UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the

Registrant x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

CHURCHILL CAPITAL

CORP VII

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Special Meeting of Churchill VII Stockholders

to Approve Business Combination with CorpAcq and Public Warrant Holder Meeting to Approve Warrant Amendment to be Adjourned and Reconvened

for August 12, 2024

Redemption deadline for stockholders moved to

August 8, 2024

NEW YORK July 18, 2024 –

Churchill Capital Corp VII ("Churchill VII") (Nasdaq: CVII), a special purpose acquisition company,

announced today that it intends to adjourn each of the special meeting of Churchill VII stockholders (the "Stockholder Special Meeting")

and the meeting of Churchill VII warrant holders (the "Warrant Holder Meeting"), which are currently scheduled for July 25,

2024, to be held in connection with the proposed business combination between CorpAcq Holdings Limited ("CorpAcq"), and Churchill

VII (the "Business Combination"). The Stockholder Special Meeting will reconvene on August 12, 2024 at 10:00 A.M., Eastern

Time, and the Warrant Holder Meeting will reconvene on August 12, 2024 at 10:30 A.M., Eastern Time.

Churchill VII stockholders and public warrant holders of record as

of the close of business on June 18, 2024 (the "Record Date") should reference the definitive proxy statement/prospectus (the

"Proxy Statement") for all relevant information and remain entitled to vote at the Stockholder Special Meeting and/or Warrant

Holder Meeting, respectively. Shareholders who have not yet done so are encouraged to vote as soon as possible. Each of the Stockholder

Special Meeting and the Warrant Holder Meeting will still be conducted virtually via webcast and can be registered for by following the

instructions provided in the Proxy Statement. As a result of the adjournments, the deadline for Churchill VII stockholders to elect redemption

of their shares in connection with the Business Combination will be extended until August 8, 2024.

The Churchill VII board of directors unanimously (of those who voted)

recommends that Churchill VII stockholders vote "FOR" the Business Combination as well as the other proposals set forth in the

Proxy Statement. Each stockholder's vote FOR ALL the stockholder proposals included in the Proxy Statement is important, regardless of

the number of shares held.

The Churchill VII board of directors unanimously (of those who voted)

recommends that Churchill VII warrant holders vote "FOR" the amendment to Churchill VII's existing warrant agreement as

well as the other proposals set forth in the Proxy Statement. Each warrant holder’s vote FOR ALL the warrant holder proposals included

in the Proxy Statement is important, regardless of the number of warrants held.

If approved by Churchill VII's stockholders, the Business Combination

is expected to be completed shortly after the Stockholder Special Meeting, subject to the satisfaction of all other closing conditions.

Following completion, the combined company will operate as CorpAcq Group Plc and is expected to be listed on the Nasdaq Global Market

under the ticker "CPGR".

Churchill VII stockholders and warrant holders who need assistance

voting, have questions regarding the meetings, or would like to request documents may contact Churchill VII's proxy solicitor, Morrow

Sodali LLC, by calling (800) 662-5200 (toll-free) or banks and brokers may call (203) 658-9400, or by emailing CVII.info@investor.morrowsodali.com.

About CorpAcq Holdings Limited

CorpAcq is a corporate compounder founded in 2006 with deep commercial

experience and a diversified portfolio of 43 companies (as of May 1, 2024) across multiple large industries. CorpAcq has a track record

of unlocking business potential and long-term growth for small and medium-sized enterprises through its established M&A playbook and

decentralized operational approach. CorpAcq's executive team develops close relationships with their subsidiaries' management to support

them with financial and strategic expertise while allowing them to retain independence to continue to operate their businesses successfully.

CorpAcq is headquartered in the United Kingdom.

About Churchill Capital Corp VII

Churchill Capital Corp VII was formed for the purpose of effecting

a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Additional Information and Where to Find It

This communication does not contain all the information that should

be considered concerning the Business Combination and the other transactions contemplated thereby (the "Transactions") and is

not intended to form the basis of any investment decision or any other decision in respect of the Transactions.

The post-effective amendment to the Registration Statement on Form

F-4 filed by CorpAcq Group Plc in respect of the Business Combination (the "Post-Effective Amendment") was made effective by

the U.S. Securities and Exchange Commission (the "SEC") on June 20, 2024 and includes the Proxy Statement to be made available

to Churchill VII’s stockholders and public warrant holders in connection with Churchill VII’s solicitation for proxies for

the vote by Churchill VII’s stockholders and public warrant holders in connection with the Transactions and other matters described

in the Post-Effective Amendment, as well as the prospectus relating to the offer and sale of securities to be issued by CorpAcq Group

Plc to Churchill VII’s stockholders and public warrant holders in connection with the completion of the Transactions.

Before making any voting or other investment decisions, Churchill VII’s

stockholders and public warrant holders and other interested persons are advised to read the Post-Effective Amendment and the Proxy Statement,

in connection with Churchill VII’s solicitation of proxies for its Stockholder Special Meeting and its Warrant Holder Meeting, as

well as other documents filed with the SEC by Churchill VII or CorpAcq Group Plc in connection with the Transactions and any amendments

thereto, as these documents will contain important information about CorpAcq, CorpAcq Group Plc, Churchill VII and the Transactions.

Stockholders and public warrant

holders may also obtain a copy of the Post-Effective Amendment and the Proxy Statement, as well as other documents filed by Churchill

VII or CorpAcq Group Plc with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request

to Churchill Capital Corp VII at 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Forward Looking Statements

This communication includes "forward-looking

statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements may be identified by the use of words such as "estimate," "plan, " "project,

" "forecast, " "intend, " "will, " "expect, " "anticipate, " "believe, "

"seek, " "target, " "continue," "could, " "may," "might," "possible,"

"potential," "predict" or other similar expressions that predict or indicate future events or trends or that are not

statements of historical matters. Churchill VII and CorpAcq have based the forward-looking statements on its current expectations about

future performance, timing and events. The forward-looking statements in this communication include, but are not limited to, statements

regarding estimates and forecasts of financial and operational metrics and the anticipated timing for the Business Combination to close.

The forward-looking statements are based on various assumptions, whether or not identified in this communication, and on the current expectations

of CorpAcq’s and Churchill VII’s respective management teams and are not predictions of actual timing and/or performance.

Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein

will be achieved. The forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must

not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual

events and circumstances are difficult or impossible to predict and may materially differ from assumptions. Many actual events and circumstances

are beyond the control of Churchill VII and CorpAcq. The forward-looking statements are subject to known and unknown risks, uncertainties

and assumptions about Churchill VII and CorpAcq that may cause the timing and/or performance indicated in this communication to be materially

different from any actual future results, levels of activity, performance or achievements expressed or implied by such forward-looking

statements. Such risks and uncertainties include changes in domestic and foreign business changes

in the competitive environment in which CorpAcq operates; CorpAcq’s ability to manage its growth prospects, meet its operational

and financial targets, and execute its strategy; the impact of any economic disruptions, decreased market demand and other macroeconomic

factors, including the effect of a global pandemic, to CorpAcq’s business, projected results of operations, financial performance

or other financial metrics; CorpAcq’s reliance on its senior management team and key employees; risks related to liquidity,

capital resources and capital expenditures; failure to comply with applicable laws and regulations or changes in the regulatory environment

in which CorpAcq operates; the outcome of any potential litigation, government and regulatory proceedings, investigations, actions (including

any potential U.S. or U.K. government shutdowns) and inquiries that Churchill VII or CorpAcq may face; assumptions

or analyses used for CorpAcq’s forecasts proving to be incorrect and causing its actual operating and financial results to be significantly

below its forecasts; CorpAcq failing to maintain its current level of acquisitions or an acquisition not occurring as planned and negatively

affecting operating results; the inability of the parties to successfully or timely consummate the Transactions, including the

risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely

affect CorpAcq Group Plc, which will be the combined company after the Transactions, or the expected benefits of the Transactions or that

the approval of the stockholders of Churchill VII is not obtained; the risk that stockholders of Churchill VII could elect to have their

shares redeemed by Churchill VII, leading to either Churchill VII failing to satisfy continued listing requirements for Nasdaq Global

Market or Churchill VII having insufficient cash to complete the Transactions; the outcome of any legal proceedings that may be instituted

against CorpAcq or Churchill VII; changes in applicable laws or regulations; the ability of Churchill VII or CorpAcq Group Plc to issue

equity or equity linked securities in connection with the Transactions or in the future; the impact

of certain geopolitical events, including wars in Ukraine and the surrounding region and the Middle East; the impact of a current or future

pandemic on CorpAcq, CCVII, or CorpAcq Group's projected results of operations, financial performance or other financial metrics, or on

any of the foregoing risks; those factors discussed in under the heading "Risk Factors" in the Post-Effective Amendment,

as may be further amended from time to time, and other documents filed, or to be filed, with the SEC by Churchill VII or CorpAcq Group

Plc. If any of these risks materialize or CorpAcq’s, CorpAcq Group Plc’s or Churchill VII’s assumptions prove incorrect,

actual timing and/or performance could differ materially from the timing and/or performance implied by the forward-looking statements.

There may be additional risks that CorpAcq, CorpAcq Group Plc nor Churchill VII presently know or that CorpAcq, CorpAcq Group Plc and

Churchill VII currently believe are immaterial that could also cause actual timing and/or performance to differ materially from those

contained in the forward-looking statements. In addition, the forward-looking statements reflect CorpAcq’s, CorpAcq Group Plc’s

and Churchill VII’s expectations and views as of the date of this communication. CorpAcq, CorpAcq Group Plc’s and Churchill

VII anticipate that subsequent events and developments will cause CorpAcq’s, CorpAcq Group Plc’s and Churchill VII’s

assessments to change. However, while CorpAcq, CorpAcq Group Plc and Churchill VII may elect to update these forward-looking statements

at some point in the future, CorpAcq, CorpAcq Group Plc and Churchill VII specifically disclaim any obligation to do so. The forward-looking

statements should not be relied upon as representing CorpAcq, CorpAcq Group Plc and Churchill VII’s assessments as of any date subsequent

to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements. An investment

in CorpAcq, CorpAcq Group Plc or Churchill VII is not an investment in any of CorpAcq’s, CorpAcq Group Plc’s or Churchill

VII’s founders’ or sponsors’ past investments or companies or any funds affiliated with any of the foregoing.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This communication is not, and under no circumstances is to be construed as, a proxy statement or solicitation of a proxy,

a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933,

as amended, or exemptions therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY

AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED

HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

CorpAcq, CorpAcq Group Plc, Churchill

VII, Churchill Sponsor VII LLC and their respective directors and executive officers may be deemed participants in the solicitation

of proxies from Churchill VII’s stockholders and public warrant holders with respect to the Transactions. A list of the names of

Churchill VII’s directors and executive officers and a description of their interests in Churchill VII is set forth in certain

filings with the SEC, including (but not limited to) the following: (1) Proxy Statement (and

specifically, the following sections: "Risk Factors-Risks Related to Churchill and the Business Combination"; "Information

Related to Churchill-Management, Directors and Executive Officers"; "The Business Combination-Interests of Certain Persons

in the Business Combination; Interests of the Churchill Initial Stockholders and Churchill’s Directors and Officers";

"Beneficial Ownership of Churchill Securities" and "Certain Relationships and Related Person Transactions-Churchill

Relationships and Related Person Transactions"), (2) the Form 10-K filed by Churchill

VII with the SEC on March 17, 2023 (and specifically, the following sections: "Item 1A. Risk Factors"; "Item

10. Directors, Executive Officers and Corporate Governance"; "Item 11. Executive Compensation"; "Item

12. Beneficial ownership"; "Item 13. Related party transactions" and "Item 15. Exhibits, Financial

Statement Schedules-Note 5. Related Party Transactions"), (3) the Form 10-Qs filed by Churchill VII with the SEC on May 10, 2023, August 9, 2023 and November 9, 2023 (and

specifically, the discussion under "Item 1. Financial Statements-Note 5. Related Party Transactions" section in each

such Form 10-Qs, respectively), (4) the Form 8-K filed by Churchill VII with the SEC on August

7, 2023 (and specifically, the disclosure under "Item 1.01 Entry Into a Material Definitive Agreement-Amended and Restated Sponsor

Agreement"), (5) the Form 8-K filed by Churchill VII with the SEC on December 26,

2023 (and specifically, the disclosure under "Item 1.01 Entry Into a Material Definitive Agreement-Consent and Merger Agreement

Amendment"), (6) the SCHEDULE 14A filed by Churchill VII with the SEC on June 20,

2024 (and specifically, the following sections: "The Business Combination-Interests of Certain Persons in the Business Combination"

and "Beneficial Ownership of Churchill Securities"), and (7) other documents that may be filed with the SEC from time

to time in connection with the Transactions, each of which will be available free of charge at the SEC’s website located at www.sec.gov,

or by directing a written request to Churchill Capital Corp VII at 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Churchill VII stockholders, potential investors and other interested

persons should read each of the filings listed above and the Proxy Statement before making any voting or investment decisions. You may

obtain free copies of these documents from the sources indicated above.

Investor Relations Contact:

Email: CorpAcqIR@icrinc.com

Media Relations Contact:

Michael Landau

Gladstone Place Partners

(212) 230-5930

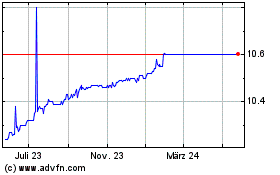

Churchill Capital Corp VII (NYSE:CVII)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Churchill Capital Corp VII (NYSE:CVII)

Historical Stock Chart

Von Mär 2024 bis Mär 2025