Chemours Swings to Loss

24 Februar 2016 - 1:40AM

Dow Jones News

Chemours Co., the performance chemicals company spun off from

DuPont Co., swung to a loss in the December quarter as it booked

$88 million in restructuring charges.

Last month, the company, whose brands include Teflon and

Ti-Pure, said it would lay off about 7% of its workers and

contractors and shut down its reactive metals business as part of a

broader cost-cutting plan.

On Tuesday, Chief Executive Mark Vergnano said the company

expects to complete the strategic review of the Chemical Solutions

business by June, and Chemours is on track to cut $500 million in

costs by the end of 2017.

The company has reached an agreement with DuPont under which

DuPont has paid Chemours about $190 million this month for future

purchases and amended its existing credit agreement. Chemours ended

the year with a net debt of about $3.6 billion.

Over all, Chemours reported a fourth-quarter loss of $86

million, or 48 cents a share, compared with a year-earlier profit

of $79 million, or 44 cents a share, on a pro forma basis.

Sales fell 12% to $1.36 billion.

Analysts surveyed by Thomson Reuters had projected a profit of 8

cents a share on $1.36 billion in revenue.

By segment, chemical solutions sales fell 10% to $256 million.

Titanium segment sales fell 14% to $589 million. And fluoroproducts

sales fell 10% to $515 million, largely due to a fall in

demand.

Shares, which began trading in July at $16, closed Tuesday at

$4.05 and were down another cent in late trading.

Write to Maria Armental at maria.armental@wsj.com and Anne

Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 23, 2016 19:25 ET (00:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

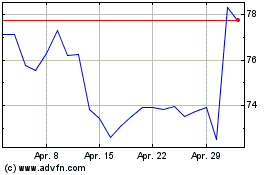

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024