0001861449false00018614492023-09-222023-09-220001861449us-gaap:CommonClassAMember2023-09-222023-09-220001861449us-gaap:WarrantMember2023-09-222023-09-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 22, 2023

Bird Global, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-41019 | | 86-3723155 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

392 NE 191st Street #20388

Miami, Florida 33179

(Address of principal executive offices and Zip code)

(866) 205-2442

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | BRDS | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable to purchase one share of Class A common stock at an exercise price of $11.50 per share | | BRDS WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On September 22, 2023, Bird Global, Inc. (the “Company”) received a written notice (the “Notice”) from the New York Stock Exchange (“NYSE” or the “Exchange”) that the NYSE would delist the Company’s shares of Class A common stock and warrants (the “Securities”) from the Exchange upon market open on September 25, 2023. Beginning September 25, 2023, trading of the Securities was suspended.

NYSE Regulation’s staff decided to delist the Securities because the Company failed to maintain an average global market capitalization of at least $15,000,000 over a consecutive 30 trading day period, as required by Section 802.01B of the NYSE Listed Company Manual. The Company has a right to appeal this determination, provided that it files a written request for such review within ten business days after receiving the Notice. The Company’s board of directors (the “Board”) intends to appeal the NYSE’s determination to delist the Securities. There can be no assurance of the outcome of any such appeal or that the Exchange will reconsider its decision to delist the Company in light of such appeal.

The Company anticipates the Securities will continue to trade on the OTC Market. The Company expects the Class A common stock to trade under the symbol “BRDS” and the warrants to trade under the symbol “BRDSW.” The Company also expects the Securities to be listed for trading on the OTCQX, which is the highest tier of the OTC Market, and has taken steps necessary to pursue such listing. The Company cannot provide assurance that its common stock will continue to trade on the OTC Market, that brokers will continue to provide public quotes of the Company’s common stock, that the brokers will develop a market for the Company’s common stock, or that the trading volume of the Company’s common stock will be sufficient enough to generate an efficient trading market.

Item 7.01 Regulation FD Disclosure.

On September 22, 2023, the Company issued a press release announcing NYSE’s decision to delist the Securities from the Exchange. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and incorporated herein by reference.

The information contained in Item 7.01 of this Current Report (including Exhibit 99.1 hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act, or the Exchange Act, except as otherwise expressly stated in such filing.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this Current Report may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements other than statements of historical fact contained in this Current Report including, but not limited to, the trading of the Securities on the OTC and OTCQX, business strategy and plans, the anticipated impacts from the acquisition of Skinny Labs, Inc. (d/b/a Spin) (the “Spin Acquisition”), and our decision to appeal and the success of any such appeal of the NYSE delisting decision. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to the expansion plans, opportunities, and costs relating to the Spin Acquisition. Other factors may also cause the Company’s actual results to differ materially from those expressed or implied in the forward-looking statements and such factors are discussed in the Company’s filings with the U.S. Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and subsequent reports filed by the Company with the SEC. Copies of the Company’s filings with the SEC may be obtained at the “SEC Filings” section of the Company’s website at www.bird.co or on the SEC’s website at www.sec.gov.

Nothing in this Current Report should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. The forward-looking statements included in this Current Report are made as of the date hereof. The Company is not under any obligation to (and expressly disclaims any such obligation) to update any of the information in this Current Report if any forward-looking statement later turns out to be inaccurate, whether as a result of new information, future events or otherwise, except as otherwise may be required by the federal securities laws.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

No. | | Description |

| |

| 99.1 | | |

| 104 | | Cover page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Bird Global, Inc. | | |

| | | | |

| Date: September 26, 2023 | | | | By: | | /s/ Michael Washinushi | | |

| | | | Name: | | Michael Washinushi | | |

| | | | Title: | | Interim Chief Executive Officer | | |

September 22, 2023 Bird Announces Suspended NYSE Trading, Will Begin Trading on the OTC Exchange Effective September 25, 2023 Business is on Track with the Integration of Recently Acquired Spin Company Intends to Appeal Determination MIAMI--(BUSINESS WIRE)-- Bird Global, Inc. (NYSE:BRDS) (“Bird” or the “Company”) a leader in environmentally friendly electric transportation, today announced it received notice from the New York Stock Exchange (“NYSE”) that NYSE will suspend trading of, and commence proceedings to, delist shares of Bird’s Class A common stock, effective at the open of business eastern standard time on September 25, 2023. The determination was made in connection with Bird's non-compliance with an NYSE listing requirement necessitating a market cap of greater than $15 million over a consecutive 30-day period. The Company does not believe the current market cap is reflective of the intrinsic value of the business and intends to appeal this determination by the NYSE. If the Company is successful in its appeal, NYSE will resume trading the Company’s Class A common stock. In the interim, the Company will remain listed on the NYSE. Following the suspension of the Company's Class A common stock on NYSE, the Company’s Class A common stock intends to trade on the OTC exchange (“OTC”) operated by OTC Markets Group Inc. and will commence trading next week. For quotes or additional information on the OTC, please visit otcmarkets.com. Bird intends to continue to operate in strict compliance with public company SEC regulations and other NYSE listing requirements, including filing quarterly financial statements, having independently audited financials, and maintaining an independent Board of Directors with strict corporate governance rules and oversight committees. Beginning in early January 2023, Bird’s Board of Directors (the “Board”) initiated a multi-step plan to improve financial and operational performance. Since then, Bird management has implemented leadership and operational restructuring and carried out various cost-saving initiatives. “Each of these steps was foundational to the Company’s recent strategic acquisition of Spin, which we believe was both integral and pivotal to building out a plan to become cash flow positive and to generate more value for Bird’s stockholders in the long- term. In addition, it is our expectation that the Company’s strategic plan to increase stockholder value will enable it to meet NYSE listing standards in the future,” said John Bitove, Chair of the Board of Directors of the Company. “We firmly believe that BRDS current market cap does not reflect the intrinsic value of the Company. And while disappointing, this change in our listing status on the NYSE does not

alter our commitment to our shareholders, our valued employees across Bird and Spin, our partners and the many global cities and institutions with which we work," said Michael Washinushi, Bird’s Interim CEO. “Our talented team and unwavering dedication to our mission of a more sustainable future are the cornerstones of our success, and they will continue to guide us. Bird’s fundamentals remain strong, and our vision for the future is as promising as ever. We believe the acquisition of Spin has made our prospects even stronger.” About Bird Bird, the largest micromobility operator in North America, is an electric vehicle company dedicated to bringing affordable, environmentally friendly transportation solutions such as e- scooters and e-bikes to communities across the world. Bird and Spin's cleaner, affordable, and on-demand mobility solutions, including Bird and Spin, are available in 350 cities, primarily across Canada, the United States, Europe, the Middle East, and Australia. We take a collaborative, community-first approach to micromobility. Bird and Spin partner closely with the cities in which it operates to provide a reliable and affordable transportation option for people who live and work there. For more information on Bird, visit www.bird.co and for more information on Spin, visit www.spin.app. Forward-looking Statements Certain statements in this press release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements other than statements of historical fact contained in this press release including, but not limited to, the trading of the Company’s Class A common stock on the OTC OTCQB and OTCQX, business strategy and plans, the anticipated impacts from the acquisition of Skinny Labs, Inc. (d/b/a Spin) (the “Spin Acquisition”), our decision to appeal and the success of any such appeal of the NYSE delisting decision, and the Company’s compliance with public company SEC regulations. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Bird and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to the expansion plans, opportunities, and costs relating to the Spin Acquisition. Other factors may also cause Bird’s actual results to differ materially from those expressed or implied in the forward-looking statements and such factors are discussed in Bird’s filings with the U.S. Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and subsequent reports filed by Bird with the SEC. Copies of Bird’s filings with the SEC may be obtained at the “SEC Filings” section of Bird’s website at www.bird.co or on the SEC’s website at www.sec.gov. Nothing in this press release should be regarded as a representation by any person that the

forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. The forward-looking statements included in this press release are made as of the date hereof. Bird is not under any obligation to (and expressly disclaims any such obligation to) update any of the information in this press release if any forward-looking statement later turns out to be inaccurate, whether as a result of new information, future events or otherwise, except as otherwise may be required by the federal securities laws. View source version on businesswire.com: https://www.businesswire.com/news/home/20230922035120/en/ Media Contact Press@bird.co Investor Contact Investor@bird.co Source: Bird Global, Inc.

v3.23.3

Cover

|

Sep. 22, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 22, 2023

|

| Entity Registrant Name |

Bird Global, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41019

|

| Entity Tax Identification Number |

86-3723155

|

| Entity Address, Address Line One |

392 NE 191st Street #20388

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33179

|

| City Area Code |

(866)

|

| Local Phone Number |

205-2442

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001861449

|

| Amendment Flag |

false

|

| Common Class A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

BRDS

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable to purchase one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

BRDS WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

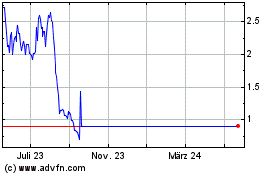

Bird Global (NYSE:BRDS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bird Global (NYSE:BRDS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024