China Sales, Higher Costs Weigh on Caterpillar--Update

25 Juli 2019 - 12:56AM

Dow Jones News

By Austen Hufford

Caterpillar Inc. trimmed back its profit forecast, amid lower

sales in China and higher tariff and labor costs, as the machinery

giant steers through a tricky moment in the global economy.

The maker of bulldozers and excavators said machine sales in

Asia declined 8% in the second quarter due to competitive pricing

pressure and the timing of a Chinese holiday that slowed purchases.

Meanwhile, revenue in the U.S. and Canada grew 11% in the quarter

thanks to strong demand from construction and mining clients.

"China was down" Caterpillar financial chief Andrew Bonfield

said on Wednesday in an interview. "That was more than offset by

the strength of our North American business."

Caterpillar said that earnings per share for the year would now

come in at the low end of its previously given range of $12.06 to

$13.06. Its shares closed down 4.5% on Wednesday.

The Deerfield, Ill., company's list of clients across the global

construction and mining industries make it a barometer for the

state of the industrial economy. While growth in the U.S. remains

relatively robust, the world economy has slowed this year as trade

tensions take a toll on commerce and sentiment.

Earlier this month, China's economic growth decelerated to its

slowest rate in decades. Caterpillar said it expects demand in

China to be stable in the second half of the year.

Caterpillar is also facing higher costs as a result of tariffs

enacted by the U.S. in its trade fight with China and other

nations.

Caterpillar said it had $70 million in costs related to tariffs

in the quarter. On top of $70 million in costs for the first

quarter, that is already more this year than the $110 million in

tariff costs the company booked last year after U.S. tariffs on

foreign steel and aluminum took effect in March 2018. The company

continues to expect $250 million to $300 million in tariff-related

costs this year.

Caterpillar has raised prices that offset those costs, and

higher prices raised the company's operating profit by $427 million

in the quarter.

Weakness in the company's domestic natural-gas business also

weighed on results. Natural-gas prices have fallen 21% this year,

according to FactSet, which has hurt investment in the sector.

Caterpillar saw lower demand for new equipment in the Permian

Basin, an important oil and gas area in the southern U.S.

Spending on infrastructure projects by state and local

governments helped boost construction-equipment sales,

Caterpillar's said, while weak home construction weighed on

results.

Caterpillar also sold a larger number of smaller,

less-profitable machines in the quarter, which had a negative

impact on profit.

"We are selling more machines, but some of the smaller

machines," Mr. Bonfield said.

Caterpillar said second-quarter revenue rose 3% from a year

earlier to $14.43 billion.

Profit per share rose 1 cent to $2.83, coming in below the $3.12

that analysts were expecting, according to FactSet.

The company reported a total profit $1.62 billion, down from

$1.71 billion, as the number of shares outstanding dropped 5%.

--Micah Maidenberg contributed to this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 24, 2019 18:41 ET (22:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

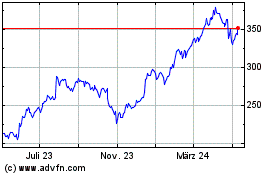

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

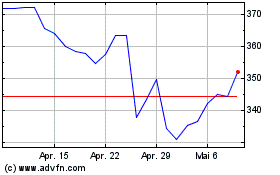

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024