Caterpillar Cuts Outlook Amid Economic Unease -- WSJ

24 Oktober 2019 - 9:02AM

Dow Jones News

By Austen Hufford

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 24, 2019).

Caterpillar Inc. cut its profit forecast for this year, saying

that global economic uncertainty is prompting customers to hold off

on big purchases.

The Deerfield, Ill., maker of construction and mining equipment

said Wednesday that sales fell across most of its product segments

and regions in the latest quarter as its dealers reduced their

inventories and customers bought fewer machines than expected.

Caterpillar now expects sales to decline this year compared to

2018 and cut its profit guidance for a second straight quarter.

"People who are buying large capital equipment are impacted by

the uncertainty in the global economy," Caterpillar financial chief

Andrew Bonfield said in an interview. "Our customers are not in

financial difficulties. Our customers are being cautious."

Its shares were up more than 1% afternoon trade even as its

quarterly revenue fell short of analysts' estimates for the first

time since the final period of 2016. Caterpillar said volume

declines reduced revenue by $751 million, with higher prices

offsetting some of the decline.

The company, which sells its heavy equipment to customers in 193

countries, is widely viewed as a barometer for global economic

health.

This year the world's economy is expected to grow at its slowest

rate since the 2009 recession, according to the International

Monetary Fund. In the U.S., there are concerns that a decline in

manufacturing is starting to weigh on the nation's economy. In

China, business activity is continuing to decelerate.

Caterpillar sells to dealers who then sell to customers. Global

end-user demand rose 6% in the third quarter even as dealers cut

their inventories of products like excavators and pipe layers. The

company expects customer demand to be flat in the current quarter

and for dealers to continue to reduce their inventory levels,

leading to a decline in Caterpillar sales for the period.

"We are taking steps to reduce production to match dealer

demand," Chief Executive Jim Umpleby told analysts Wednesday.

As a major manufacturer with a global supply chain, Caterpillar

is facing higher costs as a result of tariffs enacted by the U.S.

in its trade fight with China and other nations. Caterpillar said

it expects tariff-related costs to be below $250 million this year;

its previous projection was $250 million to $300 million. Its

tariff-related costs last year totaled $110 million.

Caterpillar said it was closely monitoring the economy to see if

further cost reductions were needed.

"We won't make a call as to whether or not we'll have a major

restructuring" Mr. Umpleby said. "We'll see what the market brings

to us over the next few months."

Caterpillar said its third-quarter revenue fell 5.6% to $12.76

billion, below the $13.4 billion expected by analysts polled by

FactSet. Profit per share fell to $2.66 from $2.88 in the same

quarter a year before. Analysts polled by FactSet were expecting

$2.90.

The company now expects earnings per share for the year of

$10.90 to $11.40, compared to its previous expectation of $12.06 to

$13.06. In July the company said it would come in at the low end of

that range.

--

Patrick Thomas

contributed to this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

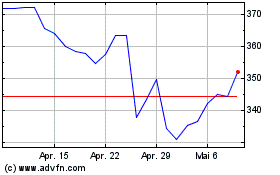

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

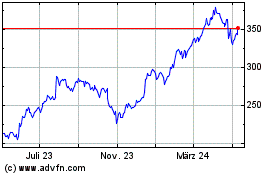

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024