Enovis™ Corporation (NYSE: ENOV), an innovation-driven medical

technology growth company, today announced its financial results

for the second quarter ended June 28, 2024. The Company will

host an investor conference call and live webcast to discuss these

results today at 8:00 am ET.

Second Quarter 2024 Financial

Results

Enovis’ second-quarter net sales of $525 million

grew 23% on a reported basis and 5% on a Comparable sales basis

from the same quarter in 2023. Second-quarter results reflect

stable execution in P&R, strong growth in International Recon,

and the addition of recent acquisitions – Lima and Novastep.

Compared to the same quarter in 2023, net sales in Recon grew 60%

on a reported basis, with 7% Comparable sales growth, and P&R

grew 2% on a reported basis and 3% on a Comparable sales basis.

Enovis also reported second-quarter net loss

from continuing operations of $18 million, or a loss of 3.5% of

sales on a reported basis, and adjusted EBITDA of $90 million, or

17.2% of sales on a reported basis, an increase of 190 basis points

versus the comparable prior-year quarter.

The Company reported second-quarter 2024 net

loss from continuing operations of $0.34 per share and adjusted

earnings per diluted share of $0.62.

“We continue to execute against our plan for the

year and are off to a great start integrating our transformational

Lima acquisition,” said Matt Trerotola, Chief Executive Officer of

Enovis. “The progress we have made year-to-date, as well as our

robust lineup of important new product introductions, sets us up

well for accelerating growth and profitability into 2025 and

beyond.”

Second Quarter 2024 Business

Highlights

- Received FDA 510k clearance for

Arvis 2.0 Shoulder and Altivate Reverse Glenoid system with both

launches expected to occur in Q3 2024

- Opened our Business Technology

Center in Lisbon to support the digitization of the Company and an

improved customer experience

- Celebrated the grand opening of a

new manufacturing facility in San Daniele to support the expansion

and optimization of our global manufacturing capabilities

- Q2 adjusted EBITDA margin improved

190 basis points year over year, driven by the addition of Lima,

product and geographic mix, new product introductions, and

execution on key EGX initiatives

2024 Financial Outlook

Enovis narrowed its revenue range and reaffirmed

adjusted EBITDA expectations for 2024. Full-year revenue is

estimated at $2.08-$2.13 billion, and adjusted EBITDA is forecasted

to be $368-$383 million. The Company also raised its full-year

adjusted earnings per diluted share guidance from $2.52-$2.67 to

$2.62-$2.77.

Conference call and Webcast

Investors can access the webcast via a link on

the Enovis website, www.enovis.com. For those planning to

participate on the call, please dial (833) 685-0901 (U.S. callers)

or +1 (412) 317-5715 (International callers) and ask to join the

Enovis call. A link to a replay of the call will also be available

on the Enovis website later in the day.

ABOUT ENOVIS

Enovis Corporation (NYSE: ENOV) is an

innovation-driven medical technology growth company dedicated to

developing clinically differentiated solutions that generate

measurably better patient outcomes and transform workflows. Powered

by a culture of continuous improvement, global talent and

innovation, the Company’s extensive range of products, services and

integrated technologies fuels active lifestyles in orthopedics and

beyond. The Company’s shares of common stock are listed in the

United States on the New York Stock Exchange under the symbol ENOV.

For more information about Enovis, please visit www.enovis.com.

Availability of Information on the Enovis

Website

Investors and others should note that Enovis

routinely announces material information to investors and the

marketplace using SEC filings, press releases, public conference

calls, webcasts and the Enovis Investor Relations website. While

not all of the information that the Company posts to the Enovis

Investor Relations website is of a material nature, some

information could be deemed to be material. Accordingly, the

Company encourages investors, the media and others interested in

Enovis to review the information that it shares on

ir.enovis.com.

Forward-Looking Statements

This press release includes forward-looking

statements, including forward-looking statements within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to,

statements concerning Enovis’ plans, goals, objectives, outlook,

expectations and intentions, including the potential benefits of

the recently completed acquisition of Lima, and other statements

that are not historical or current fact. Forward-looking statements

are based on Enovis’ current expectations and involve risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in such forward-looking statements.

Factors that could cause Enovis’ results to differ materially from

current expectations include, but are not limited to, risks related

to Enovis’ recently completed acquisition of Lima; the impact of

public health emergencies and global pandemics (including

COVID-19); disruptions in the global economy caused by escalating

geopolitical tensions including in connection with Russia’s

invasion of Ukraine; macroeconomic conditions, including the impact

of increasing inflationary pressures; supply chain disruptions;

increasing energy costs and availability concerns, particularly in

the European market; other impacts on Enovis’ business and ability

to execute business continuity plans; and the other factors

detailed in Enovis’ reports filed with the U.S. Securities and

Exchange Commission (the “SEC”), including its most recent Annual

Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q

under the caption “Risk Factors,” as well as the other risks

discussed in Enovis’ filings with the SEC. In addition, these

statements are based on assumptions that are subject to change.

This press release speaks only as of the date hereof. Enovis

disclaims any duty to update the information herein.

Non-GAAP Financial Measures

Enovis has provided in this press release

financial information that has not been prepared in accordance with

accounting principles generally accepted in the United States of

America (“non-GAAP”). These non-GAAP financial measures may include

one or more of the following: adjusted net income from continuing

operations (“Adjusted net income”), Adjusted net income per diluted

share, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted gross

profit, Adjusted gross profit margin, Comparable sales, Comparable

sales growth, and Comparable sales growth on constant currency

basis.

Adjusted net income and Adjusted net income per

diluted share excludes restructuring and other charges, European

Union Medical Device Regulation (“MDR”) and other costs,

amortization of acquired intangibles, inventory step up costs,

property plant and equipment step-up depreciation, strategic

transaction costs, stock compensation costs, other income/expense,

and it includes the tax effect of adjusted pre-tax income at

applicable tax rates and other tax adjustments. Enovis also

presents Adjusted net income margin, which is subject to the same

adjustments as Adjusted net income.

Adjusted EBITDA represents Adjusted net income

excluding interest, taxes, and depreciation and amortization.

Enovis presents Adjusted EBITDA margin, which is subject to the

same adjustments as Adjusted EBITDA.

Adjusted gross profit represents gross profit

excluding the fair value charges of acquired inventory and the

impact of restructuring and other charges. Adjusted gross profit

margin is subject to the same adjustments as Adjusted gross

profit.

Comparable sales adjusts net sales for prior

periods to include the sales of acquired businesses (including Lima

and Novastep) prior to our ownership from acquisitions that closed

in the periods presented and to exclude the net sales of certain

non-core product lines that were divested or discontinued, as

applicable, during the periods presented.

Comparable sales growth represents the change in

Comparable sales for the current period from Comparable sales for

the prior year period.

Comparable sales growth on constant currency

basis represents Comparable sales growth excluding the impact of

foreign exchange rate fluctuations.

Comparable sales, comparable sales growth and

comparative sales growth on a constant currency basis are presented

for illustrative purposes only and do not and are not intended to

comply with Article 11 of Regulation S-X promulgated by the SEC in

respect of proforma financial information, and may differ,

including materially, from proforma financial statements presented

in accordance therewith.

These non-GAAP financial measures assist Enovis

management in comparing its operating performance over time because

certain items may obscure underlying business trends and make

comparisons of long-term performance difficult, as they are of a

nature and/or size that occur with inconsistent frequency or relate

to discrete restructuring plans that are fundamentally different

from the ongoing productivity improvements of the Company. Enovis

management also believes that presenting these measures allows

investors to view its performance using the same measures that the

Company uses in evaluating its financial and business performance

and trends. Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

calculated in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP measures to their most

directly comparable GAAP financial measures. A reconciliation of

non-GAAP financial measures presented above to GAAP results has

been provided in the financial tables included in this press

release. Enovis does not provide reconciliations of adjusted EBITDA

or adjusted earnings per share on a forward-looking basis to the

closest GAAP financial measures, as such information is not

available without unreasonable efforts on a forward-looking basis

due to uncertainties regarding, and the potential variability of,

reconciling items excluded from these measures. These items are

uncertain, depend on various factors, and could have a material

impact on GAAP reported results for the guidance period.

Kyle RoseVice President, Investor

RelationsEnovis

Corporation+1-917-734-7450investorrelations@enovis.com

Enovis

CorporationCondensed Consolidated Statements of

OperationsDollars in thousands, except per share

data(Unaudited)

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 28, 2024 |

|

June 30, 2023 |

|

June 28, 2024 |

|

June 30, 2023 |

| Net sales |

|

$ |

525,160 |

|

|

$ |

428,502 |

|

|

$ |

1,041,426 |

|

|

$ |

834,653 |

|

| Cost of sales |

|

|

236,277 |

|

|

|

180,143 |

|

|

|

454,647 |

|

|

|

351,229 |

|

| Gross profit |

|

|

288,883 |

|

|

|

248,359 |

|

|

|

586,779 |

|

|

|

483,424 |

|

| Gross profit margin |

|

|

55.0 |

% |

|

|

58.0 |

% |

|

|

56.3 |

% |

|

|

57.9 |

% |

| Selling, general and

administrative expense |

|

|

264,100 |

|

|

|

207,881 |

|

|

|

519,791 |

|

|

|

415,046 |

|

| Research and development

expense |

|

|

23,479 |

|

|

|

18,918 |

|

|

|

46,856 |

|

|

|

37,111 |

|

| Amortization of acquired

intangibles |

|

|

40,936 |

|

|

|

32,249 |

|

|

|

81,867 |

|

|

|

64,289 |

|

| Restructuring and other

charges |

|

|

4,587 |

|

|

|

3,805 |

|

|

|

17,498 |

|

|

|

6,440 |

|

| Operating loss |

|

|

(44,219 |

) |

|

|

(14,494 |

) |

|

|

(79,233 |

) |

|

|

(39,462 |

) |

| Operating loss margin |

|

(8.4) % |

|

(3.4) % |

|

(7.6) % |

|

(4.7) % |

| Interest expense, net |

|

|

16,969 |

|

|

|

4,076 |

|

|

|

36,965 |

|

|

|

9,728 |

|

| Other (income) expense,

net |

|

|

(33,836 |

) |

|

|

753 |

|

|

|

(9,601 |

) |

|

|

92 |

|

| Loss from continuing

operations before income taxes |

|

|

(27,352 |

) |

|

|

(19,323 |

) |

|

|

(106,597 |

) |

|

|

(49,282 |

) |

| Income tax benefit |

|

|

(8,908 |

) |

|

|

(4,713 |

) |

|

|

(16,312 |

) |

|

|

(11,826 |

) |

| Net loss from continuing

operations |

|

|

(18,444 |

) |

|

|

(14,610 |

) |

|

|

(90,285 |

) |

|

|

(37,456 |

) |

| (Loss) income from

discontinued operations, net of taxes |

|

|

(68 |

) |

|

|

4,797 |

|

|

|

(68 |

) |

|

|

4,485 |

|

| Net loss |

|

|

(18,512 |

) |

|

|

(9,813 |

) |

|

|

(90,353 |

) |

|

|

(32,971 |

) |

| Net loss margin |

|

(3.5) % |

|

(2.3) % |

|

(8.7) % |

|

(4.0) % |

| Less: net income attributable

to noncontrolling interest from continuing operations - net of

taxes |

|

|

126 |

|

|

|

182 |

|

|

|

283 |

|

|

|

374 |

|

| Net loss attributable to

Enovis Corporation |

|

$ |

(18,638 |

) |

|

$ |

(9,995 |

) |

|

$ |

(90,636 |

) |

|

$ |

(33,345 |

) |

| Net income (loss) per share -

basic and diluted |

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(0.34 |

) |

|

$ |

(0.27 |

) |

|

$ |

(1.65 |

) |

|

$ |

(0.70 |

) |

|

Discontinued operations |

|

$ |

— |

|

|

$ |

0.09 |

|

|

$ |

— |

|

|

$ |

0.08 |

|

|

Consolidated operations |

|

$ |

(0.34 |

) |

|

$ |

(0.18 |

) |

|

$ |

(1.65 |

) |

|

$ |

(0.61 |

) |

Enovis

CorporationReconciliation of GAAP to Non-GAAP

Financial MeasuresDollars in millions, except per

share data(Unaudited)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 28, 2024 |

|

June 30, 2023 |

|

June 28, 2024 |

|

June 30, 2023 |

| Adjusted Net Income

and Adjusted Net Income Per Share |

|

|

|

| Net loss from continuing

operations attributable to Enovis Corporation(1) (GAAP) |

$ |

(18.6 |

) |

|

$ |

(14.8 |

) |

|

$ |

(90.6 |

) |

|

$ |

(37.8 |

) |

| Restructuring and other

charges - pretax(2) |

|

4.6 |

|

|

|

3.8 |

|

|

|

17.5 |

|

|

|

6.7 |

|

| MDR and other costs -

pretax(3) |

|

4.5 |

|

|

|

9.0 |

|

|

|

9.5 |

|

|

|

16.8 |

|

| Amortization of acquired

intangibles - pretax |

|

40.9 |

|

|

|

32.2 |

|

|

|

81.9 |

|

|

|

64.3 |

|

| Inventory step-up and PPE

step-up depreciation - pretax(4) |

|

26.1 |

|

|

|

— |

|

|

|

31.2 |

|

|

|

0.1 |

|

| Strategic transaction costs -

pretax(5) |

|

22.7 |

|

|

|

5.4 |

|

|

|

43.5 |

|

|

|

17.1 |

|

| Stock-based compensation |

|

7.6 |

|

|

|

8.9 |

|

|

|

14.0 |

|

|

|

15.8 |

|

| Other (income) expense,

net(6) |

|

(33.8 |

) |

|

|

0.8 |

|

|

|

(9.6 |

) |

|

|

0.1 |

|

| Tax adjustment(7) |

|

(19.6 |

) |

|

|

(12.0 |

) |

|

|

(35.2 |

) |

|

|

(25.5 |

) |

| Adjusted net income from

continuing operations (non-GAAP) |

$ |

34.4 |

|

|

$ |

33.4 |

|

|

$ |

62.2 |

|

|

$ |

57.5 |

|

| Adjusted net income margin

from continuing operations |

|

6.6 |

% |

|

|

7.8 |

% |

|

|

6.0 |

% |

|

|

6.9 |

% |

| |

|

|

|

|

|

|

|

| Weighted-average shares

outstanding - diluted (GAAP) |

|

54,856 |

|

|

|

54,511 |

|

|

|

54,772 |

|

|

|

54,419 |

|

| Net loss per share - diluted

from continuing operations (GAAP) |

$ |

(0.34 |

) |

|

$ |

(0.27 |

) |

|

$ |

(1.65 |

) |

|

$ |

(0.70 |

) |

| |

|

|

|

|

|

|

|

| Adjusted weighted-average

shares outstanding - diluted (non-GAAP) |

|

55,220 |

|

|

|

54,934 |

|

|

|

55,248 |

|

|

|

54,885 |

|

| Adjusted net income per share

- diluted from continuing operations (non-GAAP) |

$ |

0.62 |

|

|

$ |

0.61 |

|

|

$ |

1.13 |

|

|

$ |

1.05 |

|

__________(1) Net loss from continuing

operations attributable to Enovis Corporation for the respective

periods is calculated using Net loss from continuing operations

less the continuing operations component of the income attributable

to noncontrolling interest, net of taxes.(2) Restructuring and

other charges includes $— million and $0.3 million of expense

classified as Cost of sales on our Condensed Consolidated

Statements of Operations for the three and six months ended June

30, 2023, respectively.(3) Primarily related to costs specific to

compliance with medical device reporting regulations and other

requirements of the European Union MDR. These costs are classified

as Selling, general and administrative expense on our Condensed

Consolidated Statements of Operations.(4) Includes $23.9 million

and $29.0 million in inventory step-up charges and $2.2 million and

$2.2 million in PPE step-up depreciation in connection with

acquired businesses for the three and six months ended June 28,

2024, respectively. Step-up depreciation costs for such periods

primarily relate to the Lima acquisition. For the three and six

months ended June 30, 2023, PPE step-up depreciation costs were

immaterial and thus were not included as adjustments in the

computation of adjusted net income per diluted share.(5) Strategic

transaction costs includes integration costs related to recent

acquisitions and Separation-related costs.(6) Other (income)

expense, net primarily includes the fair value gain on Contingent

Acquisition shares, partially offset by the first quarter of 2024

loss on the non-designated forward currency hedge for managing

exchange rate risk related to the Euro-denominated purchase price

of the Lima Acquisition.(7) The effective tax rates used to

calculate adjusted net income and adjusted net income per share

were 23.7% and 23.2% for the three and six months ended June 28,

2024, respectively, and 17.8% and 19.1% for the three and six

months ended June 30, 2023, respectively.

Enovis

CorporationReconciliation of GAAP to Non-GAAP

Financial MeasuresDollars in

millions(Unaudited)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 28, 2024 |

|

June 30, 2023 |

|

June 28, 2024 |

|

June 30, 2023 |

| |

(Dollars in millions) |

| Net loss from continuing

operations (GAAP) |

$ |

(18.4 |

) |

|

$ |

(14.6 |

) |

|

$ |

(90.3 |

) |

|

$ |

(37.5 |

) |

|

Income tax benefit |

|

(8.9 |

) |

|

|

(4.7 |

) |

|

|

(16.3 |

) |

|

|

(11.8 |

) |

|

Other (income) expense, net |

|

(33.8 |

) |

|

|

0.8 |

|

|

|

(9.6 |

) |

|

|

0.1 |

|

|

Interest expense, net |

|

17.0 |

|

|

|

4.1 |

|

|

|

37.0 |

|

|

|

9.7 |

|

| Operating loss (GAAP) |

|

(44.2 |

) |

|

|

(14.5 |

) |

|

|

(79.2 |

) |

|

|

(39.5 |

) |

| Adjusted to add: |

|

|

|

|

|

|

|

|

Restructuring and other charges(1) |

|

4.6 |

|

|

|

3.8 |

|

|

|

17.5 |

|

|

|

6.7 |

|

|

MDR and other costs(2) |

|

4.5 |

|

|

|

9.0 |

|

|

|

9.5 |

|

|

|

16.8 |

|

|

Strategic transaction costs(3) |

|

22.7 |

|

|

|

5.4 |

|

|

|

43.5 |

|

|

|

17.1 |

|

|

Stock-based compensation |

|

7.6 |

|

|

|

8.9 |

|

|

|

14.0 |

|

|

|

15.8 |

|

|

Depreciation and other amortization |

|

30.1 |

|

|

|

20.8 |

|

|

|

57.3 |

|

|

|

40.7 |

|

|

Amortization of acquired intangibles |

|

40.9 |

|

|

|

32.2 |

|

|

|

81.9 |

|

|

|

64.3 |

|

|

Inventory step-up |

|

23.9 |

|

|

|

— |

|

|

|

29.0 |

|

|

|

0.1 |

|

| Adjusted EBITDA

(non-GAAP) |

$ |

90.2 |

|

|

$ |

65.7 |

|

|

$ |

173.4 |

|

|

$ |

122.1 |

|

| Adjusted EBITDA margin

(non-GAAP) |

|

17.2 |

% |

|

|

15.3 |

% |

|

|

16.7 |

% |

|

|

14.6 |

% |

__________(1) Restructuring and other charges

includes $— million and $0.3 million of expense classified as Cost

of sales on our Condensed Consolidated Statements of Operations for

the three and six months ended June 30, 2023, respectively.(2)

Primarily related to costs specific to compliance with medical

device reporting regulations and other requirements of the European

Union MDR. These costs are classified as Selling, general and

administrative expense on our Condensed Consolidated Statements of

Operations.(3) Strategic transaction costs includes integration

costs related to recent acquisitions and Separation-related

costs.

Enovis

CorporationReconciliation of Gross Margin (GAAP)

to Adjusted Gross Margin (non-GAAP)Dollars in

millions(Unaudited)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 28, 2024 |

|

June 30, 2023 |

|

June 28, 2024 |

|

June 30, 2023 |

| Net sales |

$ |

525.2 |

|

|

$ |

428.5 |

|

|

$ |

1,041.4 |

|

|

$ |

834.7 |

|

| Gross profit |

$ |

288.9 |

|

|

$ |

248.4 |

|

|

$ |

586.8 |

|

|

$ |

483.4 |

|

| Gross profit margin

(GAAP) |

|

55.0 |

% |

|

|

58.0 |

% |

|

|

56.3 |

% |

|

|

57.9 |

% |

| |

|

|

|

|

|

|

|

| Gross profit (GAAP) |

$ |

288.9 |

|

|

$ |

248.4 |

|

|

$ |

586.8 |

|

|

$ |

483.4 |

|

| Inventory step-up |

|

23.9 |

|

|

|

— |

|

|

|

29.0 |

|

|

|

0.1 |

|

| Restructuring and other

charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.3 |

|

| Adjusted gross profit

(Non-GAAP) |

$ |

312.8 |

|

|

$ |

248.4 |

|

|

$ |

615.8 |

|

|

$ |

483.9 |

|

| Adjusted gross profit margin

(Non-GAAP) |

|

59.6 |

% |

|

|

58.0 |

% |

|

|

59.1 |

% |

|

|

58.0 |

% |

Enovis

CorporationCondensed Consolidated Balance

SheetsDollars in thousands, except share

amounts(Unaudited)

| |

June 28, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

35,004 |

|

|

$ |

36,191 |

|

|

Trade receivables, less allowance for credit losses of $14,853 and

$9,731 |

|

394,736 |

|

|

|

291,483 |

|

|

Inventories, net |

|

615,037 |

|

|

|

468,832 |

|

|

Prepaid expenses |

|

40,550 |

|

|

|

28,901 |

|

|

Other current assets |

|

87,426 |

|

|

|

71,112 |

|

|

Total current assets |

|

1,172,753 |

|

|

|

896,519 |

|

|

Property, plant and equipment, net |

|

378,449 |

|

|

|

270,798 |

|

|

Goodwill |

|

2,353,456 |

|

|

|

2,060,893 |

|

|

Intangible assets, net |

|

1,380,478 |

|

|

|

1,127,363 |

|

|

Lease asset - right of use |

|

68,243 |

|

|

|

63,506 |

|

|

Other assets |

|

88,649 |

|

|

|

90,255 |

|

| Total assets |

$ |

5,442,028 |

|

|

$ |

4,509,334 |

|

| |

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Current portion of long-term debt |

$ |

15,028 |

|

|

$ |

— |

|

|

Accounts payable |

|

159,832 |

|

|

|

132,475 |

|

|

Accrued liabilities |

|

343,145 |

|

|

|

237,132 |

|

|

Total current liabilities |

|

518,005 |

|

|

|

369,607 |

|

|

Long-term debt, less current portion |

|

1,329,427 |

|

|

|

466,164 |

|

|

Non-current lease liability |

|

50,455 |

|

|

|

48,684 |

|

|

Other liabilities |

|

255,203 |

|

|

|

204,178 |

|

| Total liabilities |

|

2,153,090 |

|

|

|

1,088,633 |

|

| Equity: |

|

|

|

|

Common stock, $0.001 par value; 133,333,333 shares authorized;

54,866,360 and 54,597,142 shares issued and outstanding as of

June 28, 2024 and December 31, 2023, respectively |

|

55 |

|

|

|

55 |

|

|

Additional paid-in capital |

|

2,911,254 |

|

|

|

2,900,747 |

|

|

Retained earnings |

|

451,835 |

|

|

|

542,471 |

|

|

Accumulated other comprehensive loss |

|

(76,730 |

) |

|

|

(24,881 |

) |

| Total Enovis Corporation

equity |

|

3,286,414 |

|

|

|

3,418,392 |

|

| Noncontrolling interest |

|

2,524 |

|

|

|

2,309 |

|

| Total equity |

|

3,288,938 |

|

|

|

3,420,701 |

|

| Total liabilities and

equity |

$ |

5,442,028 |

|

|

$ |

4,509,334 |

|

Enovis

CorporationCondensed Consolidated Statements of

Cash FlowsDollars

in thousands(Unaudited)

| |

Six Months Ended |

| |

June 28, 2024 |

|

June 30, 2023 |

| |

|

|

|

| Cash flows from

operating activities: |

|

|

|

| Net loss |

$ |

(90,353 |

) |

|

$ |

(32,971 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

|

|

|

Depreciation and amortization |

|

139,167 |

|

|

|

105,033 |

|

|

Impairment of assets |

|

5,555 |

|

|

|

— |

|

|

Stock-based compensation expense |

|

14,102 |

|

|

|

16,981 |

|

|

Non-cash interest expense |

|

2,558 |

|

|

|

1,481 |

|

|

Fair value gain on contingent acquisition shares |

|

(20,068 |

) |

|

|

— |

|

|

Loss on currency hedges |

|

11,123 |

|

|

|

— |

|

|

Deferred income tax expense (benefit) |

|

(19,412 |

) |

|

|

(107 |

) |

|

Loss on sale of property, plant and equipment |

|

383 |

|

|

|

533 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Trade receivables, net |

|

(24,807 |

) |

|

|

(25,912 |

) |

|

Inventories, net |

|

1,953 |

|

|

|

(10,476 |

) |

|

Accounts payable |

|

(6,744 |

) |

|

|

8,324 |

|

|

Other operating assets and liabilities |

|

(41,840 |

) |

|

|

(27,326 |

) |

| Net cash provided by

(used in) operating activities |

|

(28,383 |

) |

|

|

35,560 |

|

| Cash flows from

investing activities: |

|

|

|

|

Purchases of property, plant and equipment and intangibles |

|

(76,333 |

) |

|

|

(67,248 |

) |

|

Payments for acquisitions, net of cash received, and

investments |

|

(758,190 |

) |

|

|

(98,740 |

) |

|

Payment for settlement of derivatives |

|

(4,645 |

) |

|

|

— |

|

| Net cash used in

investing activities |

|

(839,168 |

) |

|

|

(165,988 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Proceeds from borrowings on term credit facility |

|

400,000 |

|

|

|

— |

|

|

Repayments of borrowings under term credit facility |

|

(15,000 |

) |

|

|

(219,468 |

) |

|

Proceeds from borrowings on revolving credit facilities and

other |

|

940,000 |

|

|

|

370,000 |

|

|

Repayments of borrowings on revolving credit facilities and

other |

|

(446,479 |

) |

|

|

(11,538 |

) |

|

Payment of debt issuance costs |

|

(703 |

) |

|

|

— |

|

|

Payments of tax withholding for stock-based awards |

|

(4,772 |

) |

|

|

— |

|

|

Proceeds from issuance of common stock, net |

|

1,177 |

|

|

|

1,385 |

|

|

Deferred consideration payments and other |

|

(7,174 |

) |

|

|

(1,668 |

) |

| Net cash provided by

financing activities |

|

867,049 |

|

|

|

138,711 |

|

| Effect of foreign

exchange rates on Cash and cash equivalents |

|

(906 |

) |

|

|

(87 |

) |

| Increase (decrease) in Cash,

cash equivalents and restricted cash |

|

(1,408 |

) |

|

|

8,196 |

|

| Cash, cash equivalents and

restricted cash, beginning of period |

|

44,832 |

|

|

|

24,295 |

|

| Cash, cash equivalents

and restricted cash, end of period |

$ |

43,424 |

|

|

$ |

32,491 |

|

| |

|

|

|

| Supplemental

disclosures: |

|

|

|

| Fair value of contingently

issuable shares in business acquisition |

$ |

107,877 |

|

|

$ |

— |

|

Enovis CorporationGAAP

and Comparable Net SalesChange in

SalesDollars in

millions(Unaudited)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 28, 2024 |

|

June 30, 2023 |

|

Growth Rate |

|

June 28, 2024 |

|

June 30, 2023 |

|

Growth rate |

| |

GAAP |

|

GAAP |

| |

(In millions) |

| Prevention &

Recovery: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Bracing & Support |

$ |

117.5 |

|

$ |

115.0 |

|

2.2 |

% |

|

$ |

222.1 |

|

$ |

219.3 |

|

1.3 |

% |

|

U.S. Other P&R |

|

68.0 |

|

|

67.7 |

|

0.3 |

% |

|

|

134.3 |

|

|

130.1 |

|

3.2 |

% |

|

International P&R |

|

92.3 |

|

|

90.8 |

|

1.6 |

% |

|

|

180.4 |

|

|

174.8 |

|

3.2 |

% |

| Total Prevention &

Recovery |

|

277.8 |

|

|

273.5 |

|

1.6 |

% |

|

|

536.8 |

|

|

524.2 |

|

2.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Reconstructive: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Reconstructive |

|

122.1 |

|

|

106.1 |

|

15.0 |

% |

|

|

245.8 |

|

|

209.6 |

|

17.2 |

% |

|

International Reconstructive |

|

125.3 |

|

|

48.9 |

|

156.4 |

% |

|

|

258.9 |

|

|

100.8 |

|

156.8 |

% |

| Total Reconstructive |

|

247.4 |

|

|

155.0 |

|

59.6 |

% |

|

|

504.7 |

|

|

310.4 |

|

62.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Total |

$ |

525.2 |

|

$ |

428.5 |

|

22.6 |

% |

|

$ |

1,041.4 |

|

$ |

834.7 |

|

24.8 |

% |

| |

Three Months Ended |

|

Six Months Ended |

| |

June 28, 2024 |

|

June 30, 2023 |

|

Growth Rate |

|

Constant Currency Growth Rate |

|

June 28, 2024 |

|

June 30, 2023 |

|

Growth Rate |

|

Constant Currency Growth Rate |

| |

Comparable Sales (1) |

|

Comparable Sales (1) |

| |

(In millions) |

| Prevention &

Recovery: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Bracing & Support |

$ |

117.5 |

|

$ |

115.0 |

|

2.2 |

% |

|

2.2 |

% |

|

$ |

222.1 |

|

$ |

219.3 |

|

1.3 |

% |

|

1.3 |

% |

|

U.S. Other P&R |

|

68.0 |

|

|

65.3 |

|

4.0 |

% |

|

4.0 |

% |

|

|

131.6 |

|

|

125.2 |

|

5.1 |

% |

|

5.1 |

% |

|

International P&R |

|

92.3 |

|

|

89.4 |

|

3.2 |

% |

|

4.2 |

% |

|

|

178.7 |

|

|

172.1 |

|

3.8 |

% |

|

4.0 |

% |

| Total Prevention &

Recovery |

|

277.8 |

|

|

269.7 |

|

3.0 |

% |

|

3.3 |

% |

|

|

532.4 |

|

|

516.7 |

|

3.0 |

% |

|

3.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconstructive: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Reconstructive |

|

122.1 |

|

|

120.7 |

|

1.1 |

% |

|

1.1 |

% |

|

|

245.8 |

|

|

239.6 |

|

2.6 |

% |

|

2.6 |

% |

|

International Reconstructive |

|

125.3 |

|

|

111.4 |

|

12.5 |

% |

|

13.5 |

% |

|

|

258.4 |

|

|

229.9 |

|

12.4 |

% |

|

11.7 |

% |

| Total Reconstructive |

|

247.4 |

|

|

232.1 |

|

6.6 |

% |

|

7.1 |

% |

|

|

504.2 |

|

|

469.5 |

|

7.4 |

% |

|

7.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

$ |

525.2 |

|

$ |

501.8 |

|

4.7 |

% |

|

5.0 |

% |

|

$ |

1,036.6 |

|

$ |

986.2 |

|

5.1 |

% |

|

5.0 |

% |

(1) Comparable sales adjusts net sales for prior periods to include

the sales of acquired businesses prior to our ownership from

acquisitions that closed after March 31, 2023 and to exclude the

sales of divested businesses and certain discontinued Recon

products lines in conjunction with the Lima acquisition. The

acquired businesses include the Lima and Novastep acquisitions in

the Recon segment and the divested business includes a minor

product line in the P&R segment.

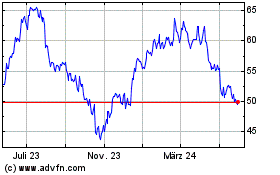

Enovis (NYSE:ENOV)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Enovis (NYSE:ENOV)

Historical Stock Chart

Von Feb 2024 bis Feb 2025