HP (NYSE: HPQ)

- Third quarter non-GAAP diluted earnings per share of $0.86,

down 14% from the prior year, within previously provided outlook of

$0.84 to $0.87 per share

- Third quarter GAAP diluted earnings per share of $0.71, up from

GAAP diluted loss per share of $4.49 in the prior year, above

previously provided outlook of $0.56 to $0.59 per share

- Third quarter net revenue of $27.2 billion, down 8% from the

prior year and down 7% when adjusted for the effects of

currency

- Cash flow from operations of $2.7 billion, down 6% from the

prior year

- Returned $283 million to shareholders in the form of dividends

and share repurchases

- Improved operating company net debt position by $1.7 billion,

the sixth consecutive quarterly reduction of over $1 billion

HP third quarter fiscal 2013 financial

performance

Q3 FY13 Q3 FY12 Y/Y

GAAP net revenue ($B) $ 27.2 $ 29.7 (8%)

GAAP operating margin 6.8% (29.7%) 36.5 pts.

GAAP net earnings (loss) ($B) $ 1.4 $ (8.9)

GAAP diluted earnings (loss) per share $ 0.71 $ (4.49)

Non-GAAP operating margin 8.4% 9.2% (0.8 pts.)

Non-GAAP net earnings ($B) $ 1.7 $ 2.0 (15%)

Non-GAAP diluted earnings per share $ 0.86 $ 1.00 (14%)

Cash flow from operations ($B) $ 2.7 $ 2.8 (6%)

Information about HP's use of non-GAAP financial information is

provided under "Use of non-GAAP financial information" below.

HP today announced financial results for its third fiscal

quarter ended July 31, 2013. Third quarter GAAP diluted earnings

per share (EPS) was $0.71, up from a GAAP diluted loss per share of

$4.49 in the prior-year period and above its previously provided

outlook of $0.56 to $0.59 per share. Third quarter non-GAAP diluted

EPS was $0.86, down from $1.00 in the prior-year period and within

its previously provided outlook of $0.84 to $0.87 per share. Third

quarter non-GAAP earnings information excludes after-tax costs of

$286 million, or $0.15 per diluted share, related to amortization

of purchased intangible assets, restructuring charges and

acquisition-related charges.

For the third quarter, net revenue of $27.2 billion was down 8%

year over year and down 7% when adjusted for the effects of

currency.

"We once again achieved the financial performance we said we

would, delivering $0.86 in non-GAAP diluted earnings per share,

within our previously provided outlook of $0.84 to $0.87," said Meg

Whitman, HP president and chief executive officer. "I remain

confident that we are making progress in our turnaround. We are

already seeing significant improvement in our operations, we are

successfully rebuilding our balance sheet, our cost structure is

more closely aligned with our revenue and we have reignited

innovation at HP, with a focus on the customer."

Outlook For the full year fiscal 2013, HP

estimates non-GAAP diluted EPS to be in the range of $3.53 to $3.57

and GAAP diluted EPS to be in the range of $2.67 to $2.71, in line

with HP's previously communicated outlook. Full year fiscal 2013

non-GAAP diluted EPS estimates exclude after-tax costs of

approximately $0.86 per share, related to the amortization of

purchased intangible assets, restructuring charges and

acquisition-related charges.

Asset management HP generated $2.7 billion

in cash flow from operations in the third quarter, down 6% from the

prior-year period. Inventory ended the quarter at $6.5 billion,

down 1 day year over year to 28 days. Accounts receivable ended the

quarter at $14.3 billion, down 1 day year over year to 47 days.

Accounts payable ended the quarter at $13.3 billion, up 7 days year

over year to 57 days. HP's dividend payment of $0.1452 per share in

the third quarter resulted in cash usage of $280 million. HP also

utilized $3 million of cash during the quarter to repurchase

approximately 168,000 shares of common stock in the open market. HP

exited the quarter with $13.7 billion in gross cash.

Third quarter fiscal 2013 segment

results

- Personal Systems revenue was down 11%

year over year with a 3.0% operating margin. Commercial revenue

decreased 3% and Consumer revenue declined 22%. Total units were

down 8% with Desktops units down 9% and Notebooks units down

14%.

- Printing revenue declined 4% year over

year with a 15.6% operating margin. Total hardware units were up 5%

with Commercial hardware units up 12% and Consumer hardware units

up 2%. Supplies revenue was down 4%.

- Enterprise Group revenue declined 9% year

over year with a 15.2% operating margin. Networking revenue was

flat, Industry Standard Servers revenue was down 11%, Business

Critical Systems revenue was down 26%, Storage revenue was down 10%

and Technology Services revenue was down 7%.

- Enterprise Services revenue declined 9%

year over year with a 3.3% operating margin. Application and

Business Services revenue was down 11% and Infrastructure

Technology Outsourcing revenue declined 7%.

- Software revenue was up 1% year over year

with a 20.5% operating margin. Support revenue was up 4%, license

revenue was flat, professional services revenue was down 11% and

SaaS revenue was up 4%.

- HP Financial Services revenue was down 6%

year over year with a 4% decrease in net portfolio assets and a 9%

decrease in financing volume. The business delivered an operating

margin of 11.3%.

More information on HP's earnings, including additional

financial analysis and an earnings overview presentation, is

available on HP's Investor Relations website at

www.hp.com/investor/home.

HP's Q3 FY13 earnings conference call is accessible via an audio

webcast at www.hp.com/investor/2013Q3webcast.

About HP HP creates new possibilities for

technology to have a meaningful impact on people, businesses,

governments and society. With the broadest technology portfolio

spanning printing, personal systems, software, services and IT

infrastructure, HP delivers solutions for customers' most complex

challenges in every region of the world. More information about HP

is available at http://www.hp.com.

Use of non-GAAP financial information To

supplement HP's consolidated condensed financial statements

presented on a GAAP basis, HP provides non-GAAP operating profit,

non-GAAP operating margin, non-GAAP net earnings, non-GAAP diluted

earnings per share, gross cash, free cash flow, net debt and

operating company net debt. HP also provides forecasts of non-GAAP

diluted earnings per share. A reconciliation of the adjustments to

GAAP results for this quarter and prior periods is included in the

tables below or elsewhere in the materials accompanying this news

release. In addition, an explanation of the ways in which HP

management uses these non-GAAP measures to evaluate its business,

the substance behind HP management's decision to use these non-GAAP

measures, the material limitations associated with the use of these

non-GAAP measures, the manner in which HP management compensates

for those limitations, and the substantive reasons why HP

management believes that these non-GAAP measures provide useful

information to investors is included under "Use of Non-GAAP

Financial Measures" after the tables below. This additional

non-GAAP financial information is not meant to be considered in

isolation or as a substitute for operating profit, operating

margin, net earnings, diluted earnings per share, cash and cash

equivalents, cash flow from operations or total company debt

prepared in accordance with GAAP.

Forward-looking statements This news

release contains forward-looking statements that involve risks,

uncertainties and assumptions. If the risks or uncertainties ever

materialize or the assumptions prove incorrect, the results of HP

may differ materially from those expressed or implied by such

forward-looking statements and assumptions. All statements other

than statements of historical fact are statements that could be

deemed forward-looking statements, including but not limited to any

projections of revenue, margins, expenses, earnings, earnings per

share, tax provisions, cash flows, benefit obligations, share

repurchases, currency exchange rates or other financial items; any

projections of the amount, timing or impact of cost savings or

restructuring charges; any statements of the plans, strategies and

objectives of management for future operations, including the

execution of restructuring plans and any resulting cost savings or

revenue or profitability improvements; any statements concerning

the expected development, performance, market share or competitive

performance relating to products or services; any statements

regarding current or future macroeconomic trends or events and the

impact of those trends and events on HP and its financial

performance; any statements regarding pending investigations,

claims or disputes; any statements of expectation or belief; and

any statements of assumptions underlying any of the foregoing.

Risks, uncertainties and assumptions include the need to address

the many challenges facing HP's businesses; the competitive

pressures faced by HP's businesses; risks associated with executing

HP's strategy; the impact of macroeconomic and geopolitical trends

and events; the need to manage third-party suppliers and the

distribution of HP's products and services effectively; the

protection of HP's intellectual property assets, including

intellectual property licensed from third parties; risks associated

with HP's international operations; the development and transition

of new products and services and the enhancement of existing

products and services to meet customer needs and respond to

emerging technological trends; the execution and performance of

contracts by HP and its suppliers, customers and partners; the

hiring and retention of key employees; integration and other risks

associated with business combination and investment transactions;

the execution, timing and results of restructuring plans, including

estimates and assumptions related to the cost and the anticipated

benefits of implementing those plans; the resolution of pending

investigations, claims and disputes; and other risks that are

described in HP's Annual Report on Form 10-K for the fiscal year

ended October 31, 2012 and HP's other filings with the Securities

and Exchange Commission, including HP's Quarterly Report on Form

10-Q for the fiscal quarter ended April 30, 2013. As in prior

periods, the financial information set forth in this release,

including tax-related items, reflects estimates based on

information available at this time. While HP believes these

estimates to be meaningful, these amounts could differ materially

from actual reported amounts in HP's Form 10-Q for the fiscal

quarter ended July 31, 2013. In particular, determining HP's actual

tax balances and provisions as of July 31, 2013 requires extensive

internal and external review of tax data (including consolidating

and reviewing the tax provisions of numerous domestic and foreign

entities), which is being completed in the ordinary course of

preparing HP's Form 10-Q. HP assumes no obligation and does not

intend to update these forward-looking statements.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

CONSOLIDATED CONDENSED STATEMENTS OF EARNINGS

(Unaudited)

(In millions except per share amounts)

Three months ended

----------------------------------

July 31, April 30, July 31,

2013 2013 2012

---------- ---------- ----------

Net revenue $ 27,226 $ 27,582 $ 29,669

Costs and expenses:

Cost of sales 20,859 21,055 22,820

Research and development 797 815 854

Selling, general and administrative 3,274 3,342 3,366

Amortization of purchased intangible

assets 356 350 476

Impairment of goodwill and purchased

intangible assets - - 9,188

Restructuring charges 81 408 1,795

Acquisition-related charges 4 11 3

---------- ---------- ----------

Total costs and expenses 25,371 25,981 38,502

---------- ---------- ----------

Earnings (loss) from operations 1,855 1,601 (8,833)

Interest and other, net (146) (193) (224)

---------- ---------- ----------

Earnings (loss) before taxes 1,709 1,408 (9,057)

(Provision) benefit for taxes (319) (331) 200

---------- ---------- ----------

Net earnings (loss) $ 1,390 $ 1,077 $ (8,857)

========== ========== ==========

Net earnings (loss) per share:

Basic $ 0.72 $ 0.56 $ (4.49)

Diluted $ 0.71 $ 0.55 $ (4.49)

Cash dividends declared per share $ 0.29 $ - $ 0.26

Weighted-average shares used to compute

net earnings (loss) per share:

Basic 1,929 1,935 1,971

Diluted 1,948 1,947 1,971

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

CONSOLIDATED CONDENSED STATEMENTS OF EARNINGS

(Unaudited)

(In millions except per share amounts)

Nine months ended

July 31,

------------------------

2013 2012

----------- -----------

Net revenue $ 83,167 $ 90,398

Costs and expenses:

Cost of sales 63,943 69,674

Research and development 2,406 2,490

Selling, general and administrative 9,916 10,273

Amortization of purchased intangible assets 1,056 1,412

Impairment of goodwill and purchased intangible

assets - 9,188

Restructuring charges 619 1,888

Acquisition-related charges 19 42

----------- -----------

Total costs and expenses 77,959 94,967

----------- -----------

Earnings (loss) from operations 5,208 (4,569)

Interest and other, net (518) (688)

----------- -----------

Earnings (loss) before taxes 4,690 (5,257)

Provision for taxes (991) (539)

----------- -----------

Net earnings (loss) $ 3,699 $ (5,796)

=========== ===========

Net earnings (loss) per share:

Basic $ 1.91 $ (2.93)

Diluted $ 1.89 $ (2.93)

Cash dividends declared per share $ 0.55 $ 0.50

Weighted-average shares used to compute net

earnings (loss) per share:

Basic 1,939 1,977

Diluted 1,952 1,977

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

ADJUSTMENTS TO GAAP NET EARNINGS, EARNINGS FROM OPERATIONS,

OPERATING MARGIN AND EARNINGS PER SHARE

(Unaudited)

(In millions except per share amounts)

Three

Three months Three

months Diluted ended Diluted months Diluted

ended earnings April earnings ended earnings

July 31, per 30, per July 31, per

2013 share 2013 share 2012 share

-------- -------- -------- -------- -------- --------

GAAP net earnings

(loss) $ 1,390 $ 0.71 $ 1,077 $ 0.55 $ (8,857) $ (4.49)

Non-GAAP

adjustments:

Amortization of

purchased

intangible

assets 356 0.19 350 0.17 476 0.25

Impairment of

goodwill and

purchased

intangible

assets(a) - - - - 9,188 4.66

Restructuring

charges 81 0.04 408 0.21 1,795 0.91

Acquisition-

related

charges 4 - 11 0.01 3 -

Wind down of

non-strategic

businesses(b) - - - - 108 0.05

Adjustments for

taxes(c) (155) (0.08) (148) (0.07) (740) (0.38)

-------- -------- -------- -------- -------- --------

Non-GAAP net

earnings $ 1,676 $ 0.86 $ 1,698 $ 0.87 $ 1,973 $ 1.00

======== ======== ======== ======== ======== ========

GAAP earnings

(loss) from

operations $ 1,855 $ 1,601 $ (8,833)

Non-GAAP

adjustments:

Amortization of

purchased

intangible

assets 356 350 476

Impairment of

goodwill and

purchased

intangible

assets(a) - - 9,188

Restructuring

charges 81 408 1,795

Acquisition-

related

charges 4 11 3

Wind down of

non-strategic

businesses(b) - - 108

-------- -------- --------

Non-GAAP earnings

from operations $ 2,296 $ 2,370 $ 2,737

======== ======== ========

GAAP operating

margin 7% 6% (30%)

Non-GAAP

adjustments 1% 3% 39%

-------- -------- --------

Non-GAAP

operating margin 8% 9% 9%

======== ======== ========

(a) For the period ended July 31, 2012, represents a goodwill impairment

charge of $8 billion associated with the Enterprise Services segment and

an intangible asset impairment charge of $1.2 billion associated with

the "Compaq" trade name.

(b) For the period ended July 31, 2012, represents primarily contract-

related charges, including inventory write-downs, related to winding

down certain retail publishing business activities within the Printing

segment.

(c) For the period ended July 31, 2012, adjustments for taxes is net of a

valuation allowance of $823 million provided for certain deferred tax

assets related to the Enterprise Services segment.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

ADJUSTMENTS TO GAAP NET EARNINGS, EARNINGS FROM OPERATIONS,

OPERATING MARGIN AND EARNINGS PER SHARE

(Unaudited)

(In millions except per share amounts)

Nine Nine

months months

ended Diluted ended Diluted

July 31, earnings July 31, earnings

2013 per share 2012 per share

--------- --------- --------- ---------

GAAP net earnings (loss) $ 3,699 $ 1.89 $ (5,796) $ (2.93)

Non-GAAP adjustments:

Amortization of purchased

intangible assets 1,056 0.54 1,412 0.71

Impairment of goodwill and

purchased intangible

assets(a) - - 9,188 4.65

Restructuring charges 619 0.32 1,888 0.95

Acquisition-related charges 19 0.01 42 0.02

Wind down of non-strategic

businesses(b) - - 72 0.04

Adjustments for taxes(c) (414) (0.21) (1,052) (0.55)

--------- --------- --------- ---------

Non-GAAP net earnings $ 4,979 $ 2.55 $ 5,754 $ 2.89

========= ========= ========= =========

GAAP earnings (loss) from

operations $ 5,208 $ (4,569)

Non-GAAP adjustments:

Amortization of purchased

intangible assets 1,056 1,412

Impairment of goodwill and

purchased intangible

assets(a) - 9,188

Restructuring charges 619 1,888

Acquisition-related charges 19 42

Wind down of non-strategic

businesses(b) - 72

--------- ---------

Non-GAAP earnings from

operations $ 6,902 $ 8,033

========= =========

GAAP operating margin 6% (5%)

Non-GAAP adjustments 2% 14%

--------- ---------

Non-GAAP operating margin 8% 9%

========= =========

(a) For the period ended July 31, 2012, represents a goodwill impairment

charge of $8 billion associated with the Enterprise Services segment and

an intangible asset impairment charge of $1.2 billion associated with

the "Compaq" trade name.

(b) For the period ended July 31, 2012, represents primarily contract-

related charges, including inventory write-downs, related to winding

down certain retail publishing business activities within the Printing

segment net of adjustments to expenses for supplier-related obligations

related to winding down the webOS device business.

(c) For the period ended July 31, 2012, adjustments for taxes is net of a

valuation allowance of $823 million provided for certain deferred tax

assets related to the Enterprise Services segment.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

CONSOLIDATED CONDENSED BALANCE SHEETS

(In millions)

July 31, October 31,

2013 2012

----------- -----------

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 13,251 $ 11,301

Accounts receivable 14,336 16,407

Financing receivables 3,113 3,252

Inventory 6,540 6,317

Other current assets 12,718 13,360

----------- -----------

Total current assets 49,958 50,637

----------- -----------

Property, plant and equipment 11,328 11,954

Long-term financing receivables and other assets 9,913 10,593

Goodwill and purchased intangible assets 34,601 35,584

----------- -----------

Total assets $ 105,800 $ 108,768

=========== ===========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Notes payable and short-term borrowings $ 7,624 $ 6,647

Accounts payable 13,293 13,350

Employee compensation and benefits 4,075 4,058

Taxes on earnings 979 846

Deferred revenue 6,571 7,494

Other accrued liabilities 13,470 14,271

----------- -----------

Total current liabilities 46,012 46,666

----------- -----------

Long-term debt 17,124 21,789

Other liabilities 17,686 17,480

Stockholders' equity:

HP stockholders' equity 24,603 22,436

Non-controlling interests 375 397

----------- -----------

Total stockholders' equity 24,978 22,833

----------- -----------

Total liabilities and stockholders' equity $ 105,800 $ 108,768

=========== ===========

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

(In millions)

Three months Nine months

ended ended

July 31, July 31,

2013 2013

------------ ------------

Cash flows from operating activities:

Net earnings $ 1,390 $ 3,699

Adjustments to reconcile net earnings to net

cash provided by operating activities:

Depreciation and amortization 1,158 3,491

Stock-based compensation expense 107 398

Provision for bad debt and inventory 48 265

Restructuring charges 81 619

Deferred taxes on earnings 70 542

Excess tax benefit from stock-based

compensation (1) (1)

Other, net 117 343

Changes in operating assets and liabilities:

Accounts and financing receivables 492 2,640

Inventory (585) (445)

Accounts payable 980 (70)

Taxes on earnings (94) (520)

Restructuring (242) (644)

Other assets and liabilities (847) (1,525)

------------ ------------

Net cash provided by operating

activities 2,674 8,792

------------ ------------

Cash flows from investing activities:

Investment in property, plant and equipment (880) (2,280)

Proceeds from sale of property, plant and

equipment 233 507

Purchases of available-for-sale securities

and other investments (296) (793)

Maturities and sales of available-for-sale

securities and other investments 282 874

Payments made in connection with business

acquisitions, net of cash acquired - (167)

------------ ------------

Net cash used in investing activities (661) (1,859)

------------ ------------

Cash flows from financing activities:

Repayment of commercial paper and notes

payable, net (37) (170)

Issuance of debt 55 254

Payment of debt (1,805) (3,473)

Issuance of common stock under employee

stock plans 67 279

Repurchase of common stock (3) (1,053)

Excess tax benefit from stock-based

compensation 1 1

Cash dividends paid (280) (821)

------------ ------------

Net cash used in financing activities (2,002) (4,983)

------------ ------------

Increase in cash and cash equivalents 11 1,950

Cash and cash equivalents at beginning of period 13,240 11,301

------------ ------------

Cash and cash equivalents at end of period $ 13,251 $ 13,251

============ ============

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

SEGMENT INFORMATION

(Unaudited)

(In millions)

Three months ended

-------------------------------------

July 31, April 30, July 31,

2013 2013 2012

----------- ----------- -----------

Net revenue:(a)

Personal Systems $ 7,704 $ 7,584 $ 8,636

Printing 5,803 6,081 6,017

----------- ----------- -----------

Total Printing and Personal

Systems Group(b) 13,507 13,665 14,653

Enterprise Group 6,786 6,819 7,492

Enterprise Services 5,843 5,999 6,397

Software 982 941 973

HP Financial Services 879 881 935

Corporate Investments 5 10 11

----------- ----------- -----------

Total segments 28,002 28,315 30,461

Elimination of intersegment net

revenue and other (776) (733) (792)

----------- ----------- -----------

Total HP consolidated net revenue $ 27,226 $ 27,582 $ 29,669

=========== =========== ===========

Earnings before taxes:(a)

Personal Systems $ 228 $ 239 $ 405

Printing 908 958 949

----------- ----------- -----------

Total Printing and Personal

Systems Group(b) 1,136 1,197 1,354

Enterprise Group 1,033 1,082 1,284

Enterprise Services 192 156 240

Software 201 180 175

HP Financial Services 99 97 97

Corporate Investments (58) (56) (57)

----------- ----------- -----------

Total segment earnings from

operations 2,603 2,656 3,093

Corporate and unallocated costs and

eliminations (200) (179) (314)

Unallocated costs related to stock-

based compensation expense (107) (107) (150)

Amortization of purchased

intangible assets (356) (350) (476)

Impairment of goodwill and

purchased intangible assets - - (9,188)

Restructuring charges (81) (408) (1,795)

Acquisition-related charges (4) (11) (3)

Interest and other, net (146) (193) (224)

----------- ----------- -----------

Total HP consolidated earnings

(loss) before taxes $ 1,709 $ 1,408 $ (9,057)

=========== =========== ===========

(a) HP has implemented certain organizational realignments in the first

quarter of fiscal 2013. As a result of these realignments, HP has re-

evaluated its segment financial reporting structure and, effective in

the first quarter of fiscal 2013, created two new financial reporting

segments, the Enterprise Group segment and the Enterprise Services

segment, and eliminated two other financial reporting segments, the

Enterprise Servers, Storage and Networking ("ESSN") segment and the

Services segment. The Enterprise Group segment consists of the business

units within the former ESSN segment and most of the services offerings

of the Technology Services ("TS") business unit, which was previously a

part of the former Services segment. The Enterprise Services segment

consists of the Applications and Business Services ("ABS") and

Infrastructure Technology Outsourcing ("ITO") business units from the

former Services segment, along with the end-user workplace support

services business that was previously a part of the TS business unit.

Taking into account these changes, HP has the following seven financial

reporting segments: Personal Systems, Printing, the Enterprise Group,

Enterprise Services, Software, HP Financial Services and Corporate

Investments.

Also as a result of these realignments, the financial results of the

Personal Systems commercial products support business, which were

previously reported as part of the TS business unit, will now be

reported as part of the Other business unit within the Personal Systems

segment, and the financial results of the portion of the business

intelligence services business that had continued to be reported as part

of the Corporate Investments segment following the implementation of

prior realignment actions will now be reported as part of the ABS

business unit. In addition, the end-user workplace support services

business, which, as noted above, was previously a part of the TS

business unit and will now become a part of the Enterprise Services

segment, will be reported as part of the ITO business unit within that

segment.

To provide improved visibility and comparability, HP has reflected these

changes to its reporting structure in prior financial reporting periods

on an as-if basis, which has resulted in the transfer of revenue and

operating profit among the Personal Systems, the Enterprise Group,

Enterprise Services and Corporate Investments segments. These changes

had no impact on the previously reported financial results for the

Printing, Software or HP Financial Services segments. In addition, none

of these changes impacted HP's previously reported consolidated net

revenue, earnings from operations, net earnings or net earnings per

share.

(b) The Personal Systems segment and the Printing segment are structured

beneath a broader Printing and Personal Systems Group ("PPS"). While PPS

is not a financial reporting segment, HP provides financial data

aggregating the segments within it in order to provide a supplementary

view of its business.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

SEGMENT INFORMATION

(Unaudited)

(In millions)

Nine months ended

July 31,

------------------------

2013 2012

----------- -----------

Net revenue:(a)

Personal Systems $ 23,492 $ 26,998

Printing 17,810 18,407

----------- -----------

Total Printing and Personal Systems Group(b) 41,302 45,405

Enterprise Group 20,589 22,320

Enterprise Services 17,761 19,257

Software 2,849 2,889

HP Financial Services 2,717 2,853

Corporate Investments 19 48

----------- -----------

Total Segments 85,237 92,772

Elimination of intersegment net revenue and

other (2,070) (2,374)

----------- -----------

Total HP consolidated net revenue $ 83,167 $ 90,398

=========== ===========

Earnings before taxes:(a)

Personal Systems $ 690 $ 1,380

Printing 2,819 2,518

----------- -----------

Total Printing and Personal Systems Group(b) 3,509 3,898

Enterprise Group 3,199 3,965

Enterprise Services 424 622

Software 538 509

HP Financial Services 297 284

Corporate Investments (179) (155)

----------- -----------

Total segment earnings from operations 7,788 9,123

Corporate and unallocated costs and eliminations (488) (670)

Unallocated costs related to stock-based

compensation expense (398) (492)

Amortization of purchased intangible assets (1,056) (1,412)

Impairment of goodwill and purchased intangible

assets - (9,188)

Restructuring charges (619) (1,888)

Acquisition-related charges (19) (42)

Interest and other, net (518) (688)

----------- -----------

Total HP consolidated earnings (loss) before

taxes $ 4,690 $ (5,257)

=========== ===========

(a) HP has implemented certain organizational realignments in the first

quarter of fiscal 2013. As a result of these realignments, HP has re-

evaluated its segment financial reporting structure and, effective in

the first quarter of fiscal 2013, created two new financial reporting

segments, the Enterprise Group segment and the Enterprise Services

segment, and eliminated two other financial reporting segments, the

Enterprise Servers, Storage and Networking ("ESSN") segment and the

Services segment. The Enterprise Group segment consists of the business

units within the former ESSN segment and most of the services offerings

of the Technology Services ("TS") business unit, which was previously a

part of the former Services segment. The Enterprise Services segment

consists of the Applications and Business Services ("ABS") and

Infrastructure Technology Outsourcing ("ITO") business units from the

former Services segment, along with the end-user workplace support

services business that was previously a part of the TS business unit.

Taking into account these changes, HP has the following seven financial

reporting segments: Personal Systems, Printing, the Enterprise Group,

Enterprise Services, Software, HP Financial Services and Corporate

Investments.

Also as a result of these realignments, the financial results of the

Personal Systems commercial products support business, which were

previously reported as part of the TS business unit, will now be

reported as part of the Other business unit within the Personal Systems

segment, and the financial results of the portion of the business

intelligence services business that had continued to be reported as part

of the Corporate Investments segment following the implementation of

prior realignment actions will now be reported as part of the ABS

business unit. In addition, the end-user workplace support services

business, which, as noted above, was previously a part of the TS

business unit and will now become a part of the Enterprise Services

segment, will be reported as part of the ITO business unit within that

segment.

To provide improved visibility and comparability, HP has reflected these

changes to its reporting structure in prior financial reporting periods

on an as-if basis, which has resulted in the transfer of revenue and

operating profit among the Personal Systems, the Enterprise Group,

Enterprise Services and Corporate Investments segments. These changes

had no impact on the previously reported financial results for the

Printing, Software or HP Financial Services segments. In addition, none

of these changes impacted HP's previously reported consolidated net

revenue, earnings from operations, net earnings or net earnings per

share.

(b) The Personal Systems segment and the Printing segment are structured

beneath a broader Printing and Personal Systems Group ("PPS"). While PPS

is not a financial reporting segment, HP provides financial data

aggregating the segments within it in order to provide a supplementary

view of its business.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

SEGMENT / BUSINESS UNIT INFORMATION

(Unaudited)

(In millions)

Growth rate

Three months ended (%)

------------------------------- -------------

July 31, April 30, July 31,

2013 2013 2012 Q/Q Y/Y

--------- --------- --------- ----- -----

Net revenue:(a)

Printing and Personal

Systems Group(b)

Personal Systems

Notebooks $ 3,722 $ 3,718 $ 4,416 0% (16%)

Desktops 3,147 3,103 3,486 1% (10%)

Workstations 537 521 526 3% 2%

Other 298 242 208 23% 43%

--------- --------- ---------

Total Personal

Systems 7,704 7,584 8,636 2% (11%)

--------- --------- ---------

Printing

Supplies 3,839 4,122 4,005 (7%) (4%)

Commercial Hardware 1,399 1,398 1,445 0% (3%)

Consumer Hardware 565 561 567 1% 0%

--------- --------- ---------

Total Printing 5,803 6,081 6,017 (5%) (4%)

--------- --------- ---------

Total Printing

and Personal

Systems Group 13,507 13,665 14,653 (1%) (8%)

--------- --------- ---------

Enterprise Group

Industry Standard

Servers 2,851 2,806 3,187 2% (11%)

Technology Services 2,174 2,272 2,349 (4%) (7%)

Storage 833 857 924 (3%) (10%)

Networking 644 618 647 4% 0%

Business Critical

Systems 284 266 385 7% (26%)

--------- --------- ---------

Total Enterprise

Group 6,786 6,819 7,492 0% (9%)

--------- --------- ---------

Enterprise Services

Infrastructure

Technology

Outsourcing 3,662 3,721 3,934 (2%) (7%)

Application and

Business Services 2,181 2,278 2,463 (4%) (11%)

--------- --------- ---------

Total Enterprise

Services 5,843 5,999 6,397 (3%) (9%)

--------- --------- ---------

Software 982 941 973 4% 1%

--------- --------- ---------

HP Financial Services 879 881 935 0% (6%)

--------- --------- ---------

Corporate Investments 5 10 11 (50%) (55%)

--------- --------- ---------

Total segments 28,002 28,315 30,461 (1%) (8%)

--------- --------- ---------

Elimination of

intersegment net

revenue and other (776) (733) (792) 6% (2%)

--------- --------- ---------

Total HP consolidated

net revenue $ 27,226 $ 27,582 $ 29,669 (1%) (8%)

========= ========= ========= ===== =====

(a) HP has implemented certain organizational realignments in the first

quarter of fiscal 2013. As a result of these realignments, HP has re-

evaluated its segment financial reporting structure and, effective in

the first quarter of fiscal 2013, created two new financial reporting

segments, the Enterprise Group segment and the Enterprise Services

segment, and eliminated two other financial reporting segments, the

Enterprise Servers, Storage and Networking ("ESSN") segment and the

Services segment. The Enterprise Group segment consists of the business

units within the former ESSN segment and most of the services offerings

of the Technology Services ("TS") business unit, which was previously a

part of the former Services segment. The Enterprise Services segment

consists of the Applications and Business Services ("ABS") and

Infrastructure Technology Outsourcing ("ITO") business units from the

former Services segment, along with the end-user workplace support

services business that was previously a part of the TS business unit.

Taking into account these changes, HP has the following seven financial

reporting segments: Personal Systems, Printing, the Enterprise Group,

Enterprise Services, Software, HP Financial Services and Corporate

Investments.

Also as a result of these realignments, the financial results of the

Personal Systems commercial products support business, which were

previously reported as part of the TS business unit, will now be

reported as part of the Other business unit within the Personal Systems

segment, and the financial results of the portion of the business

intelligence services business that had continued to be reported as part

of the Corporate Investments segment following the implementation of

prior realignment actions will now be reported as part of the ABS

business unit. In addition, the end-user workplace support services

business, which, as noted above, was previously a part of the TS

business unit and will now become a part of the Enterprise Services

segment, will be reported as part of the ITO business unit within that

segment.

To provide improved visibility and comparability, HP has reflected these

changes to its reporting structure in prior financial reporting periods

on an as-if basis, which has resulted in the transfer of revenue and

operating profit among the Personal Systems, the Enterprise Group,

Enterprise Services and Corporate Investments segments. These changes

had no impact on the previously reported financial results for the

Printing, Software or HP Financial Services segments. In addition, none

of these changes impacted HP's previously reported consolidated net

revenue, earnings from operations, net earnings or net earnings per

share.

(b) The Personal Systems segment and the Printing segment are structured

beneath a broader Printing and Personal Systems Group ("PPS"). While PPS

is not a financial reporting segment, HP provides financial data

aggregating the segments within it in order to provide a supplementary

view of its business.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

SEGMENT / BUSINESS UNIT INFORMATION

(Unaudited)

(In millions)

Nine months ended

July 31,

------------------------

2013 2012

----------- -----------

Net revenue:(a)

Printing and Personal Systems Group(b)

Personal Systems

Notebooks $ 11,568 $ 14,258

Desktops 9,571 10,519

Workstations 1,593 1,598

Other 760 623

----------- -----------

Total Personal Systems 23,492 26,998

----------- -----------

Printing

Supplies 11,854 12,144

Commercial Hardware 4,151 4,413

Consumer Hardware 1,805 1,850

----------- -----------

Total Printing 17,810 18,407

----------- -----------

Total Printing and Personal Systems

Group 41,302 45,405

----------- -----------

Enterprise Group

Industry Standard Servers 8,651 9,445

Technology Services 6,689 6,948

Storage 2,523 2,869

Networking 1,870 1,847

Business Critical Systems 856 1,211

----------- -----------

Total Enterprise Group 20,589 22,320

----------- -----------

Enterprise Services

Infrastructure Technology Outsourcing 11,119 11,868

Application and Business Services 6,642 7,389

----------- -----------

Total Enterprise Services 17,761 19,257

----------- -----------

Software 2,849 2,889

----------- -----------

HP Financial Services 2,717 2,853

----------- -----------

Corporate Investments 19 48

----------- -----------

Total segments 85,237 92,772

----------- -----------

Elimination of intersegment net revenue and

other (2,070) (2,374)

----------- -----------

Total HP consolidated net revenue $ 83,167 $ 90,398

=========== ===========

(a) HP has implemented certain organizational realignments in the first

quarter of fiscal 2013. As a result of these realignments, HP has re-

evaluated its segment financial reporting structure and, effective in

the first quarter of fiscal 2013, created two new financial reporting

segments, the Enterprise Group segment and the Enterprise Services

segment, and eliminated two other financial reporting segments, the

Enterprise Servers, Storage and Networking ("ESSN") segment and the

Services segment. The Enterprise Group segment consists of the business

units within the former ESSN segment and most of the services offerings

of the Technology Services ("TS") business unit, which was previously a

part of the former Services segment. The Enterprise Services segment

consists of the Applications and Business Services ("ABS") and

Infrastructure Technology Outsourcing ("ITO") business units from the

former Services segment, along with the end-user workplace support

services business that was previously a part of the TS business unit.

Taking into account these changes, HP has the following seven financial

reporting segments: Personal Systems, Printing, the Enterprise Group,

Enterprise Services, Software, HP Financial Services and Corporate

Investments.

Also as a result of these realignments, the financial results of the

Personal Systems commercial products support business, which were

previously reported as part of the TS business unit, will now be

reported as part of the Other business unit within the Personal Systems

segment, and the financial results of the portion of the business

intelligence services business that had continued to be reported as part

of the Corporate Investments segment following the implementation of

prior realignment actions will now be reported as part of the ABS

business unit. In addition, the end-user workplace support services

business, which, as noted above, was previously a part of the TS

business unit and will now become a part of the Enterprise Services

segment, will be reported as part of the ITO business unit within that

segment.

To provide improved visibility and comparability, HP has reflected these

changes to its reporting structure in prior financial reporting periods

on an as-if basis, which has resulted in the transfer of revenue and

operating profit among the Personal Systems, the Enterprise Group,

Enterprise Services and Corporate Investments segments. These changes

had no impact on the previously reported financial results for the

Printing, Software or HP Financial Services segments. In addition, none

of these changes impacted HP's previously reported consolidated net

revenue, earnings from operations, net earnings or net earnings per

share.

(b) The Personal Systems segment and the Printing segment are structured

beneath a broader Printing and Personal Systems Group ("PPS"). While PPS

is not a financial reporting segment, HP provides financial data

aggregating the segments within it in order to provide a supplementary

view of its business.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

SEGMENT NON-GAAP OPERATING MARGIN SUMMARY DATA

(Unaudited)

Three months Change in Operating

ended Margin (pts)

------------- ----------------------

July 31,

2013 Q/Q Y/Y

------------- ---------- ----------

Non-GAAP operating margin:(a)

Personal Systems 3.0% (0.2 pts) (1.7 pts)

Printing 15.6% (0.2 pts) (0.2 pts)

Printing and Personal Systems

Group(b) 8.4% (0.4 pts) (0.8 pts)

Enterprise Group 15.2% (0.7 pts) (1.9 pts)

Enterprise Services 3.3% 0.7 pts (0.5 pts)

Software 20.5% 1.4 pts 2.5 pts

HP Financial Services 11.3% 0.3 pts 0.9 pts

Corporate Investments NM NM NM

Total segments 9.3% (0.1 pts) (0.8 pts)

Total HP consolidated non-GAAP

operating margin 8.4% (0.2 pts) (0.8 pts)

(a) HP has implemented certain organizational realignments in the first

quarter of fiscal 2013. As a result of these realignments, HP has re-

evaluated its segment financial reporting structure and, effective in

the first quarter of fiscal 2013, created two new financial reporting

segments, the Enterprise Group segment and the Enterprise Services

segment, and eliminated two other financial reporting segments, the

Enterprise Servers, Storage and Networking ("ESSN") segment and the

Services segment. The Enterprise Group segment consists of the business

units within the former ESSN segment and most of the services offerings

of the Technology Services ("TS") business unit, which was previously a

part of the former Services segment. The Enterprise Services segment

consists of the Applications and Business Services ("ABS") and

Infrastructure Technology Outsourcing ("ITO") business units from the

former Services segment, along with the end-user workplace support

services business that was previously a part of the TS business unit.

Taking into account these changes, HP has the following seven financial

reporting segments: Personal Systems, Printing, the Enterprise Group,

Enterprise Services, Software, HP Financial Services and Corporate

Investments.

Also as a result of these realignments, the financial results of the

Personal Systems commercial products support business, which were

previously reported as part of the TS business unit, will now be

reported as part of the Other business unit within the Personal Systems

segment, and the financial results of the portion of the business

intelligence services business that had continued to be reported as part

of the Corporate Investments segment following the implementation of

prior realignment actions will now be reported as part of the ABS

business unit. In addition, the end-user workplace support services

business, which, as noted above, was previously a part of the TS

business unit and will now become a part of the Enterprise Services

segment, will be reported as part of the ITO business unit within that

segment.

To provide improved visibility and comparability, HP has reflected these

changes to its reporting structure in prior financial reporting periods

on an as-if basis, which has resulted in the transfer of revenue and

operating profit among the Personal Systems, the Enterprise Group,

Enterprise Services and Corporate Investments segments. These changes

had no impact on the previously reported financial results for the

Printing, Software or HP Financial Services segments. In addition, none

of these changes impacted HP's previously reported consolidated net

revenue, earnings from operations, net earnings or net earnings per

share.

(b) The Personal Systems segment and the Printing segment are structured

beneath a broader Printing and Personal Systems Group ("PPS"). While PPS

is not a financial reporting segment, HP provides financial data

aggregating the segments within it in order to provide a supplementary

view of its business.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

CALCULATION OF NET EARNINGS PER SHARE

(Unaudited)

(In millions except per share amounts)

Three months ended

----------------------------------

July 31, April 30, July 31,

2013 2013 2012

---------- ---------- ----------

Numerator:

GAAP net earnings (loss) $ 1,390 $ 1,077 $ (8,857)

========== ========== ==========

Non-GAAP net earnings $ 1,676 $ 1,698 $ 1,973

========== ========== ==========

Denominator:

Weighted-average shares used to

compute basic net earnings (loss) per

share and diluted net (loss) per

share 1,929 1,935 1,971

Dilutive effect of employee stock

plans 19 12 4

---------- ---------- ----------

Weighted-average shares used to

compute diluted net earnings per

share 1,948 1,947 1,975

========== ========== ==========

GAAP net earnings (loss) per share:

Basic $ 0.72 $ 0.56 $ (4.49)

Diluted(a) $ 0.71 $ 0.55 $ (4.49)

Non-GAAP net earnings per share:

Basic $ 0.87 $ 0.88 $ 1.00

Diluted(b) $ 0.86 $ 0.87 $ 1.00

(a) GAAP diluted net earnings per share reflects any dilutive effect of

outstanding stock options, performance-based restricted units,

restricted stock units and restricted stock, but that effect is excluded

when calculating GAAP diluted net (loss) per share because it would be

anti-dilutive.

(b) Non-GAAP diluted net earnings per share reflects any dilutive effect of

outstanding stock options, performance-based restricted units,

restricted stock units and restricted stock.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

CALCULATION OF NET EARNINGS PER SHARE

(Unaudited)

(In millions except per share amounts)

Nine months ended

July 31,

------------------------

2013 2012

----------- -----------

Numerator:

GAAP net earnings (loss) $ 3,699 $ (5,796)

=========== ===========

Non-GAAP net earnings $ 4,979 $ 5,754

=========== ===========

Denominator:

Weighted-average shares used to compute basic

net earnings (loss) per share and diluted net

(loss) per share 1,939 1,977

Dilutive effect of employee stock plans 13 15

----------- -----------

Weighted-average shares used to compute

diluted net earnings per share 1,952 1,992

=========== ===========

GAAP net earnings (loss) per share:

Basic $ 1.91 $ (2.93)

Diluted(a) $ 1.89 $ (2.93)

Non-GAAP net earnings per share:

Basic $ 2.57 $ 2.91

Diluted(b) $ 2.55 $ 2.89

(a) GAAP diluted net earnings per share reflects any dilutive effect of

outstanding stock options, performance-based restricted units,

restricted stock units and restricted stock, but that effect is excluded

when calculating GAAP diluted net (loss) per share because it would be

anti-dilutive.

(b) Non-GAAP diluted net earnings per share reflects any dilutive effect of

outstanding stock options, performance-based restricted units,

restricted stock units and restricted stock.

Use of non-GAAP financial measures To

supplement HP's consolidated condensed financial statements

presented on a GAAP basis, HP provides non-GAAP operating profit,

non-GAAP operating margin, non-GAAP net earnings, non-GAAP diluted

earnings per share, gross cash, free cash flow, net debt and

operating company net debt. HP also provides forecasts of non-GAAP

diluted earnings per share. These non-GAAP financial measures are

not in accordance with, or an alternative for, generally accepted

accounting principles in the United States. The GAAP measure most

directly comparable to non-GAAP operating profit is earnings from

operations. The GAAP measure most directly comparable to non-GAAP

operating margin is operating margin. The GAAP measure most

directly comparable to non-GAAP net earnings is net earnings. The

GAAP measure most directly comparable to non-GAAP diluted earnings

per share is diluted net earnings per share. The GAAP measure most

directly comparable to gross cash is cash and cash equivalents. The

GAAP measure most directly comparable to free cash flow is cash

flow from operations. The GAAP measure most directly comparable to

net debt and operating company net debt is total company debt.

Reconciliations of each of these non-GAAP financial measures to

GAAP information are included in the tables above or elsewhere in

the materials accompanying this news release.

Use and economic substance of non-GAAP

financial measures used by HP Non-GAAP operating profit and

non-GAAP operating margin are defined to exclude the effects of any

restructuring charges, charges relating to the impairment of

goodwill and purchased intangible assets, charges relating to the

amortization of purchased intangible assets, acquisition-related

charges and charges related to the wind-down of HP businesses

recorded during the relevant period. Non-GAAP net earnings and

non-GAAP diluted earnings per share consist of net earnings or

diluted net earnings per share excluding those same charges. In

addition, non-GAAP net earnings and non-GAAP diluted earnings per

share are adjusted by the amount of additional taxes or tax benefit

associated with each non-GAAP item. HP's management uses these

non-GAAP financial measures for purposes of evaluating HP's

historical and prospective financial performance, as well as HP's

performance relative to its competitors. HP's management also uses

these non-GAAP measures to further its own understanding of HP's

segment operating performance. HP believes that excluding those

items mentioned above from these non-GAAP financial measures allows

HP management to better understand HP's consolidated financial

performance in relationship to the operating results of HP's

segments, as management does not believe that the excluded items

are reflective of ongoing operating results. More specifically,

HP's management excludes each of those items mentioned above for

the following reasons:

- In the third quarter of fiscal 2012, HP decided to wind down

certain retail publishing business activities. Non-GAAP operating

profit reported in the third quarter of fiscal 2012 reflects the

elimination of certain contract-related charges, including

inventory write-downs, in connection with the wind down of that

business. Because the winding down of HP businesses is inconsistent

in amount and frequency, HP believes that eliminating these amounts

for purposes of calculating non-GAAP operating profit facilitates a

more meaningful evaluation of HP's current operating performance

and comparisons to HP's past and future operating performance.

- Goodwill is the excess of the consideration paid for acquired

companies over the estimated fair value of the tangible and

intangible assets acquired, liabilities assumed and any

noncontrolling interests in the acquiree. Purchased intangible

assets consist primarily of customer contracts, customer lists,

distribution agreements, technology patents, and products,

trademarks and trade names purchased in connection with

acquisitions. In the fourth quarter of fiscal 2012, HP recorded a

non-cash charge for the impairment of goodwill and intangible

assets associated with the acquisition of Autonomy Corporation plc.

In the third quarter of fiscal 2012, HP recorded an impairment

charge for the goodwill associated with its Services segment

following an impairment review. In addition, in that same quarter,

HP recorded an impairment charge related to the intangible asset

associated with the "Compaq" trade name acquired in 2002 in

conjunction with a change in branding strategy. HP excludes these

charges for purposes of calculating these non-GAAP measures to

facilitate a more meaningful evaluation of HP's current operating

performance and comparisons to HP's past and future operating

performance.

- HP incurs charges relating to the amortization of purchased

intangibles. HP also incurs charges relating to the amortization of

amounts assigned to intangible assets to be used in research and

development projects. All of those charges are included in HP's

GAAP presentation of earnings from operations, operating margin,

net earnings and net earnings per share. Such charges are

significantly impacted by the timing and magnitude of HP's

acquisitions and any impairment charges. Consequently, HP excludes

these charges for purposes of calculating these non-GAAP measures

to facilitate a more meaningful evaluation of HP's current

operating performance and comparisons to HP's past and future

operating performance.

- Restructuring charges consist of costs associated with a formal

restructuring plan and are primarily related to (i) employee

termination costs and benefits, and (ii) costs to vacate

duplicative facilities. HP excludes these restructuring costs (and

any reversals of charges recorded in prior periods) for purposes of

calculating these non-GAAP measures because it believes that these

historical costs do not reflect expected future operating expenses

and do not contribute to a meaningful evaluation of HP's current

operating performance or comparisons to HP's past and future

operating performance.

- HP incurs costs related to its acquisitions. As

acquisition-related expenses are inconsistent in amount and

frequency and are significantly impacted by the timing and nature

of HP's acquisitions, HP believes that eliminating the expenses for

purposes of calculating these non-GAAP measures facilitates a more

meaningful evaluation of HP's current operating performance and

comparisons to HP's past and future operating performance.

Gross cash is a non-GAAP measure that is defined as cash and

cash equivalents plus short-term investments and certain long-term

investments that may be liquidated within 90 days pursuant to the

terms of existing put options or similar rights. Free cash flow is

defined as cash flow from operations less net capital expenditures.

HP's management uses gross cash and free cash flow for the purpose

of determining the amount of cash available for investment in HP's

businesses, funding acquisitions, repurchasing stock and other

purposes. HP's management also uses gross cash and free cash flow

for the purposes of evaluating HP's historical and prospective

liquidity, as well as to further its own understanding of HP's

segment operating results. Because gross cash includes liquid

assets that are not included in GAAP cash and cash equivalents, HP

believes that gross cash provides a more accurate and complete

assessment of HP's liquidity and segment operating results. Because

free cash flow includes the effect of capital expenditures that are

not reflected in GAAP cash flow from operations, HP believes that

free cash flow provides a more accurate and complete assessment of

HP's liquidity and capital resources.

Operating company net debt is a non-GAAP measure that is defined

as total company net debt less HP Financial Services ("HPFS") net

debt. Total company net debt consists of total debt (including the

effect of hedging) less gross cash, which includes cash and cash

equivalents, short-term investments, and certain liquid long-term

investments. HPFS net debt consists of HPFS debt, which includes

primarily intercompany equity that is treated as debt for segment

reporting purposes, intercompany debt and debt issued directly by

HPFS, less HPFS cash. Total company net debt provides useful

information to management about the state of HP's consolidated

balance sheet. Operating company net debt provides additional

useful information to management about the state of HP's

consolidated balance sheet by providing more transparency into the

financial components of the operating company separate from HP's

financing business, which has different capital structure

requirements and requires much greater leverage to run

effectively.

Material limitations associated with use of

non-GAAP financial measures These non-GAAP financial measures

may have limitations as analytical tools, and these measures should

not be considered in isolation or as a substitute for analysis of

HP's results as reported under GAAP. Some of the limitations in

relying on these non-GAAP financial measures are:

- Items such as amortization of purchased intangible assets,

though not directly affecting HP's cash position, represent the

loss in value of intangible assets over time. The expense

associated with this loss in value is not included in non-GAAP

operating profit, non-GAAP operating margin, non-GAAP net earnings

and non-GAAP diluted earnings per share and therefore does not

reflect the full economic effect of the loss in value of those

intangible assets.

- Items such as restructuring charges that are excluded from

non-GAAP operating profit, non-GAAP operating margin, non-GAAP net

earnings and non-GAAP diluted earnings per share can have a

material impact on cash flows and earnings per share.

- HP may not be able to liquidate immediately the long-term

investments included in gross cash, which may limit the usefulness

of gross cash as a liquidity measure.

- Other companies may calculate non-GAAP operating profit,

non-GAAP operating margin, non-GAAP net earnings, non-GAAP diluted

earnings per share, gross cash, free cash flow, net debt and

operating company net debt differently than HP does, limiting the

usefulness of those measures for comparative purposes.

Compensation for limitations associated with

use of non-GAAP financial measures HP compensates for the

limitations on its use of non-GAAP operating profit, non-GAAP

operating margin, non-GAAP net earnings, non-GAAP diluted earnings

per share, gross cash, free cash flow, net debt and operating

company net debt by relying primarily on its GAAP results and using

non-GAAP financial measures only supplementally. HP also provides

robust and detailed reconciliations of each non-GAAP financial

measure to its most directly comparable GAAP measure within this

press release and in other written materials that include these

non-GAAP financial measures, and HP encourages investors to review

carefully those reconciliations.

Usefulness of non-GAAP financial measures to

investors HP believes that providing non-GAAP operating

profit, non-GAAP operating margin, non-GAAP net earnings, non-GAAP

diluted earnings per share, gross cash, free cash flow, net debt

and operating company net debt to investors in addition to the

related GAAP measures provides investors with greater transparency

to the information used by HP's management in its financial and

operational decision-making and allows investors to see HP's

results "through the eyes" of management. HP further believes that

providing this information better enables HP's investors to

understand HP's operating performance and to evaluate the efficacy

of the methodology and information used by management to evaluate

and measure such performance. Disclosure of these non-GAAP

financial measures also facilitates comparisons of HP's operating

performance with the performance of other companies in HP's

industry that supplement their GAAP results with non-GAAP financial

measures that are calculated in a similar manner.

© 2013 Hewlett-Packard Development Company, L.P. The information

contained herein is subject to change without notice. HP shall not

be liable for technical or editorial errors or omissions contained

herein.

Add to Digg Bookmark with del.icio.us Add to Newsvine

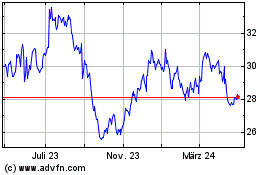

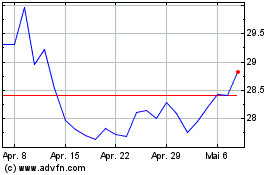

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024