Form 8-K - Current report

01 Februar 2024 - 10:30PM

Edgar (US Regulatory)

false

0001783180

0001783180

2024-01-30

2024-01-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 30, 2024

CARRIER GLOBAL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

001-39220 |

83-4051582 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

13995 Pasteur Boulevard

Palm Beach Gardens, Florida 33418

(Address of principal executive offices, including

zip code)

(561) 365-2000

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock ($0.01 par value) |

|

CARR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

At a regularly scheduled meeting

on January 30, 2024, the independent members of the Board of Directors (the “Board”) of Carrier Global Corporation (“Carrier”

or “we”) approved, following the recommendation of our Compensation Committee, the grant of a supplemental equity award (the

“Supplemental Equity Award”) to our Chief Executive Officer, David Gitlin.

Under Mr. Gitlin’s leadership,

Carrier is implementing a significant portfolio transformation to drive profitable growth and create substantial value for shareowners.

Carrier is at a pivotal moment in this portfolio transformation with the acquisition of Viessmann Climate Solutions and the divestiture

of its Fire & Security and Commercial Refrigeration businesses. The Supplemental Equity Award is designed to incentivize and support

Mr. Gitlin’s long-term retention given his critical role in guiding this transformation and further positioning Carrier as the global

leader in intelligent climate and energy solutions.

The Supplemental Equity Award is

exclusively performance based with rigorous targets tied to adjusted earnings per share growth and stock price appreciation with vesting

over five years, thereby linking it directly to retention as well as the Company’s long-term growth and further promoting the alignment

of Mr. Gitlin’s compensation with long-term shareowner value creation. In approving the award, the Compensation Committee and the

Board also considered the extremely competitive external market by direct peers and broader industrial companies for proven senior executive

talent and high-profile CEOs such as Mr. Gitlin. Mr. Gitlin’s market attractiveness is further heightened by his leadership through

a very successful period for Carrier, resulting in significant shareowner value creation since its spin-off into an independent company

in April 2020. In addition to the required achievement of specific performance hurdles, the award delivers full value only if Mr. Gitlin

remains with Carrier through 2029.

The Supplemental Equity Award was

approved, with the advice and input from the Compensation Committee’s independent compensation consultant, which included a review

of relevant benchmarking data and is in addition to Mr. Gitlin’s annual equity grant, which was approved on the same date.

The Supplemental Equity Award is

in the form of (i) performance share units (“PSUs”), for 446,110 shares at target, and (ii) stock appreciation rights (“SARs”),

for 1,725,330 shares underlying the grant, with an exercise price of $56.33 per share, which represents the closing price on the grant

date. The number of PSU shares earned under the Supplemental Equity Award will be based on the level of performance achieved against adjusted

earnings per share growth (“EPS Growth”) performance goals during the three-year performance period of 2024 through 2026 with

payout ranging from 0% to 200% of the target number of shares. Earned PSUs are subject to time-based vesting and will vest in three equal

annual installments in each of 2027, 2028 and 2029, subject to continuous employment through the vesting date. The SARs granted as part

of the Supplemental Equity Award will cliff vest on the five-year anniversary of the grant date, subject to continuous employment through

such date.

Upon a termination of employment

for any reason (other than death or disability) absent a change in control of Carrier, Mr. Gitlin will forfeit his unvested SARs and PSUs.

Upon a death or disability, Mr. Gitlin’s SARs and PSUs fully vest (with unvested PSUs vesting at target performance). If, in connection

with a change in control, Mr. Gitlin’s unvested SARs and PSUs underlying the Supplemental Equity Award are replaced and Mr. Gitlin

is terminated by Carrier for reasons other than for “cause” or Mr. Gitlin resigns for “good reason”, in either

case, within the 24-months following such change in control, then all unvested SARs and PSUs underlying the Supplemental Equity Award

will vest (with unvested PSUs vesting at the greater of target or actual performance achievement through the change in control date).

There are no retirement-eligible provisions for such award.

Mr. Gitlin’s annual equity award for 2024 will continue to be delivered

in the form of PSUs and SARs, with vesting three years from the grant date, subject to continuous

employment. The number of PSU shares earned under the annual equity award will be based on the level of performance achieved against total

shareholder return relative to a subset of industrial companies in the S&P 500 index. The annual equity awards are subject to the

same qualifying termination and retirement provisions as prior annual equity awards.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 1, 2024 |

CARRIER GLOBAL CORPORATION |

|

| |

|

|

|

| |

By: |

/s/ Kevin O’Connor |

|

| |

|

Name: Kevin O’Connor

Title: Senior Vice President and Chief Legal Officer |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

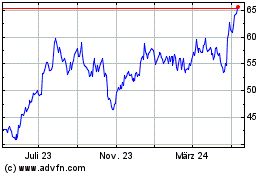

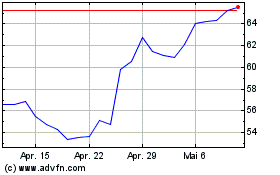

Carrier Global (NYSE:CARR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Carrier Global (NYSE:CARR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024