SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

MARKET

ANNOUNCEMENT

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A

CNPJ: 00.001.180/0001-26 | NIRE: 3330034676-7

PUBLICLY TRADED COMPANY

Centrais Elétricas Brasileiras S/A (“Company”

or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O & XELT.B), the Company provides

the following clarifications to the Market in relation to an article published today in the newspaper Valor Econômico.

Firstly, the Company informs that it observes all

the accounting rules applicable to the calculation of provisions relating to contingencies for legal proceedings, especially those involving

in-court disputes about the electricity compulsory loans. In addition, in the third quarter of 2022, Eletrobras, in conjunction with external

counsel, reviewed the legal theses adopted by it for provisioning purposes in accordance with the updated applicable case law. Further,

the Company has conducted a review of its data base regarding such legal proceedings as disclosed in the financial statements for that

quarter.

Based on its loss prognoses, as of September 30,

2022, the Company had approximately provisioned BRL26 billion for potential disbursements relating to these legal proceedings and still

presents approximately BRL5.3, billion as a possible risk of loss, all as disclosed in the September 2022 interim financial statements.

Additionally, the Company recognized BRL46.5 billion as a remote risk of loss on the same date.

As part of the proceedings considered with a remote

risk of loss, there are legal proceedings that discuss the first phase of the compulsory loans entitled the "Undertakings of the

Bearer" that represent approximately BRL25 billion and encompass taxpayer credits arising from invoices between 1964 and 1976 that

were refunded by means of bearer certificates issued by the Company. The Company understands that the bearer certificates issued as part

of the compulsory loan program do not constitute securities, are not tradeable on any stock exchange and do not have a nominal value.

This understanding was confirmed by CVM's Plenary Board in the administrative proceeding No. RJ 2005/7230 brought by holders of bearer

certificates, which decided in 2005 that "the certificates issued by the Company as a result of Law No. 4.156/1962 cannot be considered

securities". Also, a ruling issued by the Brazilian Superior Court of Justice ("STJ") (Special Appeal No. 1050199/RJ) confirmed

that these bearer certificates are non-enforceable due to the provisions of the applicable statute of limitations.

Also, categorized as a remote risk is the risk relating

to the applicable remuneration interest of 6% per annum, after the conversion meetings, in the amount of approximately BRL14 billion given

the precedent of Special Appeal No. 1003955-RS and of the recent ruling favorable to Eletrobras in the so-called “Caso Roma”

(Clarification Appeal of the Dissent Appeal as part of the Special Appeal No. 790.288/PR by the 1st Section of the STJ).

All these risks that in total represent approximately

BRL78 billion were duly disclosed in Eletrobras' "Formulário de Referência" and Form 20-F.

The news article mentions several mistaken statements

based on alleged information provided by a former party contracted by Eletrobras who did not have their claims upheld, which in the Company's

view did not have legal grounds and did not observe the contracting rules with state-owned companies relating to the contracted price

increase, given that Eletrobras understood at the time that there had been inadequate rendering of the services hired, delay in the rendering

of the services, amongst other issues discussed in the respective legal proceedings. The mater is currently being discussed in court in

a confidential legal proceeding.

Regarding the complaint made to the SEC via the

whistleblower channel, the Company reiterates that by means of the Market Announcement dated as of April 30, 2021, it has informed that

an investigationis being conducted regarding the compulsory loans and corresponding legal proceedings, which were disclosed in the Form

20-F filed with the SEC in respect of the fiscal year ended on December 31, 2018. The investigation is conducted confidentially by the

SEC.

In view of the above, the Company informs that it

will take all the suitable legal measures to reestablish the truth, and will keep the market informed of any supervening fact related

to the subject.

Rio de Janeiro, February 15, 2023

Elvira Cavalcanti Presta

Financial and Investor Relations Officer

Este documento pode conter estimativas e projeções

que não são declarações de fatos ocorridos no passado, mas refletem crenças e expectativas de nossa

administração e podem constituir estimativas e projeções sobre eventos futuros de acordo com Seção

27A do Securities Act de 1933, conforme alterado, e Seção 21E do Securities and Exchange Act de 1934, conforme

alterado. As palavras “acredita”, “poderá”, “pode”, “estima”, “continua”,

“antecipa”, “pretende”, “espera” e similares têm por objetivo identificar estimativas que necessariamente

envolvem riscos e incertezas, conhecidos ou não. Riscos e incertezas conhecidos incluem, mas não se limitam a: condições

econômicas, regulatórias, políticas e comerciais gerais no Brasil e no exterior, variações nas taxas

de juros, inflação e valor do Real, mudanças nos volumes e padrão de uso de energia elétrica pelo

consumidor, condições competitivas, nosso nível de endividamento, a possibilidade de recebermos pagamentos relacionados

a nossos recebíveis, mudanças nos níveis de chuvas e de água nos reservatórios usados para operar

nossas hidrelétricas, nossos planos de financiamento e investimento de capital, regulamentações governamentais existentes

e futuras, e outros riscos descritos em nosso relatório anual e outros documentos registrados perante CVM e SEC. Estimativas e

projeções referem-se apenas à data em que foram expressas e não assumimos nenhuma obrigação

de atualizar quaisquer dessas estimativas ou projeções em razão da ocorrência de nova informação

ou eventos futuros. Os resultados futuros das operações e iniciativas das Companhias podem diferir das expectativas atuais

e o investidor não deve se basear exclusivamente nas informações aqui contidas. Este material contém cálculos

que podem não refletir resultados precisos devido a arredondamentos realizados.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: February 15, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

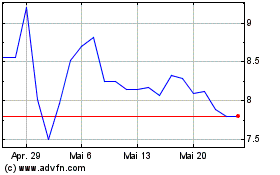

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

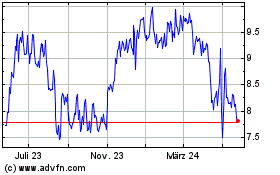

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024