0001690012false00016900122023-09-152023-09-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 15, 2023 |

InPoint Commercial Real Estate Income, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-40833 |

32-0506267 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2901 Butterfield Road |

|

Oak Brook, Illinois |

|

60523 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (800) 826-8228 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share |

|

ICR PR A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01 Other Events.

Determination of August 31, 2023 NAV per Share

The Company calculates NAV per share in accordance with the valuation guidelines that have been approved by its board of directors (the “Board”). Our NAV per share, which is updated as of the last calendar day of each month, is posted on our website at www.inland-investments.com/inpoint. The “Net Asset Value Calculation and Valuation Guidelines” section of our prospectus for our public offering (SEC Registration No. 333-264540), as supplemented, contains details regarding how our NAV is determined. Inland InPoint Advisor, LLC, our Advisor, is ultimately responsible for determining our NAV. We have included a breakdown of the components of total net asset value attributable to common stock and NAV per share for August 31, 2023.

Our total net asset value attributable to all classes of our common stock in the aggregate is presented in the following table. As of August 31, 2023, we had not sold any Class S shares of common stock in our public offering. As previously announced, on January 30, 2023, our Board unanimously approved the suspension of the sale of shares in the primary portion of our public offering and through our amended and restate distribution reinvestment plan. The following table provides a breakdown of the major components of our total net asset value attributable to common stock as of August 31, 2023 ($ and shares in thousands, except per share data):

|

|

|

|

|

Components of NAV |

|

August 31, 2023 |

|

Commercial mortgage loans |

|

$ |

756,575 |

|

Real estate held for sale, net |

|

|

12,000 |

|

Cash and cash equivalents and restricted cash |

|

|

46,349 |

|

Other assets |

|

|

8,151 |

|

Repurchase agreements - commercial mortgage loans |

|

|

(473,276 |

) |

Credit facility payable |

|

|

(18,380 |

) |

Loan participations sold |

|

|

(57,226 |

) |

Due to related parties |

|

|

(2,009 |

) |

Distributions payable |

|

|

(1,050 |

) |

Interest payable |

|

|

(1,724 |

) |

Accrued stockholder servicing fees (1) |

|

|

(189 |

) |

Other liabilities |

|

|

(5,934 |

) |

Preferred stock |

|

|

(87,446 |

) |

Net asset value attributable to common stock |

|

$ |

175,841 |

|

Number of outstanding shares |

|

|

10,114 |

|

Aggregate NAV per share |

|

$ |

17.3859 |

|

(1)Stockholder servicing fees only apply to Class T, Class S, and Class D shares. For purposes of NAV, we recognize the stockholder servicing fee as a reduction of NAV on a monthly basis as such fee is paid. Under GAAP, we accrue the full cost of the stockholder servicing fee as an offering cost at the time we sell Class T, Class S, and Class D shares. As of August 31, 2023, we have accrued under GAAP $645 of stockholder servicing fees payable to Inland Securities Corporation (the “Dealer Manager”) related to the Class T and Class D shares sold. As of August 31, 2023, we have not sold any Class S shares and, therefore, we have not accrued any stockholder servicing fees payable to the Dealer Manager related to Class S shares. The Dealer Manager does not retain any of these fees, all of which are retained by, or reallowed (paid) to, participating broker-dealers and servicing broker-dealers for ongoing stockholder services performed by such broker-dealers.

The following table provides our total NAV attributable to common stock and NAV for each class of common stock in each case as of August 31, 2023 ($ and shares in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAV Per Share |

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Total |

|

Net asset value attributable to common stock |

|

$ |

148,777 |

|

|

$ |

12,996 |

|

|

$ |

5,075 |

|

|

$ |

— |

|

|

$ |

836 |

|

|

$ |

8,143 |

|

|

$ |

175,841 |

|

Number of outstanding shares |

|

|

8,563 |

|

|

|

746 |

|

|

|

290 |

|

|

|

— |

|

|

|

48 |

|

|

|

467 |

|

|

|

10,114 |

|

NAV per share as of August 31, 2023 |

|

$ |

17.3749 |

|

|

$ |

17.4239 |

|

|

$ |

17.4804 |

|

|

$ |

— |

|

|

$ |

17.4171 |

|

|

$ |

17.4211 |

|

|

$ |

17.3859 |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

INPOINT COMMERCIAL REAL ESTATE INCOME, INC. |

|

|

|

|

Date: |

September 15, 2023 |

By: |

/s/ Cathleen M. Hrtanek |

|

|

|

Cathleen M. Hrtanek

Secretary |

Exhibit 99.1

InPoint Advisor Guide

July 2023

We have prepared the following to help guide conversations with your clients.

•Sale of Real Estate Owned (REO)

–Renaissance Chicago O’Hare was acquired in August 2020 via deed-in-lieu of foreclosure transaction and was most recently appraised at $19 million as of December 31, 2022

–Entered into a contract for sale of the property on May 31, 2023, for a purchase price of $12 million and received a non-refundable deposit from the buyer, subject to certain exceptions

–Impairment charge of $7 million recognized as a result of the sale, equating to an estimated $0.60 per share reduction in NAV as of May 31, 2023, after adjustments to the loss reserve

–Removing the troubled asset removes the potential for future operating losses due to inconsistent operating performance and will better position the portfolio in support of the exploration of strategic options

•Certain commercial real estate sectors, including the office sector, face challenges primarily due to global pandemic

–Prior to the pandemic, around 5% of full paid working days in the U.S. were completed remotely. That proportion jumped to more than 60% in May 2020 and has since stabilized to around 30% in the past year. This has had a direct effect on the office sector.1

–22% of portfolio consists of loans on office properties

•Accounting standards require estimates of current expected credit loss (CECL), which impacts net income and NAV

–Change in allowance for Q2 2023 was approximately $11.6 million to record specific reserves, resulting in a decrease in the June 30, 2023 NAV per share of approximately $1.14

–Allowance is related to five portfolio mortgage loans scheduled to mature before December 31, 2023

–Four of the five mortgage loans are backed by office properties, a sector which has experienced the significant dislocation discussed above

–7.19% annualized distribution rate2 (based on June 30, 2023 NAV)

–1.23% annualized return since inception

•Management believes that finding an alternative path toward growth will be advantageous

–Actions in January 2023 included suspension of the SRP; suspension of the sale of shares in the primary portion of the public offering; suspension of the distribution reinvestment plan; and termination of the Series A Preferred Stock Repurchase Program

–These actions addressed the deficit faced by the Company given the level of monthly SRP requests exceeding the pace of fundraising and provide flexibility to explore strategic alternatives

–Fully expects to maintain paying monthly distributions3

For additional information on the InPoint Portfolio as of June 30, 2023, as well as the Company’s historical performance, please go to https://assets.inland-investments.com/files/inpoint/InPoint-Performance.pdf.

1www.wfhresearch.com

2The historical returns are equal to the distributions paid and the changes in the NAV over the presented time period divided by the NAV at the beginning of the period. For the year ended December 31, 2022, 100% of distributions on InPoint’s common stock were funded by cash flows from operating activities. Distributions on InPoint’s common stock in 2022 were 34% covered by GAAP net income attributable

to common stockholders. The distribution rate reflects the current month’s distribution annualized and divided by the NAV as of the end of the month prior to the record date for the distribution. We cannot guarantee that we will make distributions, and if we do, such distributions have been and may again be funded from sources other than earnings and cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, and we have no limits on the amounts we may pay from such sources.

3Future distributions are at the sole discretion of the Company’s board of directors and are not guaranteed. Past distributions have been and may again be funded from sources other than earnings and cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, and the Company has no limits on the amounts it may pay from such sources.

Please see reverse side for important disclosures.

Important Risk Factors to Consider

Some of the more significant risks relating to an investment in our shares include:

•We have a limited operating history, and there is no assurance that we will achieve our investment objectives.

•Our share repurchase program is currently suspended.

•Since there is no public trading market for shares of our common stock, repurchase of shares

by us will likely be the only way to dispose of your shares. Our share repurchase plan will provide

stockholders who have held their shares for at least one year with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month at our discretion. In addition, repurchases will be subject to

available liquidity and other significant restrictions. Further, our board of directors may modify, suspend or terminate our share repurchase plan if it deems such action to be in our best interest and the

best interest of our stockholders. As a result, our shares should be considered as having only limited

liquidity and at times may be illiquid.

•We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets,

borrowings, return of capital or offering proceeds, and we have no limits on the amounts we may pay from such sources.

•The valuation of our investments is inherently subjective, and our NAV may not accurately reflect the

actual price at which our investments could be liquidated on any given day.

•We have no employees and are dependent on the Advisor and the Sub-Advisor to conduct our operations. The Advisor and the Sub-Advisor will face conflicts of interest as a result of, among other

things, the allocation of investment opportunities among us and Other Sound Point Accounts, the allocation of time of their investment professionals and the substantial fees that we will pay to the Advisor and that the Advisor will pay to the Sub-Advisor.

•Our primary offering and DRP are currently suspended. If we are not able to raise a substantial

amount of capital on an ongoing basis, our ability to achieve our investment objectives could be

adversely affected.

•If we fail to maintain our qualification as a REIT and no relief provisions apply, we will have to pay corporate income tax on our taxable income (which will be determined without regard to the

dividends-paid deduction available to REITs) and our NAV and cash available for distribution to our stockholders could materially decrease.

•As with any investment, there are certain risks associated with credit investing. Such risks include, but are not limited to:

•The risk of nonpayment of scheduled interest or principal payments on a credit investment, which may affect the overall return to the lender;

•Interest rate fluctuations, which will affect the amount of interest paid by a borrower in a floating- rate loan that adjusts to current market conditions;

•Default risk, which means that the loan may not be repaid by the borrower; and

•The risks typically associated with real estate assets, such as changes in national, regional and local economic conditions, local property supply and demand conditions, ability to collect rent from tenants, vacancies or ability to lease on favorable terms, increases in operating costs, including insurance premiums, utilities and real estate taxes, federal, state or local laws and regulations, changing market demographics, changes in availability and costs of financing and acts of nature, such as hurricanes, earthquakes, tornadoes or floods.

Forward Looking Statements

This material and other communications by InPoint Commercial Real Estate Income, Inc. or its representatives may contain “forward-looking statements,” which are not statements of fact. These statements may be identified by terminology such as “hope, “may,” “can,” “would,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “seek,” “appear,” or “believe.” Such statements reflect our current view with respect to future events and are subject to certain risks, uncertainties and assumptions related to numerous factors including, without limitation, risks related to blind pool offerings, best efforts offerings, use of short-term financing, borrower defaults, changing interest rates, the effects of the COVID-19 pandemic, particularly on hospitality and retail properties, including our hotel, and on related mortgage loans and securities, and other factors detailed under Risk Factors in our most recent Form

10-K and subsequent Form 10-Qs on file with the SEC and available online at www.sec.gov or our website at https://inland-investments.com/inpoint/sec-filings. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. You should exercise caution when considering forward-looking statements and not place undue reliance on them. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described. Except as required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason after the date they are first made.

The Inland name and logo are registered trademarks being used under license. This material has been prepared by InPoint and distributed by Inland Securities Corporation, member FINRA/SIPC, dealer manager for InPoint.

Publication Date: 7/17/2023

Exhibit 99.2

All returns indicated in the charts below are based on the aggregate net asset value (NAV) per share and are net of upfront fees and commissions. Past performance is not an indication of future results. Growth of $100,000 Investment Since Inception1 Nov 2016 - Jun 2023 $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0 11/1/20162/1/20175/1/20178/1/201711/1/20172/1/20185/1/20188/1/201811/1/20182/1/20195/1/20198/1/201911/1/20192/1/20205/1/20208/1/202011/1/20202/1/20215/1/20218/1/20211/1/20212/1/20225/1/20228/1/202211/1/20222/1/20235/1/2023 Ending value as of June 30, 2023 $108,373 Historical NAV Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2023 $19.4770 $19.0856 $19.1182 $19.1141 $18.5104 $17.3766 2022 $20.0969 $19.8704 $19.8206 $19.7621 $19.6961 $19.6320 $19.5623 $19.5152 $19.4968 $19.5117 $19.4998 $19.4819 2021 $20.1474 $20.1416 $20.1508 $20.1562 $20.2071 $20.1991 $20.2862 $20.2715 $20.2168 $20.1478 $20.0410 $20.1761 2020 $25.0088 $25.0079 No Price2 No Price2 No Price2 $21.4441 $21.5039 $21.5319 $21.5655 $21.4981 $21.4542 $20.1348 2019 $25.1116 $25.1096 $25.0441 $25.0078 $25.0027 $24.9969 $24.9894 Historical Returns YTD (Jan 2023-Jun 2023) 1 Year (Jun 2022-Jun 2023) 3 Year3 (Jun 2020-Jun 2023) 5 Year3 (Jun 2018-Jun 2023) Since Inception3 (Nov 2016) -7.60% -5.12% -0.91% -0.77% 1.23% NAV and Distribution as of June 30, 2023 NAV Annualized Gross Distribution Annualized Distribution Rate $17.3766 $1.25 7.19% 1The historical returns are equal to the distributions paid and the changes in the NAV over the presented time period divided by the NAV at the beginning of the period. For the year ended December 31, 2022, 100% of distributions on InPoint’s common stock were funded by cash flows from operating activities. Distributions on InPoint’s common stock in 2022 were 34% covered by GAAP net income attributable to common stockholders. The distribution rate reflects the current month’s distribution annualized and divided by the NAV as of the end of the month prior to the record date for the distribution. We cannot guarantee that we will make distributions, and if we do, such distributions have been and may again be funded from sources other than earnings and cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, and we have no limits on the amounts we may pay from such sources. 2In response to the COVID-19 pandemic, InPoint’s Board approved a suspension of the publication of the Net Asset Value for March, April and May 2020. 3Annualized. Past performance is no guarantee of future results.

Portfolio as of June 30, 2023 Portfolio Size1 $804M Number of Investments1 41 Range of Investment Balances $6-47.7M Historical 1st Mortgage Loan Payoffs 28 Loans 1st Mortgage Weighted Avg. Years to Maturity3 1.03 yrs Average Investment Balance $19.6M Average Leverage Ratio2 70.5% Total Historical 1st Mortgage Loan Payoff Amount $475MDebt Investments: Floating vs. Fixed RateLoans by RegionLoans by Property TypeAll Investments by Type498%Floating1%REO2%Fixed8% Mid Atlantic1%Great Lakes5%Plains16% West43% Southeast27% Southwest3% Retail6%Mixed Use8% Industrial2% Hospitality22%Office59%Multifamily2%Credit Loan97%First Mortgage Past performance is not a guarantee of future results. 1Portfolio size is based on the unpaid principal balance of our debt investments and the fair value of our real estate owned (REO) in each case as of June 30, 2023. Portfolio size, average investment balance and number of investments include our REO. 2Weighted average of the loan to values at origination, based on current loan balance as of June 30, 2023. 31st mortgage weighted average years to maturity based on current loan balance as of June 30, 2023 and the maturity date assuming no options to extend are exercised. See our Form 10-K or 10-Q most recently filed with the SEC for maximum maturities assuming all extensions are exercised. 4Based on the par value of investments as of June 30, 2023. Subject to change without notice. First mortgage loans finance commercial real estate properties and are loans that generally have the highest priority lien among the loans in a foreclosure proceeding on the collateral securing the loan. The senior position does not protect against default, and losses may still occur. Past performance is not a guarantee of future results, and there is no assurance that we will achieve our investment objectives. Credit loans, also called mezzanine loans, are secured by one or more direct or indirect ownership interests in an entity that directly or indirectly owns real estate. REO, which stands for “real estate owned,” represents real estate we have acquired through foreclosure, deed-in-lieu of foreclosure, or purchase. Important Risk Factors to Consider Some of the more significant risks relating to an investment in our shares include: We have a limited operating history, and there is no assurance that we will achieve our investment objectives. Our share repurchase program is currently suspended. Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be theonly way to dispose of your shares. Our share repurchase plan will provide stockholders who have held their shares for at least one year with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month at our discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may modify, suspend or terminate our share repurchase plan if it deems such action to be in our best interest and the best interest of our stockholders. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid. We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital oroffering proceeds, and we have no limits on the amounts we may pay from such sources. The valuation of our investments is inherently subjective, and our NAV may not accurately reflect the actual price atwhich our investments could be liquidated on any given day. We have no employees and are dependent on the Advisor and the Sub-Advisor to conduct our operations. The Advisor and the Sub-Advisor will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other Sound Point Accounts, the allocation of time of their investment professionals andthe substantial fees that we will pay to the Advisor and that the Advisor will pay to the Sub-Advisor. Our primary offering and DRP are currently suspended. If we are not able to raise a substantial amount of capital onan ongoing basis, our ability to achieve our investment objectives could be adversely affected. If we fail to maintain our qualification as a REIT and no relief provisions apply, we will have to pay corporate incometax on our taxable income (which will be determined without regard to the dividends-paid deduction available to REITs) and our NAV and cash available for distribution to our stockholders could materially decrease. As with any investment, there are certain risks associated with credit investing. Such risks include, but are not limited to: – The risk of nonpayment of scheduled interest or principal payments on a credit investment, which may affect theoverall return to the lender; – Interest rate fluctuations, which will affect the amount of interest paid by a borrower in a floating-rate loan thatadjusts to current market conditions; – Default risk, which means that the loan may not be repaid by the borrower; and – The risks typically associated with real estate assets, such as changes in national, regional and local economic conditions, local property supply and demand conditions, ability to collect rent from tenants, vacancies or ability to lease on favorable terms, increases in operating costs, including insurance premiums, utilities and real estatetaxes, federal, state or local laws and regulations, changing market demographics, changes in availability and costs of financing and acts of nature, such as hurricanes, earthquakes, tornadoes or floods. Forward Looking Statements This material and other communications by InPoint Commercial Real Estate Income, Inc. or its representatives may contain “forward-looking statements,” which are not statements of fact. These statements may be identified by terminology such as “hope, “may,” “can,” “would,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “seek,” “appear,” or “believe.” Such statements reflect our current view with respect to future events and are subject to certain risks, uncertainties and assumptions related to numerous factors including, without limitation, risks related to blind pool offerings, best efforts offerings, use of short-term financing, borrower defaults, changing interest rates, the effects of the COVID-19 pandemic, particularly on hospitality and retail properties, including our hotel, and on related mortgage loans and securities, and other factors detailed under Risk Factors in our most recent Form 10-K and subsequent Form 10-Qs on file with the SEC and available online at www.sec.gov or our website at https://inland-investments.com/inpoint/sec-filings. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. You should exercise caution when considering forward-looking statements and not place undue reliance on them. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described. Except as required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason after the date they are first made. The Inland name and logo are registered trademarks being used under license. This material has been prepared by InPoint and distributed by Inland Securities Corporation, member FINRA/SIPC, dealer manager for InPoint. Publication Date: 7/17/2023

v3.23.2

Document And Entity Information

|

Sep. 15, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 15, 2023

|

| Entity Registrant Name |

InPoint Commercial Real Estate Income, Inc.

|

| Entity Central Index Key |

0001690012

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-40833

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

32-0506267

|

| Entity Address, Address Line One |

2901 Butterfield Road

|

| Entity Address, City or Town |

Oak Brook

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60523

|

| City Area Code |

(800)

|

| Local Phone Number |

826-8228

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

true

|

| Title of 12(b) Security |

6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share

|

| Trading Symbol |

ICR PR A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

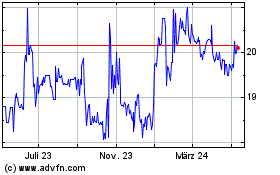

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

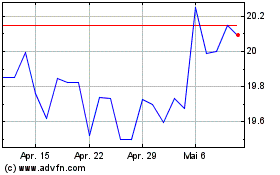

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024