Form 497 - Definitive materials

05 März 2024 - 11:09PM

Edgar (US Regulatory)

JOHN HANCOCK CAPITAL SERIES

John Hancock Classic Value

Fund

John Hancock U.S. Global Leaders Growth Fund

JOHN HANCOCK INVESTMENT TRUST

John Hancock Balanced Fund

John Hancock

Disciplined Value International Fund

John Hancock Diversified Macro Fund

John Hancock Emerging Markets Equity Fund

John Hancock ESG International Equity Fund

John Hancock ESG Large Cap Core Fund

John

Hancock Fundamental Large Cap Core Fund

John Hancock Global Thematic Opportunities Fund

John Hancock Infrastructure Fund

John

Hancock International Dynamic Growth Fund

John Hancock Seaport Long/Short Fund

John Hancock Small Cap Core Fund

JOHN HANCOCK INVESTMENT TRUST II

John Hancock Financial

Industries Fund

John Hancock Regional Bank Fund

Supplement dated March 5, 2024 to the current Prospectus, as may be supplemented (the Prospectus)

Effective March 1, 2024, APPENDIX 1 – INTERMEDIARY SALES CHARGE WAIVERS to

each fund’s Prospectus, with respect to Merrill Lynch, Pierce, Fenner & Smith Incorporated (Merrill), is amended and restated in its entirety as

follows:

MERRILL LYNCH, PIERCE, FENNER &

SMITH INCORPORATED (MERRILL)

Effective March 1, 2024, purchases

or sales of front-end (i.e. Class A) or level-load (i.e., Class C) mutual fund shares through a Merrill platform or account will be eligible only for the following sales load

waivers (front-end, contingent deferred, or back-end waivers) and discounts, which differ from those disclosed elsewhere in this fund’s prospectus. Purchasers will have

to buy mutual fund shares directly from the mutual fund company or through another intermediary to be eligible for waivers or discounts not listed below.

It is the client’s responsibility to notify Merrill at the time of purchase or

sale of any relationship or other facts that qualify the transaction for a waiver or discount. A Merrill representative may ask for reasonable documentation of such facts and

Merrill may condition the granting of a waiver or discount on the timely receipt of such documentation.

Additional information on waivers and discounts is available in the Merrill Sales

Load Waiver and Discounts Supplement (the “Merrill SLWD Supplement“) and in the Mutual Fund Investing at Merrill pamphlet at ml.com/funds. Clients are encouraged

to review these documents and speak with their financial advisor to determine whether a transaction is eligible for a waiver or discount.

Front-end Load Waivers Available at Merrill

•

Shares of mutual funds available for purchase by employer-sponsored retirement,

deferred compensation, and employee benefit plans (including health savings accounts) and trusts used to fund those plans provided the shares are not held in a

commission-based brokerage account and shares are held for the benefit of the plan. For purposes of this provision, employer-sponsored retirement plans do not include SEP

IRAs, Simple IRAs, SAR-SEPs or Keogh plans

Manulife, Manulife

Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of

The

Manufacturers Life Insurance Company and are used by its affiliates under license.

•

Shares purchased through a Merrill investment advisory program

•

Brokerage class shares exchanged from advisory class shares due to the holdings moving

from a Merrill investment advisory program to a Merrill brokerage account

•

Shares purchased through the Merrill Edge Self-Directed platform

•

Shares exchanged from level-load shares to front-end load shares of the same mutual

fund in accordance with the description in the Merrill SLWD Supplement

•

Shares purchased by eligible employees of Merrill or its affiliates and their family

members who purchase shares in accounts within the employee’s Merrill Household (as defined in the Merrill SLWD Supplement)

•

Shares purchased from the proceeds of a mutual fund redemption in front-end load shares

provided (1) the repurchase is in a mutual fund within the same fund family; (2) the repurchase occurs within 90 calendar days from the redemption trade date, and

(3) the redemption and purchase occur in the same account (known as Rights of Reinstatement). Automated transactions (i.e. systematic purchases and withdrawals) and

purchases made after shares are automatically sold to pay Merrill’s account maintenance fees are not eligible for Rights of Reinstatement

CDSC Waivers

on Front-end, Back-end, and Level Load Shares Available at Merrill

•

Shares sold due to the client’s death or disability (as defined by Internal

Revenue Code Section 22(e)(3))

•

Shares sold pursuant to a systematic withdrawal program subject to Merrill’s

maximum systematic withdrawal limits as described in the Merrill SLWD Supplement Return of excess contributions from an Individual Retirement Account (IRA)

•

Shares sold due to return of excess contributions from an IRA account

•

Shares sold as part of a required minimum distribution for IRA and retirement accounts

due to the investor reaching the qualified age based on applicable IRS regulation Shares acquired through NAV reinstatement

•

Front-end or level-load shares held in commission-based, non-taxable retirement

brokerage accounts (e.g. traditional, Roth, rollover, SEP IRAs, Simple IRAs, SAR-SEPs or Keogh plans) that are transferred to fee-based accounts or platforms and exchanged

for a lower cost share class of the same mutual fund

Front-end Load Discounts Available at Merrill: Breakpoints, Rights of

Accumulation & Letters of Intent

•

Breakpoint discounts, as described in this prospectus, where the sales load is at or

below the maximum sales load that Merrill permits to be assessed to a front-end load purchase, as described in the Merrill SLWD Supplement

•

Rights of Accumulation (ROA), as described in the Merrill SLWD Supplement, which

entitle clients to breakpoint discounts based on the aggregated holdings of mutual fund family assets held in accounts in their Merrill Household

•

Letters of Intent (LOI), which allow for breakpoint discounts on eligible new purchases

based on anticipated future eligible purchases within a fund family at Merrill, in accounts within your Merrill Household, as further described in the Merrill SLWD

Supplement

You should read this supplement in conjunction with the Prospectus and retain it for your future reference.

John Hancock Tax Advanta... (NYSE:HTY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

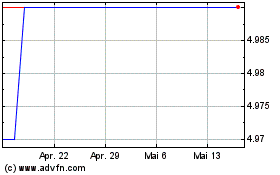

John Hancock Tax Advanta... (NYSE:HTY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024