Highest-Performing Companies to Dominate Fundraising in Venture Healthcare Market, However Challenges Persist

08 Januar 2025 - 3:00PM

Business Wire

HSBC Venture Healthcare Report: Look What You

Made Me Do showcases latest trends in Biopharma, Medical Devices,

Healthtech, and DX/Tools

- Investors finally started to invest in new deals in 2024,

shifting focus to large rounds for the highest-performing

companies

- In 2025, first-financing to remain muted, excluding biopharma,

as a weak exit landscape and trouble finding Series B investors

have pushed VC investments to later stage

- With many companies leaning on insider fundraising rounds,

there is a likelihood of consolidation or shut-downs if companies

fail to secure new investor-led rounds

The venture healthcare market saw a return to new investment, up

30% versus 2023, but not without careful consideration of risk,

with larger syndications of investors raising early-stage mega

rounds or shifting focus to later-stage, leading to fewer small

Seed and Series A deals, according to the annual HSBC Venture

Healthcare Report: Look What You Made Me Do.

“In 2023 and 2024, many companies that raised insider extensions

have not had the ‘rubber hitting the road’ moments as expected, so

it’s likely that we see after-effects, including substantial

consolidation and shut-downs as companies struggle to secure that

next round of funding,” said Jonathan Norris, Lead Author and

Managing Director, HSBC Innovation Banking, U.S. “We expect most

new investment to focus on large rounds for the highest performing

companies in 2025, which will yield a flat year of healthcare

investment.”

Biopharma Bouncing back from 2023, investment rose 33%

overall in 2024, led by oncology and platform companies, with a

surge in big financings in autoimmune, metabolic, and dermatology.

First-financing dollars more than doubled in 2024, but deals were

down as $100M+ mega-rounds accounted for 72% of all first-financing

dollars. Many of these deals were venture-created, with an

increasing focus on big exits with blank checks and deals

in-licensing China assets. Most of the mega-rounds in 2024 were

joined by crossover investors at cycle-high valuations, setting the

stage for large M&A or an active public market for IPOs. For

the year ahead, overall investment is expected to continue with

strong support from VC, crossover, and growth investors, hitting

$24-26B.

Medical Devices While there was a surge in

first-financing deals and dollars in 2Q 2024, overall

first-financing investment was down for the year, marked by early

investor fear of finding a new Series B lead and a longer time to

exit in private M&A, as Series A insider-round extensions

spiked. Notably, the top 10% of all medical device deals attracted

60% of dollars, with an influx of large financings for both

commercial scale-up and pivotal trials. Neurology, NIM, and

Orthopedic indications led overall investments. 2025 may bring a

first-financing comeback in dollars (larger rounds instead of more

deals) and greater overall investment driven by pivotal trial

funding and large commercial rounds.

Healthtech Early-stage investment in AI (artificial

intelligence) applications continued to gain momentum, particularly

within the clinical workflow subsector, although investments

overall were down compared to 2023. Overall, Healthtech investment

dollars grew from 2023 and have normalized to pre-2023 banking

crisis levels, with continued investment in companies targeting

underserved groups and in specialized care. Investment dollars

dipped in 4Q 2024 relative to earlier quarters, partially driven by

investors waiting to see what happens with potential IPOs in 2025,

as high-growth companies have been waiting in the wings. The market

may continue to normalize in 2025 for early to mid-stage companies

amid further proliferation of AI solutions, particularly in

clinical applications. All eyes are on IPOs as the market tracks

early IPO performance and digests the new deregulatory policy

positions in healthcare.

DX/Tools Overall investment was up but top-heavy as the

top 10% of deals secured 48% of all dollars. Most of the larger

deals were commercial-stage revenue-ramping companies, with the top

deals at significant revenues and commanding large valuations.

Facing financing risk and a tough exit environment, the

first-financing slowdown persisted, hitting a four-year low in

2024. Corporate investment did increase in first-financing as

traditional VCs retreated, with the largest funded deals focusing

on themes such as radiopharma, computational bio, and

oncology-focused liquid biopsy. In 2025, first-financing is likely

to remain stable, while AI-enabled deals might see a spike.

The HSBC Venture Healthcare Report was written and produced by

HSBC Innovation Banking’s Life Science and Healthcare Team, which

serves the innovation economy by providing products and solutions

to early and growth-stage companies.

“Even while investors are looking to decrease risk, the

continued inflows to emerging sectors like AI are an encouraging

sign for the year ahead,” said Katherine Andersen, Head of Life

Science and Healthcare, HSBC Innovation Banking, U.S. “This report

builds on previous insights to assess the past year of investment

activity and create data-driven predictions for the year ahead,

underpinned by our team’s dedicated experts. Our tenured and deep

sector expertise in the global life science and healthcare

ecosystems combined with the strength and stability of HSBC’s

global platform allows us to best serve our clients in these

sectors and beyond.”

Learn more about HSBC Innovation Banking.

About HSBC HSBC Holdings plc, the parent company

of HSBC, is headquartered in London. HSBC serves customers

worldwide from offices in 60 countries and territories. With assets

of US $3,099bn at 30 September 2024, HSBC is one of the world’s

largest banking and financial services organizations.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.)

serves customers through Wealth and Personal Banking, Commercial

Banking, Private Banking, Global Banking, and Markets and

Securities Services. Deposit products are offered by HSBC Bank USA,

N.A., Member FDIC. It operates Wealth Centers in: California;

Washington, D.C.; Florida; New Jersey; New York; Virginia; and

Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC

USA Inc., a wholly-owned subsidiary of HSBC North America Holdings

Inc. HSBC Innovation Banking in the U.S. is a business division

with services provided in the United States by HSBC Bank USA,

N.A.

For more information, visit: HSBC in the USA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108217327/en/

Media enquiries to: Matt Kozar Vice President of External

Communications Matt.Kozar@us.hsbc.com

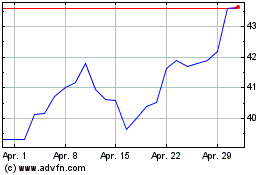

HSBC (NYSE:HSBC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

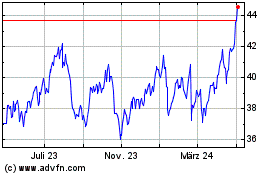

HSBC (NYSE:HSBC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025