Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Juli 2024 - 10:18PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2024

(Unaudited)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

97.2%

Australia

:

3.2%

313,758

Aurizon

Holdings

Ltd.

$

771,011

0.4

36,256

BHP

Group

Ltd.

-

Class

DI

1,079,062

0.6

41,867

BlueScope

Steel

Ltd.

590,822

0.3

15,432

Fortescue

Metals

Group

Ltd.

255,016

0.2

15,358

Rio

Tinto

Ltd.

1,321,009

0.8

7,169

Seven

Group

Holdings

Ltd.

187,909

0.1

140,740

South32

Ltd.

-

Class

DI

372,897

0.2

442,978

Telstra

Group

Ltd.

1,025,959

0.6

5,603,685

3.2

Austria

:

0.3%

24,524

Mondi

PLC

QX

487,805

0.3

Belgium

:

0.2%

10,031

(1)

Liberty

Global

Ltd.

-

Class

C

171,229

0.1

1,691

Syensqo

SA

169,240

0.1

340,469

0.2

Brazil

:

0.7%

27,187

Telefonica

Brasil

SA

227,348

0.1

143,637

TIM

SA/Brazil

435,214

0.2

52,573

Vale

SA

-

Foreign

631,869

0.4

1,294,431

0.7

Canada

:

5.1%

7,940

Agnico

Eagle

Mines

Ltd.

541,489

0.3

23,553

AltaGas

Ltd.

531,388

0.3

23,223

Barrick

Gold

Corp.

396,151

0.2

6,239

Canadian

National

Railway

Co.

794,208

0.5

6,795

Canadian

Pacific

Kansas

City

Ltd.

540,878

0.3

29,275

Canadian

Utilities

Ltd.

-

Class

A

667,572

0.4

20,255

Enbridge,

Inc.

740,531

0.4

1,583

Franco-Nevada

Corp.

194,764

0.1

7,613

(2)

Hydro

One

Ltd.

219,294

0.1

26,046

Keyera

Corp.

689,681

0.4

21,358

Kinross

Gold

Corp.

173,472

0.1

17,206

Northland

Power,

Inc.

294,141

0.2

30,548

Pembina

Pipeline

Corp.

1,134,778

0.6

14,872

Rogers

Communications,

Inc.

-

Class

B

600,903

0.3

7,746

TC

Energy

Corp.

298,712

0.2

25,078

TELUS

Corp.

412,339

0.2

9,942

West

Fraser

Timber

Co.

Ltd.

795,316

0.5

9,025,617

5.1

China

:

2.5%

922,000

AviChina

Industry

&

Technology

Co.

Ltd.

-

Class

H

418,357

0.2

314,500

BOE

Technology

Group

Co.

Ltd.

-

Class

A

177,231

0.1

1,070,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

514,718

0.3

166,000

China

Oilfield

Services

Ltd.

-

Class

H

177,414

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

617,000

China

Railway

Group

Ltd.

-

Class

H

$

332,452

0.2

1,540,000

(2)

China

Tower

Corp.

Ltd.

-

Class

H

181,845

0.1

198,000

CMOC

Group

Ltd.

-

Class

H

183,184

0.1

315,500

Fosun

International

Ltd.

177,230

0.1

257,200

Goldwind

Science

&

Technology

Co.

Ltd.

-

Class

A

276,847

0.2

1,694,800

Shanghai

Construction

Group

Co.

Ltd.

-

Class

A

545,143

0.3

87,500

Sinotruk

Hong

Kong

Ltd.

203,501

0.1

90,000

Weichai

Power

Co.

Ltd.

-

Class

H

161,670

0.1

110,300

Western

Mining

Co.

Ltd.

-

Class

A

283,563

0.2

104,700

Yutong

Bus

Co.

Ltd.

-

Class

A

352,614

0.2

71,400

Zhejiang

Dahua

Technology

Co.

Ltd.

-

Class

A

161,776

0.1

69,400

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

-

Class

H

271,792

0.1

4,419,337

2.5

France

:

4.7%

6,057

Air

Liquide

SA

1,192,461

0.7

1,308

Airbus

SE

222,492

0.1

7,712

Arkema

SA

790,292

0.4

18,537

Cie

de

Saint-Gobain

1,636,651

0.9

3,937

Eiffage

SA

435,589

0.2

63,830

Getlink

SE

1,124,843

0.6

14,340

Legrand

SA

1,557,074

0.9

15,207

Rexel

SA

462,137

0.3

4,067

Schneider

Electric

SE

1,014,633

0.6

8,436,172

4.7

Germany

:

4.0%

3,729

Brenntag

SE

268,621

0.2

22,895

Daimler

Truck

Holding

AG

979,587

0.5

61,406

Deutsche

Telekom

AG,

Reg

1,493,039

0.8

9,636

Heidelberg

Materials

AG

1,010,557

0.6

23,368

RWE

AG

888,079

0.5

13,007

Siemens

AG,

Reg

2,506,976

1.4

7,146,859

4.0

Greece

:

0.2%

33,676

(1)

Public

Power

Corp.

SA

410,884

0.2

Hong

Kong

:

0.6%

13,600

Jardine

Matheson

Holdings

Ltd.

501,160

0.3

87,500

Power

Assets

Holdings

Ltd.

485,830

0.3

986,990

0.6

India

:

2.6%

1,939

ABB

India

Ltd.

193,192

0.1

16,134

Adani

Ports

&

Special

Economic

Zone

Ltd.

278,389

0.2

21,097

Hindalco

Industries

Ltd.

174,776

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

India

(continued)

29,059

JSW

Steel

Ltd.

$

307,198

0.2

25,058

Larsen

&

Toubro

Ltd.

1,102,804

0.6

10,267

PI

Industries

Ltd.

436,021

0.2

128,646

Power

Grid

Corp.

of

India

Ltd.

478,690

0.3

426,621

Tata

Steel

Ltd.

855,767

0.5

143,255

Vedanta

Ltd.

771,333

0.4

4,598,170

2.6

Indonesia

:

0.2%

528,600

Indah

Kiat

Pulp

&

Paper

Tbk

PT

296,802

0.2

Ireland

:

1.4%

3,377

AerCap

Holdings

NV

313,081

0.2

2,129

Allegion

PLC

259,355

0.1

12,332

CRH

PLC

IE

973,192

0.6

5,830

CRH

PLC

US

476,661

0.3

12,400

(1)

James

Hardie

Industries

PLC

386,541

0.2

2,408,830

1.4

Italy

:

0.2%

44,920

Terna

-

Rete

Elettrica

Nazionale

378,067

0.2

Japan

:

8.5%

54,800

Central

Japan

Railway

Co.

1,222,274

0.7

70,800

Chubu

Electric

Power

Co.,

Inc.

978,157

0.5

7,200

FANUC

Corp.

201,543

0.1

5,200

Hitachi

Ltd.

535,536

0.3

10,400

Japan

Airlines

Co.

Ltd.

174,772

0.1

52,900

JFE

Holdings,

Inc.

800,879

0.4

3,800

Keyence

Corp.

1,712,894

1.0

16,900

Makita

Corp.

498,323

0.3

32,900

MISUMI

Group,

Inc.

566,674

0.3

78,500

Mitsubishi

Chemical

Group

Corp.

415,750

0.2

10,900

Mitsubishi

Corp.

230,060

0.1

22,100

Nippon

Express

Holdings,

Inc.

1,089,161

0.6

385,500

Nippon

Telegraph

&

Telephone

Corp.

378,564

0.2

10,100

Nippon

Yusen

KK

320,151

0.2

13,800

Nitto

Denko

Corp.

1,056,530

0.6

17,400

Osaka

Gas

Co.

Ltd.

396,165

0.2

12,800

Shimadzu

Corp.

332,817

0.2

14,000

Shin-Etsu

Chemical

Co.

Ltd.

522,600

0.3

1,300

SMC

Corp.

656,538

0.4

11,200

SoftBank

Group

Corp.

648,116

0.4

49,800

Sumitomo

Corp.

1,295,921

0.7

45,100

(1)

Tokyo

Electric

Power

Co.

Holdings,

Inc.

270,756

0.2

13,900

Toyota

Tsusho

Corp.

848,859

0.5

15,153,040

8.5

Kuwait

:

0.1%

167,838

Mobile

Telecommunications

Co.

KSCP

247,174

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Luxembourg

:

0.5%

33,905

ArcelorMittal

SA

$

894,498

0.5

Mexico

:

0.3%

49,126

Promotora

y

Operadora

de

Infraestructura

SAB

de

CV

539,513

0.3

Netherlands

:

0.1%

3,444

Akzo

Nobel

NV

241,571

0.1

Norway

:

0.2%

8,950

Yara

International

ASA

278,304

0.2

Qatar

:

0.3%

142,092

Ooredoo

QPSC

367,081

0.2

46,214

Qatar

Electricity

&

Water

Co.

QSC

190,600

0.1

557,681

0.3

Russia

:

—%

267,141

(3)

Alrosa

PJSC

—

—

4,101,092

(3)

Inter

RAO

UES

PJSC

—

—

124,960

(3)

Mobile

TeleSystems

PJSC

—

—

—

—

Saudi

Arabia

:

0.6%

23,484

Etihad

Etisalat

Co.

294,058

0.2

21,019

Sahara

International

Petrochemical

Co.

167,280

0.1

17,515

Saudi

Basic

Industries

Corp.

355,668

0.2

18,087

Yanbu

National

Petrochemical

Co.

174,708

0.1

991,714

0.6

Singapore

:

0.5%

66,500

(2)

BOC

Aviation

Ltd.

493,991

0.3

86,400

Sembcorp

Industries

Ltd.

326,490

0.2

820,481

0.5

South

Korea

:

1.7%

16,524

GS

Holdings

Corp.

521,688

0.3

6,454

(1)

HD

Korea

Shipbuilding

&

Offshore

Engineering

Co.

Ltd.

609,791

0.3

12,948

Hyundai

Steel

Co.

278,091

0.2

14,106

KT

Corp.

376,624

0.2

790

LG

Chem

Ltd.

201,907

0.1

7,051

(1)

SK

Square

Co.

Ltd.

395,538

0.2

5,624

SK

Telecom

Co.

Ltd.

207,536

0.1

3,588

SK,

Inc.

458,277

0.3

3,049,452

1.7

Spain

:

2.5%

5,683

Acciona

SA

729,618

0.4

6,159

ACS

Actividades

de

Construccion

y

Servicios

SA

275,754

0.2

5,114

(2)

Aena

SME

SA

1,000,104

0.6

13,191

Enagas

SA

202,860

0.1

49,510

Red

Electrica

Corp.

SA

892,250

0.5

273,658

Telefonica

SA

1,278,883

0.7

4,379,469

2.5

Sweden

:

2.7%

15,732

Hexagon

AB

-

Class

B

173,286

0.1

19,169

Holmen

AB

-

Class

B

802,756

0.4

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Sweden

(continued)

44,447

Husqvarna

AB

-

Class

B

$

370,111

0.2

8,240

Saab

AB

-

Class

B

200,007

0.1

21,636

Sandvik

AB

477,727

0.3

41,435

SKF

AB

-

Class

B

910,337

0.5

34,405

Telefonaktiebolaget

LM

Ericsson

-

Class

B

211,989

0.1

63,944

Volvo

AB

-

Class

B

1,721,047

1.0

4,867,260

2.7

Switzerland

:

2.8%

30,617

ABB

Ltd.,

Reg

1,688,082

0.9

69

Givaudan

SA,

Reg

325,287

0.2

21,291

Holcim

AG

1,870,413

1.0

3,848

Sika

AG,

Reg

1,173,056

0.7

5,056,838

2.8

Taiwan

:

1.4%

569,000

AUO

Corp.

313,544

0.2

426,000

China

Steel

Corp.

312,664

0.1

34,000

Delta

Electronics,

Inc.

342,601

0.2

237,000

Hon

Hai

Precision

Industry

Co.

Ltd.

1,262,143

0.7

86,000

Zhen

Ding

Technology

Holding

Ltd.

325,481

0.2

2,556,433

1.4

Thailand

:

0.3%

458,000

Indorama

Ventures

PCL

288,305

0.2

204,800

PTT

Global

Chemical

PCL

194,045

0.1

482,350

0.3

Turkey

:

0.2%

25,876

KOC

Holding

AS

191,280

0.1

72,112

Turkcell

Iletisim

Hizmetleri

AS

222,894

0.1

414,174

0.2

United

Kingdom

:

4.1%

12,729

Anglo

American

PLC

412,102

0.2

97,071

BAE

Systems

PLC

1,728,437

1.0

145,484

BT

Group

PLC

243,573

0.1

15,743

Bunzl

PLC

591,858

0.3

358,684

Centrica

PLC

651,047

0.4

3,783

Ferguson

PLC

778,315

0.4

17,479

Pentair

PLC

1,422,441

0.8

44,441

Smiths

Group

PLC

983,372

0.6

581,248

Vodafone

Group

PLC

561,947

0.3

7,373,092

4.1

United

States

:

44.5%

8,279

3M

Co.

829,059

0.5

8,020

A.O.

Smith

Corp.

670,793

0.4

11,842

AECOM

1,034,280

0.6

12,220

AMERCO

742,854

0.4

4,631

American

Electric

Power

Co.,

Inc.

417,948

0.2

9,991

AMETEK,

Inc.

1,694,274

1.0

3,346

(1)

Arista

Networks,

Inc.

995,937

0.6

107,101

AT&T,

Inc.

1,951,380

1.1

7,324

Atmos

Energy

Corp.

848,998

0.5

43,805

Baker

Hughes

Co.

1,466,591

0.8

5,719

(1)

Boeing

Co.

1,015,752

0.6

1,046

(1)

Builders

FirstSource,

Inc.

168,186

0.1

978

Carlisle

Cos.,

Inc.

409,088

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

15,110

Carrier

Global

Corp.

$

954,801

0.5

3,129

Caterpillar,

Inc.

1,059,229

0.6

1,130

Celanese

Corp.

171,805

0.1

9,237

CenterPoint

Energy,

Inc.

281,821

0.2

72,128

Cisco

Systems,

Inc.

3,353,952

1.9

17,406

(1)

Cleveland-Cliffs,

Inc.

300,776

0.2

37,275

CSX

Corp.

1,258,031

0.7

850

Deere

&

Co.

318,546

0.2

11,813

Delta

Air

Lines,

Inc.

602,699

0.3

1,107

Dover

Corp.

203,489

0.1

23,087

Dow,

Inc.

1,330,504

0.7

13,085

DTE

Energy

Co.

1,524,795

0.9

2,685

Duke

Energy

Corp.

278,085

0.2

10,106

Eastman

Chemical

Co.

1,024,041

0.6

2,603

Eaton

Corp.

PLC

866,409

0.5

21,117

Edison

International

1,622,841

0.9

3,725

Emerson

Electric

Co.

417,796

0.2

10,227

Entergy

Corp.

1,150,435

0.6

23,301

Evergy,

Inc.

1,273,633

0.7

11,325

Eversource

Energy

670,780

0.4

6,731

(1)

F5,

Inc.

1,137,337

0.6

2,652

FedEx

Corp.

673,502

0.4

17,822

Fortive

Corp.

1,326,670

0.7

13,272

Fortune

Brands

Innovations,

Inc.

929,836

0.5

24,602

Freeport-McMoRan,

Inc.

1,297,263

0.7

1,205

(1)

GE

Vernova,

Inc.

211,959

0.1

9,582

General

Electric

Co.

1,582,371

0.9

10,374

Graco,

Inc.

837,700

0.5

31,392

Halliburton

Co.

1,152,086

0.6

2,317

Honeywell

International,

Inc.

468,474

0.3

14,506

Ingersoll

Rand,

Inc.

1,349,783

0.8

4,191

International

Paper

Co.

188,972

0.1

1,550

Jabil,

Inc.

184,295

0.1

14,429

Johnson

Controls

International

PLC

1,037,589

0.6

8,881

(1)

Keysight

Technologies,

Inc.

1,229,841

0.7

10,085

Kinder

Morgan,

Inc.

196,557

0.1

3,233

Linde

PLC

US

1,408,036

0.8

375

Lockheed

Martin

Corp.

176,378

0.1

8,856

Masco

Corp.

619,212

0.3

10,107

NextEra

Energy,

Inc.

808,762

0.5

46,960

NiSource,

Inc.

1,364,658

0.8

3,170

Nordson

Corp.

744,062

0.4

4,864

Nucor

Corp.

821,286

0.5

5,642

Old

Dominion

Freight

Line,

Inc.

988,761

0.6

13,138

Otis

Worldwide

Corp.

1,303,290

0.7

6,790

Owens

Corning

1,229,465

0.7

3,338

Parker-Hannifin

Corp.

1,774,214

1.0

82,094

PG&E

Corp.

1,522,023

0.9

11,080

PPG

Industries,

Inc.

1,456,023

0.8

6,721

Raytheon

Technologies

Corp.

724,591

0.4

1,986

Reliance

Steel

&

Aluminum

Co.

597,349

0.3

4,163

Rockwell

Automation,

Inc.

1,072,097

0.6

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

10,642

RPM

International,

Inc.

$

1,192,968

0.7

18,863

Schlumberger

NV

865,623

0.5

21,419

Sempra

Energy

1,649,906

0.9

6,511

Sherwin-Williams

Co.

1,978,042

1.1

2,145

Snap-on,

Inc.

585,285

0.3

7,221

Stanley

Black

&

Decker,

Inc.

629,455

0.4

4,745

Steel

Dynamics,

Inc.

635,213

0.4

2,070

Textron,

Inc.

181,353

0.1

2,237

T-Mobile

US,

Inc.

391,386

0.2

198

TransDigm

Group,

Inc.

265,960

0.1

10,929

(1)

Trimble,

Inc.

608,527

0.3

24,590

(1)

Uber

Technologies,

Inc.

1,587,530

0.9

2,552

Union

Pacific

Corp.

594,157

0.3

3,229

United

Parcel

Service,

Inc.

-

Class

B

448,605

0.2

1,535

United

Rentals,

Inc.

1,027,544

0.6

42,809

Verizon

Communications,

Inc.

1,761,590

1.0

5,020

Vertiv

Holdings

Co.

-

Class

A

492,311

0.3

3,493

Vistra

Corp.

346,086

0.2

493

Watsco,

Inc.

234,126

0.1

8,268

Westinghouse

Air

Brake

Technologies

Corp.

1,399,194

0.8

556

WW

Grainger,

Inc.

512,332

0.3

7,549

Xcel

Energy,

Inc.

418,592

0.2

79,129,835

44.5

Total

Common

Stock

(Cost

$143,725,851)

172,866,997

97.2

EXCHANGE-TRADED

FUNDS

:

1.4%

22,066

iShares

MSCI

ACWI

ETF

2,451,091

1.4

Total

Exchange-Traded

Funds

(Cost

$2,367,208)

2,451,091

1.4

PREFERRED

STOCK

:

0.4%

Brazil

:

0.4%

28,100

Centrais

Eletricas

Brasileiras

SA

210,259

0.2

195,319

Cia

Energetica

de

Minas

Gerais

370,112

0.2

580,371

0.4

Total

Preferred

Stock

(Cost

$541,321)

580,371

0.4

Total

Long-Term

Investments

(Cost

$146,634,380)

175,898,459

99.0

Shares

RA

Value

Percentage

of

Net

Assets

SHORT-TERM

INVESTMENTS

:

0.3%

Mutual

Funds

:

0.3%

584,000

(4)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.230%

(Cost

$584,000)

$

584,000

0.3

Total

Short-Term

Investments

(Cost

$584,000)

$

584,000

0.3

Total

Investments

in

Securities

(Cost

$147,218,380)

$

176,482,459

99.3

Assets

in

Excess

of

Other

Liabilities

1,320,576

0.7

Net

Assets

$

177,803,035

100.0

(1)

Non-income

producing

security.

(2)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(3)

For

fair

value

measurement

disclosure

purposes,

security

is

categorized

as

Level

3,

whose

value

was

determined

using

significant

unobservable

inputs.

(4)

Rate

shown

is

the

7-day

yield

as

of

May

31,

2024.

Industry

Diversification

Percentage

of

Net

Assets

Electric

Utilities

7.6

%

Industrial

Machinery

&

Supplies

&

Components

7.6

Specialty

Chemicals

5.7

Integrated

Telecommunication

Services

5.5

Industrial

Conglomerates

5.1

Electrical

Components

&

Equipment

4.9

Building

Products

4.5

Steel

4.1

Trading

Companies

&

Distributors

4.1

Construction

Machinery

&

Heavy

Transportation

Equipment

3.8

Multi-Utilities

3.7

Communications

Equipment

3.2

Rail

Transportation

2.9

Aerospace

&

Defense

2.8

Construction

Materials

2.7

Diversified

Metals

&

Mining

2.5

Construction

&

Engineering

2.4

Electronic

Equipment

&

Instruments

2.4

Wireless

Telecommunication

Services

2.0

Oil

&

Gas

Equipment

&

Services

2.0

Oil

&

Gas

Storage

&

Transportation

1.7

Commodity

Chemicals

1.5

Industrial

Gases

1.5

Multi-Sector

Holdings

1.4

Air

Freight

&

Logistics

1.2

Gas

Utilities

1.1

Cargo

Ground

Transportation

1.0

Highways

&

Railtracks

0.9

Passenger

Ground

Transportation

0.9

Paper

Products

0.9

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Electronic

Manufacturing

Services

0.8

%

Gold

0.7

Copper

0.7

Independent

Power

Producers

&

Energy

Traders

0.7

Electronic

Components

0.7

Airport

Services

0.6

Forest

Products

0.4

Passenger

Airlines

0.4

Fertilizers

&

Agricultural

Chemicals

0.4

Agricultural

&

Farm

Machinery

0.4

Heavy

Electrical

Equipment

0.4

Diversified

Chemicals

0.2

Marine

Transportation

0.2

Renewable

Electricity

0.2

Marine

Ports

&

Services

0.2

Paper

&

Plastic

Packaging

Products

&

Materials

0.1

Oil

&

Gas

Drilling

0.1

Aluminum

0.1

Alternative

Carriers

0.1

Assets

in

Excess

of

Other

Liabilities*

1.0

Net

Assets

100.0%

* Includes

short-term

investments.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

May

31,

2024

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

May

31,

2024

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

5,603,685

$

—

$

5,603,685

Austria

487,805

—

—

487,805

Belgium

171,229

169,240

—

340,469

Brazil

1,294,431

—

—

1,294,431

Canada

9,025,617

—

—

9,025,617

China

—

4,419,337

—

4,419,337

France

—

8,436,172

—

8,436,172

Germany

—

7,146,859

—

7,146,859

Greece

—

410,884

—

410,884

Hong

Kong

501,160

485,830

—

986,990

India

—

4,598,170

—

4,598,170

Indonesia

—

296,802

—

296,802

Ireland

1,049,097

1,359,733

—

2,408,830

Italy

—

378,067

—

378,067

Japan

320,151

14,832,889

—

15,153,040

Kuwait

—

247,174

—

247,174

Luxembourg

—

894,498

—

894,498

Mexico

539,513

—

—

539,513

Netherlands

—

241,571

—

241,571

Norway

—

278,304

—

278,304

Qatar

—

557,681

—

557,681

Russia

—

—

—

—

Saudi

Arabia

167,280

824,434

—

991,714

Singapore

—

820,481

—

820,481

South

Korea

—

3,049,452

—

3,049,452

Spain

—

4,379,469

—

4,379,469

Sweden

—

4,867,260

—

4,867,260

Switzerland

—

5,056,838

—

5,056,838

Taiwan

—

2,556,433

—

2,556,433

Thailand

—

482,350

—

482,350

Turkey

414,174

—

—

414,174

United

Kingdom

2,200,756

5,172,336

—

7,373,092

United

States

79,129,835

—

—

79,129,835

Total

Common

Stock

95,301,048

77,565,949

—

172,866,997

Exchange-Traded

Funds

2,451,091

—

—

2,451,091

Preferred

Stock

580,371

—

—

580,371

Short-Term

Investments

584,000

—

—

584,000

Total

Investments,

at

fair

value

$

98,916,510

$

77,565,949

$

—

$

176,482,459

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(736,003)

$

—

$

(736,003)

Total

Liabilities

$

—

$

(736,003)

$

—

$

(736,003)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2024

(Unaudited)

(continued)

Voya

Infrastructure,

Industrials

and

Materials

Fund

At

May

31,

2024,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Infrastructure,

Industrials

and

Materials

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

Industrial

Select

Sector

SPDR

Fund

UBS

AG

Call

07/05/24

USD

122.030

143,407

USD

17,712,199

$

284,204

$

(443,354)

iShares

MSCI

EAFE

ETF

Goldman

Sachs

International

Call

06/20/24

USD

81.360

366,273

USD

29,734,042

212,145

(116,493)

iShares

MSCI

Emerging

Markets

ETF

Wells

Fargo

Securities

LLC

Call

06/20/24

USD

43.600

174,312

USD

7,284,498

112,483

(7,255)

Materials

Select

Sector

SPDR

Fund

Goldman

Sachs

International

Call

07/05/24

USD

90.440

79,611

USD

7,286,795

129,010

(168,901)

$

737,842

$

(736,003)

Currency

Abbreviations:

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

33,944,920

Gross

Unrealized

Depreciation

(4,680,840)

Net

Unrealized

Appreciation

$

29,264,080

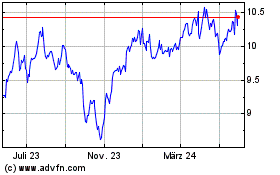

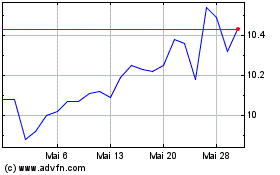

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Voya Infrastructure Indu... (NYSE:IDE)

Historical Stock Chart

Von Nov 2023 bis Nov 2024