Invitation Homes Announces Tax Treatment of 2024 Dividends

23 Januar 2025 - 10:30PM

Business Wire

Invitation Homes Inc. (NYSE: INVH) (“Invitation Homes” or the

“Company”) today announced the tax treatment of its 2024 dividends

for its Common Stock as summarized in the table below. The

Company’s tax return for 2024 has not yet been filed. As a result,

the information in the table below has been calculated using the

best available information as of the date of this release.

Please note that federal tax laws affect taxpayers differently

and the Company cannot advise its stockholders on how distributions

should be reported on their federal income tax returns. Please also

note that state and local taxation of real estate investment trust

distributions varies and may not be the same as the federal rules.

Stockholders must consult with their own tax advisors regarding

their specific tax treatment of these dividends.

Invitation Homes Inc. Common

Stock (1)

CUSIP 46187W107

Box 1a

Box 2a

Box 2b

Box 2e

Box 2f

Box 5

Record Date

Payable Date

Cash

Distribution

Taxable Dividend

(2)

Total Ordinary Dividends

Total Capital Gain Distr. (3)

Unrecap. Sec. 1250 Gain (4)

Sec. 897 Ordinary Dividends

(4)

Sec. 897 Capital Gain (4)

Sec. 199A Dividends

(5)

12/27/2023

1/19/2024

$0.280000

$0.002810

$0.001979

$0.000831

$0.000178

$0.000001

$0.000826

$0.001979

3/28/2024

4/19/2024

$0.280000

$0.280000

$0.197244

$0.082756

$0.017705

$0.000051

$0.082225

$0.197244

6/27/2024

7/19/2024

$0.280000

$0.280000

$0.197244

$0.082756

$0.017705

$0.000051

$0.082225

$0.197244

9/26/2024

10/18/2024

$0.280000

$0.280000

$0.197244

$0.082756

$0.017705

$0.000051

$0.082225

$0.197244

12/26/2024

1/17/2025

$0.290000

$0.290000

$0.204289

$0.085711

$0.018338

$0.000053

$0.085161

$0.204289

$1.410000

$1.132810

$0.798000

$0.334810

$0.071631

$0.000207

$0.332662

$0.798000

1.

All dollar amounts reported above are per share and all section

references are to the Internal Revenue Code of 1986, as amended, or

the Treasury Regulations promulgated thereunder.

2.

The $0.280000 common stock distribution with a record date of

December 27, 2023 and a payable date of January 19, 2024 represents

a split-year distribution; $0.277190 of the total amount is

considered a distribution made in 2023 for federal income tax

purposes.

3.

Of the amount reported as total

capital gain distribution in Box 2a, the One Year Amounts

Disclosure is 0.641558% and the Three Year Amounts Disclosure is

0.000000% for purposes of Sec. 1061, which generally applies to

direct and indirect holders of “applicable partnership

interests.”

4.

These amounts are a subset of,

and included in, the total capital gain distribution in Box 2a.

5.

These amounts are a subset of,

and included in, the total ordinary dividends in Box 1a.

About Invitation Homes:

Invitation Homes, an S&P 500 company, is the nation's

premier single-family home leasing and management company, meeting

changing lifestyle demands by providing access to high-quality,

updated homes with valued features such as close proximity to jobs

and access to good schools. The company's mission, "Together with

you, we make a house a home," reflects its commitment to providing

homes where individuals and families can thrive and high-touch

service that continuously enhances residents' living

experiences.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123021570/en/

Investor Relations Contact: Scott McLaughlin 844.456.INVH

(4684) IR@InvitationHomes.com

Media Relations Contact: Kristi DesJarlais 844.456.INVH

(4684) Media@InvitationHomes.com

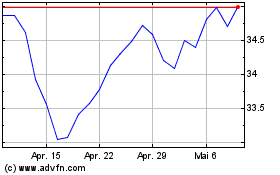

Invitation Homes (NYSE:INVH)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Invitation Homes (NYSE:INVH)

Historical Stock Chart

Von Jan 2024 bis Jan 2025