DuPont Swings to a Loss as Sales Drop

26 Januar 2016 - 2:05PM

Dow Jones News

By Lisa Beilfuss

DuPont Co., which last month struck a deal to merge with Dow

Chemical Co., swung to a loss in its latest quarter as sales fell

across all segments and were particularly hard-hit abroad due to

the strong U.S. dollar.

The Wilmington, Del.-based company, which makes products ranging

from pesticides to dietary fibers to building materials, has said

it would reshape its business ahead of the proposed tie-up with Dow

through measures including job cuts and $700 million in cost

reductions this year.

On Tuesday, DuPont said it is on pace to reduce operating costs

by about $1 billion on a run-rate basis by the end of year. "Our

merger process is on track," said Chief Executive Edward Breen, who

will remain CEO of the merged company, adding that planning has

begun to create three independent businesses in agriculture,

material science and specialty products.

In addition to the strong dollar, which makes its products more

expensive outside of the U.S., DuPont pointed to difficult global

economic conditions in agriculture and slower growth in emerging

markets for the fourth quarter and said those challenges would

continue.

For the year, the company expects to earn $2.95 to $3.10 a

share, including a higher-than-anticipated 64 cents per share in

cost savings. Analysts surveyed by Thomson Reuters have predicted

$1.31 in adjusted per-share profit this year.

In the fourth quarter, sales in its agriculture

segment--DuPont's largest--fell 11% from a year earlier as currency

effects offset gains from an improved price and product mix.

Revenue from the company's other businesses declined amid a mix of

foreign exchange hits, lower volume and less favorable pricing.

Overall for the quarter, DuPont reported a loss of $253 million,

or 29 cents a share, down from a profit of $683 million, or 74

cents a share, a year earlier. Excluding certain items, per-share

earnings fell to 27 cents from 57 cents.

Sales slid 9.4% to $5.3 billion. Stripping out the impact of

adverse exchange rates, sales fell 1%, the company said. Analysts

projected 26 cents in adjusted earnings per share on $5.53 billion

in revenue, according to Thomson Reuters.

Shares in the company, down 12% over the past three months

through Monday's close, were inactive premarket.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

January 26, 2016 07:50 ET (12:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

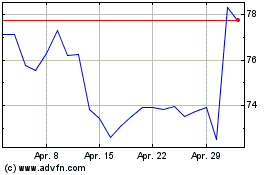

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024