false

0001828248

0001828248

2024-07-25

2024-07-25

0001828248

CVII:UnitsMember

2024-07-25

2024-07-25

0001828248

us-gaap:CommonClassAMember

2024-07-25

2024-07-25

0001828248

CVII:WarrantsMember

2024-07-25

2024-07-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 25, 2024

CHURCHILL

CAPITAL CORP VII

(Exact name of registrant as specified in its charter)

| Delaware |

001-40051 |

85-3420354 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

640 Fifth Avenue 12th Floor

New York, New York 10019

(Address of principal executive offices, including zip code)

(212) 380-7500

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading

Symbol (s) |

|

Name of each

exchange on

which registered |

| |

|

|

|

|

| Units,

each consisting of one share of Class A common stock, $0.0001 par value, and one-fifth of one warrant |

|

CVIIU |

|

Nasdaq Global Market |

| |

|

|

|

|

| Shares

of Class A common stock |

|

CVII |

|

Nasdaq Global Market |

| |

|

|

|

|

| Warrants |

|

CVIIW |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On July 25, 2024, Churchill

Capital Corp VII (“Churchill VII”) convened and then adjourned the special meeting of Churchill VII stockholders (the “Stockholder

Special Meeting”) and the meeting of Churchill VII warrant holders (the “Warrant Holder Meeting”), each to be held in

connection with the proposed business combination between CorpAcq Holdings Limited (“CorpAcq”), and Churchill VII (the “Business

Combination”), in each case as described in greater detail in Churchill VII’s definitive proxy statement filed with the U.S.

Securities and Exchange Commission (“SEC”) on June 20, 2024 (the “Proxy Statement”). The Stockholder Special Meeting

will reconvene on August 12, 2024 at 10:00 A.M., Eastern Time, and the Warrant Holder Meeting will reconvene on August 12, 2024 at 10:30

A.M., Eastern Time.

At the reconvened Stockholder

Special Meeting, Churchill VII’s stockholders of record as of the close of business on June 18, 2024 will be asked to vote on the

proposals set forth in the Proxy Statement for the Stockholder Special Meeting, including a proposal to approve the Business Combination.

At the reconvened Warrant Holder Meeting, Churchill VII’s public warrant holders of record as of the close of business on June 18,

2024 will be asked to vote on the proposals set forth in the Proxy Statement for the Warrant Holder Meeting, including a proposal to amend

the existing agreement governing the terms of Churchill VII’s warrants.

Each of the Stockholder Special Meeting and the Warrant Holder Meeting

will still be conducted virtually via webcast and can be registered for by following the instructions provided in the Proxy Statement.

As a result of the adjournments, the deadline for Churchill VII stockholders to elect redemption of their shares in connection with the

Business Combination has been extended until August 8, 2024.

Additional Information and Where to Find It

This Current Report does not contain all the information that should

be considered concerning the Business Combination, and the other transactions contemplated thereby (the “Transactions”) and

is not intended to form the basis of any investment decision or any other decision in respect of the Transactions.

The post-effective amendment to the Registration Statement on Form

F-4 filed by CorpAcq Group Plc in respect of the Business Combination (the “Post-Effective Amendment”) was made effective

by the SEC on June 20, 2024 and includes the Proxy Statement to be made available to Churchill VII’s stockholders and public warrant

holders in connection with Churchill VII’s solicitation for proxies for the vote by Churchill VII’s stockholders and public

warrant holders in connection with the Transactions and other matters described in the Post-Effective Amendment, as well as the prospectus

relating to the offer and sale of securities to be issued by CorpAcq Group Plc to Churchill VII’s stockholders and public warrant

holders in connection with the completion of the Transactions.

On June 20, 2024, Churchill VII filed the Proxy Statement with the

SEC in connection with its solicitation of proxies for the Special Stockholder Meeting and Warrant Holder Meeting which further describes

the Business Combination. Churchill VII’s stockholders and public warrant holders and other interested persons are advised to read

the Post-Effective Amendment and the Proxy Statement as well as other documents filed with the SEC by Churchill VII or CorpAcq Group Plc

in connection with the Transactions and any amendments thereto, as these documents will contain important information about CorpAcq, CorpAcq

Group Plc, Churchill VII and the Transactions. Stockholders and public warrant holders may also obtain a copy of the Post-Effective Amendment

and the Proxy Statement, as well as other documents filed by Churchill VII or CorpAcq Group Plc with the SEC, without charge, at the SEC’s

website located at www.sec.gov or by directing a written request to Churchill Capital Corp VII at 640 Fifth Avenue, 12th Floor, New York,

NY 10019.

Forward-Looking Statements

This Current Report includes "forward-looking statements"

within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as "estimate," "plan, " "project," "forecast,"

"intend," "will," "expect," "anticipate," "believe," "seek," "target,"

"continue," "could," "may," "might," "possible," "potential," "predict"

or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Churchill

VII and CorpAcq have based the forward-looking statements on its current expectations about future performance, timing and events. The

forward-looking statements in this Current Report include, but are not limited to, statements regarding estimates and forecasts of financial

and operational metrics and the anticipated timing for the Business Combination to close. The forward-looking statements are based on

various assumptions, whether or not identified in this Current Report, and on the current expectations of CorpAcq’s and Churchill

VII’s respective management teams and are not predictions of actual timing and/or performance. Nothing in this Current Report should

be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved. The forward-looking

statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult

or impossible to predict and may materially differ from assumptions. Many actual events and circumstances are beyond the control of Churchill

VII and CorpAcq. The forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about Churchill

VII and CorpAcq that may cause the timing and/or performance indicated in this Current Report to be materially different from any actual

future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Such risks and

uncertainties include changes in domestic and foreign business changes in the competitive environment in which CorpAcq operates; CorpAcq’s

ability to manage its growth prospects, meet its operational and financial targets, and execute its strategy; the impact of any economic

disruptions, decreased market demand and other macroeconomic factors, including the effect of a global pandemic, to CorpAcq’s business,

projected results of operations, financial performance or other financial metrics; CorpAcq’s reliance on its senior management team

and key employees; risks related to liquidity, capital resources and capital expenditures; failure to comply with applicable laws and

regulations or changes in the regulatory environment in which CorpAcq operates; the outcome of any potential litigation, government and

regulatory proceedings, investigations, actions (including any potential U.S. or U.K. government shutdowns) and inquiries that Churchill

VII or CorpAcq may face; assumptions or analyses used for CorpAcq’s forecasts proving to be incorrect and causing its actual operating

and financial results to be significantly below its forecasts; CorpAcq failing to maintain its current level of acquisitions or an acquisition

not occurring as planned and negatively affecting operating results; the inability of the parties to successfully or timely consummate

the Transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated

conditions that could adversely affect CorpAcq Group Plc, which will be the combined company after the Transactions, or the expected benefits

of the Transactions or that the approval of the stockholders of Churchill VII is not obtained; the risk that stockholders of Churchill

VII could elect to have their shares redeemed by Churchill VII, leading to either Churchill VII failing to satisfy continued listing requirements

for Nasdaq Global Market or Churchill VII having insufficient cash to complete the Transactions; the outcome of any legal proceedings

that may be instituted against CorpAcq or Churchill VII; changes in applicable laws or regulations; the ability of Churchill VII or CorpAcq

Group Plc to issue equity or equity linked securities in connection with the Transactions or in the future; the impact of certain geopolitical

events, including wars in Ukraine and the surrounding region and the Middle East; the impact of a current or future pandemic on CorpAcq,

CCVII, or CorpAcq Group's projected results of operations, financial performance or other financial metrics, or on any of the foregoing

risks; those factors discussed in under the heading "Risk Factors" in the Post-Effective Amendment, as may be further amended

from time to time, and other documents filed, or to be filed, with the SEC by Churchill VII or CorpAcq Group Plc. If any of these risks

materialize or CorpAcq’s, CorpAcq Group Plc’s or Churchill VII’s assumptions prove incorrect, actual timing and/or performance

could differ materially from the timing and/or performance implied by the forward-looking statements. There may be additional risks that

CorpAcq, CorpAcq Group Plc nor Churchill VII presently know or that CorpAcq, CorpAcq Group Plc and Churchill VII currently believe are

immaterial that could also cause actual timing and/or performance to differ materially from those contained in the forward-looking statements.

In addition, the forward-looking statements reflect CorpAcq’s, CorpAcq Group Plc’s and Churchill VII’s expectations

and views as of the date of this Current Report. CorpAcq, CorpAcq Group Plc’s and Churchill VII anticipate that subsequent events

and developments will cause CorpAcq’s, CorpAcq Group Plc’s and Churchill VII’s assessments to change. However, while

CorpAcq, CorpAcq Group Plc and Churchill VII may elect to update these forward-looking statements at some point in the future, CorpAcq,

CorpAcq Group Plc and Churchill VII specifically disclaim any obligation to do so. The forward-looking statements should not be relied

upon as representing CorpAcq, CorpAcq Group Plc and Churchill VII’s assessments as of any date subsequent to the date of this Current

Report. Accordingly, undue reliance should not be placed upon the forward-looking statements. An investment in CorpAcq, CorpAcq Group

Plc or Churchill VII is not an investment in any of CorpAcq’s, CorpAcq Group Plc’s or Churchill VII’s founders’

or sponsors’ past investments or companies or any funds affiliated with any of the foregoing.

No Offer or Solicitation

This Current Report does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This Current Report is not, and under no circumstances is to be construed as, a proxy statement or solicitation of a proxy,

a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933,

as amended, or exemptions therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY

AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED

HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

CorpAcq, CorpAcq Group Plc, Churchill VII, Churchill Sponsor VII LLC

and their respective directors and executive officers may be deemed participants in the solicitation of proxies from Churchill VII’s

stockholders and public warrant holders with respect to the Transactions. A list of the names of Churchill VII’s directors and executive

officers and a description of their interests in Churchill VII is set forth in certain filings with the SEC, including (but not limited

to) the following: (1) Post-Effective

Amendment (and specifically, the following sections: "Risk Factors-Risks Related to Churchill and the Business Combination";

"Information Related to Churchill-Management, Directors and Executive Officers"; "The Business Combination-Interests

of Certain Persons in the Business Combination; Interests of the Churchill Initial Stockholders and Churchill’s Directors and Officers";

"Beneficial Ownership of Churchill Securities" and "Certain Relationships and Related Person Transactions-Churchill

Relationships and Related Person Transactions"), (2) the Form

10-K filed by Churchill VII with the SEC on March 17, 2023 (and specifically, the following sections: "Item 1A. Risk

Factors"; "Item 10. Directors, Executive Officers and Corporate Governance"; "Item 11. Executive Compensation";

"Item 12. Beneficial ownership"; "Item 13. Related party transactions" and "Item 15. Exhibits,

Financial Statement Schedules-Note 5. Related Party Transactions"), (3) the Form 10-Qs filed by Churchill VII with the SEC on May

10, 2023, August 9, 2023 and November

9, 2023 (and specifically, the discussion “under "Item 1. Financial Statements-Note 5. Related Party Transactions"

section in each such Form 10-Qs, respectively), (4) the Form

8-K filed by Churchill VII with the SEC on August 7, 2023 (and specifically, the disclosure under "Item 1.01 Entry Into

a Material Definitive Agreement-Amended and Restated Sponsor Agreement"), (5) the Form

8-K filed by Churchill VII with the SEC on December 26, 2023 (and specifically, the disclosure under "Item 1.01 Entry

Into a Material Definitive Agreement-Consent and Merger Agreement Amendment"), (6) the SCHEDULE

14A filed by Churchill VII with the SEC on June 20, 2024 (and specifically, the following sections: "The Business Combination-Interests

of Certain Persons in the Business Combination" and "Beneficial Ownership of Churchill Securities"), and (7) other

documents that may be filed with the SEC from time to time in connection with the Transactions, each of which will be available free of

charge at the SEC’s website located at www.sec.gov, or by directing a written request to Churchill Capital Corp VII at 640 Fifth

Avenue, 12th Floor, New York, NY 10019.

Churchill VII stockholders, potential investors and other interested

persons should read each of the filings listed above and the Proxy Statement before making any voting or investment decisions. You may

obtain free copies of these documents from the sources indicated above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, as amended, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

|

|

|

| |

CHURCHILL CAPITAL CORP VII |

| |

|

|

| Date: July 25, 2024 |

By: |

|

/s/ Jay Taragin |

| |

|

|

Name: Jay Taragin |

| |

|

|

Title: Chief Financial Officer |

v3.24.2

Cover

|

Jul. 25, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 25, 2024

|

| Entity File Number |

001-40051

|

| Entity Registrant Name |

CHURCHILL

CAPITAL CORP VII

|

| Entity Central Index Key |

0001828248

|

| Entity Tax Identification Number |

85-3420354

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

640 Fifth Avenue

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

380-7500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Units [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units,

each consisting of one share of Class A common stock, $0.0001 par value, and one-fifth of one warrant

|

| Trading Symbol |

CVIIU

|

| Security Exchange Name |

NASDAQ

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Shares

of Class A common stock

|

| Trading Symbol |

CVII

|

| Security Exchange Name |

NASDAQ

|

| Warrants [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants

|

| Trading Symbol |

CVIIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CVII_UnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CVII_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

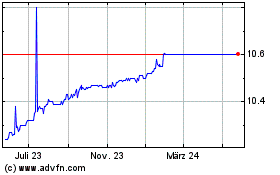

Churchill Capital Corp VII (NYSE:CVII)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Churchill Capital Corp VII (NYSE:CVII)

Historical Stock Chart

Von Nov 2023 bis Nov 2024