Fanhua Announces Details of Distribution of CNFinance Shares

10 Juni 2022 - 10:15PM

Fanhua Inc. (the “Company” or “Fanhua”) (Nasdaq: FANH), a leading

independent financial services provider in China, today announced

the details of its previously announced distribution of shares of

CNFinance Holdings Limited (“CNFinance”), whose ADSs are currently

traded on the New York Stock Exchange (NYSE: CNF).

Based on 1,074,291,784 ordinary shares of Fanhua

outstanding as of June 9, 2022, or the Record Date, Fanhua will

distribute 252,995,600 ordinary shares of CNFinance to Fanhua

shareholders on a pro rata basis. Fanhua shareholders will receive

4.71 CNFinance ordinary shares for each 20 outstanding Fanhua

ordinary shares held as of the Record Date, or 0.2355 CNFinance

ADSs for each Fanhua ADS, held as of the close of business on the

record date set by the depositary for the Fanhua ADSs. The

CNFinance ordinary shares and the CNFinance ADSs (each CNFinance

ADS represents 20 CNFinance ordinary shares) are collectively

referred to as the CNFinance Shares. The distribution date is

anticipated to be on or about June 28, 2022 (the “Distribution

Date”). Following the distribution of the CNFinance Shares,

Fanhua’s equity stake in CNFinance will decrease from approximately

18.5% currently to approximately 0.01%.

The Company will not distribute any fractional

CNFinance Shares. The number of fractional CNFinance Shares that

would be distributable to each of the Fanhua shareholders in the

form of ordinary shares will be rounded down to the nearest whole

number and be further rounded down to the nearest integral multiple

of 20.

As the depositary for the Company’s ADSs is

considered one holder on the Company’s books, the number of

CNFinance ordinary shares distributed to the depositary will be

rounded down to the nearest whole number and be further rounded

down to the nearest integral multiple of 20, rather than rounding

occurring on a holder of ADS level. No fractional CNFinance ADSs

will be distributed. Any fractional CNFinance ADSs will be

aggregated and sold on behalf of those holders of Fanhua ADSs who

would otherwise be entitled to receive a fractional CNFinance ADS.

Following the distribution and such sale, it is anticipated that

each eligible holder of Fanhua ADSs will receive a cash payment in

an amount equal to their pro rata share of the total net proceeds

from the sale of fractional ADSs, if any, less any applicable fees

and expenses.

No action or payment is required by Fanhua

shareholders to receive CNFinance Shares. An Information Statement

containing details regarding the distribution of the CNFinance

Shares will be provided to Fanhua shareholders prior to the

Distribution Date. Investors are encouraged to consult with their

financial advisors regarding the specific implications of buying or

selling Fanhua ordinary shares after the ex-dividend date of June

8, 2022.

The gross amount of the distribution of

CNFinance Shares or cash in lieu thereof will be characterized as a

taxable dividend for U.S. federal income tax purposes to the extent

paid out of our current or accumulated earnings and profits, as

determined under U.S. federal income tax principles. Because we do

not intend to determine our earnings and profits on the basis of

U.S. federal income tax principles, any distribution paid will

generally be reported as a “dividend” for U.S. federal income tax

purposes. The amount of the dividend for such tax purposes will be

equal to the sum of (x) the fair market value of CNFinance Shares

received by a U.S. holder and (y) any cash payment in lieu of

fractional CNFinance ADSs paid to a U.S. holder. You should treat

the distribution date of June 28, 2022 as the date of the dividend.

Fanhua shareholders are urged to consult with their tax advisors

with respect to the U.S. federal, state, local and foreign tax

consequences of the distribution.

About Fanhua Inc.

Fanhua Inc. is a leading independent financial

services provider. Through our online platforms and offline sales

and service network, we offer a wide variety of financial products

and services to individuals, including life and property and

casualty insurance products. We also provide insurance claims

adjusting services, such as damage assessments, surveys,

authentications and loss estimations, as well as value-added

services, such as emergency vehicle roadside assistance.

Our online platforms include: (1) Lan Zhanggui,

an all-in-one platform which allows our agents to access and

purchase a wide variety of insurance products, including life

insurance, auto insurance, accident insurance, travel insurance and

standard health insurance products from multiple insurance

companies on their mobile devices; (2) Baowang (www.baoxian.com),

an online entry portal for comparing and purchasing short term

health, accident, travel and homeowner insurance products; and (3)

eHuzhu (www.ehuzhu.com), a non-profit online mutual aid platform

in China.

As of March 31, 2022, our distribution and

service network is consisted of 734 sales outlets covering 23

provinces, autonomous regions and centrally-administered

municipalities and 109 service outlets covering 31 provinces.

For more information about Fanhua Inc., please visit

http://ir.Fanhuaholdings.com/.

Forward-looking Statements

This press release contains statements of a

forward-looking nature. These statements, including the statements

relating to the Company’s future financial and operating results,

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. You can identify these

forward-looking statements by terminology such as “will,”

“expects,” “believes,” “anticipates,” “intends,” “estimates” and

similar statements. Among other things, management's quotations and

the Business Outlook section contain forward-looking statements.

These forward-looking statements involve known and unknown risks

and uncertainties and are based on current expectations,

assumptions, estimates and projections about Fanhua and the

industry. Potential risks and uncertainties include, but are not

limited to, those relating to its ability to attract and retain

productive agents, especially entrepreneurial agents, its ability

to maintain existing and develop new business relationships with

insurance companies, its ability to execute its growth strategy,

its ability to adapt to the evolving regulatory environment in the

Chinese insurance industry, its ability to compete effectively

against its competitors, quarterly variations in its operating

results caused by factors beyond its control and macroeconomic

conditions in China, future development of COVID-19 outbreak and

their potential impact on the sales of insurance products. All

information provided in this press release is as of the date

hereof, and Fanhua undertakes no obligation to update any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although Fanhua believes that the expectations

expressed in these forward-looking statements are reasonable, it

cannot assure you that its expectations will turn out to be

correct, and investors are cautioned that actual results may differ

materially from the anticipated results. Further information

regarding risks and uncertainties faced by Fanhua is included in

Fanhua's filings with the U.S. Securities and Exchange Commission,

including its annual report on Form 20-F.

For more information, please contact:

Investor Relations

Tel: +86 (20) 8388-3191

Email: qiusr@Fanhuaholdings.com

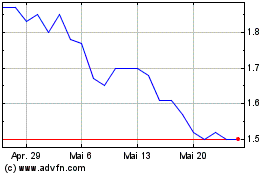

CNFinance (NYSE:CNF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

CNFinance (NYSE:CNF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025