Brown-Forman to Split Stocks 3-for-2 - Analyst Blog

15 Juni 2012 - 10:15AM

Zacks

Leading global producer and

distributor of premium alcoholic beverages, Brown-Forman

Corporation (BF.B) announced its intention to split its

Class A and Class B common stocks, proposing to distribute one

additional share to shareholders for every two shares held.

Per the announcement, Brown-Forman

proposes to distribute the new shares under the 3-for-2 stock split

in the form of a stock dividend. Presently, the split proposal is

subject to receiving shareholder approval and their vote on the

issue in the regular annual meeting to be held on July 26,

2012.

If approved, the company plans to

complete the proposed split on August 3, 2012, with the

shareholders receiving the additional shares on August 10. This

split will add to the company’s history of stock splits marking the

sixth split in the last 35 years.

Moreover, the company indicated

that the proposed stock split will not hamper the company’s

quarterly cash dividend of 35 cents per share payable on July 2,

2012.

Brown-Forman’s stock split

announcement reflects the company’s commitment to enhance long-term

value for shareholders. It also portrays the company’s confidence

to boost its longer-term prospects for earnings as well as cash

flows.

Brown-Forman reported fiscal year

2012 financial results on June 6, 2012. The company’s adjusted

earnings of $3.56 per share during fiscal 2012 fell short of the

Zacks Consensus Estimate of $3.59 as well the previous fiscal

earnings of $3.57. However, net sales during the fiscal increased

6% to $3,614.4 million compared with $3,404.3 million in fiscal

2011, surpassing the Zacks Consensus Estimate of $3,453

million.

During fiscal 2012, Brown-Forman

generated $516 million of cash from operations and deployed $192

million for dividend payout, $220 million toward share repurchase,

$58 million on capital expenditures and $248 million toward debt

repayment.

Brown-Forman ended the fiscal with

cash and cash equivalents of $338 million and long-term debt of

$506 million (including the current maturities) compared with $567

million and $759 million, respectively, in fiscal 2011.

Brown-Forman possessing brands such

as Jack Daniel’s, Finlandia, Southern Comfort and Canadian Mist,

commands a strong portfolio of globally recognized brands. We

believe this provides a competitive edge to the company and

bolsters its well-established position in the market.

Brown-Forman is in direct

competition with Beam Inc.

(BEAM),Constellation Brands Inc. (STZ) and

Diageo plc (DEO). Currently, Brown-Forman has a Zacks #3

Rank, implying a short-term Hold rating. We maintain our long-term

Neutral recommendation on the stock.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

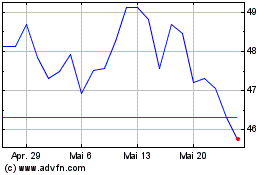

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024