Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

18 Dezember 2023 - 10:55PM

Edgar (US Regulatory)

ALUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14A-101)

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under § 240.14a-12 |

ALTERYX, INC.

(Name of

Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

AYX Transaction Investor / Analyst Courtesy Note

Subject: Alteryx Agreement to be Acquired by

Clearlake Capital and Insight Partners

Good morning,

I

am pleased to share that Alteryx has entered into a definitive agreement to be acquired by Clearlake Capital and Insight Partners for $48.25 per share. This all-cash transaction values Alteryx at

$4.4 billion, including debt. The press release we issued can be found here [HYPERLINK].

Highlights of the transaction include the following:

| • |

|

The per share cash purchase price represents: |

| |

• |

|

59% premium to Alteryx’s unaffected closing stock price on September 5, 2023, the last full trading day

prior to media reports regarding a possible sale transaction. |

| |

• |

|

Significant, certain value for Alteryx stockholders. |

| • |

|

The transaction is the result of a competitive process with multiple parties intended to maximize shareholder

value. |

| |

• |

|

It was overseen by a Special Committee of Alteryx’s Board of Directors, which consisted solely of

independent directors. |

| • |

|

The transaction is expected to close in the first half of 2024. |

| |

• |

|

The transaction was approved and recommended by the Special Committee and then approved by Alteryx’s Board

of Directors. |

| |

• |

|

The transaction is not subject to a financing condition. |

| |

• |

|

It is subject to customary closing conditions and approvals, including approval by Alteryx stockholders and

receipt of required regulatory approvals. |

| |

• |

|

Dean Stoecker, Alteryx’s largest shareholder, has agreed to vote his shares in favor of the transaction. His

ownership is just under what is required for stockholders to approve the transaction. Mr. Stoecker holds approximately 49% of Alteryx’s voting power. The transaction is not subject to a financing condition or a “majority of the

minority” stockholder vote. |

We value your investment and support.

Best regards,

NAME

Additional Information and Where to Find It

Alteryx,

Inc. (“Alteryx”), its directors and certain executive officers are participants in the solicitation of proxies from stockholders in connection with the pending acquisition of Alteryx (the “Transaction”). Alteryx plans to file a

proxy statement (the “Transaction Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies to approve the Transaction.

Mark Anderson, Charles R. Cory, Jeffrey L. Horing, Anjali Joshi, Timothy I. Maudlin, CeCe Morken, Eileen M. Schloss, Dean A. Stoecker and Dan Warmenhoven, all

of whom are members of Alteryx’s Board of Directors, and Kevin Rubin, Alteryx’s chief financial officer, are participants in Alteryx’s solicitation. Additional information regarding such participants, including their direct or

indirect interests, by security holdings or otherwise, will be included in the Transaction Proxy Statement and other relevant documents to be filed with the SEC in connection with the Transaction. The beneficial ownership of each such person, as of

the date specified, appears in the table below. Please see the section captioned “Executive Compensation—Employment Agreements and Severance and Change in Control Benefits” in Alteryx’s definitive proxy statement for its 2023

Annual Meeting of Stockholders, which was filed with the SEC on April 4, 2023, and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1689923/000114036123016229/ny20006541x2_def14a.htm, for certain illustrative information on the

payments that may be owed to Alteryx’s named executive officers in a change of control of Alteryx.

Promptly after filing the definitive Transaction Proxy Statement with the SEC, Alteryx will mail the

definitive Transaction Proxy Statement and a WHITE proxy card to each stockholder entitled to vote at the special meeting to consider the Transaction. STOCKHOLDERS ARE URGED TO READ THE TRANSACTION PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ALTERYX WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive versions of

the Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by Alteryx with the SEC in connection with the Transaction at the SEC’s website (http://www.sec.gov). Copies of Alteryx’s

definitive Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by Alteryx with the SEC in connection with the Transaction will also be available, free of charge, at Alteryx’s investor

relations website (https://investor.alteryx.com), or by emailing Alteryx’s investor relations department (ir@alteryx.com).

|

|

|

|

|

|

|

|

|

| Individual |

|

Beneficial Ownership as of December 15, 2023 |

|

| |

|

Class A Common Stock |

|

|

Class B Stock |

|

| Mark Anderson |

|

|

146,209 |

|

|

|

— |

|

| Charles R. Cory |

|

|

9,390 |

|

|

|

105,156 |

|

| Jeffrey L. Horing |

|

|

1,003,543 |

|

|

|

— |

|

| Anjali Joshi |

|

|

7,806 |

|

|

|

— |

|

| Timothy I. Maudlin |

|

|

41,171 |

|

|

|

36,451 |

|

| CeCe Morken |

|

|

7,334 |

|

|

|

— |

|

| Eileen M. Schloss |

|

|

6,715 |

|

|

|

— |

|

| Dean A. Stoecker |

|

|

424,205 |

|

|

|

7,296,804 |

|

| Dan Warmenhoven |

|

|

7,334 |

|

|

|

— |

|

| Kevin Rubin |

|

|

79,703 |

|

|

|

4,863 |

|

The amounts specified above are determined in accordance with the rules of the SEC and include securities that will vest

within 60 days of December 15, 2023. With respect to Mr. Horing, such beneficial ownership includes 911,829 shares of Class A Common Stock owned by investment funds affiliated with Insight Holdings Group, LLC, which entity is

affiliated with one of the acquirers in the Transaction.

Forward-Looking Statements

This communication may contain forward-looking statements that involve risks and uncertainties, including statements regarding: the Transaction, including:

(i) the expected timing of the closing of the Transaction; (ii) considerations taken into account by Alteryx’s Board of Directors in approving the Transaction; and (iii) expectations for Alteryx following the closing of the

Transaction. There can be no assurance that the Transaction will in fact be consummated. Risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements, in addition to those

identified above, include: (i) the possibility that the conditions to the closing of the Transaction are not satisfied, including the risk that required approvals from Alteryx’s stockholders for the Transaction or required regulatory

approvals to consummate the Transaction are not obtained, on a timely basis or at all; (ii) the occurrence of any event, change or other circumstance that could give rise to the right to terminate the Transaction, including in circumstances

requiring Alteryx to pay a termination fee; (iii) possible disruption related to the Transaction to Alteryx’s current plans and operations, including through the loss of customers and employees; (iv) the amount of the costs, fees,

expenses and charges related to the Transaction; (v) the risk that Alteryx’s stock price may fluctuate during the pendency of the Transaction and may decline if the Transaction is not completed; (vi) the diversion of Alteryx

management time and attention from ongoing business operations and opportunities; (vii) the response of competitors to the Transaction; and (viii) other risks and uncertainties detailed in the periodic reports that Alteryx files with the

SEC, including Alteryx’s Annual Report on Form 10-K and Alteryx’s quarterly report on Form 10-Q. All forward-looking statements in this communication are based

on information available to Alteryx as of the date of this communication, and Alteryx does not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which

they were made, except as required by law.

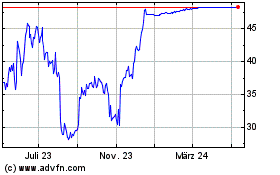

Alteryx (NYSE:AYX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

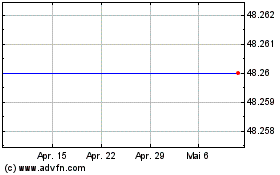

Alteryx (NYSE:AYX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025