Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 September 2024 - 12:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

23 September 2024

BHP GROUP

LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE, VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): n/a

BHP Bringing people and resources together to build a better world NOTICE OF MEETING 2024

2 BHP Notice of Meeting 2024 Contents Invitation from the Chair 2 Notice of Annual General Meeting 6 Explanatory Notes 8 Participating

and Voting 18 Invitation from the Chair 23 September 2024 Dear Shareholders, I am pleased to invite you to the 2024 Annual General Meeting (AGM) of BHP Group Limited (BHP). The AGM will be held on Wednesday 30 October 2024 at 10:00am (Brisbane

time). I am delighted that we will meet with shareholders in person again this year. For those shareholders not able to join us in person, we invite you to participate in the meeting by submitting questions and your proxy vote in advance of the

meeting. You may also watch the webcast live online at bhp.com/agm. Details can be found in this Notice of Meeting. FY2024 and our priorities Our operational and financial performance was strong in FY2024 and we made solid progress against our

social value and sustainability commitments. It is more than four years since we began the strategic transformation of BHP’s portfolio towards future-facing commodities and the world has changed markedly in that time. Today, BHP has a portfolio

of world class assets focused on products that are critical to the future. However, FY2024 was overshadowed by a fatality. We are deeply saddened by the fatality of a team member at the BMA Saraji mine in Queensland. Our heartfelt thoughts and

condolences go to their family and friends. Safety is our top priority and our commitment to zero fatalities and serious injuries at BHP is unwavering. 2024 Climate Transition Action Plan Our 2024 Climate Transition Action Plan (2024 CTAP) provides

an update on our climate strategy and our progress and plans in relation to our greenhouse gas emissions goals and targets. Our plan reaffirms our intent to play our part in the global effort to achieve the world’s net zero ambitions –

producing more of the essential commodities the world needs to develop and decarbonise, investing to reduce our operational greenhouse gas emissions, and collaborating to support lower greenhouse emissions in our value chain. BHP Group Limited ABN

49 004 028 077 is registered in Australia. Registered office: 171 Collins Street, Melbourne, Victoria, 3000, Australia.

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 3 Throughout the year, I have

engaged with investors and stakeholders on our climate change strategy. Our 2024 CTAP was released with our Annual Reporting suite in August 2024, and continues our multi-decade focus on climate and underscores our commitment to becoming a more

sustainable and resilient business. This is important work that will help set us up to grow long-term value for shareholders. There will be a ‘Say on Climate’ vote at the 2024 AGM and I recommend you vote in favour of our 2024 CTAP in Item

13. Our 2024 CTAP is available at bhp.com/CTAP2024. Board succession Our structured Board renewal process continued in FY2024 and our Board remained gender balanced. Ross McEwan joined the Board as a Non-executive Director on 3 April 2024. Ross

has significant experience in the financial services industry with deep expertise in capital allocation, risk management and value creation in complex regulatory environments. Don Lindsay also joined the Board as a Non executive Director on

1 May 2024 and brings over 40 years of global experience in the resources sector and investment banking, including in mining and resource development, financial markets, growth and value creation. Ross and Don are both seeking election at the

2024 AGM and the remaining Directors will seek re-election in line with our policy for annual Director elections. In April 2024, Ian Cockerill retired from the Board and in October 2023, we farewelled Terry

Bowen who also retired from the Board. We benefited greatly from Ian and Terry’s extensive experience and I would like to thank them for their contribution and commitment to BHP during their time on the Board. Board recommendation The Board

considers the resolutions in Items 2 to 13 are in the best interests of BHP shareholders and recommends you vote in favour of those Items. Thank you for your continued support of BHP. I encourage you to join us at the AGM and look forward to meeting

our shareholders on the day. Yours sincerely Ken MacKenzie Chair “Our operational and financial performance was strong in FY2024 and we made solid progress against our social value and sustainability commitments.”

4 BHP Notice of Meeting 2024 Our performance highlights Operational Highest copper production in over 15 years Highest production in

four years at Escondida, record production at Spence and Carrapateena, and successful integration at Copper South Australia. Production record at WAIO Second consecutive year of record iron ore production at Western Australia Iron Ore (WAIO),

through ongoing incremental supply chain improvements. Refining our steelmaking coal portfolio Successfully completed the sale of Blackwater and Daunia, further focusing our portfolio on higher-quality steelmaking coal. Jansen potash project

tracking to plan Jansen Stage 1 more than 50 per cent complete. We are on track to be a major global producer of potash by the end of the decade. Social value Decarbonisation Operational greenhouse gas (GHG) emissions (Scopes 1 and 2 emissions)

1% on FY2023 but remain on track to meet our medium term target by FY2030 1 Indigenous partnerships Record Indigenous procurement spend US$609 m up 83% on FY2023 1. For more information on the calculation of this metric and on our GHG emissions

targets and goals refer to section 6.9 of the BHP Operating and Financial Review, in the BHP Annual Report 2024, released 27 August 2024.

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 5 Financial 146USc Dividend per

share FY2023 170USc 269.5USc Underlying earnings per share FY2023 265.0USc Profit from 17.5 bn operations US$ FY2023 US$22.9 bn Total payments 11.2 bn to governments US$ FY2023 US$13.8 bn Healthy environment Area under nature-positive management

practices2 83 k hectares up 3,295 hectares since FY2023 Thriving, empowered communities Total economic contribution³ US$ We contributed US$ 41.5 bn to suppliers, and social community investments , employees and governments during the year. This

was 84% of our total economic contribution. 2024 Climate Transition Action Plan The 2024 CTAP provides an update on BHP’s climate change strategy. It explains our greenhouse emissions targets and goals and provides an update on our progress and

plans across the key aspects of our climate change strategy. Item 13 in this Notice of Meeting is an advisory vote in relation to BHP’s 2024 CTAP. The 2024 CTAP is available at bhp.com/CTAP2024. 2. For more information on this metric and our

nature related goals and targets refer to section 6.10 of the BHP Operating and Financial Review, in the BHP Annual Report 2024, released 27 August 2024. 3. For more information on our total economic contribution, refer to the BHP Economic

Contribution Report 2024, released 27 August 2024.

6 BHP Notice of Meeting 2024 Notice of Annual General Meeting Notice is given that the 2024 Annual General Meeting (AGM) of BHP Group

Limited (BHP) will be held at the Royal International Convention Centre, 600 Gregory Terrace, Bowen Hills, Brisbane, Queensland on Wednesday 30 October 2024, starting at 10:00am (Brisbane time). If it is necessary or appropriate for BHP to make

changes to the AGM arrangements or to give further updates, information will be provided on BHP’s website and lodged with the relevant stock exchanges. The Explanatory Notes and information about participating and voting form part of this

Notice of Meeting and provide important information regarding the items of business to be considered at the AGM.

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 7 Items of business Item 1

Financial Statements and reports To consider the Financial Statements for BHP Group Limited and reports of the Directors and the Auditor for the year ended 30 June 2024. Items 2 to 10 Election and

re-election of Non-executive Directors Item 2 To elect Don Lindsay as a Director of BHP Group Limited. Item 3 To elect Ross McEwan as a Director of BHP Group Limited.

Item 4 To re-elect Xiaoqun Clever Steg as a Director of BHP Group Limited. Item 5 To re-elect Gary Goldberg as a Director of BHP Group Limited. Item 6 To re-elect Michelle Hinchliffe as a Director of BHP Group Limited. Item 7 To re-elect Ken MacKenzie as a Director of BHP Group Limited. Item 8 To

re-elect Christine O’Reilly as a Director of BHP Group Limited. Item 9 To re-elect Catherine Tanna as a Director of BHP Group Limited. Item 10 To re-elect Dion Weisler as a Director of BHP Group Limited. Item 11 Adoption of the Remuneration Report To adopt the Remuneration Report for BHP Group Limited for the year ended 30 June 2024. This is a non-binding advisory vote. A voting exclusion applies to this resolution. Item 12 Approval of equity grants to the Chief Executive Officer To approve the grant of awards to the Chief Executive Officer, Mike Henry,

under the Group’s Cash and Deferred Plan and Long-Term Incentive Plan as set out in the Explanatory Notes to this Notice of Meeting. A voting exclusion applies to this resolution. Item 13 Approval of the 2024 Climate Transition Action Plan To

approve the 2024 Climate Transition Action Plan. This is a non-binding advisory vote.

8 BHP Notice of Meeting 2024 Explanatory Notes Item 1 Financial Statements and reports The Corporations Act requires BHP to lay before

the AGM its financial report, Directors’ Report and Auditor’s Report for the financial year ended 30 June 2024. This Item does not require a vote, but shareholders will be given a reasonable opportunity as a whole to ask questions or

make comments about the management of BHP. Ernst & Young (EY), BHP’s Auditor, will also be present at the meeting. Shareholders as a whole will be given a reasonable opportunity to ask EY questions about the conduct of the audit, the

preparation and content of the Auditor’s Report, the accounting policies adopted by BHP in relation to the preparation of the Financial Statements, and the independence of the Auditor in relation to the conduct of the audit. The reports are

contained in BHP’s Annual Report 2024, available on BHP’s website at bhp.com/investors/ annual-reporting. Items 2 to 10 Election and re-election of

Non-executive Directors Don Lindsay and Ross McEwan are seeking election by shareholders for the first time, having each been appointed as a Director after the 2023 AGM. The remaining Non executive Directors

retire and submit themselves for re-election. The biographical details, relevant qualifications, experience and skills of each of the Non-executive Directors standing for election or re-election are set out on the following pages. Under BHP’s Constitution, at least one third of Directors must retire (and may seek re-election) at each AGM. However, the

Board has adopted a policy under which all Non-executive Directors must seek re-election annually. The Board annually reviews the performance of each Director seeking re-election at the AGM. The Nomination and Governance Committee has also reviewed the composition of the Board. Based on these reviews and for the reasons outlined on the following pages, the Board considers all

Directors seeking election or re-election demonstrate commitment to their role. The contribution of each Director is and continues to be important to BHP’s long-term sustainable success. The Board as a

whole has an appropriate mix of skills, backgrounds, knowledge, experience and diversity to operate effectively. All Non-executive Directors have been determined by the Board to be independent, on the basis that they are free of any interest,

position or relationship that might influence or reasonably be perceived to influence in a material respect their capacity to bring an independent judgement to bear on issues before the Board and to act in the best interests of BHP as a whole rather

than in the interests of an individual security holder or other party. The Corporate Governance Statement 2024, available on BHP’s website at bhp.com/investors/annual-reporting, contains more information on the independence of Directors. The

Board (with the relevant Director seeking election or re-election abstaining) recommends shareholders vote in favour of Items 2 to 10 for the reasons set out on the following pages. Item 2 Don Lindsay BS

(Hons), MBA Independent Non-executive Director Appointment Independent Non-executive Director since May 2024 Skills and experience Don Lindsay has more than 40

years’ global experience, including in mining and resource development, financial markets, transformational leadership, growth and value creation. Don was the President and Chief Executive Officer of Teck Resources Limited (from 2005 to 2022)

and prior to that, worked for almost 20 years with CIBC World Markets Inc., where he served as President, Head of Investment and Corporate Banking and Head of the Asia Pacific Region. Don also served as Chair of the Board of Governors for Mining and

Metals for the World Economic Forum, Chair of the Business Council of Canada and Chair of the International Council on Mining and Metals. Don brings extensive experience in global resource development, as well as sustainability, community health,

safety and global education and business forums. His technical and management experience across a range of commodities and mining jurisdictions brings a unique understanding of prospective resources, cost of development and operations and the

assessment of opportunities to strengthen the portfolio of world-class assets. Prior to his appointment, BHP undertook appropriate background and experience checks on Don. Current appointments Don is Chair of the Board of Manulife Financial

Corporation (since February 2023) and the Invictus Games Vancouver Whistler 2025 (since November 2022). Committee membership Risk and Audit Committee Sustainability Committee

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 9 Item 3 Ross McEwan BBus

Independent Non-executive Director Appointment Independent Non-executive Director since April 2024 Skills and experience Ross McEwan has over 30 years’ global

executive experience, including in the financial services industry, with deep expertise in capital allocation, risk management and value creation in complex regulatory environments. Ross was the CEO of National Australia Bank (from 2019 to April

2024) and Group CEO of the Royal Bank of Scotland (from 2013 to 2019). Prior to that, he held executive roles at Commonwealth Bank of Australia, First NZ Capital Securities and National Mutual Life Association of Australasia/AXA New Zealand. Ross

brings a strong focus on people and culture, technology and innovation and has extensive experience in capital allocation and value creation. He has worked closely with a wide range of stakeholders, including customers, governments and regulators

and brings a global perspective. He has a deep understanding of organisational transformation and brings a very strong focus on the customer and technology as a driver of change. Prior to his appointment, BHP undertook appropriate background and

experience checks on Ross. Current appointments Ross is currently on the Board of QinetiQ Group Plc (since March 2024) and Ruminant Biotech Corp Limited (since June 2021). Ross will be the Lead Independent Director of Reece Limited from

1 October 2024. Committee membership Risk and Audit Committee People and Remuneration Committee Item 4 Xiaoqun Clever-Steg Diploma in Computer Science and International Marketing, MBA Independent

Non-executive Director Appointment Independent Non-executive Director since October 2020 Skills and experience Xiaoqun Clever Steg has over 20 years’ experience in

technology with a focus on software engineering, data and AI, cybersecurity and digitalisation. Xiaoqun was formerly Chief Technology Officer of Ringier AG and ProSiebenSat.1 Media SE and Chief Operating Officer of Technology and Innovation at SAP

and President of SAP Labs China. Xiaoqun brings significant expertise in the development, selection and implementation of business transforming technology, innovation and assessment of opportunities and risks in digital disruption. She has knowledge

and relationships across the technology and innovation start up sector across Europe, Asia and North America and brings depth to the Board’s review of managing cybersecurity risks as well as assessment of opportunities to invest in proven and

emerging technologies in the discovery of new mineral deposits, safer and more cost effective processing, and technologies to reduce greenhouse emissions and support the energy transition. Current appointments Xiaoqun is a Non-executive Director of Amadeus IT Group SA (since June 2020), Non executive Director of Straumann Group (since April 2024) and on the Supervisory Board of Infineon Technologies AG (since February 2020). Committee

membership Risk and Audit Committee

10 BHP Notice of Meeting 2024 Explanatory Notes continued Item 5 Gary Goldberg BS (Mining Engineering), MBA Independent Non-executive Director and Senior Independent Director Appointment Independent Non-executive Director since February 2020 Senior Independent Director since December 2020

Skills and experience Gary Goldberg has over 40 years’ global executive experience, including deep experience in mining, strategy, risk, commodity value chain, capital allocation discipline and public policy. Gary was the Chief Executive

Officer of Newmont Corporation (from 2013 to 2019), and prior to that, President and Chief Executive Officer of Rio Tinto Minerals. Gary has also been a Non-executive Director of Port Waratah Coal Services Limited and Rio Tinto Zimbabwe, and served

as Vice Chair of the World Gold Council, Treasurer of the International Council on Mining and Metals, Co Chair of the World Economic Forum Mining and Metals Industry community and Chair of the National Mining Association in the United States. Gary

is recognised for his leadership in bringing the mining industry together to raise standards in safety and environmental performance in conjunction with community and government partnerships in America and around the world. He has management

experience in implementing strategies focused on safety, decarbonisation and transformational investment for commodities with long dated cycles, along with his contribution to policy development in environmental management globally. Current

appointments Gary is a Director of Imperial Oil Limited (since May 2023). Committee membership Sustainability Committee Nomination and Governance Committee Item 6 Michelle Hinchliffe BCom, FCA, ACA Independent

Non-executive Director Appointment Independent Non-executive Director since March 2022 Skills and experience Michelle Hinchliffe has over 20 years’ experience as a

partner in KPMG’s financial services division. Michelle was formerly a partner of KPMG and held a number of roles, including as the UK Chair of Audit, a member of the KPMG UK Executive Committee, and led KPMG’s financial services practice

in Australia and was a member of the KPMG Australia Board. Michelle has expertise and experience in understanding the complexities of multi-national firms operating in multiple reporting and regulatory frameworks across Europe, the Americas, Asia

and Africa. Her financial expertise and audit experience across a range of industries and businesses, including in Australia, bring insights to the Board on BHP’s assessment of risk, returns and its long term capital plan to create financial

strength and support BHP’s future growth. Current appointments Michelle is a Non executive Director of Santander UK plc and Santander UK Group Holdings Plc (since June 2023) and Macquarie Group Limited and Macquarie Bank Limited (since March

2022). Committee membership Risk and Audit Committee (Chair) Nomination and Governance Committee

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 11 Item 7 Ken MacKenzie BEng,

FIEA, FAICD Chair and Independent Non-executive Director Appointment Independent Non-executive Director since September 2016 Chair since 1 September 2017 Skills and

experience Ken MacKenzie has global executive experience and a deeply strategic approach, with a focus on operational excellence, capital discipline and the creation of long-term shareholder value. Ken was the Managing Director and Chief Executive

Officer of Amcor Limited, a global packaging company with operations in over 40 countries, from 2005 until 2015. Ken brings business management and leadership skills in global supply chains and governance gained during his career in developed and

emerging markets in the Americas, Australia, Asia and Europe. Ken has experience in leading strategic transformation at a business and enterprise-wide level. His commitment to continuous learning and skills development provides valuable insights to

Board deliberations and guidance to BHP’s leadership team in navigating the fast-changing dynamics of the global economy and markets. Current appointments Ken is the Chair of Melbourne Business School Limited (since June 2023), sits on the

Advisory Board of American Securities Capital Partners LLC (since January 2016), and is a part time adviser at Barrenjoey (since April 2021). Committee membership Nomination and Governance Committee (Chair) Item 8 Christine O’Reilly BBus

Independent Non-executive Director Appointment Independent Non-executive Director since October 2020 Skills and experience Christine O’Reilly has over 30

years’ experience in the financial and infrastructure sectors, with deep financial and public policy expertise and experience in large-scale capital projects and transformational strategy. Christine was the Chief Executive Officer of the GasNet

Australia Group and Co Head of Unlisted Infrastructure Investments at Colonial First State Global Asset Management, following an early career in investment banking and audit at Price Waterhouse. Christine has also served as a Non-executive Director of Medibank Private Limited (from March 2014 to November 2021), Transurban Group (from April 2012 to October 2020), CSL Limited (from February 2011 to October 2020) and Energy Australia

Holdings Limited (from September 2012 to August 2018). Christine has a deep understanding of financial drivers of the businesses and experience in capital allocation discipline across sectors that have long-dated paybacks for shareholders and

stakeholders. Her insights into cost efficiency and cash flow as well as the impact of policy on innovation, investment and project development are key inputs for the Board. Current appointments Christine is a Non executive Director of Australia and

New Zealand Banking Group (since November 2021), Stockland Limited (since August 2018 and will retire on 21 October 2024), and Infrastructure Victoria (since November 2023). Christine will be the Chair of Australia Pacific Airports Corporation

from 1 October 2024. Committee membership People and Remuneration Committee (Chair) Nomination and Governance Committee Risk and Audit Committee

12 BHP Notice of Meeting 2024 Explanatory Notes continued Item 9 Catherine Tanna LLB, Honorary Doctor of Business Independent Non-executive Director Appointment Independent Non-executive Director since April 2022 Skills and experience Catherine Tanna has more than 30 years’ experience in the

resources, oil and gas, power generation and retailing sectors. Catherine was formerly Managing Director of Energy Australia between 2014 and 2021. Prior to this, she held senior executive roles with Shell and BG Group with responsibility for

international operations across Africa, North Asia, Russia, North America, Latin America and Australia. Catherine was also a member of the Board of the Reserve Bank of Australia (from 2011 to 2021) and a Director of the Business Council of Australia

(from 2016 to 2021). Catherine has a track record in leading cultural change and sponsoring gender equity, diversity and inclusion across business and more broadly. She brings an understanding of and contribution to complex regulatory and policy

environments. Catherine’s experience in seeking to align customer and community expectations, particularly Indigenous communities, with those of the enterprise and regulators provides unique insight and input to the Board. Current appointments

Catherine is a Non-executive Director at Bechtel Corporation (since May 2023), Chair of Bechtel Australia (since December 2023), Senior Advisor at McKinsey & Company Inc (since April 2022) and a member of the Advisory Board of Fujitsu

Australia (since February 2022). Committee membership Sustainability Committee (Chair) People and Remuneration Committee Nomination and Governance Committee Item 10 Dion Weisler BASc (Computing), Honorary Doctor of Laws Independent Non-executive Director Appointment Independent Non-executive Director since June 2020 Skills and experience Dion Weisler has extensive global executive experience, including

transformation and commercial experience in the global information technology sector, with a focus on capital discipline and stakeholder engagement. Dion was formerly a Director and the President and Chief Executive Officer of HP Inc. (from 2015 to

2019) and continued as a Director and Senior Executive Adviser (until May 2020). He previously held senior executive roles at Lenovo Group Limited, was General Manager Conferencing and Collaboration at Telstra Corporation and held various positions

at Acer Inc., including as Managing Director, Acer UK. Dion brings experience in transforming megatrends into opportunities and growth and valuable insight on the power of innovation, technology and data. His experience also demonstrates insights

into strategy development in the global energy transition, where safety, decarbonisation and stakeholder management are critical. Current appointments Dion is a Non-executive Director of Intel Corporation

(since June 2020) and a Non-executive Director of Thermo Fisher Scientific Inc. (since March 2017). Committee membership Sustainability Committee People and Remuneration Committee

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 13 Item 11 Adoption of the

Remuneration Report The Remuneration Report is on pages 115 131 of BHP’s Annual Report 2024. It includes information about our remuneration framework and remuneration arrangements for our Key Management Personnel (KMP) during FY2024. The vote

on this Item is advisory only and does not bind the Directors or BHP. However, the Board will take the outcome of the vote into account when reviewing BHP’s remuneration framework. Shareholders will have a reasonable opportunity as a whole to

ask questions about or make comments on the Remuneration Report. Voting exclusion statement BHP will disregard any votes cast on Item 11: – by or on behalf of a member of BHP’s KMP who are named in BHP’s Remuneration Report for the

year ended 30 June 2024 or their closely related parties, regardless of the capacity in which the vote is cast; or – as a proxy by a person who is a member of BHP’s KMP at the date of the AGM or their closely related parties, unless

the vote is cast as proxy for a person entitled to vote on Item 11: – in accordance with a direction in the proxy form; or – by the Chair of the AGM pursuant to an express authorisation in the proxy form to exercise the proxy even though

Item 11 is connected with the remuneration of BHP’s KMP. The Board recommends shareholders vote in favour of this Item. Item 12 Approval of equity grants to the Chief Executive Officer BHP is seeking shareholder approval to grant Mike Henry,

the Chief Executive Officer and an Executive Director of BHP, the following securities under BHP’s Equity and Cash Incentive Plan rules (BHP’s Incentive Plan Rules), which were adopted by BHP’s People and Remuneration Committee on

25 September 2023. The incentives will be granted under two separate schemes: Scheme Grant Cash and Deferred Plan (CDP) 35,042 CDP two year awards and 35,042 CDP five year awards (CDP awards) Long-Term Incentive Plan (LTIP) 127,848 LTIP awards

with a face value equal to 200% of Mike’s annual base salary at the date of grant (i.e. US$1.893 million x 200% = US$3.786 million) (LTIP awards) If Item 12 is approved by shareholders, awards will be made under BHP’s Incentive Plan

Rules for the CDP and LTIP awards on the terms set out below. Each CDP and LTIP award is a conditional right to one fully paid ordinary share in BHP, subject to meeting the applicable service and/or performance conditions. These conditional rights

have been proposed as they create share price alignment between Mike and ordinary shareholders but do not provide him with the full benefits of share ownership (such as dividends and voting rights) unless and until the awards vest. Under Australian

Securities Exchange (ASX) Listing Rule 10.14, shareholder approval is required for an issue of BHP securities to Directors. Approval would not be required where the terms of the grant require that the underlying shares are purchased on-market. The Board is seeking shareholder approval in the interests of transparency and good governance, and to preserve flexibility for BHP to issue shares or purchase shares on market at the relevant time.

14 BHP Notice of Meeting 2024 Explanatory Notes continued CDP awards BHP is seeking shareholder approval to grant CDP awards to Mike

Henry on the following basis: Key term Description Number of 35,042 CDP two year awards and 35,042 CDP five year awards. CDP awards Value of the As set out in the Remuneration Report released August 2024, the Board assessed Mike’s CDP awards

performance against a FY2024 scorecard containing CDP performance conditions and determined the value of the FY2024 CDP awards for Mike was US$3.113 million. Under the CDP award terms: one third is paid in cash in September 2024; one third is

granted as CDP two year awards; and one third is granted as CDP five year awards (subject to a review as set out below). Approval is being sought in relation to the grant of CDP two year awards and CDP five year awards. How the The proposed number

of CDP awards to be granted to Mike was calculated using the number of following formula: CDP awards – the maximum value of the CDP grant (being US$1.038 million for the CDP two year awards was calculated and US$1.038 million for the

CDP five year awards) multiplied by – the US$/A$ exchange rate (being the average exchange rate over the 12 months up to and including 30 June 2024, to convert the award value into Australian dollars) divided by – the average daily

closing price of BHP shares traded on the ASX over the 12 months up to and including 30 June 2024, and – rounded down to the nearest whole number of awards. Vesting Subject to the ‘cessation of employment’ provision below,

vesting of the CDP two year awards and conditions the CDP five year awards are subject to Mike’s continued employment with BHP until the end of the relevant vesting period. The vesting of the CDP five year awards is also subject to a

satisfactory performance underpin, which encompasses a holistic review of performance at the end of the vesting period, including a review of safety and sustainability performance, profitability, cash flow, balance sheet health, returns to

shareholders, corporate governance and conduct over the five year period. Vesting of On vesting, each CDP award will entitle Mike to receive one share in BHP (unless the Board CDP awards exercises its discretion to settle vested awards with a cash

payment of equivalent value instead). Before vesting, the awards do not carry entitlements to ordinary dividends or other shareholder rights. A dividend equivalent payment (DEP) is provided on vested CDP awards in either cash or additional shares.

The DEP is calculated as the value of dividends that would have been received over the vesting period if Mike had held shares in BHP, and where shares are provided, the DEP amount is divided by the closing price of BHP shares on the date prior to

vesting. The decision to vest CDP awards is subject to the overriding discretion of the Board, which may adjust vesting outcomes upwards or downwards (including to zero) if appropriate, even if performance criteria has or has not been satisfied,

including to better reflect shareholder expectations, to take into account the total value of the award at the time of any vesting, to account for personal or Group performance or any other factor that the Board reasonably determines is appropriate

to take into account in the circumstances. The Board may also impose dealing restrictions on any shares that vest. Malus and BHP’s Incentive Plan Rules allow the Board to reduce or clawback CDP awards (including any clawback DEP) in a range of

circumstances, including where the participant acts fraudulently or dishonestly, is in material breach of their obligations to BHP, or where vesting is not justified or supportable in the circumstances. The Board can also suspend or delay vesting

until the outcome of any investigation is known. Cessation of ‘Good leaver’ treatment will apply where the cessation of employment with BHP is due to retirement, employment retrenchment or redundancy or termination by mutual agreement, or

such other circumstances that do not constitute resignation or termination for cause, unless the Board decides otherwise. For a ‘good leaver’, they may receive a pro rated cash award based on performance for that year, and their unvested

CDP two year awards and a pro rated portion of their unvested CDP five year awards (pro-rated for the portion of the vesting period served) will remain on foot unless the Board determines otherwise. Where a

participant is not a ‘good leaver’, all unvested CDP awards will lapse, unless the Board determines otherwise. Change On a change of control event as defined in BHP’s Incentive Plan Rules or on the divestment of a of control material

business or subsidiary, the Board has discretion to determine the treatment of CDP awards.

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 15 LTIP awards BHP is seeking

shareholder approval to grant LTIP awards to Mike Henry on the following basis: Key term Description Number of LTIP awards 127,848 LTIP awards with a face value equal to 200% of Mike’s annual base salary at the date of grant (i.e.

US$1.893 million x 200% = US$3.786 million). How the number of LTIP awards was calculated The proposed number of LTIP awards to be granted to Mike was calculated using the following formula: – the maximum value of the LTIP grant (being

US$3.786 million) multiplied by – the US$/A$ exchange rate (being the average over the 12 months up to and including 30 June 2024, to convert the award value into Australian dollars) divided by – the average daily closing price of BHP

shares traded on the ASX over the 12 months up to and including 30 June 2024, and – rounded down to the nearest whole number of awards. The face value of US$3.786 million was determined by considering Mike’s total target

remuneration, taking into account a number of factors, including the appropriate total remuneration for Mike’s role and market competitiveness. The People and Remuneration Committee’s independent adviser provided input. Performance

conditions Vesting of Mike’s LTIP awards is conditional on achieving five year relative total shareholder return (TSR) performance conditions as set out below: – 67% of Mike’s LTIP awards will vest subject to BHP’s TSR relative

to the MSCI World Metals and Mining index TSR (Sector TSR) – 33% of Mike’s LTIP awards will vest subject to BHP’s TSR relative to the MSCI World index TSR (World TSR) Testing of performance conditions Vesting of either TSR component

of the LTIP occurs on a sliding scale between the 50th and 80th percentiles: – full vesting (100% of each TSR component of the LTIP grant) occurs where BHP’s TSR is at or exceeds the 80th percentile of the Sector TSR or the World TSR (as

applicable) – threshold vesting (25% of each TSR component of the LTIP grant) occurs where BHP’s TSR equals the 50th percentile (i.e. the median) of the Sector TSR or the World TSR (as applicable). Where the TSR performance condition is

not met, there is no retesting and LTIP awards will lapse. The People and Remuneration Committee considers the achievement against the pre determined performance conditions and what is fair and commensurate to decide if the outcome should be varied.

Vesting of LTIP awards On vesting, each LTIP award will entitle Mike to receive one share in BHP (unless the Board exercises its discretion to settle vested awards with a cash payment of equivalent value instead). Before vesting, the LTIP awards do

not carry entitlements to ordinary dividends or other shareholder rights. A DEP is provided on vested LTIP awards in the form of either cash or additional shares. The DEP is calculated as the value of dividends that would have been received over the

vesting period if Mike had held shares in BHP, and where shares are provided, the DEP amount is divided by the closing price of BHP shares on the date prior to vesting. The decision to vest LTIP awards is subject to the overriding discretion of the

Board, which may adjust outcomes upwards or downwards (including to zero) if appropriate, even if the performance criteria has or has not been satisfied, including to better reflect shareholder expectations, to take into account the total value of

the award at the time of any vesting, to account for personal or group performance or any other factor that the Board reasonably determines is appropriate to take into account in the circumstances. The Board may also impose dealing restrictions on

any shares that vest. The vesting of LTIP awards is also subject to a satisfactory performance underpin, which encompasses a holistic review of performance at the end of the vesting period, including a review of safety and sustainability

performance, profitability, cash flow, balance sheet health, returns to shareholders, corporate governance and conduct over the five-year period. Malus and clawback BHP’s Incentive Plan Rules allow the Board to reduce or clawback LTIP awards

(including any DEP) in a range of circumstances, including where the participant acts fraudulently or dishonestly, is in material breach of their obligations to BHP, or where vesting is not justified or supportable in the circumstances. The Board

can also suspend or delay vesting until the outcome of any investigation is known. Cessation of employment On cessation of employment, for a ‘good leaver’, unvested LTIP awards generally remain on foot on termination and are pro-rated for the portion of the vesting period served and the balance will lapse, unless the Board decides otherwise. These awards are eligible for vesting in the ordinary course, subject to any applicable

performance conditions. ‘Good leaver’ treatment may apply where the cessation of employment with BHP is due to retirement, retrenchment or redundancy or termination by mutual agreement, or such other circumstances that do not constitute

resignation or termination for cause. If the participant is not a ‘good leaver’, all unvested LTIP awards will lapse, unless the Board decides otherwise. Change of control On a change of control event as defined in BHP’s Incentive

Plan Rules or on the divestment of a material business or subsidiary, the Board has discretion to determine the treatment of LTIP awards.

16 BHP Notice of Meeting 2024 Explanatory Notes continued Other information There is no cost payable by Mike and no loan made by BHP to

Mike in relation to the grant of the CDP or LTIP awards or the allocation of shares on vesting of the awards. Mike is the only Director (or associate of a Director) entitled to participate in the CDP and LTIP awards in the year ended 30 June

2024. Details of Mike’s current maximum total remuneration package are set out below. More details of Mike’s remuneration are contained in the Remuneration Report, released in August 2024. Remuneration component Amount Annual base salary

US$1.893 million Pension contribution 10% of annual base salary CDP – cash Maximum of 120% of annual base salary CDP – two year awards Maximum of 120% of annual base salary CDP – five year awards Maximum of 120% of annual base

salary LTIP – five-year awards Maximum of 200% of annual base salary BHP’s Incentive Plan Rules were adopted in September 2023. A total of 86,212 awards were granted to Mike under the CDP scheme (at no cost) in 2023 as his deferred short

term incentive. 125,124 awards were granted to Mike under the LTIP scheme (at no cost) in 2023 as his long term incentive. If shareholder approval is obtained, the CDP and LTIP awards that are the subject of this approval will be granted to Mike

following the AGM and prior to 30 October 2027. If shareholder approval is not obtained, the Board will consider alternative arrangements to appropriately remunerate and incentivise Mike. Details of any securities issued under BHP’s

Incentive Plan Rules will be published in BHP’s Remuneration Report, along with a statement that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to

participate in an issue of securities under BHP’s Incentive Plan Rules after the resolution in this Item is approved and who were not named in this Notice of Meeting will not participate until approval is obtained under that rule. For

information on the CDP and LTIP refer to the Remuneration Report released in August 2024, available at bhp.com. Voting exclusion statement BHP will disregard any votes cast: – in favour of Item 12 by or on behalf of Mike Henry, or his

associates, regardless of the capacity in which the vote is cast; or – on Item 12 as a proxy by a person who is a member of BHP’s KMP on the date of the AGM or their closely related parties. However, votes will not be disregarded if they

are cast: – as proxy or attorney for a person entitled to vote on Item 12 in accordance with a direction given to the proxy or attorney to vote on Item 12 in that way; – by the Chair of the AGM as proxy for a person entitled to vote on

Item 12, in accordance with an express authorisation to exercise undirected proxies as the Chair of the AGM decides; or – by a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided

the following conditions are met: – the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on Item 12; and – the holder votes

on Item 12 in accordance with directions given by the beneficiary to the holder to vote in that way. The Board, with Mike Henry abstaining, recommends shareholders vote in favour of this Item.

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 17 Item 13 2024 Climate Transition

Action Plan Item 13 is an advisory vote in relation to BHP’s 2024 Climate Transition Action Plan (2024 CTAP). The 2024 CTAP is available at bhp.com/CTAP2024. BHP has an important role to play in supporting the global transition to a net zero

greenhouse gas emissions future. As the global population grows and urbanises and the world pursues decarbonisation and electrification, we are positioning our portfolio to increase our exposure to these trends. The 2024 CTAP demonstrates our

commitment to becoming a more sustainable and resilient business, which will help us to continue to generate long term value for our shareholders, partners and other stakeholders. It provides an update on BHP’s climate change strategy and

builds on our 2021 Climate Transition Action Plan, which was approved by shareholders at our 2021 AGM. Our 2024 CTAP explains our greenhouse gas emissions targets and goals, and provides an update on our progress and plans across the key aspects of

our climate change strategy. In particular, the 2024 CTAP includes: – our position and performance in relation to our operational greenhouse emissions (Scopes 1 and 2 emissions from our operated assets) – the medium-term target and

long-term net zero goal we have set to decarbonise how we operate – our position and performance in relation to value chain greenhouse gas emissions (Scope 3 emissions) – the medium-term goals and long-term net zero targets and goal we

have set to support efforts to reduce greenhouse gas emissions in our value chain – our portfolio strategy in an evolving external environment and how we use a 1.5ºC scenario analysis to test the resilience of our portfolio should global

ambitions be realised in the future – how we conduct our climate policy advocacy – our approach to assessing physical climate-related risks and developing our potential adaptation responses – equitable change and transition – our

approach when there are major changes to our business and/or operations – our approach to Board and management governance of climate related risk and climate transition planning, Board skills and management’s capability, and the link

between the delivery of our climate change strategy and executive remuneration – our approach to management of climate related risk, both threats and opportunities – how our Capital Allocation Framework is applied to determine the amount

and timing of investment to progress our climate change strategy – our approach to the use of carbon credits to offset greenhouse gas emissions. We believe it is important for shareholders to have ongoing opportunities to engage with us on our

climate change strategy and actions. In addition to the other avenues of engagement we provide on climate related issues, this advisory vote is intended to provide a further opportunity for shareholder engagement on these matters as set out in our

2024 CTAP. Shareholders are not being asked to determine BHP’s climate change strategy. The Board is responsible for our climate change strategy, acting in the best interests of BHP. The advisory vote is not binding but the Board will take the

outcome of the vote and discussion at the meeting into account in continuing to determine how BHP progresses and evaluates the initiatives set out in the 2024 CTAP to advance BHP’s climate change strategy. The Board recommends shareholders vote

in favour of this Item. By order of the Board Stefanie Wilkinson Group General Counsel and Group Company Secretary

18 BHP Notice of Meeting 2024 Participating and Voting This section provides information on participating and voting if you are a

shareholder and hold your BHP Group Limited shares directly. If you are a shareholder and hold your BHP Group Limited shares directly, you can: Ask questions Before the meeting Submit your questions by 5:00pm (Brisbane time) Wednesday

23 October 2024 online at bhp.com/agm. At the meeting Attend the meeting in person at the Royal International Convention Centre, 600 Gregory Terrace, Bowen Hills, Brisbane, Queensland. Vote Before the meeting Appoint a proxy by submitting your

proxy form no later than 10:00am (Brisbane time) on Monday 28 October 2024 electronically, by hand delivery, post or by fax. You can also appoint a corporate representative or attorney to vote on your behalf. At the meeting Attend the meeting

in person at the Royal International Convention Centre, 600 Gregory Terrace, Bowen Hills, Brisbane, Queensland. If you have appointed a proxy, corporate representative or attorney, they will be able to vote on your behalf at the meeting. You can

vote using the online voting platform via your smartphone at the AGM. If you do not have a smartphone, other options will be available and assistance will be provided at the AGM. Watch In person Attend the meeting in person at the Royal

International Convention Centre, 600 Gregory Terrace, Bowen Hills, Brisbane, Queensland. Online Watch a live webcast of the AGM at bhp.com/agm. At BHP, we aim to provide a healthy, safe and inclusive workplace, free from harassment and bullying. We

want all of our people to be treated fairly, respectfully and with dignity. In this spirit, we ask shareholders and guests attending the AGM to be courteous and respectful to others. The Chair of the AGM reserves the right to ensure the meeting is

conducted in this way. Security measures will be in place to ensure your safety. Please note bag searches will be in operation and any large or inappropriate items may be required to be stored in the cloakroom until the end of the event.

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 19 This section provides

information on participating and voting if you are a shareholder and hold your BHP Group Limited shares directly. 1. Am I eligible to vote at the AGM? In accordance with Regulation 7.11.37 of the Corporations Regulations 2001 (Cth), registered

holders of shares in BHP at 6:00pm (Brisbane time) on Monday 28 October 2024 are entitled to attend and vote at the AGM as shareholders. Share transfers registered after that time will be disregarded in determining entitlements to attend and

vote at the AGM. If more than one joint holder of shares is present at the AGM (personally or by proxy, attorney or representative) and tender a vote, only the vote of the joint holder whose name appears first on the register will be counted. All

Items of business set out in this Notice of Meeting will be decided by way of a poll. On a poll, shareholders have one vote for every fully paid ordinary share held (subject to the restrictions on voting set out in this Notice of Meeting). 2. How

can I attend the AGM in person or watch the AGM online? To attend in person, you must register at theAGM. Registration desks will be open from 9:00am (Brisbane time) and we ask you to arrive at least 30 minutes before the meeting starts to allow

time to register. The proxy form you receive with your Notice of Meeting has a personalised barcode, which can be scanned to register at the AGM. Bring your proxy form to the AGM to make the registration process simpler. You can watch a live webcast

online as a guest at bhp.com/agm. You will not be able to ask questions or vote online on the webcast facility. 3. How do I ask questions at the AGM? Shareholders as a whole will have a reasonable opportunity to make comments and ask questions on

the items of business in this Notice of Meeting at the AGM (including a reasonable opportunity to ask questions of BHP’s Auditor). To make a comment or ask a question at the AGM, please follow the instructions we provide to shareholders on the

day. Please note there may not be enough time during the meeting to address all comments and questions. 4. How do I ask BHP questions before the AGM? We encourage shareholders to ask questions or make comments in advance of the AGM online at

bhp.com/agm by 5:00pm (Brisbane time) Wednesday 23 October 2024. During the AGM, the Chair of the AGM will seek to address the key themes raised by shareholders before the AGM. There may not be enough time during the meeting to address all

questions or comments. Individual responses will not be sent to shareholders. 5. How do I ask BHP’s Auditor questions before the AGM? Shareholders can submit written questions to BHP’s Auditor on the content of the Auditor’s Report or

conduct of its audit of the annual financial report for the year ended 30 June 2024. Shareholders can submit questions to BHP’s Auditor before the AGM online at bhp.com/agm by 5:00pm (Brisbane time) Wednesday 23 October 2024.

BHP’s Auditor is not required to provide individual responses to shareholders. 6. How do I vote by proxy? Appointing a proxy Shareholders entitled to attend and vote at the meeting can appoint a proxy to attend and vote for them. The proxy does

not need to be a shareholder and can be an individual or a body corporate. Shareholders holding two or more shares can appoint either one or two proxies. If two proxies are appointed, the appointing shareholder can specify the proportion or number

of votes that each proxy can exercise. If no proportion or number is specified, each proxy can exercise half the shareholder’s votes. Shareholders who wish to indicate how their proxy should vote should mark the appropriate boxes on the proxy

form. If a proxy is not directed how to vote on an Item of business, or if any resolution other than those specified in this Notice of Meeting is proposed at the AGM, the appointing shareholder is authorising the proxy to vote as they decide,

subject to any applicable voting exclusions. Shareholders who return their proxy forms with a direction on how to vote but do not nominate the identity of their proxy will be taken to have appointed the Chair of the AGM as their proxy to vote on

their behalf.

20 BHP Notice of Meeting 2024 Participating and Voting continued Proxy voting on Items 11 and 12 BHP’s KMP (which includes each of

the Directors and executives named in BHP’s 2024 Remuneration Report) and their closely related parties will not be able to vote as proxy on Items 11 and 12 unless you direct them how to vote (or if the Chair of the AGM is your proxy –

refer to the next paragraph). If you appoint any of those people as your proxy, you should direct them how to vote on Items 11 and 12, otherwise they will not be able to cast a vote as your proxy on the relevant Item. If you appoint the Chair of the

AGM as your proxy, you can direct the Chair of the AGM how to vote. If you appoint the Chair of the AGM as your proxy, or the Chair of the AGM is appointed as your proxy by default, but you do not direct the Chair how to vote (by marking a box next

to Item 11 and 12) by signing and submitting the proxy form, you expressly authorise the Chair of the AGM to vote as they decide in respect of the relevant Item, even though the Items are connected with the remuneration of BHP’s KMP. Proxy

voting on a poll All Items will be decided by poll. On a poll, any directed proxies that are not voted at the meeting will automatically default to the Chair of the AGM, who is required to vote proxies as directed. Note that for proxies without

voting instructions that are exercisable by the Chair of the AGM, the Chair of the AGM intends to vote all available proxies in favour of Items 2 to 13. 7. How do I submit a proxy form? To appoint a proxy, submit the proxy form no later than 10:00am

(Brisbane time) on Monday 28 October 2024. BHP encourages you to register your voting or proxy instructions online ahead of the meeting, even if you are planning to attend in person. Proxy instructions can be lodged online via the Share

Registry website at www.investorvote.com.au. Only registered BHP shareholders may access this facility. Alternatively you may: – hand deliver or post to BHP Share Registrar Computershare Investor Services Pty Limited – Yarra Falls, 452

Johnston Street, Abbotsford VIC 3067. Postal address: GPO Box 782, Melbourne VIC 3001 Australia – fax to 1800 783 447 (within Australia) or +61 3 9473 2555 (outside Australia) – for Intermediary Online users only (custodians): submit at

intermediaryonline.com 8. I am a representative of a corporate shareholder. How can I attend and vote? A body corporate that is a shareholder or has been appointed as a proxy may appoint an individual to act as its representative at the AGM. The

appointment must comply with the requirements of section 250D of the Corporations Act. The representative should bring evidence of their appointment to the AGM, including any authority that it was signed under, unless it has previously been given to

BHP. 9. I have a power of attorney from a shareholder. How can I attend and vote? A shareholder entitled to attend and vote may appoint an attorney to act on their behalf at the AGM. The attorney does not need to be a shareholder. Attorneys must

submit the instrument appointing the attorney and the authority that the instrument is signed under or a certified copy of the authority, in the same way and by the same time as outlined for proxy forms, unless it has previously been given to BHP.

10. If I hold shares through BHP Shareplus, how do I vote? The Shareplus administrator will provide information on how to vote at the AGM. You must submit your vote by 10:00am (Brisbane time) Monday, 21 October 2024. 11. I am not a shareholder.

How can I attend or watch the meeting? Non shareholders (who are not proxy holders, corporate representatives or attorneys) may be admitted to the AGM at the discretion of BHP as guests, and are requested to register by 5:00pm (Brisbane time)

Tuesday 29 October 2024 by emailing their details to BHPAGMattendance@computershare.com.au. Non-shareholders may watch the live webcast online at bhp.com/agm. You will not be able to ask questions or vote

online on the webcast facility.

Invitation from the Chair Notice of Annual General Meeting Explanatory Notes Participating and Voting 21 If you hold BHP shares traded

on an international exchange If you hold BHP shares traded on an international exchange, you can: – attend the meeting in person if you pre register as a guest. Please register by 5:00pm (Brisbane time) on Tuesday 29 October 2024 by

emailing your details to BHPAGMattendance@computershare.com.au. – watch the webcast online as a guest at bhp.com/agm. To vote, follow the instructions below in advance of the meeting. United Kingdom I hold UK depositary interests (through

CREST) Vote online at www.investorcentre.co.uk/eproxy or by submitting the Form of Instruction and instructing Computershare how to exercise voting rights by 24 October 2024 at 12 noon (London time). I hold UK depositary interests (through the

Corporate Sponsored Nominee Facility) Vote online at www.investorcentre.co.uk/eproxy or by submitting the Form of Direction and directing Computershare how to exercise voting rights by 23 October 2024 at 12 noon (London time). South Africa I

hold shares in dematerialised form through STRATE Provide your voting instruction to the Central Securities Depository Participant (CSDP) or broker (as applicable) in enough time to allow the CSDP or broker to advise the registrar. Contact your CSDP

or broker for instructions and timing requirements for voting instructions. United States I hold American Depositary Shares (ADSs) Provide your Voting Instruction Form to the ADS Depositary, Citibank, N.A. by the deadline provided by the ADS

Depositary. Contact the registered holder of your underlying shares, the custodian or broker or whoever administers the investment on your behalf to exercise applicable voting and/or participation rights. The Depositary for the ADSs is Citibank,

N.A., and can be contacted at 1 877 CITI ADR 877 248 4237 or for those outside of the United States at 1 781 575 4555 Monday to Friday, 8:30am – 6:00pm (New York City time). For more information about your shareholdings or how to participate in

the meeting, contact BHP’s registrar Computershare at www.investorcentre.com/contact or on 1300 656 780 (within Australia) or +61 3 9415 4020 (outside Australia).

22 BHP Notice of Meeting 2024 More information Location of the Annual General Meeting Royal International Convention Centre 600 Gregory

Terrace, Bowen Hills Brisbane, Queensland How to access information on BHP You can access our Notice of Meeting at bhp.com, along with other publications that BHP produces. You can make an election on how you would like to receive certain documents

(including Annual Reports, Notices of Meeting and proxy/voting forms), including in physical or electronic form. To tell us your preference, go to //www-au.computershare.com/Investor/#Home and follow the

prompts. 2024 Annual Reporting Suite Read our reports at bhp.com Annual Report 2024 Economic Contribution Report 2024 Modern Slavery Statement 2024 Climate Transition Action Plan 2024 Cover photo The Future is Clear Harvester, Canada

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

BHP Group Limited |

|

|

|

|

| Date: September 23, 2024 |

|

|

|

By: |

|

/s/ Stefanie Wilkinson |

|

|

|

|

Name: |

|

Stefanie Wilkinson |

|

|

|

|

Title: |

|

Group General Counsel and Group Company Secretary |

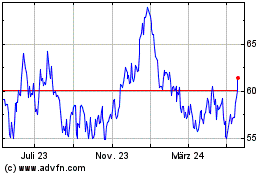

BHP (NYSE:BHP)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

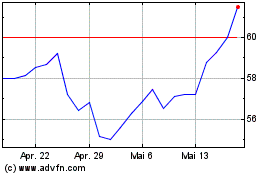

BHP (NYSE:BHP)

Historical Stock Chart

Von Nov 2023 bis Nov 2024