Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

17 März 2023 - 7:51PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2023

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7):

Banco Bilbao Vizcaya Argentaria, S.A. (“BBVA” or the “Company”), in

compliance with the Spanish Securities Market legislation, hereby proceeds to notify the following:

INSIDE INFORMATION

Further to the notice of Inside Information of 1 February 2023, with CNMV registration number 1738, and having received the required authorization

from the European Central Bank, BBVA hereby notifies the execution of a time-scheduled buyback program for the repurchase of own shares pursuant to Regulation (EU) No. 596/2014 of the European Parliament and of the Council, of 16 April

2014, on market abuse (“MAR”) and Commission Delegated Regulation (EU) No. 2016/1052, of 8 March 2016, (the “Delegated Regulation” and, together with MAR, the “Regulations”) aimed at

reducing BBVA’s share capital (the “Buyback Program”) and under the terms and conditions detailed below:

|

|

|

| Purpose: |

|

To reduce BBVA’s share capital by means of the cancellation of the acquired shares. |

|

|

| Maximum cash amount: |

|

The maximum cash amount will be 422 million Euros. |

|

|

| Maximum number of shares: |

|

The maximum number of BBVA shares to be acquired will be 563,825,149. |

|

|

| Start of the execution: |

|

Execution will start on 20 March 2023. |

|

|

| End of the execution: |

|

The Buyback Program will end no later than 12 March 2024 and, in any event, when the maximum cash amount is reached or the maximum

number of shares is acquired. However, the Company reserves the

right to temporarily suspend or to early terminate the execution of the Buyback Program in the event of any circumstance that so advises or requires. |

|

|

| Trading venue: |

|

The acquisitions will be made on the Spanish Electronic Trading Interconnection System – Continuous Market (the

“Continuous Market”) and on DXE Europe. |

|

|

| Manager: |

|

The execution will be carried out internally by the Company, executing the trades through BBVA. |

This English version is a translation of the original in Spanish for information purposes only. In case of

discrepancy, the Spanish original will prevail.

|

|

|

|

|

| Conditions of the Buyback Program: |

|

The Buyback Program will be executed pursuant to the following conditions:

Continuous Market

(i) By

purchasing in each trading session on the Continuous Market (other than a Discontinued Day) 2,500,000 shares (the “Daily Target Number of Shares in the Continuous Market”), except in cases of force majeure or if it is not possible

to purchase such number of shares due to the limitations derived from the provisions of article 3.2 of the Delegated Regulation; which, if applicable, will be duly communicated in the periodic communications made in accordance with the Regulations,

indicating the reason why the Daily Target Number of Shares in the Continuous Market has not been purchased.

For these purposes, a Discontinued Day is understood to be any trading session of the Continuous Market in which there is a

significant disruption in the market or in the quotation of the BBVA shares (including if their trading price falls below their nominal value during a substantial part of the session) or if the trading volume for the BBVA share is less than 2.5

times the Daily Target Number of Shares in the Continuous Market.

(ii) The own shares will be purchased respecting in all cases the conditions and the price

and volume limits set forth in the Regulations.

In particular, it is hereby stated that the Daily Target Number of Shares in the Continuous Market is less than 25% of the average

daily volume of the BBVA shares in the Continuous Market in the month preceding this communication (thus complying with the provisions of article 3.3.a) of the Delegated Regulation).

DXE Europe

(i) By

purchasing in each trading session on DXE Europe (other than a Discontinued Day) 500,000 shares (the “Daily Target Number of Shares in DXE Europe”), except in cases of force majeure or if it is not possible to purchase such number

of shares due |

This English version is a translation of the original in Spanish for information purposes only. In case of

discrepancy, the Spanish original will prevail.

|

|

|

|

|

|

|

to the limitations derived from the provisions of article 3.2 of the Delegated Regulation; which, if applicable,

will be duly communicated in the periodic communications made in accordance with the Regulations, indicating the reason why the Daily Target Number of Shares in DXE Europe has not been purchased.

For these purposes, a Discontinued Day is

understood to be any trading session of DXE Europe in which there is a significant disruption in the market or in the quotation of the BBVA shares (including if their trading price falls below their nominal value during a substantial part of the

session) or if the trading volume for the BBVA share is less than 2.5 times the Daily Target Number of Shares in DXE Europe.

(ii) The own shares will be purchased respecting in all cases the conditions and the price

and volume limits set forth in the Regulations.

In particular, it is hereby stated that the Daily Target Number of Shares in DXE Europe is less than 25% of the average daily volume

of the BBVA shares in DXE Europe in the month preceding this communication (thus complying with the provisions of article 3.3.a) of the Delegated Regulation). |

The share purchase transactions carried out, as well as the completion or, as the case may be, the

interruption of the Buyback Program, will be duly reported in accordance with the Regulations.

Madrid, 17 March 2023

This English version is a translation of the original in Spanish for information purposes only. In case of

discrepancy, the Spanish original will prevail.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argentaria, S.A. |

|

|

|

|

| Date: March 17, 2023 |

|

|

|

|

|

By: /s/ Jose Maria Caballero Cobacho |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: Jose Maria Caballero Cobacho |

|

|

|

|

|

|

|

|

|

|

Title: Assets and Liabilities Management Director |

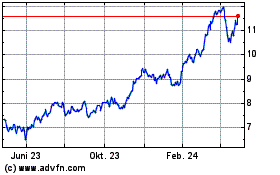

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

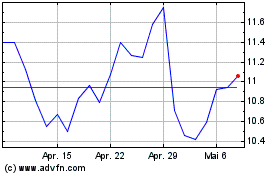

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024