0001609253false00016092532024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 7, 2024

_____________________

California Resources Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

| Delaware | 001-36478 | 46-5670947 |

(State or Other Jurisdiction of

Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | |

| 1 World Trade Center | |

| Suite 1500 | |

| Long Beach | |

| California | 90831 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (888) 848-4754

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☑ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | CRC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On February 7, 2024, California Resources Corporation (the “Company”) issued a press release announcing the signing of a definitive merger agreement to combine with Aera Energy, LLC (the “Merger Agreement”). A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

On February 7, 2024, the Company will hold an investor call relating to the transactions contemplated by the Merger Agreement. An investor presentation has been made available online in the Investor Relations section of the Company’s website for reference during such call. A copy of the investor presentation is attached hereto as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference herein.

Statements contained in the exhibits to this report that state the Company’s or its management’s expectations or predictions of the future are forward-looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933, as amended (the “Securities Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Factors that could affect these results include those mentioned in the documents that the Company has filed with the Securities and Exchange Commission (the “SEC”). The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although the Company may do so from time to time as management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure including disclosure in the Investor Relations portion of the Company’s website.

The information under Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and 99.2, are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| California Resources Corporation |

| | | |

| | | |

| | | |

| /s/ Michael L. Preston | |

| Name: | Michael L. Preston |

| Title: | Executive Vice President, Chief Strategy Officer and General Counsel |

DATED: February 7, 2024

NEWS RELEASE

California Resources Corporation to Combine with Aera Energy

Transaction highly accretive across key 2024E financial metrics

Complementary assets to significantly scale E&P business and expand leading carbon management platform

LONG BEACH, California, February 7, 2024 – California Resources Corporation (NYSE: CRC) today announced the signing of a definitive merger agreement to combine with Aera Energy, LLC (Aera) in an all-stock transaction. The transaction values Aera at approximately $2.1 billion, inclusive of Aera’s net debt and certain other obligations1, and is expected to be immediately accretive. At closing, Aera's owners will receive 21.2 million shares of CRC’s common stock, equal to approximately 22.9% of CRC’s fully diluted shares.

“This strategic transaction will create scale in our operations, generate significant free cash flow, accelerate cash returns to shareholders and expand our energy transition platform,” said Francisco Leon, CRC’s President and Chief Executive Officer. “We remain committed to reducing emissions and this combination will advance our goal to permanently sequester 5 million metric tons per year of CO2 in our underground storage vaults. We are highly confident in our ability to drive sustainable savings that will enhance shareholder returns and deliver meaningful long-term value for our stakeholders. On behalf of CRC, we look forward to working with our new colleagues at Aera. Together, this combination will create an unquestioned leader in energy transition, producing low carbon intensity fuels that California needs while accelerating the decarbonization of the State’s industrial and energy industries.”

Erik Bartsch, Aera’s President and Chief Executive Officer added: “Aera and CRC are two great companies with decades of experience and track records that will serve as a foundation for a strong combination. We are committed to continuing to deliver the energy Californians need today and working to deploy carbon capture at-scale.”

Highlights:

•Immediately accretive to key financial metrics: Priced at approximately 2.6x enterprise value1 / 2024E Adjusted EBITDAX2,3, the transaction is expected to be immediately accretive to key 2024E financial metrics, and reflects approximately a 45% improvement to operating cash flow per share and 90% accretion to free cash flow per share3.

•Creates scale and enhances asset durability: The transaction adds large, conventional, low decline, oil weighted, proved developed producing reserves and sustainable cash flow. Aera had average third quarter 2023 production of approximately 76 thousand barrels of oil equivalent per day (Boe/d) (95% oil) and estimated proved reserves of approximately 262 million Boe at year-end 20224. On a pro forma 2024E basis, CRC will have estimated production of approximately 150 thousand Boe/d (76% oil) and proved reserves of approximately 680 million Boe4 (90% proved developed). The combined company will own interests in five of the largest oil fields in California with opportunities to increase oil recovery.

•Significantly increases free cash flow outlook and expands cash return to shareholders: Pro forma 2024E free cash flow2 is expected to more than double to approximately $685 million3 at strip pricing as of January 25, 2024 of $79.81 Brent and $2.65 Henry Hub, and total nearly $3.0 billion5 through 2028. Following the close of the transaction, CRC plans to allocate its free cash flow to enhance shareholder returns, reduce debt and fund opportunistic expansion of its carbon management business. The Board

has authorized a 23% increase to CRC’s Share Repurchase Program to $1.35 billion and extended the program’s authorization through year-end 2025. Post closing, and subject to Board approval, the Company expects to increase its fixed quarterly dividend.

•Expands leading carbon management platform: The combination will expand CRC’s leading carbon management business through the addition of surface acreage and rights, and significant new carbon dioxide (CO2) pore space to enable future carbon capture and sequestration (CCS) development. Through this combination, CRC will receive interests in approximately 220,000 net mineral acres with nearly 80% of the acreage within field boundaries held in mineral fee and 100,000 fee surface acres. Pro forma, CRC will have more than 1.9 million net mineral acres. CRC will also obtain 1 pending Environmental Protection Agency (EPA) Class VI permit application for 27 million metric tons (MMT) of storage capacity in the Belridge Field. CRC also expects to submit an additional Class VI permit for approximately 27MMT of storage at the Coles Levee Field. The Company will have the potential to nearly double its injection rate capacity near CTV I, creating a premier “decarbonization hub” for CO2 storage.

•Significant, identified synergies, with upside: Identified synergies are expected to total $150 million annually and be realized within 15 months of closing. Cumulative synergies over the next decade have an estimated PV-10 value of nearly $1.0 billion. Synergies are expected to be realized primarily through lower operating costs, capital efficiencies, G&A reductions and optimization of shared field infrastructure.

•Maintains strong balance sheet, enhances liquidity: On a pro forma basis, CRC will maintain a strong balance sheet and estimates that its leverage ratio2 will be below 0.5x within one year of closing. Pro forma, the Company expects to have more than $800 million of liquidity within one year of closing and enhanced access to capital.

•Continued leadership across leading energy transition initiatives: Combination of Carbon TerraVault platform and Aera’s Low Carbon Solutions to enable further expansion to a variety of energy transition technologies in development including Direct Air Capture (DAC), geothermal, solar, and water treatment, and enable additional clean tech partnership opportunities with a goal to further decarbonize California

Transaction Details:

Under the terms of the merger agreement, CRC will issue 21.2 million shares of its common stock to the equity owners of Aera, and refinance Aera’s outstanding debt. CRC has secured a firm commitment for a $500 million bridge loan facility to facilitate closing. At current valuations, the pro forma business would have an enterprise value of approximately $5.6 billion1, with CRC shareholders owning approximately 77.1% of the combined company.

Aera is owned by entities managed by IKAV (51%), an international asset management group, and Canada Pension Plan Investment Board (CPP Investments) (49%). Post closing, IKAV-managed entities and CPP Investments will collectively hold 22.9% of CRC’s common stock.

“This transaction provides CPP Investments with an excellent opportunity to scale up our investment in California's energy transition, with Aera and CRC both aligned in their commitment to enabling new carbon management solutions and each bringing complementary strengths to the table,” said Bill Rogers, Managing Director, Global Head of Sustainable Energies, CPP Investments. CPP Investments’ Sustainable Energies Group takes advantage of growing market opportunities as the energy sector evolves and global power demand grows, especially for low-carbon energy alternatives and carbon solutions. “The combined company is set to play a leading role in California’s energy transition, which we view as a promising source of long-term risk-adjusted returns for the CPP Fund.”

Constantin von Wasserschleben, Chairman of IKAV added: ”The combination of CRC and Aera has strong industrial logic and aligns with our philosophy to make investments that effect positive change in the world. The merger brings together the strengths of both companies, who will be better together to operate what will be the

largest oil and gas company in California by production. We believe that the world needs access to affordable, reliable and lower carbon energy sources and we advocate a co-existence between renewable and conventional energy for decades to come. We look forward to partnering with the CRC team to shape the future path of the energy transition.”

The CRC management team will run the combined company which will be headquartered in Long Beach, California, and at closing IKAV and CPP Investments will each nominate one representative to the CRC Board.

IKAV and CPP Investments will be subject to customary lock-up periods, which preclude the sale of any shares for six months after closing. At least 2/3 of issued shares will be subject to a 12 month lock up and at least 1/3 of the issued shares will be subject to an 18 month lock up period.

The merger agreement has been unanimously approved by CRC’s Board of Directors and the shareholders of Aera. The transaction is subject to customary closing conditions, regulatory approvals and CRC shareholder approval. The transaction, which has an effective date of January 1, 2024, is expected to close in the second half of 2024.

Pro Forma Estimated 2024 Outlook3:

The transaction has an effective date of January 1, 2024 and on a combined basis CRC expects to produce between 145 and 150 MBoe/d (~76% oil) in 2024. CRC plans to run a one rig program in the first half of 2024 and will focus on workover and maintenance activity. Assuming resumption of a normalized level of new well permit approvals in the second half of 2024, CRC plans to run four to five operated rigs on a combined basis at that time. As CRC waits for the Kern County Environmental Impact Report (KCEIR) litigation ruling expected in the second quarter of 2024, management continues to seek previously started Conditional Use Permits (CUPs) for its core fields.

CRC expects to provide more complete guidance following closing of the transaction.

| | | | | |

| |

| PRO FORMA CRC GUIDANCE | Total 2024E |

| Net Total Production (MBoe/d) | 145 – 150 |

| Oil Production (%) | 76% |

Adjusted EBITDAX2 ($ millions) | $1,460 - $1,615 |

| Capital ($ millions) | $420 - $470 |

Free Cash Flow2 ($ millions) | $650 - $720 |

Note: Free cash flow is before synergies.

Shareholder Return Strategy

CRC is committed to returning significant cash to shareholders through dividends and repurchases of its common stock. On February 6, 2024, CRC’s Board of Directors approved an increase of the Share Repurchase Program to $1.35 billion, an increase of $250 million, and extended the program through December 31, 2025. Adjusting for this increase, CRC has approximately $750 million of capacity remaining under the repurchase program as of December 31, 2023. Post closing, and subject to Board approval, the Company expects to increase its fixed quarterly dividend.

Conference Call Information

A conference call is scheduled for February 7, 2024, at 9:00 a.m. Eastern Time. To participate in the call, please dial (877) 328-5505 (International calls please dial +1 (412) 317-5421) or access via webcast at www.crc.com 15 minutes prior to the scheduled start time to register. Participants may also pre-register for the

conference call at https://dpregister.com/sreg/10186471/fb99757555. A digital replay of the conference call will be archived for approximately 90 days and supplemental slides for the conference call will be available online in the Investor Relations section of www.crc.com.

1 Aera’s enterprise value was calculated as 21.2 million of shares of CRC common stock based on a per share price of $46.81 as of February 2, 2024 plus $1.1B of assumed debt and other liabilities, which excludes a discounted hedge liability of ~$240MM, to be issued or assumed by CRC pursuant to the merger agreement. CRC’s enterprise value was calculated as $3.5 billion assuming company’s share price of $46.81 as of February 2, 2024, 71.4 million of fully diluted shares and $116MM of Net Debt2 as of 3Q23.

2 Represents a non-GAAP measure. For all historical non-GAAP financial measures please see the Investor Relations page at www.crc.com for a reconciliation to the nearest GAAP equivalent and other additional information. CRC is unable to provide a reconciliation of non-GAAP financial measures contained in this release that are presented on a forward-looking basis for the described transaction because CRC is unable, without unreasonable efforts, to estimate and quantify the most directly comparable GAAP components, largely because predicting future operating results is subject to many factors outside of CRC's control and not readily predictable and that are not part of CRC's routine operating activities, including various economic, regulatory, political and legal factors.

3 Unless otherwise noted, pro forma 2024 estimates are calculated assuming (i) the transaction closed on January 1, 2024, (ii) estimated annualized synergies are excluded, and (iii) strip pricing as of January 25, 2024 of $79.81 per barrel of oil Brent price, NGL realizations of 68% of crude price and Henry Hub gas price of $2.65 per MMBtu. Total pro forma capital includes combined Carbon Management Business and E&P, Corporate and Other business needs. CRC plans to run a one rig program in the first half of 2024 focusing on workover and maintenance activity. In the second half of 2024, and assuming a successful resolution to the Kern County EIR litigation and resumption of a normalized level of permit approvals, CRC plans to run four to five rigs on a pro forma basis. Pro forma per share metrics are calculated using 92.6 million of fully diluted shares of CRC common stock post close, including 21.2 million shares of CRC common stock to be issued at closing of the transaction. All future quarterly dividends and share repurchases are subject to changes in commodity prices, restrictions under credit agreement covenants and the approval of CRC's Board. Pro forma 2024 estimates are forward-looking statements and are based on management’s expectations. Actual results could differ materially. Pro forma 2024E free cash flow of $685MM represents a midpoint of a range between $650MM and $720MM.

4 Reserves determined as of December 31, 2022 and use 2022 SEC Prices of $100.25 per barrel for oil and $6.36 per MMBtu for natural gas.

5 The free cash flow amount shown is cumulative over the 2024-2028 period and includes impact of existing hedge settlements and excludes synergies. These estimates are calculated assuming (i) the transaction closed on January 1, 2024, (ii) strip pricing as of January 25, 2024 of $79.81 per barrel of oil Brent price in 2024, $76.33 per barrel of oil in 2025 and $73.36 per barrel of oil 2026 - 2028, NGL realizations of 68% of crude price and Henry Hub gas price of $2.65 per MMBtu in 2024, $3.50 per MMBtu in 2025, $3.77 per MMBtu in 2026 and $3.78 per MMBtu 2027 - 2028, (iii) net total annual production between 145 – 150 mboepd (76% oil), (iv) decline rates between 10% to 15%, (v) G&A expenses of ~ $380MM through 2028, (vi) total pro forma capital needs of $420MM to $580MM inclusive of Carbon Management, and (vii) 4 to 5 rigs scenario starting from 2H24 and assuming a successful resolution to the Kern County EIR litigation and resumption of a normalized level of permit approvals. Pro forma 2024 - 2028 estimates are forward-looking statements and are based on management’s expectations. Actual results could differ materially.

About California Resources Corporation

CRC is an independent energy and carbon management company committed to energy transition. CRC produces some of the lowest carbon intensity oil in the US and is focused on maximizing the value of its land, mineral and technical resources for decarbonization efforts. For more information about CRC, please visit www.crc.com.

About Aera

Formed in 1997, Aera is based in Bakersfield, California, in the heart of Kern County – one of the largest oil-producing regions in the nation – with additional operations in Ventura, Monterey and Fresno counties. Aera is known for excellent safety and environmental performance. For more information about Aera, please visit www.aeraenergy.com.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. As of September 30, 2023, the Fund totaled C$576 billion. For more information, please visit www.cppinvestments.com.

About IKAV

IKAV is an international asset management group headquartered in Germany, with local offices in Luxembourg, Italy, Spain, Portugal, USA and France. The group was established in 2010. It provides institutional investors with investment solutions spanning a broad range of infrastructure energy assets, including solar, concentrated solar power, wind, energy efficiency, geothermal, thermal power plants and upstream. IKAV is a buy and hold investor with a vertically integrated business model to optimize its investment portfolio and to make its assets in line with the global net zero strategy over the upcoming decades. For more information, please visit ikav.com.

Advisors

Citi and Jefferies are serving as financial advisors and Sullivan & Cromwell LLP is serving as legal advisor to CRC. Wells Fargo acted as lead financial advisor alongside Truist and Latham & Watkins LLP is serving as legal advisor to CPP Investments & IKAV.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the transactions contemplated by the merger agreement pursuant to which California Resources Corporation (“CRC”) has agreed to combine with Aera Energy, LLC (“Aera”) (the “Merger Agreement”), including the proposed issuance of CRC’S common stock pursuant to the Merger Agreement. In connection with the transaction, CRC will file a proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (“SEC”), as well as other relevant materials. Following the filing of the definitive proxy statement, CRC will mail the definitive proxy statement and a proxy card to its stockholders. INVESTORS AND SECURITY HOLDERS OF CRC ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CRC, Aera, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain copies of the proxy statement (when available) as well as other filings containing information about CRC, Aera and the transaction, without charge, at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by CRC will be available, without charge, at CRC’s website, www.crc.com.

Participants in Solicitation

CRC and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the transaction. Information about the directors and executive officers of CRC is set forth in the proxy statement for CRC’s 2023 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2023. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the transaction when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication contains statements that CRC believes to be “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than historical facts are forward-looking statements, and include statements regarding the benefits of the transaction, CRC's future financial position and operating results, business strategy, projected revenues, earnings, costs, capital expenditures and plans, objectives and intentions of management for the future. Words such as "expect," "could," "may," "anticipate," "intend," "plan," “ability,” "believe," "seek," "see," "will," "would," "estimate," "forecast," "target," "guidance," "outlook," "opportunity" or "strategy" or similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements are based upon the current beliefs and expectations of the management of CRC and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, projected in, or implied by, such statements. Although CRC believes the expectations and forecasts reflected in its forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond CRC's control. No assurance can be given that such forward-looking statements will be

correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that could cause CRC's actual results to be materially different from those described in the forward-looking statements include:

(i)the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the transaction that could reduce anticipated benefits or cause the parties to abandon the transaction,

(ii)the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement,

(iii)the possibility that stockholders of CRC may not approve the issuance of new shares of common stock in the transaction,

(iv)the risk that any of the other closing conditions to the transaction may not be satisfied in a timely manner,

(v)transaction costs,

(vi)unknown liabilities,

(vii)the risk that any announcements relating to the transaction could have adverse effects on the market price of CRC’s common stock,

(viii)the ability to successfully integrate the businesses,

(ix)the ability to achieve projected operational and capital synergies and the risk it may take longer than expected to achieve those synergies,

(x)the risk the pending transaction could distract management from ongoing operations,

(xi)the effects of disruption to CRC’s or Aera’s respective businesses and operations, including the ability of CRC and Aera to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers,

(xii)the ability of CRC to obtain the required debt financing pursuant to its commitment letters and, if obtained, the potential impact of additional debt on CRC’s business and the financial impacts and restrictions due to the additional debt,

(xiii)risks related to potential litigation brought in connection with the transaction,

(xiv)risks related to financial community and rating agency perceptions of CRC or Aera or their respective businesses, operations, financial condition and the industry in which they operate,

(xv)risks related to the potential impact of general economic, political and market factors on CRC, Aera or the transaction, and

(xvi)those expressed in its forward-looking statements including those factors discussed in Part I, Item 1A – Risk Factors in CRC's Annual Report on Form 10-K and its other SEC filings available at www.crc.com.

CRC cautions you not to place undue reliance on forward-looking statements contained in this communication, which speak only as of the filing date, and CRC is under no obligation, and expressly disclaims any obligation to update, alter or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise. This communication contains information from third party sources, including information from Aera regarding its assets, operations and results. This data may involve a number of assumptions and limitations. CRC has not independently verified such third-party information and does not warrant the accuracy or completeness of such information.

Joanna Park (Investor Relations)

818-661-3731

Joanna.Park@crc.com

Richard Venn (Media)

818-661-6014

CRC.Communications@crc.com

Expanding Our Leading Energy Platform Complementary Assets and Highly Accretive Transaction

(i) the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the transaction that could reduce anticipated benefits or cause the parties to abandon the transaction, (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (iii) the possibility that stockholders of CRC may not approve the issuance of new shares of common stock in the transaction, (iv) the risk that any of the other closing conditions to the transaction may not be satisfied in a timely manner, (v) transaction costs, (vi) unknown liabilities, (vii) the risk that any announcements relating to the transaction could have adverse effects on the market price of CRC’s common stock, (viii) the ability to successfully integrate the businesses, (ix) the ability to achieve projected operational and capital synergies and the risk it may take longer than expected to achieve those synergies, (x) the risk the pending transaction could distract management from ongoing operations, (xi) the effects of disruption to CRC’s or Aera’s respective businesses and operations, including the ability of CRC and Aera to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers, (xii) the ability of CRC to obtain the required debt financing pursuant to its commitment letters and, if obtained, the potential impact of additional debt on CRC’s business and the financial impacts and restrictions due to the additional debt, (xiii) risks related to potential litigation brought in connection with the transaction, (xiv) risks related to financial community and rating agency perceptions of CRC or Aera or their respective businesses, operations, financial condition and the industry in which they operate, (xv) risks related to the potential impact of general economic, political and market factors on CRC, Aera or the transaction and (xvi) those expressed in its forward-looking statements including those factors discussed in Part I, Item 1A – Risk Factors in CRC's Annual Report on Form 10-K and its other SEC filings available at www.crc.com. Cautionary Note Regarding Forward-Looking Statements This communication contains statements that CRC believes to be “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than historical facts are forward-looking statements, and include statements regarding the benefits of the transaction, CRC's future financial position and operating results, business strategy, projected revenues, earnings, costs, capital expenditures and plans, objectives and intentions of management for the future. Words such as "expect," "could," "may," "anticipate," "intend," "plan," “ability,” "believe," "seek," "see," "will," "would," "estimate," "forecast," "target," "guidance," "outlook," "opportunity" or "strategy" or similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements are based upon the current beliefs and expectations of the management of CRC and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, projected in, or implied by, such statements. Although CRC believes the expectations and forecasts reflected in its forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond CRC's control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that could cause CRC's actual results to be materially different from those described in the forward-looking statements include: Forward-Looking / Cautionary Statements – Certain Terms CRC cautions you not to place undue reliance on forward-looking statements contained in this communication, which speak only as of the filing date, and CRC is under no obligation, and expressly disclaims any obligation to update, alter or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise. This communication contains information from third party sources, including information from Aera regarding its assets, operations and results. This data may involve a number of assumptions and limitations. CRC has not independently verified such third-party information and does not warrant the accuracy or completeness of such information. 2 Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the transactions contemplated by the merger agreement pursuant to which California Resources Corporation (“CRC”) has agreed to combine with Aera Energy, LLC (“Aera”) (the “Merger Agreement”), including the proposed issuance of CRC’S common stock pursuant to the Merger Agreement. In connection with the transaction, CRC will file a proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (“SEC”), as well as other relevant materials. Following the filing of the definitive proxy statement, CRC will mail the definitive proxy statement and a proxy card to its stockholders. INVESTORS AND SECURITY HOLDERS OF CRC ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CRC, Aera, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain copies of the proxy statement (when available) as well as other filings containing information about CRC, Aera and the transaction, without charge, at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by CRC will be available, without charge, at CRC’s website, www.crc.com. Non-GAAP Financial Measures: This presentation contains certain financial measures that are not prepared in accordance with generally accepted accounting principles (“GAAP”). These measures are identified with an “*” and include Adjusted EBITDAX, PV-10, Leverage Ratio, Net Debt, Liquidity and Free Cash Flow. For all historical non-GAAP financial measures please see the Investor Relations page at www.crc.com for a reconciliation to the nearest GAAP equivalent and other additional information. CRC is unable to provide a reconciliation of non-GAAP financial measures contained in this presentation that are presented on a forward-looking basis for the described transaction because CRC is unable, without unreasonable efforts, to estimate and quantify the most directly comparable GAAP components, largely because predicting future operating results is subject to many factors outside of CRC's control and not readily predictable and that are not part of CRC's routine operating activities, including various economic, regulatory, political and legal factors. Participants in Solicitation CRC and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the transaction. Information about the directors and executive officers of CRC is set forth in the proxy statement for CRC’s 2023 Annual Meeting of Stockholders, which was filed with the SEC on March 16, 2023. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the transaction when it becomes available.

Complementary Combination, Higher Returns & Enhanced Platform 3 ATTRACTIVELY PRICED AND ACCRETIVE TO KEY FINANCIAL METRICS EXPANDS CALIFORNIA’S LEADING ENERGY AND CARBON PLATFORM SIGNIFICANT SYNERGIES WITH UPSIDE MAINTAIN STRONG BALANCE SHEET & SHAREHOLDER RETURNS STRATEGY ▪ Expect leverage ratio* of <0.5x within 12 months post close; Increase SRP to $1.35B and expecting to raise quarterly dividend post close ▪ Expect ~$150MM in ongoing synergies within 15 months post close (assuming consistent activity set); ~10% improvement in pro forma 2024E breakeven price2 $2.1B Transaction Value1 77% CRC to Issue 21.2 Million Shares Pro Forma CRC Ownership CRC to Lead Combined Business CPP Investments and IKAV Will Appoint 2 New Directors to CRC’s Board TRANSACTION SUMMARY + See Slide 16 “Assumptions, Estimates and Endnotes” and for information regarding pro forma 2024 estimates. CREATES SCALE, ENHANCES ASSET DURABILITY ▪ Priced at 2.6x EV1/2024E Adj. EBITDAX*; Expected to more than double CRC’s 2024E free cash flow* ▪ Expecting to more than double CRC’s oil production; Oil % increases from 60% to 76% ▪ Doubles CTV’s premium CO2 pore space capacity and improves ability to service emissions in San Joaquin Basin $500MM Committed Bridge Financing

Aera Assets Overview 4See Slide 16 “Assumptions, Estimates and Endnotes”. HIGH QUALITY ASSETS ▪ Vast, conventional, low-decline, 95% oil- weighted ▪ Acreage position largely held in fee ▪ Long history of successful infill developments ▪ Owned in-field infrastructure STRONG FREE CASH FLOW GENERATION SIGNIFICANT CARBON POTENTIAL TOP TIER, PROVEN OPERATOR ▪ Strong revenue based on Brent-index pricing ▪ Low royalty burden with 95% average NRI that leads to strong margins ▪ 25 years of profitable and safe operations2 ▪ Strong focus on the environment and regulatory compliance ▪ More than 25 years as a trusted California operator ▪ Legacy Exxon and Shell JV; acquired by investment firms IKAV and Canada Pension Plan Investment Board (CPP Investments) San Ardo Midway Sunset Belridge ▪ CCS/CO2 storage potential: ▪ Belridge: Class VI EPA permit application for 27MMT submitted and on track for 2025 approval2 ▪ Coles Levee: CRC plans to submit an additional Class VI EPA permit for ~27MMT of CO2 storage post close ▪ Additional carbon management opportunities with Direct Air Capture(DAC) and solar Coles Levee Combining With California’s Second Largest Oil Producer1 Coalinga Net acres: ~10,600 NRI: 95% Ventura Net acres: ~5,500 NRI: 85% Midway Sunset Net acres: ~14,800 NRI: 94% Belridge Net acres: ~28,500 NRI:94% San Ardo Net Acres:~4,250 NRI:90% Other Net acres: ~171,350 2023E Top California Oil Producers1 Others FEE MINERAL LEASEHOLD Aera’s Net Mineral Acres

California’s Premier Energy Platform 5 Pro Forma Operating Metrics 3Q23 Net Total Production (MBOED) 85 76 161 3Q23 Oil (%) 60% 95% 76% PDP Decline (%) 10% - 15% 10% - 15% 10% - 15% NRI (%) 86% 95% 91% Net Mineral Acres (‘000s) 1,692 220 1,912 2022 Reserves1 (MMBOE) 417 262 679 Financial Estimates (to be updated post close) ’24E Adj. EBITDAX* ($MM) $690 - $765 $770 - $850 $1,460 - $1,615 ’24E Free Cash Flow* ($MM) (before synergies) $270 - $300 $380 - $420 $650 - $720 ’24E Leverage Ratio* 0.0x 0.7x <0.5x 2024E CMB Metrics SJB Storage Capacity (MMT) 46 542 100 Class VI Permits Filed with the EPA 6 22 8 Surface Net Acres (‘000s) 102 100 202 BTM Solar Projects Capacity (MW) 38MW 50MW 88MW Complementary Assets See Slide 16 “Assumptions, Estimates and Endnotes” and for information regarding pro forma 2024 estimates. Operating and Financial Metrics Cashflow Carbon California Higher Less Better Midway Sunset Belridge

▪ New ownership of Aera’s brownfield emissions and sequestration reservoirs improves integrated project economics and unlocks a faster path to decarbonization ▪ Able to provide carbon storage for 100MMT of emissions in the San Joaquin Basin ▪ Adds additional emissions reducing opportunities with Solar and DAC ▪ Positions CRC as California’s Decarbonization Operator of Choice Strengthening Our Carbon TerraVault Story ▪ Acquiring large, fee simple1 and bolt-on assets helps streamline storage development ▪ Up to 54MMT of additional CO2 storage potential ▪ Class VI permit filed for 27MMT of CO2 storage, on track for 2025 approval ▪ CRC plans to submit an additional Class VI permit for ~27MMT of CO2 storage2 CTV I (26R) CTV I (A1 - A2) Long word …........... Carbon Frontier Coles Levee 38 MMT 8 MMT 27 MMT ~27 MMT ~100MMT Premium CO2 Storage Space Capacity in SJB2 Est. Final EPA Class VI Permit Receipt4 1H24 2H24 1H25 To Be Announced 26R A1-A2 Carbon Frontier 2 Belridge Coles LeveeElk Hills See Slide 16 “Assumptions, Estimates and Endnotes”. 6 Doubling Premium Pore Space in The San Joaquin Basin Aligning CRC with California’s Decarbonization Goals Increasing Economic Potential ▪ New reservoirs would be eligible to be presented to CTV JV, potential for Brookfield contributions3 ($10/MT buy-in for the estimated metric tons of storage capacity net to Brookfield’s 49% percent ownership in the CTV JV) ▪ Incremental pore space has potential EBITDA*,3 of $70MM to $180MM (CTV type curve “storage only” to “full service” business model over a standardized 40-year project life and fully subscribed)

Expanding Cash Flow and Free Cash Flow Generation $0 $300 $600 $900 Accretive to Operating Cash Flow Per Share Resilient Free Cash Flow* Generation 7 ~80% of pro forma 2024E net oil production hedged, underpins cash flow Pro forma 2024E ~90% uplift in cash flow from operations and >140% in free cash flow* further enhanced by synergies (assuming consistent Brent prices) Robust free cash flow generation allows for acceleration of shareholder returns, rapid debt reduction and future growth opportunities See slide 16 for information regarding pro forma 2024 estimates. $65 Brent $3.50 SoCal Border Price $75 Brent $4.00 SoCal Border Price $85 Brent $4.50 SoCal Border Price CRC 2024E Operating Cash Flow 71.4MM Fully Diluted Shares Pro Forma 2024E Operating Cash Flow 92.6MM Fully Diluted Shares ~45% Improvement in Operating Cash Flow Per Share P ro F o rm a 2 0 2 4 E F re e C a s h F lo w * S e n s itiv ity ($ M M ) (b e fo re s yn e rg ie s )

Top-Tier Independent, Low Decline, Conventional Oil Producer 0 20 40 60 80 100 120 140 160 180 CIVI PR PF CRC MUR CHRD MTDR CRGY KOS SM CPE VTLE TALO CRC MGY BRY 2024E Net Oil Production (MBOD)1 Peer Group 2022 SEC Reserves2 (MMBOE) PRO FORMA 2024E BASE OIL DECLINE RATE: ~13% PEER GROUP5 AVERAGE BASE OIL DECLINE RATE: ~30%3 See Slide 16 “Assumptions, Estimates and Endnotes” and for information regarding pro forma 2024 estimates. Pro Forma CR >110MBOD ~76% ~8% ~16% Oil NGLs Gas PRO FORMA 2024E NET TOTAL PRODUCTION + + 8

Synergies to Drive Significant Cost Savings Pro Forma 2023 Operating Costs and G&A Synergies CAPEX & Infrastructure Synergies Pro Forma 15 Months Post Close Est. Annualized Synergies ($MM) See Slide 16 “Assumptions, Estimates and Endnotes”. 9 + All-In Costs1 ~$1.0B PV-10 of Est. Organic Synergies Over 10 Years Est. Annualized Organic Synergies2 of ~$150MM ++

0% 1% 2% 3% 4% Compelling Shareholder Returns Program1 10See Slide 17 “Assumptions, Estimates and Endnotes”. Fixed Dividend Current ~2.70% Fixed Yield2 S&P Small Cap 600 XOP O&G E&P ETF S&P Mid Cap 400 S&P 500 Real EstateEnergy Utilities Consumer Staples Materials Financials IndustrialsHealth Care Information Technology Consumer Discretionary Comm. Services S&P 500 Sectors ▪ Intend to raise quarterly fixed dividend post close ▪ Competitive current fixed dividend yield vs. market participants ▪ Expanding SRP1 ~23% to $1.35B and extending through December 31, 2025 with $747MM remaining capacity Current Annualized Fixed Dividend Yield (%) Peer Group3

0.0x 0.5x 1.0x 1.5x 2.0x ▪ Free Cash Flow Deployment Priorities Significant FCF Drives Shareholder Returns, Balance Sheet Strength & Growth Opportunities $0.0 $1.5 $3.0 $4.5~$3.0B Pro Forma 5 Year Cumulative Free Cash Flow* ($B) Return Significant Cash to Shareholders ▪ Intends to increase fixed dividend ▪ Opportunistic buybacks with $747MM remaining authorization2 1. SHAREHOLDER RETURNS Invest for the Future ▪ Advance and grow the Carbon Management Business 3. GROWTH INVESTMENTS See slide 16 for information regarding pro forma 2024 estimates. See Slide 17 “Assumptions, Estimates and Endnotes”. 2024E Leverage Ratio*,3 Peer Group PEERS’ AVERAGE Superior Leverage Profile vs. peer group 1 2 3 4 TARGET4 4 5 6 7 8 9 10 11 12 13 2. BALANCE SHEET STRENGTH Maintain Low Leverage Ratio* ▪ Projecting pro forma leverage ratio of <0.5x within 12 months post close ▪ Invest to Maintain Flat Production Post Close: 11 (before synergies) + $65 Brent $3.50 SoCal Border Price $75 Brent $4.00 SoCal Border Price $85 Brent $4.50 SoCal Border Price At $75 Brent

12 + See Slide 17 “Assumptions, Estimates and Endnotes”. EXPANDING CALIFORNIA’S LEADING ENERGY PLATFORM Expands Leading Carbon Management Platform and Continued Leadership Across Sustainability Initiatives Accretive Across Key Financial Metrics Creates Scale and Asset Durability Enhances Cash Flow, Increases Free Cash Flow Available for Shareholder Returns, Maintains Strong Balance Sheet1

Appendix

Pro Forma 2024 Estimates (complete guidance available at closing) 14 Midstream Infrastructure Carbon Capture & StorageLow Carbon Intensity Production BTM Solar Opportunities FTM/Grid Power Production Geothermal Opportunities Southern California Central California Northern California ~76% ~8% ~16% Oil NGLs Gas 2024E NET TOTAL PRODUCTION 145 – 150MBOE/D Net Total Production $1,460 – $1,615MM Adj. EBITDAX* $420 – $470MM Capital $650 – $720MM Free Cash Flow* Cashflow Carbon California Higher Less Better 1 4 – 5 1H24 2H24 2024E ACTIVE DRILLING RIGS + See Slide 17 “Assumptions, Estimates and Endnotes”. (before synergies) (before synergies) (before synergies) (76% oil)

Strong Capital Structure & Credit Profile 15 Transaction Value $2.1B Equity (21.2 million shares at $46.81 per share as of February 2, 2024) ~$1.0B Assumed Debt and Other1 ~$1.1B Transaction Summary ▪ 21.2MM shares of CRC’s common stock to be issued to Aera’s owners, IKAV managed entities and CPP Investments, with CRC’s pro forma share count of 92.6MM of fully diluted shares ▪ Expect to have more than $800 million of liquidity within one year post close2 and enhanced access to capital ▪ Commitment to achieve a leverage ratio* <0.5x within one year post close2 CRC 3Q23 Leverage Ratio* Pro Forma 2023E Leverage Ratio* Targeted Debt Reduction Pro forma Target Leverage Ratio* 12 Months Post Close Path to Target Leverage Ratio2 ($MM) <0.5x 0.1x See slide 16 for information regarding pro forma 2024 estimates. See Slide 17 “Assumptions, Estimates and Endnotes”. * Leverage and debt levels are net. Strong Balance Sheet Position, Ample Liquidity and Financial Flexibility

Assumptions, Estimates and Endnotes: Pro forma 2024 estimates. This presentation includes certain forward-looking estimates of our pro forma combined operating and financial results for the year ended December 31, 2024. Unless otherwise noted, pro forma 2024 estimates are calculated assuming (i) the transaction closed on January 1, 2024, (ii) estimated annualized synergies outlined on slide 9 are excluded, and (iii) strip pricing as of January 25, 2024 of $79.81 per barrel of oil Brent price, NGL realizations of 68% of crude price and Henry Hub gas price of $2.65 per MMBtu. Total pro forma capital includes combined Carbon Management Business and E&P, Corporate and Other business needs. CRC plans to run a one rig program in the first half of 2024 focusing on workover and maintenance activity. In the second half of 2024, and assuming a successful resolution to the Kern County EIR litigation and resumption of a normalized level of permit approvals, CRC plans to run four to five rigs on a pro forma basis. Pro forma per share metrics are calculated using 92.6 million of fully diluted shares of CRC common stock post close, including 21.2 million shares of CRC common stock to be issued at closing of the transaction. All future quarterly dividends and share repurchases are subject to changes in commodity prices, restrictions under credit agreement covenants and the approval of CRC's Board. Pro forma 2024 estimates are forward-looking statements and are based on management’s expectations. Actual results could differ materially. Endnotes: Slide 3: (1) Aera’s enterprise value was calculated as 21.2 million of shares of CRC common stock based on a per share price of $46.81 as of February 2, 2024 plus $1.1B of assumed debt and other liabilities, which excludes a discounted hedge liability of ~$240MM, to be issued or assumed by CRC pursuant to the merger agreement. CRC’s enterprise value was calculated as $3.5B assuming company’s share price of $46.81 as of February 2, 2024, 71.4 million of fully diluted shares and $116MM of Net Debt* as of 3Q23. (2) Breakeven price represents the Brent price that CRC expects will generate sufficient revenue to allow CRC to cover its operating costs, taxes other than on income, capital expenditures and debt service. Breakeven price assumes pro forma 2024 estimates outlined on slide 14. Slide 4: (1) Source: Enverus 2023 data as of February 2, 2024. In 2023, California’s oil producers accounted for approximatively 23% of oil consumed by local refiners in California, source: www.energy.ca.gov. (2) EPA.gov. Slide 5: (1) Reserves determined as of December 31, 2022 and use 2022 SEC Prices of $100.25 per barrel for oil and $6.36 per MMBtu for natural gas. (2) Includes 27MMT Carbon Frontier Class VI permit submitted to EPA and a 27MMT Class VI EPA permit at Coles Levee that CRC plans to file in a reasonable period of time after close. Slide 6: (1) Fee simple covers ~95% of storage plume as per CRC internal estimates. (2) Internal CRC estimates. Includes unsubmitted permit for 27MMT for Coles Levee. (3) See slides 42 to 45 in CRC’s 2024 January deck for the details on the CTV JV and CTV JV project economic type curve assumptions. EBITDA estimates include 45Q tax credits. Results subject to effects of taxes, timing, pace of project development and Brookfield further approval to fund capital and participate in the CCS projects. (4) EPA.gov Slide 8: (1) Peer group’s production data from FactSet as of February 1, 2024. (2) Reserves determined as of December 31, 2022 and use 2022 SEC Prices of $100.25 per barrel for oil and $6.36 per MMBtu for natural gas. (4) Peer group average PDP oil decline rate consists of public data from Enverus (January 2024) except for (a) CRGY PDP decline rate of 20% as per company’s 3Q23 earnings presentation, and (b) BRY’s PDP decline rate of 13% as per Jefferies initiation report from October 18, 2022. Slide 9: (1) Represents all operating expenses and capital expenditures. (2) Excludes costs to achieve savings and taxes. 16

Assumptions, Estimates and Endnotes (cont.): Endnotes (cont.): Slide 10: (1) Future quarterly dividends and share repurchases are subject to changes in commodity prices, restrictions in our credit agreement covenants and approval of CRC’s Board. (2) Represents annualized 2024E fixed dividend by CRC’s market capitalization as of February 2, 2024. Sector yields sourced from FactSet as of February 2, 2024. (3) Peer dividend data from FactSet as of February 2, 2024. Peer group includes: BRY, CHRD, CIVI, CPE, CRGY, KOS, MGY, MTDR, MUR, PR, SM, TALO and VTLE. Slide 11: (1) The free cash flow amount shown is cumulative over the 2024-2028 period includes impact of existing hedge settlements and excludes synergies. These estimates are calculated assuming (i) the transaction closed on January 1, 2024, (ii) $65, $75 and $85 per barrel of oil Brent price through 2024 - 2028, NGL realizations of 68% of crude price and SoCal Border gas price of $3.50, $4.00 and $4.50 per MMBtu through 2024 - 2028, respectively, (iii) net total annual production between 145 – 150 mboepd (76% oil), (iv) decline rates between 10% to 15%, (v) G&A expenses of ~ $380MM through 2028, (vi) total pro forma capital needs of $420MM to $580MM inclusive of Carbon Management, and (vii) 4 to 5 rigs scenario starting from 2H24 and assuming a successful resolution to the Kern County EIR litigation and resumption of a normalized level of permit approvals. Pro forma 2024 - 2028 estimates are forward-looking statements and are based on management’s expectations. Actual results could differ materially. (2) All CRC’s future quarterly dividends and share repurchases are subject to commodity prices, credit agreement covenants and Board of Directors approval. These preliminary estimates are forward-looking statements and are based on management’s expectations. Actual results could differ materially. (3) 2024E leverage metrics data from FactSet as of February 1, 2024. Peer group includes: BRY, CHRD, CIVI, CPE, CRGY, KOS, MGY, MTDR, MUR, PR, SM, TALO and VTLE. (4) Targeted pro forma leverage ratio of ~0.5x within 12 months post close. Slide 12: (1) Assuming consistent Brent prices. Slide 15: (1) Debt and other includes long term debt, deferred consideration, make-whole obligations, and excludes the mark-to-market $240MM value of hedges among other items. (2) The liquidity range and target leverage ratio 12 months post close were calculated (i) use of strip pricing as of January 25, 2024 of $79.81 per barrel of oil Brent price, NGL realizations of 68% of crude price and Henry Hub gas price of $2.65 per MMBtu, (ii) assuming transaction closed on January 1, 2024, subject to customary closing conditions, regulatory approvals and CRC shareholder approval, (iii) estimated liquidity at 12/31/24 calculated as unrestricted cash of $335MM and $630MM capacity on CRC’s Revolving Credit Facility less $153MM in outstanding letters of credit, and (iii) partial realization of synergies due to a smaller period. These preliminary estimates are forward-looking statements and are based on management’s expectations. Actual results could differ materially. 17

Term Definition Bcf Billion Cubic Feet BMT Billion Metric Tons CARB California Air Resources Board CCS Carbon Capture and Storage CCS+ Carbon Capture and Storage + EOR CDMA Carbon Dioxide Management Agreement CEQA California Environmental Quality Act CGP Cryogenic Gas Plant CI Carbon Intensity CMB Carbon Management Business CO2 Carbon Dioxide CTV Carbon TerraVault (a subsidiary of CRC) DAC Direct Air Capture D&C Drilling and Completions E&P Exploration and Production EHPP Elk Hills Power Plant EIR Environmental Impact Report EOR Enhanced Oil Recovery EPA Environmental Protection Agency ESG Environmental, Social and Governance EV Enterprise Value FCF Free Cash Flow FEED Front End Engineering and Design FID Final Investment Decision GHG Greenhouse Gas IRR Internal Rate of Return Glossary Term Definition KMTPA Thousand Metric Tons Per Annum LCFS Low Carbon Fuel Standard MMT Million Metric Tons MMTPA Million Metric Tons Per Annum MRV Monitoring, Reporting and Verification Plan MT Metric Tons MTPA Metric Tons Per Annum ND Net Debt NRI Net Revenue Interest OCF Operating Cash Flow PD Proved Developed PDP Proved Developed Producing PF Pro Forma PUD Proved Undeveloped RSG Responsibly Sourced Gas ROFL Right of First Look R/P Reserves to Production Ratio RTC Round-the-Clock SFDR Sustainable Finance Disclosure Regulation SRP Share Repurchase Program SJB San Joaquin Basin SJV San Joaquin Valley TBA To Be Announced Tcf Trillion Cubic Feet WI Working Interest 18

Joanna Park (Investor Relations) 818-661-3731 Joanna.Park@crc.com Richard Venn (Media) 818-661-6014 Richard.Venn@crc.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

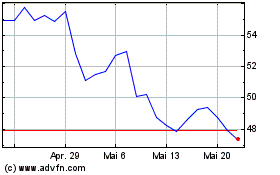

California Resources (NYSE:CRC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

California Resources (NYSE:CRC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024