SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

| 2021 Variable Compensation Program (RVA) | |

| | | |

RULES OF ANNUAL VARIABLE COMPENSATION PROGRAM

OF ELETROBRAS COMPANIES’ OFFICERS

YEAR 2021

1.1

The object of these rules is to establish the ANNUAL VARIABLE

COMPENSATION PROGRAM OF OFFICERS – RVA for the year of calculation of RESULTS in order to encourage their productivity, in keeping

with Article 152 of Law 6404, dated December 15, 1976, of Decree No. 8945/2016, Article 37, Paragraph Five, as well as other applicable

legal provisions.

Sole Paragraph - RVA is restricted to the Executive Board

of Eletrobras companies and does not include Directors.

1.2

The definition of anchoring RVA to the RESULTS of indicators

as to the goals set, in a manifest connection with PDNG – Business Master Plan, and PNG’s – Business and Management

Plans, for the time span from 2021 to 2025 aims to channel the efforts of the company’s managers in furtherance of the strategic

goals defined for a five-year period, rewarding a management that enhances the company’s sustainability over time, thus adding value

for all stakeholders.

2.1

It is understood that the amount to be distributed as RVA, which

is calculated as defined in item 5, will be paid in cash and in installments in arrears, based on the fees in force on the date of payment

(provided that the company actually makes their VARIABLE COMPENSATION payment), not including one twelfth of the 13th salary

and paid vacation duties, except for the specific treatment given to RVA payments of the Holding, which will be made by means of a stock-based

instrument, as provided in item 8.7 and its subitems in this rule.

2.2

RVA is not subject to the Resolution of the Coordination and

Control Board of State-Owned Companies – CCE No. 10, dated May 30, 1995 and, therefore, does not compete with the Profit and/or

Result Sharing of employees within the threshold of 25% of the dividends.

2.3

The payment of RVA for the year of calculation of RESULTS by

the companies participating in the program will be subject to the following situations:

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page1/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

Paragraph

1 If the company has a positive net income in the year for calculating the RESULTS.

Paragraph

2 If at least the mandatory dividend is paid to the shareholders of the company to which the Officer or CEO is connected, as

established in Article 152 of Law 6404/76.

Paragraph

3 The full distribution of dividends defined at the Shareholders’ Meeting or equivalent.

Paragraph

4 Actual distribution of PLR to employees.

Paragraph

5 Be contained within the global compensation threshold of Officers approved by Sest – Office of Coordination and

Governance of State-Owned Companies.

Paragraph

6 The company that maintains retained losses even after the occurrence of positive net income in the year under assessment, or

that posts loss in the year, cannot pay RVA.

Paragraph

7 The actual payment of RVA is subject to the company’s financial availability, while the right to receive remains

unchanged, and the taking out of a loan for its payment being precluded.

Paragraph

8 For the purpose of calculating RVA, considering indicators with achievement of goals lower than 80% or with a payment factor

(Fpi) lower than 50% will not be allowed.

Paragraph

9 Bonus payment of up to three (3) fees for excelling goals will be awarded if at least 95% of the payment factor (Fpi) is

reached in all goals. If this requirement is not met, the maximum amount awarded will account for nine (9) fees.

Paragraph

10 It will be the responsibility of each company to pay RVA to their respective Officers.

Paragraph

11 The internal audit department will be responsible for reporting on compliance with the rules, including with regard to

deferral and payments made.

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page2/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

| 3 | REQUIREMENTS FOR PAYMENT |

3.1

The amount of up to 12 fees (9 fees + 3 bonus fees) to be distributed in each

company to its Officers as RVA will be calculated according to the ascertainment of the results addressed in item 5.

3.2

Considering the existence of goals and weights per company and by Board, there

may be a difference in compensation between Officers of the same company and of different companies.

3.3

The total amount to be received by the Executive Board will be limited to 10%

of the company’s own Net Income, under the terms of Article 152 of Law 6404/76.

4.1

This program is structured based on goals for Results indicators. These are Indicators

connected to PDNG – Business and Management Master Plan and CMDE – Contract for Business Performance Goals, in addition to

those for Evaluation of Officers, Sest Compliance, and Project Success (pertaining to the business units). Each board will have at least

one project chosen for follow-up as concerns RVA, monitored by the Corporate Project Management Office.

4.2

The indicators, their goals, protocols, and related weights

are shown in the annexes standardized by SEST for each Eletrobras company that, coupled with these rules, make up RVA.

4.3

In case of change to the indicators that make up the current

RVA, relevant justifications should be included in a Technical Note to be submitted to SEST.

| 5 | ASCERTAINMENT OF RESULTS |

5.1

The illustrative table below will be used to present the methodology

for calculating the RVA result:

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page3/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

| a |

b |

d |

e |

f |

g |

h |

i |

| Level |

Indicator |

Weight |

Goal |

Accomplished |

% of Achievement |

Fpi |

Fpi x Pi |

| |

|

|

|

|

|

|

|

| Corporate (Strategic) |

Indicator 1 |

15% |

|

|

|

|

|

| Indicator 2 |

20% |

|

|

|

|

|

| Indicator 3 |

10% |

|

|

|

|

|

| Indicator 4 |

15% |

|

|

|

|

|

| Indicator 5 |

10% |

|

|

|

|

|

| Indicator 6 |

10% |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Collective Board |

Indicator 7 |

5% |

|

|

|

|

|

| Indicator 8 |

5% |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Tactical/Operational Business Unit |

Indicator 9 |

10% |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted Percentage of Goal Achievement per Board (Total Σ (Fpi x Pi)) |

|

| Individual Amount of RVA to be paid per Board (H x Σ(Fpi x Pi)) |

|

5.2

The RVA amount will be calculated as follows:

| 5.2.1 | Firstly, the “% of achievement” of the goal

(column g) of each indicator should be calculated, that is, the amount accomplished for each indicator against the established goal. |

| 5.2.2 | Then, the goal achievement % for each goal should be used

to calculate the Payment Factor – Fpi (column h) of the respective indicator, according to the ruler that is established in annex

I of SEST letter. As for the Sest Compliance indicators, as well as for the index of Strategic Alignment IAE – CMDE, calculating

the “% of achievement” is unnecessary, and the result should be attributed to Fpi directly in the respective ruler. |

| 5.2.3 | Bonus payment for excelling goals will be awarded if, in

all indicators, at least 95% of the payment factor (Fpi) is achieved. If this requirement is not met, Fpi of each indicator will be limited

to 100%. |

| 5.2.4 | Once the Payment Factor - Fpi (column h) has been defined,

the next step is to calculate the product Fpi by Weight – Pi (column d) defined for each indicator, Fpi x Pi (column i). |

| 5.2.5 | The sum of the multiplications of all the lines of the indicators

will account for the Weighted Percentage of Goal Achievement per Board = ∑ (Fpi x Pi). |

| 5.2.6 | Lastly,

the amount of RVA to be paid per Board will be the Weighted Percentage by the number of fees

(H) defined by Sest for the company in the base year, H x ∑ Fpi x Pi. For the

2021 RVA Program, the payment of 9 fees (H) + 3 bonus fees is foreseen, totaling up

to 12 fees, according to the conditions provided in item 2.3. |

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page4/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

| 5.2.7 | Should the participant accumulates more than one Board,

the average of the results obtained in the respective Boards will be calculated for the purposes of the business unit indicator. |

| 6 | QUALIFICATION - AUDIT REQUEST |

| 6.1 | This rule applies exclusively to 2021 RVA over the period

from January 01, 2021 to December 31, 2021. |

| 6.2 | This deflator is applicable to Officers of the Executive

Management Bodies of Eletrobras Companies, which have organizational units in pending situation with the Internal Audit. |

| 6.3 | The appointments/resignations of Officers that occur over

a certain period will be considered for attributing the actual responsibility for the pending situation. |

| 6.4 | RVA deflator will comply with the following criteria: |

| Internal Audit Recommendations and/or Determinations of Control Bodies not implemented |

RVA Deflator |

| Up to one (01) |

5% |

| from two (02) to five (05) |

10% |

| more than five (05) |

15% |

| 6.5 | For purposes of ascertaining the discount deflator percentage,

the following points will be considered, providing that they are classified as medium or high criticality: |

| 6.5.1 | Internal audit recommendations not implemented and expired

in the 2nd term extension, on the base date of December 31, 2021, of the organizational units that make up each Executive Management

Body. |

| 6.5.2 | Internal audit recommendations not implemented and expired

in the initial term, with no statement by managers regarding requests for extension of term, on the base date of December 31, 2021, of

the organizational units that make up each Executive Management Body. |

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page5/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

| 6.5.3 | The Measure Plans not responded to because of omission of

the managers of the organizational units that make up each Executive Management Body, from two consecutive months, within the period between

January 01, 2021 and December 31, 2021. |

| 6.5.4 | Determinations and recommendations of TCU – Federal

Accounting Court, and recommendations of CGU – Office of the Federal Controller General, not implemented within the term, on the

base date of December 31, 2021, with the requests for extensions before such Control Bodies having been exhausted (non-cumulative). |

| 6.6 | Any decision to apply the RVA discount deflator will be

made within the scope of the Board of Directors of Eletrobras Companies. |

| 7 | MEASURING THE DEGREE OF COMPLIANCE WITH

GOAL PLAN |

7.1

The Management and Sustainability Board will follow up and ascertain

the results of the indicators and projects of this program against the goals set, coupled with the divisions in the Eletrobras companies

that also participate in the RVA program.

7.2

Eletrobras’ Board of Directors is responsible for approving

the RVA program, which includes the Rule, indicators, goals, justifications, category weights, corporate indicator weights, and projects

related to each Officer.

7.3

The internal audit and the Board of Directors will be expressly

responsible for validating compliance with the goals and rules of RVA Program.

7.4

Eletrobras, through the division responsible for managing the

RVA Program, will forward to each company the result of measuring the agreed goals.

7.5

If there is a need to adjust the scope of the RVA project, so

that this adjustment impacts the measurement of any of the “performance indicators” of the project’s ISP (IDP, IDCo,

and IDB – project term indicator, project budgeted cost indicator, and project benefit indicator), this adjustment should be described

in detail through a “change request,” which, to be implemented in the project, should have the approval of the project leader,

approver, and sponsor, and should also be approved by the Board of Directors of the company in which the RVA project is implemented.

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page6/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

7.6

The project changes described above may only be carried out

until the month of September of the current year, with the respective approval of the company’s Board of Directors.

8.1

The payment of RVA may be made after the payment of the PLR

— Profit and Result Sharing and the dividends approved at the Shareholders’ Meeting, being deferred in five (05) years as

shown in the table below and provided for in the accounts.

| Payment in Arrears |

Program |

Year +1 |

Year +2 |

Year +3 |

Year +4 |

Year +5 |

| Program of Base Year |

60% |

|

|

|

|

| |

10% |

|

|

|

| |

|

10% |

|

|

| |

|

|

10% |

|

| |

|

|

|

10% |

8.2

The payment of the installments in arrears of the Year +2, Year

+3, Year +4 and Year +5 in each company will be conditioned to the fulfillment of the commitments it has undertaken in regard to the payment

of PLR and of the dividends approved in the Shareholders’ Meeting pertaining to the year of ascertainment of RESULTS, in accordance

with paragraphs 2, 3 and 4 of item 2.3 of this rule.

8.3

In the years following the base year, in the event of a loss,

the installment in arrears will not be paid.

8.4

In the years subsequent to the base year, in the event of a

reduction lower than 20% of the net income vis-à-vis the base year of the RVA that resulted in the right to payment, the amount

of the installment in arrears will be fully paid.

8.5

In the years subsequent to the base year, in the event of a

reduction greater than 20% of the net income vis-à-vis the base year of the RVA that resulted in the right to payment, the amount

of the installment in arrears will be paid in equal proportion to such reduction.

8.6

The payment will keep proportionality to the period actually

worked by the participants over the year of ascertainment of the RESULTS.

| 8.7 | From the amount of RVA calculated, for

the CEO and each Officer: |

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page7/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

| 8.6.1 | For Eletrobras companies, including the Holding, 60% will

be paid in cash, based on the fee in force on the payment date, in the first accounting year following the achievement of the goals (Year

+1); and |

| 8.6.2 | The remaining 40% of the installments in arrears will be

paid based on the fee in force on the payment date, as defined in item 8.1. |

8.8

For the Holding, payments of installments deferred between Year

+2 and Year +5 will be made through a stock-based instrument, in compliance with items 8.1, 8.2 and 8.3, calculated as follows:

| A) | The company’s average unit share price is calculated

considering the last 60 trading sessions of the accounting year prior to the RVA Program, considering the average prices of ON and PN

shares, weighted by the weight of capital; |

| B) | The amount of RVA that each manager will be entitled to

is divided by the average share price to obtain the number of reference shares; |

| C) | The amount to be paid for each of the installments deferred

between Year +2 and Year +5 will be calculated by the number of corresponding reference shares, multiplied by the average price of the

company’s unit share considering the last 60 trading sessions of the accounting year relative to the year of the installment in

arrears, according to the proportion defined in item 8.1. |

| D) | In all cases above, outliers will be removed from the sample

of 60 trading sessions, considering 90% confidence for the normal distribution. |

| 9 | ADDITIONAL / DISCOUNT - CAPITALIZATION

DEMAND INDEX |

9.1

It is possible to trigger an additional or discount of, respectively, up to 30% upward or downward when reaching the goal, according

to the table below:

| Additional |

Up to 30% to be applied to the sum of the product between the Fpi of each indicator and its respective weight |

| Deflator |

Up to 30% to be applied to the sum of the product between the Fpi of each indicator and its respective weight |

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page8/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

9.2

The percentage of an additional or discount will be calculated

through the achievement of each company in the indicator “Capitalization Demand Index,” which consists of up to 5 sub-indicators

relative to the capitalization project.

9.3

The Capitalization Project team will define the number of demands

and the period of fulfillment of each sub-indicator.

9.4

The certificate on whether or not the demands have been fulfilled

will be prepared by the team that coordinates the Capitalization Project.

9.5

To obtain the “% of accomplishment in IDC”, the

average range for the 5 sub-indicators (accordingly) will be ascertained, and then matched in the ruler below:

| % Of Accomplishment in IDC |

% of Additional / Deflator |

Additional / Deflator |

| |

X = |

100% |

100% |

Additional of up to 30% to be applied to the sum of the product between the Fpi of each indicator and its respective weight |

| 99.0% |

< x < |

99.9% |

99% |

| 98.0% |

< x < |

98.9% |

98% |

| 97.0% |

< x < |

97.9% |

97% |

| 96.0% |

< x < |

96.9% |

96% |

| 95.0% |

< x < |

95.9% |

95% |

| 90.0% |

< x < |

94.9% |

75% |

| 80.0% |

< x < |

89.9% |

50% |

| 60.0% |

< x < |

79.9% |

-25% |

Deflator of up to 30% to be applied to the sum of the product between the Fpi of each indicator and its respective weight |

| 40.0% |

< x < |

59.9% |

-50% |

| 20.0% |

< x < |

39.9% |

-75% |

| |

< |

19.9% |

-100% |

9.6

If the “% of accomplishment of IDC” is less than

80%, the “% of deflator” and 30% will be multiplied, in order to ascertain the discount of up to 30% to be applied to the

sum of the product between the Fpi of each indicator and its respective weight.

9.7

If the “% of accomplishment of IDC” is greater than

80%, the "% of additional” and 30% will be multiplied, in order to ascertain the increase of up to 30% to be applied in the

sum of the product between the Fpi of each indicator and its respective weight.

9.8

In the case of triggering an additional, the difference obtained

between the amount measured in 2021 RVA with the application of the additional and the amount measured in 2021 RVA without the application

of the additional will be paid in the cash installment of 2021 RVA.

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page9/10 |

| 2021 Variable Compensation Program (RVA) | |

| | | |

9.9

The amount resulting from the application of the additional

is subject to the limitation of nine (9) fees, even if at least 95% of payment factor (Fpi) has not been reached in all goals.

9.10

Despite the possibility of the additional, 2021 RVA remains

limited to twelve (12) fees.

10.1

RVA will be followed up by the parties at periodic meetings

to be held at intervals not exceeding three (03) months and will be treated confidentially, being restricted to the Executive Board and

the Board of Directors of each company and of the Holding.

10.2

After payment of RVA, a report containing the result and analysis

of accomplishment of the goals pertaining to the year of these rules, as well as the payment made to each member of the Executive Board,

will be forwarded to the Secretariat of Coordination and Governance of State-Owned Companies – SEST.

11.1

Termination upon initiative of the Officer or the Company: the

participant is entitled to receive for the current year and other installments, in accordance with the maintenance of the results provided

for in item 8.

11.2

The exception to item 10.1 occurs in cases of resignation for

inappropriate conduct, in which the dismissed Officer will not be entitled to any installment of the Program.

11.3

For the purpose of calculating the RVA due to the Officer who

has left or entered the base year in order to ascertain the RESULTS, the same results of the indicators calculated for the Board object

of the movement will be used.

All provisions of this RVA rules will remain in force as long as there are installments

in arrears to be managed.

| | | |

| | Confidential Copy Sest Final Statement – Feb./2022 | Page10/10 |

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: March 18, 2022

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

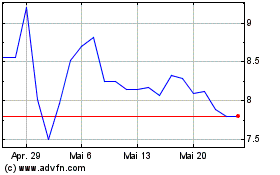

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

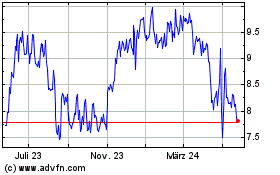

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024