Beam Acquires Irish Distillery - Analyst Blog

19 Januar 2012 - 5:40PM

Zacks

Recently, liquor producer, Beam Inc. (BEAM),

announced the completion of its acquisition of renowned Irish

whiskey maker Cooley Distillery. Beam got hold of this leading

spirits company for about $95 million on a debt-free basis.

As per the transaction, Beam paid Cooley shareholders $8.25 in

cash in exchange of every Cooley share. The acquisition is expected

to facilitate Beam in building brand portfolio while enhancing

market share in the world’s fastest growing spirits categories.

Beam expects earnings from the addition of Cooley’s brands to

increasingly reflect in Beam’s financial statements after 2012. The

acquisition will have no impact on fiscal 2012 earnings.

About Cooley Distillery

The award winning Cooley Distillery, based in Cooley Mountains,

Ireland, was founded in 1987. Cooley is one of the only three

sources for Irish whiskey. Cooley has a huge production capacity

and sales approximately 250,000 9-liter cases per year, which

includes its brands, private label products and bulk sales to

third-party customers.

The product portfolio of the Irish distillery includes Kilbeggan

Irish whiskey, Tyrconnell Single Malt, Connemara Peated Single Malt

and Greenore Single Grain Irish whiskey.

Our Take on the Acquisition

We believe that Beam’s deal with Cooley provides a solid gateway

for Beam to enter into one of the spirits industry's fastest

growing categories. The Irish whiskey category grew 11.5% in 2010

to 4.86 million cases, according to a report released by Impact

Databank. Moreover, the acquisition will facilitate Beam in adding

more consumers and building a strong platform for future

growth.

Deerfield, Illinois-based spirits giant Beam engages in

producing and selling branded distilled spirits products worldwide.

The company’s portfolio includes 10 of the world’s top 100 premium

spirits brands and some of the industry’s fastest growing

innovations.

Worldwide, the company generated 2010 sales of about $2.7

billion on volume of 33 million 9-liter cases. Beam was formerly

part of Fortune Brands, which separated into two publicly traded

companies, Beam Inc. and Fortune Brands Home & Security

Inc. (FBHS).

Beam, which competes with well-established players, such as

Diageo plc (DEO) and Brown-Forman

Corporation (BF.B), currently has a Zacks #5 Rank,

implying a short-term Strong Sell rating on the stock. However, the

company retains a long-term Neutral recommendation.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

FORTUNE BRD H&S (FBHS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

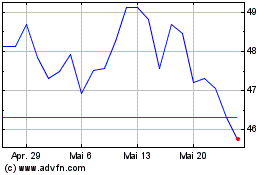

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024