Securities Registration (section 12(b)) (8-a12b)

14 September 2022 - 7:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20459

FORM 8-A

FOR

REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

Banco Bilbao

Vizcaya Argentaria, S.A.

(Exact name of registrant as specified in its charter)

|

|

|

| Kingdom of Spain |

|

None |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| Calle Azul, 4

Madrid Spain |

|

28050 |

| (Address of principal executive offices) |

|

(Zip Code) |

Securities to be registered

pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class

to be so registered: |

|

Name of each exchange on which

each class is to be registered: |

| 5.862% Senior Non-Preferred Fixed-to-Fixed Rate Notes due 2026 |

|

New York Stock Exchange |

| 6.138% Senior Non-Preferred Fixed-to-Fixed Rate Notes due 2028 |

|

New York Stock Exchange |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General

Instruction A.(c) or (e), check the following box. ☒

If this form relates to the registration of a class of securities pursuant to

Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check the following box. ☐

If this

form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following box. ☐

Securities Act registration statement file number to which this form relates:

333-266391

Securities to be registered pursuant to Section 12(g) of the Act:

None.

INFORMATION REQUIRED IN REGISTRATION STATEMENT

| Item 1. |

Description of Registrant’s Securities to be Registered |

The securities to be registered hereby are the $1,000,000,000 aggregate principal amount of 5.862% Senior Non-Preferred

Fixed-to-Fixed Rate Notes due 2026 (the “2026 Notes”) and $750,000,000 aggregate principal amount of 6.138% Senior

Non-Preferred Fixed-to-Fixed Rate Notes due 2028 (the “2028 Notes” and together with the 2026 Notes, the

“Notes”) of Banco Bilbao Vizcaya Argentaria, S.A. (the “Registrant”). The Registrant has filed with the Securities and Exchange Commission (the “Commission”) pursuant to Rule 424(b) under the

Securities Act of 1933 the prospectus supplement dated September 6, 2022 (the “Prospectus Supplement”) to a prospectus dated July 29, 2022 (the “Prospectus”) filed with a registration statement on Form F-3 (Registration No. 333-266391) relating to the Notes to be registered hereunder.

For a description of the Notes to be registered hereunder, reference is made to the information contained in the sections captioned “Certain Terms of the

Notes” on pages S-31 through S-46 of the Prospectus Supplement, “U.S. Federal Tax Considerations” on page S-51 of

the Prospectus Supplement, “Spanish Tax Considerations” on pages S-47 through S-50 of the Prospectus Supplement and “Annex A – Direct Refund from

Spanish Tax Authorities Procedures” on page S-A-1 of the Prospectus Supplement, which information is hereby incorporated by reference.

|

|

|

| Exhibit |

|

Description of Exhibit |

|

|

| 4.1 |

|

Senior Non-Preferred Indenture dated as of June

25, 2019 among the Registrant, The Bank of New York Mellon, London Branch, as Trustee, Transfer Agent and Paying Agent and The Bank of New York Mellon as Security Registrar (incorporated herein by reference to Exhibit 4.7 to the Registrant’s registration

statement on Form F-3 filed with the Commission on July 29, 2022) |

|

|

| 4.2 |

|

First Supplemental Indenture for the 2026 Notes among the Registrant, The Bank of New York Mellon, London Branch, as Trustee, Paying Agent, Transfer

Agent and Calculation Agent and The Bank of New York Mellon as Security Registrar dated as of September 14, 2022 (incorporated herein by reference to Exhibit 4.8 to the Registrant’s report on Form

6-K filed with the Commission on September 14, 2022) |

|

|

| 4.3 |

|

Second Supplemental Indenture for the 2028 Notes among the Registrant, The Bank of New York Mellon, London Branch, as Trustee, Paying Agent, Transfer

Agent and Calculation Agent and The Bank of New York Mellon as Security Registrar dated as of September 14, 2022 (incorporated herein by reference to Exhibit 4.9 to the Registrant’s report on Form

6-K filed with the Commission on September 14, 2022) |

|

|

| 4.5 |

|

Forms of Security Certificates representing the Notes (incorporated herein by reference to Exhibits 4.8 and 4.9

to the Registrant’s report on Form 6-K filed with the Commission on September 14, 2022, which include such Forms of Security Certificates) |

|

|

| 99.1 |

|

Prospectus dated July 29, 2022 and related Prospectus Supplement dated September

6, 2022 (incorporated herein to the extent provided above by reference to the Registrant’s filing under Rule 424(b)) |

SIGNATURES

Pursuant to the requirements of Section 12 the Securities Exchange Act of 1934, the registrant has duly caused this registration

statement to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

| BANCO BILBAO VIZCAYA ARGENTARIA, S.A. |

|

|

| By: |

|

/s/ Ignacio Echevarría Soriano |

| Name: |

|

Ignacio Echevarría Soriano |

| Title: |

|

Authorized Representative |

Date: September 14, 2022

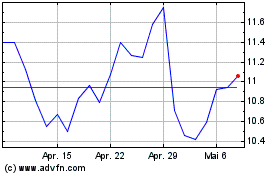

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

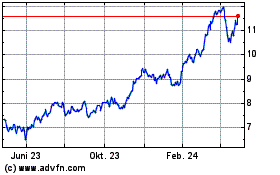

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

Von Jul 2023 bis Jul 2024