SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2021

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

Policy of Transactions with Related Parties of Eletrobras Companies

Areas in charge of the issuance

Governance, Risk & Compliance Board / Corporate Governance

Area.

Target audience

Employees, managers, officers and directors of Eletrobras companies.

Approval

Resolution RES-771/2021, from 12/06/2021, of Eletrobras’

Executive Board.

Resolution DEL-235/2021, from 12/17/2021, of Eletrobras’

Board of Directors.

Repository

All policies of Eletrobras companies may be found online at:

https://eletrobras.com/pt/Paginas/Estatuto-Politicas-e-Manuais.aspx

Copyright and confidentiality

The contents of this document may not be reproduced without the

proper consent. All rights reserved to Eletrobras and to all other Eletrobras companies.

Maximum review period: 1 year

History of Editions

|

Editions

|

Approval

|

Major changes

|

|

1.0

|

RES-836/2014, from 12/22/2014.

|

Not applicable.

|

|

2.0

|

RES-029/2018, from 01/15/2018 and

DEL-005/2018, from 01/29/2018.

|

General revision of the policy.

|

|

3.0

|

RES-766/2020, from 12/21/2020 and

DEL-223/2020, from 12/23/2020.

|

Update of items 4 (Guidelines), 5 (Responsibilities) and 6 (Concepts).

|

|

4.0

|

RES-771/2021, from 12/06/2021 and

DEL-235/2021, from 12/17/2021.

|

Review for compliance with the applicable legislation, with Audit Report No. 03/2021, adaptation to the flowchart and internal controls and adoption of the Related Party Transaction Identification Form (TPR).

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

Summary

|

Introduction

|

4

|

|

1

|

Purpose

|

4

|

|

2

|

References

|

4

|

|

3

|

Principles

|

5

|

|

4

|

Guidelines

|

5

|

|

4.1

|

General Guidelines

|

5

|

|

4.2

|

Identification of Related Parties

|

6

|

|

4.3

|

Proposition

|

7

|

|

4.4

|

Structuring and approval

|

7

|

|

4.5

|

Prior Review of Transactions with Related Parties

|

9

|

|

4.6

|

Transactions With No Need of Prior Review

|

9

|

|

4.7

|

Prohibited transactions

|

10

|

|

4.8

|

Disclosure

|

10

|

|

4.8.1

|

Accounting disclosure

|

10

|

|

4.8.2

|

Disclosure of transactions with related parties to the capital market

|

11

|

|

5

|

Responsibilities

|

13

|

|

6

|

Concepts

|

15

|

|

7

|

General Provisions

|

18

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

Introduction

The policy on transactions with related parties must be in accordance

with the requirements of competitiveness, compliance, transparency, fairness and commutativity, as provided for in the applicable legislation.

1 Purpose

To establish guidelines and responsibilities to be complied with

when there are Transactions with Related Parties (TRP), in order to safeguard the interests of Eletrobras, their shareholders and their

companies, and to govern the transfer of information necessary to comply with the legislation of applicable capital markets, in Brazil

and abroad, and to contribute to increase the transparency and trust of investors and other stakeholders on the practices adopted by Eletrobras.

2 References

2.1 Act No. 6,404 from

December 15th, 1976 – Brazilian Corporations Act – provides for joint-stock companies.

2.2 Act No. 12,813 from

May 16th, 2013 – provides for the conflict of interests while holding a position or employment with the Federal Executive

branch and impediments after holding such a position or employment; and revokes the provisions contained in Act No. 9,986 from July 18th,

2000, and in Provisional Presidential Decrees No. 2,216-37 from August 31th, 2001, and 2,225-45 from September 4th,

2001.

2.3 Act No. 13,303 from

June 30th, 2016 – State-Owned Companies Act – provides for the legal status of public companies, semi-public companies

and their subsidiaries, within the scope of the Federal Government, the States, the Federal District and the Municipalities.

2.4 Decree No. 8,945

from December 27th, 2016 – regulates, within the scope of the Federal Government, Act No. 13,303 from June 30th,

2016, which provides for the legal status of public companies, semi-public companies and their subsidiaries, within the scope of the Federal

Government, the States, the Federal District and the Municipalities.

2.5 Enactments issued

by the Brazilian Securities and Exchange Commission (CVM) – CVM Resolution No. 44, 480/09, 481/09, 488/10, 509/11, 520/12, 525/12,

547/14 and 552/14, CVM Resolution No. 642/10 and CVM Guidance Opinion No. 35/08 (CVM Opinion No. 35).

2.6 Commission of Accounting

Pronouncements (CPC) 05 (R1) – Disclosure concerning Related Parties.

2.7 Brazilian Institute

of Corporate Governance (IBGC) – Guidance Letter on Transactions between Related Parties.

2.8 Primer with Recommendations

from the Brazilian Securities and Exchange Commission (CVM) on Corporate Governance, from June 2002.

2.9 Policy on Transactions

with Related Parties – SEST/MP proposed model.

2.10 Eletrobras’

Articles of Incorporation.

2.11 Policy of Addressing

Conflicts of Interests at Eletrobras Companies.

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

2.12 Consequence Policy

of Eletrobras Companies.

2.13 Regulations of

Authorities of Eletrobras Companies.

2.14 Code of Ethical

Conduct & Integrity.

2.15 Manual of the Board

Member Representing Eletrobras Companies.

3 Principles

3.1 Identification of

actions and procedures to be followed for the satisfactory processing of conflicting interests.

3.2 Assurance of the

effectiveness and independence of the negotiation and decision-making process.

3.3 Assurance of the

strictly commutative nature of the agreed conditions or of the adequate compensatory payment.

3.4 Information to the

market on the terms, conditions and parties involved in transaction with related parties, ensuring the disclosure in an appropriate and

timely manner, in accordance with applicable legislation.

3.5 Adoption of the

best corporate governance practices in transactions with related parties.

3.6 Compliance with

the Code of Ethical Conduct and Integrity and with applicable legislation.

3.7 Watching over the

interest of the company in which they operate, preserving equity among all shareholders, ensuring the advantage that offsets the costs

and risks of monitoring and image of the transaction with a related party.

3.8 Compliance with

the fiduciary duties, namely those of loyalty and of due care.

4 Guidelines

4.1 General Guidelines

4.1.1 Eletrobras companies

are capable of performing transactions with related parties to take advantage of synergies and to achieve operational efficiency, thus

improving their jointly considered result.

4.1.2 The negotiation

and decision-making processes of transactions with related parties entered into by Eletrobras companies must be independent, fitted with

commutability and negotiated under market conditions, or bring about an adequate compensation, thus avoiding undue favoring of the related

party to the detriment of the company’s interest.

4.1.3 To be valid and

legitimate, a transaction with a related party must be reasonable, justified and balanced, i.e., contracted on fair bases and market conditions,

so that no business benefits exclusively only one of the parties.

4.1.4 The prior analysis

of the transactions with related parties by the proposing areas must be performed considering the following dimensions:

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

|

a)

|

the negotiation that preceded the transaction with related

parties;

|

|

|

b)

|

the analysis concerning the advantage of the transaction

compared to the costs of monitoring and image risks, when compared to the alternative transaction with an unrelated party, if any; and

|

4.1.5 The areas proposing

the matters, within the scope of Eletrobras companies, should examine the transaction with related parties proposed in relation to the

alternatives available in the market in an informed, reflected and disinterested manner, and choose the one that best meets the company’s

interest.

4.1.6 The areas proposing

the matters, within the scope of Eletrobras companies, must exercise, on a case-by-case basis, the preventive control over the admissibility

of transactions with related parties, upon initial verification of its reasonableness and the adequacy of the decision-making mechanism

adopted, without neglecting the duty of care assigned to managers and committee members, when involved, considering their obligation to

monitor, investigate and examine, using their best efforts to preserve and create value for the organization.

4.1.7 Whoever has a

conflicting interest with the companies involved should not be a part of the process of negotiation, structuring or deliberation of transactions

with related parties, in compliance with the provisions contained in Eletrobras Companies’ Conflict of Interest Management Policy.

4.1.8 The transactions

with related parties must not arise from the influence of the related party in the formation of the will of the business agency. They

must result from the effective negotiation between independent parties and from the well-founded, reflected deliberation of the governance

bodies, in the company's best interest.

4.1.9 If a professional

has an interest of their own or that conflicts with that of the company in the transaction with related parties, they must, justifiably,

refrain from participating in the negotiation and from the decision-making process related to the operation.

4.1.9.1 This obligation

applies to shareholders, board members and members of the Board of Directors’ advisory committees, officers, members of the audit

committee and professionals in charge of structuring the operation and to any party related to these entities.

4.1.9.2 Whenever it

is applicable, the conflicted party must have it entered upon the minutes, or an equivalent document, the nature and extent of their conflict.

4.1.10 When assessing

the negotiation, the way in which the transaction with related parties will be proposed, structured, deliberated, approved and disclosed

must be taken into account.

4.1.11 The proposing

areas must follow the CVM Instructions and Resolutions and internal regulations, in compliance with the applicable deadlines for disclosure

to the market, in the event of the execution of a transaction with related parties.

4.2 Identification of Related

Parties

|

|

4.2.1

|

The List of Eletrobras’ Related Parties shall consist of:

|

|

|

a)

|

Eletrobras companies (direct or indirect subsidiaries);

|

|

|

b)

|

subsidiaries, affiliates and entities connected to them;

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

|

c)

|

affiliates, joint ventures, joint operations, structured

entities;

|

|

|

d)

|

subsidiaries of affiliates;

|

|

|

e)

|

supplementary social security, assistance and health entities

of Eletrobras companies;

|

|

|

f)

|

entities connected to the controlling shareholder;

|

|

|

g)

|

members of the Board of Directors, Audit Committees, Statutory

Committees and Executive Boards of Eletrobras companies.

|

|

|

4.2.2

|

The area proposing the matter, within the scope of the Eletrobras companies, must:

|

|

|

a)

|

consult, prior to entering into a transaction, but not limited

to the List of Eletrobras’ Related Parties;

|

|

|

b)

|

assess the configuration of a transaction with a related

party, properly instructing the decision-making process with the justifications and documents for the characterization or lack thereof

of a transaction with a related party;

|

|

|

c)

|

follow what is provided about it in this policy.

|

4.2.3 The area proposing

the matter should identify, when instructing the matter, cases in which the Federal Government (Public Authority) has significant influence

on the decision-making process of a given company, as the transaction with such company will be considered a transaction with a related

party of the Eletrobras companies.

4.2.4 Those appointed

by the Eletrobras boards as people in charge for TPR in the holding, treated as “Focal Points”, will update the List of Eletrobras’

Related Parties whenever the need is identified, in addition to the semiannual frequency.

4.3 Proposition

4.3.1 In view of the

possibility of performing a transaction with related parties, it is the duty of all those involved to make efforts to identify conflict

situations and prevent the influence of the interested or conflicted party, as well as their vote, if applicable.

4.3.1.1 The area proposing

the matter shall reveal, as soon as possible, through the instruction of the matter which will be submitted for approval, the potential

conflict related to the transaction with related parties, by the conflicted party.

4.4 Structuring and approval

4.4.1 The proposing

areas involved in the structuring of the matter must complete the Form for the Identification of Transactions with Related Parties, which

must be signed by the analyst and the superintendent of the proposing area, and said form must be part of the documents of instruction

of the matter.

4.4.2 In addition to

the usual documents of instruction of the decision-making process, the proposing area is responsible for instructing the TPR matter with

documents that convey the following additional information, under the risk of not proceeding with the process:

|

|

a)

|

the main characteristics of the operation;

|

|

|

b)

|

identification of related parties;

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

|

c)

|

existing figures, terms and balances;

|

|

|

d)

|

rights and obligations involved, if applicable;

|

|

|

f)

|

nature of the compensation to be paid;

|

|

|

g)

|

guarantee information given or received;

|

|

|

h)

|

allowance for doubtful debts and expenses from losses recognized

during the period;

|

|

|

i)

|

remuneration of key management personnel;

|

|

|

j)

|

interest of the parent company and the subsidiary in a defined

advantage plan with risks shared between entities of the company, if applicable;

|

|

|

k)

|

information regarding the performance of the commutativity

tests: “fairness test” or “arms-length bargain comparison”, their description and result, or, as applicable, description

of the adequate compensatory payment;

|

|

|

l)

|

indication as to the need or lack thereof for prior analysis

by the Statutory Audit and Risk Committee (CAE), in accordance with the rules of authorities contemplated in sub-items 4.4.9 and 4.5.1;

and

|

|

|

m)

|

information required by CVM Instructions and Resolutions

and applicable legislation, for disclosure to the market, if applicable.

|

4.4.3 When instructing

the matter, the proposing area should perform the commutativity test in one of the following ways:

|

|

a)

|

by comparing the business with other similar ones already

completed in the market (“Fairness Test”); or

|

|

|

b)

|

by comparing it with another hypothetic one, if it were

completed with an independent third party, i.e., by verifying if the operation would be performed in the same terms with a third party

that is not a related party ("Arms-length Bargain Comparison").

|

4.4.4 If any doubts

appear while performing the commutativity tests or in case of complex operations (such as corporate restructuring), the analysis must

be performed by an independent specialized institution not connected to the companies involved in the transaction with related parties.

4.4.4.1 The performance of corporate restructurings involving

parties related to the companies of the Eletrobras System must ensure equal treatment for all shareholders.

4.4.5. The proposing

area must inform, with visual clarity and objectivity, in the context of the submission form, of the resolution draft and of the report

to the Executive Board:

|

|

a)

|

whether or not the matter fits the TPR concept; and

|

|

|

b)

|

whether or not there is a need for it to be disclosed to

the market, pursuant to sub-item 4.8.2;

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

|

c)

|

whether or not there is a need to submit it to the Statutory

Audit and Risk Committee (“CAE”), pursuant to the provisions contained in sub-item 4.4.2, clause “l”.

|

4.4.6 Eletrobras’

corporate governance area, when consulted by the proposing area regarding doubts as to the identification of a transaction with related

parties or upon being informed about the execution of a TPR transaction, must issue a statement regarding the transaction and provide

the analysis for it to be included in the matter of instruction by the proposing area.

4.4.7 Any matter dealing

with transactions with related parties must contain, in addition to the information established in sub-items 4.4.1, 4.4.2, 4.4.5 and 4.4.6,

a presentation contemplating the analysis and characteristics of the TPR, which must be submitted to the instances of approval in accordance

with the competent authority.

4.4.8 The authority

of approval of a transaction with related parties depends on its materiality, in light of the provisions contained in Act No. 6,404/76,

in this policy and in the Regulations of Jurisdiction of the Eletrobras Companies.

4.4.8.1 The approval of transactions between related parties

in publicly-held companies corresponding to more than fifty percent (50%) of the value of their total assets, according to the last approved

balance sheet, must be approved by a shareholders meeting.

4.4.9 The Statutory

Audit and Risk Committee (CAE) will assess and monitor, along with management, with the internal audit department, with the internal controls

department and with the accounting department, the system of internal controls of disclosure of the transactions with related parties,

and will also previously and exclusively review the transactions appurtenant to the Board of Directors, in compliance with the Regulations

of Authorities of Eletrobras Companies, with CVM Instruction 552/2014 and its amendments, pursuant to this policy.

4.4.10 In order to fulfill

the role defined in this policy, the CAE will rely on the advice of the proposing departments, such as accounting, power trading, financial,

among others, of Eletrobras and their companies, each within their specialty.

4.5 Prior Review of Transactions

with Related Parties

4.5.1 The area proposing

the matter must request, to the Board advisor and to the Governance Department of Eletrobras’ Board of Directors, the timely inclusion

in the agenda, for prior analysis by the Statutory Audit and Risk Committee (CAE), of the proposals for transactions to be entered into

with related parties, whose approval authority is of the Boards of Directors of Eletrobras companies; in accordance with the Regulation

of Authorities of Eletrobras Companies.

4.6 Transactions With No Need

of Prior Review

4.6.1 Transactions

with related parties which are of an operational, recurring nature, integrating routine activities of the company and requiring a short-term

decision to close the operation, are exempt from prior review, such as:

|

|

a)

|

treasury and cash management operations (foreign exchange

operations in the cash market, forward with or without physical delivery or for future liquidation, operations of financial investment

of cash and contracting of securities and bank guarantees);

|

|

|

b)

|

fundraising operations, subject to Eletrobras’ fundraising

plan, in accordance with the current Business and Management Master Plan (PDNG);

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

|

c)

|

operations with the Federal Government and/or its entities

occurring through a public competition process (bidding proceedings).

|

4.6.2 Transactions subject

to specific regulation where there is no type of negotiation between the parties, with rules established for all companies, such as federal

tax payments, are exempt from prior review.

4.6.3 The proposing

area must justify, in the instruction material, justifiably, the reasons why the transaction with a related party is considered an exception

to the prior review.

4.7 Prohibited transactions

4.7.1 The following

transactions with related parties are prohibited:

|

|

a)

|

those performed under conditions other than those of the

market, or that, in any way, may harm the company’s interests or which do not ensure equal treatment to all the company’s

shareholders;

|

|

|

b)

|

those involving the participation of employees and administrators

whose businesses of a private or personal nature interfere or conflict with the company's interests or result from the use of confidential

information obtained due to the exercise of the position or function they hold within the company;

|

|

|

c)

|

granting of loans and securities of any kind to controlling

shareholders and administrators;

|

|

|

d)

|

those performed to the detriment of the company, favoring

an affiliate, subsidiary or parent company, and the transactions between such parties must be subject to strictly commutative conditions.

|

4.7.2 The proposing

area must justify, in the instruction material, justifiably, the reasons why the transaction with a related party is not considered a

prohibited transaction.

4.8 Disclosure

4.8.1 Accounting disclosure

4.8.1.1 The financial

statements of Eletrobras companies containing transactions with related parties must contain the disclosures which are necessary to emphasize

to their stakeholders the possibility that the entity’s balance sheet and income statement are affected by the existence of businesses

with related parties.

4.8.1.2 For transactions

with related parties of entities which are not related to the State, the terms under which they were made must be disclosed.

4.8.1.3 Atypical transactions with related parties entered into

after the closing of the accounting period covered by the accounting statements or a 12-month period after the closing of the company’s

accounting period should also be disclosed.

4.8.1.4 For transactions

with related parties of entities which are related to the State, the entity must briefly state, in a note, the operation in which there

is a relationship with the State, as well as other related information.

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

4.8.1.5 If the independent

business environment can be effectively demonstrated, it must be disclosed that the transactions with related parties were performed under

terms equivalent to those prevailing in the transactions with independent parties.

4.8.1.6 Items which

are similar in nature may be disclosed in the aggregate, except when separate disclosure is necessary for the understanding of the effects

of the transactions with related parties on the company's financial statements.

4.8.1.7 The transactions

with related parties must be disclosed in the notes to the company's financial statements, in accordance with the accounting pronouncements

issued by the Commission of Accounting Pronouncements (CPC) and with the International Financial Reporting Standards (IFRS), issued by

the International Accounting Standards Board (IASB).

4.8.1.8 The company will promote the disclosure of transactions

with related parties in the Reference Form, under the terms of the applicable CVM Instruction.

4.8.1.9 The transactions

with related parties will be disclosed in a timely, clear and accurate manner, when current legislation so determines.

4.8.1.10 In order to ensure proper disclosure, the accounting

departments of Eletrobras companies must keep a permanent reconciliation of the accounting balances of the transactions with related parties

previously submitted in previous accounting disclosures.

4.8.2 Disclosure of transactions

with related parties to the capital market

4.8.2.1 Pursuant to

sub-section XXXIII of article 30 of CVM Instruction No. 480 from December 07th, 2009, with the new wording given by CVM Instruction

No. 552 from October 09th, 2014, Eletrobras’ Finance & Investor Relations Board must report to the market, through

the Investor Relations Superintendence, by filing a report of transactions with related parties with the Brazilian Securities and Exchange

Commission, the transactions with related parties defined in sub-item 4.8.2.5, referring to all the information provided for in annex

30-XXXIII of CVM Instruction No. 552/2014 (Report on transactions between related parties).

4.8.2.2 In addition,

the reports of transactions with related parties filed with the CVM are sent to the US Securities and Exchange Commission (SEC) and to

stock exchanges in Brazil and abroad where Eletrobras has listed securities, in addition to the online disclosure on Eletrobras’

Investor Relations website.

4.8.2.3 Transactions

meeting the criteria established in the applicable CVM Instruction must be disclosed to the market within seven business days from their

execution.

4.8.2.4 Any transaction

with related parties which falls within one of the assumptions provided for in sub-item 4.8.2.5 can only be made public after the proper

disclosure to the market by Eletrobras' Finance & Investor Relations Board.

4.8.2.5 Transactions

with related parties which must be reported to the market:

|

|

a)

|

The transaction with related parties, all

of them together or related transactions, whose total amount exceeds the lowest of the following amounts:

|

|

|

-

|

$ 50,000,000.00 (fifty million Brazilian

Reais); or

|

|

|

-

|

1% (one percent) of the total assets of

the Eletrobras company involved, considering the amount of the asset determined based on the latest financial statements or, when applicable,

on the latest consolidated financial statements disclosed by the company.

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

|

b)

|

At management’s discretion, the transaction with related parties, all of them together or related

transactions, whose total amount is lower than the parameters provided for in clause “a”, considering:

|

-

the characteristics of the operation;

-

the nature of the relationship of the related party with the Eletrobras

company; and

-

the nature and extent of the related party’s interest in the

operation.

4.8.2.6 Deadline for the submission of information on transactions

with related parties which must be reported to the market:

|

|

a)

|

if the TPR falls into one of the cases

provided for in sub-item 4.8.2.5, the area proposing the TPR must complete the Market Report Form, containing all the information in item

4.8.2.7, and submit it to Eletrobras’ investor relations area for evaluation, with a copy to Eletrobras’ corporate governance

area, within three business days prior to the date of the Executive Board meeting.

|

|

|

b)

|

The General Secretariat or Governance Secretariat

of each Eletrobras company must report, in writing or electronically to Eletrobras’ Chief Governance, Risks and Compliance Officer

and to Eletrobras’ Chief Finance and Investor Relations Officer, within three business days, regardless of the resolution levels,

the approval, in the company in which they operate, of any transaction with related parties which falls within one of the cases provided

for in sub-item 4.8.2.5.

|

|

|

c)

|

Without prejudice to the aforementioned

provisions, within three business days at the most from the execution, the management of the area in charge of the transaction must confirm

to Eletrobras’ Chief Financial and Investor Relations Officer, in writing or electronically, that the transaction was finalized

so that Eletrobras may disclose the operation to the market in a timely manner.

|

4.8.2.7 Without prejudice to other information which may eventually

be required by the applicable CVM Instruction, the proposing department must submit, to Eletrobras’ Chief Financial and Investor

Relations Officer, within the timeframe established in sub-item 4.8.2.6, the following information regarding transactions with related

parties which fall within the criteria contained in sub-item 4.8.2.5:

|

|

a)

|

description of the transaction, including:

|

-

the parties and their relationship with the issuer; and

-

the subject matter and the main terms and conditions.

|

|

b)

|

if, when, how and to what extent the counterparty

in the transaction, their partners or administrators participated in:

|

|

|

-

|

Eletrobras' decision-making process concerning

the transaction, describing such participation; and

|

|

|

-

|

the process of negotiation of the transaction

as Eletrobras' representatives, describing such participation.

|

|

|

c)

|

detailed justification of the reasons why

management considers that the transaction has met commutative conditions or provides for adequate compensatory payment, stating things

such as:

|

|

|

-

|

if they have requested bids,

performed any price-taking procedure, or attempted, in any other way, to perform the transaction with third parties, explaining, if not, the reasons why they did not

do so or, if so, the procedures performed and their results;

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

|

|

-

|

the reasons that led them to perform the

transaction with the related party and not with third parties;

|

|

|

-

|

detailed description of the actions performed

and procedures adopted to ensure the commutativity of the operation.

|

|

|

d)

|

if the transaction in question is a loan

granted by Eletrobras to the related party, the information provided for in this sub-item must necessarily include:

|

|

|

-

|

an explanation of the reasons why Eletrobras

chose to grant it, stating any securities required;

|

|

|

-

|

a brief analysis of the borrower's credit

risk, including independent risk rating, if any;

|

|

|

-

|

a description of how the interest rate

was determined, considering the market risk free rate and the borrower's credit risk;

|

|

|

-

|

a comparison of the loan interest rate

with other similar investments existing on the market, explaining the reasons for any discrepancies;

|

|

|

-

|

a comparison of the loan interest rate

with the rates of other loans received by the borrower, explaining the reasons for any discrepancies;

|

|

|

-

|

a description of the impact of the transaction

on the issuer's financial liquidity status and level of indebtedness.

|

4.8.2.8 The transactions

which are subject to specific regulation where there is no type of negotiation between the parties, with rules established for all companies,

such as federal tax payments, will not be disclosed under the terms of ICVM 552/2014 and applicable amendments.

5 Responsibilities

It is incumbent upon Eletrobras’ managers, members of the

audit committee, members of the committees that advise the Board of Directors and employees to comply with the guidelines and principles

established in this policy.

5.1 Board of Directors:

5.1.1 To resolve on

this policy and its revisions.

5.1.2 To resolve on

the transactions with related parties under their competence, in accordance with the applicable legislation and with the Regulations of

Authorities of Eletrobras Companies, and must also consider the importance, nature and materiality of the operation, as well as the CAE’s

non-binding opinion.

5.2 Statutory Audit

and Risk Committee:

5.2.1 To supervise the

fulfillment and performance of this policy.

5.2.2 To give an opinion

on the transactions with related parties submitted to it pursuant to sub-item 4.5.1 of this policy, stating its opinion in the certificate

addressing the prior advisory meeting.

5.2.3 To assess and

monitor, along with management, with the internal controls department, with the accounting department and the system of internal controls

of disclosure of the transactions with related parties.

5.3 Executive Board:

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

5.3.1 To approve this

policy and ensure its implementation.

5.3.2 To approve the

transactions with related parties under their competence and in accordance with the Regulations of Authorities of Eletrobras Companies.

5.4 Focal Points:

5.4.1 To create, update

and validate the List of Eletrobras’ Related Parties, whenever a need for change is identified, in addition to a semiannual periodic

revision.

5.4.2 To support the

identification of a transaction between related parties of the Eletrobras companies, whenever required by the corporate governance department,

or by the corresponding business area in the Eletrobras companies.

5.5 General Secretariat or Governance Secretariat:

When the transaction with related parties is identified and instructed

by the area proposing the matter, within the criteria established in this Policy, the general secretariat or governance secretariat must:

5.5.1 Check the necessary

documentation in the matters submitted to the respective governance collegiate bodies.

5.5.2 Report the approvals

of the transactions with related parties to Eletrobras’ Chief Financial and Investor Relations Officer and to Eletrobras’

Chief Governance, Risk and Compliance Officer, as per sub-item 4.8.2.6, clause “b”.

5.6 Eletrobras’ Investor Relations Superintendence:

5.6.1 Assess the information

on the CVM market report form, received from the area proposing the TPR and disclose it in accordance with current legislation in the

markets where the company has their securities listed, in compliance with the specifics defined in sub-item 4.8.2.

5.7 Area proposing the matter:

5.7.1 Request the Eletrobras

corporate governance department to change the List of Eletrobras’ Related Parties of the operations under their management, upon

validation by the Focal Point of such board.

5.7.2 Instruct in the

matter, if the TPR falls into one of the cases provided for in sub-item 4.8.2, completing the CVM market report form and submit it for

evaluation of Eletrobras’ investor relations area, with a copy to Eletrobras’ corporate governance area, in compliance with

the necessary timeliness for compliance with the disclosure period provided for in sub-item 4.8.2.3.

5.7.3 Assess whether

the operation is a TPR, by completing the TPR Identification Form and, if in doubt in said identification, refer to Eletrobras’

corporate governance department.

5.7.4 Report, to Eletrobras’

corporate governance department, the identification of all TPRs, to control and monitor the operations.

5.7.5 Include, in the

presentation, that they shall monitor the instruction of the matter, in accordance with the approval authority, the review of the TPR

issued by the corporate governance department.

5.8 Eletrobras’ corporate governance department:

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

5.8.1 Centralize the

demands for changes in the List of Eletrobras’ Related Parties, received from the Focal Points, or validated by them, and also update

them in the company’s electronic registration system.

5.8.2 Submit the List

of Eletrobras’ Related Parties to the Focal Points every six months for validation or request for changes, if such a need is identified.

5.8.3 Issue a statement

on queries related to the transactions with related parties to be sent to the proposing areas, based on the information supporting the

transaction, including the TPR Identification Form, and may act alone or along with the Focal Points, depending on the complexity of the

transaction with related parties.

5.8.4 Guide the application

of this policy and promote its update.

5.9 Area of registration of Eletrobras companies:

5.9.1 Include, maintain

and update the records in the SAP of: customers, suppliers, human resources and partner company.

5.9.2 Meet the requests

of Eletrobras’ corporate governance department to change the records, arising from the identification of related parties.

5.10 Eletrobras’

accounting department:

5.10.1 Ensure the accounting

information is disclosed in accordance with the provisions contained in sub-item 4.8.1.

5.11 Eletrobras’

internal controls department:

5.11.1 Define the group

of internal controls necessary to comply with this policy.

5.11.2 Support the parameterization

of the system to automate the controls over transactions and guarantee their effectiveness.

5.12 Other managers

of Eletrobras:

5.12.1 Adopt the internal

controls which are appropriate to comply with and monitor the guidelines contained in this policy.

5.12.2 Comply with and

enforce this policy, also regarding the determination and the fulfillment of the decision-making process provided for therein.

5.12.3 Disclose and

give ample transparency to the transactions with related parties performed under the terms provided for in this policy.

6 Concepts

6.1 Company management – board of directors and

executive board of Eletrobras and of their companies.

6.2 Areas proposing the matter – for the purposes

of this policy, the organizational units and/or boards are responsible for instructing the matter to be submitted to the governance bodies

of the Eletrobras companies to be reviewed and considered, identifying transactions which may be classified under the concept of transactions

with related parties in accordance with the Commission of Accounting Pronouncements.

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

6.3 Registration

of Eletrobras’ Related Parties - a set of information of an Eletrobras’ related party, registered in the company’s

electronic system.

6.4 Commutativity – condition in which a relationship

is profitable for all contracting parties (“win-win” relationship), subject to all relevant factors, such as exchange relationship,

adequacy of the assessment methodology adopted to the involved assets, reasonableness of the projections and verification of alternatives

available in the market.

6.5 Market conditions - these are the commercial transactions

characterized by: (i) taking place within the standards generally adopted in the market for similar businesses, when such comparison is

possible; (ii) taking place with the purpose of serving the company’s best interests; and (iii) the transaction having been completed

with the care that would be expected from actual independent parties.

6.6 Conflict of interests

- situation produced when the personal or private interests of the policy recipients, as well as their family members, may potentially

or effectively interfere with the performance of their professional assignments or potentially or effectively come into conflict with

the legitimate interests of the Eletrobras companies.

|

|

a)

|

Actual conflict of interest: a factual situation in which

all elements of a conflict of interest exist.

|

|

|

b)

|

Potential conflict of interest: a factual situation in which

all the elements of a conflict of interest do not yet exist, but which may develop into an actual conflict.

|

|

|

c)

|

Apparent conflict of interest: a factual situation in which

an observer could reasonably conclude there has been a conflict of interest.

|

6.7 Duty of care – obligation of the administrator

to fulfill their duties with responsibility and zeal.

6.8 Duty of loyalty – obligation of a person

to negotiate seeking to serve the interest of the company they represent, in the best possible way.

6.9 Affiliates – companies in which Eletrobras

has a significant influence.

6.10 Subsidiaries

- companies in which the parent company, either directly or through other subsidiaries, holds partner rights that permanently assure them

preponderance in the corporate resolutions and the power to elect the majority of managers.

6.11 Materiality

of the transaction with related parties – amount considered relevant for the purposes of authority of approval or disclosure

of a transaction with related parties.

6.12 Close family

member – spouse, partner and children or dependents of a person, of their spouse or partner.

6.13 Operation under

strictly commutative terms – an action with balance or equivalence in the business considerations, i.e., when a party undertakes

to give or do something that is considered equivalent to what is given to them or to what is done for them.

6.14 Corporate agency

– company agency defined in their articles of incorporation, such as: shareholders’ meeting, audit committee, board of directors,

commissions and executive board.

6.15 Adequate compensatory

payment – actual assurance to the equity interest hindered by a business in which the transaction with a related party has no

commutative provisions.

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

6.16 Conflicted party

– an entity or individual with a particular interest in the transaction, which may eventually interfere, either potentially or effectively,

with the legitimate interests of one or more parties involved.

6.17 Unrelated party

- any individual or entity not related in the concept of related party, according to the accounting pronouncements issued by the Commission

of Accounting Pronouncements (CPC), shall be considered as an Unrelated party of Eletrobras companies.

6.18 Related party

– an individual or entity related to one of the Eletrobras companies, in accordance with the applicable Technical Pronouncement

of the Commission of Accounting Pronouncements (CPC), namely:

|

|

a)

|

an individual or a close member of their family who has

a fully or joint control over an Eletrobras company;

|

|

|

b)

|

has a significant influence over an Eletrobras company;

|

|

|

c)

|

holds a position that gives them the authority and responsibility

for planning, directing and controlling an Eletrobras company or the parent company of an Eletrobras company;

|

|

|

d)

|

individuals with ownership interest (either direct or indirect)

which is equal to or greater than twenty percent (20%), according to the applicable CPC, of the capital stock of an Eletrobras company;

|

|

|

e)

|

an entity that meets one of the following conditions:

|

|

|

-

|

the entity and the Eletrobras company are

members of the same economic group, i.e., the parent company and each subsidiary are inter-related, as well as the jointly-controlled

entities are related to each other;

|

|

|

-

|

the entity is an affiliate or part of a

joint venture with a different entity (or an affiliate or a jointly-controlled subsidiary of an entity member of an economic group of

which the other entity is a member);

|

|

|

-

|

both entities are part of a joint venture

with a third entity;

|

|

|

-

|

an entity is part of a joint venture with

a third entity and the other entity is an affiliate of that third entity;

|

|

|

-

|

the entity is a post-employment benefit

plan whose beneficiaries are the employees of both entities, the one reporting the information and the one related to the one reporting

the information. If the entity reporting the information is itself a post-employment benefit plan, the employees who contribute with it

will also be considered parties related to the entity reporting the information;

|

|

|

-

|

the entity is a subsidiary, either fully

or jointly-controlled, of an individual identified in clauses “a”, “b” and “c”;

|

|

|

-

|

an individual who has the full or joint

control of an Eletrobras company exerts significant influence over the entity, or holds a position that gives them the authority and responsibility

for planning, directing and controlling an Eletrobras company (or the parent company of the entity);

|

|

|

f)

|

members of the audit committee, of the board of directors

and statutory committees, and of the executive board, as well as their spouses, partners and relatives, by blood or affinity, to the second

degree;

|

|

|

g)

|

an individual, legal entity, government, company or entity

present in the List of Eletrobras’ Related Parties.

|

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

6.19 Key personnel

– an individual who has the authority and responsibility for planning, directing and controlling the activities of the entity,

either directly or indirectly, including any manager (executive or otherwise).

6.20 Public Authority

- group of agencies with authority to perform the works of the State, consisting of Legislative Branch, Executive Branch and Judiciary

Branch.

6.21 Focal Points

– for the purposes of this policy, these are professionals appointed by Eletrobras’ boards as those in charge of negotiating

the transactions between related parties in their respective boards.

6.22 Regulations

of Authorities of Eletrobras Companies – a document establishing guidelines and responsibilities for the limits of authorities

of approval by the authorizing levels of Eletrobras and Eletrobras companies, whether they are related to tangible or intangible values,

whether or not involving other organizations, without prejudice to other duties defined in the articles of incorporation of Eletrobras

companies not included in these regulations.

6.23 List of Eletrobras’

Related Parties - a report consisting of all the records of Eletrobras’ related parties, individuals and legal entities.

6.24 Transaction

with Related Parties (TPR) - transfer of funds, services or obligations between one or more companies of the Eletrobras system and

a related party, regardless of whether or not an amount is charged as consideration.

6.25 Related transactions

– group of similar transactions with a logical relationship to each other due to their purpose or parties, such as subsequent transactions

resulting from a first transaction previously completed, provided it has established its primary terms, including the amounts involved

and continuous transactions comprising periodic provisions, provided the amounts involved are previously known.

7 General

Provisions

7.1 The guidelines established

in this policy should be abided by all employees of Eletrobras companies, directors, officers, shareholders, in addition to any business

partners, suppliers, service providers and employees of commercial partners and special purpose entities.

7.2 Any relaxations

and/or modifications by the regulatory agency must be considered along with this Policy.

7.3 In view of the compliance

with the specific needs of each company, this policy can be broken down into other specific regulatory documents, always in line with

the principles and guidelines established hereunder.

7.4 The transactions

which are subject to specific regulation are transactions where there is no negotiation between the parties, value and rules are defined

for any companies, such as: payment of federal taxes, supply of vehicles at gas stations and services provided by the post office.

7.5 The Eletrobras companies

must adapt their regulatory documents and the controls which may eventually be necessary in line with the provisions contained in this

policy, within a maximum period of 90 days from the approval by Eletrobras’ Board of Directors.

7.6 The formal channel

for receiving complaints involving transactions with related parties is Eletrobras’ Complaints Channel, which can be visited online

at http://web-intranet/InformacoesCorporativas/SitePages/Canaldedenuncias.aspx or

by calling number 0800 721 9885, every day.

|

POLICY OF TRANSACTIONS WITH RELATED PARTIES OF ELETROBRAS COMPANIES

|

|

|

|

7.7 This policy must be revised

at least annually, and approved by the Board of Directors, with the exception of the internal rule that governs the revisions of the policies

of Eletrobras companies, in compliance with applicable legislation.

7.8 Supersedes edition 3.0 of policy

POL-19, approved by DEL-223/2020 from 12/23/2020, and adopts the new POL-TPR coding, according to the appendix of coding of regulatory

documents of the Corporate Standardization System standard – NO-DCGC-01, edition 1.0, approved by RES-553/2021 from 08/30/2021.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: December 17, 2021

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

|

|

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

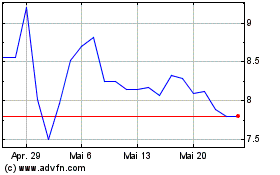

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2024 bis Aug 2024

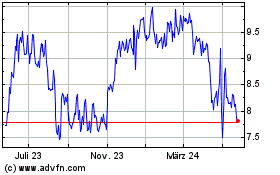

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Aug 2023 bis Aug 2024