As filed with the U.S. Securities and

Exchange Commission on January 6, 2023

1933 Act File No. 333-

1940 Act File No. 811-22974

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

x

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

¨

Pre-Effective Amendment No.

¨ Post-Effective Amendment No.

and

x REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

x

Amendment No. 44

EAGLE POINT CREDIT COMPANY INC.

(Exact name of Registrant as specified

in charter)

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Address of Principal Executive Offices)

(203) 340-8500

(Registrant’s telephone number, including

Area Code)

Thomas P. Majewski

600 Steamboat Road, Suite 202

Greenwich, CT 06830

(Name and address of agent for service)

Copies of Communications to:

Thomas J. Friedmann

Philip T. Hinkle

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110

(617) 728-7120

Approximate

date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

| ¨ | Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment

plans. |

| x | Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415

under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment

plan. |

| x | Check box if this Form is

a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

| ¨ | Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that

will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. |

| ¨ | Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

It is proposed that this filing will

become effective (check appropriate box):

| ¨ | when declared effective pursuant to Section 8(c) of the Securities Act. |

If appropriate, check the following box:

| ¨ | This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. |

| ¨ | This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: |

| ¨ | This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities

Act registration statement number of the earlier effective registration statement for the same offering is: |

| ¨ | This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities

Act registration statement number of the earlier effective registration statement for the same offering is: |

Check each box that appropriately characterizes

the Registrant:

| x | Registered Closed-End Fund (closed-end

company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)). |

| ¨ | Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under

the Investment Company Act). |

| ¨ | Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3

under the Investment Company Act). |

| x | A.2 Qualified (qualified to register

securities pursuant to General Instruction A.2 of this Form). |

| ¨ | Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| ¨ | Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”)). |

| ¨ | If an Emerging Growth Company, indicate by check mark if the Registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| ¨ | New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant

shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary

prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Preliminary

Prospectus Dated January 6, 2023

PRELIMINARY PROSPECTUS

$1,000,000,000

Eagle

Point Credit Company Inc.

Common

Stock

Preferred Stock

Subscription Rights

Debt Securities

We

are an externally managed, non-diversified closed-end management investment company that has registered as an investment company under

the Investment Company Act of 1940, as amended, or the “1940 Act.” Our primary investment objective is to generate high current

income, with a secondary objective to generate capital appreciation. We seek to achieve our investment objectives by investing primarily

in equity and junior debt tranches of collateralized loan obligations, or “CLOs,” that are collateralized by a portfolio consisting

primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various industry

sectors. We may also invest in other related securities and instruments or other securities and instruments that the Adviser believes

are consistent with our investment objectives, including senior debt tranches of CLOs, loan accumulation facilities (“LAFs”),

securities issued by other securitization vehicles, such as credit-linked notes and collateralized bond obligations, or “CBOs”,

and synthetic investments, such as significant risk transfer securities and credit risk transfer securities issued by banks or other financial

institutions. From time to time, in connection with the acquisition of CLO equity, we may receive fee rebates from the CLO issuer. LAFs

are short- to medium-term facilities often provided by the bank that will serve as the placement agent or arranger on a CLO transaction.

LAFs typically incur leverage between four and six times prior to a CLO’s pricing. The CLO securities in which we primarily seek

to invest are unrated or rated below investment grade and are considered speculative with respect to timely payment of interest and repayment

of principal. Unrated and below investment grade securities are also sometimes referred to as “junk” securities. In addition,

the CLO equity and junior debt securities in which we invest are highly leveraged (with CLO equity securities typically being leveraged

ten times), which magnifies our risk of loss on such investments. See “Risk Factors — Risks Related to Our Investments

— We may leverage our portfolio, which would magnify the potential for gain or loss on amounts invested and will increase the risk

of investing in us.”

Eagle

Point Credit Management LLC, or the “Adviser,” our investment adviser, manages our investments subject to the supervision

of our board of directors. As of September 30, 2022, the Adviser, collectively with an affiliate of the Adviser, Eagle Point Income

Management LLC, or “Eagle Point Income Management,” had approximately $7.3 billion in total assets under management, including

capital commitments that were undrawn as of such date. Eagle Point Administration LLC, an affiliate of the Adviser, or the “Administrator,”

serves as our administrator.

We

may offer, from time to time, in one or more offerings or series, together or separately, up to $1,000,000,000 of our common stock,

Preferred Stock (as defined herein), subscription rights or debt securities, which we refer to, collectively, as the

“securities.” We may sell our securities through underwriters or dealers, “at-the-market” to or through a

market maker into an existing trading market or otherwise directly to one or more purchasers or through agents or through a

combination of methods of sale. The identities of such underwriters, dealers, market makers or agents, as the case may be, will be

described in one or more supplements to this prospectus. The securities may be offered at prices and on terms to be described in one

or more supplements to this prospectus. In the event we offer common stock, the offering price per share of our common stock

exclusive of any underwriting commissions or discounts will not be less than the net asset value, or “NAV,” per share of

our common stock at the time we make the offering except (1) in connection with a rights offering to our existing stockholders,

(2) with the consent of the majority of our common stockholders, (3) upon the conversion of a convertible security in

accordance with its terms or (4) under such circumstances as the Securities and Exchange Commission, or the “SEC,”

may permit.

In

addition, this prospectus relates to 5,822,728 shares of our common stock that may be sold by the selling stockholders identified under

“Control Persons, Principal Stockholders and Selling Stockholders.” Sales of our common stock by the selling

stockholders, which may occur at prices below the NAV per share of our common stock, may adversely affect the market price of our common

stock and may make it more difficult for us to raise capital. The selling stockholders acquired their shares of our common stock in connection

with our conversion to a corporation. Each offering by the selling stockholders of their shares of our common stock through agents, underwriters

or dealers will be accompanied by a prospectus supplement that will identify the selling stockholder that is participating in such offering.

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

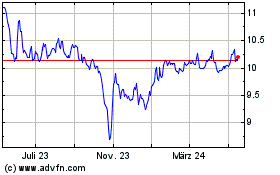

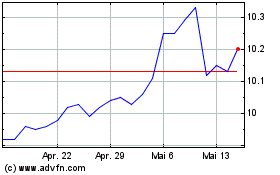

Our

common stock, 6.50% Series C Term Preferred Stock due 2031, 6.75% Series D Preferred Stock, 6.6875% notes due 2028, 5.375%

notes due 2029 and 6.75% notes due 2031 trade on the New York Stock Exchange under the symbols “ECC,” “ECCC,”

“ECC PRD,” “ECCX,” “ECCV,” and “ECCW,” respectively. Based on the closing price of our

common stock on January 4, 2023, the aggregate market value of the 5,822,728 shares of our common stock held by the selling stockholders

is approximately $59.7 million. We determine the NAV per share of our common stock on a quarterly basis. As of September 30, 2022, the

NAV per share of our common stock was $10.23 (the last date prior to the date of this prospectus as of which we determined our NAV).

Management’s unaudited estimate of our NAV per share of our common stock as of November 30, 2022 was $9.66. The last reported

closing sales price for our common stock on January 4, 2023 was $10.25 per share, representing a 0.2% premium to our NAV per share as of September 30, 2022.

Shares

of common stock of closed-end management investment companies that are listed on an exchange frequently trade at a discount to their NAV.

If our shares of common stock trade at a discount to our NAV, it will likely increase the risk of loss for purchasers of our securities.

Investing

in our securities involves a high degree of risk, including the risk of a substantial loss of investment. Before purchasing any securities,

you should read the discussion of the principal risks of investing in our securities, which are summarized in “Risk Factors”

beginning on page 13 of this prospectus.

This

prospectus contains important information you should know before investing in our securities. Please read this prospectus and retain it

for future reference. We file annual and semi-annual stockholder reports, proxy statements and other information with the Securities and

Exchange Commission, or the “SEC.” To obtain this information free of charge or make other inquiries pertaining to us, please

visit our website (www.eaglepointcreditcompany.com) or call (844) 810-6501 (toll-free). You may also obtain a copy of any information

regarding us filed with the SEC from the SEC’s website (www.sec.gov).

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is

truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to consummate

sales of securities unless accompanied by a prospectus supplement.

The date of this prospectus is

[●], 2023

TABLE OF CONTENTS

Page

******

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not, and the selling stockholders

have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We are not, and the selling stockholders identified under “Control Persons, Principal

Stockholders and Selling Stockholders” are not, making an offer to sell these securities in any jurisdiction where the offer

or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front

cover of this prospectus. Our business, financial condition and results of operations may have changed since that date. We will notify

securityholders promptly of any material change to this prospectus during the period in which we are required to deliver the prospectus.

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement that we have filed with the SEC using the “shelf” registration process. Under

the shelf registration process, we may offer from time to time up to $1,000,000,000 of our securities on the terms to be determined at

the time of the offering. We may sell our securities through underwriters or dealers, “at-the-market” to or through a market

maker, into an existing trading market or otherwise directly to one or more purchasers or through agents or through a combination of methods

of sale. The identities of such underwriters, dealers, market makers or agents, as the case may be, will be described in one or more supplements

to this prospectus. The securities may be offered at prices and on terms described in one or more supplements to this prospectus. In addition,

this prospectus relates to 5,822,728 shares of our common stock that may be sold by the selling stockholders

identified under “Control Persons, Principal Stockholders and Selling Stockholders.” This prospectus provides

you with a general description of the securities that we and the selling stockholders may offer. Each time we or the selling stockholders

use this prospectus to offer securities, we will provide a prospectus supplement that will contain specific information about the terms

of that offering. The prospectus supplement may also add, update or change information contained in this prospectus, and the prospectus

and prospectus supplement will together serve as the prospectus. Please carefully read this prospectus and any prospectus supplement,

together with any exhibits, before you make an investment decision.

PROSPECTUS SUMMARY

The

following summary highlights some of the information contained in this prospectus. It is not complete and may not contain all the information

that is important to a decision to invest in our securities. You should read carefully the more detailed information set forth under “Risk

Factors” and the other information included in this prospectus and any applicable prospectus supplement. Except where the context

suggests otherwise, the terms:

| • | The “Company,” “we,” “us,” and “our” refer to Eagle

Point Credit Company Inc., a Delaware corporation, and its consolidated subsidiaries or, for periods prior to our conversion to a corporation

on October 6, 2014, Eagle Point Credit Company LLC, a Delaware limited liability company; |

| • | The “Adviser” refers to Eagle Point Credit Management LLC, a Delaware limited liability

company; |

| • | The “Administrator” refers to Eagle Point Administration LLC, a Delaware limited liability

company; and |

| • | “Risk-adjusted returns” refers to the profile of expected asset returns across a range

of potential macroeconomic scenarios, and does not imply that a particular strategy or investment should be considered low-risk. |

Eagle Point Credit

Company Inc.

We

are an externally managed, non-diversified closed-end management investment company that has registered as an investment company under

the 1940 Act. We have elected to be treated, and intend to qualify annually, as a regulated investment company, or “RIC,”

under Subchapter M of the Internal Revenue Code of 1986, as amended, or the “Code,” commencing with our tax year ended November 30,

2014.

Our

primary investment objective is to generate high current income, with a secondary objective to generate capital appreciation. We seek

to achieve our investment objectives by investing primarily in equity and junior debt tranches of CLOs that are collateralized by a portfolio

consisting primarily of below investment grade U.S. senior secured loans with a large number of distinct underlying borrowers across various

industry sectors. We may also invest in other related securities and instruments or other securities and instruments that the Adviser

believes are consistent with our investment objectives, including senior debt tranches of CLOs, LAFs, securities issued by other securitization

vehicles, such as credit-linked notes and CBOs, and synthetic investments, such as significant risk transfer securities and credit risk

transfer securities issued by banks or other financial institutions. We may also acquire securities issued by other investment companies,

including closed-end funds, business development companies (“BDCs”,) mutual funds, and exchange-traded funds (“ETFs”,)

and may otherwise invest indirectly in securities consistent with our investment objectives, including through a joint venture vehicle.

The amount that we will invest in other securities and instruments, which may include investments in debt and other securities

issued by CLOs collateralized by non-U.S. loans or securities of other collective investment vehicles, will vary from time to time and,

as such, may constitute a material part of our portfolio on any given date, all as based on the Adviser’s assessment of prevailing

market conditions. From time to time, in connection with the acquisition of CLO equity, we may receive fee

rebates from the CLO issuer.

The

CLO securities in which we primarily seek to invest are rated below investment grade or, in the case of CLO equity securities, are unrated,

and are considered speculative with respect to timely payment of interest and repayment of principal. Unrated and below investment grade

securities are also sometimes referred to as “junk” securities. In addition, the CLO equity and junior debt securities in

which we invest are highly leveraged (with CLO equity securities typically being leveraged ten times), which magnifies our risk of loss

on such investments. LAFs are short- to medium-term facilities often provided by the bank that will serve as the placement agent or arranger

on a CLO transaction. LAFs typically incur leverage between four and six times prior to a CLO’s pricing.

These

investment objectives and strategies are not fundamental policies of ours and may be changed by our board of directors without prior approval

of our stockholders. See “Business.”

In the

primary CLO market (i.e., acquiring securities at the inception of a CLO), we seek to invest in CLO securities that the Adviser

believes have the potential to generate attractive risk-adjusted returns and to outperform other similar CLO securities issued within

the respective vintage period. In the secondary CLO market (i.e., acquiring existing CLO securities), we seek to invest in CLO

securities that the Adviser believes have the potential to generate attractive risk-adjusted returns.

The Adviser pursues a differentiated strategy

within the CLO market focused on:

| • | proactive sourcing and identification of investment opportunities; |

| • | utilization of the Adviser’s methodical investment analysis and due diligence process; |

| • | active involvement at the CLO structuring and formation stage; and |

| • | taking, in many instances, significant stakes in CLO equity and junior debt tranches. |

We

believe that the Adviser’s direct and often longstanding relationships with CLO collateral managers, its CLO structural expertise

and its relative scale in the CLO market will enable us to source and execute investments with attractive economics and terms relative

to other CLO opportunities.

When

we make a significant primary market investment in a particular CLO tranche, we generally expect to be able to influence the CLO’s

key terms and conditions. In particular, the Adviser believes that, although typically exercised only a minority of the time in the Adviser’s

experience, the protective rights associated with holding a majority position in a CLO equity tranche (such as the ability to call the

CLO after the non-call period, to refinance/reprice certain CLO debt tranches after a period of time and to influence potential amendments

to the governing documents of the CLO) may reduce our risk in these investments. We may acquire a majority position in a CLO tranche directly,

or we may benefit from the advantages of a majority position where both we and other accounts managed by the Adviser collectively hold

a majority position, subject to any restrictions on our ability to invest alongside such other accounts. See “Conflicts of

Interest — Co-Investments and Related Party Transactions.”

We

seek to construct a portfolio of CLO securities that provides varied exposure across a number of key categories, including:

| • | number of borrowers underlying each CLO; |

| • | industry type of a CLO’s underlying borrowers; |

| • | number and investment style of CLO collateral managers; and |

The

Adviser has a long-term investment horizon and invests primarily with a buy-and-hold mentality. However, on an ongoing basis, the Adviser

actively monitors each investment and may sell positions if circumstances change from the time of investment or if the Adviser believes

it is in our best interest to do so.

“Names

Rule” Policy

In

accordance with the requirements of the 1940 Act, we have adopted a policy to invest at least 80% of our assets in the particular type

of investments suggested by our name. Accordingly, under normal circumstances, we invest at least 80% of the aggregate of our net assets

and borrowings for investment purposes in credit and credit-related instruments. For purposes of this policy, we consider credit and credit-

related instruments to include, without limitation: (i) equity and debt tranches of CLOs, LAFs, securities issued by other securitization

vehicles, such as credit-linked notes and CBOs, and synthetic investments, such as significant risk transfer securities and credit risk

transfer securities issued by banks or other financial institutions; (ii) secured and unsecured floating rate and fixed rate loans;

(iii) investments in corporate debt obligations, including bonds, notes, debentures, commercial paper and other obligations of corporations

to pay interest and repay principal; (iv) debt issued by governments, their agencies, instrumentalities, and central banks; (v) commercial

paper and short-term notes; (vi) preferred stock; (vii) convertible debt securities; (viii) certificates of deposit, bankers’

acceptances and time deposits; and (ix) other credit-related instruments. Our investments in derivatives, other investment companies,

and other instruments designed to obtain indirect exposure to credit and credit-related instruments are counted towards our 80% investment

policy to the extent such instruments have similar economic characteristics to the investments included within that policy.

Our 80% policy with

respect to investments in credit and credit-related instruments is not fundamental and may be changed by our board of directors

without stockholder approval. Stockholders will be provided with sixty (60) days’ notice in the manner prescribed by the SEC before

making any change to this policy. Our investments in derivatives, other investment companies, and other instruments designed to obtain

indirect exposure to credit and credit-related instruments are counted towards our 80% investment policy to the extent such instruments

have similar economic characteristics to the investments included within that policy.

This policy

is not a fundamental policy of ours and may be changed by our board of directors without prior approval of our stockholders.

Eagle Point Credit

Management

The

Adviser manages our investments subject to the supervision of our board of directors pursuant to an amended and restated investment advisory

agreement, or the “Investment Advisory Agreement.” An affiliate of the Adviser, Eagle Point Administration, performs, or arranges

for the performance of, our required administrative services. For a description of the fees and expenses that we pay to the Adviser and

the Administrator, see “The Adviser and the Administrator — Investment Advisory Agreement — Management Fee and

Incentive Fee” and “The Adviser and the Administrator — The Administrator and the Administration Agreement.”

The Adviser was

established in 2012 by Thomas P. Majewski and Stone Point Capital LLC, or “Stone Point,” as investment manager of Trident

V, L.P. and related investment vehicles, which we refer to collectively as the “Trident V Funds.” Stone Point, an investment

adviser registered with the SEC, is a specialized private equity firm focused on the financial services industry.

The

Adviser is registered as an investment adviser with the SEC. The Adviser, collectively with Eagle Point Income Management, as of September 30,

2022, had approximately $7.3 billion of total assets under management, including capital commitments that were undrawn as of such date.

Based on the Adviser’s CLO equity assets under management, the Adviser believes that, collectively with Eagle Point Income Management,

it is among the largest CLO equity investors in the market. The Adviser is primarily owned by the Trident V Funds through intermediary

holding companies. Additionally, the Adviser’s Senior Investment Team also holds an indirect ownership interest in the Adviser.

The Adviser is ultimately governed through intermediary holding companies by a board of managers, or the “Adviser’s Board

of Managers,” which includes Mr. Majewski and certain principals of Stone Point. See “The Adviser and the Administrator.”

The

“Senior Investment Team” is led by Mr. Majewski, Managing Partner and founder of the Adviser, and is also comprised of

Daniel W. Ko, Principal and Portfolio Manager, and Daniel M. Spinner, Principal and Portfolio Manager. The Senior Investment Team is primarily

responsible for our day-to-day investment management and the implementation of our investment strategy and process.

Each

member of the Senior Investment Team is a CLO industry specialist who has been directly involved in the CLO market for the majority of

his career and has built relationships with key market participants, including CLO collateral managers, investment banks and investors.

Members of the Senior Investment Team have been involved in the CLO market as:

| • | the head of the CLO business at various investment banks; |

| • | a lead CLO structurer and collateralized debt obligation, or “CDO,” workout specialist at an investment bank; |

| • | a CLO equity and debt investor; |

| • | principal investors in CLO collateral management firms; and |

| • | a lender and mergers and acquisitions adviser to CLO collateral management firms. |

We

believe that the complementary, yet highly specialized, skill set of each member of the Senior Investment Team provides the Adviser with

a competitive advantage in its CLO-focused investment strategy. See “The Adviser and the Administrator — Portfolio Managers.”

In addition

to managing our investments, the Adviser, the Adviser’s affiliates and the members of the Senior Investment Team manage investment

accounts for other clients, including Eagle Point Income Company Inc., or “Eagle Point Income Company” or “EIC,”

a publicly traded closed-end management investment company that is registered under the 1940 Act and for which Eagle Point Income Management serves as investment

adviser and Eagle Point Institutional Income Fund, or “Eagle Point Institutional Income” or “EPIIF,” a non-listed,

closed-end management investment company that is registered under the 1940 Act, privately offered pooled investment vehicles and institutional

separate accounts. Many of these accounts pursue an investment strategy that substantially or partially overlaps with the strategy that

we pursue. See “Risk Factors — Risks Related to Our Business and Structure — There are significant actual and

potential conflicts of interest which could impact our investment returns.”

CLO Overview

Our investment

portfolio is comprised primarily of investments in the equity and junior debt tranches of CLOs. The CLOs that we primarily target are

securitization vehicles that pool portfolios of primarily below investment grade U.S. senior secured loans. Such pools of underlying assets

are often referred to as a CLO’s “collateral.” While the vast majority of the portfolio of most CLOs consists of senior

secured loans, many CLOs enable the CLO collateral manager to invest up to 10% of the portfolio in assets that are not first lien senior

secured loans, including second lien loans, unsecured loans, senior secured bonds and senior unsecured bonds.

CLOs are generally

required to hold a portfolio of assets that is highly diversified by underlying borrower and industry and that is subject to a variety

of asset concentration limitations. Most CLOs are non-static, revolving structures that generally allow for reinvestment over a specific

period of time (the “reinvestment period”) which is typically up to five years. The terms and covenants of a typical CLO structure

are, with certain exceptions, based primarily on the cash flow generated by, and the par value (as opposed to the market price or fair

value) of, the collateral. These covenants include collateral coverage tests, interest coverage tests and collateral quality tests.

A

CLO funds the purchase of a portfolio of primarily senior secured loans via the issuance of CLO equity and debt securities in the form

of multiple, primarily floating rate, debt tranches. The CLO debt tranches typically are rated “AAA” (or its equivalent) at

the most senior level down to “BB” or “B” (or its equivalent), which is below investment grade, at the junior

level by Moody’s Investors Service, Inc., or “Moody’s,” S&P Global Ratings, or “S&P,”

and/or Fitch Ratings, Inc., or “Fitch.” The interest rate on the CLO debt tranches is the lowest at the AAA-level and

generally increases at each level down the rating scale. The CLO equity tranche is unrated and typically represents approximately 8% to

11% of a CLO’s capital structure. Below investment grade and unrated securities are sometimes referred to as “junk”

securities. The diagram below is for illustrative purposes only and highlights a hypothetical structure intended to depict a typical CLO.

A minority of CLOs also include a B-rated debt tranche (in which we may invest), and the structure of CLOs in which we invest may otherwise

vary from this example. The left column represents the CLO’s assets, which support the liabilities and equity in the right

column. The right column shows the various classes of debt and equity issued by the hypothetical CLO in order of seniority as to rights

in payments from the assets. The percentage ranges appearing below the rating of each class represents the percent such class comprises

of the overall “capital stack” (i.e., total debt and equity issued by the CLO).

CLOs have two priority-of-payment schedules

(commonly called “waterfalls”), which are detailed in a CLO’s indenture and govern how cash generated from a CLO’s

underlying collateral is distributed to the CLO’s equity and debt investors. The interest waterfall applies to interest payments

received on a CLO’s underlying collateral. The principal waterfall applies to cash generated from principal on the underlying collateral,

primarily through loan repayments and the proceeds from loan sales. Through the interest waterfall, any excess interest-related cash flow

available after the required quarterly interest payments to CLO debt investors are made and certain CLO expenses (such as administration

and collateral management fees) are paid is then distributed to the CLO’s equity investors each quarter, subject to compliance with

certain tests.

A CLO’s indenture typically requires

that the maturity dates of a CLO’s assets, typically five to eight years from the date of issuance of a senior secured loan, be

shorter than the maturity date of the CLO’s liabilities, typically 12 to 13 years from the date of issuance. However, CLO investors

do face reinvestment risk with respect to a CLO’s underlying portfolio. In addition, in most CLO transactions, CLO debt investors

are subject to prepayment risk in that the holders of a majority of the equity tranche can direct a call or refinancing of a CLO, which

would cause the CLO’s outstanding CLO debt securities to be repaid at par. See “Risk Factors —

Risks Related to Our Investments — We and our investments are subject to reinvestment risk.”

Our Structure

We

were organized as Eagle Point Credit Company LLC, a Delaware limited liability company, on March 24, 2014, converted to a Delaware

corporation on October 6, 2014 and completed our initial public offering on October 7, 2014. We have two wholly-owned subsidiaries:

(1) Eagle Point Credit Company Sub (Cayman) Ltd., or the “Cayman Subsidiary” and (2) Eagle Point Credit Company

Sub II (Cayman) Ltd., or the “Cayman II Subsidiary.” We generally gain access to certain newly issued Regulation S securities

and hold other securities through the Cayman Subsidiary, and hold certain other investments through the Cayman II Subsidiary. Regulation

S securities are securities of U.S. and non-U.S. issuers that are issued through offerings made pursuant to Regulation S under the Securities

Act of 1933, as amended, or the “Securities Act.” Each of our subsidiaries is advised by the Adviser pursuant to the Investment

Advisory Agreement. The following chart reflects our organizational structure and our relationship with the Adviser and the Administrator

as of the date of this prospectus:

Financing and Hedging

Strategy

Leverage

by the Company. We may use leverage as and to the extent permitted by the 1940 Act. We are permitted to obtain leverage

using any form of financial leverage instruments, including funds borrowed from banks or other financial institutions, margin facilities,

notes or Preferred Stock and leverage attributable to reverse repurchase agreements or similar transactions. Over the long term, management

expects us to operate under normal market conditions generally with leverage within a range of 25% to 35% of total assets, although the

actual amount of our leverage will vary over time. Certain instruments that create leverage are considered to be senior securities under

the 1940 Act.

With

respect to senior securities representing indebtedness (i.e., borrowing or deemed borrowing, including our 6.6875% notes due 2028,

or the “2028 Notes,” our 5.375% notes due 2029, or the “2029 Notes,” our 6.75% notes due 2031, or the “2031

Notes,” and collectively with the 2028 Notes and the 2029 Notes, the “Notes”), other than temporary borrowings as defined

under the 1940 Act, we are required under current law to have an asset coverage of at least 300%, as measured at the time of borrowing

and calculated as the ratio of our total assets (less all liabilities and indebtedness not represented by senior securities) over the aggregate amount of our outstanding senior securities representing

indebtedness. With respect to senior securities that are stocks (i.e., shares of our Preferred Stock), we are required under current

law to have an asset coverage of at least 200%, as measured at the time of the issuance of any such shares of Preferred Stock and calculated

as the ratio of our total assets (less all liabilities and indebtedness not represented by senior securities) over the aggregate amount

of our outstanding senior securities representing indebtedness plus the aggregate liquidation preference of any outstanding shares of

Preferred Stock.

As

of September 30, 2022, we had two series of Preferred Stock outstanding, the 6.50% Series C Term Preferred Stock due

2031, or the “Series C Term Preferred Stock,” and the 6.75% Series D Preferred Stock, which is “perpetual”

and has no fixed maturity date, or the “Series D Preferred Stock” and together with the Series C Term Preferred

Stock and any additional shares of Preferred Stock, which the Company may issue from time to time, the “Preferred Stock.”

As

of September 30, 2022, our leverage, including the outstanding Notes and the Preferred Stock, represented approximately 35.1% of

our total assets (less current liabilities). On a pro forma basis, after giving effect to

the issuance in our “at-the-market” offering of 3,316,246 shares of our common stock from October 1, 2022 through November 30,

2022, our leverage, including the outstanding Notes and the Preferred Stock, represented approximately 34.9% of our total assets (less

current liabilities) as of November 30, 2022 (based on management’s unaudited

estimate of our NAV as of such date). As of September 30, 2022, our asset coverage ratios in respect of (i) senior

securities representing indebtedness and (ii) our outstanding Preferred Stock, each as calculated pursuant to Section 18 of

the 1940 Act, were 421% and 285%, respectively. In the event we fail to meet our applicable asset coverage ratio requirements, we may

not be able to incur additional debt and/or issue additional Preferred Stock, and could be required by law or otherwise to sell a portion

of our investments to repay some debt or redeem shares of Preferred Stock (if any) when it is disadvantageous to do so, which could have

a material adverse effect on our operations, and we may not be able to make certain distributions or pay dividends of an amount necessary

to continue to qualify as a RIC for U.S. federal income tax purposes.

We

expect that we will, or that we may need to, raise additional capital in the future to fund our continued growth, and we may do so by

entering into a credit facility, issuing additional shares of Preferred Stock or debt securities or through other leveraging instruments.

Subject to the limitations under the 1940 Act, we may incur additional leverage opportunistically and may choose to increase or decrease

our leverage. In addition, we may borrow for temporary, emergency or other purposes as permitted under the 1940 Act, which indebtedness

would be in addition to the asset coverage requirements described above. By leveraging our investment portfolio, we may create an opportunity

for increased net income and capital appreciation. However, the use of leverage also involves significant risks and expenses, which will

be borne entirely by our stockholders, and our leverage strategy may not be successful. For example, the more leverage is employed, the

more likely a substantial change will occur in our NAV. Accordingly, any event that adversely affects the value of an investment would

be magnified to the extent leverage is utilized. See “Risk Factors — Risks Related to Our Investments — We may

leverage our portfolio, which would magnify the potential for gain or loss on amounts invested and will increase the risk of investing

in us” and see also “Business — Our Structure —Other

Investment Techniques” for a more detailed description of the Company’s investment techniques.

Derivative

Transactions. We may engage in “Derivative Transactions,” as described below,

from time to time. To the extent we engage in Derivative Transactions, we expect to do so to hedge against interest rate, credit, currency

and/or other risks, or for other investment or risk management purposes. We may use Derivative Transactions for investment purposes to

the extent consistent with our investment objectives if the Adviser deems it appropriate to do so. We may purchase and sell a variety

of derivative instruments, including exchange-listed and over-the-counter, or “OTC,” options, futures, options on futures,

swaps and similar instruments, various interest rate transactions, such as swaps, caps, floors or collars, and credit transactions and

credit default swaps. We also may purchase and sell derivative instruments that combine features of these instruments. Collectively, we

refer to these financial management techniques as “Derivative Transactions.” Our use of Derivative Transactions, if any, will

generally be deemed to create leverage for us and involves significant risks. No assurance can be given that our strategy and use of derivatives

will be successful, and our investment performance could diminish compared with what it would have been if Derivative Transactions were

not used. See “Risk Factors — Risks Related to Our Investments — We are subject to risks associated with any hedging

or Derivative Transactions in which we participate”.

Temporary

Defensive Position. We may take a temporary defensive position and invest all or a substantial portion of our total assets

in cash or cash equivalents, government securities or short-term fixed income securities during periods in which

we believe that adverse market, economic, political or other conditions make it advisable to maintain a temporary defensive position.

As the CLOs and LAFs in which we invest are generally illiquid in nature, we may not be able to dispose of such investments and take

a defensive position. To the extent that we invest defensively, we likely will not achieve our investment objectives.

Operating and Regulatory Structure

We

are an externally managed, non-diversified closed-end management investment company that has registered as an investment company under

the 1940 Act. As a registered closed-end management investment company, we are required to meet certain regulatory tests. See “Regulation

as a Closed-End Management Investment Company.” In addition, we have elected to be treated, and intend to qualify annually,

as a RIC under Subchapter M of the Code, commencing with our tax year ended on November 30, 2014.

Our

investment activities are managed by the Adviser and supervised by our board of directors. Under the Investment Advisory Agreement, we

have agreed to pay the Adviser an annual base management fee based on our “Total Equity Base” as well as an incentive fee

based on our “Pre-Incentive Fee Net Investment Income.” See “The Adviser and the Administrator — Investment

Advisory Agreement — Management Fee and Incentive Fee.” “Total Equity Base” means the NAV attributable

to the common stock and the paid-in, or stated, capital of the Preferred Stock.

We

have also entered into an administration agreement, which we refer to as the “Administration Agreement,” under which we have

agreed to reimburse the Administrator for our allocable portion of overhead and other expenses incurred by the Administrator in performing

its obligations under the Administration Agreement. See “The Adviser and the Administrator — The Administrator and the

Administration Agreement.”

Conflicts of Interest

Our

executive officers and directors, and the Adviser and certain of its affiliates and their officers and employees, including the Senior

Investment Team, have several conflicts of interest as a result of the other activities in which they engage. The Adviser and the Administrator

are affiliated with other entities engaged in the financial services business. In particular, the Adviser and the Administrator are affiliated

with Eagle Point Income Management and Stone Point, and certain members of the Adviser’s Board of Managers are principals of Stone

Point. Pursuant to certain management agreements, Stone Point has received delegated authority to act as the investment manager of the

Trident V Funds, which hold a significant number of shares of our common stock. See “Control Persons, Principal Stockholders

and Selling Stockholders.” The Adviser and the Administrator are primarily owned by the Trident V Funds through intermediary

holding companies. The Trident V Funds and other private equity funds managed by Stone Point invest in financial services companies. These

relationships may cause the Adviser’s, the Administrator’s and certain of their affiliates’ interests, and the interests

of their officers and employees, including the Senior Investment Team, to diverge from our interests and may result in conflicts of interest

that may not be foreseen or resolved in a manner that is always or exclusively in our best interest.

Our

executive officers and directors, as well as other current and potential future affiliated persons, officers and employees of the Adviser

and certain of its affiliates, may serve as officers, directors or principals of, or manage the accounts for, other entities, including

EIC and EPIIF, with investment strategies that substantially or partially overlap with the strategy that we pursue. Accordingly, they

may have obligations to investors in those entities, the fulfillment of which obligations may not be in the best interests of us or our

stockholders. Further, certain of our stockholders are affiliated with our Adviser or may from time to time have business relationships

with the Adviser. In such cases, such stockholders may have an incentive to vote shares held by them in a manner that takes such relationships

into account. As a result of these relationships and separate business activities, the Adviser has conflicts of interest in allocating

management time, services and functions among us, other advisory clients and other business activities. See “Conflicts of

Interest.”

Pursuant to the investment

allocation policies and procedures of the Adviser and Eagle Point Income Management, they seek to allocate investment opportunities among

accounts in a manner that is fair and equitable over time. In addition, an account managed by the Adviser, such as us, is expected to

be considered for the allocation of investment opportunities together with other accounts managed by certain affiliates of the Adviser,

including Eagle Point Income Management. There is no assurance that such opportunities will be allocated to any particular account equitably

in the short-term or that any such account, including us, will be able to participate in all investment opportunities that are suitable

for it. See “Conflicts of Interest — Code of Ethics and Compliance Procedures.”

Co-Investment

with Affiliates. In certain instances, we co-invest on a concurrent basis with other accounts managed by the Adviser and

may do so with other accounts managed by certain of the Adviser’s affiliates, subject to compliance with applicable regulations

and regulatory guidance and the Adviser’s written allocation procedures. See “Conflicts of Interest — Co-Investments

and Related Party Transactions.”

Summary Risk Factors

The

value of our assets, as well as the market price of our securities, will fluctuate. Our investments should be considered risky, and you

may lose all or part of your investment in us. Investors should consider their financial situation and needs, other investments, investment

goals, investment experience, time horizons, liquidity needs and risk tolerance before investing in our securities. An investment in our

securities may be speculative in that it involves a high degree of risk and should not be considered a complete investment program. We

are designed primarily as a long-term investment vehicle, and our securities are not an appropriate investment for a short-term trading

strategy. We can offer no assurance that returns, if any, on our investments will be commensurate with the risk of investment in us, nor

can we provide any assurance that enough appropriate investments that meet our investment criteria will be available.

The

following is a summary of certain principal risks of an investment in us. See “Risk Factors” for a more complete

discussion of the risks of investing in our securities, including certain risks not summarized below.

| • | Risks of Investing in CLOs and Other Structured Debt Securities. CLOs and other structured

finance securities are generally backed by a pool of credit-related assets that serve as collateral. Accordingly, CLO and structured finance

securities present risks similar to those of other types of credit investments, including default (credit), interest rate and prepayment

risks. In addition, CLOs and other structured finance securities are often governed by a complex series of legal documents and contracts,

which increases the risk of dispute over the interpretation and enforceability of such documents relative to other types of investments. |

| • | Subordinated Securities. CLO equity and junior debt securities that we may acquire are subordinated

to more senior tranches of CLO debt. CLO equity and junior debt securities are subject to increased risks of default relative to the holders

of superior priority interests in the same CLO. In addition, at the time of issuance, CLO equity securities are under-collateralized in

that the face amount of the CLO debt and CLO equity of a CLO at inception exceed its total assets. We will typically be in a subordinated

or first loss position with respect to realized losses on the underlying assets held by the CLOs in which we are invested. |

| • | High Yield Investment Risk. The CLO equity and junior debt securities that we acquire are

typically rated below investment grade, or in the case of CLO equity securities unrated, and are therefore considered “higher yield”

or “junk” securities and are considered speculative with respect to timely payment of interest and repayment of principal.

The senior secured loans and other credit-related assets underlying CLOs are also typically higher yield investments. Investing in CLO

equity and junior debt securities and other high yield investments involves greater credit and liquidity risk than investment grade obligations,

which may adversely impact our performance. |

| • | Leverage Risk. The use of leverage, whether directly or indirectly through investments such

as CLO equity or junior debt securities that inherently involve leverage, may magnify our risk of loss. CLO equity or junior debt securities

are very highly leveraged (with CLO equity securities typically being leveraged ten times), and therefore the CLO securities in which

we invest are subject to a higher degree of loss since the use of leverage magnifies losses. |

| • | Credit Risk. If (1) a CLO in which we invest, (2) an underlying asset of any such

CLO or (3) any other type of credit investment in our portfolio declines in price or fails to pay interest or principal when due

because the issuer or debtor, as the case may be, experiences a decline in its financial status, our income, NAV and/or market price would

be adversely impacted. |

| • | Key Personnel Risk. We are dependent upon the key personnel of the Adviser for our future

success. |

| • | Conflicts of Interest Risk. Our executive officers and directors, and the Adviser and certain

of its affiliates and their officers and employees, including the Senior Investment Team, have several conflicts of interest as a result

of the other activities in which they engage. See “Conflicts of Interest.” |

| • | Prepayment Risk. The assets underlying the CLO securities in which we invest are subject

to prepayment by the underlying corporate borrowers. In addition, the CLO securities and related investments in which we invest are subject

to prepayment risk. If we or a CLO collateral manager are unable to reinvest prepaid amounts in a new investment with an expected rate

of return at least equal to that of the investment repaid, our investment performance will be adversely impacted. |

| • | LIBOR Risk. Certain CLO equity and debt securities in which we invest earn interest at,

and CLOs in which we invest typically obtain financing at, a floating rate based on LIBOR. After the global financial crisis, regulators

globally determined that existing interest rate benchmarks should be reformed based on concerns that LIBOR was susceptible to manipulation.

Replacement rates that have been identified include the Secured Overnight Financing Rate (SOFR, which is intended to replace U.S. dollar

LIBOR and measures the cost of overnight borrowings through repurchase agreement transactions collateralized with U.S. Treasury securities)

and the Sterling Overnight Index Average Rate (SONIA, which is intended to replace pound sterling LIBOR and measures the overnight interest

rate paid by banks for unsecured transactions in the sterling market). Each of LIBOR, SONIA and SOFR is referred to herein as a “Benchmark.”

To the extent that any LIBOR replacement rate utilized for senior secured loans differs from that utilized for debt of a CLO that holds

those loans, for the duration of such mismatch, the CLO would experience an interest rate mismatch between its assets and liabilities,

which could have an adverse impact on the cash flows distributed to CLO equity investors as well as our net investment income and portfolio

returns until such mismatch is corrected or minimized. As of the date hereof, certain senior secured loans have transitioned to utilizing

SOFR based interest rates and certain CLO debt securities have also transitioned to SOFR. |

| • | Liquidity Risk. Generally, there is no public market for the CLO investments we target.

As such, we may not be able to sell such investments quickly, or at all. If we are able to sell such investments, the prices we receive

may not reflect the Adviser’s assessment of their fair value or the amount paid for such investments by us. |

| • | Incentive Fee Risk. Our incentive fee structure and the formula for calculating the fee

payable to the Adviser may incentivize the Adviser to pursue speculative investments and use leverage in a manner that adversely impacts

our performance. |

| • | Fair Valuation of Our Portfolio Investments. Generally

there is no public market for the CLO investments we target. As a result, the Adviser values these securities at least quarterly, or more

frequently as may be required from time to time, at fair value. The Adviser’s determinations of the fair value of our investments

have a material impact on our net earnings through the recording of unrealized appreciation or depreciation of investments and may cause

our NAV on a given date to understate or overstate, possibly materially, the value that we ultimately realize on one or more of our investments. |

| • | Limited Investment Opportunities Risk. The market for CLO securities is more limited than

the market for other credit related investments. We can offer no assurances that sufficient investment opportunities for our capital will

be available. |

| • | Non-Diversification Risk. We are a non-diversified investment company under the 1940 Act

and expect to hold a narrower range of investments than a diversified fund under the 1940 Act. |

| • | Market Risk. Political, regulatory, economic and social developments, and developments that

impact specific economic sectors, industries or segments of the market, can affect the value of our investments. A disruption or downturn

in the capital markets and the credit markets could impair our ability to raise capital, reduce the availability of suitable investment

opportunities for us, or adversely and materially affect the value of our investments, any of which would negatively affect our business.

These risks may be magnified if certain events or developments adversely interrupt the global supply chain, and could affect companies

worldwide. |

| • | LAFs Risk. We may invest in LAFs, which are short to medium term facilities often provided

by the bank that will serve as placement agent or arranger on a CLO transaction and which acquire loans on an interim basis which are

expected to form part of the portfolio of a future CLO. Investments in LAFs have risks similar to those applicable to investments in CLOs.

Leverage is typically utilized in such a facility and as such the potential risk of loss will be increased for such facilities employing leverage. In the event

a planned CLO is not consummated, or the loans are not eligible for purchase by the CLO, the Company may be responsible for either holding

or disposing of the loans. This could expose the Company primarily to credit and/or mark-to-market losses, and other risks. |

| • | Currency Risk. Although we primarily make investments denominated in U.S. dollars, we may

make investments denominated in other currencies. Our investments denominated in currencies other than U.S. dollars will be subject to

the risk that the value of such currency will decrease in relation to the U.S. dollar. |

| • | Hedging Risk. Hedging transactions seeking to reduce risks may result in poorer overall

performance than if we had not engaged in such hedging transactions, and they may also not properly hedge our risks. |

| • | Reinvestment Risk. CLOs

will typically generate cash from asset repayments and sales that may be reinvested in substitute assets, subject to compliance with applicable

investment tests. If the CLO collateral manager causes the CLO to purchase substitute assets at a lower yield than those initially acquired

or sale proceeds are maintained temporarily in cash, it would reduce

the excess interest-related cash flow, thereby having a negative effect on the fair value of our assets and the market value of our securities.

In addition, the reinvestment period for a CLO may terminate early, which would cause the holders of the CLO’s securities to receive

principal payments earlier than anticipated. There can be no assurance that we will be able to reinvest such amounts in an alternative

investment that provides a comparable return relative to the credit risk assumed. |

| • | Interest Rate Risk. The price of certain of our investments may be significantly affected

by changes in interest rates, including recent increases in interest rates. |

| • | Refinancing Risk. If we incur debt financing and subsequently refinance such debt, the replacement

debt may be at a higher cost and on less favorable terms and conditions. If we fail to extend, refinance or replace such debt financings

prior to their maturity on commercially reasonable terms, our liquidity will be lower than it would have been with the benefit of such

financings, which would limit our ability to grow, and holders of our common stock would not benefit from the potential for increased

returns on equity that incurring leverage creates. |

| • | Tax Risk. If we fail to qualify for tax treatment as a RIC under Subchapter M of the Code

for any reason, or become subject to corporate income tax, the resulting corporate taxes could substantially reduce our net assets, the

amount of income available for distributions, and the amount of such distributions, to our common stockholders and for payments to the

holders of our other obligations. |

| • | Derivatives Risk. Derivative instruments in which we may invest may be volatile and involve

various risks different from, and in certain cases greater than, the risks presented by other instruments. The primary risks related to

Derivative Transactions include counterparty, correlation, liquidity, leverage, volatility, OTC trading, operational and legal risks.

In addition, a small investment in derivatives could have a large potential impact on our performance, effecting a form of investment

leverage on our portfolio. In certain types of Derivative Transactions, we could lose the entire amount of our investment; in other types

of Derivative Transactions the potential loss is theoretically unlimited. |

| • | Counterparty Risk. We may be exposed to counterparty risk, which could make it difficult

for us or the CLOs in which we invest to collect on obligations, thereby resulting in potentially significant losses. |

| • | Global Economy Risk. Global economies and financial markets are highly interconnected, and

conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial

market. |

| • | Price Risk. Investors who buy shares at different times will likely pay different prices. |

| • | Russia Risk. Russia’s military incursion into Ukraine, the response of the United

States and other countries, and the potential for wider conflict, has increased volatility and uncertainty in the financial markets and may adversely affect the Company. |

Our Corporate Information

Our

offices are located at 600 Steamboat Road, Suite 202, Greenwich, CT 06830, and our telephone number is (203) 340-8500.

FEES AND EXPENSES

Information

about the Company’s fees and expenses may be found in the “Fees and Expenses” section of the Company’s most recent

Annual Report on Form N-CSR

for the fiscal year ended December 31, 2021, filed with the SEC on February 17, 2022, which is incorporated by reference herein.

RISK FACTORS

Investing

in our securities involves a number of significant risks. In addition to the other information contained in this prospectus, you should

consider carefully the following information before making an investment in our securities. The risks set out below are not the only risks

we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us might also impair our operations

and performance and the value of our securities. If any of the following events occur, our business, financial condition and results of

operations could be materially adversely affected and the value of our securities may be impaired. In such case, the price of our securities

could decline, and you may lose all or part of your investment.

Risks Related to Our Investments

Investing in senior secured loans

indirectly through CLO securities involves particular risks.

We

obtain exposure to underlying senior secured loans through our investments in CLOs, but may obtain such exposure directly or indirectly

through other means from time to time. Such loans may become nonperforming or impaired for a variety of reasons. Nonperforming or impaired

loans may require substantial workout negotiations or restructuring that may entail a substantial reduction in the interest rate and/or

a substantial write-down of the principal of the loan. In addition, because of the unique and customized nature of a loan agreement and

the private syndication of a loan, certain loans may not be purchased or sold as easily as publicly traded securities, and, historically,

the trading volume in the loan market has been small relative to other markets. Loans may encounter trading delays due to their unique

and customized nature, and transfers may require the consent of an agent bank and/or borrower. Risks associated with senior secured loans

include the fact that prepayments generally may occur at any time without premium or penalty.

In

addition, the portfolios of certain CLOs in which we invest may contain middle market loans. Loans to middle market companies may carry

more inherent risks than loans to larger, publicly traded entities. These companies generally have more limited access to capital and

higher funding costs, may be in a weaker financial position, may need more capital to expand or compete, and may be unable to obtain financing

from public capital markets or from traditional sources, such as commercial banks. Middle market companies typically have narrower product

lines and smaller market shares than large companies. Therefore, they tend to be more vulnerable to competitors’ actions and market

conditions, as well as general economic downturns. These companies may also experience substantial variations in operating results. The

success of a middle market business may also depend on the management talents and efforts of one or two persons or a small group of persons.

The death, disability or resignation of one or more of these persons could have a material adverse impact on the obligor. Accordingly,

loans made to middle market companies may involve higher risks than loans made to companies that have greater financial resources or are

otherwise able to access traditional credit sources. Middle market loans are less liquid and have a smaller trading market than the market

for broadly syndicated loans and may have default rates or recovery rates that differ (and may be better or worse) than has been the case

for broadly syndicated loans or investment grade securities. There can be no assurance as to the levels of defaults and/or recoveries

that may be experienced with respect to middle market loans in any CLO in which we may invest. As a consequence of the forgoing factors,

the securities issued by CLOs that primarily invest in middle market loans (or hold significant portions thereof) are generally considered

to be a riskier investment than securities issued by CLOs that primarily invest in broadly syndicated loans.

Covenant-lite

loans may comprise a significant portion of the senior secured loans underlying the CLOs in which we invest. Over the past decade, the

senior secured loan market has evolved from one in which covenant-lite loans represented a minority of the market to one in which such

loans represent a significant majority of the market. Generally, covenant-lite loans provide borrower companies more freedom to negatively

impact lenders because their covenants are incurrence-based, which means they are only tested and can only be breached following an affirmative

action of the borrower, rather than by a deterioration in the borrower’s financial condition. Accordingly, to the extent that the

CLOs that we invest in hold covenant-lite loans, our CLOs may have fewer rights against a borrower and may have a greater risk of loss

on such investments as compared to investments in or exposure to loans with financial maintenance covenants.

Our investments

in CLO securities and other structured finance securities involve certain risks.

Our

investments consist primarily of CLO securities, and we may invest in other related structured finance securities. CLOs and

structured finance securities are generally backed by an asset or a pool of assets (typically senior secured loans and other

credit-related assets in the case of a CLO) that serve as collateral. We and other investors in CLO and related structured finance

securities ultimately bear the credit risk of the underlying collateral. In most CLOs, the structured finance securities are issued

in multiple tranches, offering investors various maturity and credit risk characteristics, often categorized as senior, mezzanine

and subordinated/equity according to their degree of risk. If there are defaults or the relevant collateral otherwise underperforms,

scheduled payments to senior tranches of such securities take precedence over those of junior tranches which are the focus of our

investment strategy, and scheduled payments to junior tranches have a priority in right of payment to subordinated/equity

tranches.

CLO

and other structured finance securities may present risks similar to those of the other types of debt obligations and, in fact, such risks

may be of greater significance in the case of CLO and other structured finance securities. For example, investments in structured vehicles,

including CBOs and equity and junior debt securities issued by CLOs, involve risks, including credit risk and market risk. Changes in

interest rates and credit quality may cause significant price fluctuations. A CBO is a trust which is often backed by a diversified pool

of high risk, below investment grade fixed income securities. The collateral can be from many different types of fixed income securities,

such as high yield debt, residential privately issued mortgage-related securities, commercial privately issued mortgage related securities,

trust preferred securities and emerging market debt. The pool of high yield securities underlying CBOs is typically separated into tranches

representing different degrees of credit quality. The higher quality tranches have greater degrees of protection and pay lower interest

rates, whereas the lower tranches, with greater risk, pay higher interest rates.

In

addition to the general risks associated with investing in debt securities, CLO securities carry additional risks, including: (1) the

possibility that distributions from collateral assets will not be adequate to make interest or other payments; (2) the quality of

the collateral may decline in value or default; (3) our investments in CLO equity and junior debt tranches will likely be subordinate

in right of payment to other senior classes of CLO debt; and (4) the complex structure of a particular security may not be fully

understood at the time of investment and may produce disputes with the issuer or unexpected investment results. Changes in the collateral

held by a CLO may cause payments on the instruments we hold to be reduced, either temporarily or permanently. Structured investments,

particularly the subordinated interests in which we invest, are less liquid than many other types of securities and may be more volatile

than the assets underlying the CLOs we may target. In addition, CLO and other structured finance securities may be subject to prepayment

risk. Further, the performance of a CLO or other structured finance security may be adversely affected by a variety of factors, including

the security’s priority in the capital structure of the issuer thereof, the availability of any credit enhancement, the level and

timing of payments and recoveries on and the characteristics of the underlying receivables, loans or other assets that are being securitized,

remoteness of those assets from the originator or transferor, the adequacy of and ability to realize upon any related collateral and the

capability of the servicer of the securitized assets. There are also the risks that the trustee of a CLO does not properly carry out its

duties to the CLO, potentially resulting in loss to the CLO. In addition, the complex structure of the security may produce unexpected

investment results, especially during times of market stress or volatility. Investments in structured finance securities may also be subject

to liquidity risk.

Our investments

in the primary CLO market involve certain additional risks.

Between

the pricing date and the effective date of a CLO, the CLO collateral manager will generally expect to purchase additional collateral obligations

for the CLO. During this period, the price and availability of these collateral obligations may be adversely affected by a number of market

factors, including price volatility and availability of investments suitable for the CLO, which could hamper the ability of the collateral

manager to acquire a portfolio of collateral obligations that will satisfy specified concentration limitations and allow the CLO to reach

the target initial par amount of collateral prior to the effective date. An inability or delay in reaching the target initial par amount

of collateral may adversely affect the timing and amount of interest or principal payments received by the holders of the CLO debt securities

and distributions on the CLO equity securities and could result in early redemptions which may cause CLO equity and debt investors to

receive less than face value of their investment.

Our portfolio

of investments may lack diversification among CLO securities which may subject us to a risk of significant loss if one or more of these

CLO securities experience a high level of defaults on collateral.

Our

portfolio may hold investments in a limited number of CLO securities. Beyond the asset diversification requirements associated with

our qualification as a RIC under the Code, we do not have fixed guidelines for diversification, we do not have any limitations on

the ability to invest in any one CLO, and our investments may be concentrated in relatively few CLO securities. As our portfolio may

be less diversified than the portfolios of some larger funds, we are more susceptible to risk of loss if one or more of the CLOs in

which we are invested experiences a high level of defaults on its collateral. Similarly, the aggregate returns we realize may be

significantly adversely affected if a small number of investments perform poorly or if we need to write down the value of any one

investment. We may also invest in multiple CLOs managed by the same CLO collateral manager, thereby increasing our risk of loss in

the event the CLO collateral manager were to fail, experience the loss of key portfolio management employees or sell its

business.

Failure to maintain

a broad range of underlying obligors across the CLOs in which we invest would make us more vulnerable to defaults.

We

may be subject to concentration risk since CLO portfolios tend to have a certain amount of overlap across underlying obligors. This trend

is generally exacerbated when demand for bank loans by CLO issuers outpaces supply. Market analysts have noted that the overlap of obligor

names among CLO issuers has increased recently and is particularly evident across CLOs of the same year of origination, as well as with

CLOs managed by the same asset manager. To the extent we invest in CLOs which have a high percentage of overlap, this may increase the

likelihood of defaults on our CLO investments occurring together.

Our portfolio

is focused on CLO securities, and the CLO securities in which we invest may hold loans that are concentrated in a limited number of industries.

Our

portfolio is focused on securities issued by CLOs and related investments, and the CLOs in which we invest may hold loans that are concentrated

in a limited number of industries. As a result, a downturn in the CLO industry or in any particular industry that the CLOs in which we

invest are concentrated could significantly impact the aggregate returns we realize.

Failure by a

CLO in which we are invested to satisfy certain tests will harm our operating results.

The