VAALCO Energy, Inc. (NYSE: EGY, LSE: EGY) ("VAALCO" or the

"Company") today reported operational and financial results

for the first quarter of 2024.

First Quarter 2024 Highlights and

Recent Key Items:

- Closed the accretive all

cash acquisition of Svenska Petroleum Exploration AB (“Svenska”)

for a net purchase price of $40.2 million;

- Following the planned shutdown for maintenance in

April, the Baobab field is back on production with a current rate

in excess of 5,000 VAALCO working interest (“WI”)(1) barrels of oil

equivalent per day (“BOEPD”) (99% oil);

- Strategically expands West African focus area with a

sizeable producing asset that has significant upside potential and

future development opportunities in Cote d’Ivoire, a

well-established and investment-friendly country;

- Reported Q1 2024 net

income of $7.7 million ($0.07 per diluted share) and Adjusted

Net Income(2) of $6.5 million ($0.06 per diluted

share);

- Delivered strong Adjusted

EBITDAX(2) of $61.7 million and funded $16.7 million in

cash capital expenditures from cash on hand and cash from

operations;

- Achieved production

of 16,848 net revenue interest (“NRI”)(3) BOEPD and WI(1)

production of 21,807 BOEPD;

- Reported NRI sales

of 1,490,000 barrels of oil equivalent (“BOE”),

or 16,373 BOEPD, near the high end of guidance;

- Posted unrestricted cash of

$113.3 million after paying out $6.5 million in dividends in the

quarter and completing $5.5 million in share

buybacks;

- Since inception of the share buyback program,

VAALCO has purchased approximately $30 million in shares;

and

- Announced quarterly cash

dividend of $0.0625 per share of common stock to be paid on June

21, 2024.

|

|

(1) |

|

All WI production rates and volumes are VAALCO’s working interest

volumes, where applicable |

| |

(2) |

|

Adjusted EBITDAX, Adjusted

Net Income, Adjusted Working Capital and Free Cash Flow are

Non-GAAP financial measures and are described and reconciled to the

closest GAAP measure in the attached table under “Non-GAAP

Financial Measures.” |

| |

(3) |

|

All NRI production rates are

VAALCO's working interest volumes less royalty volumes, where

applicable |

| |

|

|

|

George Maxwell, VAALCO’s Chief Executive Officer

commented, “We continue to deliver strong operational and

financial results in line with or ahead of our guidance. Sales for

the first quarter were near the high end of guidance and our costs

were below the low end of guidance. Coupled with a strong pricing

environment, VAALCO was able to generate solid earnings and

Adjusted EBITDAX. We continued to return meaningful cash to our

shareholders through our ongoing dividend program. Additionally, we

finalized the agreements in Equatorial Guinea and are proceeding

with our Front-End Engineering Design (“FEED”) study. We anticipate

the completion of the FEED study will lead to an economic Final

Investment Decision (“FID”) which will enable the development of

the Venus Plan of Development (“POD”). In April, we closed the all

cash Svenska acquisition, ahead of schedule, for a net purchase

price of $40.2 million. It has been a very productive start to

2024."

“We continue to enhance our diversified

portfolio by building size and scale that allows VAALCO to generate

significant free cash flow and execute our strategic vision. We are

excited to be partnering with Petroci and CNR International, and

believe the Baobab field in Cote d’Ivoire is an outstanding asset

with significant upside potential. We have updated our full year

2024 guidance and released our second quarter guidance, both of

which reflects the positive impact to production and production

expense per barrel, which should lead to improved margins and

greater Adjusted EBITDAX. As you can see, this acquisition is

highly accretive on key metrics to our shareholder base and

provides another strong asset to support future growth and

returning value to shareholders.”

Operational Update

Egypt

VAALCO focused on enhancing production in the

first quarter of 2024 through a series of planned workovers, as

well as through interventions using the OGS-10 rig. VAALCO

finalized the K-81 recompletion at the start of the first quarter

which was a carry-over from its 2023 drilling activity. The EA-55

well, drilled in October 2023, was fraced and put online in January

2024. Three additional workover recompletions were completed in the

first quarter with one more in progress. With the low cost of

workovers, the well economics are strongly positive.

A summary of the Egyptian workover campaign's impact in Q1 2024

is presented below:

|

VAALCO Egypt 2024 Workover Wells |

|

| Well |

Workover date |

Type |

Completion Zone |

|

PerforationInterval (ft) |

|

|

IP-30 Rate(BOPD) |

|

|

K-81 |

1-Jan-24 |

Recompletion |

Asl-D |

|

|

13.1 |

|

|

|

154 |

|

| EA-55 |

10-Jan-24 |

Frac & Complete |

Redbed |

|

Hydraulic Frac |

|

|

|

143 |

|

| H-22 |

7-Feb-24 |

Recompletion |

Yusr-A |

|

|

9.8 |

|

|

|

82 |

|

| K-65_ST1 |

14-Feb-24 |

Recompletion |

Asl-D |

|

|

13.1 |

|

|

|

43* |

|

| K-85 |

16-Mar-24 |

Recompletion |

Asl-D |

|

|

13.1 |

|

|

|

420 |

|

| K-84 |

21-Mar-24 Under WO |

Recompletion |

Asl-G |

|

|

16.4 |

|

|

In Progress |

|

| |

|

|

|

|

|

|

|

|

|

|

Canada

The 2024 drilling campaign commenced in January

with the drilling of 9-12-30-4W5, spud on January 17th. The well

was drilled to a total depth of 22,732 feet. The second well of the

program, 10-12-30-4W5, was spud on February 9th, and drilled to a

total depth of 21,736 feet. The third well of the program,

11-12-30-4W5 was spud on February 23rd, and drilled to a total

depth of 21,624 feet. The fourth well of the program was spud

on March 9th, and drilled to a total depth of 20,669 feet. Each of

these wells included a 2.75 mile lateral. The drilling rig was

released on March 24th. Completion of the wells was initiated

in late March, and was completed in April, followed by equipping

and tie-in, with first production forecasted to be in May 2024.

Gabon

VAALCO is currently finalizing locations

and planning for the next drilling campaign at Etame that is

expected to occur late in 2024 and into 2025. In October 2022,

VAALCO successfully completed its transition to a Floating Storage

and Offloading vessel (“FSO”) and related field reconfiguration

processes. This project provides a low cost FSO solution that

increases the storage capacity for the Etame block and improved

operational performance. The Company continues to

emphasize operational excellence, production uptime and

enhancement in 2024 to minimize decline until the next

drilling campaign.

The focus is on the continued production

optimization of the new flow line configurations through the Etame

Facility, for final processing before being pumped to the FSO. This

continued optimization and understanding of the

post-reconfiguration process dynamics of the Etame platform, have

resulted in a very high uptime of the Etame Facility and, in

turn, the complete Etame field during the first quarter of 2024.

Combining this with focus on individual well and facility chemical

injection optimization and facility pipelines has provided

more stable operations resulting in lower downtime. Through the end

of 2023 and in the first quarter of 2024, this continued to be

a focus with positive results in production rates and uptime.

Financial Update –

First Quarter of 2024

VAALCO reported net income of $7.7 million

($0.07 per diluted share) for the first quarter of

2024 which was down compared with net income of $44.0

million ($0.41 per diluted share) in the fourth quarter of

2023 and up compared to $3.4 million ($0.03 per diluted

share) in the first quarter of 2023. The decrease in earnings

compared to the fourth quarter of 2023 is mainly due to decreased

sales revenue, increased depreciation, depletion and

amortization (“DD&A”) expense, transaction costs, and

higher credit losses, partially offset by decreased production

expense and lower income taxes. The increase in earnings

compared to the first quarter of 2023 is primarily due to

higher sales revenue due to increased volumes partially offset

by higher production expense, transaction costs, higher DD&A

expense, losses on derivatives and higher income taxes.

Adjusted EBITDAX totaled $61.7 million in the

first quarter of 2024, a decrease from $95.9

million in the fourth quarter of 2023, primarily due to

lower sales and commodity pricing. The increase in first

quarter 2024 Adjusted EBITDAX to $61.7 million compared

with $47.8 million, generated in the same period in 2023, is

primarily due to increased revenue as a result of increased

sales.

|

Quarterly Summary - Sales and Net Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| $ in

thousands |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

Gabon |

|

|

Egypt |

|

|

Canada |

|

|

Total |

|

|

Gabon |

|

|

Egypt |

|

|

Canada |

|

|

Total |

|

| Oil Sales |

|

|

64,788 |

|

|

|

63,192 |

|

|

|

4,153 |

|

|

|

132,133 |

|

|

|

100,398 |

|

|

|

79,043 |

|

|

|

5,476 |

|

|

|

184,917 |

|

| NGL Sales |

|

|

— |

|

|

|

— |

|

|

|

1,977 |

|

|

|

1,977 |

|

|

|

— |

|

|

|

— |

|

|

|

2,019 |

|

|

|

2,019 |

|

| Gas Sales |

|

|

— |

|

|

|

— |

|

|

|

820 |

|

|

|

820 |

|

|

|

— |

|

|

|

— |

|

|

|

818 |

|

|

|

818 |

|

| Gross Sales |

|

|

64,788 |

|

|

|

63,192 |

|

|

|

6,951 |

|

|

|

134,931 |

|

|

|

100,398 |

|

|

|

79,043 |

|

|

|

8,313 |

|

|

|

187,754 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling Costs & carried

interest |

|

|

1,174 |

|

|

|

(111 |

) |

|

|

(143 |

) |

|

|

920 |

|

|

|

1,711 |

|

|

|

— |

|

|

|

(702 |

) |

|

|

1,009 |

|

| Royalties & taxes |

|

|

(8,458 |

) |

|

|

(26,120 |

) |

|

|

(1,118 |

) |

|

|

(35,696 |

) |

|

|

(13,699 |

) |

|

|

(24,393 |

) |

|

|

(1,517 |

) |

|

|

(39,609 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue |

|

|

57,504 |

|

|

|

36,961 |

|

|

|

5,690 |

|

|

|

100,155 |

|

|

|

88,410 |

|

|

|

54,650 |

|

|

|

6,094 |

|

|

|

149,154 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oil Sales MMB (working

interest) |

|

|

770 |

|

|

|

950 |

|

|

|

61 |

|

|

|

1,781 |

|

|

|

1,165 |

|

|

|

1,023 |

|

|

|

77 |

|

|

|

2,265 |

|

| Average Oil Price

Received |

|

$ |

84.19 |

|

|

$ |

66.52 |

|

|

$ |

67.83 |

|

|

$ |

74.21 |

|

|

$ |

86.18 |

|

|

$ |

77.27 |

|

|

$ |

71.12 |

|

|

$ |

81.65 |

|

| Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Brent Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

83.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

84.01 |

|

| Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Sales MMCF (working

interest) |

|

|

— |

|

|

|

— |

|

|

|

469 |

|

|

|

469 |

|

|

|

— |

|

|

|

— |

|

|

|

471 |

|

|

|

471 |

|

| Average Gas Price

Received |

|

|

— |

|

|

|

— |

|

|

$ |

1.75 |

|

|

$ |

1.75 |

|

|

|

— |

|

|

|

— |

|

|

$ |

1.74 |

|

|

$ |

1.74 |

|

| Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Aeco Price ($USD) |

|

|

— |

|

|

|

— |

|

|

$ |

1.46 |

|

|

$ |

1.46 |

|

|

|

|

|

|

|

|

|

|

$ |

1.86 |

|

|

$ |

1.86 |

|

| Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NGL Sales MMB (working

interest) |

|

|

— |

|

|

|

— |

|

|

|

76 |

|

|

|

76 |

|

|

|

— |

|

|

|

— |

|

|

|

80 |

|

|

|

80 |

|

| Average Liquids Price

Received |

|

|

— |

|

|

|

— |

|

|

$ |

25.98 |

|

|

$ |

25.98 |

|

|

|

— |

|

|

|

— |

|

|

$ |

25.09 |

|

|

$ |

25.09 |

|

| Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue and Sales |

|

Q1 2024 |

|

|

Q1 2023 |

|

|

% Change Q1 2024 vs. Q1 2023 |

|

|

Q4 2023 |

|

|

% Change Q1 2024 vs. Q4 2023 |

|

|

Production (NRI BOEPD) |

|

|

16,848 |

|

|

|

18,306 |

|

|

|

(8 |

)% |

|

|

18,065 |

|

|

|

(7 |

)% |

| Sales (NRI BOE) |

|

|

1,490,000 |

|

|

|

1,224,000 |

|

|

|

22 |

% |

|

|

1,994,000 |

|

|

|

(25 |

)% |

| Realized commodity price

($/BOE) |

|

$ |

66.43 |

|

|

$ |

65.68 |

|

|

|

1 |

% |

|

$ |

73.96 |

|

|

|

(10 |

)% |

| Commodity (Per BOE including

realized commodity derivatives) |

|

$ |

66.41 |

|

|

$ |

65.63 |

|

|

|

1 |

% |

|

$ |

73.89 |

|

|

|

(10 |

)% |

| Total commodity sales

($MM) |

|

$ |

100.2 |

|

|

$ |

80.4 |

|

|

|

25 |

% |

|

$ |

149.2 |

|

|

|

(33 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VAALCO had net revenues decrease by

$49.0 million or 33% as total NRI sales volumes of

1,490,000 BOE was lower than Q4 2023 but rose 22%

compared to 1,224,000 BOE for Q1 2023. Q1 2024 NRI

sales were at the higher end of VAALCO's guidance. The Company

expects second quarter 2024 NRI sales to be between

18,100 and 20,000 BOEPD, reflecting the addition of the

Svenska acquisition volume in May and June.

Q1 2024 realized pricing (net of

royalties) was 10% lower compared to Q4 2023 but slightly

higher compared to Q1 2023.

| Costs and Expenses |

|

Q1 2024 |

|

|

Q1 2023 |

|

|

% Change Q1 2024 vs. Q1 2023 |

|

|

Q4 2023 |

|

|

% Change Q1 2024 vs. Q4 2023 |

|

|

Production expense, excluding offshore workovers and stock comp

($MM) |

|

$ |

32.1 |

|

|

$ |

29.3 |

|

|

|

10 |

% |

|

$ |

46.3 |

|

|

|

(31 |

)% |

| Production expense, excluding

offshore workovers ($/BOE) |

|

$ |

21.58 |

|

|

$ |

23.90 |

|

|

|

(10 |

)% |

|

$ |

23.27 |

|

|

|

(7 |

)% |

| Offshore workover expense

($MM) |

|

$ |

(0.1 |

) |

|

$ |

(1.1 |

) |

|

|

93.5 |

% |

|

$ |

— |

|

|

|

— |

% |

| Depreciation, depletion and

amortization ($MM) |

|

$ |

25.8 |

|

|

$ |

24.4 |

|

|

|

6 |

% |

|

$ |

20.3 |

|

|

|

27 |

% |

| Depreciation, depletion and

amortization ($/BOE) |

|

$ |

17.3 |

|

|

$ |

19.90 |

|

|

|

(13 |

)% |

|

$ |

10.20 |

|

|

|

70 |

% |

| General and administrative

expense, excluding stock-based compensation ($MM) |

|

$ |

5.9 |

|

|

$ |

4.6 |

|

|

|

27 |

% |

|

$ |

6.1 |

|

|

|

(4 |

)% |

| General and administrative

expense, excluding stock-based compensation ($/BOE) |

|

$ |

3.9 |

|

|

$ |

3.70 |

|

|

|

6 |

% |

|

$ |

3.0 |

|

|

|

31 |

% |

| Stock-based compensation

expense ($MM) |

|

$ |

0.9 |

|

|

$ |

0.6 |

|

|

|

50.0 |

% |

|

$ |

0.9 |

|

|

|

- |

% |

| Current income tax expense

(benefit) ($MM) |

|

$ |

25.7 |

|

|

$ |

12.3 |

|

|

|

109 |

% |

|

$ |

14.3 |

|

|

|

80 |

% |

| Deferred income tax expense

(benefit) ($MM) |

|

$ |

(3.4 |

) |

|

$ |

2.5 |

|

|

|

(238 |

)% |

|

$ |

(2.6 |

) |

|

|

32 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total production expense (excluding offshore

workovers and stock compensation) of $32.1 million in

Q1 2024 was lower compared to Q4 2023 and

slightly higher than the same period in 2023. The decrease in

Q1 2024 expense compared to Q4 2023 was driven

primarily by lower costs related to lower sales

volumes. The increase in Q1 2024 compared to

Q1 2023 was primarily driven by increased expense

associated with higher sales as well as higher costs associated

with boats, diesel and operating costs. VAALCO has seen withholding

tax, inflationary and industry supply chain pressure on personnel

and contractor costs.

Q1 2024 had no offshore workovers, and

the slightly negative workover expense in

Q1 2024 was the result of a reversal of accruals.

Q1 2024 production expense per BOE,

excluding offshore workover expense, decreased

to $21.58 per BOE which was down compared

with Q4 2023 and Q1 2023 partially due to the devaluation

of the Egyptian pound on local costs and lower engineering and

maintenance spend mainly due to the timing of planned projects

partially offset by higher workover costs in Egypt.

DD&A expense for Q1 2024 was

$25.8 million which was higher than $20.3 million in

Q4 2023 and higher than $24.4 million in

Q1 2023. The increase in Q1 2024 DD&A

expense compared to Q4 2023 and Q1 2023 is due to

higher depletable costs in Gabon, Egypt, and Canada.

General and administrative (“G&A”) expense,

excluding stock-based compensation, decreased to $5.9 million

in Q1 2024 from $6.1 million in Q4 2023 and

increased from $4.6 million in Q1 2023. The increase

in general and administrative expenses compared to Q1 2023 is

primarily due to higher professional service fees, salaries

and wages, and accounting and legal fees. Q1 2024 cash

G&A was within the Company’s guidance. The Company has made

meaningful progress toward reducing absolute G&A costs when

compared against the combined TransGlobe and VAALCO

Q1 2023 costs.

Non-cash stock-based compensation expense was

$0.9 million for Q1 2024 compared to $0.6 million

for Q1 2023. Non-cash stock-based compensation expense for

Q4 2023 was $0.9 million.

Other income (expense), net, was an

expense of ($0.5) million for Q1 2024, compared to an

expense of ($1.2) million during Q1 2023 and an

expense of ($0.8) million for Q4 2023. Other income

(expense), net, normally consists of foreign currency

losses.

Foreign income taxes for Gabon are settled by

the government taking their oil in-kind. Q1 2024 income

tax expense was an expense of $22.2 million and is comprised of

current tax expense of $25.7 million and deferred tax

benefit of $3.4 million. Current quarter tax was impacted

by non-deductible items (such as the Svenska transaction costs) and

the change in market value of tax barrels due to Gabon State

mark-to-market at quarter end. Q4 2023 income tax expense

was an expense of $37.6 million. This was comprised of

$41.1 million of current tax expense and a deferred tax

benefit of $3.5 million. Q1 2023 income tax expense

was an expense of $14.8 million. This was comprised of

$12.3 million of deferred tax expense and a current tax

expense of $2.5 million. For all periods, VAALCO’s overall

effective tax rate was impacted by non-deductible items associated

with derivative losses and corporate expenses.

Capital Investments/Balance Sheet

For the first quarter of 2024, net capital

expenditures totaled $16.6 million on a cash basis and

$24.0 million on an accrual basis. These expenditures were

primarily related to costs associated with the development drilling

programs in Egypt and Canada.

At the end of the first quarter of 2024,

VAALCO had an unrestricted cash balance of $113.3

million. Working capital at March 31, 2024 was $86.5

million compared with $100.7 million at December 31, 2023, while

Adjusted Working Capital(3) at March 31, 2024 totaled $99.0

million.

Cash Dividend Policy and Share Buyback

Authorization

VAALCO paid a quarterly cash dividend of $0.0625

per share of common stock for the first quarter of

2024 on March 28, 2024. The Company also announced its next

quarterly cash dividend of $0.0625 per share of common stock for

the second quarter of 2024 ($0.25 annualized), to be paid

on June 21, 2024 to stockholders of record at the close

of business on May 17, 2024. Future declarations of quarterly

dividends and the establishment of future record and payment dates

are subject to approval by the VAALCO Board of Directors (the

"Board").

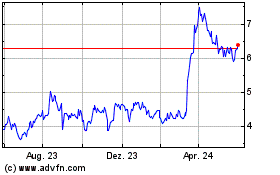

On November 1, 2022, VAALCO announced that its

newly expanded Board formally ratified and approved the share

buyback program that was announced on August 8, 2022 in

conjunction with the pending business combination with

TransGlobe. The Board also directed management to implement a

Rule 10b5-1 trading plan to facilitate share purchases through open

market purchases, privately negotiated transactions, or otherwise

in compliance with Rule 10b-18 under the Securities Exchange Act of

1934. The plan provided for an aggregate purchase of currently

outstanding common stock up to $30 million. Payment for shares

repurchased under the program were funded using the Company's cash

on hand and cash flow from operations. The share buyback program

was completed on March 12, 2024. Under the share buyback

program, VAALCO purchased a total of 6,797,711 shares at an

average price of $4.41 per share.

Svenska Acquisition

VAALCO closed its acquisition of Svenska

for the net purchase price of $40.2 million, on April 30, 2024

after regulatory and government approvals were received.

Svenska’s primary license interest is a 27.39%

non-operated working interest (30.43% paying interest) in the CI-40

license, which includes the producing Baobab field, located in

deepwater offshore Cote d’Ivoire. The field is operated by CNR

International, which holds a 57.61% working interest in the

project, with the national oil company, Petroci Holding, owning the

remaining 15% working interest (10% of which is carried by the

other license partners). The CI-40 license has an initial term

through mid-2028 with the contractual option to extend the license

term by 10 years to 2038, subject to certain conditions. Current

production from the Baobab field is approximately 5,000 WI BOEPD,

with 1P WI CPR reserves of 13.0 MMBOE (99% oil), and 2P WI CPR

reserves of 21.7 MMBOE (97% oil) as of October 1, 2023. These

reserve figures reflect currently sanctioned development

activities; however, CI-40 has a significant growth runway with

incremental development potential on the Baobab field, as well as

the nearby Kossipo field, expected to provide a material uplift to

the reserve and production volumes, supporting long-term production

of the asset into the late 2030s. Cumulative gross production from

the field has been approximately 150 MMBOE, a portion of the

estimated over one billion barrels of oil equivalent volumes

initially in place.

CI-40 has a long history of production and

significantly de-risked reservoirs. With almost 20 years of

production to date, the floating, production, storage and

offloading vessel ("FPSO") is planned to come off station at

the start of 2025 for planned maintenance and upgrade work to allow

the FPSO to continue to produce through the end of the expected

extended field license in 2038. The scope of work for the FPSO

upgrade is currently being finalized. Production on Baobab is

expected to re-start in 2026 following the FPSO work program. In

addition, a fully appraised development drilling program is

expected to start in 2026, targeting the significant incremental

probable reserve base on the field. VAALCO sees reduced geological

risk relating to this drilling program and the joint venture

partners have already commenced the ordering of certain long-lead

drilling items. Further future drilling phases have not yet been

sanctioned, but there is significant incremental potential in both

the Baobab field itself, as well as the nearby Kossipo development,

which has also been appraised by two wells drilled in 2002 and

2019.

In addition to the CI-40 license in Cote

d’Ivoire, Svenska currently owns a 21.05% working interest in the

early stage Uge discovery in the OML 145 concession in Nigeria

alongside partners ExxonMobil (21.05%), Chevron (21.05%), Oando

(21.05%) and NPDC (15.80%). There are minimal commitments on this

license interest and no drilling or development is currently

planned.

Hedging

The Company continued to opportunistically hedge

a portion of its expected future production to lock in strong cash

flow generation to assist in funding its capital and shareholder

returns programs.

The following includes hedges remaining in

place as of the end of the first quarter of 2024:

| Settlement

Period |

Type of Contract |

Index |

|

Average Monthly Volumes |

|

|

Weighted Average Put Price |

|

|

Weighted Average Call Price |

|

| |

|

|

|

(Bbls) |

|

|

(per Bbl) |

|

|

(per Bbl) |

|

|

April 2024 - June 2024 |

Collars |

Dated Brent |

|

|

65,000 |

|

|

$ |

65.00 |

|

|

$ |

100.00 |

|

| July 2024 - September

2024 |

Collars |

Dated Brent |

|

|

80,000 |

|

|

$ |

65.00 |

|

|

$ |

92.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 Guidance:

The Company has provided second quarter

2024 guidance and updated its full year 2024 guidance to

reflect the closing of the Svenska acquisition in April. All of the

quarterly and annual guidance is detailed in the tables below.

| |

|

|

FY 2024 |

|

|

Gabon |

|

|

Egypt |

|

|

Canada |

|

|

Cote d'Ivoire |

|

|

Production (BOEPD) |

WI |

|

23600 - 26500 |

|

|

|

8300 - 9600 |

|

|

|

9800 - 10600 |

|

|

|

2700 - 3200 |

|

|

|

2800 - 3100 |

|

| Production (BOEPD) |

NRI |

|

18900 - 21400 |

|

|

|

7200 - 8300 |

|

|

|

6700 - 7400 |

|

|

|

2200 - 2600 |

|

|

|

2800 - 3100 |

|

| Sales Volume (BOEPD) |

WI |

|

24300 - 27200 |

|

|

|

8300 - 9500 |

|

|

|

9800 - 10600 |

|

|

|

2700 - 3200 |

|

|

|

3500 - 3900 |

|

| Sales Volume (BOEPD) |

NRI |

|

19200 - 21800 |

|

|

|

7200 - 8300 |

|

|

|

6700 - 7400 |

|

|

|

2200 - 2600 |

|

|

|

3100 - 3500 |

|

| Production Expense

(millions) |

WI & NRI |

|

$162.0 - $174.5 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production Expense per

BOE |

WI |

|

$16.00 - $19.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production Expense per

BOE |

NRI |

|

$21.00 - $24.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Offshore Workovers

(millions) |

WI & NRI |

|

$1 - $10 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash G&A (millions) |

WI & NRI |

|

$20.0 - $28.0 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CAPEX (millions) |

WI & NRI |

|

$115 - $140 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DD&A ($/BOE) |

NRI |

|

$20.00 - $22.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Q2 2024 |

|

|

Gabon |

|

|

Egypt |

|

|

Canada |

|

|

Cote d'Ivoire |

|

|

Production (BOEPD) |

WI |

|

23800 - 27000 |

|

|

|

8000 - 9200 |

|

|

|

10000 - 11300 |

|

|

|

3000 - 3300 |

|

|

|

2800 - 3200 |

|

| Production (BOEPD) |

NRI |

|

19000 - 21800 |

|

|

|

7000 - 8000 |

|

|

|

6900 - 7800 |

|

|

|

2500 - 2800 |

|

|

|

2800 - 3200 |

|

| Sales Volume (BOEPD) |

WI |

|

22800 - 25400 |

|

|

|

7400 - 8100 |

|

|

|

10000 - 11300 |

|

|

|

3000 - 3300 |

|

|

|

2400 - 2700 |

|

| Sales Volume (BOEPD) |

NRI |

|

18100 - 20000 |

|

|

|

6500 - 7000 |

|

|

|

6900 - 7800 |

|

|

|

2500 - 2800 |

|

|

|

2200 - 2400 |

|

| Production Expense

(millions) |

WI & NRI |

|

$35.5 - $45.5 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production Expense per

BOE |

WI |

|

$11.50 - $16.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Production Expense per

BOE |

NRI |

|

$15.00 - $20.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Offshore Workovers

(millions) |

WI & NRI |

|

$0 - $0 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash G&A (millions) |

WI & NRI |

|

$5.0 - $7.0 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CAPEX (millions) |

WI & NRI |

|

$30 - $50 MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DD&A ($/BOE) |

NRI |

|

$20.00 - $22.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference Call

As previously announced, the Company will hold a

conference call to discuss its first quarter 2024 financial

and operating results tomorrow, Wednesday, May 8, 2024, at 10:00

a.m. Central Time (11:00 a.m. Eastern Time and 4:00 p.m. London

Time). Interested parties may participate by dialing (833)

685-0907. Parties in the United Kingdom may participate toll-free

by dialing 08082389064 and other international parties may dial

(412) 317-5741. Participants should request to be joined to the

“VAALCO Energy First Quarter 2024 Conference Call.” This call

will also be webcast on VAALCO’s website at www.vaalco.com. An

archived audio replay will be available on VAALCO’s website.

A “Q1 2024 Supplemental Information”

investor deck will be posted to VAALCO’s web site prior to its

conference call on May 8, 2024 that includes additional

financial and operational information.

About VAALCO

VAALCO, founded in 1985 and incorporated under

the laws of Delaware, is a Houston, Texas, USA based, independent

energy company with a diverse portfolio of production,

development and exploration assets across Gabon, Egypt, Cote

d'Ivoire, Equatorial Guinea and Canada.

For Further Information

|

|

|

| |

|

| VAALCO Energy, Inc.

(General and Investor Enquiries) |

+00 1 713 623 0801 |

| Website: |

www.vaalco.com |

| |

|

| |

|

| Al Petrie Advisors (US

Investor Relations) |

+00 1 713 543 3422 |

| Al Petrie / Chris Delange |

|

| |

|

| Buchanan (UK Financial

PR) |

+44 (0) 207 466 5000 |

| Ben Romney / Barry Archer |

VAALCO@buchanan.uk.com |

| |

|

Endnote

1. Reserves estimates in this announcement were

prepared in accordance with the definitions and guidelines set

forth in the 2018 Petroleum Resources Management Systems approved

by the Society of Petroleum Engineers. See “Oil and Natural Gas

Reserves” for further information.

Forward Looking Statements

This press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”) and Section 21E of the

Securities Exchange Act of 1934, as amended, which are intended to

be covered by the safe harbors created by those laws and other

applicable laws and “forward-looking information” within the

meaning of applicable Canadian securities laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

All statements other than statements of historical fact may be

forward-looking statements. The words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,”

“target,” “will,” “could,” “should,” “may,” “likely,” “plan” and

“probably” or similar words may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. Forward-looking statements in

this press release include, but are not limited to, statements

relating to (i) estimates of future drilling, production, sales and

costs of acquiring crude oil, natural gas and natural gas liquids;

(ii) expectations regarding VAALCO's ability to effectively

integrate assets and properties it has acquired as a result of the

Svenska acquisition into its operations; (iii) expectations

regarding future exploration and the development, growth and

potential of VAALCO’s operations, project pipeline and investments,

and schedule and anticipated benefits to be derived therefrom; (iv)

expectations regarding future acquisitions, investments or

divestitures; (v) expectations of future dividends, buybacks and

other potential returns to stockholders; (vi) expectations of

future balance sheet strength; (vii) expectations of future equity

and enterprise value; and (viii) VAALCO’s ability to finalize

documents and effectively execute the POD for the Venus development

in Block P.

Such forward-looking statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the forward-looking statements. These risks

and uncertainties include, but are not limited to: risks relating

to any unforeseen liabilities of VAALCO; the ability to generate

cash flows that, along with cash on hand, will be sufficient to

support operations and cash requirements; risks relating to the

timing and costs of completion for scheduled maintenance of the

FPSO servicing the Baobab field; and the risks described

under the caption “Risk Factors” in VAALCO’s 2023 Annual

Report on Form 10-K filed with the SEC on March 15, 2024.

Dividends beyond the second quarter of

2024 have not yet been approved or declared by the Board of

Directors for VAALCO. The declaration and payment of future

dividends remains at the discretion of the Board and will be

determined based on VAALCO’s financial results, balance sheet

strength, cash and liquidity requirements, future prospects, crude

oil and natural gas prices, and other factors deemed relevant by

the Board. The Board reserves all powers related to the declaration

and payment of dividends. Consequently, in determining the dividend

to be declared and paid on VAALCO common stock, the Board may

revise or terminate the payment level at any time without prior

notice.

Oil and Natural Gas

Reserves

This press release contains crude oil and

natural gas metrics which do not have standardized meanings or

standard methods of calculation as classified by the Securities and

Exchange Commission (the “SEC”) and therefore such measures may not

be comparable to similar measures used by other companies. Such

metrics have been included herein to provide readers with

additional measures to evaluate the acquisition of Svenska;

however, such measures may not be reliable indicators of future

performance.

WI CPR Reserves

WI CPR reserves represent proved (1P) and proved

plus probable (2P) estimates as reported by Petroleum Development

Consultants Limited and prepared in accordance with the definitions

and guidelines set forth in the 2018 Petroleum Resources Management

Systems approved by the Society of Petroleum Engineers. The SEC

definitions of proved and probable reserves are different from the

definitions contained in the 2018 Petroleum Resources Management

Systems approved by the Society of Petroleum Engineers. As a

result, 1P and 2P WI CPR reserves may not be comparable to United

States standards. The SEC requires United States oil and gas

reporting companies, in their filings with the SEC, to disclose

only proved reserves after the deduction of royalties and

production due to others but permits the optional disclosure of

probable and possible reserves in accordance with SEC

definitions.

1P and 2P WI CPR reserves, as disclosed herein,

may differ from the SEC definitions of proved and probable reserves

because:

- Pricing for SEC is the average closing price on the first

trading day of each month for the prior year which is then held

flat in the future, while the 1P and 2P WI CPR pricing is based on

pricing assumptions for future Brent oil pricing for 2023 of $84.5

and up to 2030 the Brent Oil price follows the average of four

available forecasts and assumes flat real thereafter. Oil price is

escalated 2% per year;

- Lease operating expenses are typically not escalated under the

SEC’s rules, while for the WI CPR reserves estimates, they are

escalated at 2% annually beginning in 2024.

Management uses 1P and 2P WI CPR reserves as a

measurement of operating performance because it assists management

in strategic planning, budgeting and economic evaluations and in

comparing the operating performance of Svenska to other companies.

Management believes that the presentation of 1P and 2P WI CPR

reserves is useful to its international investors, particularly

those that invest in companies trading on the London Stock

Exchange, in order to better compare reserve information to other

London Stock Exchange-traded companies that report similar

measures. However, 1P and 2P WI CPR reserves should not be used as

a substitute for proved reserves calculated in accordance with the

definitions prescribed by the SEC. In evaluating VAALCO’s business,

investors should rely on VAALCO’s SEC proved reserves and consider

1P and 2P WI CPR reserves only supplementally. As a result of the

consummation of the Acquisition, VAALCO will report Svenska’s

reserves in accordance with the definitions and regulations

promulgated by the SEC.

Other Oil and Gas Advisories

Investors are cautioned when viewing BOEs in

isolation. A BOE conversation ratio of six thousand cubic feet of

natural gas to one barrel of oil equivalent (6 MCF: 1 Bbl) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. Given that the value ratio based on the current price of

crude oil as compared to natural gas is significantly different

from the energy equivalency of 6:1, utilizing a conversion on a 6:1

basis may be an incomplete as an indication of value.

Inside Information

This announcement contains inside information as

defined in Regulation (EU) No. 596/2014 on market abuse which is

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (“MAR”) and is made in accordance with the

Company’s obligations under article 17 of MAR. The person

responsible for arranging the release of this announcement on

behalf of VAALCO is Matthew Powers, Corporate Secretary of

VAALCO.

VAALCO ENERGY, INC AND SUBSIDIARIESConsolidated Balance Sheets

(Unaudited)

| |

|

As of March 31, 2024 |

|

|

As of December 31, 2023 |

|

| ASSETS |

|

(in thousands) |

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

113,321 |

|

|

$ |

121,001 |

|

|

Restricted cash |

|

|

140 |

|

|

|

114 |

|

|

Receivables: |

|

|

|

|

|

|

|

|

|

Trade, net of allowances for credit loss and other of $0.8 and $0.5

million, respectively |

|

|

44,897 |

|

|

|

44,888 |

|

|

Accounts with joint venture owners, net of allowance for credit

losses of $0.8 and $0.8 million, respectively |

|

|

35 |

|

|

|

1,814 |

|

|

Egypt receivables and other, net of allowances for credit loss and

other of $6.0 and $4.6 million, respectively |

|

|

44,591 |

|

|

|

45,942 |

|

|

Crude oil inventory |

|

|

2,386 |

|

|

|

1,948 |

|

|

Prepayments and other |

|

|

12,374 |

|

|

|

12,434 |

|

|

Total current assets |

|

|

217,744 |

|

|

|

228,141 |

|

| |

|

|

|

|

|

|

|

|

| Crude oil, natural gas and

NGLs properties and equipment, net |

|

|

457,419 |

|

|

|

459,786 |

|

| Other noncurrent assets: |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

- |

|

|

|

1,795 |

|

|

Value added tax and other receivables, net of allowances for credit

loss and other of $0.0 and $0.0 million, respectively |

|

|

5,033 |

|

|

|

4,214 |

|

|

Right of use operating lease assets |

|

|

1,444 |

|

|

|

2,378 |

|

|

Right of use finance lease assets |

|

|

89,587 |

|

|

|

89,962 |

|

|

Deferred tax assets |

|

|

30,329 |

|

|

|

29,242 |

|

|

Abandonment funding |

|

|

6,268 |

|

|

|

6,268 |

|

|

Other long-term assets |

|

|

1,323 |

|

|

|

1,430 |

|

|

Total assets |

|

$ |

809,147 |

|

|

$ |

823,216 |

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

16,747 |

|

|

$ |

22,152 |

|

|

Accounts with joint venture owners |

|

|

3,836 |

|

|

|

5,990 |

|

|

Accrued liabilities and other |

|

|

60,345 |

|

|

|

67,597 |

|

|

Operating lease liabilities - current portion |

|

|

1,466 |

|

|

|

2,396 |

|

|

Finance lease liabilities - current portion |

|

|

10,974 |

|

|

|

10,079 |

|

|

Foreign income taxes payable |

|

|

37,836 |

|

|

|

19,261 |

|

|

Total current liabilities |

|

|

131,204 |

|

|

|

127,475 |

|

| Asset retirement

obligations |

|

|

47,644 |

|

|

|

47,343 |

|

| Operating lease liabilities -

net of current portion |

|

|

- |

|

|

|

33 |

|

| Finance lease liabilities -

net of current portion |

|

|

77,802 |

|

|

|

78,293 |

|

| Deferred tax liabilities |

|

|

71,228 |

|

|

|

73,581 |

|

| Other long-term

liabilities |

|

|

8,679 |

|

|

|

17,709 |

|

|

Total liabilities |

|

|

336,557 |

|

|

|

344,434 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $25 par value; 500,000 shares authorized, none

issued |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.10 par value; 160,000,000 shares authorized,

121,940,831 and 121,397,553 shares issued, 103,455,525 and

104,346,233 shares outstanding, respectively |

|

|

12,194 |

|

|

|

12,140 |

|

|

Additional paid-in capital |

|

|

358,827 |

|

|

|

357,498 |

|

|

Accumulated other comprehensive income |

|

|

426 |

|

|

|

2,880 |

|

|

Less treasury stock, 18,485,306 and 17,051,320 shares,

respectively, at cost |

|

|

(77,566 |

) |

|

|

(71,222 |

) |

|

Retained earnings |

|

|

178,709 |

|

|

|

177,486 |

|

|

Total shareholders' equity |

|

|

472,590 |

|

|

|

478,782 |

|

|

Total liabilities and shareholders' equity |

|

$ |

809,147 |

|

|

$ |

823,216 |

|

|

|

VAALCO ENERGY, INC AND SUBSIDIARIESConsolidated Statements of

Operations (Unaudited)

| |

|

Three Months Ended |

|

| |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

December 31, 2023 |

|

| |

|

(in thousands except per share amounts) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil, natural gas and natural gas liquids sales |

|

$ |

100,155 |

|

|

$ |

80,403 |

|

|

$ |

149,154 |

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Production expense |

|

|

32,089 |

|

|

|

28,200 |

|

|

|

46,397 |

|

|

FPSO demobilization and other costs |

|

|

— |

|

|

|

— |

|

|

|

1,837 |

|

|

Exploration expense |

|

|

48 |

|

|

|

8 |

|

|

|

706 |

|

|

Depreciation, depletion and amortization |

|

|

25,824 |

|

|

|

24,417 |

|

|

|

20,344 |

|

|

Transaction costs related to acquisition |

|

|

1,313 |

|

|

|

— |

|

|

|

— |

|

|

General and administrative expense |

|

|

6,710 |

|

|

|

5,224 |

|

|

|

7,005 |

|

|

Credit losses and other |

|

|

1,812 |

|

|

|

935 |

|

|

|

(7,343 |

) |

|

Total operating costs and expenses |

|

|

67,796 |

|

|

|

58,784 |

|

|

|

68,946 |

|

|

Other operating income (expense), net |

|

|

(166 |

) |

|

|

— |

|

|

|

731 |

|

| Operating income |

|

|

32,193 |

|

|

|

21,619 |

|

|

|

80,939 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative instruments gain

(loss), net |

|

|

(847 |

) |

|

|

21 |

|

|

|

2,500 |

|

|

Interest expense, net |

|

|

(935 |

) |

|

|

(2,246 |

) |

|

|

(1,077 |

) |

|

Other income (expense), net |

|

|

(487 |

) |

|

|

(1,153 |

) |

|

|

(797 |

) |

|

Total other income (expense), net |

|

|

(2,269 |

) |

|

|

(3,378 |

) |

|

|

626 |

|

| Income before income

taxes |

|

|

29,924 |

|

|

|

18,241 |

|

|

|

81,565 |

|

| Income tax expense |

|

|

22,238 |

|

|

|

14,771 |

|

|

|

37,574 |

|

| Net income |

|

$ |

7,686 |

|

|

$ |

3,470 |

|

|

$ |

43,991 |

|

| Other comprehensive income

(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation adjustments |

|

|

(2,454 |

) |

|

|

(125 |

) |

|

|

2,036 |

|

| Comprehensive income |

|

$ |

5,232 |

|

|

$ |

3,345 |

|

|

$ |

46,027 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

share |

|

$ |

0.07 |

|

|

$ |

0.03 |

|

|

$ |

0.41 |

|

| Basic weighted average shares

outstanding |

|

|

103,659 |

|

|

|

107,387 |

|

|

|

104,893 |

|

| Diluted net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

share |

|

$ |

0.07 |

|

|

$ |

0.03 |

|

|

$ |

0.41 |

|

| Diluted weighted average

shares outstanding |

|

|

104,541 |

|

|

|

108,752 |

|

|

|

105,020 |

|

| |

VAALCO ENERGY, INC AND SUBSIDIARIES Consolidated Statements

of Cash Flows (Unaudited)

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(in thousands) |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

7,686 |

|

|

$ |

3,470 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

25,824 |

|

|

|

24,417 |

|

|

Bargain purchase loss |

|

|

— |

|

|

|

1,412 |

|

|

Deferred taxes |

|

|

(3,441 |

) |

|

|

2,471 |

|

|

Unrealized foreign exchange loss |

|

|

(102 |

) |

|

|

512 |

|

|

Stock-based compensation |

|

|

898 |

|

|

|

649 |

|

|

Cash settlements paid on exercised stock appreciation rights |

|

|

(154 |

) |

|

|

(233 |

) |

|

Derivative instruments (gain) loss, net |

|

|

847 |

|

|

|

(21 |

) |

|

Cash settlements paid on matured derivative contracts, net |

|

|

(24 |

) |

|

|

(59 |

) |

|

Cash settlements paid on asset retirement obligations |

|

|

(29 |

) |

|

|

(123 |

) |

|

Credit losses and other |

|

|

1,812 |

|

|

|

935 |

|

|

Other operating loss, net |

|

|

166 |

|

|

|

13 |

|

|

Operational expenses associated with equipment and other |

|

|

302 |

|

|

|

(640 |

) |

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Trade, net |

|

|

(9 |

) |

|

|

21,357 |

|

|

Accounts with joint venture owners, net |

|

|

(683 |

) |

|

|

18,911 |

|

|

Egypt receivables and other, net |

|

|

1,346 |

|

|

|

(2,309 |

) |

|

Crude oil inventory |

|

|

(438 |

) |

|

|

(8,443 |

) |

|

Prepayments and other |

|

|

(2,278 |

) |

|

|

983 |

|

|

Value added tax and other receivables |

|

|

(2,734 |

) |

|

|

(1,361 |

) |

|

Other long-term assets |

|

|

(1,017 |

) |

|

|

1,051 |

|

|

Accounts payable |

|

|

(5,984 |

) |

|

|

(6,739 |

) |

|

Foreign income taxes receivable/(payable) |

|

|

18,912 |

|

|

|

8,193 |

|

|

Deferred tax liability |

|

|

— |

|

|

|

(3,250 |

) |

|

Accrued liabilities and other |

|

|

(19,068 |

) |

|

|

(19,190 |

) |

|

Net cash provided by (used in) operating activities |

|

|

21,832 |

|

|

|

42,006 |

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

Property and equipment expenditures |

|

|

(16,618 |

) |

|

|

(27,700 |

) |

|

Net cash provided by (used in) investing activities |

|

|

(16,618 |

) |

|

|

(27,700 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from the issuances of common stock |

|

|

447 |

|

|

|

274 |

|

|

Dividend distribution |

|

|

(6,463 |

) |

|

|

(6,735 |

) |

|

Treasury shares |

|

|

(6,344 |

) |

|

|

(5,377 |

) |

|

Payments of finance lease |

|

|

(2,095 |

) |

|

|

(1,701 |

) |

|

Net cash provided by (used in) in financing activities |

|

|

(14,455 |

) |

|

|

(13,539 |

) |

|

Effects of exchange rate changes on cash |

|

|

(208 |

) |

|

|

(309 |

) |

| NET CHANGE IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH |

|

|

(9,449 |

) |

|

|

458 |

|

| CASH, CASH EQUIVALENTS AND

RESTRICTED CASH AT BEGINNING OF PERIOD |

|

|

129,178 |

|

|

|

59,776 |

|

| CASH, CASH EQUIVALENTS AND

RESTRICTED CASH AT END OF PERIOD |

|

$ |

119,729 |

|

|

$ |

60,234 |

|

| |

VAALCO ENERGY, INC AND SUBSIDIARIESSelected Financial and

Operating Statistics(Unaudited)

| |

|

Three Months Ended |

|

| |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

December 31, 2023 |

|

|

NRI SALES DATA |

|

|

|

|

|

|

|

|

|

|

|

|

| Crude oil, natural gas and

natural gas liquids sales (MBOE) |

|

|

1,490 |

|

|

|

1,224 |

|

|

|

1,994 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| WI PRODUCTION DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

Etame Crude oil (MBbl) |

|

|

819 |

|

|

|

942 |

|

|

|

887 |

|

|

Egypt Crude oil (MBbl) |

|

|

950 |

|

|

|

903 |

|

|

|

1,024 |

|

|

Canada Crude Oil (MBbl) |

|

|

61 |

|

|

|

93 |

|

|

|

77 |

|

|

Canada Natural Gas (Mcf) |

|

|

469 |

|

|

|

415 |

|

|

|

471 |

|

|

Canada Natural Gas Liquid (MBbl) |

|

|

76 |

|

|

|

77 |

|

|

|

81 |

|

|

Canada Crude oil, natural gas and natural gas liquids (MBOE) |

|

|

215 |

|

|

|

239 |

|

|

|

236 |

|

|

Total Crude oil, natural gas and natural gas liquids production

(MBOE) |

|

|

1,984 |

|

|

|

2,084 |

|

|

|

2,146 |

|

|

Gabon Average daily production volumes (BOEPD) |

|

|

9,001 |

|

|

|

10,463 |

|

|

|

9,641 |

|

|

Egypt Average daily production volumes (BOEPD) |

|

|

10,440 |

|

|

|

10,033 |

|

|

|

11,126 |

|

|

Canada Average daily production volumes (BOEPD) |

|

|

2,363 |

|

|

|

2,656 |

|

|

|

2,563 |

|

|

Average daily production volumes (BOEPD) |

|

|

21,807 |

|

|

|

23,152 |

|

|

|

23,330 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NRI PRODUCTION DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

Etame Crude oil (MBbl) |

|

|

713 |

|

|

|

820 |

|

|

|

772 |

|

|

Egypt Crude oil (MBbl) |

|

|

641 |

|

|

|

616 |

|

|

|

697 |

|

|

Canada Crude Oil (MBbl) |

|

|

51 |

|

|

|

82 |

|

|

|

63 |

|

|

Canada Natural Gas (Mcf) |

|

|

392 |

|

|

|

367 |

|

|

|

384 |

|

|

Canada Natural Gas Liquid (MBbl) |

|

|

63 |

|

|

|

68 |

|

|

|

66 |

|

|

Canada Crude oil, natural gas and natural gas liquids (MBOE) |

|

|

179 |

|

|

|

211 |

|

|

|

193 |

|

|

Total Crude oil, natural gas and natural gas liquids production

(MBOE) |

|

|

1,533 |

|

|

|

1,647 |

|

|

|

1,662 |

|

|

Gabon Average daily production volumes (BOEPD) |

|

|

7,835 |

|

|

|

9,115 |

|

|

|

8,391 |

|

|

Egypt Average daily production volumes (BOEPD) |

|

|

7,044 |

|

|

|

6,844 |

|

|

|

7,576 |

|

|

Canada Average daily production volumes (BOEPD) |

|

|

1,971 |

|

|

|

2,347 |

|

|

|

2,098 |

|

|

Average daily production volumes (BOEPD) |

|

|

16,848 |

|

|

|

18,306 |

|

|

|

18,065 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE SALES PRICES: |

|

|

|

|

|

|

|

|

|

|

|

|

| Crude oil, natural gas and

natural gas liquids sales (per BOE) - WI basis |

|

$ |

69.62 |

|

|

$ |

66.42 |

|

|

$ |

73.98 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Crude oil, natural gas and

natural gas liquids sales (per BOE) - NRI basis |

|

$ |

66.43 |

|

|

$ |

65.68 |

|

|

$ |

73.96 |

|

| Crude oil, natural gas and

natural gas liquids sales (Per BOE including realized commodity

derivatives) |

|

$ |

66.41 |

|

|

$ |

65.63 |

|

|

$ |

73.89 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| COSTS AND EXPENSES (Per BOE of

sales): |

|

|

|

|

|

|

|

|

|

|

|

|

| Production expense |

|

$ |

21.54 |

|

|

$ |

23.04 |

|

|

$ |

23.27 |

|

| Production expense, excluding

offshore workovers and stock compensation* |

|

|

21.56 |

|

|

|

23.91 |

|

|

|

23.25 |

|

| Depreciation, depletion and

amortization |

|

|

17.33 |

|

|

|

19.95 |

|

|

|

10.20 |

|

| General and administrative

expense** |

|

|

4.50 |

|

|

|

4.27 |

|

|

|

3.51 |

|

| Property and equipment

expenditures, cash basis (in thousands) |

|

$ |

16,618 |

|

|

$ |

27,700 |

|

|

$ |

42,391 |

|

*Offshore workover costs excluded from the three

months ended March 31, 2024 and 2023 and December

31, 2023 are $(0.1) million, $(1.1) million and

$0.0 million, respectively.*Stock compensation associated with

production expense excluded from the three months ended March 31,

2024 and 2023 and December 31, 2023 are

immaterial.**General and administrative expenses include $0.58,

$0.52 and $0.50 per barrel of oil related

to stock-based compensation expense in the three months ended

March 31, 2024 and 2023 and December 31,

2023, respectively.

NON-GAAP FINANCIAL MEASURES

Management uses Adjusted Net Income to evaluate

operating and financial performance and believes the measure is

useful to investors because it eliminates the impact of certain

non-cash and/or other items that management does not consider to be

indicative of the Company’s performance from period to period.

Management also believes this non-GAAP measure is useful to

investors to evaluate and compare the Company’s operating and

financial performance across periods, as well as facilitating

comparisons to others in the Company’s industry. Adjusted Net

Income is a non-GAAP financial measure and as used herein

represents net income before discontinued operations, impairment of

proved crude oil and natural gas properties, deferred income tax

expense, unrealized commodity derivative loss, gain on the Sasol

Acquisition and non-cash and other items.