Iron Mountain Incorporated Announces Tax Treatment of 2024 Distributions

23 Januar 2025 - 1:15PM

Business Wire

Iron Mountain Incorporated (NYSE: IRM), a global leader in

information management services, today announced the tax treatment

for all 2024 distributions on its common stock.

Form 1099 Box 1a

Form 1099 Box 1b

Form 1099 Box 2a

Form 1099 Box 2b

Form 1099 Box 2f

Form 1099 Box 3

Form 1099 Box 5

Payment Date

Total Distribution

Ordinary Taxable

Dividend

Qualified Taxable Dividend

(1)

Total Capital Gain

Distribution

Unrecaptured Sec. 1250 Gain

(2)

Section 897 Capital Gain

(2)

Return of Capital

Section 199A Dividend

(1)

($ per share)

($ per share)

($ per share)

($ per share)

($ per share)

($ per share)

($ per share)

($ per share)

Jan 4, 2024

$0.650000

$0.536996

$0.000000

$0.000000

$0.000000

$0.000000

$0.113004

$0.536996

Apr 4, 2024

$0.650000

$0.536996

$0.000000

$0.000000

$0.000000

$0.000000

$0.113004

$0.536996

Jul 5, 2024

$0.650000

$0.536996

$0.000000

$0.000000

$0.000000

$0.000000

$0.113004

$0.536996

Oct 3, 2024

$0.715000

$0.590695

$0.000000

$0.000000

$0.000000

$0.000000

$0.124305

$0.590695

Totals

$2.665000

$2.201683

$0.000000

$0.000000

$0.000000

$0.000000

$0.463317

$2.201683

(1)

Qualified Taxable Dividend and Section 199A Dividend are subsets

of, and included in, Ordinary Taxable Dividend.

(2)

Unrecaptured Section 1250 Gain and Section 897 Capital Gain are

subsets of, and included in, Total Capital Gain Distribution.

If you held common stock of Iron Mountain in your name at any

time during 2024, an IRS Form 1099-DIV will be provided to you by

Computershare, Iron Mountain’s transfer agent. If you held shares

in “street name” during 2024, the IRS form provided by your bank,

brokerage firm or nominee may report only the gross distributions

paid to you. Therefore, you may need the information included in

this press release to properly complete your federal tax

return.

Please note that federal tax laws affect taxpayers differently,

and we cannot advise you on how distributions should be reported on

your federal income tax return. Please also note that state and

local taxation of REIT distributions vary and may not be the same

as the federal treatment.

About Iron Mountain

Iron Mountain Incorporated (NYSE: IRM) is trusted by more than

240,000 customers in 60 countries, including approximately 95% of

the Fortune 1000, to help unlock value and intelligence from their

assets through services that transcend the physical and digital

worlds. Our broad range of solutions address their information

management, digital transformation, information security, data

center and asset lifecycle management needs. Our longstanding

commitment to safety, security, sustainability and innovation in

support of our customers underpins everything we do.

To learn more about Iron Mountain, please visit

www.IronMountain.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123762805/en/

Investor Relations Contact: Mark Rupe SVP, Investor Relations

Mark.Rupe@ironmountain.com (215) 402-7013 Erika Crabtree Manager,

Investor Relations Erika.Crabtree@ironmountain.com (617)

535-2845

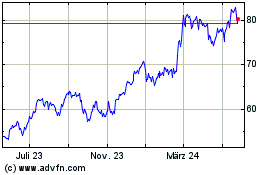

Iron Mountain Inc REIT (NYSE:IRM)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

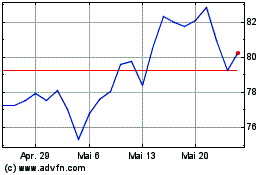

Iron Mountain Inc REIT (NYSE:IRM)

Historical Stock Chart

Von Jan 2024 bis Jan 2025