December 31, 2022 are Pro Rata and have not been recast to reflect the acquisition of the JV properties in 2023. |

| | | | | | | | |

1 Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

| | | | | |

| Consolidated Balance Sheets |

| In thousands, except share and per share amounts |

| | | | | | | | | | | |

| As of |

| December 31, 2023 | | December 31, 2022 |

| Assets | (unaudited) | | |

| Investment properties | | | |

| Land | $ | 694,668 | | | $ | 650,764 | |

| Building and other improvements | 1,956,117 | | | 1,825,893 | |

| Construction in progress | 5,889 | | | 5,005 | |

| Total | 2,656,674 | | | 2,481,662 | |

| Less accumulated depreciation | (461,352) | | | (389,361) | |

| Net investment properties | 2,195,322 | | | 2,092,301 | |

| Cash, cash equivalents and restricted cash | 99,763 | | | 137,762 | |

| Investment in unconsolidated entities | — | | | 56,131 | |

| Intangible assets, net | 114,485 | | | 101,167 | |

| Accounts and rents receivable | 35,353 | | | 34,528 | |

| Deferred costs and other assets, net | 42,408 | | | 51,145 | |

| Total assets | $ | 2,487,331 | | | $ | 2,473,034 | |

| | | |

| Liabilities | | | |

| Debt, net | $ | 814,568 | | | $ | 754,551 | |

| Accounts payable and accrued expenses | 44,583 | | | 42,792 | |

| Distributions payable | 14,594 | | | 13,837 | |

| Intangible liabilities, net | 30,344 | | | 29,658 | |

| Other liabilities | 29,198 | | | 28,287 | |

| Total liabilities | 933,287 | | | 869,125 | |

| Commitments and contingencies | | | |

| | | |

| Stockholders' Equity | | | |

| Preferred stock, $0.001 par value, 40,000,000 shares authorized, none outstanding | — | | | — | |

Common stock, $0.001 par value, 146,000,000 shares authorized,

67,807,831 shares issued and outstanding as of December 31, 2023 and

67,472,553 shares issued and outstanding as of December 31, 2022 | 68 | | | 67 | |

| Additional paid-in capital | 5,468,728 | | | 5,456,968 | |

| Distributions in excess of accumulated net income | (3,932,826) | | | (3,879,847) | |

| Accumulated comprehensive income | 18,074 | | | 26,721 | |

| Total stockholders' equity | 1,554,044 | | | 1,603,909 | |

| Total liabilities and stockholders' equity | $ | 2,487,331 | | | $ | 2,473,034 | |

| | | | | | | | |

2 Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

| | | | | |

| Consolidated Statements of Operations and Comprehensive (Loss) Income |

| In thousands, except share and per share information, unaudited |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Income | | | | | | | |

| Lease income, net | $ | 64,332 | | | $ | 58,418 | | | $ | 257,146 | | | $ | 232,980 | |

| Other property income | 390 | | | 275 | | | 1,450 | | | 1,161 | |

| Other fee income | — | | | 578 | | | 80 | | | 2,566 | |

| Total income | 64,722 | | | 59,271 | | | 258,676 | | | 236,707 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Depreciation and amortization | 28,091 | | | 23,897 | | | 113,430 | | | 94,952 | |

| Property operating | 11,776 | | | 11,983 | | | 42,832 | | | 40,239 | |

| Real estate taxes | 7,448 | | | 7,330 | | | 34,809 | | | 32,925 | |

| General and administrative | 8,408 | | | 10,103 | | | 31,797 | | | 33,342 | |

| Total operating expenses | 55,723 | | | 53,313 | | | 222,868 | | | 201,458 | |

| | | | | | | |

| Other (expense) income | | | | | | | |

| Interest expense, net | (9,697) | | | (8,648) | | | (38,138) | | | (26,777) | |

| Loss on extinguishment of debt | (15) | | | (85) | | | (15) | | | (181) | |

| | | | | | | |

| Gain on sale of investment properties, net | — | | | 1,393 | | | 2,691 | | | 38,249 | |

| Equity in (losses) earnings of unconsolidated entities | (110) | | | (121) | | | (557) | | | 3,663 | |

| Other income and expense, net | 3,713 | | | 1,378 | | | 5,480 | | | 2,030 | |

| Total other (expense) income, net | (6,109) | | | (6,083) | | | (30,539) | | | 16,984 | |

| | | | | | | |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| | | | | | | |

| Weighted-average common shares outstanding, basic | 67,563,908 | | | 67,428,549 | | | 67,531,898 | | | 67,406,233 | |

| Weighted-average common shares outstanding, diluted | 68,090,912 | | | 67,428,549 | | | 67,813,180 | | | 67,525,935 | |

| | | | | | | |

| Net income (loss) per common share - basic | $ | 0.04 | | | $ | — | | | $ | 0.08 | | | $ | 0.77 | |

| Net income (loss) per common share - diluted | $ | 0.04 | | | $ | — | | | $ | 0.08 | | | $ | 0.77 | |

| | | | | | | |

| Distributions declared per common share outstanding | $ | 0.22 | | | $ | 0.21 | | | $ | 0.86 | | | $ | 0.82 | |

| Distributions paid per common share outstanding | $ | 0.22 | | | $ | 0.21 | | | $ | 0.85 | | | $ | 0.82 | |

| | | | | | | |

| Comprehensive (loss) income | | | | | | | |

| Net income (loss) | $ | 2,890 | | | $ | (125) | | | $ | 5,269 | | | $ | 52,233 | |

| Unrealized (loss) gain on derivatives | (7,268) | | | (860) | | | 6,228 | | | 32,052 | |

| Reclassification (to) from net (loss) income | (3,786) | | | (1,756) | | | (14,875) | | | (1,009) | |

| Comprehensive (loss) income | $ | (8,164) | | | $ | (2,741) | | | $ | (3,378) | | | $ | 83,276 | |

| | | | | | | | |

3 Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

| | | | | |

| Consolidated Supplemental Details of Assets and Liabilities |

| In thousands |

| | | | | | | | | | | |

| As of |

| December 31, 2023 | | December 31, 2022 |

| Accounts and rents receivable | | | |

| Billed base rent, recoveries, and other revenue | $ | 12,215 | | | $ | 14,701 | |

| Straight-line rent receivables | 23,138 | | | 19,827 | |

| Total | $ | 35,353 | | | $ | 34,528 | |

| | | |

| Deferred cost and other assets, net | | | |

| Derivative assets | $ | 18,196 | | | $ | 25,201 | |

| Lease commissions, net | 14,995 | | | 13,834 | |

| Other assets | 3,309 | | | 4,092 | |

| Right of use assets, net | 2,253 | | | 2,650 | |

| Deferred costs, net | 2,206 | | | 3,089 | |

| Loan fees, net | 1,449 | | | 2,279 | |

| Total | $ | 42,408 | | | $ | 51,145 | |

| | | |

| Other liabilities | | | |

| Deferred revenues | $ | 8,878 | | | $ | 9,531 | |

| Unearned lease income | 8,061 | | | 7,155 | |

| Security deposits | 7,127 | | | 6,318 | |

| Operating lease liabilities | 3,023 | | | 3,265 | |

| Other liabilities | 1,987 | | | 2,018 | |

| Derivative liabilities | 122 | | | — | |

| Total | $ | 29,198 | | | $ | 28,287 | |

| | | | | | | | |

4 Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

| | | | | |

| Consolidated Supplemental Details of Operations |

| In thousands |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31 | | Year Ended December 31 |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Income | | | | | | | |

| * | Minimum base rent | $ | 41,687 | | | $ | 37,158 | | | $ | 165,267 | | | $ | 145,467 | |

| * | Real estate tax recoveries | 6,947 | | | 6,964 | | | 31,220 | | | 30,107 | |

| * | Common area maintenance, insurance, and other recoveries | 8,380 | | | 7,610 | | | 30,731 | | | 28,072 | |

| * | Ground rent income | 4,740 | | | 3,813 | | | 19,044 | | | 14,991 | |

| Amortization of market-lease intangibles and inducements, net | 626 | | | 995 | | | 3,343 | | | 5,589 | |

| * | Short-term and other lease income | 1,779 | | | 1,475 | | | 4,389 | | | 4,333 | |

| Termination fee income | 17 | | | (13) | | | 836 | | | 339 | |

| Straight-line rent adjustment, net | 1,081 | | | 566 | | | 3,464 | | | 2,645 | |

| Reversal of (provision for) uncollectible straight-line rent, net | (224) | | | 124 | | | (115) | | | 1,170 | |

| * | Provision for uncollectible billed rent and recoveries | (701) | | | (425) | | | (1,628) | | | (1,065) | |

| * | Reversal of uncollectible billed rent and recoveries | — | | | 151 | | | 595 | | | 1,332 | |

| Lease income, net | 64,332 | | | 58,418 | | | 257,146 | | | 232,980 | |

| | | | | | | | |

| * | Other property income | 390 | | | 275 | | | 1,450 | | | 1,161 | |

| | | | | | | | |

| JV property management fee | — | | | 283 | | | 48 | | | 1,301 | |

| JV asset management fee | — | | | 196 | | | 32 | | | 882 | |

| JV leasing commissions | — | | | 99 | | | — | | | 383 | |

| Other fee income | — | | | 578 | | | 80 | | | 2,566 | |

| | | | | | | | |

| Total income | $ | 64,722 | | | $ | 59,271 | | | $ | 258,676 | | | $ | 236,707 | |

| | | | | | | | |

| Operating Expenses | | | | | | | |

| Depreciation and amortization | $ | 28,091 | | | $ | 23,897 | | | $ | 113,430 | | | $ | 94,952 | |

| | | | | | | | |

| * | Property operating | 11,776 | | | 11,983 | | | 42,832 | | | 40,239 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| * | Real estate taxes | 7,448 | | | 7,330 | | | 34,809 | | | 32,925 | |

| | | | | | | | |

| General and administrative expenses | 6,607 | | | 7,980 | | | 25,302 | | | 29,297 | |

| Stock based compensation costs | 2,411 | | | 2,686 | | | 9,021 | | | 6,806 | |

| Capitalized direct development compensation costs | (610) | | | (563) | | | (2,526) | | | (2,761) | |

| General and administrative | 8,408 | | | 10,103 | | | 31,797 | | | 33,342 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total operating expenses | $ | 55,723 | | | $ | 53,313 | | | $ | 222,868 | | | $ | 201,458 | |

* Component of Net Operating Income

| | | | | | | | |

5 Supplemental - Quarter Ended December 31, 2023 | |

| | |

| | |

| | | | | |

| Reconciliation of Non-GAAP Measures |

| In thousands |

Same Property NOI

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31 | | Year Ended December 31 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Income | | | | | | | |

| Minimum base rent | $ | 36,739 | | | $ | 35,889 | | | $ | 135,732 | | | $ | 130,613 | |

| Real estate tax recoveries | 6,345 | | | 6,655 | | | 25,821 | | | 26,244 | |

| Common area maintenance, insurance, and other recoveries | 7,413 | | | 7,187 | | | 24,829 | | | 24,119 | |

| Ground rent income | 3,683 | | | 3,690 | | | 13,535 | | | 13,319 | |

| Short-term and other lease income | 1,763 | | | 1,462 | | | 4,244 | | | 4,203 | |

| Provision for uncollectible billed rent and recoveries | (662) | | | (286) | | | (1,325) | | | (814) | |

| Reversal of uncollectible billed rent and recoveries | — | | | 11 | | | 395 | | | 1,279 | |

| Other property income | 339 | | | 277 | | | 1,212 | | | 1,127 | |

| Total income | 55,620 | | | 54,885 | | | 204,443 | | | 200,090 | |

| | | | | | | |

| Operating Expenses | | | | | | | |

| Property operating | 10,271 | | | 11,537 | | | 33,841 | | | 35,695 | |