true

2022

FY

0001432364

0001432364

2022-01-01

2022-12-31

0001432364

dei:BusinessContactMember

2022-01-01

2022-12-31

0001432364

ifrs-full:PreferenceSharesMember

2022-01-01

2022-12-31

0001432364

azul:AmericanDepositarySharesAsEvidencedByAmericanDepositaryReceiptsEachRepresentingThreePreferredSharesMember

2022-01-01

2022-12-31

0001432364

ifrs-full:OrdinarySharesMember

2022-12-31

0001432364

ifrs-full:PreferenceSharesMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F/A

☐ REGISTRATION

STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December

31, 2022

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________

to _______________

OR

☐ SHELL

COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company

report

Commission file number: 001-38049

AZUL SA

(Exact name of Registrant as specified

in its charter)

N/A

(Translation of the Registrant’s name into English)

Federative Republic of Brazil

(Jurisdiction of incorporation or organization)

Avenida

Marcos Penteado de Ulhôa Rodrigues, n. 939, 8th floor

Edifício Jatobá, Condomínio Castelo Branco Office Park

Tamboré, Barueri, State of São

Paulo, Zip Code 06460-040

Federative Republic of Brazil

(Address of principal executive offices)

Alexandre Wagner Malfitani (Chief Financial

Officer and Investor Relations Officer)

E-mail: invest@voeazul.com.br

Telephone: +55 (11) 4831-2880

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Business Contact Avenida

Marcos Penteado de Ulhôa Rodrigues, n. 939, 8th floor Edifício Jatobá, Condomínio Castelo Branco Office

Park

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

|

Preferred

Shares without par value ☒

|

AZUL |

New York Stock Exchange* |

| American Depositary Shares (as evidenced by American Depositary Receipts), each representing three Preferred Shares |

New York Stock Exchange |

*Not for trading purposes, but only in

connection with the listing on the New York Stock Exchange of American Depositary Shares representing those Preferred Shares.

Securities registered or to be registered

pursuant to Section 12 (g) of the Act: None

Securities for which there is a reporting

obligation pursuant to Section 15 (d) of the Act: None

Indicate the number of outstanding shares

of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

928,965,058 Common

Shares

335,623,408 Preferred Shares

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

If this report is an annual or transition

report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the

Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large

accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒

Accelerated filer ☐

Non-accelerated filer ☐

Emerging growth company ☐

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. ☐

Indicate by

check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its

internal control over financial reporting under Section 404 (b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public

accounting firm that prepared or issued its audit report.

Yes ☒ No ☐

† The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012.

Indicate by check mark whether the registrant

has filed a report or an attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b))

Yes ☒ No ☐

If securities are registered pursuant to

Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the

correction of an error to previously issued financial statements. ☐

Indicate by check mark

whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by

any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting

the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in

response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18

☐

If this is an annual report, indicate by

check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant

has filed all documents and reports required to be filed by Sections 12, 13 or 15 (d) of the Securities Exchange Act of 1934 subsequent

to the distribution of securities under a plan confirmed by a court:

Yes ☐ No ☐

Auditor Name: Ernst & Young

Auditores Independentes S/S Ltda. Auditor Location: São Paulo, Brazil Firm ID: 1448

EXPLANATORY NOTE

Azul S.A. (the

“Company”) filed its Annual Report on Form 20-F for the fiscal year ended December 31, 2022 with the Securities and

Exchange Commission (the “SEC”) on April 20, 2023 (the “Original Filing”).

This Amendment

No. 1 on Form 20-F/A (this “Amendment”) is filed by the Company with the SEC solely to amend the Reports of Independent

Registered Public Accounting Firm of Ernst & Young Auditores Independentes S/S Ltda. (“EY”), the Company’s

independent registered public accounting firm, in Item 18 “Financial Statements” in the Original Filing to correct

errors in such reports.

This Amendment

corrects the Report of Independent Registered Public Accounting Firm of EY on financial statements appearing on pages F-3 to F-5 of the

Original Filing by deleting from such report three paragraphs commencing “We obtained an understanding, evaluated the design

and tested the operating effectiveness of the controls over…”, each of which was included under the sub-heading “How

We Addressed the Matter in our audit” therein. This Amendment also corrects the Report of Independent Registered Public Accounting

Firm of EY on internal control over financial reporting appearing on page F-6 of the Original Filing by inserting the following sentence

into such report: “These material weaknesses were considered in determining the nature, timing and extent of audit tests applied

in our audit of the 2022 consolidated financial statements, and this report does not affect our report dated April 19, 2023, which expressed

an unqualified opinion thereon.”

In addition,

this Amendment also amends Item 19 “Exhibits” in the Original Filing by (i) replacing EY’s Consent of Independent

Registered Public Accounting Firm with an updated Consent of Independent Registered Public Accounting Firm attached to this Amendment

as Exhibit 23.1, and (ii) as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, including as Exhibits to this

Amendment currently dated certifications from the Company’s Chief Executive Officer and Chief Financial Officer as required by Section

302 and 906 of the Sarbanes-Oxley Act of 2002, which certifications are attached to this Amendment as Exhibits 12.1, 12.2, 13.1 and 13.2.

Except as described

above, this Amendment does not modify or update disclosures in, or exhibits to, the Original Filing. Therefore, this Amendment speaks

as of April 20, 2023 (the filing date of the Original Filing) and, except as described above, does not modify or update any other disclosures

contained in the Original Filing for other events or information subsequent to the date of the filing of the Original Filing. Accordingly,

this Amendment should be read in conjunction with the Original Filing and the Company’s filings with the SEC subsequent to the filing

of the Original Filing.

For the avoidance

of doubt, there have been no changes to the Company’s consolidated financial statements set forth in the Original Filing.

PART III

ITEM 18. FINANCIAL

STATEMENTS

See each Report of Independent Registered Public Accounting Firm of EY included herewith each of which replaces the corresponding

Report of Independent Registered Public Accounting Firm of EY appearing on pages F-3 to F-5 and on page F-6, respectively, of the Original

Filing.

ITEM 19. EXHIBITS

| |  | São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil Tel: +55 11 2573-3000 ey.com.br | |

Report

of Independent Registered Public Accounting Firm

To the Shareholders and the Board

of Directors of

Azul S.A.

Opinion on the Financial Statements

We have audited the accompanying

consolidated statement of financial position of Azul S.A. (the “Company“) as of December 31, 2022 and 2021, the related consolidated

statements of operations, comprehensive loss, changes in equity, and cash flows, for each of the three years in the period ended December

31, 2022, and the related notes (collectively referred to as the “consolidated financial statements“). In our opinion, the

consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022

and 2021, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2022, in conformity

with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board - IASB.

We also have audited, in accordance

with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's internal control over financial

reporting as of December 31, 2022, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission (2013 framework), and our report dated April 19, 2023, expressed an adverse opinion thereon.

Basis for Opinion

These financial statements are

the responsibility of the Company's management. Our responsibility is to express an opinion on the Company’s financial statements

based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the

Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission

and the PCAOB.

We conducted our audits in accordance

with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether

the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to

assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated

below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated

to the audit committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and

(2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter

in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below,

providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Air Traffic Liability - Breakage

Revenue

| |

Description of the Matter

|

At December 31, 2022, the Company’s air traffic liability

balance, representing deferred revenue related to air transportation service and loyalty program (“TudoAzul”) points, was

R$ 4,660,271 thousand.

As disclosed in Note 29.1 to the consolidated financial statements,

the Company defers air transportation service and its loyalty program issued points and recognizes revenue when air transportation service

is actually provided. In accounting for the air traffic liability, the Company estimates the air tickets and TudoAzul points that will

expire unused (breakage). The Company recognizes breakage revenue in proportion to the usage of the related tickets or proportionally

during the period in which the remaining points are actually redeemed.

Breakage revenue on tickets sold is estimated using statistical

models primarily based on historical data, ticket terms and customers’ travel behavior. Breakage revenue on outstanding loyalty

program points is estimated using statistical models based on historical data, including redemption patterns.

Auditing the Company’s accounting for breakage revenue

was complex due to the judgment involved, such as expectations of the expiration of unused tickets and loyalty program points future redemption

patterns.

|

| |

How We Addressed the Matter in our audit

|

To test the estimate of breakage revenue, our audit procedures

included, among others, comparing breakage rates with historical data and analyzing breakage rate trends over the years. We also evaluated

the financial statements disclosures included in Note 29 to the consolidated financial statements.

|

Maintenance Reserve Deposits

| |

Description of the Matter

|

As disclosed in Note 9.2 to the consolidated financial statements,

at December 31, 2022, the Company’s aggregate current and non-current maintenance reserve deposits balance totaled R$2,610,943 thousand,

net of the provision for loss of R$446,342 thousand, resulting in a net balance of R$2,164,601 thousand. Certain master lease agreements

provide for the payment of aircraft and engine maintenance reserve deposits made to the lessors to be held as collateral for the performance

of major maintenance activities, and therefore these deposits are reimbursable upon completion of the maintenance event.

As disclosed in Note 9.1.2, at December 31, 2022, the Company

assesses whether the maintenance reserve deposits required by the master lease agreements are expected to be recovered based on the expected

usage of the aircraft and timing of future maintenance events. A provision for loss is recorded for deposits that are not probable to

be recovered.

Auditing the recoverability of the maintenance reserve deposits

was specially challenging due to the degree of judgment required in estimating the expected usage of the aircraft and timing of future

maintenance events.

|

| |

How We Addressed the Matter in our audit

|

To test the maintenance reserve deposits balance net of the

provision for loss, our audit procedures included, among others, confirming maintenance reserve deposit balances for individual contracts

with the respective lessors; tracing elements of actual maintenance expenses incurred to supporting documentation; evaluating the Company’s

analysis of the recoverability of the maintenance reserve deposits that includes the assessment of the timing of future maintenance event

and expected usage of the aircraft; comparing relevant inputs in the Company´s estimate to contractual agreements with the lessors.

We also assessed the Company’s disclosures in respect of its maintenance reserve deposits in Notes 9.1.2 and 9.2 to the consolidated

financial statements.

|

Assessment of the impacts of the

COVID-19 pandemic and capital structure and net working capital

| |

Description of the Matter

|

As discussed in Note 1.2 and 1.4 to the consolidated financial

statements, as a result of the effects of COVID-19 global pandemic during the years 2020 and 2021, the Company and the aviation industry

experienced a significant decline in the demand for air transportation services. The Company has suffered recurring losses, has presented

a total negative equity (deficit) and has a working capital deficiency of R$10,184,169 thousand as of December 31, 2022. Management has

taken a series of measures to address the situation created by the pandemic and concluded that those measures allow the Company to continue

operating and fulfilling its obligations in the normal course of business, and that, therefore, the use of the going concern basis of

accounting continues to be applicable for the preparation of the Company’s consolidated financial statements.

Auditing management assessment was complex and required significant

auditor judgement, as the judgements and assumptions applied by management in making their assessment include estimating future demand

and revenue as well as evaluating the impacts from negotiations with lessors and financial institutions, the Company’s access to

additional capital and other future market conditions that are subject to significant estimation uncertainty. Those assumptions and judgements

are forward-looking and could be affected by future economic events and market conditions.

|

| |

How We Addressed the Matter in our audit

|

To test management assessment our audit procedures included,

among others, involving our valuation specialists to assist in evaluating the management financial forecasting model and key assumptions;

testing the mathematical accuracy of that model; comparing key inputs against historical financial information and records; performing

a sensitivity analysis; inspecting supporting documentation such as lease contract amendments and renegotiations; and assessing management

application of the relevant accounting framework. We also assessed the Company’s disclosures in respect of its assessment of the

impacts of the COVID-19 pandemic and capital structure and net working capital in Notes 1.2 and 1.4 to the consolidated financial statements.

|

/s/ ERNST & YOUNG Auditores

Independentes S/S Ltda.

We have served as the Company’s

auditor since 2009.

São Paulo, Brazil

April 19, 2023

Report

of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Directors

of

Azul S.A.

Opinion on Internal Control

over Financial Reporting

We have

audited Azul S.A.’s internal control over financial reporting as of December 31, 2022, based on criteria established in Internal

Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) (the

COSO criteria). In our opinion, because of the effect of the material weaknesses described below on the achievement of the objectives

of the control criteria, Azul S.A. (the Company) has not maintained effective internal control over financial reporting as of December

31, 2022, based on the COSO criteria. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial

reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial

statements will not be prevented or detected on a timely basis. The following material weaknesses have been identified and included in

management’s assessment. Management has identified material weaknesses related to the identification, design and execution of relevant

controls in information technology general controls (ITGC) and related information produced by entity that support underlying data used

in routine and non-routine business and financial reporting processes and controls, to fully address the requirements of the COSO criteria.

We also

have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company’s

consolidated statements of financial position as of December 31, 2022 and 2021, and the related consolidated statements of operations,

comprehensive loss, changes in equity, and cash flows for each of the three years in the period ended December 31, 2022, and the related

notes. These material weaknesses were considered in determining the nature, timing and extent of audit tests applied in our audit of the

2022 consolidated financial statements, and this report does not affect our report dated April 19, 2023, which expressed an unqualified

opinion thereon.

Basis for Opinion

The Company’s

management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness

of internal control over financial reporting included in the accompanying Management’s Report on Internal Control over Financial

Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance

with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted

our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether effective internal control over financial reporting was maintained in all material respects.

Our audit

included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists,

testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other

procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations

of Internal Control Over Financial Reporting

A company’s

internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance

of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2)

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with

generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations

of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements.

Because

of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any

evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions,

or that the degree of compliance with the policies or procedures may deteriorate.

/s/ ERNST & YOUNG Auditores

Independentes S/S Ltda.

São Paulo, Brazil

April 19, 2023

SIGNATURES

The registrant

hereby certifies that it meets all of the requirements for filing on Form 20-F and has duly caused and authorized the undersigned

to sign this Amendment No. 1 to Annual Report on Form 20-F/A on its behalf.

Azul S.A.

| |

|

|

| |

By: |

/s/ John Peter Rodgerson |

| |

|

Name: John Peter Rodgerson |

| |

|

Title: Chief Executive Officer |

| |

|

|

| |

By: |

/s/ Alexandre Wagner Malfitani |

| |

|

Name: Alexandre Wagner Malfitani |

| |

|

Title: Chief Financial Officer and Investor Relations Officer |

Barueri/SP, Brazil

December 28,

2023

Exhibit 12.1

CERTIFICATION

PURSUANT TO RULES 13a-14(a) AND 15d-14(a) AS ADOPTED UNDER SECTION 302 OF THE SARBANES-OXLEY ACT

I, John Peter Rodgerson, certify that:

1.

I have reviewed the Annual Report on Form 20-F of Azul S.A. (the “company”),

as amended by the Amendment No. 1 on Form 20-F/A (the “report”);

2.

Based on my knowledge, the report does not contain any untrue statement of a material fact or omit

to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not

misleading with respect to the period covered by the report;

3.

Based on my knowledge, the financial statements, and other financial information included in the

report, fairly present in all material respects the financial condition, results of operations and cash flows of the company as of, and

for, the periods presented in the report;

4.

The company’s other certifying officer and I are responsible for establishing and maintaining

disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting

(as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the company and have:

| (a) | Designed such disclosure controls and procedures, or caused such disclosure

controls and procedures to be designed under our supervision, to ensure that material information relating to the company, including its

consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which the report is

being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such

internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting

principles; |

| (c) | Evaluated the effectiveness of the company’s disclosure controls and

procedures and presented in the report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end

of the period covered by the report based on such evaluation; and |

| (d) | Disclosed in the report any change in the company’s internal control

over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely

to materially affect, the company’s internal control over financial reporting; and |

5.

The company’s other certifying officer and I have disclosed, based on our most recent evaluation

of internal control over financial reporting, to the company’s auditors and the audit committee of the company’s board of

directors (or persons performing the equivalent functions):

| (a) | all significant deficiencies and material weaknesses in the design or operation

of internal control over financial reporting which are reasonably likely to adversely affect the company’s ability to record, process,

summarize and report financial information; and |

| (b) | any fraud, whether or not material, that involves management or other employees

who have a significant role in the company’s internal control over financial reporting. |

Barueri/SP, Brazil, December 28,

2023

By: /s/

John Peter Rodgerson

Name: John

Peter Rodgerson

Title: Chief

Executive Officer

Exhibit

12.2

CERTIFICATION PURSUANT TO RULES

13a-14(a) AND 15d-14(a) AS ADOPTED UNDER SECTION 302 OF THE SARBANES-OXLEY ACT

I, Alexandre Wagner Malfitani, certify that:

| 1. | I have reviewed the Annual Report on Form 20-F of Azul S.A. (the “company”),

as amended by the Amendment No. 1 on Form 20-F/A (the “report”); |

| 2. | Based on my knowledge, the report does not contain any untrue statement

of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such

statements were made, not misleading with respect to the period covered by the report; |

| 3. | Based on my knowledge, the financial statements, and other financial information

included in the report, fairly present in all material respects the financial condition, results of operations and cash flows of the company

as of, and for, the periods presented in the report; |

| 4. | The company’s other certifying officer and I are responsible for establishing

and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over

financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the company and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure

controls and procedures to be designed under our supervision, to ensure that material information relating to the company, including its

consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which the report is

being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such

internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting

principles; |

| (c) | Evaluated the effectiveness of the company’s disclosure controls and

procedures and presented in the report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end

of the period covered by the report based on such evaluation; and |

| (d) | Disclosed in the report any change in the company’s internal control

over financial reporting that occurred during the period covered by the annual report that has materially affected, or is reasonably likely

to materially affect, the company’s internal control over financial reporting; and |

| 5. | The company’s other certifying officer and I have disclosed, based

on our most recent evaluation of internal control over financial reporting, to the company’s auditors and the audit committee of

the company’s board of directors (or persons performing the equivalent functions): |

| (a) | all significant deficiencies and material weaknesses in the design or operation

of internal control over financial reporting which are reasonably likely to adversely affect the company’s ability to record, process,

summarize and report financial information; and |

| (b) | any fraud, whether or not material, that involves management or other employees

who have a significant role in the company’s internal control over financial reporting. |

Barueri/SP, Brazil

- December 28, 2023

By:

/s/ Alexandre Wagner Malfitani Name: Alexandre

Wagner Malfitani

Title: Chief

Financial Officer and Investor Relations Officer

Exhibit 13.1

Azul S.A.

Certification Pursuant to 18

U.S.C. Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

In connection with

the filing with the U.S. Securities and Exchange Commission by Azul S.A. (the “company”) of its Annual Report on Form 20-F

for the fiscal year ended December 31, 2022, as amended by the Amendment No. 1 on Form 20-F/A on the date hereof (the “Report”),

pursuant to Exchange Act Rules 13a - 14(b) or 15d - 14(b) and to 18 U.S.C. Section 1350 as

adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, the undersigned officer of the company hereby certifies, to such officer´s

knowledge, that:

| (a) | the Report fully complies with the requirements of Section 13(a) or 15(d)

of the Securities Exchange Act of 1934; and |

| (b) | the information contained in the Report fairly presents, in all material

respects, the financial condition and results of operations of the company. |

Barueri/SP, Brazil -

December 28, 2023

By: /s/

John Peter Rodgerson

Name: John

Peter Rodgerson

Title: Chief

Executive Officer

A signed original of this written

statement required by Section 906 has been provided to the company and will be retained by the company and furnished to the U.S. Securities

and Exchange Commission or its staff upon request.

Exhibit 13.2

Azul S.A.

Certification Pursuant to 18

U.S.C. Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

In connection

with the filing with the U.S. Securities and Exchange Commission by Azul S.A. (the “company”) of its Annual Report on Form

20-F for the fiscal year ended December 31, 2022, as amended by the Amendment No. 1 on Form 20-F/A on the date hereof (the “Report”),

pursuant to Exchange Act Rules 13a - 14(b) or 15d - 14(b) and to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002, the undersigned officer of the company hereby certifies, to such officer´s knowledge, that:

(a)

the Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange

Act of 1934; and

(b)

the information contained in the Report fairly presents, in all material respects, the financial

condition and results of operations of the company.

By: /s/

Alexandre Wagner Malfitani

Name: Alexandre

Wagner Malfitani

Title: Chief

Financial Officer and Investor Relations Officer

Barueri/SP, Brazil - December 28, 2023

A signed original of this written

statement required by Section 906 has been provided to the company and will be retained by the company and furnished to the U.S. Securities

and Exchange Commission or its staff upon request.

Exhibit 23.1

Consent of Independent

Registered Public Accounting Firm

We consent to the incorporation

by reference in the Registration Statement (Form F-3 No. 333-257584) of Azul S.A. of our reports dated April 19, 2023, with respect to

the consolidated financial statements of Azul S.A., and the effectiveness of internal control over financial reporting of Azul S.A., included

in the Annual Report (Form 20-F) for the year ended December 31, 2022, as amended by the Amendment No. 1 on Form 20-F/A.

/s/ ERNST & YOUNG

Auditores Independentes S/S Ltda.

São Paulo, Brazil

December 28, 2023

v3.23.4

Cover

|

12 Months Ended |

|

Dec. 31, 2022

shares

|

|---|

| Entity Addresses [Line Items] |

|

| Document Type |

20-F/A

|

| Amendment Flag |

true

|

| Amendment Description |

EXPLANATORY NOTE

Azul S.A. (the

“Company”) filed its Annual Report on Form 20-F for the fiscal year ended December 31, 2022 with the Securities and

Exchange Commission (the “SEC”) on April 20, 2023 (the “Original Filing”).

This Amendment

No. 1 on Form 20-F/A (this “Amendment”) is filed by the Company with the SEC solely to amend the Reports of Independent

Registered Public Accounting Firm of Ernst & Young Auditores Independentes S/S Ltda. (“EY”), the Company’s

independent registered public accounting firm, in Item 18 “Financial Statements” in the Original Filing to correct

errors in such reports.

This Amendment

corrects the Report of Independent Registered Public Accounting Firm of EY on financial statements appearing on pages F-3 to F-5 of the

Original Filing by deleting from such report three paragraphs commencing “We obtained an understanding, evaluated the design

and tested the operating effectiveness of the controls over…”, each of which was included under the sub-heading “How

We Addressed the Matter in our audit” therein. This Amendment also corrects the Report of Independent Registered Public Accounting

Firm of EY on internal control over financial reporting appearing on page F-6 of the Original Filing by inserting the following sentence

into such report: “These material weaknesses were considered in determining the nature, timing and extent of audit tests applied

in our audit of the 2022 consolidated financial statements, and this report does not affect our report dated April 19, 2023, which expressed

an unqualified opinion thereon.”

In addition,

this Amendment also amends Item 19 “Exhibits” in the Original Filing by (i) replacing EY’s Consent of Independent

Registered Public Accounting Firm with an updated Consent of Independent Registered Public Accounting Firm attached to this Amendment

as Exhibit 23.1, and (ii) as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, including as Exhibits to this

Amendment currently dated certifications from the Company’s Chief Executive Officer and Chief Financial Officer as required by Section

302 and 906 of the Sarbanes-Oxley Act of 2002, which certifications are attached to this Amendment as Exhibits 12.1, 12.2, 13.1 and 13.2.

Except as described

above, this Amendment does not modify or update disclosures in, or exhibits to, the Original Filing. Therefore, this Amendment speaks

as of April 20, 2023 (the filing date of the Original Filing) and, except as described above, does not modify or update any other disclosures

contained in the Original Filing for other events or information subsequent to the date of the filing of the Original Filing. Accordingly,

this Amendment should be read in conjunction with the Original Filing and the Company’s filings with the SEC subsequent to the filing

of the Original Filing.

For the avoidance

of doubt, there have been no changes to the Company’s consolidated financial statements set forth in the Original Filing.

|

| Document Registration Statement |

false

|

| Document Annual Report |

true

|

| Document Transition Report |

false

|

| Document Shell Company Report |

false

|

| Document Period End Date |

Dec. 31, 2022

|

| Document Fiscal Period Focus |

FY

|

| Document Fiscal Year Focus |

2022

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-38049

|

| Entity Registrant Name |

AZUL SA

|

| Entity Central Index Key |

0001432364

|

| Entity Incorporation, State or Country Code |

D5

|

| Entity Address, Address Line One |

Avenida

Marcos Penteado de Ulhôa Rodrigues, n. 939, 8th floor Edifício Jatobá, Condomínio Castelo Branco Office

Park

|

| Entity Address, City or Town |

Barueri

|

| Entity Address, Country |

BR

|

| Entity Address, Postal Zip Code |

06460-040

|

| Entity Well-known Seasoned Issuer |

Yes

|

| Entity Voluntary Filers |

No

|

| Entity Current Reporting Status |

Yes

|

| Entity Interactive Data Current |

Yes

|

| Entity Filer Category |

Large Accelerated Filer

|

| Entity Emerging Growth Company |

false

|

| Document Accounting Standard |

International Financial Reporting Standards

|

| Entity Shell Company |

false

|

| ICFR Auditor Attestation Flag |

true

|

| Document Financial Statement Error Correction [Flag] |

false

|

| Auditor Name |

Ernst & Young

Auditores Independentes S/S Ltda.

|

| Auditor Location |

São Paulo, Brazil

|

| Auditor Firm ID |

1448

|

| Preferred Shares |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

Preferred

Shares

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| Entity Common Stock, Shares Outstanding |

335,623,408

|

| American Depositary Shares |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

American Depositary Shares (as evidenced by American Depositary Receipts), each representing three Preferred Shares

|

| Trading Symbol |

AZUL

|

| Security Exchange Name |

NYSE

|

| Common Shares |

|

| Entity Addresses [Line Items] |

|

| Entity Common Stock, Shares Outstanding |

928,965,058

|

| Business Contact |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

Avenida

Marcos Penteado de Ulhôa Rodrigues, n. 939, 8th floor Edifício Jatobá, Condomínio Castelo Branco Office

Park

|

| Entity Address, City or Town |

Barueri

|

| Entity Address, Country |

BR

|

| Entity Address, Postal Zip Code |

06460-040

|

| Contact Personnel Name |

Alexandre Wagner Malfitani

|

| Contact Personnel Email Address |

invest@voeazul.com.br

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe basis of accounting the registrant has used to prepare the financial statements included in this filing This can either be 'U.S. GAAP', 'International Financial Reporting Standards', or 'Other'. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

| Name: |

dei_DocumentAccountingStandard |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:accountingStandardItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a registration statement. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

| Name: |

dei_DocumentRegistrationStatement |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true for a Shell Company Report pursuant to section 13 or 15(d) of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

| Name: |

dei_DocumentShellCompanyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ifrs-full_ClassesOfShareCapitalAxis=ifrs-full_PreferenceSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ifrs-full_ClassesOfShareCapitalAxis=azul_AmericanDepositarySharesAsEvidencedByAmericanDepositaryReceiptsEachRepresentingThreePreferredSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ifrs-full_ClassesOfShareCapitalAxis=ifrs-full_OrdinarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

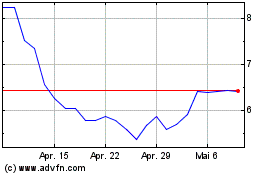

Azul (NYSE:AZUL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Azul (NYSE:AZUL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024