Note:

As of 2019, the Company started to consider, in its recurring EBITDA, RBSE revenue from concessions extended under Law 12,783/2013, in

order to maintain a protocol similar to the debenture covenants issued in 2019. Considering the privatization of the distributors was

completed in April 2019, and these operations no longer be part of its core business, the company treated as non-recurring the relevant

effects of financial income, expenses, PL reversals and prospective allowance for loan losses (CPC 48) of loans contracted with them before

or as a result of the privatization process, although revenues and eventual provisions arising from contracted loans may continue to affect

the company's accounting results until its complete exhaustion. However, they were treated as recurring PCLDs of oustanding effective

debt of distributors as well as debts related to the energy supply.

1.3.1. Indebtedness

and Receivables

1See

Explanatory Note 18b to the Financial Statements.

|

Total Consolidated Gross Debt without RGR - R$ billion |

|

Gross Controlling Debt without Third Party RGR– R$ billion |

| |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

After 2027 |

Total (R$ billion) |

| Amortization with RGR and Debentures |

8.2 |

4.8 |

6.7 |

4.7 |

4.2 |

1.7 |

13.7 |

44.0 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 29 |

| Marketletter 4Q21 |

| | |

|

Table 17: Foreign Exchange Exposure |

|

| |

|

|

|

| Assets |

US$ thousand |

% |

| Itaipu Loans Receivables |

123,445 |

50% |

| Itaipu Financial Assets |

125,004 |

50% |

| TOTAL |

248,449 |

100% |

| Liabilities* |

US$

thousand |

% |

| Bonus 2025 - Eletrobras |

503,386 |

34% |

| Bonus 2030 - Eletrobras |

749,525 |

50% |

| Other |

237,913 |

16% |

| TOTAL |

1,490,824 |

100% |

| |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

After 2027 |

TOTAL |

| Asset (US$ million) |

203.45 |

43.51 |

1.49 |

0.00 |

0.00 |

0.00 |

0.00 |

248.45 |

| Liabilities (US$ million) |

59.77 |

46.16 |

19.60 |

518.13 |

19.60 |

19.60 |

807.95 |

1.490.82 |

| Foreign Exchange Exposure |

143.68 |

-2.65 |

-18.11 |

-518.13 |

-19.60 |

-19.60 |

-807.95 |

-1.242.37 |

Due to the atypical scenario and potentially

unpredictable characteristics, it is not possible to accurately predict the scenarios that may materialize in the coming months in the

company's operations.

*In the balance of Bonuses 2030 and 2025 there

is an accounting effect on the deferral of expenses with the repurchase of the bonus 2021 due to the operation carried out in February.

Bonus 2021 had its discharge held in October 2021 at its maturity.

Ratings

|

Table 18: Ratings |

| Agency |

National Classification / Perspective |

Last Report |

| Moody’s BCA |

“Ba3”: / Stable |

16/09/2020 |

| Moody’s Senior Unsecured Debt |

“Ba2”: / Stabel |

16/09/2020 |

| Fitch - Issuer Default Ratings (Foreign Currency) |

“BB-”: / Negative |

02/06/2021 |

| Fitch - Issuer Default Ratings (Local Currency) |

“BB-”: / Negative |

02/06/2021 |

| S&P LT Local Currency – Escala Nacional Brasil |

brAAA / Stable |

12/03/2021 |

| S&P Issuer Credit Rating – Escala Global |

BB- / Stable |

12/03/2021 |

*CreditWatch

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 30 |

| Marketletter 4Q21 |

| | |

Financing and

Loans Granted (Receivables)

|

Loans and Financing to be received Total Consolidated - R$ million |

It does not include: receivable of Itaipu's financial assets

of R$ 697 million and PCLD of R$ 1,244 million and current charges.

|

Loans and financing receivables – R$ billion |

| Projection Receivables |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

After 2026 |

TOTAL |

| Controller |

2,813 |

2,285 |

1,684 |

990 |

775 |

548 |

3,146 |

12,242 |

Does not include charges and PCLD.

Table 20: CCC credits granted by Privatized Distributors

In the process of privatization of distributors, CCC credits

were transferred that depended on the analysis and supervision of ANEEL. These credits are activated in the Company's Financial Statements

of 12/31/2021, in two accounts, which are the Right to Compensation and Receivables, according to Explanatory Notes 15 and 11 of 4Q21,

and below detailed:

reservation

Right

|

Net Assets Recorded - R$ thousand |

| R$ thousand |

Amazonas |

Ceron |

Electroacre |

Boa Vista |

Total |

| NT Aneel+ Claims under analysis Aneel + "inefficiency" |

2,357,102 |

3,088,101 |

120,227 |

122,420 |

5,687,849 |

| Current Rights |

|

|

|

|

|

| Total (a) |

2,357,102 |

3,088,101 |

120,227 |

122,420 |

5,687,849 |

The

balance of R$ 2,357.1 million from Amazonas is composed of a return obligation to the CCC of the order of R$ 514.2 million referring to

the final result of the inspection of the first and second period carried out by ANEEL, and a credit to be received from the National

Treasury of economic and energy "inefficiency" of R$ 2,871.3 million. The credit of economic and energy "inefficiency"

will be used to lower the grant value of the new generation concessions in the capitalization process of Eletrobras. The amount to be

returned to the CCC was defunded from the credit received from the Sector Fund in relation to the amounts transferred from the other distributors.

That is, Eletrobras will receive the net value of the eight CCC inspection processes carried out by ANEEL.

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 31 |

| Marketletter 4Q21 |

| | |

|

Conversion into Loans |

| R$ thousand |

Amazonas |

Ceron |

Electroacre |

Boa Vista |

Total |

| Conversion into Loans (b) |

442,366 |

|

|

|

442,366 |

Note:

The credit of BRL 442.4 million in the table above was also a CCC credit, assigned by Amazonas to Eletrobras, however, as they are not

part of the inspection processes, and as it is a current credit, it has already been paid by CCC to Amazonas Distribuidora, and could

not have been assigned to Eletrobras, so it was converted into a debt of the distribution company with Eletrobras.

|

Total Credits Granted to Eletrobras |

| R$ thousand |

Amazonas |

Ceron |

Electroacre |

Boa Vista |

Total |

| Net assigned credit (1) |

2,799,468

|

3,088,101

|

120,227

|

122,420

|

6,130,215

|

Of

the credits updated until 12/31/2021, the amount of R$ 2,781.4 million is the net final result of the inspection processes of the four

distributors, and will be paid by the CCEE (manager of the CCC/CDE Sector Fund) in 60 installments, as of Jan/22, updated according to

the IPCA index. The amount of R$ 2,906.5 million of "inefficiency" credits will be used to lower the grant value of the new

generation concessions in Eletrobras' capitalization process. And the amount of R $ 442.4 million refers to an agreement entered into

with Amazonas to return the current CCC credit made in the past by the very distribution company, totaling a final amount of credits of

R $ 6,130.2 million taken on from the distribution companies in their privatization processes.

At a meeting held on September 28th, 2021, Aneel management

resolved the inspection processes at CCC, still pending analysis, according to an inspection period at Ceron, Eletroacre and Boa Vista.

The amounts approved by Aneel management were in line with the amounts presented in the latest technical notes issued by SFF-SFG-SRG/ANEEL.

The amount of R$ 806.6 million (Apr/21 position) was approved as a result of the second inspection period at Ceron, as well as the negative

amount of R$ 97.5 million (Apr/21 position) to be returned to the CCC as a result of the second inspection period of Eletroacre, and the

negative amount of R$ 29.7 million (Apr/21 position) for the second inspection period at Boa Vista.

Thus, all eight inspection processes (first and second periods

at Amazonas, Eletroacre, Ceron and Boa Vista) were closed and the payment conditions of the final net value of such eight processes to

Eletrobras were defined. Aneel resolved on the final amount on the inspection at CCC reimbursed to Amazonas Energia, Ceron, Eletroacre

and Boa Vista Energia in the amount of R$ 2,670.5 million, restated by the IPCA index of Aug/2021, which must be reimbursed by CCC to

Eletrobras, as holder of the credits taken on from such distribution companies. This amount will be received in 60 months, in equal installments

restated by the IPCA index, with the first payment being made in January 2022.

As for "inefficiency" credits, Law No. 14,182/2021

increased the scope of "inefficiency" by 14 months, from Jul/09 – Apr/16 (Law 13,299/2016) to Jul/09 – Jun/17, the

positive effect of which was already reflected in the 3rd ITR of 2021. Furthermore, CNPE resolution no. 15/2021 subsequently

amended by CNPE resolution No. 30/2021, issued on December 21st, 2021, which defined the grant amount to be paid by Eletrobras

for the new generation concessions in the company’s capitalization process, informed the amount of R$ 2,906,498,547.37 of "inefficiency"

credits at Amazonas and Boa Vista, restated under the expectation for the IPCA index until Dec/21, which will deduct the grant amount

to be paid by Eletrobras. As the CNPE updated the “inefficiency” credits in accordance with the IPCA index, Eletrobras has

already adjusted the 3rd ITR, changing the update of the “inefficiency” credits from Selic to IPCA. Thus, the positive impact

of the 14-month increase in the coverage of "inefficiency" credits was partially neutralized by the negative impact of the exchange

of the restatement of these credits from Selic to IPCA, leaving a positive net value of R$ 341.5 million (Sep/21 position), already recorded

in 3Q21.

However, as can be observed in the two CNPE Resolutions, the

amount of the "inefficiency" credit that will deduct the grant amount to be paid by Eletrobras for the new generation concessions,

has already been defined predicting inflation until December 31, 2021, with no possibility to change the defined value, with the inclusion

of the real inflation of the period. That is, even though the “inefficiency” credits restated in accordance with the IPCA

index by 12.31.2021 reached the amount of R$ 2,991,978,955, Eletrobras recorded under their assets, the amount of only R$ 2,906,498,547.37,

limited by CNPE Resolutions, which represents a loss of R$ 85.5 million, if the "inefficiency" credits were restated in accordance

with the actual inflation for the period, measured by the IPCA index.

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 32 |

| Marketletter 4Q21 |

| | |

In 4Q21, Eletrobras has recorded the amount of R$ 6,130.2 million

of credits assumed by distributors in its privatization processes. The amount of R$ 2,781.4 million as a final result of ccc inspection

processes carried out by ANEEL and which will be paid by the Fund to Eletrobras, the amount of R$ 2,906.5 million of "inefficiency"

credits assumed from Amazonas and Boa Vista, which will be used to lower the grant amount to be paid by Eletrobras for the new generation

concessions in the company's capitalization process, and R$ 442.4 million recorded in the account loans and financing related to the current

credit return contract signed with Amazonas Energia, which is still in the grace period of the payment of the principal. It is important

to highlight that Eletrobras made in 3Q21 provision in the amount of R$ 340.1 million related to the current credits of Ceron, Eletroacre

and Boa Vista Energia (credits made before the transfer of the right to Eletrobras, and therefore need to be returned to Eletrobras) since

contracts have not yet been signed with these three distributors for the return of the value. Currently, Eletrobras has been discussing

with the three companies the amount to be paid to Eletrobras. After the definition of the amounts and payment terms, the contracts will

be signed and Eletrobras will reverse part or all of this provision made of R$ 340.1 million.

RBSE Reprofiling

In September 2021, there was the accounting of the reprofiling of the financial

component of RBSE. The DECISION of ANEEL caused a reduction in the payment curve of the amounts related to the periodic review of the

Annual Permitted Revenues - RAP associated with the transmission facilities for the cycles 2021/2022 and 2022/2023 and an increase in

the flow of payments in the cycles after 2023, extending such installments until the 2027/2028 cycle, while preserving the remuneration

for the cost of own capital – Ke. For more details, see note 17 of the Financial Statements of 2021.

|

Table 21: Reprofiling RBSE – R$ million: |

| REPROFILED Financial Component |

Cycle 2021-2022 |

2022-2023 |

2023-2024 |

2024-2025 |

2025-2026 |

2026-2027 |

2027-2028 |

| CHESF |

639 |

886 |

1,648 |

1,648 |

1,648 |

1,648 |

1,648 |

| ELECTRONORTE |

278 |

393 |

769 |

769 |

769 |

769 |

769 |

| ELECTROSUL |

161 |

215 |

360 |

360 |

360 |

360 |

360 |

| FURNAS |

806 |

1,199 |

2,635 |

2,635 |

2,635 |

2,635 |

2,635 |

| Total |

1,884 |

2,693 |

5,411 |

5,411 |

5,411 |

5,411 |

5,411 |

| Economic Component |

Cycle 2021-2022 |

2022-2023 |

2023-2024 |

2024-2025 |

2025-2026 |

2026-2027 |

2027-2028 |

| CHESF |

1,091 |

1,091 |

654 |

654 |

654 |

654 |

654 |

| ELECTRONORTE |

562 |

562 |

242 |

242 |

242 |

242 |

242 |

| ELECTROSUL |

187 |

187 |

69 |

69 |

69 |

69 |

69 |

| FURNAS |

1,785 |

1,785 |

1,136 |

1,136 |

1,136 |

1,136 |

1,136 |

| Total |

3,625 |

3,625 |

2,102 |

2,102 |

2,102 |

2,102 |

2,102 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 33 |

| Marketletter 4Q21 |

| | |

| Total RBSE after REPROFILING |

Cycle 2021-2022 |

2022-2023 |

2023-2024 |

2024-2025 |

2025-2026 |

2026-2027 |

2027-2028 |

| CHESF |

1,730 |

1,976 |

2,302 |

2,302 |

2,302 |

2,302 |

2,302 |

| ELECTRONORTE |

841 |

955 |

1,011 |

1,011 |

1,011 |

1,011 |

1,011 |

| ELECTROSUL |

348 |

402 |

430 |

430 |

430 |

430 |

430 |

| FURNAS |

2,590 |

2,984 |

3,771 |

3,771 |

3,771 |

3,771 |

3,771 |

| Total |

5,509 |

6,318 |

7,513 |

7,513 |

7,513 |

7,513 |

7,513 |

The above amounts include TFSEE (Electric Power Services Inspection

Fee) charges and resources for R&D and Energy Efficiency, and do not include PIS and Cofins. In addition, the data refer to the tariff

cycle and not to the calendar year.

The values approved in the reprofiling were updated by the

IPCA.

Amortizations RBSE 2021- R$ thousand

| |

Chesf |

CGT Electrosul |

Electronorth |

Furnas |

Total |

| 2021 |

2,304,174 |

472,674 |

1,109,202 |

3,522,630 |

7,408,680 |

Note: TFSEE and R&D's

values are included. PIS and COFINS are not included.

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 34 |

| Marketletter 4Q21 |

| | |

1.4.

Investments

|

Table 22: Investments by Segment - R$ million |

| Investment (Corporate + Partnerships) |

Invested 1Q21 |

Invested 2Q21 |

Invested 3Q21 |

Invested 4Q21 |

Invested 2021 |

Budgeted PDNG 4T21 |

% achievement 4Q21 |

Budgeted PDNG 2021 |

% achievement 2021 |

| |

|

|

|

|

|

|

|

|

|

| Generation |

314 |

529 |

572 |

872 |

2.287 |

2.183 |

40% |

5.065 |

45% |

| Corporate Expansion |

145 |

329 |

431 |

598 |

1.502 |

1.255 |

48% |

3.173 |

47% |

| Maintenance |

130 |

152 |

139 |

253 |

674 |

416 |

61% |

1.138 |

59% |

| SPEs - contributions |

19 |

17 |

2 |

22 |

59 |

78 |

28% |

294 |

20% |

| SPEs - acquisitions |

21 |

31 |

- |

- |

52 |

435 |

0% |

459 |

11% |

| Transmission |

142 |

360 |

378 |

982 |

1.863 |

767 |

128% |

2.497 |

75% |

| Corporate Expansion |

16 |

38 |

34 |

19 |

107 |

33 |

59% |

124 |

86% |

| Reinforcements and Improvements |

96 |

213 |

300 |

449 |

1.057 |

303 |

148% |

1.379 |

77% |

| Maintenance |

30 |

27 |

44 |

90 |

191 |

93 |

97% |

315 |

61% |

| SPEs - contributions |

- |

- |

- |

206 |

206 |

47 |

439% |

47 |

439% |

| SPEs - acquisitions |

1 |

83 |

- |

218 |

302 |

292 |

75% |

631 |

48% |

| Others* |

65 |

91 |

75 |

297 |

528 |

163 |

182% |

684 |

77% |

| Total |

522 |

981 |

1.024 |

2.151 |

4.678 |

3.113 |

69% |

8.245 |

57% |

Others: Research, Infrastructure, Environmental Quality

* For further details of investments, by subsidiary or

by project, see Annex 3 to this Investor Report, to be released in March 2022.

In 2021, R$

4,678 million of the R$ 8,245 million budgeted for the year were invested.

In Generation, the total investment was R$ 2,287 million,

with emphasis on: Angra-3 R$ 1,240 million, representing 44% of the total budget for 2021, referring to the resumption of the works, with

resources from Eletrobras Holding contributions. The main highlight is the completion of the bidding process for the hiring of a company

to resume the civil work and part of the electromechanical assembly, an initiative that integrates the plan to accelerate the critical

path of the plant. At the Santa Cruz Thermal Power Plant, Furnas form realized R$ 187 million, with 100% of its budget planned for 2021.

The annual budget was used for the implementation of the Combined Cycle of the Santa Cruz Thermoelectric Power Plant. In addition, we

highlight the expansion of the Generation Capacity of the Curuá-Una Hydroelectric Power Plant (PA), from Eletronorte: R$ 53 million

made and investment in maintenance of chesf's Generation System totaling R$ 162 million. The investments were made in the modernization

and digitization of the Sobradinho UhE, Paulo Afonso EPHE, and several projects in several Chesf plants. In SPEs, SPEs – The main

achievements in 2021 was the acquisition of a stake in the Complex Pindaí wind farm by Chesf, totaling R$ 20.6 million, and the acquisition of a stake in

the Serra do Facão E.U. by Furnas, for a total of R$ 31 million, both in line with the planned value for the year.

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 35 |

| Marketletter 4Q21 |

| | |

In Transmission, the total investment was R$ 1,863 million,

with emphasis on Reinforcements and Improvements, with investments of R$ 1,057 million, with chesf's largest achievement, totaling R$

610 million (87%), distributed in several projects, which resulted in more than 2,500 works executed, such as the revitalization of transmission

lines, improvements in protection systems, automation and telecommunications etc. In expansion, Chesf carried out R$ 106 million whose

main works in progress are the LT São Luiz II/ São Luiz III projects; LT Paraiso Açu C3; LT Pau Ferro/Santa Rita

C1; LT Mossoro/Açu C2 and LT Banabuiu/ Russas 230K C2.

In transmission maintenance, Furnas made R$ 127 million (55%)

and Eletronorte with R$ 58 million (70%).

In SPES, we highlight CGT Eletrosul, which acquired CEEE's participation

in SPES TSLE and FOTE, for the incorporation of assets, totaling R$ 301 million. A contribution was also made for the settlement of Debentures

of TSLE in a total of R$ 196 million, not foreseen.

Investment

Frustrations

In generation, there was total frustration of R$2,778 million

in 2021, especially the Angra 3 nuclear power plant, representing 74% of all frustration, equivalent to R$ 1,573 million. In Angra 1 and

2 plants, there was the frustration of R$ 256 million, due to difficulties in the supplier market, delay in the supply of quotations,

lack of raw materials, and delay in delivery of imported equipment and components, as well as prioritization of operational maintenance

activities. In the generation SPEs, there was total frustration of R$ 643 million, especially Furnas, which had a total of R$ 406 million

planned for the acquisition of stakes in SPEs that did not occur in the period.

In Transmission, there was total frustration of R$ 634 million

in 2021, with R$ 98 million in reinforcements and improvement due to problems faced by some substations, frustration of R$ 93 at Chesf

due to delays in supplies and increased prices of raw materials and frustration of R$ 76 million in Furnas due to delays in bidding and

issuance of environmental licenses. In addition, Furnas had planned a budget of R$ 294 million for acquisitions of new transmission projects,

which did not occur in the period.

1.5. Commercialization

1.5.1. ENERGY Sold in 4Q21

- Generators - TWh

In terms of the evolution of the energy market, Eletrobras Companies,

in 4Q21, sold 49.0 TWh of energy, against 52.9 TWh traded in the same period of the previous year, representing a drop of 7.4%. These

volumes include the energies sold from the plants under the quota regime, renewed by Law 12.783/2013, as well as by the plants under the

operating regime (ACL and ACR).

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 36 |

| Marketletter 4Q21 |

| | |

Sales: includes developments under Law 13.182/15

Average ACR Prices on the chart do not include Itaipu and Quotas (O&M).

They include Electronuclear.

1.5.2. Energetic Balance

| Energy Balance (MWmed) |

2021 |

2022 |

2023 |

2024 |

2025 |

|

|

| |

|

| Ballast |

9,282 |

9,399 |

9,324 |

9,312 |

8,825 |

|

|

| |

Own Resources (1) |

8,099 |

8,226 |

8,226 |

7,930 |

7,930 |

|

|

| |

Energy Purchase |

1,183 |

1,097 |

1,086 |

895 |

895 |

|

|

| Sales |

7,281 |

6,409 |

6,027 |

4,853 |

3,444 |

|

|

| |

ACL - Bilateral Contracts + MCP held |

5,244 |

3,875 |

2,701 |

1,519 |

1,522 |

|

|

| |

ACR - Except quotas |

2,037 |

2,152 |

2,152 |

1,925 |

1,925 |

|

|

| |

Average Selling Price R$/MWh |

241.34 |

219.85 |

228.84 |

228.30 |

228.23 |

|

|

| |

Average Purchase Price R$/MWh |

288.77 |

254.82 |

257.00 |

247.84 |

247.84 |

|

|

| |

Average Selling Price R$/MWh (2) |

194.38 |

175.34 |

173.06 |

179.90 |

179.85 |

|

|

| |

Average Purchase Price R$/MWh (2) |

263.66 |

235.84 |

236.30 |

236.30 |

236.30 |

|

|

| Balance (Ballast - Sales) |

2,001 |

2,991 |

3,297 |

4,460 |

5,381 |

|

|

| Discontracted Energy* |

22% |

32% |

35% |

48% |

61% |

|

|

|

* The uncontracted

portion includes energy reserved for the company's hedge, strategically defined according to gsf estimate for the period.

Contracts concluded by 31/12/2021.

The developments of Law 14,182/2021, the process of descotization of the plants under

the regime of Physical Guarantee Quotas and the creation of the new state-owned company are not being considered in the balance sheet. |

|

Portions of Physical Guarantee Quotas and Nuclear Energy Quotas are not included

in the balance sheet.

In the Average Sales Prices are not being considered the enterprises under physical

guarantee quotas and nuclear energy quotas.

In the Own Resources, for hydroelectric projects, an estimate of GFIS2 was considered,

that is, the Physical Guarantee considering the Adjustment Factors due to Internal Losses, Losses in the Basic Network and Availability.

1)

The extension of the grant term of the Mascarenhas de Moraes and Tucuruí UHEs was considered according to the provisions

of ANEEL Homologatory Resolution No. 2,932 of September 14, 2021.

Regarding the PIEs of which Amazonas GT (incorporated by Eletronorte) buys energy

and passes on to the Distributor, it was considered the reversal of assets for Eletronorte from the date of the termination of current

contracts (May/2015), and considered new sales contracts for the Distributor from that date, according to instructions of MP 855/2018.

2)

Not considered in the prices of purchase and sale of energy, the prices of contracts of Amazonas GT (incorporated by Eletronorte),

including the contracts of PIEs, arising from the process of deverticalization of Amazonas Distribuidora, it is worth mentioning that,

in this case, the operations of purchase and sale of energy do not reflect economic impact ("pass-through").

|

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 37 |

| Marketletter 4Q21 |

| | |

| Physical and Nuclear Power Warranty Quotas (MWmed) |

2021 |

2022 |

2023 |

2024 |

2025 |

| Physical Guarantee Quotas of Hydroelectric Power Plants (3) |

7,464 |

7,464 |

7,451 |

7,451 |

7,451 |

| Nuclear Power Quotas |

1,573 |

1,573 |

1,573 |

1,573 |

1,573 |

| 3) | Total Physical Guarantee Amounts of the enterprises. It was considered the concession under provisional administration of the Jaguari

UHE remaining until 2022. |

Considered only existing CCGF, different from the publications until 2Q21, which considered

the end of the contracts of the Mascarenhas de Moraes HCC, in Jan/2024, and the Tucuruí HUP, in August/2024, and from these dates,

these plants were considered in the Regime of Physical Guarantee Quotas.

| With the developments of Law 14,182/2021 and the process of destitution of the plants under the regime of Physical Guarantee Quotas, the following scenario is presented considering its effectiveness: |

| Scenario Law 14,182/2021 (MWmed) |

2021 |

2022 |

2023 |

2024 |

2025 |

| Physical Guarantee Quotas of Hydroelectric Power Plants (3) (4) |

7,464 |

7,464 |

5,961 |

4,470 |

2,980 |

| Descotization (5) |

0 |

0 |

1,332 |

2,663 |

3,995 |

| New Grants (6) |

0 |

0 |

5,728 |

5,728 |

5,728 |

| 4) | Total Physical Guarantee Amounts of the enterprises. Descotization occurring gradually over 5 years from 2023. |

| 5) | Total Physical Guarantee Amounts of the enterprises. In descotization, the plants currently under quota regime will have a new concession

under the regime of Independent Energy Producer - PIE, occurring gradually in 5 years from 2023. The Physical Guarantee values were defined

in Ordinance GM/MME No. 544/21. |

| 6) | Total Physical Guarantee Amounts of the enterprises. Considered new concession grants

from 2023 for the Sobradinho, Itumbiara, Tucuruí, Curuá-Una and Mascarenhas de Moraes plants, whose Physical Guarantee values

were defined in Ordinance GM/MME No. 544/21. Regardless of what is observed in item (1). |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 38 |

| Marketletter 4Q21 |

| | |

2.

Result Analysis

of the Parent Company

In 4Q21, Eletrobras Holding posted net income of R$602 million,

a reduction of 68% compared to the net income of R$1,879 million in 4Q20. The 4Q21 result was decisively influenced by: (i) Equity Equity

Result, in the amount of R$ 2,203 million in 4ITR21, while in 4Q20 it was 3,568 million, a reduction of R$ 1,365 million, mainly influenced

by the subsidiary Eletrosul , which has a variation mainly due to the recording of active deferred tax credits in 4Q20, which did not

occur in 4Q21; (ii) contingencies of R$728 million, of which R$803 million refer to a compulsory loan; (iii) a deterioration in the financial

result of R$1,007 million, partially offset by: (iv) the positive effect of the holding by the holding company of R$439 million in receivables

from Amazonas Energia (R$420 million) and Roraima Energia (R$ 19 million), arising from Fixed Assets in Progress - AIC of said distributors,

accounted for on the base date of February 2017, but not priced in the privatization value of said distributors and which were contractually

expected to be paid after recognition by Aneel at BRRL; (v) reduction in personnel costs of -R$104 million, with emphasis on -R$91 million

resulting from the reduction in actuarial liabilities resulting from the migration of 67 participants from DB – defined benefit

to CD – defined contribution, generating “shortening of the liability” (reduction of liabilities), as there was a drop

in the projected flow of benefit payments, resulting in an actuarial gain perceived in the 4Q21 result.

|

Evolution of Results - R$ million |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 39 |

| Marketletter 4Q21 |

| | |

2.1 Shareholdings

in the Parent Company

In 4Q21, the results of Equity Interests positively impacted

the Parent Company's results of R$ 2,203 million, resulting from the equity result of investments in subsidiaries and affiliates, while

the result in 4Q20 was R$ 4,178 million (the value of 4Q20 was resubmitted due to the remeasurement of the transmission assets –

see Note Explicative 4.4 of the Financial Statements). The highlight for improvement in chesf results (+R$ 3,323 million), Eletronorte

(4ITR21 went to R$1,204 million from 4ITR20 R$ 761 million). Furnas (4ITR21 went to R$73 million from 4ITR20 (R$ 241 million)) and partially

offset by the lower result in CGT Eletrosul (4ITR21 went to (R$124 million) from 4ITR20 1,560 million).

2.2 Operating

Provisions of the Parent Company

In 4Q21, the Operating Provisions negatively impacted the Parent

Company's results by R$ 1,389 million, compared to a positive reversal of R$ 2,497 million in 4Q20. This variation is mainly explained

by: (i) negative effect on provisions for judicial contingencies, with emphasis on compulsory loan lawsuits in the amount of R$ 803 million,

compared to a provision of R$ 2,251 million in 4Q20; and (ii) R$ 620 million of provision of credits to

be received against Amazonas Energia, with R$ 572 million estimating the risk of prospective default and the difference only in real default.

|

Tabela 24: Provisões Operacionais (R$ milhões) |

| |

|

|

|

| |

4T21 |

4T20 |

| Guarantees |

2 |

11 |

| Contingencies |

-728 |

-2,260 |

| PCLD - Financing and Loans |

-625 |

140 |

| Overtime liabilities in Subsidiaries |

- |

- |

| Investment Losses |

-20 |

-363 |

| Provision for Implementation of Shares - Compulsory Loan |

-15 |

8 |

| ANEEL Provision - CCC |

- |

-45 |

| Other |

-2 |

12 |

| TOTAL |

-1,389 |

2,497 |

2.3 Parent

Company's Financial Results

The financial result decreased by R$ 1,007 million, mainly due

to: (i) passive exchange variation, which went from R$ 365 million in 4Q20 to R$ -91 million in 4Q21 due to the variation in the dollar

of -7.87 %, in 4Q20 and 2.59% in 4Q21, (ii) net monetary restatement, which went from R$ 334 to R$ 1 million, due to a reduction of R$

160 million referring to Eletronorte's retained dividends (years 2018 and 2019), which were allocated to the end of 2020 by the subsidiary

(with no corresponding effect in 4Q21) and a reduction of R$ 141 million in revenue from monetary variation on CCC credits assumed by

Eletrobras due to the privatization process of the companies of distribution.

In addition, in 4Q21 there were definite losses recognized in 3Q21 on CCC credits, given the conclusion of the process of monitoring reimbursements

by ANEEL. Finally, it should be noted that the monetary variation on the "inefficiency" balance was also negatively affected

due to CNPE Resolution No. million, and (iii) recording of a financial expense of R$350 million, arising from the Debt Renegotiation Agreement

with Eletronorte, referring to obligations to pay dividends from previous years, which included the reduction (receipt) of a credit with

Eletrobras itself.

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 40 |

| Marketletter 4Q21 |

| | |

Table 26: Financial Results (R$ million)

| FINANCIAL RESULT |

|

|

4Q21 |

4Q20 |

| Financial Revenues |

|

|

|

|

| Interest income, commissions and fees |

|

|

240 |

252 |

| Revenue from financial investments |

|

|

85 |

-58 |

| Increased moratorium on electricity |

|

|

46 |

- |

| Net monetary updates |

|

|

1 |

471 |

| Net exchange variations |

|

|

- |

365 |

| Interest Income on Dividends |

|

|

15 |

-137 |

| Other financial revenues |

|

|

87 |

39 |

| |

|

|

|

|

| Financial Expenses |

|

|

|

|

| Debt charges |

|

|

-400 |

-362 |

| Leasing charges |

|

|

-1 |

-1 |

| Net exchange variations |

|

|

-91 |

- |

| Charges on shareholder resources |

|

|

-1 |

- |

| Other financial expenses |

|

|

-528 |

-105 |

| |

|

|

-545 |

515 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 41 |

| Marketletter 4Q21 |

| | |

3.General

Information

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 42 |

| Marketletter 4Q21 |

| | |

Capital Stock

Eletrobras' capital stock, on December 31, 2021, totaled R$

39,057 billion, represented by 1,568,930,910 shares, of which 1,288,842,596 are common shares and 280,088,314 are preferred shares.

|

Table 27: Social Capital Structure |

| Eletrobras Capital Stock |

|

|

| |

|

|

|

|

|

|

| Equity position at 12/31/2021 |

% Capital |

|

|

|

| |

|

|

|

|

|

|

| Shareholders |

Quant. |

Value (R$) |

Species/Classe |

Total |

|

|

| |

|

| |

|

|

|

|

|

|

| ORDINARY |

1.288.842.596 |

32.084.698.524,23 |

100,00% |

82,15% |

|

|

| Union |

667.888.884 |

16.626.555.917,17 |

51,82% |

42,57% |

|

|

| BNDESPAR |

141.757.951 |

3.528.950.032,66 |

11,00% |

9,04% |

|

|

| BNDES |

74.545.264 |

1.855.744.316,08 |

5,78% |

4,75% |

|

|

| Citibank (ADR's Depositary Bank) |

52.065.112 |

1.296.119.035,28 |

4,04% |

3,32% |

|

|

| Iberclear as Latibex |

340.835 |

8.484.812,85 |

0,03% |

0,02% |

|

|

| FIA Dynamics and Banclass |

65.536.875 |

1.631.487.726,37 |

5,08% |

4,18% |

|

|

| FND |

45.621.589 |

1.135.712.719,15 |

3,54% |

2,91% |

|

|

| FGHAB |

1.000.000 |

24.894.194,70 |

0,08% |

0,06% |

|

|

| Northeast Bank |

1.420.900 |

35.372.161,25 |

0,11% |

0,09% |

|

|

| Other |

238.665.186 |

5.941.377.608,72 |

18,52% |

15,21% |

|

|

| |

|

|

|

|

|

|

| PREF. A |

146.920 |

3.657.455,09 |

100,00% |

0,01% |

|

|

| Victor Adler |

52.200 |

1.299.476,96 |

35,53% |

0,00% |

|

|

| Shareholders to Identify |

42.451 |

1.056.783,46 |

28,89% |

0,00% |

|

|

| Other |

52.269 |

1.301.194,66 |

35,58% |

0,00% |

|

|

| |

|

|

|

|

|

|

| PREF. B |

279.941.394 |

6.968.915.567,21 |

100,00% |

17,84% |

|

|

| Citibank (ADR's Depositary Bank) |

5.340.887 |

132.957.081 |

1,91% |

0,34% |

|

|

| Iberclear as Latibex |

139.153 |

3.464.102 |

0,05% |

0,01% |

|

|

| BNDESPAR |

18.691.102 |

465.299.932,37 |

6,68% |

1,19% |

|

|

| BNDES |

18.262.671 |

454.634.487,64 |

6,52% |

1,16% |

|

|

| 3G Radar Funds |

30.890.676 |

768.998.503 |

11,03% |

1,97% |

|

|

| Shareholders to Identify |

2.035.995 |

50.684.456 |

0,73% |

0,13% |

|

|

| Union |

494 |

12.297,73 |

0,00% |

0,00% |

|

|

| Other |

204.580.416 |

5.092.864.707,99 |

73,08% |

13,04% |

|

|

| Total |

1.568.930.910 |

39.057.271.546,52 |

- |

100,00% |

|

|

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 43 |

| Marketletter 4Q21 |

| | |

Asset Behavior

Analysis

Shares

|

Table 28: B3, ELET3 and ELET6 |

| Price and Volume |

(R$)

ELET3

(Shares ON) |

(R$)

ELET6

(Shares PN) |

(pts.)

IBOV

(Index) |

(pts.)

IEE

(Index) |

| Closing Price on 12/31/2021 |

33.41 |

33.01 |

104822 |

76305 |

| Maximum in the quarter |

40.61 |

40.55 |

114648 |

80439 |

| Average in the quarter |

35.11 |

34.79 |

106742 |

76795 |

| Minimum in the quarter |

32.07 |

31.72 |

100775 |

74371 |

| |

|

|

|

|

| Variation in 4Q21 |

-13.2% |

-14.7% |

-5.5% |

-2.5% |

| Variation in the last 12 months |

-2.0% |

-3.5% |

-11.9% |

-7.9% |

| Average Daily Traded Volume 4Q21 (R$ million) |

188.1 |

96.2 |

- |

- |

| (1) | The closing price of preferred and common shares and Net Income per share. Accrued net income for the

last 12 months was taken into account for the calculation; |

| (2) | The closing price of preferred and common shares and End-of-period Book Value per share. |

|

Evolution of Shares Traded at B3 |

Source: AE Broadcast

Index number 09/30/2020 = 100 and ex-dividend

values.

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 44 |

| Marketletter 4Q21 |

| | |

ADR Programs

|

Tabela 29: NYSE, EBRN and EBRB |

| Price and Volume |

(US$) NYSE

EBRN |

(US$) NYSE EBRB |

| Closing Price on 12/31/2021 |

6.09 |

6.00 |

| Maximum in the quarter |

7.41 |

7.51 |

| Average in the quarter |

6.32 |

6.26 |

| Minimum in the quarter |

5.68 |

5.61 |

| |

|

|

| Variation in 4Q21 |

-14.2% |

-16.9% |

| Variation in the last 12 months |

-6.5% |

-8.5% |

| Average Daily Traded Volume 4Q21 (R$ million) |

9,976 |

119 |

|

Evolution of Shares Traded in ADR |

Source: AE Broadcast

Index number 12/31/2020 = 100

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 45 |

| Marketletter 4Q21 |

| | |

Latibex - Madrid Stock

Exchange

|

Tabela 30: LATIBEX, XELTO E XELTB |

| Price and Volume |

(€) LATIBEX

XELTO |

(€) LATIBEX XELTB |

| Closing Price on 12/31/2021 |

5.25 |

5.00 |

| Maximum in the quarter |

6.45 |

6.55 |

| Average in the quarter |

5.54 |

5.66 |

| Minimum in the quarter |

5.10 |

5.00 |

| |

|

|

| Variation 4Q21 |

-14.6% |

-18.0% |

| Variation in the last 12 months |

-6.2% |

-10.7% |

| Average Daily Traded Volume 4Q21 (R$ million) |

7.0 |

6.7 |

|

Evolution of Foreign Currencies |

Index number 12/31/2020 = 100.

Source: Central Bank

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 46 |

| Marketletter 4Q21 |

| | |

Number of employees

PARENT

COMPANY

|

Table 31: Employees by Working Time |

| Time worked in the company (years) |

4Q21 |

| Until 5 |

21 |

| 6 to 10 |

38 |

| 11 to 15 |

382 |

| 16 to 20 |

150 |

| 21 to 25 |

19 |

| More than 25 |

59 |

| Total |

669 |

|

Table 32: EMPLOYEES BY FEDERATION STATE |

| Federation State |

4Q21 |

| Rio de Janeiro |

653 |

| São Paulo |

0 |

| Brasília |

15 |

| Expatriate |

1 |

| Total |

669 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 47 |

| Marketletter 4Q21 |

| | |

Balance sheet

|

(R$ Thousand) |

| Asset |

Parent Company |

Consolidated |

| 12.31.2021 |

12.31.2020 |

12.31.2021 |

12.31.2020 |

| CURRENT |

|

|

|

|

| Cash and cash equivalents |

7,384 |

21,630 |

192,659 |

286,607 |

| Restricted cash |

2,544,594 |

3,412,292 |

2,544,594 |

3,573,362 |

| Marketable securities |

6,026,365 |

7,740,051 |

16,335,604 |

14,039,358 |

| Customers |

719,906 |

481,109 |

5,094,976 |

5,971,657 |

| Asset contractual transmission |

- |

- |

7,356,356 |

10,364,908 |

| Loans and financing |

2,275,301 |

5,937,323 |

1,251,766 |

4,748,651 |

| Equity Pay |

5,028,731 |

4,720,491 |

443,142 |

675,510 |

| Taxes to recover |

456,725 |

519,200 |

755,906 |

833,960 |

| Income tax and social contribution |

640,191 |

829,569 |

1,487,777 |

1,292,750 |

| Reimbursement rights |

741,225 |

- |

768,848 |

4,684 |

| Warehouse |

293 |

305 |

627,573 |

509,991 |

| Nuclear fuel stock |

- |

- |

487,895 |

428,340 |

| Derivative financial instruments |

- |

- |

690,333 |

317,443 |

| Hydrological risk |

- |

- |

- |

- |

| Others |

685,320 |

1,683,297 |

2,014,705 |

1,855,175 |

| Asset held for sale |

289,331 |

289,331 |

387,690 |

289,331 |

| |

|

|

|

|

| |

19,415,396 |

25,634,598 |

40,439,824 |

45,191,737 |

| |

|

|

|

|

| NON CURRENT |

|

|

|

|

| LONG-TERM REALIZABLE |

|

|

|

|

| Reimbursement rights |

5,529,316 |

5,583,447 |

5,627,386 |

5,583,447 |

| Loans and financing |

8,180,605 |

11,197,073 |

4,591,761 |

6,176,238 |

| Customers |

- |

- |

993,080 |

1,061,899 |

| Marketable securities |

398,280 |

322,884 |

398,648 |

323,236 |

| Nuclear fuel stock |

- |

- |

1,490,820 |

1,264,780 |

| Taxes to recover |

3,365 |

2,781 |

449,258 |

430,045 |

| Income tax and social contribution deferred |

- |

- |

1,500,987 |

2,068,894 |

| Bonds and related deposits |

6,393,647 |

4,676,895 |

8,247,485 |

6,752,685 |

| Asset contractual transmission |

- |

- |

52,158,612 |

41,023,616 |

| Financial assets – Concessions and Itaipu |

428,685 |

1,103,034 |

2,601,027 |

3,199,751 |

| Derivative financial instruments |

- |

- |

653,022 |

310,100 |

| Advances for future capital increase |

3,932,463 |

1,223,108 |

- |

1,541 |

| Decommissioning Fund |

2,055,713 |

1,753,827 |

2,055,713 |

1,753,827 |

| Others |

2,024,412 |

1,153,411 |

1,087,508 |

1,286 |

| |

28,946,666 |

27,016,460 |

81,855,307 |

71,236,785 |

| INVESTIMENTS |

88,740,622 |

77,538,694 |

27,647,781 |

29,089,522 |

| Fixed assets net |

235,453 |

244,673 |

33,367,981 |

32,662,912 |

| INTANGIBLE |

61,387 |

42,974 |

4,992,176 |

785,493 |

| TOTAL NON-CURRENT ASSETS |

117,984,128 |

104,842,801 |

147,863,245 |

133,774,712 |

| TOTAL ASSETS |

137,399,524 |

130,477,399 |

188,303,069 |

178,966,449 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 48 |

| Marketletter 4Q21 |

| | |

|

(R$ thousand) |

| Liabilities and Shareholder’s Equity |

Parent Company |

Consolidated |

| 31.12.21 |

31.12.20 |

31.12.21 |

31.12.20 |

| CURRENT |

|

|

|

|

| Loans and financing |

5,310,178 |

7,984,194 |

8,234,753 |

11,410,751 |

| Compulsory loan |

76,944 |

57,201 |

76,944 |

57,201 |

| Suppliers |

773,858 |

705,908 |

4,031,532 |

3,904,051 |

| Advances from customers |

1,370,946 |

1,060,770 |

1,460,455 |

1,134,845 |

| Taxes payable |

259,336 |

335,432 |

804,485 |

1,194,042 |

| Income tax and social contribution |

- |

- |

19,624 |

319,435 |

| Onerous contracts |

- |

- |

10,517 |

40,196 |

| Remuneration to shareholders |

1,381,111 |

1,530,718 |

1,406,891 |

1,547,158 |

| Financial liabilities – Concessions and Itaipu |

578,626 |

647,214 |

578,626 |

647,214 |

| Estimated liabilities |

153,568 |

167,344 |

1,602,947 |

1,454,148 |

| Reimbursement Obligations |

836,744 |

1,373,656 |

859,003 |

1,618,508 |

| Post-employment benefits |

- |

- |

233,304 |

192,209 |

| Provisions for contingencies |

2,267,649 |

1,332,779 |

2,267,649 |

1,722,562 |

| Regulatory charges |

- |

- |

542,913 |

586,845 |

| Lease |

7,773 |

7,595 |

209,774 |

217,321 |

| Others |

64,061 |

111,998 |

236,183 |

353,580 |

| |

13,080,794 |

15,314,809 |

22,575,600 |

26,400,066 |

| Liabilities associated with assets held for sale |

- |

- |

168,381 |

- |

| |

13,080,794 |

15,314,809 |

22,743,981 |

26,400,066 |

| NON-CURRENT |

|

|

|

|

| Financing and loans and Debentures |

19,294,960 |

20,014,081 |

35,780,892 |

35,591,282 |

| Suppliers |

- |

- |

16,555 |

16,556 |

| Advances from customers |

- |

- |

186,348 |

290,870 |

| Compulsory loan |

1,139,391 |

989,908 |

1,139,391 |

989,908 |

| Obligation for asset retirement |

- |

- |

3,268,301 |

3,040,011 |

| Provisions for contingencies |

23,666,275 |

16,526,961 |

31,142,222 |

24,108,078 |

| Post-employment benefits |

885,455 |

1,131,997 |

5,851,502 |

6,824,632 |

| Provision for unsecured liabilities |

- |

- |

708,516 |

4,191 |

| Onerous contracts |

- |

- |

428,164 |

414,705 |

| Reimbursement obligations |

- |

- |

- |

22,259 |

| Lease |

40,560 |

48,333 |

693,710 |

835,873 |

| Grants payable – Use of public goods |

- |

- |

81,655 |

65,954 |

| Advances for future capital increase |

77,336 |

74,060 |

77,336 |

74,060 |

| Derivative financial instruments |

- |

- |

- |

10,014 |

| Regulatory charges |

- |

- |

649,341 |

744,442 |

| Taxes payable |

- |

- |

260,612 |

182,179 |

| Income tax and social contribution |

569,816 |

650,523 |

7,244,737 |

3,705,055 |

| Outhers |

2,523,733 |

2,248,420 |

1,613,042 |

1,899,211 |

| TOTAL NON-CURRENT LIABILITIES |

48,197,526 |

41,684,283 |

89,142,324 |

78,815,089 |

| |

|

|

|

|

| EQUITY |

|

|

|

|

| Share capital |

39,057,271 |

39,057,271 |

39,057,271 |

39,057,271 |

| Capital reserves |

13,867,170 |

13,867,170 |

13,867,170 |

13,867,170 |

| Profit reserves |

30,890,165 |

28,908,054 |

30,890,165 |

28,908,054 |

| Advances for future capital increase |

- |

- |

- |

- |

| Others comprehensive income accumulated |

-7,963,402 |

-8,354,188 |

-7,693,402 |

-8,354,188 |

| |

|

|

|

|

| |

|

|

|

|

| Non-controlling share |

- |

- |

295,560 |

272,987 |

| |

|

|

|

|

| TOTAL SHAREHOLDERS’ EQUITY |

76,121,204 |

73,478,307 |

76,416,764 |

73,751,294 |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

137,399,524 |

130,477,399 |

188,303,069 |

178,966,449 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 49 |

| Marketletter 4Q21 |

| | |

Income Statement

|

(R$ thousand) |

| |

Parent Company |

Consolidated |

| |

31.12.21 |

31.12.20 |

31.12.21 |

31.12.20 |

| NET OPERATING REVENUE |

1,365,825 |

297,036 |

37,616,241 |

29,080,513 |

| Operating Costs |

|

|

|

|

| Personnel, Material and Services |

- |

- |

-3,528,181 |

-3,309,522 |

| Energy purchased for resale |

-1.273.156 |

-175,124 |

5,932 |

-2,400,358 |

| Charges upon use of the electricity network |

- |

- |

-2,461,443 |

-2,500,315 |

| Fuel for electricity production |

- |

- |

-2,338,395 |

-2,092,135 |

| Construction |

- |

- |

-1,395,066 |

-966,443 |

| Depreciation |

- |

- |

-1,639,879 |

-1,637,730 |

| Amortization |

- |

- |

-268,669 |

-59,275 |

| Operating provisions/reversals net |

- |

- |

177,482 |

-302,563 |

| Other Costs |

- |

- |

-512,830 |

-158,679 |

| GROSS RESULT |

92,669 |

121,912 |

25,655,192 |

15,653,493 |

| Operating Expenses |

|

|

|

|

| Personnel, Material and Services |

-551,426 |

-657,204 |

-3,998,259 |

-3,669,866 |

| Depreciation |

-11,841 |

-12,802 |

-147,561 |

-133,912 |

| Amortization |

-11 |

-11 |

-25,350 |

-31,952 |

| Donations and contributions |

-87,399 |

-105,174 |

-164,696 |

-167,408 |

| Operating provisions/reversals net |

-12,254,011 |

-3,608,305 |

-15,070,521 |

-7,070,988 |

| Others |

-257,986 |

-169,354 |

-1,135,154 |

-1,870,450 |

| |

-13,162,674 |

-4,552,850 |

-20,541,541 |

-12,944,576 |

| Regulatory Remeasurements - Transmission Contracts |

- |

- |

4,858,744 |

4,228,338 |

| OPERATING INCOME BEFORE FINANCIAL RESULT |

-13,070,005 |

-4,430,938 |

9,972,395 |

6,937,255 |

| Financial Results |

|

|

|

|

| Financial Revenues |

|

|

|

|

| Income from interest, commissions and fees |

937,275 |

1,367,694 |

692,767 |

863,828 |

| Income from financial investments |

291,494 |

695,384 |

637,001 |

972,602 |

| Increased moratorium on electricity |

69,273 |

1,525 |

325,943 |

341,672 |

| Active monetary updates |

1,383,457 |

1,073,322 |

1,690,933 |

1,161,004 |

| Active exchange variations |

1,788,917 |

5,253,760 |

1,729,815 |

5,115,712 |

| Dividend Interest Revenue |

224,481 |

- |

-15,129 |

- |

| Gains on derivatives |

- |

- |

879,553 |

332,017 |

| Other financial revenues |

215,680 |

177,028 |

482,707 |

343,688 |

| Financial Expenses |

|

|

|

|

| Debt charges |

-1,445,438 |

-1,700,741 |

-2,740,371 |

-2,853,532 |

| Leasing charges |

-4,859 |

-5,562 |

-449,295 |

-367,234 |

| Charges on shareholder resources |

-3,276 |

-23,814 |

-3,826 |

-81,766 |

| Passive monetary updates |

-1,482,606 |

-722,574 |

-1,852,581 |

-877,628 |

| Passive exchange variations |

-2,095,356 |

-5,232,661 |

-2,133,384 |

-5,659,849 |

| Losses on derivatives |

- |

- |

-153,727 |

- |

| Other financial expenses |

-1,014,390 |

-1,042,058 |

-1,146,745 |

-962,160 |

| |

-1,135,348 |

-158,697 |

-2,059,339 |

-1,671,646 |

| INCOME BEFORE EQUITY |

-14,205,353 |

-4,589,635 |

7,916,056 |

5,265,609 |

| RESULTS OF EQUITY |

18,640,740 |

10,928,323 |

1,867,546 |

1,670,903 |

| OTHER INCOME AND EXPENSES |

1,210,754 |

- |

1,210,754 |

16,134 |

| OPERATING RESULTS BEFORE TAXES |

5,646,141 |

6,338,688 |

10,994,356 |

6,952,646 |

| Current Income Tax and Social Contribution |

- |

- |

-1,457,752 |

-2,418,461 |

| Deferred Income Tax and Social Contribution |

- |

- |

-3,822,971 |

1,853,128 |

| NET INCOME |

5,646,141 |

6,338,688 |

5,713,633 |

6,387,313 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 50 |

| Marketletter 4Q21 |

| | |

Cash Flow Statement

|

(R$ thousand) |

| |

|

Parent Company |

Consolidated |

| |

31.12.21 |

31.12.20 |

31.12.21 |

31.12.20 |

| Operating activities |

|

|

|

|

| Income before income tax and social contribution |

5.646.141 |

6.338.688 |

10.994.356 |

6.952.646 |

| Adjustments to reconcile income to cash provided by operations: |

|

|

|

|

| Depreciation and amortization |

11.852 |

12.812 |

2.081.459 |

1.862.869 |

| Net exchange and monetary changes |

405.588 |

-371.847 |

565.217 |

260.761 |

| Financial charges |

291.817 |

362.423 |

2.515.854 |

2.438.704 |

| Income from equity method |

-18.640.740 |

-10.928.323 |

-1.867.546 |

-1.670.903 |

| Other Revenue & Expenses |

-1.210.754 |

- |

-1.210.754 |

-16.134 |

| Contractual revenue - Transmission |

- |

- |

-17.450.333 |

-12.247.523 |

| Construction revenue - Generation |

- |

- |

-82.205 |

-37.800 |

| Regulatory Remeasurements - Transmission Contracts |

- |

- |

-4.858.744 |

-4.228.338 |

| Construction cost - transmission |

- |

- |

1.312.861 |

- |

| Operating allowances (reversals) |

12.254.011 |

3.608.305 |

14.893.039 |

7.373.552 |

| Interest of non-controlling shareholders |

- |

- |

- |

-73.699 |

| GSF Reimbursement |

- |

- |

-4.265.889 |

- |

| Financial instruments - derivatives |

- |

- |

-725.826 |

-332.017 |

| Others |

-2.735 |

255.443 |

2.564.191 |

221.811 |

| |

-7.180.961 |

-7.061.187 |

-6.528.676 |

-5.520.074 |

| (Increases)/decreases in operating assets |

|

|

|

|

| Customers |

- |

1 |

1.705.583 |

1.454.193 |

| Marketable and securities |

1.638.290 |

-952.915 |

-2.511.670 |

-3.580.871 |

| Right to reimbursement |

- |

- |

-22.909 |

76.487 |

| Warehouse |

12 |

-33 |

-719.144 |

-38.167 |

| Nuclear fuel inventory |

- |

- |

-285.595 |

-313.743 |

| Financial assets - Itaipu |

605.581 |

746.673 |

605.581 |

746.673 |

| Assets held for sale |

- |

317.440 |

- |

2.314.709 |

| Hydrological Risk |

- |

- |

1.787 |

41.243 |

| Credits with subsidiaries - CCD |

- |

- |

- |

- |

| Others |

1.322.091 |

301.232 |

1.551.932 |

116.654 |

| |

3.565.974 |

412.396 |

325.565 |

-2.091.208 |

| Increases/(decreases) in operating liabilities |

|

|

|

|

| Suppliers |

67.950 |

186.075 |

99.527 |

781.295 |

| Advances |

- |

- |

- |

-73.748 |

| Lease |

- |

5.562 |

- |

402.881 |

| Estimated liabilities |

-13.776 |

20.238 |

233.086 |

94.915 |

| Indemnification obligations |

- |

- |

- |

267.111 |

| Sectorial charges |

- |

- |

-82.459 |

-26.627 |

| Liabilities associated with assets held for sale |

- |

- |

- |

-1.661.335 |

| Accounts payable with subsidiaries |

- |

- |

- |

- |

| Others |

128.741 |

334.585 |

2.060.393 |

-710.777 |

| |

539.748 |

546.460 |

48.729 |

-925.585 |

| |

|

|

|

|

| Payment of financial charges |

-1.328.795 |

-923.272 |

-2.545.474 |

-1.701.076 |

| Receipt of RAP and indemnities |

- |

- |

14.832.701 |

9.153.453 |

| Receipt of financial charges |

861.026 |

1.114.743 |

567.736 |

662.713 |

| Payment of income tax and social contribution |

-172.502 |

-203.217 |

-2.184.202 |

-3.537.980 |

| |

|

|

|

|

|

|

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 51 |

| Marketletter 4Q21 |

| | |

| Receipt of return on investments in equity interests |

7.302.271 |

4.679.285 |

2.175.585 |

1.195.566 |

| Payment of supplementary social security |

-21.595 |

-13.057 |

-418.059 |

-305.292 |

| Payment of judicial contingencies |

-3.355.498 |

-3.175.996 |

-6.228.610 |

-3.247.582 |

| Guarantees and escrow deposits |

-2.462.388 |

-940.782 |

-2.510.199 |

-951.327 |

| |

|

|

|

|

| |

|

|

|

|

| Net cash provided by (used in) operating activities |

3.393.421 |

774.063 |

-8.230.605 |

5.127.361 |

| |

|

|

|

|

| Financing activities |

|

|

|

|

| Loans and financing obtained and debentures obtained |

2.700.000 |

5.193.319 |

4.828.697 |

9.157.868 |

| Payment of loans and financing and debentures – main |

-7.181.654 |

-9.230.730 |

-8.429.427 |

-12.613.613 |

| Payment of remuneration to shareholders |

-3.813.501 |

-2.579.118 |

-3.747.606 |

-2.593.945 |

| Receipt of advance for future capital increase - |

- |

- |

- |

- |

| Payment of financial leases |

-12.454 |

-13.136 |

-600.470 |

-556.876 |

| Others |

- |

- |

-499.734 |

-82.424 |

| |

|

|

|

|

| |

|

|

|

|

| Net cash provided by (used in) financing activities |

-8.307.609 |

-6.629.666 |

-8.448.540 |

-6.688.970 |

| |

|

|

|

|

| Investment activities |

|

|

|

|

| Granting of loans and financing |

- |

- |

- |

- |

| Receipt of loans and financing |

7.581.413 |

6.224.747 |

-4.834.033 |

4.138.002 |

| Acquisition of fixed assets |

-2.621 |

-1.529 |

-2.573.439 |

-2.254.786 |

| Acquisition of intangible assets |

-18.424 |

-23.466 |

-118.805 |

-142.003 |

| Acquisition/capital contribution in equity interests |

-3.744 |

- |

-274.354 |

-68.169 |

| Acquisition of contractual assets |

- |

|

-1.299.710 |

| Granting of advance for future capital increase |

-2.656.682 |

-1.280.200 |

- |

-6.780 |

| Disposal of investments in equity interests |

- |

939.479 |

- |

941.779 |

| Net cash flow in the acquisition of investments |

4.899.942 |

5.859.031 |

1.867.435 |

- |

| Others |

- |

- |

-443.738 |

-166.492 |

| Net cash provided by (used in) investment activities |

4.899.942 |

5.859.031 |

123.987 |

1.512.909 |

| |

|

|

|

|

| Increase (decrease) in cash and cash equivalents |

-14.246 |

3.428 |

-93.948 |

-48.700 |

| |

|

|

|

|

| Cash and cash equivalents at the beginning of the year |

21.630 |

18.202 |

286.607 |

335.307 |

| Cash and cash equivalents at the end of the year |

7.384 |

21.630 |

192.659 |

286.607 |

| |

-14.246 |

3.427 |

-93.948 |

-48.700 |

MARKETLETTER 4Q2021 Disclaimer: This material contains calculations that may not produce a precise sum or result due to rounding performed. . | 52 |

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: March 19, 2022

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

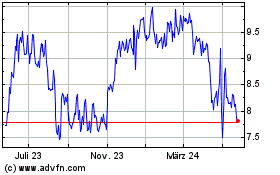

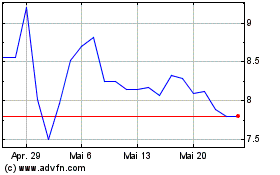

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024