DuPont Confronts Stiff Challenges Amid Merger Plan--Earnings Preview

22 Januar 2016 - 8:08PM

Dow Jones News

By Jacob Bunge

DuPont Co. is scheduled to announce its fourth-quarter results

before the market opens on Tuesday. Here's what to look for:

EARNINGS FORECAST: Analysts expect operating income of 25 cents

a share for the third quarter, according to Thomson Reuters,

compared with 71 cents a year earlier.

REVENUE FORECAST: Revenue of $5.5 billion is forecast for the

quarter, versus $7.4 billion a year earlier.

WHAT TO WATCH:

DOWDUPONT'S FUTURE: Investors have had the holiday season to

digest DuPont's plan to merge with rival Dow Chemical Co. and then

split into three separate companies, but questions still

remain--including whether Dow and DuPont may yet tweak the

structure of the deal. Bernstein analysts say that shareholders of

both companies like the deal's concept, but not the way it is set

up, with "suboptimal" synergies and the likely delay of some

hoped-for changes, like improving operations in some of Dow and

DuPont's businesses. "We find it unlikely that [DuPont CEO Ed]

Breen will have the time to focus on super-charging growth during

the merger-split," according to Bernstein.

COMMODITY PRESSURE: Crop prices have climbed since the start of

the year, led by corn, where futures have gained 2.9%. But few

expect commodity prices to stage a major turnaround, as private

forecasters peg slightly higher U.S. acreage planted this spring.

J.P. Morgan analysts don't expect any material improvement in

farmers' cash receipts until at least 2018, adding that "even a

weather event equivalent to the drought in 2012 wouldn't be enough

to counter today's oversupply of major crops given the level of

global production in the last 3 years." Little relief, then, for

seed and pesticide suppliers like DuPont, which had to lower its

profit guidance in 2014 and 2015 partly because of the slumping

farm economy.

PLAN OF ATTACK: DuPont's already announced drastic steps to

navigate the deepening challenges of slowing economic growth in big

overseas markets like China and the rising value of the U.S.

dollar, including the planned layoffs of about 5,000 employees

world-wide and streamlining some corporate functions. But investors

remain skeptical of DuPont's prospects, with shares down more than

18% since the start of the year, more than double the declines of

major U.S. stock indexes. Beyond defensive measures, shareholders

will be looking for Mr. Breen and his deputies to outline plans for

new products, like a just-announced project with Archer Daniels

Midland to develop new corn-based packaging materials, and battle

for more market share in established businesses, like pesticides

and plastics.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

January 22, 2016 13:53 ET (18:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

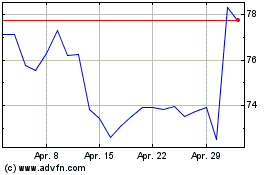

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024