Direct Selling Acquisition Corp. Announces Adjournment of Special Meeting of Stockholders

17 März 2023 - 4:24PM

Business Wire

Direct Selling Acquisition Corp. (the “Company”) (New York Stock

Exchange: DSAQ), announced today that it intends to adjourn,

without conducting any business, the Company’s special meeting of

stockholders (the “Special Meeting”) originally scheduled to be

held on March 22, 2023, and to reconvene the Special Meeting at

11:00 a.m., Eastern time, on March 24, 2023. In connection with the

adjournment of the Special Meeting, the Company is extending the

deadline for holders of its shares of Class A common stock to

exercise their right to redeem their shares for their pro rata

portion of the funds available in the Company’s trust account, or

to withdraw any previously delivered demand for redemption, to 5:00

p.m., Eastern time, on March 22, 2023 (two business days before the

adjourned Special Meeting).

The Special Meeting is being held to vote on the proposals

described in the Company’s definitive proxy statement, filed with

the Securities and Exchange Commission (the “SEC”) on March 2,

2023, relating to its proposed extension of the deadline to

complete its initial business combination (the “Extension”).

The Company also announced that DSAC Partners LLC, a Delaware

limited liability company (or one or more of its affiliates,

members or third-party designees) (the “Lender”), will make

additional contributions to the Company’s trust account following

the approval and implementation of the Extension. If the Extension

is approved at the Special Meeting, the Lender will deposit

$480,000 into the Company’s trust account in exchange for a

non-interest bearing, unsecured promissory note issued by the

Company to the Lender. Further, if the Extension is approved, and

in the event that the Company has not consummated such initial

business combination by June 28, 2023, the Company may extend the

deadline by which to consummate such initial business combination

by one additional month up to nine times, provided that the Lender

deposits $160,000 into the Company’s trust account for each such

monthly extension, for an aggregate deposit of up to $1,920,000 in

exchange for a non-interest bearing, unsecured promissory note

issued by the Company to the Lender. The Company will be able to

effect each such monthly extension by resolution of its board of

directors without a stockholder vote.

In addition, on March 17, 2023, the Company announced that it

has entered into a non-binding letter of intent for a potential

business combination with a private company in the urban mobility

sector. No assurances can be made that the Company will

successfully negotiate and enter into a definitive agreement for a

business combination or that the Company will be successful in

completing the business combination.

About Direct Selling Acquisition Corp.

Direct Selling Acquisition Corp., led by Chief Executive Officer

Dave Wentz, is a special purpose acquisition company incorporated

formed for the purpose of entering into a business combination with

one or more businesses. While the Company may pursue an initial

business combination with a company in any sector or geography, it

intends to focus its search on domestically based businesses within

the direct selling industry.

Forward-Looking Statements

This press release may include, and oral statements made from

time to time by representatives of the Company may include,

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Statements regarding

possible business combinations and the financing thereof, and

related matters, as well as all other statements other than

statements of historical fact included in this press release are

forward-looking statements. When used in this press release, words

such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would” and similar

expressions, as they relate to us or our management team, identify

forward-looking statements. Such forward-looking statements are

based on the beliefs of management, as well as assumptions made by,

and information currently available to, the Company’s management.

Actual results could differ materially from those contemplated by

the forward-looking statements as a result of certain factors

detailed in the Company’s filings with the Securities and Exchange

Commission (“SEC”). All subsequent written or oral forward-looking

statements attributable to us or persons acting on our behalf are

qualified in their entirety by this paragraph. Forward-looking

statements are subject to numerous conditions, many of which are

beyond the control of the Company, including those set forth in the

Risk Factors section of the Company’s registration statement and

prospectus for the Company’s initial public offering filed with the

SEC. The Company undertakes no obligation to update these

statements for revisions or changes after the date of this release,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230317005251/en/

Direct Selling Acquisition Corp. Investor Relations

Contact: Ryan Bright ir@dsacquisition.com

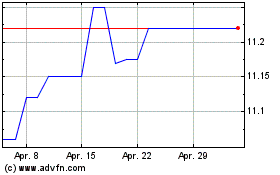

Direct Selling Acquisition (NYSE:DSAQ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Direct Selling Acquisition (NYSE:DSAQ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024